Cheer up, bears!

It’s not all bad.

I mean, you have to listen to Appraiser every single day, rubbing it in your face, but other than that, there’s lots of data out there to create a bearish argument for the Toronto market.

For what it’s worth, I enjoy your comments. All of them. Every last one, whether bearish or bullish, well-researched or andecdata, and even the ones that take swings at me, which I find amusing.

The back-and-forth arguments, from my perspective, serve as more than just a debate on the market. To me, they’re a look into the minds of people from many different backgrounds, of different ages, working in different industries, many of whom want the market to be something so badly, whether that’s up, down, or sideways.

We can always debate where the market is going, but interestingly-enough, even in the face of solid sales data, we can always debate where the market currently is as well.

For example: the average home price in Toronto just hit an all-time high. It’s impossible to debate where the market is, right?

Wrong.

Because you guys do it every day!

The bears among you, in the face of all-time-high prices, want to formulate an argument that the market is propped up by low interest rates, or that it’s the government pumping money into the economy, or post-pandemic demand, etc.

How in the WORLD can we not all come to the same conclusion here – that the market is at an all-time high?

I’ve never understood perma-bears.

And while this is a “Friday Rant,” I’m not meaning to be insulting, because I have more respect for my readers and commenters than you can possibly understand. I was being facetious about “gloating,” but I do want to sound off on this idea of a perma-bear.

It just makes no sense.

I mean, does this not sound like “the definition of insanity,” to you? That doing the same thing over and over, and expecting a different result, is tantamount to calling for the “big crash” and never seeing it happen?

In my mind, perma-bears come in three forms:

1) People who can’t afford to buy what they want, and become bearish out of spite.

2) People who didn’t act, have regret, and are in denial – thus also becoming bearish out of spite.

3) People who can’t look up from the textbook long enough to see what’s actually happening.

And I’m not talking about you guys – the ones who comment here daily. Many of you are bearish for very good reasons, and aren’t considered “perma-bears.”

The perma-bears are the ones that simply will never change their minds. Ever.

The sky is blue, they think it’s green, and it doesn’t matter how long it’s blue for, they just refuse to agree.

Why?

Well, three very good reasons above!

I’ve been in real estate now for the better part of two decades. I have more stories about bears than you can possibly imagine. Some short-term, some long-term, but all of whom were wrong.

I told a friend of mine back in 2004 that we would be selling our family home in Leaside, and he said to me, “You should sell it today, then buy it back for half in two years.”

The level of confidence that he had was astounding. His father was an extremely successful businessman, and my friend would routinely come up with asinine ideas about the stock market, real estate market, or investing, based on things he had heard his father discuss with his partners.

Perhaps they were bearish on the market, but the ego on this guy was as unbelievable as his contention that the market was about to drop 50% (in fact, the average home price has almost tripled since…)

Since that first ridiculous bearish sentiment, I’ve encountered oh-so-many market bears, all of whom have been wrong.

To be fair, on a long-enough time horizon, every bear is proved wrong.

So what kind of timeline are we working with in the context of “right and wrong?”

Let me show you three charts dating back to the early 1970’s and see if you can identify which is which.

Take a moment before scrolling down and think about it.

I’m confident that many of you will identify all three…

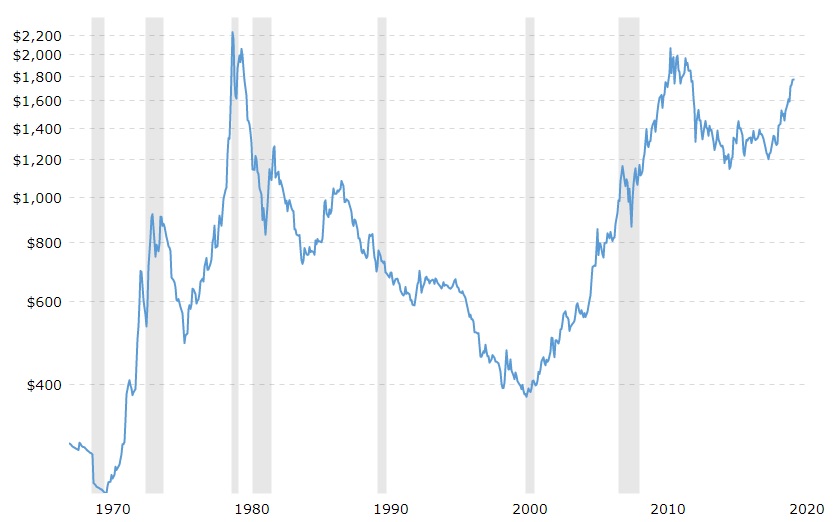

Chart #1:

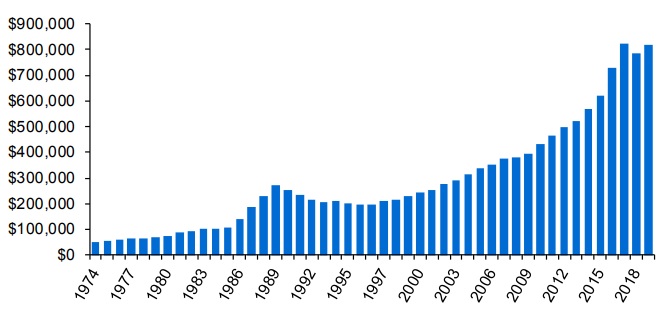

Chart #2:

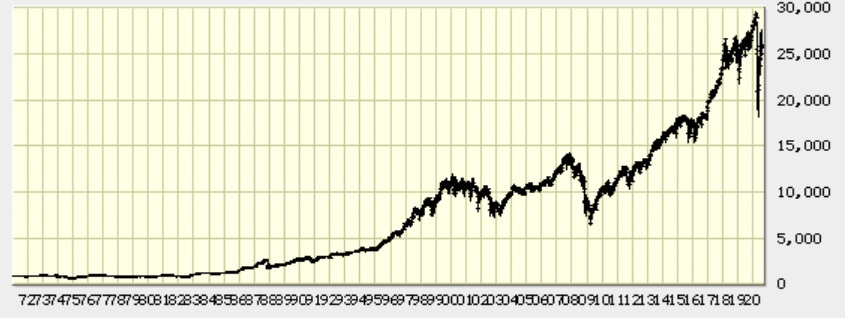

Chart #3:

Too easy, right?

The first is the price of gold, which fluctuated far more than most would believe (myself included), in a general discussion about the history of the price of gold.

The second is the average Toronto home price, which I think you ascertained from the prices, and the familiarity of that blue bar chart.

The third is the Dow Jones, which I also think you figured out from that massive cliff in 2020.

The common thread between the Dow Jones and the average Toronto home price is that they are obscene uptrends, over the course of the long-term.

You could re-run these charts in forty years, and you’ll see the same thing. Whether you choose to re-run the chart for all ninety years, or just the forty years ahead, you’ll see both charts doing nothing but trending up.

So I ask again: how can one be a perma-bear?

And to that point, how long is the timeline to evaluate when one is either right or wrong?

A story I have told many times goes as follows…

An extended family member and myself met back in 2011. We became friends and started to golf in the summer, and he told me that the real estate market was about to drop. He was young, working in finance, and had probably talked to a lot of people in his circle.

In 2012, we golfed all summer, and he told me that, despite the increase in prices over the last year, he still believed the market was going to drop. In fact, he knew it would.

The following year, I smirked as I asked him for his thoughts on the market, and once again, he told me that the drop was going to come! “It has to! It just has to! This can not continue! The drop is going to be spectacular!”

Then the next year, he told me that he’d bought a luxury condo.

And since then, he’s made a million-dollar tax-free capital gain.

I was on the verge of labelling him a “perma-bear,” because he exhibited some of the traits I described above, mainly #2 and #3.

He was, as the poker folks say, “pot committed.” He had been sitting on the sidelines for four years, waiting for the market to drop, and with every passing year, he was losing out more and more on the market gain, and subconsciously or otherwise, being filled with more and more regret. The deeper you dig yourself in, the harder it is to climb out.

He also clung to the economic measures and theories he learned in business school that suggest the market should start trending down, in spite of evidence to the contrary.

Everything in his entire being wanted the market trend down so badly, since he was, at first, looking for a deal, and then eventually trying to make back his “losses” from sitting on the sidelines. Everything he knew about economics and finance would have to be ignored if the market did not trend down. But eventually, he cut his losses.

Many perma-bears aren’t that fortunate.

This “going down with the ship” mentality that many perma-bears possess is self-destructive and could be avoided with a sliver of humility. And again, while I don’t believe that all the bearish readers here on TRB fit this same description, you know that these perma-bears do exist.

With all due respect, and please don’t consider this hindsight speaking, I have no idea how people could have suggested that the $910,000 February average home price wouldn’t be seen again until 2024, or 2028, or 2030. It’s just absurd.

Hindsight: check.

Property owner: check.

Real estate agent: check.

Easy for me to say, right?

Honestly, I just don’t understand the mentality of people who want to ignore what’s happened in this market.

I was on MLS today looking at a condo up for sale on Richmond Street, and I realized that I had shown this very same unit back in 2011. I went through my files and found the offer we had made – for $340,216. We lost. And then I lost the clients.

I don’t have the email, but I remember the content:

“David, we’ve decided that we no longer want to participate in this real estate bubble. We are going to wait a couple of years for the market to return to normal, but we appreciate the time you have spent with us.”

That might not be exact, but the words “real estate bubble” stand out in my mind.

This poor couple. Honestly. They determined that the market was in a bubble. They established the timeline of “a couple of years.” They came up with the definition of “normal.”

This condo is up for sale today for $649,000.

Hindsight: check.

Real estate agent: check.

But what in the world am I supposed to say?

I called these folks up and chatted with them after I got that email, I’ll never forget it. Words like “everybody knows” were used, and advice from “all the people at our offices” were quoted.

I had lost three offers with these guys on condos, and then they subsequently allowed themselves to be beaten. Instead of marching on, they let their frustration take control of their market views. It wasn’t a matter of, “This market is tough,” but rather, “This market is over-priced, and this can’t continue.”

They refused to conclude, “We need to come up with a bit more money,” and instead decided, “Prices are going to plummet.”

When they couldn’t get what they wanted, and when the market wasn’t going to do what they wanted it to do, they decided that Toronto was in a “bubble,” and they became bears.

They never bought. I just looked them up.

And this is merely one example of many that I keep on file in my mind. I could regale you with others, but that would be in poor taste, if some of this isn’t already…

I’m not writing this in attempts to gloat, but as I said, out of frustration, and misunderstanding.

I don’t just understand the concept of, “I’ve been a bear for six years.”

Look at the chart again:

How can you be a bear for six years?

What do you think is going to happen, and when?

I understand my golf-buddy being a bear for three years, and then switching gears and buying a place. That makes sense, and it’s acceptable.

I understand those of you that think this June average home price is a mirage, and that September could be weak.

But I don’t understand the perma-bear mindset, because it makes no sense. Not in the face of that chart above.

A reader asked me in Wednesday’s post why I was so excited that the average home price is up a mere 2.3% since February, as though that’s really not all that big a deal.

Well, if a worldwide pandemic doesn’t tank the Toronto real estate market, then what will?

I do not want to convince people that the Toronto real estate market is indestructible, or that buying any property in the city is a good investment. I’m not trying to suggest that the average home price will increase every single month forever, or that NOW is the time to buy, right this minute!

But for every “fan” of Garth Turner who turned perma-bear in the late-2000’s, that’s lost out on a lifetime of tax-free capital gains, there’s a complete moron who got shit-rich by simply buying a house or condo in the city.

Being a perma-bear is a decision. It’s not something that just evolves. It’s like holding a grudge against a family member; you have to try to do it.

Those charts don’t lie. They won’t lie.

In six years, or sixteen years, the average Toronto home price will be higher than it is today.

So how can a person possibly remain bearish for a half-decade or more?

Look in the mirror.

I have a feeling this is who you’ll see looking back at you…

J G

at 7:20 am

“With long enough time horizon, every bear is wrong” that’s obvious David, it’s called inflation.

What the perma bulls need to understand is how is Toronto Re doing RELATIVELY to other investments. Some believe they are winning as long as it’s going up in absolute value.

You know where I stand on that, yesterday I also posted about other markets in Ont like Ottawa and Windsor gaining 40-50% in the past 3 years.

Chris

at 8:22 am

Agreed J G. The price of almost every asset climbs over the long run, due to the relentless action of inflation. Not really a compelling argument.

Your second point is also bang on. I’ve encountered stock market investors with this same mentality. They make some picks and celebrate that they made money when their portfolio goes up 10% on the year, failing to realize that the indices went up by 12% on average.

I also continue to think it’s far too early to claim that the pandemic has run its course and had its impact on Toronto real estate. We’re nowhere near the end of Covid-19. I would say the same about stock prices too, I don’t think that market turmoil from the pandemic is in the rear view mirror.

I suspect our resident stock market perma bear agrees with me on that last point.

Appraiser

at 9:06 am

You know what they say, if you find yourself in a hole – stop digging.

Chris

at 9:25 am

So you’re no longer bearish on equity markets?

L Martin

at 3:04 am

There is also the issue of when the market diverged significantly from expectations based on the fundamentals, it is trying to tell you something- i.e. rallying in the face of a worldwide pandemic and bearish economic data, the likes of which we have never seen. That is a market telling you it wants to go up, and it likely resolves or eventually makes sense with the economic data staging a recovery as unprecedented as its decline.

Chris

at 7:13 am

The real estate market or equity markets? Because much of what you said could apply equally to either.

L Martin

at 9:42 am

Both

Professional Shanker

at 10:28 am

I am frankly surprised David is taking a victory lap right now.

-no vaccine

-unemployment at 12.3%

-Border closed

-I could go on and on about the obvious risks which we are all familiar with.

In late 2020 & 2021 we will have significantly more clarity but medium term economic damage from this will transpire and will impact asset prices. Patching the hole in the dry wall right now is massive amounts of gov’t stimulus, does this mean everything is fine and we are in a secular bull market for RE over the next couple years? I can make a reasonable case either way for detached, but I cannot make that same case for high density urban RE.

Chris

at 10:51 am

“Patching the hole in the dry wall right now is massive amounts of gov’t stimulus, does this mean everything is fine and we are in a secular bull market for RE over the next couple years?”

Exactly. One could make a similar argument about stock markets. Is it reasonable to believe to that stock prices have reached what appears to be a permanently high plateau? Or are they being propped up by the US Fed’s unprecedented level of stimulus?

Dana Senagama, the Principal Market Analyst responsible for the Greater Toronto Area at CMHC touched on this in the interview I posted yesterday. She pretty clearly explained we have not yet seen the full impact of the pandemic, and to get a clear picture of how it will reverberate through our economy and real estate markets will take more than the four months that have so far elapsed.

Professional Shanker

at 12:04 pm

If everything was fine structurally – JP Morgan, regarded as the best bank in the world would not be trading roughly 35% off their pre-covid highs.

There are much better barometers than what I just mentioned but they are just one.

To be clear – I hope we V – but in July, declaring victory might be premature, but hey I am more risk adverse than most.

Chris

at 1:17 pm

A V-shaped recovery would be ideal, but unfortunately doesn’t seem to be on the cards.

Even if we manage to keep new cases low and fend off a second wave, the economic damage that will be wrought upon the USA and the rest of the world from the accelerating pandemic will invariably impact the Canadian economy to a great extent.

There were 223,230 new cases added around the world yesterday, the highest on record. Hence, to proclaim the pandemic’s impacts over seems pre-mature.

Chris

at 9:05 am

“Fewer People = Less Demand

Easing Population Growth to Weigh on Housing

The pandemic-induced slowdown in population growth is expected to linger through at least 2021. Lesser inflows of immigrants and non-permanent residents will impact rental and ownership housing markets alike. The impact on the former will be more immediate while building over time in the case of the latter.”

– TD Economics

https://economics.td.com/ca-housing-population

Appraiser

at 9:12 am

Yeah, less demand in Saskatoon, Timmins and Chicoutimi maybe, but the GTA?

Oh, and TD’s record on predicting the housing market is about as strong as all of the other major banks – dismal; but still better than CMHC.

Chris

at 9:24 am

“The impact of reduced immigration flows would vary across the country. Most immigrants tend to settle in Toronto, Vancouver, Montreal, and Calgary with these CMA’s accounting for over 60% of inflows last year (Chart 8). These regions also saw the largest slowdown in immigration over March/April, with levels down 60% year-on-year, compared to a decline closer to 50% in other jurisdictions. Moving forward, the largest blow to housing demand from an immigration slowdown would likely be imparted on these four CMAs, given their popularity as “landing pad” destinations.”

Read before commenting.

Connie

at 9:56 am

New immigrants aren’t the ones buying toronto priced townhouses/semis/detached. That’s at a price point only dual income professionals or business people can afford now. And those are also the people who continue to be employed and wfh during the pandemic in stable white collar jobs. Maybe you can say immigration slowdown will effect the condo market because foreign investors from asia are no longer coming out in such droves, but I also doubt it. My young single friends are all ready on the sidelines with a fistful of cash to snap up the first good deal in the condo market, as are I’m sure a lot of people. The pent up demand for property ownership way outstrips the effect of immigration slowdown.

Chris

at 1:08 pm

“New immigrants aren’t the ones buying toronto priced townhouses/semis/detached.”

From TD’s report:

“Immigrants also tend to own more expensive properties than the non-immigrant population. Data from Statistics Canada indicates that in 2018, average assessed values for properties owned by recent immigrants were much higher than the non-immigrant population in Nova Scotia, B.C. and Ontario (Chart 7). And, this gap was even higher for immigrants living in Canada for a longer period, meaning that it was not simply a function of the rapid rise in home prices observed in some markets in recent years. This data suggests that (all else equal) weaker immigration flows would weigh disproportionately on average prices, which are influenced by more expensive properties.”

https://economics.td.com/ca-housing-population

Ed

at 3:09 pm

Some rich immigrants come here and buy expensive homes immediately.

Most immigrants come and after saving for years will transition from being renters to owners. Hence less immigration now will affect the housing market a few years from now to a small degree.

Connie is right and you can pull a hundred different quotes to try and bolster you argument but she is still correct.

Chris

at 3:33 pm

Per the report, approx. 40% of recent immigrants (arrived within 5 years) were homeowners; not a majority, but hardly an insignificant number.

Of these recent immigrant homeowners, they purchased more expensive homes than non-immigrants.

These two factors combine to make the statement “New immigrants aren’t the ones buying toronto priced townhouses/semis/detached” questionable, and seemingly not based on any hard data, but rather an opinion.

If you personally want to believe Connie’s opinion, you go right ahead, Ed. But you simply declaring it correct, and TD economist Rishi Sondhi’s data wrong, does not at all make it so.

Appraiser

at 3:45 pm

People seem to forget that on a regular basis some 2.5+ million Canadians live / work abroad every year. We may not be receiving immigrants as quickly right now, but with travel restrictions to many places world-wide, neither are Canadians emigrating at the same rate as before.

All those people ‘gotta live somewhere.

Chris

at 4:28 pm

How many of those Canadian expats do you expect will return here? How many have jobs, homes, friends, family, entire lives and significant ties in their new countries of residence?

Connie

at 10:14 pm

Sure it’s my opinion that new immigrants aren’t overwhelmingly snatching up 1 million dollar homes, but that’s also based on stats.

“Recent immigrants own 5% of single-detached properties in Toronto. As a group, recent and longer-term immigrants own 39% of these properties.” and “The study shows that immigrant owners own proportionately fewer single-detached houses than Canadian-born owners in both cities”

https://www150.statcan.gc.ca/n1/pub/11-626-x/11-626-x2019001-eng.htm#n13-refa

Of course there’s going to be the rich investor here and there buying a mansion, but on the grand scheme of things, “recent” immigrants aren’t the ones buying all the property. Furthermore, you might discount this as an opinion, but both my husband and I are immigrants, as are a great number of our friend circles and it’s simply not true that us/our parents just went ahead and bought a house soon after we came to Canada. As Ed said “most immigrants come and after saving for years will transition from being renters to owner” which I fully agree with.

You’re also totally ignoring the part where I said that pent up demand far outstrips immigration slowdown. The majority of jobs lost during covid: wholesale and retail trade, accommodation and food services. Those jobs weren’t particularly high paying already, and people employed in those sectors aren’t really your demographics for buying “toronto priced townhouses/semis/detached”

https://www.cbc.ca/news/canada/toronto/ontario-covid19-april-jobs-1.5562034

But that’s just my opinion 🙂

Ed

at 8:29 am

As per your own quote “Per the report, approx. 40% of recent immigrants (arrived within 5 years) were homeowners;”

-40%

-5 yrs

This will not have a immediate effect. You only want to perceive it that way.

Thank you for proving your statement to be misguided.

Chris

at 8:54 am

Strawman argument, Ed.

Nowhere have I or the report said the impact on home purchases from lower immigration will be immediate. Clearly, most immigrants don’t step off the plane and head straight out to buy a home. But 40% ownership among new/recent (read: within five years of arrival) is not insignificant by any means.

“As immigrants and non-permanent residents mostly rent when they first arrive in Canada, the rental market is likely to feel a large and immediate impact from a population slowdown. This comes at a time when markets are already reeling, as pandemic-related job losses have disproprotionately hit younger workers.

The ownership housing market will also feel the impact, as fewer newcomers purchase properties and there is less demand for investor-owned rental units. In fact, slower population growth explains about one-third of our downgraded view for Canadian sales growth through 2021, compared to our expectations in April.

Some offset will come from strong past population growth, as immigrant homeownership rates rise with a lag.”

Try actually reading the report. Then hopefully you’ll have a better understanding of what it says, and the data contained therein.

Kyle

at 8:12 pm

Connie is bang on here. Whoop dee doo if TD says immigration will slow. There is a housing crisis. So it’s only slowly getting worse instead of rapidly getting worse.

Chris

at 8:19 pm

Same response as to Ed applies here.

BeeKay

at 10:13 am

Longtime lurker here but this is the first time I have felt compelled to comment.

I can relate to the psychology and spiteful feelings that David mentions for permanent-bears because I was feeling that way in the 1980’s. I had just graduated and started on what turned out to a very successful career path in Information technology. But getting an entry point into the Toronto Real Estate market was always just beyond my reach. I was basically at number 1 on this list and somewhat bitter as a result.

1) People who can’t afford to buy what they want, and become bearish out of spite.

2) People who didn’t act, have regret, and are in denial – thus also becoming bearish out of spite.

3) People who can’t look up from the textbook long enough to see what’s actually happening.

Then the 1990’s came along. Prices came down and interest rates dropped. Now comes one of those life changing decisions. Do I say I told you so – its was a bubble – and sit on the sidelines? If I had made that choice I would now be at number 2 on David’s list and probably still bitter today.

Thank goodness, I realized it was an opportunity to buy that I might never have again.

My life would be much different today if I hadn’t bought in when I had the chance.

Regarding number 3 on the list. Expecting the world to behave like your Economics 101 textbook is a mistake. The economic models are simplified to help the student understand basic concepts such as supply and demand. I have read some advanced macroeconomics and finance texts in the last decade or so (way beyond Economics 101) and the the rising prices of urban real estate worldwide is neither surprising nor likely to change.

condodweller

at 12:02 pm

This is a good example of an alternate outcome that could have happened, and still could happen. I have told a similar story of what happened with my parents who were also looking to buy during the 80’s. They started looking I guess during the mid 80’s but at least a few years prior to the crash. Right at the height of the market they got frustrated and started looking at alternate financing in order to secure a 3 bed condo for IIRC around 300k. This was at the time when banks wanted 25% down and while in some case they provided a second mortgage at a higher rate, if you didn’t have 25% you were out of luck. They became a spiteful bear according to David’s definition and decided that prices were just too high and it was not worth buying, and started saving for a larger down payment.

This is the point where people who buy David’s narrative would say he is absolutely right. It makes no sense to wait as prices only go up in the long term. You would be forgiven to think that my parents made a mistake and lost out, were priced out and became bitter renters who never ended up owning their home. Well, you’d be wrong.

What actually happened, as most of us know the market did crash. What’s more, when it did crash it continued to decline for the next 7 years and if you look at David’s chart of housing prices didn’t recover until around 2004 or 2013 if you factor in inflation.

Some might think that my parents bought after the crash and have been happy home owners ever since. No, they bought several years after the crash. You might also think that was the best possible outcome as they bought at the bottom. No, the bottom didn’t occur for another few years. Interestingly, they were still thinking that prices were high and were reluctant to make the purchase. They actually credit me, as a teenager at the time, for telling them that even though they thought the price was still high and the payments would impose some financial difficulty going forward, their rent would continue to rise but their mortgage will stay constant, for the most part (it actually went down due to lowering interest rates) and it would end one day. This is exactly what happened. They still had to take on a second mortgage to come up with the 25% down on which they made accelerated payments to eliminate, then they applied that to the mortgage which they also paid off early that allowed them a comfortable rent free/mortgage free life prior to retirement. If you think that’s not such a big deal, then consider that they were immigrants who were over 40 when they arrived to Canada.

Regarding the idea that they lost out by waiting as many might think, well think again. They were renting a three bed apartment for about $600. The rent would add up to about $20k for about three years after they decided not to buy the condo for about $300k. They ended up buying a semi detached house for less than $200k. It cost them $20k to save $100k plus interest on that $100k had they bought pre-crash.

As I have said before, the higher the prices go, it just might make sense to hold off.

M

at 12:44 pm

Bears- using pre-2008 economics/central bank policy to conclude that assets prices are overvalued, haven’t adapted and are wrong.

Bulls- overconfident in their ability to interpret the market, they make the correct choice without even realize the reasons for it working.

Where will future prices go? That depends on to what degree you think governments and central banks can manipulate markets.

Bulls are cocky even though the government is ‘cheating’ for them.

Bears are salty because they don’t understand how they’re ‘losing’ the game even though they’re playing by the old rules.

Appraiser

at 3:37 pm

@M Is it your position that the government is “cheating” on behalf of the bulls because of the current bail-out conditions (ie. CERB etc.), or for the past 40 years as well?

M

at 8:24 am

For the past 40 years. By cheating though I just mean interfering in a free market more towards a pro-homeownership stance, and I don’t think that’s a bad thing.

J

at 12:56 pm

The quality of the Dow Jones chart above makes it hard to compare against Toronto home prices. But the fact is that a $50k (average Toronto home price I read from the chart for 1974) would have grown to $8.3 million invested in the S&P 500 from 1974 to 2019. Last time I checked that buys a bit more than the average house (but maybe I should wait for the July stats).

Sure, gains in equity investments aren’t necessarily tax free, but then again if you consider TFSA/RRSP plus ~10% round trip transaction costs and large costs of ownership for real estate, the playing field is more even.

Those would-be buyers of the $340k in 2011 would have seen that amount grow to $1.4 million invested in the S&P 500 until 2019. So if they made good choices I don’t feel too badly for them.

The comparisons between investing in equities and real estate are always murky mostly because real estate buyers typically use leverage, but leverage cuts both ways (ask a condo speculator who was already cash flow negative pre-COVID).

This post insinuates the dangerous notion that you need to buy right now or you’ll regret it. Bottom line, buy only because you want to AND can afford to, or you may suffer even in a bullish market. Complete morons don’t always get shit-rich in real estate, nor is real estate the only means to get shit-rich.

(By the way, I don’t think I fall into any of those 3 categories. I own a house in Toronto which I bought last year at what I would consider an inflated price, but only because I wanted it and could afford it. My only future hope/expectation of the house is that the roof continues to keep me dry.)

Logan

at 1:27 pm

You’ve made some great comments here, which I agree with.

Real estate allows one to use leverage, which you and David have commented on, but real estate also has a lot of associated costs like property taxes, insurance, maintenance fees, general maintenance & repair, etc, which equities don’t have.

David wrote: “…there’s a complete moron who got shit-rich by simply buying a house or condo in the city.” Unless said moron is willing to significantly downsize, or sell and leave the GTA, I question how rich they actually are.

Caprice

at 2:27 pm

Plenty of said “morons” have made out like bandits by buying multiple rental properties in the last 20 years.

jeanmarc

at 3:13 pm

I do not fit any of the above 3. Bought my first property back in 2000 for $237K. Even though I no longer own it, the value is approx $930K two years ago. RE will always be a good purchase that will always increase in value with the desired locations.

Peggy

at 4:11 pm

In 1993 my husband and I were tenants that were living in a crummy warehouse. A friend of ours asked us if we wanted to rent his house, as he was leaving. 3 months after we moved in, the landlord announced that the house was going to be put up for sale. Did we want to buy it? The decision had nothing to do our attitudes and ideas about the real estate market. We just didn’t want to move–which is why we bought that house!!

David Fleming

at 3:19 pm

I’m late to the party here.

Something I regret not including in the post above, which I feel may have got ahead of many of today’s comments:

1) Appreciation on a primary residence is a tax-free capital gain.

2) Buying stocks and buying a primary residence should not be compared because they are purchased for completely different reasons.

A lot of the folks on here want to continue to talk about Tesla’s stock in comparison to the discusson about the real estate market, but unless you’re living in your Tesla, I don’t understand. Guys like J G, Chris, et al are investors, and having conversations stricly about real estate as an investment.

My stories about perma-bears involve people who didn’t buy their HOME because they felt the market would plummet. I’m not talking about timing the Nasdaq, guys.

A very, very small percentage of house purchases are second properties being used as investments. Most are primary residences in which people live, sleep, eat, and raise their families. These gains are tax-free.

And without getting into politics today, I will say that the current social climate out there (not to mention Trudeau’s half-billion-dollar debt) will lead to a tax bracket over 60% in a decade. You heard it here first. So all the more reason to value the tax-free capital gain on a primary residence.

J

at 3:37 pm

I do agree that comparisons between buying a primary residence and investing in equities are not usually very useful (in spite of my comparison above).

But the two ideas can converge when considering “buy now” FOMO. If a primary reason for buying is to avoid missing out on future gains, your strategy needs rethinking in my opinion. If it’s not the perfect time to buy, short-term and long-term historical investment returns demonstrate that you may not fall behind and might end up ahead by deferring your purchase, even in a strong RE market.

Chris

at 3:40 pm

“Guys like J G, Chris, et al are investors, and having conversations stricly about real estate as an investment.”

Correct. I’ve said many many times that rent vs. buy has far too many nuances to make any broad sweeping generalizations upon. If you want to own a home to live in, buy within your means, plan to stay there for a sufficient length of time, etc., in a lot of cases it makes sense even if one thinks valuations are elevated.

“I will say that the current social climate out there (not to mention Trudeau’s half-billion-dollar debt) will lead to a tax bracket over 60% in a decade. You heard it here first. So all the more reason to value the tax-free capital gain on a primary residence.”

I’m less certain of this. What I think is a certainty is higher property taxes. Tory floated the possibility of Toronto property taxes increasing 35% just the other day.

What I would also keep an eye on is a scaling back of the capital gains exemption on principal residences. I’m sure we all remember Adam Vaughan’s leaked memo about having capital gains taxed at a level that decreases the longer you owned your home. Governments of all stripes are going to be in dire need of tax revenue as we come out of this pandemic. It’s not a certainty, but real estate could be an alluring target for them.

jeanmarc

at 7:00 pm

David,

“2) Buying stocks and buying a primary residence should not be compared because they are purchased for completely different reasons.”

I disagree with part of this statement. Back during the dot.com days, I was heavily invested to help build up my net worth (i.e. CMGI, Lycos, Broadcom, Brocade, Broadvision, Intel, Cisco, Microsoft, Oracle, I could go on on) in order to buy my first property. This may not be for everyone due to risk tolerance. I am sure others have their own stories.

Verbal Kint

at 7:52 pm

If the good Lord hadn’t wanted people to compare the relative merits of homes and stocks (and avocado toast…), He wouldn’t have priced them all in dollars.

Logan

at 4:53 pm

Was I feeling bear-ish towards real estate from 2010-2017? Yes

Do I wish I bought my primary residence sooner than October 2019? Yes

Did the down payment I used in October 2019 sit as cash for the past 10 years? No, it was invested in equities, and I added to my positions as I worked and saved. And yes, I paid my capital gains taxes when I cashed out.

Would I be further ahead had I purchased my primary residence in 2010? Maybe? Likely. I haven’t done the math, but that missed opportunity was somewhat mitigated by being fully invested during that time period.

Kyle

at 7:54 pm

This post is bang on David. While you were gracious enough to try to give many of the resident perma-bears that comment here a pass, i think the regular readers knows that your description describes some of the resident perma bear commenters here to a T.

No matter how many empty theories they come up wh only to see those theories fall flat on their face, and no matter how many times the bulls prove to be right, it’s always the same with them – let’s look to the future and pin all our hopes on some new empty theory that might finally bring about a RE crash. Quite literally the very definition of insanity as you say. Or more like dogma or religion as i would say.

For the average readers who come here looking for useful information, i would highly recommend you go back and read the comments and consider the track record of any of the commenters before applying any weight to what they say. Over time when you’ve read the blogs and comments, you will realize there are some people who have real life experience are een watchers of the market and are in a good position to speak and who come here to share useful information. Then there are those who are absolutely in no position to speak, who keep pumping their same narrative, no matter how absolute garbage that narrative is.

Chris

at 8:18 pm

Tell us how you really feel.

Christopher

at 9:07 pm

A long time ago I made a table of the monthly mortgage payments using the discounted 5 year fixed rate to see what people are actually paying For an average home. I haven’t run the numbers, but considering that rates were at 3.5% in 2018 and are now at 2.3% I don’t think payments have actually increased at all. I’m agnostic about the price of homes in the GTA and bearish on the ability of people to take on higher monthly mortgage payments. Interest rates and amortization periods will have huge influence on what happens to prices going forwards.

J

at 9:39 pm

June 2018:

TREBB Average Home Price – $808,066

5-Year Fixed Discounted Mortgage Rate (from Ratehub) – 3.04%

Monthly Mortgage Payment (with 20% down over 25 years) – $3,073

Monthly Mortgage Payment adjusted for inflation – $3,135

June 2020:

TREBB Average Home Price – $930,869

5-Year Fixed Discounted Mortgage Rate (from Ratehub) – 1.99%

Monthly Mortgage Payment (with 20% down over 25 years) – $3,150

Monthly Mortgage Payment adjusted for inflation – $3,150

It’s hard to underestimate the correlation between interest rates and home prices (but also hard to predict where interest rates are going).

Christopher

at 10:44 pm

Thanks for running the numbers! Recording setting prices but affordability hasn’t changed much at all the past few years. If I recall correctly prices doubled from 2007 to 2014 with no change to mortgage affordability due to falling Interest rates. The real decrease in affordability for GTA real estate all happened happened from 2014 to 2018 and we’ve been holding steady since then as you’ve just shown.

Jimbo

at 9:34 pm

I did the same a year ago. The monthly is driving the price, I’m not sure where it tops out at of interest rates stay at 2.5%.

condodweller

at 11:07 pm

My parents’ interest rate in the early 90’s was about 12%, mine in the mid 90s was about 7% which has steadily decreased to current rates. Based on price action over the last few years, it seems that on average people can afford $900k. The BOC policy rate is at 0.25% and they have stated that they are not interested in negative rates. Therefore at most there is another quarter % cut possible. If it is true that the reason prices have gone up is due to lower rates, not because people can afford higher prices then it follows that we are near the top with prices.

This is the reason I found it interesting when people picked 2030 to regain previous highs. I realize that David has called them brutally wrong but without the 1.5% rate cut post covid I doubt we would have reattained the Feb high. I also think that those who think the reason we reached the high was due to a surge in pent up demand are partly correct. It was likely the two items that contributed.

I believe it was Jeff who said we will never reattain the previous highs adjusted for inflation. That was an interesting call that I thought might happen and now that rates are almost at 0 and we are at a new high I think that we are very close to an all time high in prices unless there is a significant increase in income in the future and we do not get negative rates.