What’s the difference between a 7-day vacation and a 14-day vacation?

Duh. About seven days!

But seriously, what’s the difference?

The first one is too short and the second one is too long.

My wife and I both agreed, back in 2013, that a mere one week Honeymoon in the Bahamas would be too short, and that’s why we decided to stay for a full two weeks.

On the seventh day, when everybody around us was looking sad, preparing to head home, we were absolutely elated to be staying! To leave now would be way too soon!

But by the time the eleventh day rolled around, I was a little fidgety. By day twelve, I was thinking I’d had enough. And by day thirteen, I was picturing home.

There is such a notion as “too much of a good thing.”

Oscar Wilde famously wrote, “Everything in moderation; including moderation.”

So as amazing as summer was, and as much as it sucks to say goodbye to it, I was just about ready.

I’m a person that thrives on routine. I do well when I have a schedule, a set of responsibilities, and I’m never looking around wondering what to do. I’m not good when I’m sedentary, and my idle hands are the devil’s playground.

So when summer languishes, camp is over for the kids, and those children have grown tired of activities that had excited them only a couple of weeks earlier, I start to get a bit antsy.

Let me drop my daughter off at school at 8:25am, arrive at the office at 8:40am, crack the lid on my Tim Horton’s coffee, and get to work!

I’m genuinely looking forward to getting back into a routine, although some of that has more to do with a rough string of health and body issues of late. My golf game screwed up my back a little by early-August and that required some time off. Then I got hand-foot-and-mouth disease, which only kids are supposed to get, and yet my children never got it but I did. Then, I pulled the SI-joint in my lower back right before the long weekend and had to hobble around the house and the office for five days. So when I say I’m looking forward to getting “into a routine,” I mean one for my mind and body as well.

I’ve always believed that working on your mental health can come from working on your physical health. If I take a long Sunday run of 10-15KM, I’ll finish, and my mind is clear. I’ll shower, stretch, and be calm for the rest of the day. If I can get home to work out on a Tuesday or Thursday at 6:00pm just twice per week, I feel great not only that night, but the next morning as well.

Perhaps I’m too binary, but I always find that change is the easiest to implement when you’ve got other changes happening as well; when there’s a start or end of something else. So with summer in the rear-view mirror and Labour Day passed as well, I’m very excited about a new routine.

To my running friends, I’ll say this: it was a tough year! I was off to a great start but mangled my ankle in early-April and was only starting up again in August when I hurt my back. My brother and I set a goal of running a marathon in the fall of 2023 and that starts with achieving and maintaining physical health this fall.

Is anybody else using this end of summer as a turning point, or is it just me?

In the real estate world, the end of summer can’t be anything but a turning point, and it’s the same every year. Perhaps this is just a case of my personal and professional lives both benefiting from the same timing.

This week will probably be slow in the real estate market, since half the schools are going back on Wednesday rather than Tuesday, and parents will unddoubtedly be focused on things other than that email from their happy-go-lucky Realtor, showing them that shiny new listing that they ought to see!

Next week, I expect the market to explode with new listings. Mark my words. It starts September 12th. But for many who are reading this today, September 6th, the fall real estate market is already underway, whether it’s full capacity, or not.

It’s going to be a busy fall if not an interesting one, and I honestly don’t recall a time when I heard so many people ask, “What do you think is going to happen?” than I did in the last few weeks of summer, with regards to the fall market.

We knew, on January 1st, that the New Year’s market would be nuts.

We knew, last Labour Day, that the fall market would be nuts.

But nobody knows quite what to expect this coming fall, and that includes yours truly.

I do know, however, which topics of conversation will be at the forefront, and many of these will have a direct effect on what transpires with respect to home prices, sales volume, inventory levels, and affordability this fall.

Let’s have a look, and yes, I happened to fashion this into one of my classic “Top Ten” lists…

–

1) Interest Rates

Boy oh boy, are we tired of reading those two words yet?

I thought “inflation” was going to be the word of the year for 2022, but by this point, it’s all about interest rates.

Of course, interest rates are tied to inflation, so they’re not mutually exclusive. But if we’re hearing one more than the other as we head into September, it’s definitely “interest rates.”

I’m not without guilt in this regard.

In fact, I started 2022 with a post on January 6th called “Burning Questions For 2022,” and the second question on my list was “What will happen with interest rates?”

We’ve already discussed the fact that I was wrong with my predictions, thoughts, and opinions on interest rates. I scoffed at the notion of five interest rate increases in 2022 and basically said that it would never happen. It just couldn’t. But that’s because I have zero faith in our federal government, and while the Bank of Canada is supposed to act independently from the PM’s office, I’m also cynical in that regard.

Imagine a Bank of Canada with balls. Er, it’s 2022, so I can’t say that. Let’s say guts. A Bank of Canada with guts. A Bank of Canada who can act decisively, make unpopular decisions, and put a plan of action in place – then follow it.

That’s exactly what we saw in 2022.

Why, exactly? Well, have a look at these stats:

TRREB average home price:

December: $1,157,849

January: $1,242,793

February: $1,334,554

Inflation:

December: 4.8%

January: 5.1%

February: 5.7%

Whether the Bank of Canada acted decisively because they had always planned to do so, or whether they put their multi-increase plan in place because of how home prices and inflation figures looked to start the year, I guess we’ll never know for sure.

But by the time we saw the first rate hike on March 2nd, 2022, inflation was already out of control.

We all know what followed with interest rates:

March 2nd: +0.25%

April 13th: +0.50%

June 1st: +0.50%

July 13th: +1.00%

Just like that, we went from near-all-time low mortgage rates to rates that some Canadians had never seen before.

Imagine being the would-be buyer who heard about 1.49%, five-year, fixed-rate mortgages in 2021, only to now find out that you’re looking at 5.79%?

That’s a wake-up call!

And with an interest rate announcement scheduled by the Bank of Canada for tomorrow – September 7th, things are only going to get more interesting!

Any wagers on what we see?

The July 13th announcement was rumoured to be fifty basis points and the BOC was teasing that it could be seventy-five. I went on record by saying that there’s no way it would be seventy-five basis points, and that the BOC was simply posturing; that they were high on the power of their own voices. Well, I was half-right, because they did not increase the interest rate by seventy-five points. They increased it by one-hundred basis points…

So again, I ask: any wagers on what we see?

We wouldn’t be the only people making wagers.

“Odds Of Bank Of Canada Hiking 75 Basis Points In September Just Went Down”

Financial Post

August 10th, 2022

This article is clearly stale-dated, but it was written about one month after the July rate hike of 100 basis points, and one month before the scheduled announcement in September.

The sub-heading reads “Markets trim bets from 60% change to 45% after data show U.S. inflation cooling.”

So maybe a “bet” that takes odds from 60% to 45% isn’t really worth writing an entire article, but it shows you that people have been watching, discussing, predicting, and wagering on this September outcome from the very moment that the rate was raised on July 13th.

Then again, people are already betting on what could happen after the September 7th announcement:

“Bank Of Canada Could Put Rate Hikes On Pause After September”

Financial Post

August 30th, 2022

This article cites CIBC’s managing director who said that a “narrative shift is coming” and believes the Bank of Canada will pause its rate hikes after September 7th, when he expects the BOC to increase the rate by seventy-five basis points.

Embedded in the article is an interview with David Rosenberg who said, “Rate hikes will end sooner than the markets think.”

There’s so much talk!

How can we possibly keep up?

So what does all this mean for real estate buyers?

It means a decrease in purchasing power, for one thing.

But as I’ve mentioned off-and-on through the past few months, it also means that buyers are going to have voices coming at them from all directions this fall, and that includes their own little voice, inside their head, going back and forth about what they should do. The same could be said for sellers who don’t need to sell but are contemplating it. More on this in a later point.

–

2) Inflation

Wait, what?

Inflation?

“But David, you said above that you’re skipping over “inflation” to deal with “interest rates” so you could spare us such an incredibly boring, and already-talked-about topic!”

Sorry, not sorry! I know that these two topics run so closely together that to discuss one of them is almost like discussing the other, but interest rate hikes are in response to inflation, and that’s both the rate of inflation in Canada and the United States.

Here’s a headline from August 26th:

“U.S. Fed Chair Signals ‘Pain’ Ahead: More Rate Hikes Needed To Tame Inflation”

Why do we care about what’s happening in the United States? Well, because we’re going to continue following their lead for the time being as we have always done.

The United States’ rate of inflation is a little higher than Canada, but like Canada, it also trailed off a tad in July:

From a whopping 9.1% in June down to 8.5% in July, but this is still more than four times the 2% target that most central banks will set.

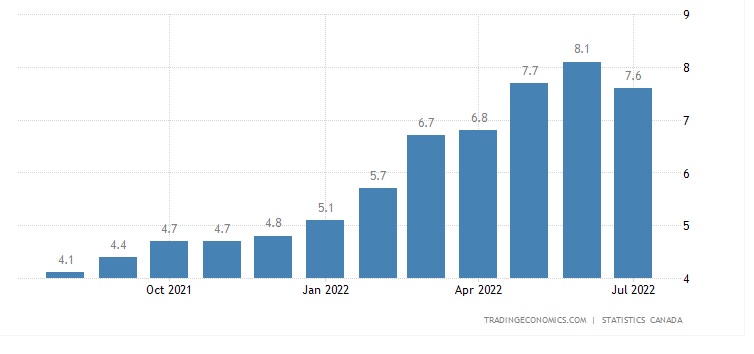

By comparison, Canada has consistently been behind the United States by a percentage point or more:

On the optimistic side, we can now say that inflation in July is lower than June and May.

On the pessimistic side, we can still point to the fact that we started 2021 at a little more than 1%, and that it takes time for inflationary pressures to subside.

We’ve all noticed the decrease in gas prices at the pumps. I filled up at $1.47 this weekend, and I can remember paying more than $2.00 in the summer. That’s going to help ease inflation figures, but there’s no guarantee that the August inflation figure is lower than July.

Can anybody tell me what this chart represents?

Maybe you don’t know what this represents, but put your technical analysis hat on and tell me what you see.

I see a level of “support” there two months ago that a bull would hope remains intact in about 1-2 weeks when that downtrending line looks like it’s going to test the support level.

I see a possible “dead cat bounce” there in the last few weeks as well.

Many of you have lived this over the last few weeks.

This is the Dow Jones for the last 12 months:

A lot of people were excited in the summer, saying, “My portfolio is up 13% in July!”

No kidding. It might have been down 10%, 20%, 30%, or more from the start of the year, and we know lots of tech-heavy folks got blown up and saw portfolio values cut in half, but all the rage in July was about this huge comeback!

Well, now what?

That chart doesn’t lie.

Those June/July lows around 30,000 were forgotten rather quickly when the DOW cut through 34,000 in mid-August, but with the down now threatening to drop below 31,000, you have to ask yourself: “Was the ‘comeback’ just a blip on the radar in a long-term downtrend?”

My point to this is that, to tie the theory back to the inflation figures, you can’t assume that a drop in inflation from 8.1% in June to 7.6% in July is representative of a new trend. It’s one month, and we need to see August drop, then September, and then October to conclude “inflation is easing.”

Inflationary measures aren’t an exact science. The so-called “basket of goods” is an average and it’s susceptible to the same margins of error and sensitivities as your local opinion poll.

In an unrelated story, a recent opinion poll about inflation shows that the public believes the Bank of Canada is making headway:

“Bank of Canada Makes Headway In Convincing Public It Is Serious About Inflation: Poll”

Financial Post

September 1st, 2022

From the article:

The share of Canadians who expressed some confidence that the central bank remains committed to its two-per-cent inflation target jumped to 57 per cent, according to a Nanos Research Group survey conducted for Bloomberg News. That’s up from 49 per cent in May.

The pick-up in confidence is a welcome development for policy makers led by Governor Tiff Macklem. The Bank of Canada is in the middle of one of its most aggressive interest-rate hiking cycles ever to quell inflation that has hit four-decade highs and is hovering at around eight per cent.

The accelerated hikes are in large part a confidence-building exercise to convince Canadians that officials remain focused on cooling price pressures and bringing inflation back down to the central bank’s target.

Expected inflation is a major determinant of actual inflation, since businesses increase prices and workers seek pay raises in part on what they anticipate prices will look like in future. That’s why policy makers have become very concerned about the self-fulfilling dynamics of persistently high inflation.

–

Does anybody want to explain “expected inflation” versus “actual inflation”? I feel like I’m watching Benjamin Tal speak…

Speaking of noted economists, what does David Rosenberg think?

“Inflation Will Collapse In Next Year: David Rosenberg”

Bloomberg

August 30th, 2022

This is a video and it’s worth watching if you have time.

Did you know that the price of lumber is down 70%? No? Then watch. The host keeps interrupting Mr. Rosenberg and it’s painful to watch (as is his bowtie) but you’ll get through it.

So maybe I’m the only one who watches Bloomberg TV and searches “inflation” in the Wall Street Journal app, but I still believe that inflation will remain one of the hottest topics in the world of business, economics, and real estate this fall, and it is for very, very good reason.

–

3) August TRREB Stats

This is slowly starting to feel identical to my blog post, “The Road Ahead,” from a few months back, but trust me when I say I didn’t plan it out this way. It just seems like not much has changed since then.

As was the case two months ago, inflation and interest rates were the two topics of discussion that were being bantered about the most in real estate circles, but as was also the case two months ago, I think the most recent real estate statistics are going to have a big effect on the market moving forward.

Labour Day isn’t exactly late this year. It’s come as late as September 7th in years’ past, but with many schools starting on Wednesday rather than Tuesday, it’s going to make for an odd first full week of September.

As a result, the real estate market will be slow to round into form. My team have several listings coming out next week – the week of the 12th, but we elected not to list on the week of the 5th for the reasons described above. I suspect there will be sellers who list this week, but many agents to whom I’ve spoken have echoed my sentiments.

It’s hard to predict when the TRREB stats will be released for the month of August. Not on Labour Day, that’s for sure. So the soonest we might see them is today; September 6th. But rest assured, whether the stats are good or bad, or neither, the media will have Thursday, Friday, and the weekend-editions to tell their stories, right before we start the first ‘real’ week back in September on the 12th.

What will those statistics tell us?

It almost doesn’t matter.

The media always tell the story that will get the most clicks. Or likes. They might use average price to tell their tale, or maybe sales data instead. They could focus on year-over-year data or month-over-month. How the media shapes the narrative will go a long way toward directing our fourth “discussion point” which I’ll share later on.

But for now, let me show you what I will be looking for in the August TRREB stats and what I think will be the best predictor of things to come.

In my last few “TRREB STATS” blog posts, I’ve focused mainly on sales and new listings, since the decline in prices is obvious, and we’re more interested in the root cause of the decline in prices – aside from simply an increase in interest rates or a decrease in consumer confidence.

The 7,283 sales recorded in the month of May are the second-lowest all-time in the month of May (I don’t track pre-millennium stats, since the city was half the size), and the only reason there’s a year with fewer than 7,283 sales was because of the pandemic in 2020 which saw a mere 4,606 sales.

The 6,474 sales recorded in the month of June are the lowest all-time in the month of June.

The 4,912 sales recorded in the month of July are the lowest all-time in the month of July.

You can clearly see where I’m going to focus my attention in August, right?

Now, if new listings were at all-time low levels as well, then this might be a moot point. But the problem is: they’re not.

In fact, when I compare year-over-year stats for sales versus new listings, it shows that sales have declined at a pace far exceeding that of new listings.

Have a look:

Sales have declined between 40-50% in May, June, and July, but new listings remain flat.

This means that at the end of every month, there’s far more inventory left over, compared to the previous year, or even the previous month.

As this trend continues, inventory piles up.

Then more new inventory hits the market, and if sales continue their trend, then the mound of inventory gets higher and higher.

I’m not a statistician so take this with a grain of salt, but I believe that if this trend continued from August, through to the ‘peak’ months in September and October, then we’re going to head into a full-blown buyer’s market by November.

Some will say we’re already there; a “buyer’s market.” But we’re not. We’re in a balanced market.

I’ve seen a lot of properties end up with multiple offers, many are still selling over asking, and while prices are down, it’s not quite a true “buyer’s market” yet since sellers still have leverage in certain market segments.

But the only thing stopping this market from turning into a true buyer’s market is about 2-3 more months of a sales-to-new-listings ratio in the 40% or below range.

–

I’m going to pause here for the night and we’ll come back to this on Thursday where we have seven other topics to get through, and thus I’d better be less verbose or you’ll be reading that post into next week…

Francesca

at 7:49 am

David, I agree with you regarding the vacation length: we find 7 days when we go down south isn’t enough but 14 is too much. For us 9-10 nights is the perfect sweet spot! As for hand and foot disease, my husband caught it too when our daughter was the same age as yours and his symptoms were ten times worse than hers go figure! We had never even heard about it until then. The joys having school aged kids right?!

As for the fall market, I am with you in not knowing what will happen as this year really seems to be an outlier with the high interest rates and inflation.

I do see some bidding wars mostly for houses but I think most condos are selling at list price or below. In my Willowdale area I see more condos being terminated now than sold or being reduced in price and then either sold or still terminated. It seems like we may be at a standstill in certain areas of the market where sellers are still expecting winter 2022 prices and buyers want to lowball offers as much as they can. Only those that truly need to sell will compromise on price it seems.

Another topic I’d like to see spoken about is buyers remorse. Specifically speaking to people who bought at the peak this past winter knowing the value of their house has decreased significantly already and for those who have a variable mortgage if there is regret not having locked in a fixed one when rates were lower.

Daniel

at 1:35 pm

Stats are out.

https://trreb.ca/index.php/market-news/market-watch

Price and sales are both up over July.

Jimbo

at 4:50 pm

I will bite on the prediction for interest rates.

I believe it will be 100bps and a pause into the new year. I believe this to be the case for two reasons.

1. US jobs are increasing.

2. US inflation will still be above 7%.

We need to keep pace with them to keep our dollar somewhat strong. I think we can go lower than them for our set rate, but not by more than 50bps.

If it isn’t 100, it will be 50 followed by 75 if the 75 is needed in 2023.

JVR

at 1:16 pm

Nope, there will not be a pause based on hawkish outlook from both the BOC and US Fed. There will absolutely be increases at the next meetings in October and December, and into 2023. Inflation is nowhere near their target range, core categories outside gas is still increasing.

Jimbo

at 1:16 pm

October will tell. I think they pause in October and re-evaluate after the FED.

Appraiser

at 6:30 pm

Interest rates are already too high. The stress test is totally ridiculous.

Rents are skyrocketing and the Housing Crisis is worse than ever.

Jimbo

at 10:28 pm

Why do you believe the interest rates are too high? I think the stress test can be cancelled if the BOC hits 3.25%. If the US goes to a 4.0% rate in early 2023, the stress test will serve zero purpose.

It is unfortunate that the rental market is as bad as the housing market. Toronto doesn’t have a healthy housing market IMO, but it has been very functional over the years.

Appraiser

at 8:06 am

Higher interest rates are not going to end the war in Ukraine, deliver natural gas to Germany or increase the production of semi-conductors.

Inflation is a complicated world-wide phenomenon caused by problems that cannot be solved with simplistic solutions.

“If the only tool you have is a hammer, it is tempting to treat everything as if it were a nail” ~Abraham Maslow

Jimbo

at 12:02 pm

I do agree with you for the most part but I will but down counter arguments anyways.

They won’t end Russia’s assault on the Ukraine, but it will limit the ability of other countries to produce and lend to Ukraine. IMO rates going higher could gift the Ukraine to Russia, but would need to be much higher for this to happen.

The higher rates will slow demand for things that require chips.

The part I disagree with you: inflation is a world wide phenomenon that is caused by multiple countries lowering rates. So bringing the rates up will fix inflation for G20 and devalue the currency of other nations. This should allow those other nations to grow through out of country investment. Maybe this solved China in 30 years

Appraiser

at 2:01 pm

Unless the goal is to manufacture a recession in order to teach the economy a lesson – I don’t get it.

Jimbo

at 5:21 pm

Recessions are necessary within a capital driven society to limit growth and drive efficiency.

I’m not sure it will work this time

J G

at 10:00 am

Interest rate is not high enough!

Appraiser

at 10:40 am

Is that a slogan, or does your argument offer nothing more?

J G

at 10:47 am

Another 3 quarters for you perma-bull, see you at the next hike in October!

Appraiser

at 1:57 pm

The bull / bear debate was over long ago. Try to keep up.

J G

at 2:53 pm

“Sure feels like the market has bottomed out.” – You just a few days ago lol

https://torontorealtyblog.com/blog/the-fall-market-is-coming/

Did you buy in Feb? If this is bottom, please go out and buy, already significantly discounted from peak

Average Joe

at 11:26 pm

Well, well, well. Turns out the whole bull run was just leverage and loose monetary policy hot air all along.

Funny how we have record low unemployment, a tech hiring boom, record immigration and low inventory and the market is still in shambles.

The real estate business was just one big government handout to generate GDP.

Gabe

at 6:52 pm

You can always count on TREB and the RE industry to whine when things aren’t going their way:

https://financialpost.com/real-estate/toronto-home-sales-slide-august/wcm/7de0ff36-dc25-4199-93d3-838c10889fbf/amp/

Lower the stress test. Huh. Sure.

Condodweller

at 11:35 am

Well, the cure for high inflation is higher rates, or so we’re told. The higher rates are already having their intended effect i.e. lower RE prices. I guess lower prices are what all the bulls will have to come to terms with.

So 3% increase decreased inflation by about .5%. So back of the napkin calculation to get back from 7.5% to 2% inflation we need 33% interest rates. Is that about right? Ok, that’s a bit extreme but 10-15% should do it.

Jimbo

at 12:40 pm

This isn’t a linear function……

Condodweller

at 7:11 pm

I didn’t say it was….

Mxyzptlk

at 8:46 am

“So 3% [interest rate] increase decreased inflation by about 0.5%”

I know you are aware that interest rate increases take anywhere from four to six quarters before having much of an impact on inflation, so perhaps let’s wait until the new year before passing judgment.

Condodweller

at 9:17 am

It’s actually 3-6 months, not quarters. That’s under “normal” circumstances of a usual 25 basis point incremental changes. With the unprecedented magnitude of increases of 3% in less than a year, I would expect a quicker response. It’s already been over 6 months with barely a dent in inflation.

My comment was part tongue in cheek, part sarcasm, with a bit of exaggeration, this is a RE blog not an economic forum after all, but if you look at what happened during the 70s, which even Powell referenced in his last speech, it’s not outside the realm of possibilities.

Mxyzptlk

at 1:23 pm

@Condodweller

Respectfully, the BoC disagrees:

“The Bank of Canada’s policy actions relating to the overnight interest rate have almost immediate effects on the exchange rate and interest rates, but current estimates suggest that it takes between 12 and 18 months for most of the effect on aggregate output to be observed. Most of the effect on inflation is not apparent for between 18 and 24 months.”

https://www.bankofcanada.ca/publications/books-and-monographs/why-monetary-policy-matters/4-monetary-policy/

Condodweller

at 9:23 pm

Hmm that’s interesting. At first I thought the key was “but current estimates suggest” given how bad the situation is but when I google it I see 1 to 2 years. That’s news to me but I must be mixing it up with something else. I stand corrected.

Jimbo

at 1:19 pm

My friend, 11 times 0.5 is 5.5 and 11 times 3% is 33.

That is a linear calculation of 11x.

Your 10-15% guess it will be good enough is still more linear than quadratic.

I’m not asking for a Taylor polynomial, but come on man

Condodweller

at 9:46 pm

11x/2 or 3 is neither linear nor quadratic, technically. I’ve already been wrong once. Since we’re friends you gotta let me have this one ????