God, did I ever miss writing!

There’s nothing quite like sitting at my desk with a coffee, putting on “crappy music” according to those in my office who don’t know anything from before the year 2000, and just pummeling the keys on my keyboard.

So many thoughts, and yet only three blogs in a week.

I wouldn’t say there’s one “type” of blog that I like writing more than others. The “day in the life” stories are quick writes, and make for funny topics, but they don’t really give me that release. The “big picture” topics take forever to write, but leave me feeling more productive, and accomplished.

Of course, within every blog, there’s opinion, and while I go back and edit a lot of comments and political views that make their way into my blogs, I also feel that the ones I leave in allow me to make my voice heard in a world where voices are increasingly being silenced unless they fall into the popular majority, and are scrubbed clean to not offend the habitually offended.

Sitting on the corner of Yonge & Dundas and ranting about the Greenbelt just isn’t the same as writing it all here…

I actually didn’t plan on Monday’s blog stealing the thunder away from 2019, but that’s how it goes sometimes. I like the idea of a continuous Mon/Wed/Fri blog to start out the first week back both here on Toronto Realty Blog, and in the Toronto real estate market.

So at the risk of adding too much fluff here, let’s get right to today’s topic: the top ten “burning questions,” as I refer to them, for the year ahead in Toronto real estate. I came up with a lengthy list, but whittled it down to ten. As always, I welcome your thoughts (and additional questions) in the comments section.

–

1) What will happen with interest rates?

Really? This is the first burning question?

Yes, it is. And it’s more important than the second question, because it likely has the greatest effect on the second question.

Everybody wants to know “What’s going to happen with home prices?” Which is effectively to ask, “What’s going on with the market.” Be specific, or be vague, but either way, I think we can all agree that the factor that will have the greatest potential effect on the market will be interest rates.

Now before we discuss where we’re headed, perhaps we should discuss where we’ve been.

Here’s a look at the overnight lending rate in the past decade:

As you can see from the above chart, the Bank of Canada has increased the target interest rate five times since the summer of 2017.

In 2018 alone, we saw three interest rate increases.

In the summer of 2017, the overnight rate sat at a paltry 0.5%, where it had been for two full years.

Also important to note that the rate sat at 1.0% for four full years from the fall of 2010 to early 2015, and this was after a little more than one full year at 0.25%.

There’s a lot of talk among not just market bears, but other interested and opining parties that consistently point to the culture of low interest rates over the past decade as a major force behind the real estate boom in Canada.

Now to be fair, I might counter that interest rates were far higher from 1996 to 2007 in a period that saw the average Toronto home price increase every single year. So it’s not as though an overnight lending rate of 4% had killed the market; quite the contrary.

All of this begs the question: are rates going up? And a fifty-dollar follow-up: how high could they go?

A less-informed onlooker might look at the chart above and simply conclude, “Holy cow, the 2019 rate is the highest since 2009,” but I have to think there’s more to the Toronto market than just the interest rate.

Nevertheless, that’s another topic.

So what do we actually expect to happen with rates this year?

I’m sure many of you have been following the story south of the border where just before Christmas, the U.S. Federal Reserve raised their interest rate for the fourth time in 2018, one more than the Bank of Canada. The 0.25% hike now puts the rate in the “range” of 2.25% to 2.50%, which is the highest since 2008.

Interesting. The U.S is now at their highest point since 2008, and Canada is at their highest point since 2009. Who says we’re not cousins anymore?

Perhaps more interesting than the story of the rate hike itself was the fallout thereafter.

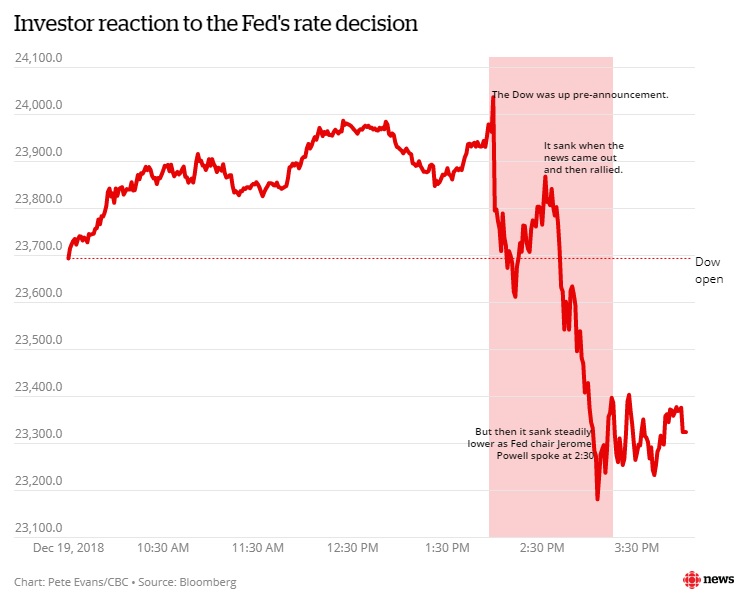

Just look at what happened to the DOW Jones on December 19th when the announcement was made, in this chart from CBC and Bloomberg:

And what happened after this?

The market kept tanking!

The announcement was made on December 19th, and on that day, the DOW Jones dropped 351.98 points.

Then 464.06 points the next day.

And then 414.23 points the day after.

And the carnage was complete on December 24th with a massive 653.17 point drop.

Now those of you that work in finance will point out that there was low volume on the 24th, and that the DOW is now back in line with the December 18th closing price but that’s not my point.

It’s more the reaction to the interest rate announcement that requires attention.

Because if and when the Bank of Canada makes an announcement this year, onlookers will be on pins and needles. And if a rate hike does occur, will Canadians react like Wall Street traders did in December?

FYI, here are the announcement dates:

- Wednesday, January 9

- Wednesday, March 6

- Wednesday, April 24

- Wednesday, May 29

- Wednesday, July 10

- Wednesday, September 4

- Wednesday, October 30

- Wednesday, December 4

So here’s my bold prediction in a blog post that’s not really supposed to contain predictions: we will see a rate CUT before we see a rate HIKE in 2019. Yes, you heard it here first.

Variable-rate borrowers, rejoice!

–

2) Where is the average home price going?

Oh such a good question!

And to think we barely covered this on Monday! 🙂

There was actually a lot of shock and awe about the 2018 home price, and perhaps I shouldn’t be surprised.

The Toronto-GTA average home price was “only” down 4.3% year-over-year, which I think surprised a lot of people. I’ve heard from people who deemed 2017-2018 a “crash,” but simply don’t have the numbers to back that up.

I mean, 4.3%? That’s not really a crash, is it?

Are the market bears cheering that 4.3%? Is it time to jump into the market, with a huge 4.3% savings, while ignoring the previously-gained 100% in less than a decade?

In any event, as I explained on Monday, the Toronto-416 home price was actually up by 0.2%, and this was even more surprising to many.

To play devil’s advocate, and attempt to try to show I’m not a market cheerleader, let me explain how this came to pass.

2017 was a year of peaks and valleys, and when the average home price hit $916,000 and $920,000 respectively in March and April, the subsequent drop huge. The average home price dropped to $746,000 in July, and $732,000 in August, before coming back to $780,000 in October.

The “average” sale price in 2017 takes all of this into account. The “average” sale price in 2017 does not care only about the peak sale price in March or April, but rather encompasses the rest of the year as well. This is what many people fail to recognize when they talk about the drop in average sale price.

There was far less volatility in 2018 with respect to the average sale price. Ignoring January, which is a slow and awkward month, the average home price was between $765,000 and $808,000, all year long.

That’s a consistency we didn’t see in 2017, and the result was “only” a 4.3% drop in the average Toronto-GTA home price, and as mentioned, a small increase in the Toronto-416 price.

Perception is not always reality, and many perceived 2018 to be a kick in the nuts to the Toronto real estate market. But it simply wasn’t.

I would further argue that for the Toronto-416 market to show a 0.2% increase, and with the Toronto-GTA home price showing a 4.3% decrease, the areas outside Toronto-416 must have declined by around 8-10%.

All in all, we saw the central core of Toronto remain in demand, and to be quite honest, I see this continuing in 2019.

I’ll say this – we won’t see an 8% increase in the average home price, either GTA-wide, or in the core. But we won’t see an 8% decrease either. If anything, I would expect a year of flat growth, and if I had to bet on either a 2% increase or 2% decrease, I’d take the former.

Over the holidays and into the near year, I received five inquiries from buyers who are all starting their housing search this week. I don’t exactly have numbers for historical context on this, but I would think that over the past five years, I usually gain 4-6 buyer-clients coming into the new year. I’m one person, and this is a small sample size, but it seems to me that the buyers are still buying.

Where I would forecast weakness this year is in the luxury market ($4M and up), but not for every house in that segment. There’s always the sought-after home that gets multiple offers, breaks records, and/or ends up in the newspaper. But overall, I don’t know how many people are shopping for $5.6 Million houses in 2019.

I would also forecast some weakness in the $2M – $3M range in some areas of North Toronto. There are so many “new-builds” out there, and while most developers price very high, in full anticipation of waiting months for a buyer to materialize, I think there’s just too much product in this market segment, and those particular buyers are looking for deals.

Most areas outside the core are going to be weak this year, but I see strength in areas of Mississauga that are near the Go Train (this is where the exodus is ending up – more on this later), and most of Oakville. Moving east, is another story. As cheap as real estate is in Ajax, Pickering, Oshawa, and Whitby, I don’t see nearly the same demand out there. I also heard, anecdotally, that when General Motors announced the closure of their plant in Oshawa, the market was flooded with houses for sale.

I welcome your thoughts and predictions on this “burning question,” as I’m sure it will be one of the top two discussion points for this blog…

–

3) Will there be further changes to rental legislation?

Gawd, how could there be?

What a difference a year can make, right?

First, we have the Liberals introduce the “Fair Housing Plan” with rent controls, and a new Ontario Standard Lease.

Then, we have the Progressive Conservatives step up and announce the rent controls will be stopped in their tracks, on a go-forward basis, at least.

What more could we possibly see take place?

The Rental Market was my #3 story of 2018, and for good reason. It’s become prohibitively expensive to live in Toronto these days, and there are a multitude of reasons.

Supply and demand is one, no doubt.

Investment in condominiums, another.

And in case you missed it, I caught a well-known Toronto developer price-fixing in the rental market last year, and wrote about it on TRB. I didn’t name the developer, because they are the litigious type, and because they were so careful not to put anything in writing. But it’s a good read if you have time – bookmark it and come back later if you must.

The Liberals and the PC’s have different ideologies, and the unwinding of Liberal rent controls was a very telling sign of where things are, and could be headed in 2019.

I find it quite interesting, however, that the British Columbia government took a different approach.

Last fall, the B.C. government announced that they would cut the allowable rent increase by 2.0%, and limit it to the rate of inflation! Inflation? Really? What incentive would anybody have to purchase a property for investment and rent it out if they weren’t able to………….wait……………oh…………..I see the point here…

So while the B.C. government has enacted in-your-face policies aimed at cooling the real estate market, such as the controversial Foreign Buyer’s Tax, they’re also trying to suppress real estate investment with moves like tying rent increases to inflation.

In a free market, rent increases would be tied to market forces. If there’s less of a market for a property, the market rent could go down. Not likely, of course. But there are two sides to every coin.

I don’t see the Ontario government doing anything like this, in fact, I could see Doug Ford allowing for larger rent increases. I give that about a 25% chance of happening this year.

As for other potential changes to rental legislation, I don’t see any on the horizon. Rent controls and the allowable increases will be the story for 2019.

–

Let’s break here, and come back to the rest of the Top-10 on Friday.

The first three burning questions, in my opinion, are those that burn the brightest, so the remainder will be snappy!

Appraiser

at 8:24 am

“Did Toronto’s Housing Market Have a Soft Landing?”

https://www.movesmartly.com/articles/did-torontos-housing-market-make-a-soft-landing

Chris

at 9:03 am

“All of this doesn’t mean the Toronto housing market is in the clear and prices will start rising again. The reality is that house prices are still quite high in Toronto relative to incomes and there are a number of factors that could result in some instability in our housing market.”

Appraiser

at 1:01 pm

“…there is little doubt that up to now the GTA has achieved a soft landing.”

Yeah, yeah I know the crash is coming…if, if, if…

Chris

at 1:24 pm

Just so we’re clear, you’re using John Pasalis’ assessment on market movement “up to now”, and disregarding his comments about the Toronto housing market not being in the clear, in an effort to predict the future?

That seems reasonable.

Appraiser

at 1:35 pm

All we know is “up to now”, the rest is pure conjecture… if, if, if…

And for some it’s always negative.

Chris

at 1:40 pm

This blog post is on the topic of predictions.

Further, if we’re talking about “up to now”, so be it, discuss retrospective data to your heart’s content. But don’t then try to wade into forecasting with sarcastic comments about “the crash is coming”, etc.

Appraiser

at 5:57 pm

So it appears that we are agreed that until further notice we are experiencing a “soft landing”.

How mythical is that?

Chris

at 7:52 pm

First recorded instance if it holds. I’d wait a bit longer before you go updating the wiki though.

Kyle

at 9:29 am

It will be interesting to see how prices respond this year. I think there are a lot of condo owners who’ve done well and will be eyeing this rare opportunity to trade up this year, but opposing that i see a new wrinkle in the interest rate story. Since B20, mortgage originations have dropped off significantly, so prices *may* not respond as quickly to lower rates the way they have in the past. Overall i see 2019 tracking slightly ahead of 2018.

More remote, but not out of the question, is i could see them tweaking B20 by adjusting the qualifying rates down.

Chris

at 10:36 am

Your predictions are pretty reasonable. I’ll lean a little more pessimistic. I think 2019 will track slightly behind 2018, with sales volume remaining low, and prices stagnating or declining modestly.

It’s certainly not a perfect comparison, but Toronto seems to have followed Vancouver relatively well, with a lag of approx. nine months. Vancouver today is looking rocky, with sales volumes falling to deep lows, and prices declining in all segments. I don’t think Toronto will move to the same degree as Vancouver, as there is less foreign capital, and a stronger economy to support real estate valuations, plus prices didn’t spike as dramatically as they did in the Lower Mainland. There’s also the confounding variables of political intervention, with the BC government continuing to try to cool the market, while I doubt the Ontario PCs will do the same.

One way or another, I think we will have a good indication of what the rest of the year has in store once the Spring market gets going. If volumes rebound, and prices start to tick upwards, it may portend a decent year overall. If volumes remain low, listings surge, and prices stall or decline, 2019 may wind up as a real dud.

Professional Shanker

at 1:27 pm

B20 won’t likely be reduced/lifted until the cycle is complete, which would be confirmed by an IR cut. Or if B20 is adjusted, perhaps it is due to reduced sales which you are eluding to!

Same story as last year, my call is for 75,000 units transacted & an average price of $779,000, -1%. This is based on 1) No recession, 2) No movement in Canada benchmark rate. 905 will be a drag once again, very few can afford detached homes in 905 and 416, affordability is more constrained in 2019 than 2018. If people can’t afford the move up product the average price cannot move materially! Condo prices will finally moderate, although I have been wrong on condo prices for longer than I care to admit!

If the bears and bulls agree on 2019 – what does this say?

Kyle – Do you think there is a glut of condo owners which can afford/qualify to move up even with the spread between detached/semi-detached and condos narrowing in 2018? Did they not take advantage of this opportunity in H2 2017 & 2018?

Kyle

at 1:42 pm

Yes i do think there’s a glut of condo owners who can afford /qualify to move up, precisely because the spread narrowed. Like i said to Chris yesterday, normal people don’t just move to time the market. They move when it is the right time for them. Just because the spread narrowed during 2018, doesn’t mean that everyone immediately took advantage of that and there’s no one left in 2019.

Professional Shanker

at 2:21 pm

This would be a tailwind for 2019 if it materializes. Your point on life circumstances is noted and true.

Kyle

at 2:51 pm

The initial reason for implementing B20 was because OSFI wanted to mitigate potential systemic risk if rates increased rapidly, such that in theory those qualifying could essentially withstand an overnight 2% hike in rates. I and may others would say this is overly prudent and completely unnecessary.

The downsides are it reduces sales and drastically reduces the effectiveness of BoC’s policies. If BoC reduces rates, but many people can’t qualify to take advantage of them then there is far less benefit from the rate cut.

If our economy does hit tough times, then B20 drastically increases (or contributes through reduction in sales) to the risk of a recession, which is a far bigger risk to our Country than the marginal risk to the system that they may be trying to mitigate.

Joel

at 10:13 am

I am a mortgage broker and there are so many people that bought a condo 5ish years ago with 5-10% down that now have large amounts of equity.

These buyers can extend their mortgages to 30 years with 20% down and qualify for houses in the low million range.

I agree with Kyle and think that we will see many of these owners cashing out on their condos and buying houses.

I have already talked to someone that is looking to do this within the year and if prices of houses dont rise I think this will be very viable for many condo owners.

Those who bought a 1+1 or 2 bed 5 years ago are likely ready for something bigger and probably have 300-500k in equity now.

Professional Shanker

at 11:38 am

David – Bold prediction on the interest rate decrease – a contrarian view which is now becoming less so by the day it seems! I always appreciate a contrarian pick, it is how fortunes are made!

If Canada does lower their rate it will be either due to: 1) WTI falls to $20/barrel or 2) US has reversed course and has lowered their benchmark rate.

If the latter happens this would indicate the worldwide economy is in recession and would spell doom for all asset prices (houses included, even Toronto core ones too!). This is really not something that would be supportive of house prices increases at this point in our economic expansion. If interest rates are cut in 2019, then it is guarantee house prices will fall on a nominal level from 2018.

An oil price relating interest rate cut, would be foolish just as it was in 2015 – Alberta is in no better shape and we brought forward 5 to 10 years of home price appreciation in the East into 2 short years as speculation ran hot!

W

at 1:22 pm

Hardly contrarian, markets have priced in 50% chance of rate cut by EOY 2019. This was before today’s BoC decision, so things may have changed since.

m m

at 1:28 pm

Hi David, any comment on this article?

This is how Canada’s housing correction begins

https://www.macleans.ca/economy/realestateeconomy/this-is-how-canadas-housing-correction-begins/

It’s a bit better sourced than most articles, and it quotes Pasalis and Rabidoux.

Professional Shanker

at 1:37 pm

Maclean’s has publishing similar pieces for many years, not sure how long…..

Appraiser

at 6:48 pm

Great Canadian real estate crash of 2013 The housing bubble has burst, and few will emerge unscathed by Chris Sorensen Jan 9, 2013

Appraiser

at 1:37 pm

Same old same old from Jason Kirby and Macleans, with the same old same old sources.

I’ll never forget their infamous call from 2013 that the market was crashing.

A classic!

Kyle

at 1:50 pm

Jason Kirby knows absolutely nothing about real estate and he has been saying the same thing since 2008: https://www.macleans.ca/economy/business/it-could-happen-here/

Basically he writes real estate fiction which makes great click-bait for bears.

Appraiser

at 6:12 pm

The level of belief perseverance with some of these bear/clowns is astounding. And always in search of vindication after the fact, for their absolute bullshit calls of the past.

Housing Bear

at 3:06 pm

Late to the party.

@ Kyle – and in regards to your questions yesterday – why wait if you acknowledge that prices will one day recover? And why would some here choose to “short” the housing market.

1st- Opportunity cost/ time value of money – This holds true for people in my situation or would be buyers. If you are heavily invested in an asset class and that asset goes through a long period of contraction/recovery, sure if you can hold you will one day walk away with a relative profit but those are years of lost wealth accumulation. Furthermore, if you are leveraged, you will be paying interest on those paper losses for the life of the mortgage.

Side note- you called Chris out yesterday for not factoring in rent when pointing out the risk of leveraged investments. If you are not cash flow positive, then yes, if you are not getting appreciation it is a bad investment.

Questions to ask yourself as a potential buyer- Do you see factors or combination of factors that could make this asset class vulnerable? If so maybe wait. Next, could your household income become vulnerable in a recession where you could risk losing everything? If so, maybe wait.

2nd – Personal one for me, and kind of the opposite perspective of if you can afford to buy, and or need it for life purposes then go for it. I had a lot of equity (over 80%), a house a lot bigger than I needed, and with my job I have to travel a lot and can work from home whenever I need ( I may not require a long term property in Toronto) . So I figured, I can afford to sell, and the flexibility of renting is actually more ideal for my lifestyle right now. Even with a very low mortage relative to equity, when i factored in my monthly mortgage payments, tax, hydro etc I am actually spending less month over month as a renter. I will admit, if I had kids or thought i would for sure be in Toronto forever, I probably would have kept my property because there was no chance i would be going under water or defaulting. Different for people who were buying at that time.

3rd- greed – If I am right about where our housing market and economy are headed. I will be in a very unique position to take advantage of a once in a generation type opportunity to buy up assets on the cheap. I am mostly in short term debt instruments (USD and CAD) right now, the only thing that can really knock over my position would be an aggressive outburst of inflation (close to hyperinflation levels), which doesn’t look like its in the cards for the short term anyway.

In regards to predictions for 2019.

Depending on how credit conditions and the state of the economy play out over the course of this year. Prices remain relatively flat or fall slightly for the next couple months (ignore averages). Spring market isn’t terrible but not that great (sales volume similar to 2018), but we see a small rise in inventory . Condo prices start to fall gradually. By fall inventory has started to build in both SFH and condo market. We start to see stories about newly built units getting discounted more aggressively. YOY are prices are down compared to 2018 4-8% (averages). John P is right that until we get a big spike in inventory, we will not have an aggressive collapse. If downward pressure starts to build early in the year, then the averages could be down upwards of 12%.

Reasoning and factors I am looking at.

– Now that the BOC is looking like they are pausing at least for now this should buy the market a bit of time- This will reduce the amount of pressure on existing owners, may or may not have much of an impact on new buyers. Two sides to credit conditions. 1)Cost of money (rates) – the cheaper money is the more total debt you can afford to carry on your income. 2) availability of credit – If BOC is holding its rate (or slashes) because it sees a recession coming, and that recession looks like it is starting to materialize, then expect normal banks to be much more conservative in who they lend to and how much they lend out in total.

Headwind – recent data shows that more household have been running into financial trouble so maybe the rate levels we are already at are enough to bring down existing debt holders. – cost of money

Tailwind- Recent changes to covered bonds should allow banks to raise more money to then lend back out. – availability of credit

Kyle

at 5:24 pm

These are all fine points, but not applicable to the vast majority of bears.

For point 1, Sure there are opportunity costs to holding real estate, but whatever else you invest in needs to outperform (on an after-tax basis) real estate prices by enough to cover your cost of rent, in order to win. In Toronto, where the average rent is high, this is very risky. Your pay off is asymmetrical and looks sort of like this:

1. Portfolio outperforms real estate: You profit by your outperformance less your rent (i.e. small win)

2. Portfolio matches real estate: You lose by the cost of rent (i.e. small loss)

3. Portfolio underperforms real estate: You lose by the underperformance and the cost of rent (i.e. big loss)

Obviously the size of the investment relative to the amount of rent will make a big difference. For example if rent costs 24K, and your portfolio value is $500K, your portfolio needs to outperform real estate by at least 4.8% before you make money. on the other hand if your portfolio value is $1MM, then you only have to outperform by 2.4%. I reckon most bears don’t have $500K, let alone $1MM in investable assets.

For point 2, This is really unique to your situation. Most people will at some point need to cover their short. Those not looking to downsize are unhedged to rises in real estate prices, so they very well may end up unintentionally being forced to down size when they cover their short.

For point 3, You have positioned yourself defensively and are not getting any real appreciation. So unless your interest from debt instruments is more than your cost of rent, you’ve basically just put yourself into the exact following situation:

“not cash flow positive, then yes, if you are not getting appreciation it is a bad investment.”

Professional Shanker

at 6:02 pm

Something which is not explicitly stated in your response is the Cost of Ownership = interest costs (renting money from a lender) + property overhead (taxes, condo fees, general maintenance, etc.).

Depending on your leverage (say 80%) the cost of ownership can equal if not surpass the cost of rent. This cost of ownership has been all but dismissed from 2013 to 2016 due to the significant gains in price appreciation. From 2017 to present day it has become more relevant!

Libertarian

at 10:07 am

I agree completely about how Cost of Ownership is always ignored. Most people talk about how they bought a property for $500,00 and now it’s worth $1 million, so they’ve doubled their money. “Real Estate is the best! Real Estate is Awesome!” But it’s not that simple…so many other costs, which you point out. Many other ones too.

You’re also right about how it’s gotten more relevant since last year. I suspect it will get even more relevant going forward now that prices are flat-lining.

I’m a homeowner, so I won’t tell anybody that they should rent instead of buy. But I will say, don’t consider your home to be a lottery ticket that will make you rich when it comes time to retire. Yes, your house will be worth more, but that’ll be mostly from inflation.

Chris

at 10:57 am

Fully agree. Costs of ownership (interest and taxes paid, amount spent on maintenance, etc.) are far too often ignored, and can absolutely add up to substantial amounts over time.

Another thing that I find many gloss over is the disposition costs involved in real estate. A 4% realtor commission (split between the buyer and seller agents) will erode $40,000 from the sale of this hypothetical $1 Million home. Add legal fees, and this costs climbs further. If the seller is downsizing and buying another home, they may also incur municipal and provincial land transfer taxes, title insurance costs, appraisal and home inspection fees, moving expenses, etc.

Yet most will simply take their selling price, subtract their buying price, and claim the result as their profit.

Housing Bear

at 10:36 am

Fair point on rent, but as Shanker pointed out, you do need to deduct all ownership costs (other than principal repayment) from the rent total to find out your true return. The instruments I am in right now are beating inflation (my old detached house would not have been), and are very close to covering my rent if not doing so as well . This is because as you said, I am positioned very defensively right now. If I had more confidence in equities or the economy in general, I would be in more aggressive investments where I would easily be covering my rent plus growing my portfolio. A lot of the same factors I think will hit RE I also believe will hit equities (especially US ones).

The key thing to my current position (vs say owning a cash flow negative property) is that it is very unlikely that I could also suffer a capital loss….. more of a treading water strategy until the storm clears.

Time will tell if my strategies pays off or not.

Kyle

at 11:25 am

So we’re all totally clear here, the cost of ownership is largely paid by the inhabitant of the property not necessarily the owner of the property. If you rent and invest in a portfolio, you are still paying that cost, you’re just paying it for your landlord. So in it is a cost under both scenarios, and therefore washes out.

Chris

at 11:54 am

Let’s look at a real-world example. A quick search produced 106 – 993 Queen St. W. It is currently on the market both for sale and for rent. It is listed for sale at $1,359,000, and for rent at $4,000/month.

https://www.realtor.ca/real-estate/20146509/1-bedroom-condo-106-993-queen-street-w-toronto

If I were to purchase this unit, with a 20% down payment, 3.44% mortgage rate, 25 year amortization, my monthly mortgage payment would be $5,394. Ratehub estimates property tax at $1,133 per month and property insurance at $50 per month. Stated condo fees are $776 per month. This is a total of $7,353/month, or $88,236/year. But, to be fair, we should deduct principal repayment, which would be $28,026 in year one. So my ownership costs, excluding principal repayment would come to $60,210.

If I were to rent the condo for $4,000/month, I will recoup $48,000/year. This would still leave $12,210 of ownership costs unpaid.

I’ve omitted any consideration of tax, as there would be tax incurred on the rental income, but also deductions applicable to mortgage interest. So for simplicity, I’m talking in pre-tax terms. I’ve also omitted any consideration of the opportunity cost of the 20% down payment.

Maybe I’m missing something from my assessment, so please correct me if I have. But at a relatively quick glance, this looks like a cash-flow negative investment opportunity, where the cost of ownership would not be fully paid by a tenant.

Kyle

at 12:11 pm

I’m not sure this example is representative of anything other than a Seller who thinks their property is worth more than it truly is or it could be a Seller who’s motivation isn’t profit maximization (maybe he/she is relocating for a few years and would rather rent it out than sell for less than what they think it is worth). But more importantly not every property makes a good rental investment, especially as you get into the higher end. There are far fewer higher end renters who can afford to

All this to say, your example is not representative of a “real world” renter/landlord scenario.

Chris

at 12:20 pm

I chose this example because it was the exact same unit listed both for sale and for rent. Perhaps instead, I’ll take a look on Bungol at recent sold and rented prices for comparable units, to strip out the unrealistic asking price impact. To Ed/crazyegg’s point, I’ll try to find some examples of smaller units, rather than luxury ones.

I know CIBC’s Ben Tal recently talked about how many condo landlords who purchased in 2017 are cash flow negative. However, to my knowledge, this doesn’t strip out principal repayment. So wouldn’t quite mesh with the current debate on ownership cost being covered by tenancy cost.

Chris

at 12:42 pm

Alright, another example, this time 705-36 Charlotte St. and 701-36 Charlotte St.

One unit recently sold for $631,000, the other (slightly larger) unit recently leased for $2,700/month.

20% down payment, 3.44%, 25 year am., estimated tax of $526 and insurance of $50, stated condo fees of $701, result in annual cost of $45,372. Principal repayment year one is $13,013, so ownership cost is $32,359.

Rental income of comparable unit would be $32,400.

So yep, pretty much a wash. In this case, I suppose a deciding factor for someone may come down to where they think the $126,000 will generate a better return: as a down payment on a condo, or invested in equities and bonds?

Kyle

at 1:25 pm

In your example the condo breaks even, so the cost are totally borne by the tenant, and the landlord doesn’t make anything, in fact he probably has to pay income tax on his net, so IRL he is paying out of his pocket to keep this investment. But that calculation is for Year 1. And yes in Toronto the cap rates are kind of shitty, so year 1 is not so good.

Most landlords buy with a long time horizon, and over time the return improves each year. Rents increase each year compounded, while costs are pretty fixed/sticky. And the amount going to mortgage interest drops each year.

For example: Let’s say that for arguments sake that owner of the Charlotte St, unit bought 5 years ago before markets went up 50%, he would only have paid 420K, but yet he would still be able to rent it out for 2,700/month. He is now making money each and every month, and this doesn’t include the $211K in apprecation.

Over the long run, many a tenant who stays with the same landlord for 25 years, could have bought that property a few times over with the cumulative amount of rent they’ve paid.

Chris

at 1:57 pm

Yes, the landlord will have tax on his rental income, but can also deduct some expenses, such as mortgage interest. As I said, in the interest of simplicity, I omitted all of these.

Some ownership costs, like mortgage payments, will be fixed/sticky. Others will increase, such as maintenance fees (a Toronto Star story in Jan. 2018 found average fees rose 2.5% YoY) and property tax.

I agree with your assertion that someone who bought the Charlotte St unit years ago would be doing well, both from appreciation and from rent . In this specific case, the condo was purchased in 2003 for $325,000. Though that’s taking a retrospective view, as opposed to one from today onward.

That being said, you are correct that as more is directed to principal repayment, and less to interest, the landlord will net more. Assuming that rent and other non-fixed expenses all climb by 2% (except maintenance fees, which climb by 2.5%), by year five, rental income will outstrip ownership expense by $3,170 for the year. Not a huge return, but better than year one.

Once again, I think much will go hinge on someone’s expected rate of return. Do they think they will generate a better return through the appreciation plus dividends of a balanced investment portfolio, or through the appreciation plus net income generated on a rental condo?

To your final paragraph, if someone was planning on staying put for 25 years, they would be better off to buy. This goes back to our previous discussion about rent vs. buy, and how one of the major inputs to this decision is expected length of residence. I don’t know too many people who would rent the same place for 25 years.

Anyways, interesting discussion. As in the case of rent vs. buy, invest in condos vs. equities doesn’t seem like a straightforward answer either.

Jimbo

at 1:09 am

I’m more of a bear but I will add some thought to this.

Do a property bought in 2012 and compare with a current rental. Now instead of looking at selling price today add inflation of 1.5-2.0% on the property each year. This would kind of simulate what could happen in the next 5 years.

Now you get transferred to another city and don’t want to sell, so you rent your property out for the next 3-5 years and expect to be able to increase rent to tenant at a rate of 2% a year.

Would it be better to sell and buy when you return or just rent it out….. A lot of people will choose to rent it out as they fear they could get priced out. On the other hand a lot of other people may see better value in other places within that neighborhood and will risk selling IOT buy a more desirable place when they return.

One thing we tend to miss as bears or maybe we think it becomes to risky is the compounded inflation is on a leveraged asset, so it is hard to beat those returns until your investment grows quite a bit (also why it is important to invest even if you buy a house). Now if I’m a bull I need to realise that yes I’m getting good rent for my place to cover the bills but am I okay with renting in my temporary location paying someone else’s bills on top of covering my mortgage…..

Kyle

at 9:36 am

@ Jimbo

This is a very complex scenario that you spelled out and it depends a lot more on situational factors, rather than market factors.

For example:

– How long is the relocation for? (e.g. short term, then you have to pay transaction costs if you unload, longer term there is a lot of hassle to being a long distance landlord)

– Where is the relocation? (Does that Country have a favourable tax treaty that makes it worth selling to cut ties with Canada? Do they offer Golden Visa programs? Will you want to become a dual citizen?)

– Confidence that you’ll actually want to stay in the new Country? Some people get there and realize they hate it.

– Will you want a place to stay when you come back to visit?

– Will you want your kids to go to the same school when you return?

People in these situations are not making these decisions from an investor, market timing or financial profit maximizing perspective.

Chris

at 11:55 am

Sorry, forgot link to rental listing:

https://www.realtor.ca/real-estate/20146654/1-bedroom-condo-106-993-queen-street-w-toronto

crazyegg

at 12:10 pm

Hi Chris,

It is difficult to generate a positive cash flow with a premium priced (“larger”) unit like the one listed above.

Makes much more sense to buy the cheapest smallest unit in the same building. Ideally, consider buying construction. That has been my strategy and it seems to have worked well…

The rents that are currently being generated each month by the smaller units are proportionately much higher vs the rents charged for the larger units. And don’t even consider buying a spot…

Regards,

ed…

Professional Shanker

at 12:55 pm

Crazyegg – Understand that if you had purchased years back, your investment property would have made lots of $$$$ through appreciation.

I don’t pretend/want to understand your holistic financial situation but given current cap rates why wouldn’t you sell long ago purchased units, the windfall would be massive! You can wait until rents increase/property values decline.

What is your ROI expectation from 2019 forward, can’t be close to what you have previously earned can it?

My questions are of pure curiosity, do you review your properties annually and if so how do you assess them for forward looking returns, is their even a point if you are long?

Appraiser takes a very long term approach so short term movements in price are moot to him.

Kyle

at 1:09 pm

If he bought long ago he’s laughing and with each successive year his return improves. Rent increase every year, while the monthly costs are more fixed/sticky. And each year more and more of the mortgage payment goes toward principal repayment (i.e. directly to his equity).

Why on earth would he want to sell unless he had to?

Appraiser

at 8:26 pm

Analysis based on anecdote and conjecture.

Typical bear philosophy.

Chris

at 10:16 pm

Rather than the usual complaints and hollow criticisms, appraiser, why don’t you try contributing something of substance to the discussion? You know, sort of like what everyone else is doing. Give it a shot!

crazyegg

at 3:31 pm

Hi All,

I would love to see a change in the Ontario legislation to make it easier for those renters who are paying abnormally low rents.

An 1.8% increase each year doesn’t cut it anymore in this environment, especially for those landlords like myself who play by the book…

Allowing for a greater latitude in an above guideline increase would be most welcome.

Regards,

ed…

Steve

at 1:20 pm

As an ex-banker, and with many friends still inside the high ranks of the banks, I expect to see lower interest rates in the spring. The banks and CUs took the fall 2018 season off in regards to highly competitive rate competition, and they anticipate this will change. Look for heavy competition among the FIs resulting in some major mortgage rate declines in the spring market.

As for home prices, speaking for the midtown/downtown core where I live, prices continue to rise for the $1mil to $1.7mil houses, and I think this will continue. Inventory in Toronto proper is still very low, and demand is still huge — it all comes down to whether those who want to buy can qualify. The lower spring rates will help in this regard.

Steve

at 1:34 pm

Forgot to add… the banks took a haircut in 2018 with the tougher mortgage qualification and are looking to get some of that back. Poaching mortgage clients is one of the few ways banks can gain net new customers, so I expect the spring mortgage season to be fierce and low.

Jimbo

at 1:16 am

How many renewers will be unable to reqaulify and get stuck at their current bank? I’m thinking 5% down buyers from 5 years ago and maybe people with $50k plus expended HELOC.

They may have equity from 5 years of growth but will the equity keep pace with the growth of the Already more expensive place they decided not to buy 5 years ago?

They did qaulify under B20 once already 5 years ago since they had to get mortgage insurance or am I wrong on that part?

Steve

at 10:24 pm

Fortunately, banks don’t make renewers jump through hoops and don’t do much of a deep dive into personal financial situations. They tend to hold their nose and be happy they are keeping a client. Two friends in not-so-great financial and job situations recently renewed. Both were renewed easily with little to no delay and with very good rates, I might add (3.5 for a 5 yr fixed).

Appraiser

at 5:59 pm

“Fed will be patient with rate hikes, Jerome Powell says”

https://www.cbc.ca/news/business/jerome-powell-speech-1.4973133

Oops, one big bear driver just went off the road.

Chris

at 9:19 am

Patience does not equate to a cessation of rate hikes, nor a cut.

“A total of two [US Fed] increases for 2019 now appears to be the most likely scenario…a gradual rise is still anticipated as expectations of key rate hikes should progressively make a comeback.”

– Desjardins Economics, January 10, 2019

Appraiser

at 5:20 pm

So another 25 basis points in 6 months and maybe another in 12 months….YAAAAAWN!

Mxyzptlk

at 5:41 pm

But these rate hikes, minor though they may be, will negatively impact hundreds- nay, thousands! – of households. Because, you know, they just will!!!

Chris

at 6:09 pm

Hmm, very similar commentary style, posting for the first time ever, 21 minutes delayed, in support of appraiser.

Seems legit.

Chris

at 5:59 pm

“Bankruptcies are up in Canada, the head of the Bank of Canada said this week, and he expects they’ll rise even more as the central bank continues to hike interest rates.”

https://www.ctvnews.ca/canada/as-bankruptcies-edge-up-poloz-personally-responds-to-canadians-concerns-1.4249320

From another article:

“The number of consumers seeking debt relief jumped 5.1 per cent to 11,320 in November from a year earlier, the Ottawa-based Office of the Superintendent of Bankruptcy reported on Jan. 4. October and November combined saw 22,961 consumer insolvency filings, the most for those two months since at least 2011.”

And from yet another:

“Canadians living in two of the country’s largest cities may find themselves more “vulnerable” to interest rate increases as personal debt levels in Toronto and Vancouver continue to hit record-levels, warns a report by Canada Mortgage Housing Corp.”

Add to that the fact that economists estimate rate changes take upwards of six months to work their way through the economy, so recent hikes may still have yet to show their full impact.

But sure, it’s just another 0.50%. No biggie.

Appraiser

at 6:29 pm

“Bankruptcies in Canada increased to 240 Companies in October from 210 Companies in September of 2018. Bankruptcies in Canada averaged 384.19 Companies from 2004 until 2018, reaching an all time high of 872 Companies in March of 2004 and a record low of 177 Companies in January of 2017.”

https://tradingeconomics.com/canada/bankruptcies

You are a joke!

Chris

at 8:37 pm

You’re citing Trading Economics data on company bankruptcies to counter the Bank of Canada’s CMHC’s and the Office of the Superintendent of Bankruptcy’s assessments of household bankruptcies and the impact of interest rates on Canadians.

You’re posting supportive responses to your posts using alternate names.

Sorry, what was that you were saying about being a joke?

Alexander

at 1:14 pm

My predictions for 2019

1. Interest rate will be increased at least once in 2019 by Bank of Canada, but at least in spring mortgage rates will be lower to take advantage of.

2. Prices for condos will continue to increase 2-5% in GTA. Detached prices in Toronto will be flat and there will be less sales in this segment. There will be price and sales pressure on suburbs detached. So generally prices would be flat (+/-2%).

3. I wish there will some loosening of rental restriction in Ontario and I know it is wishful thinking.

Demarcus Vbiles

at 2:32 pm

I dont genuinely wish to list them all outside but its a lot of brands Im sure youre familiar with.

https://w3bin.com/domain/andorwp.com