I don’t care if you’re buying lunch off a food truck, a pair of designer jeans, or a new home – it always feels amazing to get a great deal!

But what about the next level up from a “deal.” What’s better than a deal, and what does that look and feel like?

In a word, it’s a “steal,” and it rarely, if ever, happens in the Toronto real estate market.

But every once in a blue moon, I work on a transaction that makes me feel like I got away with highway robbery. A true “steal” in every sense of the word…

If you don’t know who is pictured above, then not only do you not know baseball, but you clearly haven’t read a book or newspaper, or watched TV or a movie in a long, long time.

Jackie Robinson is one of the most famous baseball players of all time, although some try to claim he wasn’t as good as his legend.

I’ve heard him called “overrated” because he is most well-known for breaking the colour barrier in Major League Baseball, and his statistics weren’t as impressive as other players of the same stature.

But consider that Jackie Robinson didn’t start playing in the Major Leagues until he was 28 years old, and thus at least six years, in his prime, were deducted from his playing career.

Ernie Banks, who also played second base, and who started his career after Jackie Robinson had paved the way, started playing at 22-years-old, and 183 of his career 512 homeruns (36%) came before he turned 28; the same age Jackie Robinson started playing in the MLB.

And let’s not forget that the “Gold Glove” award for defensive prowess only came into existence AFTER Jackie Robinson’s career was over, otherwise he would have been far more decorated.

What does this have to do with real estate? Nothing.

But when I thought of “stealing home” as today’s blog title, I thought of Jackie Robinson. And when I thought of Jackie Robinson, I thought of a radio show I heard this past summer on Sirius where they tried to strip away at Jackie’s legend, and as a massive baseball fan, and avid historian, I think that’s unfair.

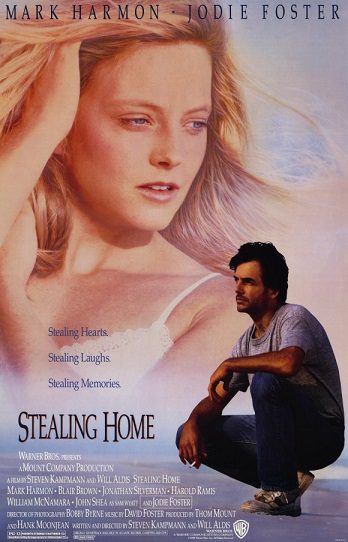

Perhaps when you thought of stealing home, you thought of this:

And who could blame you?

Mark Harmon was voted “Sexiest Man Alive” in 1986, and by 1988 he’s playing opposite a 26-year-old Jodie Foster.

Stealing Hearts, Steeling Laughs, Stealing Memories. Stealing Home

Wow, I’m sold! I wonder if my local video rental store has this on Beta, since my family figured VHS was going to lose out in the cassette-wars…

Okay, let’s get back on track here. I fear this tangent into 50’s baseball and 80’s movies is going to lose my real estate readers.

I wanted to talk today about the idea of “stealing” a property in Toronto real estate.

Is it impossible? Almost.

Is it all relative, and can the idea of a “steal” have different meaning to different people? Absolutely.

Now and again, I’ll receive a phone call from somebody who I know right away is what we call a “shooter,” and who has one of three ideas, that nobody, anywhere, ever, has ever had before:

1) “I want to buy a house, fix it up, and sell it for more money.”

2) “I want to focus on bank foreclosures and auctions.”

3) “I’m sort of in the market right now, but only if I get a downright steal.”

None of these comments, as you can guess, ever lead to a productive conversation.

The market for “flipping” houses is tighter than ever, and a person who hasn’t done this a half-dozen times before isn’t going to be successful in this market.

Bank foreclosures in Toronto are almost non-existent, and we don’t have “auctions” for foreclosures like we see in some areas of the United States, like Florida or Arizona. Those people hoping to find this in Toronto have been watching too much television.

And a “steal” in Toronto is about as far-fetched as the first two ideas.

In a market as hot as Toronto’s, which is about as hot as you’ll find on planet earth, how can you steal a property when the rest of the market sits idly by?

What makes you, or your agent, more savvy than the other 40,000 agents and tens of thousands of buyers?

And if the market is truly as hot as it is, why would any seller need to “dump” a property, that would result in a “steal?”

Those who set out looking for a steal will likely be unsuccessful, as the old adage, “if something is too good to be true, it probably is,” will ring true.

If you search MLS and look for properties that have been on the market for 90 days or more, you might expect to find a seller who is desperate to sell, but in fact, you’ll usually find sellers who have over-priced intentionally, as they’re just sitting, waiting, and wishing that somebody would pay their price. You might also find a property that’s tenanted, where the seller has no real motivation to sell.

It’s hard to seek a true “steal,” in to be perfectly honest, I find they’re usually deals you stumble upon, when the circumstances are right. And it’s always the perfect storm of circumstances, as several things have to transpire at the same time, in order to create the opportunity.

There has to be something wrong with the property, in order to secure a steal. Or at least the appearance of something wrong.

Tenanted properties don’t show well, and often tenants make showings difficult, so properties can linger on the market for a while, at which point the leverage shifts to the potential buyer.

Older condominiums don’t sell quite as well for the most part, so often the “steal” is in the eyes of a buyer who doesn’t put so much of a value on “new and shiny.”

Renovation projects don’t appeal to everybody, and most of my young condo buyers are so busy working to pay off their mortgage that they don’t have time to renovate, so a “project” is out, before we even go in.

I could go on, but I think the set of circumstances is better depicted in real life than in terms of a hypothetical.

On Monday night, I experienced a true “steal,” in every sense of the word, and it was part luck, and part diligence.

I’m not going to give out the address, since the deal hasn’t closed, but also because it wouldn’t be nice to the seller and agent. But I will say that it’s in King East.

The property was a 1-bed, 1-bath, 678 square feet, with both parking and locker. The unit has 9-foot ceilings, and is of a soft-loft style. The building is popular, and both the building itself and the location would rank a solid B+ relative to what’s going on in the neighbourhood.

I first showed my client this property one month ago, right after we met for the first time. He was a first time buyer, and I told him, “I know you’ve just started your search, so I don’t expect you to jump on anything, but this is the best deal for an entry-level unit in C08 right now, and I’d like to see something like this when you’re ready to buy.”

Who knew that this unit would not only be available when he was ready to buy, but that he would actually end up buying it.

So what’s the going rate for a 678 square foot loft with parking and locker? What constitutes a “steal” in this market? $400,000? $360,000? $345,000?

How about $330,000.

Yes, I’m feeling pretty damn good about it.

But a LOT of chips had to fall into place for this to happen, so let me outline them, in quasi-chronological order:

1. Tenanted Property. The unit was originally tenanted, and thus not only had it been beaten up over time, but showings were made difficult by the tenant, and the unit didn’t show as well as it could have.

2. Vacant Unit. Eventually, the tenant left, and the unit remained vacant. Vacant units don’t show well either, and perhaps it’s a toss-up between what shows worse: a tenanted unit, or a vacant unit. As the listing wore on, the unit looked worse and worse. There were dozens of footprints on the laminate flooring from agents and buyers not removing their shoes, there were business cards left all over the kitchen counter, the odd coffee cup was left behind by a would-be buyer, and the feature sheets were out of date, and reflected the wrong price – after the price drop.

3. Unit Needs Work. This building dates back about a decade, maybe slightly less, and the unit was NOT comparable to something finished in 2014. There was an unusual amount of tile in the unit, and not just limited to the foyer – it ran the whole length of the hallway, and into the kitchen. The laminate was awful, and my client agreed that he would rip up ALL the flooring, and replace it with something more modern. The light fixtures were putrid and had to be removed and replaced, and the bathroom vanity was awful too. All told, the unit needed $10,000 worth of work.

4. Changing Styles. Styles come and go in all walks of life, and real estate is no different. That really light brown – almost walnut coloured flooring may have been hot in 2005, but it’s awful today. Grey walls, tile floors, no lights in the bedroom, and that “open bedroom ceiling” have all been extinct for some time. The unit was a great “space” at 678 square feet, but needed some changes.

5. Days On Market. When we made our offer, the unit had been on the market for seventy days, with two small price reductions. If a unit has been on the market that long, the seller has absolutely no leverage. Couple this with the fact that it’s vacant, and the seller can’t claim, “I don’t need to sell,” like so many do when the DOM racks up!

6. Time Of Year. We made our offer on December 1st, which is in the slowest month of the year for real estate, and perhaps 7-10 days from when the market officially takes a vacation until 2015. Had we made this offer in September, I’m positive we would have been unsuccessful.

7. Buyer Ready To Move. My buyer was ready, and believe me when I say that can’t be over-looked. I had shown him this property a month ago, and it was one of the first properties he’d seen, so the “insane deal” I was claiming this to be, couldn’t have possibly been absorbed. Having seen other units, he was aware now of just what a deal this was. And within three minutes of revisiting the unit, he said, “F*** it, let’s do it.” And that was that.

8. Quick Closing. We offered the seller a closing date of December 15th, which was 14 days away. Any seller of a vacant unit would KILL to get a quick closing, as this offers a cost savings. Each month of ownership could equate to $2,500 once mortgage, taxes, maintenance fees, and utilities are considered.

9. Seller’s Lack of Alternative. What’s the upside for the seller here? Keep the unit and re-list it in January? What if it took a month to sell, and that buyer wanted a 60-day closing? The seller wouldn’t get his money out until April 1st, and that might cost $10,000 more than what our offer provided for.

In the end, all the stars aligned, and my buyer really, truly, got a “steal.”

I mean, the unit was listed at $346,650, so our $330,000 purchase price might not have been expected by another would-be buyer, and at the risk of sounding brash, I’d like to think my negotiating was part of the process. Call it point #10.

And at the risk of sounding like a cheerleader, I wonder why the rest of the market was asleep on this one.

Maybe a lot of buyers don’t want to renovate.

Maybe most buyers can’t offer a 14-day close.

Maybe some agents didn’t think they could get the unit for $330,000.

And I have to think that a lot of folks saw the 70 days on market, and just figured, “That property would have sold by now if it was worth it.”

I don’t know, and I don’t care.

All I know, is that this is the best deal I’ve got for a condo buyer in quite some time. It’s a paltry $487 per square foot, and anybody who knows real estate probably hasn’t seen a PPSQFT start with a “4” in years and years.

The funny thing is, I’m not sure if my buyer is completely aware of just how great a deal he got. I’m a salesperson, so perhaps it’s expected that I’ll eventually pat my clients on the back and tell them how well they made out. But I can’t wait to see this unit when he’s done fixing it up, and I can’t wait to see what the next sale in the building looks like.

Who said the market was over, anyways?

Bjork

at 12:22 pm

Had similar situation with a delusional seller who had overpriced the unit by $40K. 2 price drops and over 3 months later I made a solid offer and he rejected it citing “I don’t have to sell, the mortgage is paid off”. I walked away.

Keep in mind the place was in terrible condition and other similar units in the building that were in better shape and staged came and sold within days of hitting the market. Meanwhile he’s sitting there 3 1/2 months later thinking he will find some fool who will overpay.

Mike

at 4:20 pm

Your situation is nothing like the one in the story, to think so would be delusional.

Free Country

at 5:52 pm

Thank you for this. I already feel better about what I paid for my place.

ICP

at 11:34 pm

Er…a little bit more info…maintenence fees, are they reasonable after 10 years? Are there any large expenditures that are about to hit the condo? Kudos on the ‘steal’, but you have to wonder, if it sounds too good to be true….