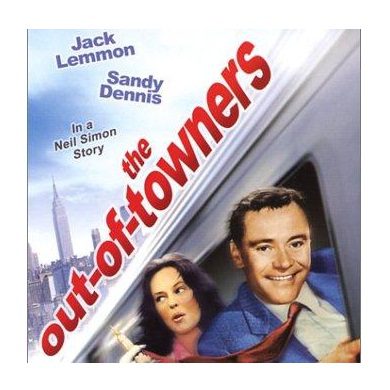

In the movie, “The Out Of Towners” from 1970, starring Oscar-winning actor, Jack Lemmon, the story revolves around a husband and wife, who (as you might guess….) are from out of town, and end up in New York City, suffering problem after problem as they fight their way through new territory.

In today’s real estate market, I’m finding that the out of towners are creating problem after problem, as they try to work, and advise clients, in markets with which they are completely unfamiliar.

Lawyers, mortgage brokers, appraisers, home inspectors, and realtors – those people who guide buyers and sellers through the process of transacting in real estate, often have absolutely no clue what’s going on outside their home turf…

Recall my blog post about the out-of-town lawyer, who advised his buyer (not my client in this case, as I was representing the seller), to back out of a deal because he felt that $0.50/sqft maintenance fees were outrageously high, even though they are among the lowest in the city of Toronto.

He was trying to find issues where there weren’t any, and objected to the condo corporation running a budget deficit one year, even though they had a surplus the next.

He was from Quebec. The deal was in Toronto. Go figure. You can read the whole story HERE.

Every person has a different threshold for risk, and a different level of conservatism.

I’m sure that somebody read my blog post and said, “Well, if the buyer’s lawyer felt that the lobby should have been made of Belgian chocolate, and it wasn’t, then who are we to disagree with a lawyer?”

I suppose there’s some merit to that.

By the same token, you might disagree with some of the following stories I’m going to tell, but I think that generally speaking, a lot of out-of-town lawyers, mortgage brokers, appraisers, home inspectors, and realtors are giving their clients poor advice, because they don’t know the market that their clients are working in.

I’ve seen this time and time again over the past few years, and since Toronto’s real estate market is probably the hottest in Canada, and one of the hottest on planet earth right now, it take a certain level of knowledge of the market to be able to advise clients who are working in it!

I’ve seen, either through my own experiences or via that of my colleagues, real estate transactions being lost because of the advice of a professional who was working out of their comfort zone.

Just listen…

Last month, one of my clients was making an offer on a property in Queen West, that was an absolute show-stopper.

It was probably the nicest property of its kind to come out in recent memory, and like any other property in Toronto these days, it was going to get multiple offers.

My clients were pre-approved for a mortgage, in fact, they were pre-approved for far more than the price they would be offering on the house.

All buyers are pre-approved for mortgages these days, right? Isn’t this a given in today’s market?

Anyways, my buyers met with me to sign the offer, and one of them said, “Our mortgage broker told us to put in a financing condition. Is that okay?”

I said, “There are eight offers on the property, and I think we know that they’re going to be unconditional, and the sellers certainly aren’t going to accept a conditional offer on their home tonight.”

My clients were nodding along. They knew this. But they just had to talk through it.

“Our mortgage broker said…..I know it’s weird, and wrong, but he said……to put a condition in the offer, just in case we want to get out of the deal.”

Get out of the deal?

What kind of market are we working in?

Make no bones about it – we are absolutely, positively in a pure seller’s market when it comes to single-family homes, and no buyer has the luxury of choosing to “get out of the deal,” if they so choose. Buyers, in fact, should be so lucky to be the “winner” in multiple offers, with their clean offer, against seven other buyers.

We went in with no condition, and we got the property. My clients are moving in July, they’re over the moon happy, and who knows would could have happened if they’d listened to poor advice…

A colleague of mine told a story last week at our Monday morning meeting about appraisers, and how some of them have no clue what they’re doing.

He sold a one of his listings in the midtown area, and the buyer provided a firm offer, with no conditions.

The buyer’s mortgage lender sent out an appraiser, as is the procedure, only this appraiser provided a value of $100,000 below the purchase price.

This wasn’t rocket-science here; it was a 3-bed, 2-bath semi-detached house with a finished basement, main-floor family room, and parking, that sold for $900,000.

But the appraiser, who was from Burlington, used 22 comparable sales in his “report,” and HALF of those “comparable sales” were more than 5 KM away from the subject property.

How about this: how about compare apples to apples? If you’re looking at semi-detached houses in Leaside, then why would you compare them to semi-detached houses at Woodbine & Danforth?

Another colleague told the story of a buyer-client who hired a home inspector who freely admitted that most of the houses he inspects are in brand-new sub-divisions north of the city. He then came down to inspect a listing in Cabbagetown, and gasped at the condition of the home.

He had no basis of comparison, since a 100-year-old Victorian contained features and styles that were completely foreign to him. At least he was an honest guy, and while he tore the property apart in his report, he filled it with circled question-marks, and told the buyer to seek a second opinion.

Don’t think I’m laying the blame on everybody but real estate agents. I’ve got a few stories about them as well…

A listing agent I spoke with over the weekend (from another brokerage) has a loft listing in the downtown core, listed at $470,000, and he got an offer from an agent who works in Pickering. This agent sent him a dozen “comparable” sales, both in the building, and in neighbouring buildings, from upwards of TWO YEARS AGO. She argued that his price was too high, based on comparable sales, but refused to acknowledge that prices had increased.

Maybe prices stay constant in Pickering…

Another colleague of mine just sold her house – listed at $999,000, for just shy of $1.3M, with ten offers.

One agent showed up in person – with his clients, and presented an offer for $999,000, that was conditional on the sale of his clients’ house. He was from Ajax, but he may as well have been from the moon.

Now back to a story of my own – a client of mine here in Toronto just purchased a condo in Oakville, conditional on financing and a review of the condo’s status certificate.

Her mortgage broker told her that she had to sell her condo first, and couldn’t believe that she went out and bought a condo without selling first.

Let me say this: in today’s market, about 95% of my clients BUY first, then sell afterwards.

This guy was living in the 1980’s.

But as if that wasn’t bad enough, he insisted on getting an “original copy” of the Agreement of Purchase & Sale for her deal in Oakville.

Really?

An original copy?

Yes. He said it had to be hand-signed, and couldn’t be faxed, scanned, emailed, or any combination thereof.

This was a first for me. In ten years, I have never seen a mortgage broker (or lawyer, or agent…) insist on an original signed copy of an Agreement.

When I see a house on Glencairn Avenue get SEVENTY-TWO offers, I know that there are 50 buyer-agents who didn’t do their job.

But lawyers, mortgage brokers, home inspectors, and appraisers can provide advice that’s just as bad, if not worse.

I tell my buyer clients, “In a perfect world your real estate agent, mortgage broker, and lawyer will work together to make this purchase as easy as possible.”

But there are a lot of people involved in a transaction, and a lot of moving parts.

Get one piece of bad advice from one of the parties involved, and it can throw the whole equation out of whack.

So for the love of God, if you’re buying a house in Toronto, don’t use a mortgage broker from Ottawa, a home inspector from Barrie, and a real estate lawyer from Ajax, and a Realtor who works in St. Catharines, but says she can learn the Toronto market on the fly.

Disagree if you want, but I just don’t trust the out-of-towners…

Monika

at 8:38 am

am I correct in assuming your Oakville buyer used an Oakville agent on the buying side?

David Fleming

at 1:43 pm

@ Monika

That’s correct.

I don’t know condos in Oakville, so I told my client that I would be doing her a disservice if I represented her.

I practice what I preach.

Paully

at 8:16 am

That brings up a good question: How should someone who is being relocated find a great agent in a new town that they know nothing about?

Jason H

at 9:26 am

Well I know it goes against what David has spoken about in the past and I relocated and had to find a good agent (in an area David is not in) and went through Zoocasa. The agent we recently used to purchase (and I’ve had 4 different ones to date) has simply been phenomenal and highly rated within their broker (Remax).

Worked for me.. maybe it’ll work for you.

George

at 10:12 am

The common denominator in all of this is people. More than a few people are not particularly clever. Luckily, there are only a few billion of us, or else the universe would be in big trouble.

I have a request about waiving the financing condition…

Have you ever seen waiving the condition backfire on a potential buyer, or is that something that is exceedingly rare?

David Fleming

at 1:42 pm

@ George

If you have a mortgage pre-approval, and you submit an offer without a condition, the pre-approval can still be pulled by the lender at any time.

But even if you have a condition, and the lender says, “you’re good, go ahead and waive your condition,” they can still pull financing at any time.

I think in this market, anybody can get financing. If you’re approved for $800K, and for whatever reason, the lender pulls the committment (which is very rare, but it can happen), there are twenty other lenders lined up to give you financing.

Spiltbongwater

at 11:47 am

I think there is a large level of risk in buying first and selling after. Why not sell first, rent a place for year, and buy while renting?

Potato

at 8:57 pm

There’s also a large level of risk to not including a financing clause when you do in fact need financing.

But people in this market aren’t concerned with tail risks of large magnitude, rather the more probable risks of moderate inconvenience. Could you imagine the horror of selling first and not finding a new place with matching closing date, and having to rent? Or put stuff in storage?

Geoff

at 10:43 am

It’s calculated risk on all sides. No need for such sarcasm. Especially if you have children, managing the logistics of a move is very complicated, and can involve changing school districts, finding daycare (impossible!), managing traffic patterns, and more. Also given how lucrative selling houses are, finding a whole house to rent, in a neighbourhood you want to live in, is not a given either. Logistics is a bitch, and it’s not ‘moderate inconvenience’ to bounce your 5 and 8 year olds around from school to school. And yes, TDSB is very picky on school boundaries.

Kyle

at 8:16 pm

I think it depends on what you’re selling and what you’re buying. But at the end of the day bridge financing for up to a month is not a life and death situation, and in fact can make the move a lot less stressful if there is a little overlap.

A Grant

at 8:21 pm

Honestly, as an “out of towner” living in Ottawa, that’s one of the reasons I find your blog so fascinating. It gives an honest picture of a real estate market that’s so foreign to me. For instance, the idea that 95% of your clients BUY first, then sell afterwards. Given how soft the market is in Ottawa, that just seems insane to me. Especially if you’re moving from a condo to a house, in which case to can pretty much guarantee that you’ll be carrying two mortgages for a significant period if you buy first.

Ed

at 11:46 am

David, I thought this might bring a tear to your eye.

http://news.nationalpost.com/2014/05/13/the-broadview-hotel-aka-jillys-strip-club-has-been-sold-to-a-real-estate-developer/

Ali Javaheri

at 1:10 am

Great blog post, this post is described well about The Out Of Towners. This post is really helpful for everyone. Well done and keep sharing