While that might sound like a keyword-friendly title, I assure you it’s not by design. But rather, it’s the most basic way we can address, discuss, and analyze the current state of the Toronto real estate market.

There are reports that the sky is falling, and there are market bulls out there pumping the real estate market’s tires, calling this a “blip,” and/or ignoring the numbers.

So let me attempt to provide an unbiased look at what’s going on in the market, and while any attempt will seem biased, depending on what side of the argument you are on, I assure you one thing is for certain: nobody can accurately predict the future…

Do you know what absolutely amazes me about Google?

They’re one of the largest and most successful companies in the world, and they have a search engine that’s market share is larger than every competitor combined, and yet if I want to do a search within a specific time period, I can’t.

Tell me if I’m wrong here, but there’s no way to search specifically, and only, web-pages created, say, between January 1st, 2004, and December 31st, 2004.

Now why do I want to search something from 2004?

Well, because over the past few years, I’ve kept magazine covers, and newspaper articles, about the Toronto real estate market crash.

It’s been a hobby of mine, since I have always been a market bull, and I knew that the day of reckoning for all those market bears would likely never come, unless, their predictions had been well-tracked.

Use Garth Turner as an example, just for fun.

March 17th, 2008 – his book, “The Greater Fool: The Troubled Future Of Real Estate” hit bookshelves. His hypothesis, as we all know, was that the real estate market was going to crash. And while I don’t have a copy in front of me, we could probably agree that his definition of a crash, along with many others, was that prices would drop somewhere in the neighbourhood of 30-50%.

The problem with that, of course, is that since Mr. Turner’s book was published, prices of Toronto real estate have increased around 140% – or at least that was the number this past April, before prices started to decline.

So for Mr. Turner, and every other market bear who has been predicting the real estate market’s demise, I ask this: “If you predict a 10%, 20%, 30%, or 40% decline in prices, and the market does decline by 10%, 20%, 30%, or 40%, but does so after the market increases by 140%, do you say, ‘I told you so?'”

I think that’s the definition of rhetorical, since not a single “expert” out there has come forward so far and said, “Holy $*@&$ was I ever wrong!”

But now that our real estate market has seen two consecutive months of a decline in the average home price, people are coming out of the woodworks, applauding their predictions from yesteryear, and ignoring the soaring price increases that followed.

So if only Google allowed me to search for more and more outlandish predictions, then I could really add to my collection!

Here’s one I have on hand, from Toronto Life in July of 2010:

So many aspects of this ought to make you chuckle.

First, they’re saying “$1.05 Million” as though it’s a lot of money, and relative to what prices are like today, it’s amusing.

Second, the “$151,000 over asking” seems trivial, against the $300’s, $400’s, and $500’s over asking that we saw this spring.

And last but not least, the B-Word: Bubble.

“We’re in a bubble? Now What?”

“When it will pop”

“How bad it will be”

The bubble they spoke of – that 50% decline, just around the corner, never popped. Instead, the average home price of $420,892 when this issue hit newsstands increased to $920,791 this past April – an increase of 119%. Read: not a 50% decline and/or bubble “popping.”

So at the risk of sounding like a greater fool than those who read Garth Turner’s book, and suggesting that I’m giving an “unbiased look at what’s going on in the market,” the point I’m trying to make is that if prices in Toronto drop, you simply cannot ignore the massive increases that preceded.

And with that really long lead-in, let’s get to the numbers.

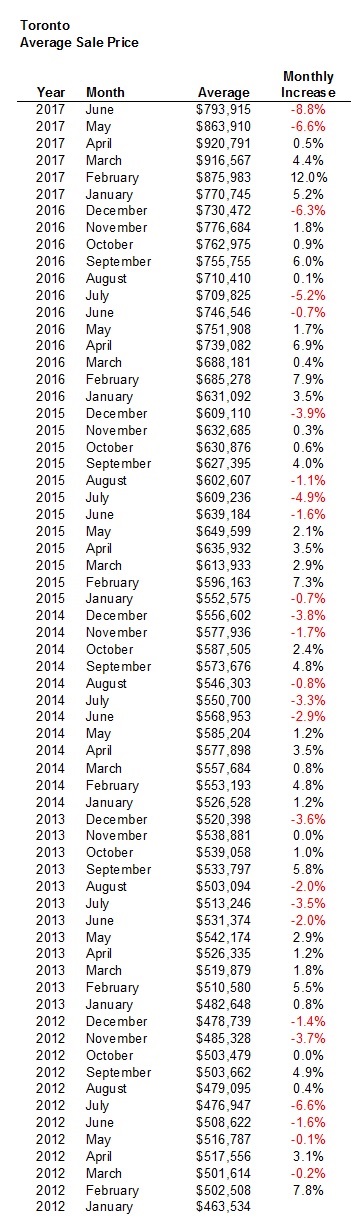

TREB released its June Market Watch last week, and it showed a decline in the average home price from $863,910 in May, to $793,915 in June – an 8.8% decrease.

I’m not going to attempt to sugarcoat this; that’s a big number!

And it came on the heels of the $863,910 average home price in May, declining from a $920,791 average home price in April – a 6.6% decrease.

That’s a 13.8% decline in two months.

There are other numbers to talk about – active listings, total sales, etc. But price is what concerns home-owners, and home-buyers.

So the obvious question is: if you’re a home-owner, did your property just decline 13.8% in value in two months?

No. It didn’t.

Argue with me if you want, but I’m giving you my professional opinion.

Did the value of your home drop from April to July? Absolutely.

But the “average home price” from TREB is simply that: an average. It’s volatile, inexact, and a month-to-month comparison, in my opinion, shouldn’t be used in real estate.

A 3-month moving average? Sure, that’s better.

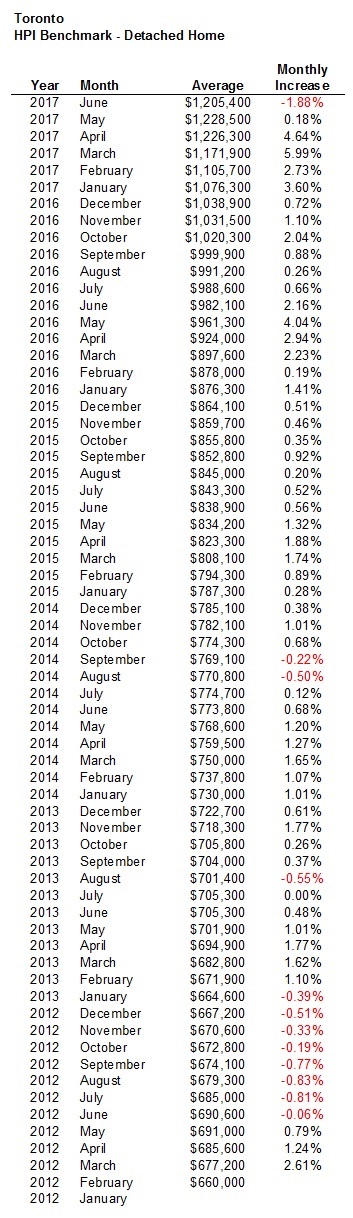

But I prefer the MLS “HPI” or Home Price Index.

Before we get to that, however, I want to look at those month-over-month numbers.

I’ve shown you this chart before in another post, perhaps a couple of months ago, but here it is again, up-to-date:

There are a few points I want to make about the month-over-month numbers, which I believe explain why you can’t look at the last two months’ decline as a measure of the overall market.

First and foremost, there are 65 month-over-month percentage increase/decreases.

The average home price has increased from $463,534 in January of 2012 to $793,915 in June of 2017 – a 71.3% increase in a little more than five years.

So with a 71.3% increase, in those 65 months of ups-and-downs, how many months would you expect to be increases?

All of them?

With a massive 71.3% increase in such a short window, maybe almost all of them?

Not quite.

Months of Decrease: 25

Months of Increase: 40

In 38.4% of the months posted in the chart above, the month-over-month average home price in Toronto decreases.

The second point I want to make is that people are looking at two months in a row of average home price decreases as a pattern.

Two months? Two consecutive months?

That’s like the Blue Jays winning two games in a row, and calling it a “streak.”

Two consecutive months of declining prices is significant based on the first four months of 2017 that we had, but only in that context. On its own, it’s not unusual. In fact, this marks the eighth time from 2012 to 2017 that the average home price has declined two months in a row.

The third point I want to bring up is the most telling, and it gets right to the heart of the June numbers.

The average home price in June declined, and by a big number.

But relative to other June’s, was this uncommon?

In the previous five months of June, how many of those months saw a decline in average home price?

Five.

All five.

No, the declines weren’t as pronounced. And you can point out from this chart that the 8.8% decline in average home price this past June is the largest decline on the chart. But the 12% increase that preceded in February is also the largest as well.

If you want to call the two consecutive months of declining average home price in April and May a “pattern,” then surely six consecutive declines in average home price in the month of June has to be a pattern as well.

Now let’s shift gears to the HPI Benchmark.

I’ve been charting for detached for the same time period, and here’s how it looks:

This will undoubtedly support any bullish argument toward the market, but I assure you that’s not my intent.

As I said, I don’t believe a month-over-month average is the best way to assess the market.

If you want to know more about how the HPI is calculated, or what it is, check it out here: http://www.crea.ca/housing-market-stats/mls-home-price-index/

In any event, it shows a decline, and that represents both the value of a property, but also a buyer’s willingness to pay, as well as, in my opinion, a buyer’s willingness to enter the market.

So I guess what I’m trying to say here, folks, is that the Toronto market has dipped, no question about it. Prices have dropped, sales are down, and public opinion is that of concern.

But you have to look at the numbers, and what’s behind them, to get a clearer picture of what’s going on.

And to show you I’m not pumping the market’s tires, let me say this: I honestly think that the average home price in July, and August will be lower.

That’s right – I believe we’ll see four consecutive months of a decline in the average home price.

But again, look at the numbers, and what’s behind them – this is the summer, and the summers are usually slower in Toronto real estate.

And again, five out of the last five months of July have seen a decrease in the average home price.

Last July saw a decline of 5.2%.

So then the real question becomes: what happens in September?

The fall market is usually frenetic because it’s only 2 1/2 months, unlike the spring market, which is basically 6-months (I know it’s confusing since January to June is not “spring” but rather winter, spring, and summer, but that’s what we call it).

Interest rates could be rising this week.

The 5-year, fixed-rate mortgages have already increased by 25 basis-points.

So does the market decline into the fall, or pick back up after a four-month downturn?

As I said at the onset, “Nobody can accurately predict the future,” so you might think my question was a trap. But while nobody can accurately predict the future, there is something to be said for public sentiment.

So in the spirit of predictions, I’ll wager that 60% or more of you will comment below with a bearish outlook.

And let us not forget that the public is made of consumers, and public sentiment affects consumer behaviour.

So I for one, and genuinely interested in what you have to say…

Ed

at 8:06 am

The HPI benchmark numbers really surprised me. In Etobicoke my feeling is that the market peaked in late Feb or early March but the numbers above say otherwise. I guess that is why you will get many different opinions, every market is different. What happens in Markham or Richmond Hill might be totally different then what happens in the core of the city, I think it already is.

A

at 6:35 pm

Some would say HPI works well just like driving with your eyes on the rear view mirror… as long as no obstacles, it will be safe driving…

alert

at 3:55 pm

I am interested in seeing the sales data/statistics for Markham area condos. Is there a website that has this data? Thanks

IanC

at 8:51 am

Not sure if this is what you mean, but after I google something, I can refine the time by clicking tools, and then when “Any Time” appears as the default, I click “custom range”.

Gerry mackenzie

at 9:18 am

“Blip”… “It’s just a gully that’s all. Just nerves” – The Big Short (2015)

iwill

at 9:19 am

What about flips? I think they artificially distort the average sale price and it really may not have anything to do with the market but rather the money invested in the property.

In 2016 a house sells for $1.2M, The speculator invests $600K and then sells the house for $2.2M. According to average sale prices, this will inflate the average sale price 80% year over year, but in reality its closer to 10-15%.

all it takes is 5-10% of the market to be flips and it can heavily distort the numbers since most flips have to be in the $2M range now. I think if someone someone can account for the money invested in RE, then the increases in the market are much more normalized.

T

at 3:20 am

Not really. A $2M buyer is going to buy a $2M home. Whether it is a fully renovated ‘flip’ or a new build. It’s that $2M purchase (or closed deal depending on index) which is used in the average sale price. Not the increase in the value of the renovated and flipped property or derivative of.

Joel

at 9:42 am

I have seen several articles lately discussing the rising costs of renting in the city. With the new regulations put in capping that amount that a rental can be increased by, many landlords are starting rental contracts with an extra couple of hundred built in.

As the rental prices go up, I think it is going to make more sense for many to buy. My prediction is that January 2017 prices are going to be within a couple of percent as January 2018 prices.

Kyle

at 9:52 am

Toronto real estate often shows large month to month Average sale price fluctuations, caused by changes to the mix of property types (e.g. ratio of freehold vs condo). IMO, If you’re trying to call a direction, it only makes sense to compare year/year. Compared to last Jun, the market is up 6%, yes this is much lower than the 22% (Jan), 28% (Feb), 33% (Mar), 24% (Apr) and 15% (May). but until prices drop below same period last year, what we are seeing is the market decelerating, not going in reverse.

IMO, this deceleration is temporary much like what happened in Vancouver. The foreign buyer tax created a brief period of buyers sitting on the fence and some sellers panicking. But gradually buyers are coming back and prices are once again setting records across all property types with supply once again shrinking.

Chris

at 3:41 pm

Yes, Toronto real estate’s average price fluctuates month to month; however, in the data-set David provided, there are no two consecutive months with >5% decline. I agree with you that we need more time to determine if this is a blip or a sustained decline, but I don’t think you can simply write off this 14% drop as “business as usual”.

I also think it’s unwise to compare Toronto to Vancouver. Hot on the heels of Vancouver’s implementation of the foreign buyer’s tax, they also introduced 5-year interest free loans (sounds eerily familiar to teaser rate loans…) for first time home buyers, on homes up to $750,000.

As we can see in the graph below, while detached homes (typically above $750,000) have stagnated, lower end homes (condos, townhouses) have climbed. How much of this is artificial price increases caused by a government subsidy? As the saying in economics goes, a subsidy without regulation simply leads to higher prices.

http://www.mikestewart.ca/wp-content/uploads/2017/07/June-2017-Vancouver-Price-Increase-Chart-from-1977-REBGV-Statistics-Package.jpg

And in case you were curious, at their recent update, the BC government indicated they had 1,200 applications for this loan. Not all have been accepted yet, but I suspect this has had an impact on the lower end of the market.

https://www.bchousing.org/news?newsId=1479148972266

Kyle

at 4:47 pm

As mentioned previously, the loans that are being provided would be to buyers buying well below the average price. Thus the more loans provided the lower the average price should be. So BC loans does not explain why average prices have rebounded. If anything they would be masking the strength of the rebound.

Chris

at 5:01 pm

Kyle please look at the graph. It shows that detached is stagnant while condos and townhouses are climbing.

Kyle

at 5:21 pm

The HPI of a home in GV is $998,700, the average sold price is $1.3M and rising. Mathematically the only way loans could be increasing HPI and average sold price is if they were being spent on homes above these averages. However, only homes below $750K are eligible for the loan: https://www.bchousing.org/housing-assistance/bc-home-partnership/program-overview-applicant-information

Chris

at 5:28 pm

Yes Kyle, I said in my original post that the loan program is for homes priced below $750,000.

However, if you look at the graph I provided, you can clearly see that the average price of those homes above that mark (detacheds) has stagnated, while those homes below that mark (townhouses and condos) has increased.

I can’t say for certain that this is a product of the loan program, but I think we can both agree that it has likely had an impact.

T

at 3:13 am

I can’t believe this Kyle guy is still debating everything you post. I always love how he is proved wrong, ignorant, or just plane unintelligent – and continues to debate like it never happened.

Chris. You must love intellectually wrestling with Kyle and others like him on this blog. Or you are a saint and really trying to save them. Either way, it’s crazy, but good on you.

Your comments are always a good read but the responses you get always make me laugh.

Chris

at 8:54 am

Not a saint, I just really enjoy debating. I’m happy to go back and forth with Kyle, Kramer, and the likes, particularly in a civil discussion.

Kyle

at 9:40 am

T

You’re hilarious please articulate where Chris has proven me wrong above. I know you’re all butt hurt from me proving how stupid you are in past posts (an incredibly easy feat i might add), but if you’re going to claim that i’ve been proven wrong, please back it up.

Dan

at 11:08 am

A partial answer: you can search within a specific timeframe.

Click on “tools” (below the search bar), “anytime”, “Custom range” and you are off to the races.

https://www.google.ca/search?q=toronto+real+estate+bubble&biw=1680&bih=895&source=lnt&tbs=cdr%3A1%2Ccd_min%3A1%2F1%2F2004%2Ccd_max%3A12%2F31%2F2004&tbm=

Libertarian

at 11:14 am

I think there is a possibility of it being different this time because the 3 levels of gov’t have all gotten involved and are proactively going after speculators (rent controls, CRA audits, Air BnB rules, etc.). Of course, that won’t do much to change the market for detached homes, but as David wrote near the end, “And let us not forget that the public is made of consumers, and public sentiment affects consumer behaviour.”

I think that there are a lot of real estate investors out there and that has attracted many more over the years, which is why demand has been so high. But if people decide to get out of real estate investing and start badmouthing it, then of course there is the potential of prices going lower over the next few years.

Chris

at 3:50 pm

Sentiment is probably the most interesting part of this debate.

It might just be me, but in discussions with friends, family, colleagues, it seems that the attitude has shifted. A few months ago, real estate was a safe bet, just jump in and ride the latter upwards. Now many people (who follow the market much less closely than I do) are advocating caution and patience.

The difference in sentiment is very stark. As I said, this is totally anecdotal, but it’s interesting nonetheless.

Libertarian

at 12:38 pm

Yes, it’s anecdotal, but practically everything about real estate is. The industry itself and the government haven’t been doing much to collect data. It was somewhat like the wild, wild west out there. But now that the government has realized that they should be tracking this stuff, it’ll be interesting to see what impact that has on investors.

As you’ve written in your other comments above, Pasalis found that investors are roughly 20% of the market. I referred to that article months ago on this blog. I’m surprised that story didn’t get more media attention, especially considering that Tony Robbins and Pitbull sold out a real estate investment seminar. The people who went to that seminar did not go to buy their primary residence as a long-term financial plan.

Chris

at 1:33 pm

Pasalis’ research is definitely very interesting, and I agree with you, it’s surprising it didn’t get more mainstream attention. In some of the areas he studied, speculative investors buying up cash-flow negative properties are a huge segment of the market. Presumably higher interest rates and decreasing property values will push these investors out, leaving behind a significantly reduced number of buyers.

That absurd Real Estate Wealth Expo definitely epitomizes that attitude. If you haven’t seen it already, this Toronto Life article offers some pretty comical quotes from that debacle:

http://torontolife.com/real-estate/think-going-go-even-sky-high-wealth-expo-attendees-talk-torontos-housing-market/

Juan

at 12:23 pm

Does the CREA actually disclose the exact formula for the HPI? Because if they don’t it has no validity. Just another case of RE agents inventing stats to support their profession.

Chris

at 3:44 pm

http://www.crea.ca/wp-content/uploads/2016/07/HPI_Methodology.pdf

Just the Facts

at 5:33 pm

Page 6 of the MLS® Home Price Index

Methodology document “… To mitigate volatility, a moving three-year sample period is used …”

Now you understand why the lagging HPI is useless in a market which has just turned.

Edwin

at 9:37 am

So basically the HPI in May 2017 was using sales numbers from June 2014-May 2017, and the June 2017 HPI is calculated using July-2014-June-2017 sales?

So the elimination of June 2014 data, replaced with June 2017 data, caused a 1.88% drop month over month? Am I reading that correctly?

Daveyboy

at 12:51 pm

This is going to be epic. Good luck Toronto.

Garth Turner is the man!!

LarryD

at 3:59 pm

Absolutely! Okay, he’s been spinning his wheels for a decade, but this is his time, baby!

Daveyboy

at 1:04 pm

http://www.zolo.ca.

Check out the market stats section

Geoff

at 2:40 pm

Mark Hanna: Number one rule of Wall Street. Nobody… and I don’t care if you’re Warren Buffet or if you’re Jimmy Buffet. Nobody knows if a stock is gonna go up, down, sideways or in f ing circles. Least of all, stockbrokers, right?

For me personally one month does not a trend make. Nor 3 months. But I also have no skin in the game. Unlike the perception of many ‘bears’ I actually think prices going down is a good thing for society (as a homeowner, I want my son to have an opportunity to own in a way that the math doesn’t freak me out on either).

AT555

at 3:17 pm

You can certainly do a search between Jan 1, 2004 and Dec 31, 2004 in google under tools and custom time

AT555

at 3:30 pm

This is good analysis David and I do believe that the dip is going to be temporary and market will be in positive before we see out 2017.

Mr.Audi

at 3:53 pm

Money is cheap and as long as money will continue to cost next to nothing the RE prices will keep going up.

chris Hadley

at 4:21 pm

Then you should expect a big drop, since the government is about to apply stress testing to all mortgages (even those that don’t need insurance) and bond yeilds are spiking. The combination of these two market shocks will effectively double the cost of money over the next 6 months. Yes double.

A

at 6:30 pm

Really? Double the cost of money as in mortgage rates going from ~2.5% to 5%?

Mike

at 7:08 pm

A

The stress test is going to require all uninsured debtors would be able to service their mortgage if rates went up by 200 bps. So if you had a uninsured mortgage at 2.5% you’d need to be able to prove that you could service it at 4.5%, so in effect rates have almost doubled.

In addition to that, pretty much everyone believes that the BoC will raise rates in the next two meetings, which would mean an increase of 1-1.5%.

So worst case scenario, if you’re looking at a rate of 2.5% today, you’d be looking at an effective rate of 6%. You wouldn’t have to pay that, but you’d have to be able to service it.

Kramer

at 11:39 pm

I don’t think y’all are using the word “effectively” effectively here. Think “effective tax rate”… one’s “effective tax rate” is what you actually pay.

5 years ago MOST of today’s current homeowners were already living in their homes and paying 4% mortgages (the ones that had a mortgage… some don’t) on larger mortgage balances and doing just fine. 4% felt like a gift from the Gods. These homeowners have enjoyed 6-7 years of higher principal payments on their mortgage… reducing mortgage balances faster.

They could pay 4% before… and now, with smaller mortgage balances and 5 years of salary growth (yes, some people have significant salary growth over 5 years), their personal financials are way stronger… both balance sheet and income statement.

I’m a homeowner… I plan on paying approximately 2.8% for the next 5 years. The following 5 years will probably be locked in at 4.5% (I think that is a very conservative guesstimate). Not taking into account my shrinking mortgage balance, that’s 3.65% over the next 10 years.

If I took into account my shrinking mortgage balance, that would give me my EFFECTIVE rate over the 10 years… and it will be smaller than 3.65%… call it 3.5% (This is not absurd and absurd prediction… You can lock in 10% now with Tangerine for 3.89%… you’re paying a premium for locking in 10 all at once).

3.5% MORTGAGE RATE FOR 10 YEARS??????????????

SIGN ME UP.

Kramer

at 11:48 pm

(* You can lock in 10 YEARS now with Tangerine for 3.89%)

Mike

at 11:55 pm

Kramer,

Effective Rate and Effective Tax Rate are two completely different concepts.

Effective Tax Rate is what you actually pay

Effective Rate is the interest rate with all factored in, you don’t actually pay the Effective Rate, you pay the Nominal Rate.

Not sure what you’re point was on the rest of your post about people who owned houses 5-years ago and paying down their mortgage. Housing prices are set by those buying and selling houses. So if house prices drop 30% it won’t effect those who don’t want or need to buy or sell.

That said, if you need to qualify for your mortgage you’ll be under the same rules and while you may have a larger principal than you did when you bought 5-years ago, with house prices dropping that could easily eat away at your equity.

Kramer

at 12:15 am

I guess my overall point is that saying:

– “so in effect rates have almost doubled”

– “effectively double the cost of money over the next 6 months. Yes double.”

…are not useful statements… in fact they are misleading and borderline ignorant,

The rest of my rant was to show that in REALITY… over the next 10 years I will ACTUALLY be paying 3.5% on my mortgage, which is RIDICULOUSLY LOW.

And an “effective interest rate” takes into account compounding periods… to show what you ACTUALLY pay despite what the STATED interest rate is.

No definition of “effective interest rate” takes into account Canada’s mortgage qualification/stress test rules.

Mike

at 9:06 am

The whole point of the article and the ensuing discussion was to discuss the future of the market and what will happen with prices.

Not sure how the fact that you’ve locked in for the next ten years becomes relevant?

Like it or not, if/when the stress test comes in it will still impact your ownership; locked in or not.

Chris

at 9:11 am

Kramer,

Your posts seem to mostly refer to your own situation. While it’s good to hear that you are personally able to handle increasing interest rates or decreasing home values, you are but one data point.

As I alluded to in my post above though, many are using real estate as a get-rich-quick scheme. Whether they are doing this through over-leverage on their primary residence, or through speculative investments on cash-flow negative properties (to name but two possible examples), they are in a much more precarious position than you are.

I’m glad that you will be alright whater tomorrow brings. It sounds as though you have invested wisely in real estate; for the long-term, in a home you can afford. Unfortunately, many others did not follow your lead.

Kramer

at 9:30 am

Chris, my friend… I am one data point, but I am much more representative of “the whole” than your “not-really-data-points” of “people using get rich quick schemes”.

And Mike… Connect the dots. Historically low interest rates have been driving real estate prices the past 7 years… and what I am trying to say is that people (like me – in normal situations) will continue to pay historically low interest rates for the next decade. You are communicating that interest rates will “effectively double” tomorrow. I know you’re bearish, but that’s just fear mongering… and posting a normal every day market situation is more useful than posting outlandish crap about interest rates “effectively doubling”. Post responsibly.

Kramer

at 9:35 am

And I’m not posting on this thread anymore so go ahead and get your final words in, but I will happily start a new one more directly connected to where prices are going taking into consideration all the drivers and where they are today vs. pre-Kathleen Wynne’s 16 Point Plan.

Chris

at 9:46 am

Kramer,

I respectfully disagree. Perhaps I should have provided you with more data in my initial post; that was my mistake.

As John Pasalis documents in the paper below, speculative investment is responsible for a large percentage of sales (17-21% in some areas, 36-39% in hottest neighborhoods). The vast majority of these recently purchased properties are cash-flow negative. I would encourage you to read the paper, it is long but very interesting.

http://realosophyrealty.blob.core.windows.net/static/InvestorDemandHouses.pdf

A recent MNP poll found that >25% of mortgage holders are already in over their head, and 77% would have difficulty absorbing as little as an additional $130 per month of interest payments on debt.

http://business.financialpost.com/personal-finance/debt/more-than-quarter-of-canadian-mortgage-holders-in-over-their-head-even-before-rate-hike/wcm/63f39678-8018-4899-af06-66bed7b41774

Finally, the Financial Consumer Agency of Canada statistics show that there are three million active HELOCs in the nation, with an average balance of $70,000. These will also be impacted by rising rates, as well as decreasing property values.

http://www.cbc.ca/news/business/interest-rates-helocs-canada-debt-1.4192847

Put this all together and it does not exactly paint a bright picture for the financial health of Canada’s households.

As I said, I’m glad that you personally will be alright. But you are one data point. There are many other data points that currently find themselves in a much more precarious position.

johnny Internet

at 11:24 am

Touchy.

Kyle

at 2:19 pm

I agree with Kramer, most of the bearish evidence being presented contains a slant or is based unfounded assumptions.

Just because a real estate investment is cash-flow negative does not necessarily mean they are trying to get rich quick or will tank their owners if rates rise. Many would argue that cash-flow negative investors are more likely investing with a longer time horizon in mind. Also mortgage interest can be written off against income, so investors (or as you perfer to call them speculators) are generally less sensitivity to rate increases than end users.

The Manulife survey as has been previously discussed is nothing more than a piece of marketing fluff created by Manulife to sell one of their products. For real mortgage statistics please refer to this:

file:///C:/Users/link/Downloads/FallSurveyReportFinal_1481152471%20(1).pdf

“For homes purchased during 2014 to 2016, the average contracted amortization period is 22.4

years. Canadians are highly motivated to repay their mortgages as quickly as possible and these

surveys find consistently that each year more than a third of mortgage holders take actions that

will shorten their amortization periods (making lump sum payments, increasing their regular

payment to more than is required, or increasing the frequency of payments). The most recent

buyers expect that, on average, they will repay their mortgages in 18.8 years, which is 3.6 years

shorter than their average contracted period.”

Chris

at 2:34 pm

Kyle,

Which resources that I provided links to are slanted or based on unfounded assumptions? The one from John Pasalis of Realosophy? The one citing the MNP survey? The one providing data from the Financial Consumer Agency of Canada? What are your specific criticisms of their methodologies?

I’m also not sure why you brought up Manulife or a survey of theirs, when none of the sources discussed that company? Are you confusing MNP Accounting with Manulife?

Finally, you seem to have linked to a file on your personal hard-drive, rather than an online link which is accessible to the rest of us.

Kyle

at 4:19 pm

Pasalis’ report has this foregone assumption that anyone buying a cash-flow negative property “is losing money every month” (which is actually untrue), because they expect to make back what they’ve lost through appreciation. This assumption is unfounded and arrived at simply through inquiries he received to his brokerage which he then extrapolates to every cash flow negative situation across the City.

As David has often related he gets lots of crazy inquiries from “investors”, looking for that too-good-to-be-true deal, looking to Short Toronto real estate, looking for foreclosures, etc. IMO, these individuals are hardly a basis for a sound hypothesis. Besides that there are legit reasons people will accept a cash flow negative situation, which he has clearly dismissed: tax reasons, intention to use the property as en end user in the future, long term investor with expectation that rents will rise in the future, etc.

Sorry confused the MNP survey with the near identical mortgage survey conducted by Manulife: http://www.cbc.ca/news/business/manulife-housing-debt-1.4127243

Both are sentiment surveys based not on respondents’ actual financial capacities, but on how they feel towards the question they’re being asked. Questions have clearly been designed with a slant. 48% are “concerned” about impact of rising rates, more than a quarter feel they “are in over their heads”, 70% rate their ability to cope with a 1% hike as “less than optimal”. How many respondents actually went and calculated how a 1% increase actually impacted them before providing their response? And how many went and reassessed their budgets to see whether they should be concerned before providing their response?

The mortgage stats report i provided are based on peoples’ actual mortgage data. This is a far better representation of mortgage holders’ financial situation. Here is the correct link: https://mortgageproscan.ca/en/site/doc/40632

Chris

at 7:58 pm

Kyle,

You’re incorrect in your assessment of Pasalis’ methodology. Please re-read the report more closely. He did not determine investor numbers simply through inquiries to his brokerage.

From page 7:

“For the purposes of my analysis, an investor is defined as someone who has bought a property that was listed on the MLS and subsequently listed it for lease on the MLS either in the same calendar year or in the first two months of the following calendar year.”

He also explains that his methodology very likely underestimates the number of investors, for a multitude of reasons. I won’t get into them here, but as I said, please re-read the report to learn more.

It is also quite telling that the Bank of Canada felt Pasalis’ research was robust enough to include it in their most recent Financial System Review earlier this year. You’ll forgive me if I assign more weight to the BoC’s opinion than I do to that of a stranger on an internet blog.

https://pbs.twimg.com/media/DB0sdfzVoAEs9_A.jpg:large

Yes, the MNP survey is based on sentiment. As we’ve discussed at length on other posts here, sentiment plays a very important role in the real estate market. So for you to simply discount sentiment as unimportant is foolhardy.

For more concrete financial data, I included the Financial Consumer Agency of Canada statistics, showing HELOC usage.

The mortgage stats you provided are nice, although they are from late 2016. I think we can both agree that the market has evolved since that time. The market is much less liquid, and as we know, nobody has difficulty paying their mortgage in a liquid, upwards moving market (if they do, they simply sell and pay off their debt). It isn’t until liquidity dries up that arrears tick upwards.

http://globalnews.ca/video/3577965/greater-toronto-area-home-foreclosures-on-the-rise

Admittedly, these figures are not from the most reputable source (seem to come from one mortgage broker), but interesting nonetheless.

The mortgage statistics you shared are also based on sentiment surveys (they feel they will repay early, etc.).

Kyle

at 9:20 pm

I’m not referring to Pasalis’ methodology, i am talking about his blanket assumptions which he clearly state at the beginning:

“Generally, real estate investors want to buy a property that can be rented out for enough money

to cover all expenses including the monthly mortgage payment (“carrying costs”). But when

speaking with these investors, we found that many of them were not particularly concerned

about the rental income that the home could generate and in many cases were content with

personally paying to cover the shortfall between the rent and the carrying costs. When we asked

these investors why they would want an investment that loses money each month, they would

respond by saying that they don’t mind losing $1K each month because if the house is

increasing in value by 15%-25% per year, the appreciation in the property’s value will more than

make up any shortfall in their rent when it comes time to sell.”

Daveyboy

at 3:53 pm

I guess this will ne the only place on Earth where the average family income is 75 k and a house is over a million. This is a no brainer.

I no longer live in Toronto. Once you remove yourself from that enviroment, you start to realize how screwed up it is.

Best of luck Toronto

A

at 6:29 pm

SF is not very far off these numbers, if you use median income. So Toronto is not the only place. We have not even mentioned Vancouver.

T

at 2:37 am

SF is very far off. People make much more in the Bay Area. Yes housing is expensive if you want to live walking distance to salt water, inland much less so.

You also can’t compare one of the most beautiful areas of the world with Toronto. Vancouver is closer, but still not even the same ballpark.

I can’t stand when Canadians compare Toronto and Vancouver to the best cities in the world, especially to justify property values.

I bet you have never been to SF, never mind traveled throughout the area, nor took any time to investigate property values in the area.

For Real

at 11:25 am

San Francisco/San Jose (Bay Area) are significantly more expensive than Toronto when you compare their median multiples (median home price / median incomes). And I agree they should be.

Appraiser

at 9:04 pm

One should think about being a homeowner as a long-term plan. Real estate is not a get-rich-quick scheme. Despite the infomercials.

At least 50% of homeowners will spend 40 or more years in the role, with many of those latter years mortgage-free, even after climbing the proverbial property ladder. The average Canadian homeowner that is mortgage-free did so after 17 years.

If you think that GTA real estate will be cheaper in 30 or 50 years, then home ownership may not be for you. (P.S. market timers get crushed).

Tim tisdelle

at 9:33 pm

Those that get caught up in manias and take on more debt than they can service get crushed.

Chris

at 9:37 pm

And yet many are treating real estate as a get-rich-quick scheme. Sure, those buying a home to live in for 40 years don’t fit into this category. But those making speculative investments on cash-flow negative properties arguably do. And as John Pasalis documents, this is a substantial segment of the market:

http://realosophyrealty.blob.core.windows.net/static/InvestorDemandHouses.pdf

I doubt anyone thinks real estate will be cheaper in 30-50 years. The simple reality of inflation alone basically makes that an impossibility.

However, it’s much harder to predict what home prices will be in the shorter term (2-5 years). Perhaps you’re more bullish on this time frame; personally, I’m more bearish.

XYZABC

at 11:42 am

I don’t believe anyone’s numbers, too much of apples being bunched in with oranges.

So, I opened up July 2016 and July 2017 monthly reports from TREB and went to page 8 which shows Toronto detached sales. And this is what i get on a city level for detached comparing July 2017 to July 2016. And July 2017 to April 2017.

Column1 Sales Avg Price Median Price New Listings Active Listings Avg SP/LP Avg DOM

Jul-17 848 $1,386,524 $1,085,313 2,096 2,196 100% 14

Jul-16 954 $1,202,753 $915,500 1,334 1,002 105% 14

Apr-17 1268 $1,578,542 $1,285,000 2,565 1,605 112% 8

Change July 17 to 16 -11% 15% 19% 57% 119% -5% 0%

Change July to April 17 -33% -12% -16% -18% 37% -11% 75%

Prices still way ahead of July 16, but lower than April – some due to the massive supply increase and some due to seasonality.

T

at 4:00 am

Don’t believe those numbers either. The MLS has deal info but not necessarily the actual price property traded for on closing. Lately the closing price is often less than the ‘firm’ deal price.

LarryD

at 1:38 pm

Let’s not lose sight of the fact that the number of GTA homes that have been sold in the past twelve months is 108,043 (figures from TREB) which represents roughly five percent of all GTA homes, meaning fewer than one in two hundred changes hands in an average month. This is not to say that month-to-month figures can’t speak to buyer/seller sentiment, but let’s not forget to keep these monthly figures in their proper perspective.

T

at 3:53 am

What people fail to realize is 95% of the time buyers spend all they are able to (and often then some). A drastic change in price often means a big change in what buyers are able to spend and the quality of buyers. Credit is tightening, banks are forcing lower property value appraisals, and most who could afford to buy (first home or move up) has, and now we are pushing through less qualified buyers at lower price points (the last ones in are always the ones who can least afford it). This is all a repetitive cycle which is generations old. I have no idea how so many can’t see it. Time to open your eyes.

This isn’t a debate opener. I don’t care about what Kramer or Kyle has to say. It’s time we start talking history, trends, reality. Final warning, the next season is going to be shocking.

Kramer

at 8:53 am

So you’re selling all your real estate then? Or you already have?

Or you’ve never owned and have no idea what you’re talking about?

Which is it?

T

at 10:23 am

Owned severel properties in the gta over the past few decades. As of last November, I have sold them all.

Kramer

at 10:52 am

So you rent now? Or you moved out of Ontario, or off the grid up north? Which is it?

T

at 11:27 am

I have recently moved into an apartment in Toronto after I sold my last house. I’m now living in Harbour Square actually. Nice private view of the lake.

But I am mostly out of the country enjoying beautiful cities with my fiancée. I did well in business and real estate at a somewhat young age, so I can afford to sit back and watch this housing bubble play out before I make any big moves.

I’m probably leaving Toronto permanently anyways. Everyone has gone absolutely stupid, nothing else better to talk about than real estate. Often misguided and unintelligent views of it I may add. You are a case in point. I understand why I have time lately to engage with others online. You, on the other hand, given your view of the market and poor math and comprehension skills, are obviously a realtor with too much time on your hands. Especially lately as you are posting more frequently.

Kramer

at 11:50 am

Good for you big shooter! We’re all very impressed and hope you fulfill your dream of leaving Toronto permanently.

PS: No, I’m not a realtor. But you did just prove Kyle right… you’re a purebred champion douchebag.

T

at 12:47 pm

This is the thing about Canada lately, and why I may leave.

Instead of recognizing success and learning from those whom have it, often Canadians tear down the successful. Somehow turning success into a negative.

Try asking a successful person how they did it. Learn from them. Be successful yourself. And no, it’s not all about money. Find good mentors. That’s what I did.

It’s called hard work, sacrifice, and good planning. Canadians have forgotten this. These days it’s about buying as much real estate as you can, with as much leverage as you can obtain, and sit on it for a while until you cash out huge gains on the backs of other Canadians. The fact this blog exists and is frequently (well to often) by the likes of you, with the agenda you and your other hand consistently push, proves this entirely.

Also – being a realtor is not a bad thing as long as you are an intelligent and kind individual. I find the best realtors don’t even need to make a commission to get by, they do it for love. Unfortunately 90 – 95% shouldn’t be realtors. Sad but true.

Kyle

at 9:28 pm

Also the hard data in the mortgage report i provided is based off of actual mortgage data that they refer to as their “core” resaerch data which they then added sentiment data to for the non financial questions, like do people think they will rent out parts of their house.

“Mortgage Professionals Canada has conducted semi-annual consumer surveys since 2005. The

research has a core of data on the mortgage market. The content has evolved over time, as

Mortgage Professionals Canada has sought to contribute to an increased understanding of the

residential mortgage market…Included in this edition of the survey, in addition to the core research, is:

Consumers’ opinions were sought on the impacts for the new mortgage insurance rules.

A short discussion (“A Further Note on Housing Affordability”) illustrates the consequences of

using posted rates to analyze housing affordability, rather than the mortgage interest rates

that can actually be found in the market.

Expectations about retirement (in relation to mortgage indebtedness) are explored.

Consumers were asked about three options for making home ownership more affordable:

renting out part of the home, buying with friends, and buying with relatives. “

Kyle

at 9:29 pm

Meant to post as a reply below to Chris

Chris

at 9:57 pm

Do you discard all of Pasalis’ research just because of an assumption in his introduction, which you personally disagree with? Because the crux of his report is to highlight the high levels of investment activity in real estate, compared to historical norms, particularly in certain areas of the GTA. As I stated in another comment, the concern becomes what action do all of these investors take if their property is cash-flow negative, and is falling in value?

Yes, the mortgage research you shared has hard financial data, as well as sentiment data, such as regarding how long buyers expect they will take to pay off their mortgage. Similar to the mixture of hard financial data and sentiment data that I provided (MNP and Financial Consumer Agency of Canada research).

Kyle

at 10:10 pm

I don’t discard his research, but i do discard his assumptions, conclusions and inferences. IMO all he has really established is that recently more people have bought at an historically unfavourable price to rent ratio that is all.

Chris

at 10:23 pm

So you personally have no concerns with what his research found? Because the Bank of Canada did.

They specifically mention that increased investment during a time of declining net rental yields is consistent with what they term extrapolative expectations. They also go on to explain why this is dangerous:

“Prices that are inflated because of extrapolative expectations tend to be more sensitive to adverse demand shocks. When expectations reverse and prices recede, investors may quickly sell their assets, possibly leading to fire sales with adverse consequences for the rest of the market.”

https://pbs.twimg.com/media/DB0sdfzVoAEs9_A.jpg:large

We now have two months of fairly significant price recession. I think we can also agree there has been an “adverse demand shock”, as sales tumble and listings spike. As I have alluded to multiple times, and the Bank of Canada clearly spells out, the problem becomes compounded if these high number of investors move to sell their assets, as has been seen before after periods of extrapolative expectations.

Kyle

at 10:57 pm

You asked me to explain what i consider to be an unfounded assumption, and i clearly did. It’s up to each individual to decide whether they want to accept it or not, but as far as i’m concerned he hasn’t even sufficiently established that these owners renting out their places are even investors, let alone speculators.

I can come up with just as many valid unfounded explanations for why everyday people would chose to buy a property and rent it out for less than what it would cost to carry based on his assumptions. If he can use dinner party talk as a foundation, then so can i – i have heard dinner talk of people buying properties with the intent of doing major renovations, and renting them out while they wait for designs, permits, COA and OMB. I have heard dinner talk of people buying a place in anticipation of downsizing in a few years, and renting it out in the meantime. I have heard dinner talk of people buying properties for their children in anticipation of them moving out at some point. I have heard dinner talk of foreigners who are in the process of moving here permanently for work, buy a place and rent it out until they come. None of these people i refer to will be strapped when interest rates rise 25-50 bps, and none of these people have short term profit taking intentions.

And personally i have no concerns at all with his or the Bank of Canada’s opinions, because that is all they are – opinions. Of which i have my own, as i said before what i see happening is a temporary market dislocation. And once that settles, this buyer/seller stand-off ends with buyers blinking first. As long as the job market remains healthy that’s how it always ends.

Kyle

at 11:05 pm

Also the listing spike you speak of is rapidly disappearing…like i said temporary dislocation. Same thing happened in Vancouver, same thing happened here in 2008-09. Once the 2008-09 spike was absorbed it was followed by a long protracted period of ridiculously low supply.

Chris

at 8:32 am

Kyle,

Sorry, but your dinner party discussions don’t hold nearly the same weight as Pasalis’ research. You may disagree with some of his assumptions in his introductory comments, but his data is concrete and his methodology robust. As I stated already, so much so that our central bank cited it.

You also can’t really refer to the Bank of Canada’s Financial System Review as an “opinion” in the same breath as your own personal opinion. Surely your ego isn’t so large that you consider the two to be equals?

Finally, no, the listing spike is not disappearing. As part of my own personal research, I keep tabs on the number of active listings in Toronto on Zolo, Remax and Realtor.ca. While today’s number is below the peak seen in June, it is still very elevated. The Market Stats section of the Zolo website has a graph under the heading Toronto Housing Inventory that succinctly illustrates this.

https://www.zolo.ca/toronto-real-estate/trends

Real estate, like most other asset classes, is cyclical. We’ve had a very long period of growth and expansion. To expect it to continue unabated is naive. We will, eventually, suffer a downturn and recession. Whether we are entering it currently is certainly up for debate, but the fundamentals of market cycles are not.

Kyle

at 9:24 am

Again, i never said i have issue with Pasalis’ research, methodolgy and number crunching. I have issue with the dubious connection he makes between this research and his conclusions. His rationale in his own words not mine:

“Many real estate investors we hear from either at our office or at dinner parties believe it’s

completely rational to buy houses that lose money every month as investments ”

And no i never said the spike has dissappeared, i said it is disappearing, new listings at the end of June, are roughly the same as they were last year (i.e. before the rules came in):

https://pbs.twimg.com/media/DD5PNQHWsAAcnj9.jpg:large

And as i’ve said before, it has nothing to do with egos. Being right or wrong is not determined by who you are. Time and history determines who was right, not credentials.

Chris

at 9:37 am

Right, but Pasalis did the research, and the Bank of Canada made the inference, as I discussed above, in their explanation of extrapolative expectations. The BoC made the conclusion that high levels of investment activity in the face of declining yields could lead to problems.

Active listings are above where they were last June. The graph you linked to is New Listings, and shows that the number of new listings is up over last year. The Zolo graph I sent you previously also demonstrates that active listings is higher than last year. Combine this with the drop in sales, and we can see the adverse demand shock that the BoC referred to materializing.

Sure, anyone can make a right call or a wrong call. But, as I have said before, you’ll forgive me if I place more weight on the published research of the Bank of Canada than I do on the opinion of a stranger on an internet blog.

Kyle

at 10:01 am

By all means, place your weight on whomever you like. Time will be the judge.

Chris

at 10:07 am

For sure; and you’re certainly entitled to your opinion.

Anyways, good discussion on this topic!

T

at 3:40 am

Do you guys hold each other at the urinals?

T

at 3:41 am

Kyle and Kramer that is.

Kramer

at 8:54 am

Do you bears s##t in the woods… together?

Chris

at 9:04 am

…maybe let’s all try to stay on topic?

Kramer

at 1:05 am

Kyle, that is how I feel about the market today as well. Temporary dislocation due to the market getting spooked on both sides after a ridiculous run-up in prices up to April. It took several rounds of intervention to slow this market down, but this market will balance itself out, because looking at the long-term, none of the key fundamentals have changed:

– Interest rates are still ridiculously low and will be in a ridiculously low range for many years to come.

– The job market is solid

– There is net immigration

– Toronto continues to grow into one of the best cities in the world (all criteria)

– Foreign investment in Toronto will continue, business-wise and real estate-wise

I’m not gonna sugar coat it for people who bought in Feb/March… they missed out on what many others got a few months after their home purchases, a nice cushion filled with cash to sleep well on at night. But as LarryD brought up below, this is a small % of the total homeowners. Luckily MOST of them bought to live in and hold for several years and can afford the property (yay for our lending rules) even with rate increases (yay for stress tests).

As for the rest of the homeowners in the GTA, they are in excellent financial positions regarding their homes, and this is because of a history of solid lending standards in our country which have meant: good downpayments, the benefit of ridiculously low mortgage rates for approx. 7 years, and growth in their equity. Combine that with the fundamentals above, and you have a very strong market base. Yes there are exceptions, but there always are, and they are always at risk of being shaken out. You have to focus on the broader picture.

My gut tells me that the doomsayers are trying to stretch any info they gather as much as they can to make this seem like a ticking time bomb as seen in the USA. But how will these data points significantly disrupt, OVER THE LONG RUN, the strong market base and the fundamentals in the GTA. Do us a favour and play it out, concluding with where you think things will be in 5 and 10 years from now, taking into account the fundamentals, the market base, and your favorite ticking time bombs.

Over the long run, I look at any issue in the GTA that is unrelated to the fundamentals listed above as a paddle boat in the way of an tanker. There will be some turbulence (seeing it now) as the market balances out from the intervention and a overzealous run up in prices, but the fundamentals will dominate over the long run. And this is why I predict the GTA market’s price path to mirror what is happening in Vancouver in the short-run and over the next 5-10 years.

Chris

at 8:44 am

Kramer,

Odds are 92% of an interest rate today, ~40% of another rise by the end of the year. Low by historical standards yes, but increasing rates will be a problem for highly indebted Canadians. It doesn’t really matter what rates were in the 1980s. It matters what rates are today, what they will be next year, and how much of a rate increase you can handle with your debt load.

We also know that most households are certainly not in excellent financial shape. Debt is at record levels (~167% of income). The Bank for International Settlements has flagged Canada as being at high risk of a credit crisis (in the same boat as China). We have documented cases of mortgage fraud (Home Capital), as well as soft/gray-area fraud (bundled loans, etc.), hence why OFSI is now recommending a stress test on all buyers to prevent any workarounds.

Foreign investment is slowing, in light of both the Non-Resident Speculation Tax, as well as the reversal of capital outflows from China (now onto five consecutive months of climbing foreign exchange reserves).

I’m not a doomsayer, thinking that Canada is on the brink of collapse. We’re an advanced nation, with strong institutions, the rule of law, an abundance of natural resources, etc., and will, hopefully, continue to be a desirable place to live for a very long time to come.

But the GTA real estate market is significantly over-valued. A small army of organizations and economists have confirmed this through a myriad of research and data. And therefore, I am bearish on the real estate market, at current valuation levels. I suspect we have further to fall before the market regains rationality.

T

at 3:38 am

A couple of things.

1. Let’s not get all down and dirty and start throwing around names, starting some kind of Canadian real estate bull blog vs Canadian real estate bear blog.

2. The market (and prices) did dip in 2008. It wasn’t a full on crash as the US made borrowing money almost free with emergency rates, and Canada followed. Of course the population would take as much free money as they could get their hands on – and of course they would sink it into hard assets they know and have emotional connections with.

3. Garth Turner has been preaching a balanced approach to wealth building and management, including managing our most precious asset of time, and not dumping all of you wealth in a single asset chasing a market obviously inflated by debt as it is full of risk.

4. $200,000 goes up 140% to $480,000. $480,000 goes down by 40% to $288,000. Then calculate in the transaction costs and carrying costs. Garbage investment. Math is a wonderful thing.

5. Realtors… can’t move with them, can’t move without them. There are definitely far too many of them however. We need to raise the bar in this profession.

Chris

at 8:50 am

We avoided 2008 quite nicely, but many economists do share the opinion that we borrowed our way out of a recession. Eventually, this needs to be paid back.

The math part is always a good reminder. I’ve heard a number of people cite this as a reason they’ll be fine regardless. They forget that percentages equate to a greater absolute number at higher valuations.

T

at 9:31 pm

We did avoid the 2008, but it wasn’t without a cost.

Math only works if you have a solid understanding of it and all the inputs as they relate to the problem being solved. You do. Unfortunately many others (most) do not. I commend you on trying to get through to those who present themselves on this blog.

Kyle

at 9:34 am

“Do you guys hold each other at the urinals?” = T is a douche bag

“Do you guys hold each other at the urinals?” + “Let’s not get all down and dirty and start throwing around names” = T is a weasly douche bag

“Stop being a troll.” + “Do you guys hold each other at the urinals?” + “Let’s not get all down and dirty and start throwing around names” = T is a pathetic, snivelling, weasly douche bag

Math is a wonderful thing!

Chris

at 9:40 am

As I said below, maybe let’s all try to stay on topic? And this isn’t just directed at you Kyle, but also at T and Kramer.

I’ve been enjoying our civil debate. Let’s not all go off the rails.

T

at 10:29 am

I call it like I see it Kyle.

TOCondoNews

at 10:41 am

There are just so many things wrong about this analysis.

Rather than detail why your math and analysis is incorrect, here is a section from Rob Carrick’s column in today’s Globe & Mail …

“Forget housing as an investment

The real estate sector likes to say the huge house price gains of the past few years in some cities are justified by underlying factors like strong immigration, a limited supply of newly constructed homes and our world-class cities. But the real force in housing was low interest rates. Every step higher for rates weakens housing in the expensive markets in and around the cities of Vancouver and Toronto.

There are plenty of markets in Canada that are affordable now and will remain so as mortgage rates rise. But a continued increase in rates will take the froth out of housing everywhere. Houses as an investment? Maybe if you buy in after a market correction.”

Aron

at 5:44 pm

If you want to buy a property for 3 years or less. Do not buy but if you want to keep your property for 5 years plus, you will never lose investing. Do not believe the hype and negative people. People are because they have imvested in houses or codos at some point in the past.

Austin Dai

at 5:47 pm

The HPI showed the price had a light drop on house and a medium rise on condos. The agerage has been dropped by 13%. What did they say togther? The foreign buyer tax kept the foreigh buyers who were mostly aiming for high price houses AWAY and the price DID NOT change!!!!

Not My Real Name

at 9:01 am

“Tell me if I’m wrong here, but there’s no way to search specifically, and only, web-pages created, say, between January 1st, 2004, and December 31st, 2004.”

I won’t say you are wrong, but you can filter Google results by date: After a search, click on the Tools box, and new line shows up. Click on “Any time” and select custom date in the drop down list.

JCM

at 1:01 am

Can we please acknowledge for once that market psychology drove the market on the way up and that the market psychology has rapidly shifted?

“2 months don’t make a pattern”? Maybe not, but the market has dramatically changed.

Kramer

at 10:09 pm

Gotta get to 100 comments.

Chris

at 9:46 am

101 dalmati-….I mean comments?

John Hutchinson

at 2:43 pm

With all due respect, your argument is bogus. The MLS HPI fails to grasp the current situation, which is OK in general but unhelpful when there has been an abrupt change in the wind. Of the decreases in the regular chart, virtually all are consequence of seasonal factors. Having followed the TREB since the mid-1980s, it is manifestly evident that prices decline in the summer months and December/January which pretty well accounts for above 75% of the 25 monthly decreases that are cited.

Because of seasonal factors, house prices will likely decline by another 5 – 10% this summer. This is itself is of little significance. But a 20% decline in the market, if it was put in the context of the stock market, would be deemed a bear market. Housing is less volatile.

Sia

at 4:15 pm

Nothing to add , but I think the price is going down