Tell me if I sound like a broken record here, when I talk about the problem of “supply and demand” once again.

But tell me I sound like a broken record, and it won’t stop me from writing this blog post, or many more like it.

I’m tired of reading sensational media stories that try to prove a person, a group, or an idea is responsible for “unaffordable” house prices.

In the end, it’s basic, simple, logical supply and demand…

It’s boring.

That’s why nobody wants to hear about it.

“Supply and demand” isn’t the answer that people want to hear when they ask the question, “Why is Toronto’s real estate market continuing to climb?”

We recently saw what can happen when you sensationalize an idea. Vancouver made one of the most questionable fiscal policies of all last month when they decided to ban foreign investment. I know, I know, they didn’t “ban” foreign investment. But by instituting a 15% tax on purchases, they’ve reduced foreign demand by approximately 100%.

Topic for another day, I know.

But the point is that whether it’s the media, the government, or the masses, nobody wants to believe in an “efficient market” and the fundamentals of supply and demand.

So over the weekend, I figured I would look at the first seven months of 2016, to get a sense of what’s happened with supply and demand.

What’s going on with the number of active listings?

How quickly are properties selling?

What’s going on with total sales?

And of course, how does this affect price?

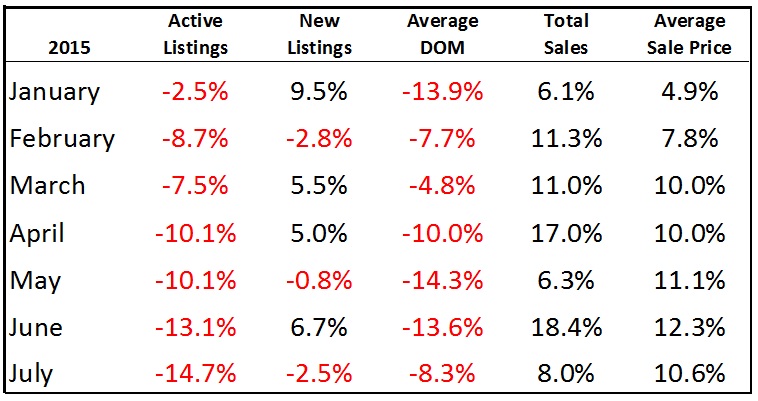

Here’s a look at 2016 thus far:

Those are epic numbers.

30%.

You’ve got three months – May, June, and July, where supply is down a whopping 30%.

And April ain’t no slouch either, coming in at almost 27%.

Save for the month of February, “new listings” were down every single month as well.

And properties are selling faster as “days on market” plummeted by over a quarter by July.

With sales up dramatically – 21.1% in February alone, and an average of 12% per month from January to June, is it any wonder why prices are up double-digit percentages every month?

Supply (in the form of active listings) is down roughly 30%.

Demand (in the form of sales) is up roughly 10%.

Show me any other product or service where supply is down, demand is up, and prices don’t increase.

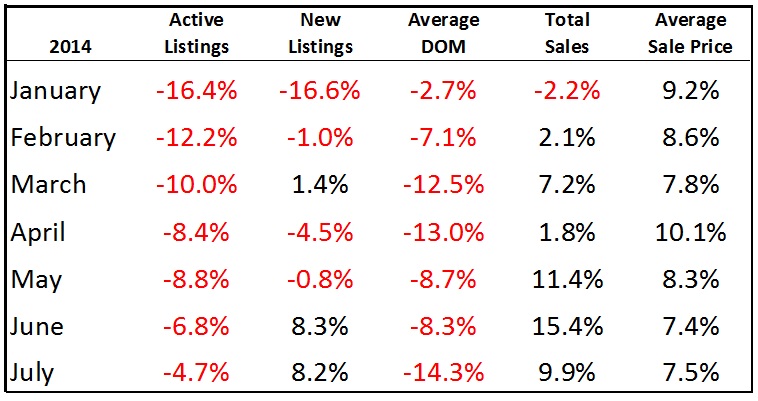

Now how do the 2016 numbers compare to last year?

Have a look:

What we see here is more of the same.

Active listings were down every month, as were days on market.

Total sales and average price were up too.

Not to the same extent, across the board.

Active listings were “only” down around 10%, compared to 30% thus far in 2016.

The average sale price was still double-digit in five of seven months, although we’re looking around 15% for 2016, and around 9.5% for 2015.

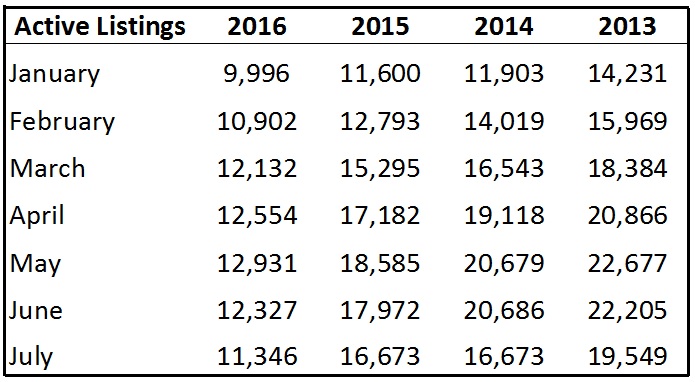

And now what of 2014?

Very similar patterns.

Active listings were down every month, once again.

Although it’s quite interesting to note that the high point of -16.4% was actually reached in January, and that number decreased virtually every month through July.

This was two years ago, and clearly a lot has changed in the 2016 market.

But these three charts show that inventory has dropped massively every month, every year, through the last three years.

The charts also show that sales are up, thus demand is higher.

And the result, as we all know, is higher prices.

Maybe the percentages aren’t enough for you.

We all absorb information differently, so while you might not be shocked on a percentage basis, take a look at the totals – and we’ll extend through to 2013 this time:

Those numbers are staggering!

Look at a month like May or June – you go from over 22,000 listings, to down in the 12,000’s!

Vancouver has thrown around words like “crisis” and “epidemic” to describe their market. Should we be calling this an “inventory epidemic” as well?

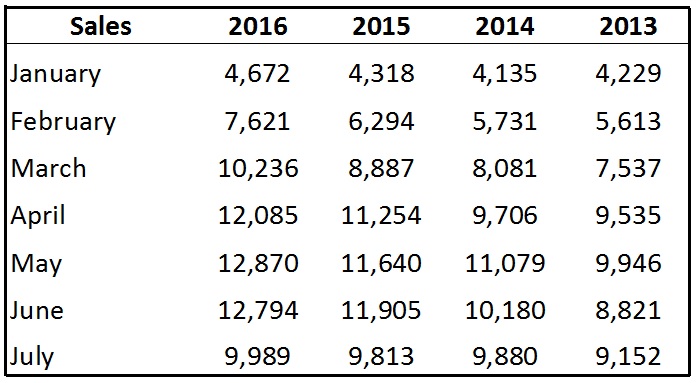

Same goes for sales – the numbers are staggering, they just work in the opposite direction:

Sure, January seems consistent.

But every single month has had substantially more sales in 2016 than in 2013 – and this is despite the lower inventory!

So to sum it all up, let’s see what’s happened with both active listings and sales from 2013 to 2016:

That’s wild.

Just think, for a moment, about the month of June, where you have 44.5% fewer listings available, and 45.0% more sales.

What would happen to the price of, say, oil, if you generated 44.5% fewer barrels, but there was a need for 45.0% more from the consuming public?

Prices would skyrocket.

And in the case of real estate in Toronto, prices have done exactly that.

There is no “person” responsible for higher prices in Toronto.

There is no group of people, no wing of government, no idea, no ideology, and no policy responsible.

Supply has plummeted.

Demand has gone through the roof.

It’s simple, logical, basic grade twelve economics.

It’s time people start accepting that…

Homeowner

at 7:26 am

Every single bubble in history from tulips to tech stocks also was created due to demand far outstripping supply. You’re absolutely right David . The real question is whether people “NEED” to participate in the bubble .

O

at 12:27 pm

Do you need to have a short commute for work in the city? Do you need to be near subways and good schools? Do you need to be near hospitals and services, world class sports, dining and entertainment? If so, there are probably 10s of thousands of other people who feel the same way. This has nothing to do with tulips or what happened in the past. The correction is the upward swing. This is the new normal.

Frank

at 1:54 pm

people can rent and enjoy all of those things – they don’t need to participate in this by purchasing a house. What scares me is that everyone is so damn confident about the market . A number of friends are looking to buy a detached and flip it next year for a 10-15% gain in two years. It’s a Can’t miss investment and they take out second mortgages for the downpayment I agree fundamentally that there are many reasons why the high prices are supportable from immigration to green belt to supply shortage . Then again I remember many friends telling me why Nortel and other tech stocks were great buys in 2000 at 1000 times Pe as well.

O

at 2:43 pm

Ok, then let me add: do you need to be in control of your own destiny and not have your life change due to a landlord? Do you need to have your home decorated/renovated the way you want? Do you need privacy and the space to do what you want? When I maried my wife she was in a super cheap rent controlled apt in a good part of town, but she HAD TO HAVE her own garden. That is what got us into the market. Yes, renting works for some people, but my point still stands. A lot of people want the stability and life style that comes with home ownership…not everyone, but enough to fuel this market. Not trying to be flippant, juts pointing it out how I see it.

Izzy_Bedibida

at 6:13 pm

Yes…. Everybody wants those thing’s and enjoy what the city has to offer.The problem arises when the premium spent to enjoy those perks and activities cuts into the cost of actually enjoying the activities. How are businesses supposed to survive if the locals have no income left after mortgage,rent and other costs of living are paid?

Kyle

at 2:06 pm

Can we just stop with the irrelevant comparisons of TO real estate to tulips, Nortel/tech stocks or the US in 2008 already? Other than experiencing a period of rising prices, these things have absolutely nothing in common.

And seriously people, rising prices does not automatically equate to a bubble.

Ken Davenport

at 6:30 pm

Crisis ? What Crisis ? They should have seen this coming a year ago

Here’s Vancouver’s Annual Price Changes.

Single Town Apt

Jul-16 38.0% 29.4% 27.0%

Apr-16 30.1% 22.1% 20.6%

Jan-16 25.9% 14.6% 15.9%

Oct-15 20.1% 9.3% 11.4%

Jul-15 16.2% 7.8% 5.9%

Apr-15 12.5% 5.7% 4.4%

Jan-15 8.4% 4.3% 2.5%

Oct-14 7.9% 4.7% 4.0%

Jul-14 6.5% 3.4% 2.2%

Apr-14 4.7% 2.0% 2.6%

Jan-14 3.2% 1.7% 3.7%

Oct-13 -0.5% 0.1% -0.9%

Mike

at 1:36 pm

Kyle-

How can you say that Nortel, the stock market and the 2008 collapse in the US are irrelevant to the Toronto housing market?

Nortel- What Nortel did would be considered fraudulent in today’s markets but perfectly allowable at the turn of the century when they were booking sales that they provided financing for. When Nortel was flying high they made almost 90% of the infrastructure that built the internet. People weren’t going to stop using the internet anytime soon, in fact demand was only going to increase. As long as people continued to use the internet then Nortel would still fly high. At the time of its collapse it would take you 30-years to recoup your investment in Nortel because the stock was considered “over valued” by most analysts using traditional valuation methods. That didn’t stop people buying the stock and raising its price. Until one day the music stopped and the company collapsed. The internet is still going and growing but Nortel is long gone. You don’t think that a change in policy could effect Toronto real estate prices?

US 2008- The US market was fueled by low cost of borrowing and ease of acquisition of capital. You don’t see that in Toronto? Anyone can buy a house today, you can even get zero-equity loans, just like you could in the US. What happened in the US was that when the credit market slowed loans started to default. Crazy part about it was that it was triggered by the National Bank of Canada when they said they weren’t going to participate in certain money market products because of concerns about the underlying. That tightened credit across North America causing loans not being extended. Now you’ve got people who can’t refinance loans either forced to sell or default. As that happens more product comes into the market but demand is killed because it’s harder to get financing; you start to see a massive retraction in prices. We can talk about how it happened in the US or how it’s happened her and in Vancouver in the past. BTW Vancouver has always had limited amount of land to build on because of it’s geography (river two sides, mountains one and an ocean on the other) as well as a strong foreign investment and year-over-year population increases yet has had several pull back in their real estate markets.

Stock Market- How can you say increasing housing prices are not comparable to the stock market? If anything it shows what state we’re in on the Market Cycle. Yes, market cycle. We all like to trot out our first year understanding of economics by quoting supply and demand but we ignore market cycle. The one great thing is that all markets are cyclical. What goes up must come down. Peak market is usually indicated by new record highs, sound familiar? Toronto housing prices are exactly like the stock market because they are cyclical and usually lagging equity markets. When equity markets fall then houses usually fall soon after (stock market crash of 87, housing crash of 89 is a good example). The problem we’ve had is low rates not only help home buyers but also kill bond returns . Traditionally, when equity markets fell, debt markets prospered and vice versa. But with Governments intent on stimulating economies by providing cheap debt, corporate debt markets have suffered so capital must be invested back in equities in order to generate return (whole supply demand thing again). In addition, fiance is one of the, if not the largest industry in Toronto. If the stock markets suffer then people lose their jobs, people without jobs can’t buy houses and your demand begins to wane. So they’re pretty tightly tied together.

Kyle

at 2:12 pm

Bending over backwards to try to manufacture commonality, with a complete disregard for materiality and probability, still doesn’t make any of them relevant.

Mike

at 5:33 pm

Yes, why let facts get in the way.

Kyle

at 6:11 pm

LOL, buddy you still don’t have a clue what a fact is (i.e. “What goes up must come down” – this is not a fact, statements like that are what’s called bullshit). And even if you did know what a fact is, you need to understand that barfing up irrelevant and immaterial ones doesn’t support your case.

Nortel crashed because of wide scale fraud, they lied on their financial statements and the growth that people were expecting was fictitious. Not relevant to TO housing.

US home prices crashed because of wide scale fraud, they were lending to buyers who didn’t qualify or couldn’t afford their mortgages. And they were lending based on the value of the asset rather than the owners ability to afford them. Not relevant to TO housing.

I’m not even going to spell out the stupidity of your last argument. The housing market DOES NOT FOLLOW the stock market. Just by looking at a graph of stocks vs a graph of house prices, anyone can see that your claim to the contrary is sheer stupidity, never mind the obvious logic fail.

Mike

at 10:58 pm

I’m looking at an Andex chart that show’s a correlation between the equity markets and housing, what chart are you using?

Kyle

at 1:39 pm

The TSX has crashed on Aug 2000 (tech burst), June 2008 (Credit crisis), Aug 2011 (Europe debt crisis), June 2015 (China stock market crash lead to financial contagion). Compare that to this:

http://www.trebhome.com/market_news/market_watch/historic_stats/pdf/Historic_1606.pdf

Seriously, i give up. Trying to enlighten you is like giving medicine to the dead.

Mike

at 10:52 pm

So wait, your source is TREB. Hahaha nothing like getting your info from a third-party, non-relate source.

Get real.

Please, come up with some actual facts.

Kyle

at 2:23 pm

Let me make this simple. Those that compare TO real estate against tulips, Nortel or the US housing market are basing their argument on stupid people logic: Price of A is rising. Price of B, C and D also rose but then subsequently crashed, therefore price of A will also crash.

The question is WHAT CAUSED THE PRICES CRASH TO CRASH? Not whether people still use the internet, not whether you can get a loan for cheap, not whether there is a cycle. While those too are irrelevant straw man arguments, they are not as irrelevant as the stupid people logic behind the original comparison.

Mike

at 5:31 pm

Kyle-

So your argument is that since it hasn’t crashed yet it won’t crash? Nice, I guess you’ve got 15-years of data to prove that your right.

Kyle

at 5:46 pm

No, my argument is that the things that caused prices to crash in your example…you know like wide scale fraud, are irrelevant to TO housing.

Kramer

at 4:05 pm

Mike, that’s not how it played out in the US…

Mortgage brokers were giving adjustable rate mortgages to anyone with a pulse, even for second or third properties…

This was possible because mortgage brokers didn’t care because the banks bought these mortgages from them so they could package them up into dogshi+ MBS bonds… which were then sold to investors around the world who didn’t know any better.

The mortgage rates ‘adjusting’ higher as per the contracts these home buyers signed is what finally caused defaults to skyrocket and the house of cards to collapse.

The only way to compare this to Canada would be if let’s say over the last 5 years everyone got really low variable mortgages (which is has happened) and then all of the sudden the Bank of Canada increased interest rates like 10%… if that happened, yes there would be a mortgage meltdown in Canada. Which is why the Bank of Canada is not going to jack interest rates 10% tomorrow… BELIEVE THAT!

Mike

at 5:27 pm

Kramer-

What part of that doesn’t happen here?

Do you think that RBC, TD, CIBC or Scoita hold on to their loans? Nope, they’re packaged and sold off, just like they use to do. Do you think that Home Trust or Equity bank holds on to their debt? Nope, packaged up and sold off.

We don’t need mortgage rates to go up to 10% to see a blood bath. BMO has stated that half a percent will put 30% of mortgage holders into trouble. Scotia has said that they’re restricting lending in Toronto, National Bank soon followed. You can bet that if they’re doing it the other four are doing it.

US lenders were giving out one-year loans to people who would refinance them a year later with more favorable terms because the value of the property would increase and represent equity. Kind of sounds like what our secondary lenders do, doesn’t it? They’re lend to anybody who can make the payments at 8% for a year with the hopes that the buyer will refinance a year later. What happens a year later when instead of 8% that lender needs 9 or 10%?

Kyle

at 6:15 pm

Seriously after your hiatus, you still haven’t mastered basic comprehension.

Kramer

at 7:29 pm

Mike, there are just so many reasons why it is not even close.

First of all CIBC doesn’t package MBS bonds filled with CIBC mortgages that are all going to default if rates go up a few %. CIBC doesn’t give out such mortgages. There are strict lending rules here that the big banks follow. If you don’t have 20% down you have to buy mortgage insurance. All of these are backstops. Furthermore… Last I heard big banks in Canada don’t buy risky subprime loans from secondary lenders and package them into bonds.. If they are, we would know about it loud and clear. If you have an article or anything showing this please share it.

The lending rules in Canada that 95% of mortgages all under result in our landscape being absolutely nothing like the USA 2008. My sister in law couldn’t find a house for 8 months and her and her husband are as credit worthy as they come. Even with her creditworthiness if she didn’t put down 20% she would need to buy mortgage insurance.

Anyone buying an investment/second property in Canada has to put 20% down minimum and can only count half the rental income as income against securing a mortgage . This is another key backstop the USA didn’t have AT all, which allowed anyone to irresponsibly buy second even third properties with 0 to 5% down.

It’s not comparable at all. I’m not saying there aren’t possible issues coming in the future that might impact prices, but this is nothing at all like the Hubble in the USA.

Kramer

at 8:07 pm

Read this, seriously it’s excellent. I learned a lot…

https://www.cmhc-schl.gc.ca/en/corp/nero/jufa/jufa_018.cfm

Kramer

at 8:26 pm

In Canada, NHA mortgage-backed securities are pools of Canada Mortgage and Housing Corporation (CMHC) insured residential mortgages. CMHC is a federal government Crown corporation created in 1945 under the NHA.

From a credit quality perspective, NHA mortgage-backed securities are considered to be “AAA” instruments, like Government of Canada Bonds.

Mike

at 10:48 pm

Kramer-

Yes, talk to Alex Avery about CIBC’s mortgage exposure and he’ll answer your question about “sub-prime” and packaged notes.

You need to realise that most mortgages don’t involve CHMC.

EdH

at 8:47 am

But what is fuelling the demand? Is it local buyers looking to purchase a home for their families, foreign flight capital seeking safe refuge, or speculators hoping to cash in? It’s all of the above. But when demand becomes detached from “healthy” fundamentals — people buying homes due to job relocation or family expansion (basically, needing a place to live and wanting a community to call home) — things can get very precarious.

What we see now is a lot of demand fuelled by “unhealthy” factors, like greed, speculation, and fear mongering. Not to mention governmental interventions, like ultra-low interest rates and other manipulations designed to encourage borrowing and increase our debt.

So there are a lot of things influencing demand, but the balance is leaning too heavily towards the unhealthy type, IMO.

Laker

at 9:42 am

I agree – it’s overly simplistic to just throw our hands up and say “supply has plummeted and demand has gone through the roof”. An imbalance in supply and demand is the cause for all price movements in any traded asset. The more important question is why supply going down or demand going up, and is the current trend permanent or just temporary.

If you’re looking to transact today, to a certain extent it doesn’t matter – you have to deal in the market we have. But just saying “simple supply and demand” doesn’t actually explain anything.

Real estate millennial

at 1:04 pm

I don’t think this a regression to the mean type of problem and we’re past a trend. Is there room for a market correction similar to 2008 yes but we didn’t have a full American bubble burst 2008 why would we have one now? David can post the TREB pricing graph trend over the last 20 years it stalls in 2008 and starts climbing again in 2009.

My main point is our supply problem is created by two things geographical bounds and immigration/migration. The GTA accounts for 20% of Canada’s population and is number 1 for migration and immigration of all Canada (more people move here in short). The GTA is an artifical island create by the Green belt. I could keep going but I think we can figure the rest out from here.

Solution: transit Toronto is nearing the heels of a world class city but we lack transit. when Pickering, Ajax, Vaughan and even further Guelph, Milton, Caledon become more accessible by high speed transit we’ll see a levelling of prices (not a drastic correction). When you compare London, New York, Shanghai and other world class cities to Toronto and its surroundings areas Toronto starts to resemble these places that are generations older. The core is extremely expensive the surroundings areas are cheaper with friendlier transit.

Those of an older generation miss the old Toronto pre amalgamation and north st Clair wasn’t Toronto. Times have changed and so has the picture of your dreams. Just live with the reality of it I’m in my mid 20’s and I don’t bother to complain, I live in the new Toronto!

Kyle

at 2:36 pm

Excellent comment Real estate millenial.

The reasons for growing demand and shrinking supply are pretty observable to anyone actually looking for them. On the demand side, Toronto is a large Global city that attracts tens of thousands of new people every year. The majority of the jobs that exist and job growth in Canada has happened in Toronto and Vancouver. Millenials (the largest generation) are entering their prime home buying years, while the baby boomers (the second largest generation) are opting to stay in their properties.

On the supply side, the transaction costs of moving are between 8-10% of a new property. Leading more and more people to stay put and renovate or make do, rather than move. Thus the record low months of inventory number.

Both of these are long term trends that i don’t see reversing anytime soon.

Formerly Frosty

at 5:32 pm

Can 8-10% LTT and realtor fees really be deterring sellers when the value of their homes increase 20+% in the last year alone?

I listening to you now on greenbelt and immigration issues, but I’ll believe you later. (RE Millennial, that’s an SNL reference from before you were born!).

Kyle

at 9:25 am

The 20% increase applies to the homeowner’s current house and their prospective purchase, so it doesn’t really help the owner. IMO, a big deterrent with moving (especially up) is the high transaction costs. Let’s say you’re in a $1M semi and plan to move up to a $1.3M detached. The transaction costs in Toronto are just shy of $100K, so you end up paying $400K more to get $300K more house. And given there are so few detached houses available to select from, the detached will likely still need some $$ to make it suitable for you. I think that is making a lot of people question whether they really need to move.

Formerly Frosty

at 7:05 pm

Thank you, Kyle. I appreciate you taking the time to illustrate the problem.

Lucie

at 4:43 pm

EdH…you may be onto something here.

Julia

at 10:38 am

I can only speak from personal experience as to what I think is adding to the lack of supply but I doubt that I’m the only one in this situation at this point in time. We have been in what we consider to be our starter home for over 11 years now. Our initial goal was to move up to a larger home in the same area in 5 years but that seems wildly out of reach now given the accelerating prices, the land transfer tax and the realtor fees. And so we are staying put and renovating as are many of our friends who are also in their first homes. This obviously is affecting the supply available to today’s first time homebuyers. One of the ways to encourage us and others in similar situation to move up would be to lower land transfer taxes and to (gasp!) cap the real estate agent fees. Shaving $100k plus off our moving costs would definetly encourage us to look around for a new home.

Marina

at 10:54 am

You are definitely not the only one. We too are stuck in our “starter home”.

Another factor is the rapid updating and tearing down of existing homes. On my street alone (not neighborhood – just the street!), there have been over 30 tear-downs in the last 5 years. 30! Average prices in the city are going way up for this reason too.

Combine that with massive commute times from the suburbs, and you have a lot of people who can’t upgrade in their area, and do not want to move out of the city. Hence no inventory.

O

at 12:20 pm

Ditto. We love our house, but is not our “to die in” house. However, we will under no circumstances pay the double LTT so we have stayed put and used that money for other things.

Geoff

at 12:49 pm

We are totally stuck in our starter home. Not due to the double transfer tax, but the rapidly rising house prices. I’ve estimated that to move to a semi (from our current detached) don mills home to say leaside – as was the plan – would result in a net additional mortgage of about PLUS another $500K. For $250K I can send my son to private school for grade 7 to 12, a primary reason for moving being the not so great schools in my area. yes I lose out on potential capitalizing my expense, but so be it..

jeff316

at 9:45 am

Geoff, hats off to you for posting truthfully and honestly. If I have to read one more “I can’t afford to move because of the land transfer tax” I will bang my head against my desk, If the LTT is keeping someone in their home, they couldn’t afford a new one anyway. But we humans love a good excuse.

Libertarian

at 11:55 am

Geoff and Jeff316 bring up good points about whether it is in a person’s best interest to pour more and more money into shelter. Perhaps people have decided that it’s not fun to be house poor.

A theme in these comments is “Why is demand so high?” It’s because we as a society have accepted the simple belief that it is better to own the roof over your head than rent it. While I agree with that belief in principle, I do not believe in spending every dollar earned on shelter. There are other costs in life (food, clothing, children, children’s education, savings, hobbies, vacations, etc.). Since people aren’t moving up the property ladder, it would seem that people are choosing those other costs over shelter. It will be interesting to see if this trend eventually leads to a decrease in demand. As prices continue to go up, affordability decreases, people can’t move up the property ladder, and everybody (owners and renters) stays in the same situation. Detached houses are traded between the super rich.

Julia

at 2:16 pm

Jeff316 – I urge you to read more closely – no one here said that they can’t afford to pay the double LTT but rather that it’s a deterrent from moving. To Kyle’s and Goeff’s point below there are better ways to spend $100k than to hand it over to the government.

O

at 3:47 pm

Yes, we can afford it, but choose not to pay it.

jeff316

at 9:31 am

Julia I read it. You listed the LTT and real estate agent fees in the same line as house prices. That’s bunk. The LTT is perfectly affordable in this economic climate. It you right, or anyone else’s, to find it unpalatable. That’s fine! But the LTT is not preventing anyone from moving. It shouldn’t even be in the same line on a page as rising house prices and other fees.

Izzy Bedibida

at 8:49 am

My widowed mom is another reason for this supply shortage. Her and her widowed and retired friends all live in modest semis and small bungalows. They are all one floor , easy to take care, have small backyard’s for their garden and a place for their grandchildren. They are all healthy and feisty enough to maintain the homes in reasonable matter. Plus that work keeps them active healthy and happy. None are really for the old folks home. Homes have been mortgage free for decades and all have good savings and widows supplements. Other downsizing options are a non starter for them. Towns and stacked towns have too many stairs and no garden. Rental apartments in the area generally cater to riffraff . Condos are too small or expensive for a proper suite and again no garden. According to them they can hire a gardener and a handyman with the equivalent in condo fees.

Lucie

at 4:42 pm

You make excellent points Izzy. I have seen and experienced the exact thing you are describing. Makes sense.

Kyle

at 4:55 pm

This is bang on. The boomers aren’t selling. It’s cheaper, more predictable and preferential for many of them to stay in the house that they already own free and clear, where their expenses are basically fixed and where they have everything they’re used to having. There’s a lot more uncertainty with selling and trying to manage the proceeds to ensure you have enough to make rent for the rest of your life and where you’re exposed to market risk.

O

at 12:03 pm

agree 100%

Joel

at 11:34 am

Yes, where I live there are many elderly people and couples. Great family homes are being used by a single elderly person. Instead of building condos for young people downtown, they need to build vibrant condos for the elderly in the communities they have lived in for the last 30 – 50 years. This would provide a better solution for all.

However I know that many elderly people do not want to move out of their homes and are upset at the idea of leaving. Hopefully younger generations will not be this way.

Andrew

at 11:33 am

supply and demand yes, but that just tells us that the sky is blue.

when are listings going to come roaring back and will the demand be there to meet these listings when rates start to creep up?

Geoff

at 12:47 pm

October 17, 2016.

Condodweller

at 2:25 pm

No, November 3, 2016…….or April 5, 2025

Kramer

at 3:50 pm

So you insult the author for providing concrete data and a clear conclusion, and then ask him to look into a crystal ball and speculate about the future.

Tom

at 1:54 pm

For your next article you might want to look into the *reasons* why this is happening instead of just making an observation about what is happening. The latter is boring and simple (your words).

What is restricting supply? Some commenters have mentioned the land transfer tax. Then there’s limitations on development. Land owners holding out for a bigger payoff. Etc.

What is creating so much demand? Skyrocketing salaries? (Don’t think so) People moving into Toronto? Where are they coming from? What makes it possible for them to afford $1M+ homes? Foreign capital?

Libertarian

at 3:12 pm

Thank you for reminding people that the government (at all three levels) has no clue what it’s doing! To add to that, the media supports the government, whatever it is doing, because the media is in the business of writing about the government. Unfortunately, it seems that more and more people are believing that the solutions to all of our problems is more government, not less. And of course, the media loves that idea! Here’s hoping that your blog can convince people to rely less on government.

Sid

at 1:36 am

What is going on can be termed as the “Greecification” of Canada. We have become inundated with a vast number of Dumbed down journalists and an every increasing unionized government bureaucracy that does very little work of any true measurable value.

In Alberta as soon as the NDP took office, the NDP premier allocated 700 Million towards the creation of an entire new govt. bureaucracy. The newly created bureaucracy is now hiring Several Hundred “community liaison officers” each at a annual salary of 94,000/year. The job is essentially a machinery to spread the NDP propaganda points for their 9 Billion tax grab in the name of Carbon legislation. ( So far no one has called the Alberta NDP out on why they have allocated several Billions to subsidize importing edible foods to be used as “biodiesel”. This is absolute nonsense of a plan )

Geoff

at 5:00 pm

FANTASTIC article. It’s refreshing to finally see someone write about Toronto Real Estate with sufficient DATA to make any kind of definite CONCLUSION and not ending the article with “Only time will tell. Until then, keep rolling your dice folks.”

For those of you in posts below who requested being shown how to chew gum.

WHY HAS DEMAND BEEN INCREASING?

1. Sinking Interest Rates

2. Growing Population

3. Both Local & Foreign Investment (because investing in fixed income markets isn’t that profitable in case you haven’t noticed with all the headlines flashing “NEGATIVE YIELD BONDS”)

All of the above are facts, the data is easily found. If the first two on the list are green and your city is not in a big recession, you’re going to have INCREASING DEMAND FOR HOUSING… and if all else is equal with supply, you will then have increased prices. As for number 3 above, the state of the global economy is just the cherry on top driving capital into equities and real assets. Where else are people with capital going to put it? Low or zero interest bonds? Your bank account?

Now factor in available supply which, as per the excellent data, is decreasing… why is it decreasing? OK if you really need to be shown how to tie your shoelaces… because 1) less people are moving because moving is increasingly expensive in fees and trading up is more expensive than ever at these prices so people are renovating or just holding still “stuck in their starter homes” as many described below and 2) because there is not enough serviceable land available and ramping up the home building industry’s overall capacity in a place like Ontario doesn’t happen as fast as it does in Miami or Ft. Lauderdale that would start pumping out 100 new single detached houses tomorrow if they smelled demand for 50.

Result, double digit price increases.

Again, great article… I hope this shuts up a lot of people… even if we just shut up the people who try to equate this to 2008 in the USA, that will be a great start… and if those people still don’t understand why this is relevant, it’s because in 2008 in the USA, they were building and building and building and there was NO LACK OF SUPPLY for the unstoppable bubbled, speculative and FRAUD DRIVEN demand.

M

at 12:02 pm

jobs are in Toronto, if they. Were distributed more this problem end not happen. I am now willing to take a 50% paycut to avoid commuting or raising kids in Toronto

Mr. Late

at 10:23 pm

I wonder about whether “demand” will hold up for much longer ……

John

at 10:25 pm

As long as rates are low and population is growing.

Condodweller

at 2:22 pm

Or as long as people are willing to pay $2,000,000 for an 800sqft house just because it happens to be in a desirable area.

We are already seeing evidence of price exhaustion in the core by the rising prices in the 905 as people rather move out than pay up. I’m curious what will happen once we surpass the $1,000,000 mark in the commutable areas like Hamilton, Oshawa, and Newmarket. Heck, Newmarket SHFs are close to the million mark already.

What amazes me is that people are still buying pre-construction condos which won’t be ready for 4 years.

BALMUKUND BHATT

at 10:58 am

If you compare Price to rental ratio or affordability ratio Toronto is still dirt cheap as its rental ratio is 20 mines it will take 20 year to recover your principal with rental assuming you are not getting any price appreciation where city like tokyo , shanghai, Shenzhen, mumbai, hongkong ,london etc all have ratio above 50 some city has ratio around 69 so i feel it is beginning of boom

Condodweller

at 2:15 pm

If we are to believe that we are in a boom that is going to continue for the foreseeable future, then transaction cost should not be a deterrent for listing a home for those who want to move up since with rising prices the transaction fees are only going to get larger. Which means if you want to move up, don’t walk, run to the bank and your agent and do it now!

Kramer

at 3:43 pm

No one knows if the boom will continue… thinking you can afford to trade-up based on speculation that the boom will continue is 2008 USA behaviour. No one run to the bank! Take a breath!

Condodweller

at 12:24 pm

Kramer, we are talking about supply and demand here, not affordability. For those who can’t afford it, hopefully, they have the good sense of not doing it. But that’s a whole different discussion.

Good lord...

at 4:26 pm

I applaud the author for explaining some of what has happened, and NOT speculating about what is going to happen… which is what many of you want him to do. There is no point in trying to speculate.

If you are buying a property to live in, don’t buy a house based on what you speculate will happen in the future… buy it based on your need and long term affordability and be prepared to hold it for a while.

If you are buying an investment property, but it based on fundamentals (i.e. cash flow/yield) and be prepared to hold it over the long run like any proper investment.

If everyone stuck to those strategies, everyone will be fine. If you veer away from those strategies then you are merely speculating and yes your risk of getting into an ugly situation always goes up the more you speculate.

DON’T SPECULATE!!!!!!!!!!!!!!!!!!!!

natrx

at 11:58 am

Realtor costs and land transfer tax IS a HUGE factor. My retired parents in a detached bungalow see little point in selling and downsizing to a condo. Better for their children to ‘assume’ it somehow, saving on the costs.

Guaranteed this is happening to alot more places than is given credit for or realized.

Simple as that.

Sid

at 1:18 am

Why is Toronto’s real estate market continuing to climb?

The real answer is Foreign Speculative and Money Laundering Demands.

Canada has become awash with Chinese current and ex government officials and criminals who are routing their ill gotten gains into Canadian real estate markets for the following reasons;

(1) Need to offshore ill gotten wealth before they get caught by another faction of the government.

(2) Speculation on further real estate gains

(3) Currency speculation. The CAD may go lower, but in the long run oil prices will never stay at 50/barrel. When the CAD rises, they will

(a) Sell at a higher price ( because of real estate price gains from rampant uncontrolled speculation)

(b) Once the profits are exchanged from a higher CAD to the local currency, the profit is further magnified.

Citation: What I mention above is not heresy or conjecture. It is a fact. CBC had this headline a while ago:

Mother of Vancouver mayor’s girlfriend could face death penalty in China

Mayor Gregor Robertson silent on Chinese press reports as he awaits more information on Zhang Mingjie

Zhang is a former deputy director of the Harbin development and reform commission in northeast China. China Daily says Zhang is “charged with three counts of corruption and abuse of power” in an alleged “land swindle” involving up to 350 million yuan — just over $69 million Cdn

What China Daily does not mention is this Zhang Mingjie authorized entire villages to be emptied by the gangsters and “dis-appeared”. Not only did she expropriate illegally the villagers land, the villagers lost their lives as unwilling organ donors.

Canadian politicians know full well what is going on and what is driving the Canadian real estate markets higher. It is corrupt money from over seas. They won’t do anything about this because:

(a) Canadian politicians benefit directly from backroom palm greasing deals

(b) The politicians love the higher property taxes they can collect to pass onto their electorate. The government unions.

Exorbitant Canadian real estate is a clear and present danger to the welfare of every Canadian. Unfortunately only the union members vote with dedication as they need to protect their Cadillac wages, pensions and benefit deals.