I hope everybody is well-rested, and had an awesome holiday break!

While I don’t mean to continue this “Top Five” trend that finished 2015’s blog posts and now adorns the subject-line at the top of the site today, I would be remiss if I didn’t provide some sort of “intro to 2016,” as well as talk about the year ahead.

Trust me when I say that I didn’t set out to repeat subject matter we’ve talked about before, but rather after two weeks of pondering what the “top stories” would be as we head into the 2016 real estate market, it ended up being the usual suspects, as you’ll see below…

I swear, I think I have the cleanest and most organized condo in Toronto.

Don’t get me wrong, I relish the opportunity to have ten days off, relax with my wife, and enjoy some down-time.

But I’m not really good at sitting around.

And eventually, I clean.

I clean, and I organize. And I never know where I’m going to end up once I’ve started.

On Christmas Eve, my wife and I got back to the condo around 3:00pm, with plans of “relaxing” and having some drinks. We parked the car in the underground space, and I went to the locker to get her winter coat out of storage.

The trip to the storage locker got me thinking: why don’t I clean out the hall closet in the condo? We need to switch over our summer gear for our winter gear, so I may as well do an inventory, de-clutter, and clean in the process. Simple enough, right?

But while cleaning and organizing the hall closet, I needed to put a few things into the bathroom cabinet, which also needed to be cleaned and organized. And upon starting that job, it took me into the den, which had been accumulating excess items for two years. You know where this is going…

That saying, “It’s going to get worse before it gets better” certainly rings true, and my wife was distraught over the mess I’d made, even though I said I was going to clean!

But by 8:30pm, I had cleaned and organized my entire condo storage locker, the hall closet, my bathroom vanity, the storage bins and work space in the den, and the pantry in the kitchen.

One space leads to another, and that leads to another after that.

What is the point to this story?

Well, I’m glad to be back at work. And I think my wife is happy to have me out of the condo as well.

Time off is great, but too much time off can be counter-productive.

I feel like I’m “back at school” after a long Christmas break, or summer break, or any break that brings about new beginnings.

While some people expect the 2016 Toronto real estate market to pick up exactly where it left off in early-December before things really slowed down, I think it’s going to take two weeks to really ramp up.

As for the big picture, I’d like to look at five topics which I think will are not only hot topics today, but will serve as hot topics throughout the entirety of 2016.

1) The Market

I really don’t want to spend a lot of time on this, since it’s always at the top of these lists.

But yes, the number-one story of this year is going to be the market in general, and what happens with prices.

And while I’m usually focused on Toronto, as most of us do, I think this year we’ll want to keep an eye on both the Toronto market, and the Canadian market as a whole.

As I wrote in my end-of-2015 blog post, the average price of a Toronto home increased for the eighteenth straight year. That’s every year from 1997 to 2015, and the average price has gone from $211,307 to $567,198 (using November’s numbers, since December’s weren’t in yet).

Now to be fair, those 18-straight-increases come after the market topped out in 1989, and bottomed out in 1996. So it seems to reason that after hitting a bottom in 1996, the market would respond.

But eighteen straight years?

THAT is what people continue to talk about.

When will we see prices remain flat, or even……wait for it……drop?

Not this year, in my opinion.

Oh yeah, I know, I know, I’m a real estate agent, so what else am I going to say?

But I’m not saying the market will continue to appreciate because I want it to, but rather because it’s an easy prediction by which to be proven correct.

How much the market goes up is more the question.

And as I said at the onset, I think we’ll want to focus on how much the Toronto market increases, and how much the Canadian market overall increases.

Using the November 2015 vs November 2014 numbers, the following markets have decreased:

St. John -8.0%

Calgary -3.7%

Edmonton -3.1%

Saskatoon -1.9%

Quebec City -1.3%

And the following markets, again, based on November numbers, have seen less than 2% growth in the past year:

Montreal 0.5%

Ottawa 1.4%

And while Vancouver’s market went up 16.1%, Victoria’s 6.2%, Toronto’s 9.5%, and Hamilton-Burlington’s 8.3%, we’re going to want to know what’s going on outside the two meccas of Canadian real estate.

2) Interest Rates

Another boring topic, right?

Another topic of far, far too much discussion, perhaps?

Well whether it’s boring or not, it’s important. And the real estate bears think that interest rates are what will ultimately crash our market, and send it into a 40-50% correction.

Some, real estate bears, that is.

Some of the bears that I know see a “correction” in Toronto as being 10%, which isn’t really a correction, but more of a “fluctuation.”

In any event, I’m not denying that an increase in interest rates is going to have an effect on the market. But I would want to ask:

1) How much of an increase are we talking?

2) When is this going to happen?

Perhaps the second question is easiest to answer first, and that answer is likely: “not any time soon.”

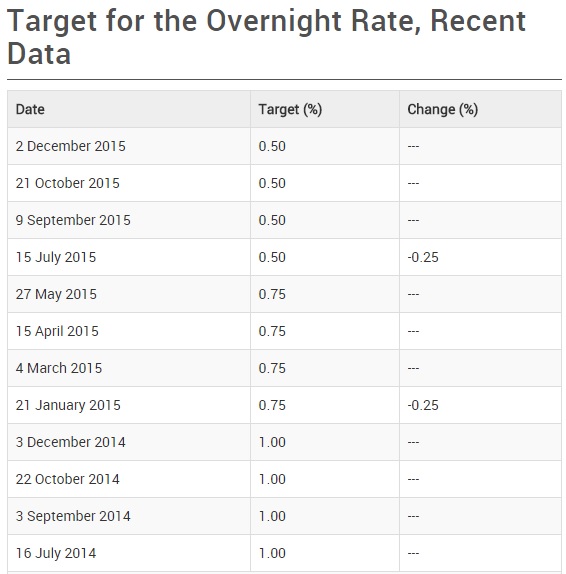

The Bank of Canada, while rumoured to raise rates all through 2015, actually cut interest rates twice!

The first interest rate cut caught everybody off guard, and the second was surprising, but not completely unforeseen.

We all know that the United States Federal Reserve raised their interest rate in December for the first time since 2006. The increase in the interest rate is significant, but let’s not forget that their rate was at 0% to begin with, and that rate had been at zero since December 16th, 2008.

I’ve never been a fan of comparing every single thing we do here in Canada to the U.S., and I don’t think their raising of interest rates says anything about our market, bad or good.

So back to the first question above: how much of an increase are we talking about?

The Bank of Canada overnight lending rate is currently at 0.5%, down from 1% around this time last year.

Keeping in mind that a 25-basis-point, or 0.25% drop in the overnight lending rate does NOT directly translate into a 0.25% drop in the rate on a 5-year, fixed-rate mortgage, dare I say that even if we went all the way back to an overnight lending rate of 1%, it would have virtually no effect on the Toronto market.

That is to say that if the overnight lending rate DOUBLED from where it currently sits, there would be virtually no effect on our market.

Disagree if you’d like, but with a 5-year, fixed-rate mortgage sitting somewhere around 2.69%, would an increase to, say 2.99% really shake up the market?

How about an increase to 3.29%? Or 3.49%?

Because we are a ways away from that!

I’m of the opinion that until we see the 5-year, fixed-rate mortgage head over 4% , you won’t be able to “feel” an effect on our market here in Toronto. I say “feel” because I’m sure there would be some data out there to suggest something to the contrary, whether it’s the amount of loans being written, or approvals, or what have you. But until we see a $649,000 house go up for sale that “should” get eight offers, and 120% of list price end up selling for $649,000, I wouldn’t say we’d be “feeling” the heat.

3) “Other” Real Estate Options

I’ve written about this before in the past, but what “other” options exist for those folks who can’t afford to buy a house in Toronto?

Not a condo, but a house?

I was out for dinner on Saturday night with some friends, and we were catching up about the whereabouts of this person and that person, from way-back-when.

I was asking my one buddy about his group of friends from university; “What about so-and-so, what’s he up to? Where does he live”

I was amazed to hear that one friend-of-a-friend, who had previously owned a condo in downtown Toronto, and then rented a larger unit, had bought a house in Port Credit with his wife, and takes the GO Train into Union every day as he works for a bank.

Another one of the “other guys” lives in Burlington with a wife and two kids, in a 4-bedroom house, and he too commutes into downtown Toronto every single day to work for, you guess it, another bank.

Yet another one of these guys lives in Oakville, and one in Orangeville (although he’s a professional poker player, so I suppose he can live anywhere).

So either my buddy’s “university crew” really doesn’t like him, and have all moved away from him, or there’s a growing pattern here.

One of my long-time clients who lived two blocks from me down here in the St. Lawrence Market area bought a house in Oakville last November, and are two weeks from saying goodbye from Toronto-living. He’ll still commute into the downtown core every morning, but his wife will be working in Oakville after her maternity-leave is finished.

In 2014, I believe I had two or three clients sell their condos and move out of Toronto.

In 2015, I had four.

Perhaps you can’t draw a conclusion from either my dinner-time conversation with a friend, or the slight uptick in clients who I moved out of Toronto last year, but either way, this is a story that’s working keeping tabs on.

4) CMHC Policy

God, these topics really aren’t sexy eh?

For those of you that are more akin to my “Photos of the Week” blogs, I promise the content will continue to fluctuate.

But we all know the CMHC can have a massive effect on the real estate market by the policies they update, change, or implement, and we need look no further than how busy they were in 2015 to see that.

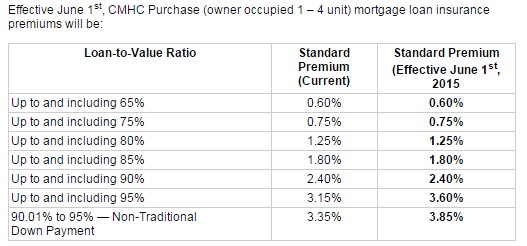

In April of 2015, the CMHC announced that the insurance premiums for mortgages where the buyers have less than a 10% down payment would be increased by approximately 15%. These changes took effect on June 1st, 2015.

In June of 2015, the CMHC announced that they would allow homeowners to count income from their secondary units when qualifying for a loan. These rules took effect on September 28th.

In December of 2015, the CMHC announced that the minimum down payment rules were changing, effective February 15th, 2016. The 5% down payment remains for houses under $500,000, but now buyers must have 10% down on the amount between $500,000 – $999,999.

One year, three big changes. Two expected to have a “cooling” effect, and one expected to fuel the real estate fire.

Suffice it to say, I don’t think the CMHC will sit on their hands in 2016.

5) Millennials In Toronto’s Real Estate Market

This is a topic that deserves more than whatever space and time I have left right now.

So let me dedicate a full post to this, and thus I’ll leave things here, and come back to this on Wednesday…

A Grant

at 9:07 am

With respect to your thoughts on the market and “other” real estate options, it would be interesting to see the price decreases mentioned above broken down by downtown-suburbs-exburbs. I’m assuming that, in markets where prices depreciated, houses in the core fared better. Or did bidding wars mean that prices downtown areas had further to fall?

Not to say that housing prices in Toronto will drop this year, but as a thought experiment, it might be interesting to see how similar decreases would impact neighbourhoods like Leaside or the Annex vs. neighbourhoods in north Scarborough and Etobicoke.

And happy new year David!

Mark N

at 10:23 am

Happy New Year David!

One thing to consider in seeing the ‘university crew’ moving from condos to houses in the burbs is their age demographic – mid 30’s – and their reproductive phase of life. Moving from a 2 bedroom condo to a 4 bedroom house becomes a practical necessity when you are adding 2 children to the equation. And as you said about one of your clients “his wife will be working in Oakville after her maternity-leave is finished”.

You are describing age cohort that is in need of more living space but are often too early in their careers to afford that increased space in Toronto, and hence they decamp to the burbs.

What about considering a wider range of age cohorts including older and more established buyers, empty nesters etc?

Jim B

at 10:52 pm

The addition of two kids makes adding two bedrooms a “necessity”? Damn, wish my parents knew that back in the Seventies, when I shared a room with two brothers (with another brother and sister in bedroom #3).

McBloggert

at 9:24 am

We Millenials live in a gilded age, I am pretty sure if you packed four kids into two bedrooms child protective services gets called in…I am not sure though – but I don’t want to find out.

However, I think most professionals earning good salaries expect a certain standard of living they have set for themselves and if they can’t provide that in the core, then the suburbs might be the answer. Cramming kids into a $850K condo or moving to the burbs? I think some people are taking the latter.

That being said, according to a few articles I read last year, the appreciation of certain burbs are outpacing even hot pockets in the core. It is crazy to see the year over year increases over 10% in areas we traditionally would never think of as being desirable – admittedly with our, and perhaps our media’s very downtown/mid-town focused perspective.

Here is a fun game for you, give yourself a $1M budget and go “shopping” in Richmond Hill, Markham, King City and Oakville. It is surprising, but your budget may not stretch as far as you thought! Sure there are some crappy new subdivisions, but if you want prime locations in these areas – you aren’t getting much for $1M. Heck, I was poking around Old Oakville and Lorne Park for fun on MLS and you are getting tears downs for $1.5M…

condodweller

at 12:53 am

Happy New Year!

I must say these top 5 are very unsurprising, except for maybe #5. Let’s hope that jobs in Toronto are not going to become a top 5 issue this year as I believe it is the biggest risk to the market. With BOC talking about negative rates in Canada I don’t think rates are going to be an issue this year resulting in a solid mid single digit price increase in the GTA. The CMHC seems to be spot on with their policies and it’s going to be which change finally breaks the camel’s back and is it going to be this year. I am for one looking forward to the millennial story as apparently they are now the largest segment of the population.

I suspect the Toronto rental market might make an appearance in the top 5 this year which nicely ties in with the millennial story.

Boris

at 10:15 am

BoC rates are going lower this year, not higher. That doesn’t mean mortgage rates will go lower, possibly they are slightly higher.

Canada is in a tailspin and it’s just accelerating. We will look back in two quarters and a recession will be called for the period we are currently in. Data now is still backward looking but collapsing. Check out Western Canada’s new EI claims data….its starting…

lui

at 1:15 pm

Alberta seen a 150% increase in the food banks usage and the pawnshops are filled to the brim with luxury items for sale,its a recession proof business.Commercial real estate has already has a excess of 5% when it was less 1.5% only 9 months ago with more new units coming online but owners are not lowering prices yet but will have to if oil slumps continues to 2017.Rental units that once was occupy by oil sand workers sits empty,almost 35,000 units been listed with no renters in sight but rents still have seen little reduction.Owners are hoping for a slight recovery.

Boris

at 9:24 am

Pow, called it:

http://business.financialpost.com/personal-finance/mortgages-real-estate/royal-bank-of-canada-raises-rates-on-new-mortgages-starting-jan-8

Rates lower, mortage rates slightly higher

rob fjord

at 10:32 am

interesting real estate charts from armstrong….

http://armstrongeconomics-wp.s3.amazonaws.com/2015/10/Real-Estate-Advertisement-2015.jpg

Chroscklh

at 10:42 am

David – this good top topic to think about as head to the 2016. On the interest rate, buyer should recall mortgage rate function of 5-yr Gov of Can bond. This bond move with BoC interest rate policy yes, but also move in spread to U.S. Treasury 5-yr. With central bank policy divergence, Fed may raise few more time in 2016, which may pull GoC 5-yr (and mortgage rate) higher a bit. But pathetic Canadian economy and pathetic CAD mean probably not much – and if BoC lower rate too, effect less pronounce for sure. But on the house price, I think many market protect but if int rate stay low cuz economy suck more than baby bear on momma teet, Chroscklh can’t see much appreciate before market throw hands up. Then this 2-3 yrs from now and the int rate start go up too. Is culminate in maybe several yr flat growth? No big deal but feel bad anyone bought $100k over ask in Sept. But is all relative – back home my country over holiday, value of house depend on if Putin annex it. Him no annex – good location, many bear, is very stable market. Until tank show up and Putin begin measure window for curtain.

David Fleming

at 11:44 am

@ Chroscklh

Sooooo…….our search party found you?

Happy New Year!

Chroscklh

at 3:34 pm

Please be to having good year to you as well! I was in eastern europe for couple month – have property there which if no live in for many years, villager can squat and take for self. Govt no protect cuz this their main source revenue – take you house, sell it back to you.

lui

at 10:51 am

I enjoy seeing the “handyman” specials done by DIY renovators but do a video of it instead of snap shots.Markets will be affected by China possible meltdown in 2016 which has already shown signs that investors are getting very nervous and the government cannot keep on spending billions of dollars to stop the bleeding each time the market hits the sell button.Toronto and Vancouver markets will do well Alberta is going to be heading south in 2016 and I will be deny the promotion again this year because of political BS in the office.

Joel

at 4:34 pm

If anything I think that would cause more money to come from China to Canada as they look for a safe place to park their money.

Joel

at 1:28 pm

I think another thing we will see and talk about this year is a developer doing something shady. We saw this last year with the developer that sold their almost done condos to a REIT and I think we will see something as outrageous this year again.