If there’s ever been a constant about our real estate market, it’s this: people always want to know whether it’s going up or whether it’s going down.

Actually, scratch that.

If there’s ever been a constant about our real estate market, it’s this: Toronto is too expensive.

Actually, scratch that.

Can’t it be both?

Based on the comments from TRB readers so far this year, I’d say the people are pretty mixed on where market activity and prices are headed. It seems to me that our split between bullish outlooks and bearish outlooks are about 60/40, but this is based on who responds.

Agents are bullish, that’s for sure. But to be fair, some agents are bullish because they’re out in the field and seeing things first hand, and others are bullish because they simply feel the need to be.

The media is bearish, but that’s got the obvious asterisk attached.

And what of economists?

They’re typically a bit more conservative in nature and while I would argue that some have been wrong more often than right (like the guys calling for the market correction every year for a decade…), their insights are going to be interesting no matter what.

This past week, I read not one but two economic forecasts from noteable institutions and economists, RBC and Desjardins respectively. While one of these reports is Canada-wide, one is Ontario-wide, and neither is Toronto-specific, we should take a look to see what some of the bright minds are thinking.

Up first, RBC’s Canadian Housing Market Outlook, which is titled, “Bottom Of The Downturn Is In Sight.”

Here’s the link: RBC Special Housing Report

The report is too lengthy to replicate in full, but let’s take a look at some of the more important sections

The Canadian housing market correction has yet to run its course but it’s gradually letting up. We think activity will hit bottom sometime this spring. Prices will level out a few months later—provided the Bank of Canada is done raising interest rates. All told, our forecast calls for a 15% peak-to-trough decline in the national RPS Home Price Index. Roughly half of that is still to come.

Let’s break that down, since you could take 3-4 word snippets of this and create an argument either way.

Negative: “The Canadian housing market correction has yet to run its course.”

Positive: “…but it’s gradually letting up.”

Positive: “We think activity will hit bottom sometime this spring.”

Neutral: “Prices will level out a few months later.”

Negative: “Our forecast calls for a 15% peak-to-trough decline in the national RPS Home Price Index. Roughly half of that is still to come.”

That’s quite a bit to digest!

Personally, I agree with everything except “half of that is still to come,” as far as the Toronto market goes, but this report is looking at the whole country.

Then this part:

What happens next will disappoint housing bulls. We see the recovery phase starting slowly later this year as affordability issues and a weaker economy continue to hold back buyers. The pace should progressively pick up in 2024 once the economy clears its soft patch, inflation returns to target and the Bank of Canada reverses part of the massive rate increases it’s imposed since March 2020.

Booming immigration will fuel demand through the medium term (and possibly beyond), raising the odds of deep supply shortages in the future if homebuilding fails to pick up materially.

If there’s one constant among economists’ outlooks for the Canadian real estate market it’s that they all mention immigration.

This is something I’ve been writing about for years now.

With massively increased immigration targets and an existing lack of supply, there’s going to be an awful imbalance in the near future, and this is going to result in higher prices.

Hate me for saying it if you want to, but what other conclusion could we draw?

RBC’s report seems to agree:

From the report:

Could things heat up to an uncomfortable degree again in the future? We certainly wouldn’t rule it out. It’ll all come down to the supply response. And on that front, the recent track record for construction has been underwhelming. While homebuilding has picked up in Canada over the past three years—housing completions rose from less than 190,000 units in 2019 to roughly 220,000 units in 2021 and 2022—it was nowhere near enough to meet supercharged demand. We estimate that our housing stock must expand by at least 270,000 units per year by 2025 just to accommodate the growth in households, let alone address the housing affordability crisis in many Canadian cities. Needless to say, homebuilding needs to ramp up considerably from this point on. It’s unclear, though, whether the construction industry has the capacity to do so in the face of significant labour shortages.

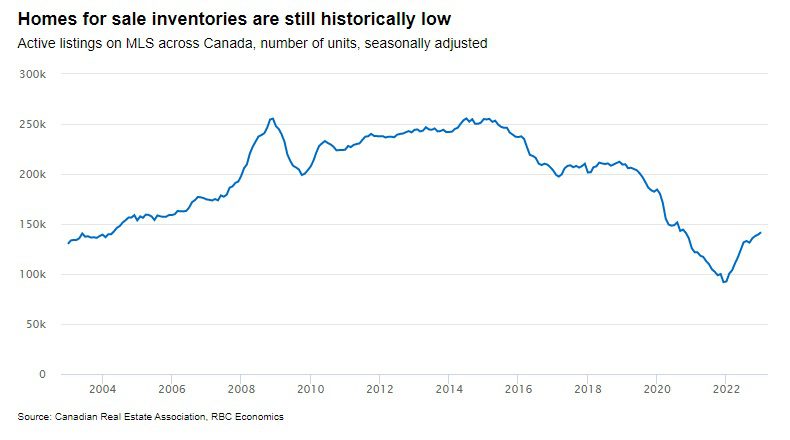

Then we’re provided with this rather telling chart:

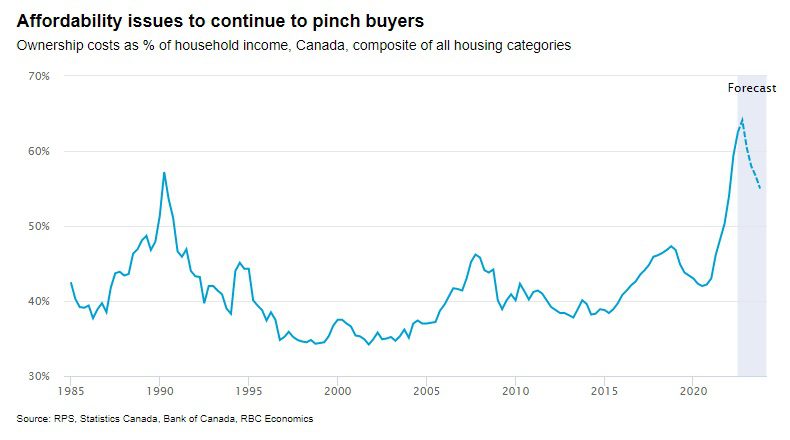

Despite all of this, RBC’s outlook in the short-term is still bearish, citing this chart in affordability:

From the report:

We expect home prices to continue declining in the coming months as a result. The national RPS HPI is likely to fall another 8% by the third quarter from fourth quarter levels—with markets in B.C. and Ontario still bearing the biggest downside risk. Our peak-to-trough price forecasts range from -19% in Ontario and -16% in B.C. to -6% in Alberta and -5% in Newfoundland and Labrador.

It’s hard to look at that chart and provide any bullish outlook, but let me try…

Not everybody in Canada owns. Not everybody in Canada is going to own.

Ownership costs as a percentage of household income looks at all households, even those where people aren’t going to buy.

I expect the rate of home ownership in this country to continue to decline, and as a result, a chart like the one above will see an increase.

–

Up next, Desjardins’ Economic Viewpoint, which is titled, “It All Comes Down To Location, Location, Location.”

Here’s the link: Desjardins Economic Viewpoint

Unlike the RBC report which focused on the whole country, this one is focused on the province.

Here’s their first thoughts:

In recent months, the pace of the housing market correction has slowed considerably. Indeed, we expect sales to find a bottom early in the second half of 2023 and home prices to

begin rising shortly thereafter. Meanwhile housing starts, which have fallen recently from near‑historic highs, should bottom out in the early part of 2024 before gradually climbing higher. This change in fortune will likely be the result of interest rate cuts following a prolonged pause by the Bank of Canada. A persistently tight labour market, still elevated household savings and high levels of immigration will also play a role in supporting housing demand in Canada.

Interesting viewpoint.

“We expect sales to find a bottom early in the second half of 2023 and home prices to begin rising shortly thereafter.”

My first reaction was to disagree and say, “What do they mean sales are going to find a bottom in the early second half? Sales have rebounded!”

But the GTA saw only 3,100 sales in January which was the second-lowest in any month of January, and only 4,783 sales in February, which was also the second-lowest in any month of February.

So they’re right.

About sales, at least.

They note “…home prices to begin rising shortly thereafter.”

I would note that home prices have risen already, and not just in Toronto but rather all regions in the GTA, including Durham, York, Halton, and Peel. Don’t forget, GTA sales make up an overwhelming majority of Provincial sales.

Their forecast for both sales and prices through 2023 and into 2024 are noted here:

Again, I remain confused. They noted they: “We expect sales to find a bottom early in the second half of 2023 and home prices to begin rising shortly thereafter,” but this graph seems to show prices moving up in 2024.

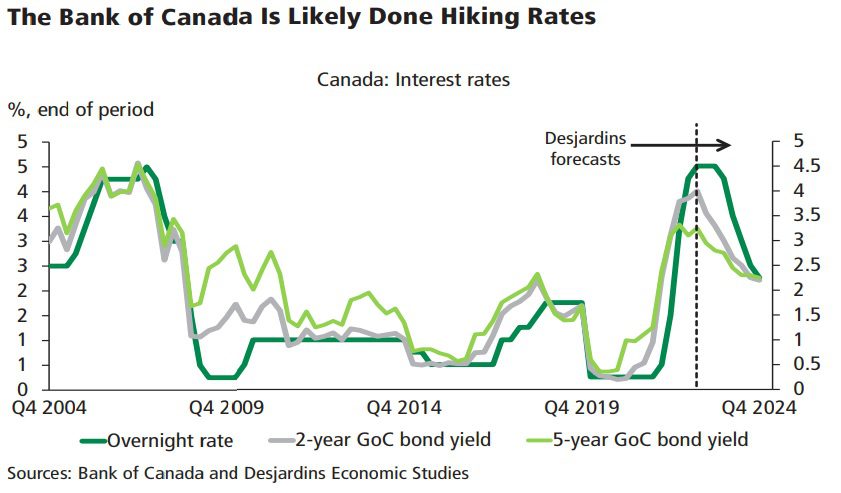

As for their forecast on interest rates, Desjardins is echoing most economists when they predicted that rates would remain at current levels through the end of the year before dramatically declining in 2024:

Just like the report from RBC, the folks at Desjardins spent a lot of time talking about immigration and housing.

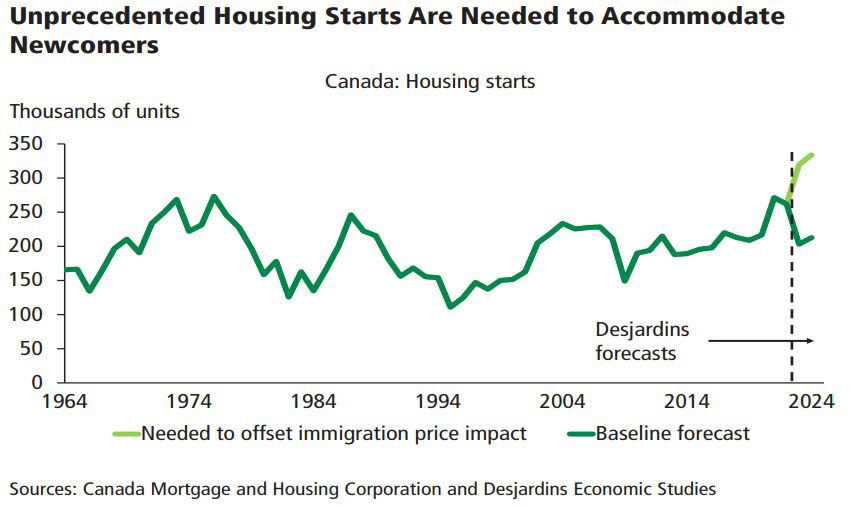

Here’s a look at housing starts in Ontario compared to the number of starts needed to offset immigration and avoid price increases:

Very interesting chart!

And very in line with what so many economists out there are saying.

Desjardins had previously written a feature on immigration and housing called, “The Ins And Outs Of Immigration And Canada’s Housing Market”

Link HERE.

From the report:

Naturally, an increase in immigration will spur sales activity. If these newcomers to Canada continue the recent trend of moving to Ontario and British Columbia, affordability there and nationally will erode further. However, if they move to places that have done a better job historically of integrating immigrants, such as the Prairie provinces, this will provide a substantive offset to the impact of higher immigration on home prices.

Increasing the housing supply beyond the typical demand response would also take pressure off prices but requires extraordinary policy intervention and resolve. Indeed, we estimate that housing starts would have to increase immediately by almost 50% nationally relative to our baseline scenario and stay there through 2024 to offset the price gains from the increase in federal immigration. This is equivalent to about 100,000 more housing starts on average annually in 2023 and 2024 relative to our baseline, and would lead to the highest level of housing starts in Canadian history.

That’s not encouraging.

“Housing starts would need to increase immediately by almost 50% nationally relative to our baseline scenario and stay there through 2024 to offset the price gains from the increase in federal immigration.”

Topic for another day, perhaps, but that’s just not going to happen.

I find it very interesting that both RBC and Desjardins dedicated a part of their reports to immigration and housing, but I also think this is only the beginning of the discussion. These immigration numbers are real. It’s happening. So if the building of houses and condos doesn’t skyrocket, then there’s a dearth of supply, and prices increase.

Facts.

This is the number one reason why I question anybody’s bearish outlook in the medium-term, let alone the long-term.

But in the short-term? I suppose anything can happen.

I remain bullish here in the 416 and I think that some of the forecasts noted above are ignoring what’s happening in the 416 today.

The idea that “activity will hit bottom this spring” seems to be accurate but with respect to price, these forecasts are a little behind. I don’t think prices will start to increase by the second-half of 2023 because the increase has already started.

All in all, I expected more bearish predictions from these economists since economists are often bearish even in a hot bull market.

Take a look at the title from last month’s Economic Viewpoint by Desjardins:

“The Housing Market Rout May Not Be As Bad As We Once Feared”

I guess that’s a big of a neg, right?

“I love those earrings! My mother has the same ones…”

I’m going to flag this theme and come back to it in one month’s time. I expect the March TRREB stats to be very bullish and while these economists reports are typically national or provincial, it’ll be interesting to see how the opinions look by mid-April…

Appraiser

at 9:15 am

Strong employment data this morning from both Canada (+22,000) and the U.S. (+311,000).

Annualized wage increases in Canada running at +5.4% https://www150.statcan.gc.ca/n1/daily-quotidien/230310/dq230310a-eng.htm

https://www.bls.gov/news.release/empsit.nr0.htm

Ace Goodheart

at 10:14 am

RE: “The pace should progressively pick up in 2024 once the economy clears its soft patch, inflation returns to target and the Bank of Canada reverses part of the massive rate increases it’s imposed since March 2020.”

This is what I keep reading everywhere.

And it is annoying, because it is probably not accurate.

Canada is a tiny little bit player on the world economic scene. We live next to the folks who print the world’s reserve currency and run the only undefeated military in the recorded history of planet earth. The sun never sets on the American empire.

During the winter months, it hardly rises on the Canadian one.

We have a persistently hawkish Federal Reserve bank. So long as that situation continues, no BoC governor is going to reduce rates here, and likely they are going to have to keep going up. Otherwise, we will experience rapid currency devaluation and all the nasty stuff that comes along with that.

We are completely at the mercy of the Federal Reserve. Anyone who does not understand that, really does not understand economics, at all.

Bryan

at 4:46 pm

Annualized CPI inflation since June has been 0.98% in Canada and 1.45% in the states. That is 7 months of data showing pretty much unequivocally that inflation is basically over (for now). Once June hits, the year over year numbers will be right back on target.

Rapid currency devaluation? A 50bp hike by the fed will sink the Loonie maybe 1 cent. The Fed has 2 meetings before the YoY numbers blow the hawkish narrative out of the water. Worst case scenario (and it would be a silly thing to do), they go up 50bp and then 25 in those meetings. Canada is on track to be a full 1% lower than target on inflation by June. That’s more than enough buffer against inflation to let the dollar sink.

Ace Goodheart

at 4:51 pm

I hope so.

That is not how it looks to me, but it would be better if you are right, than if I end up being right.

The way I see it, the Fed will remain hawkish for all of 2023 and into 2024.

I don’t see inflation being as easy a beast to tame.

Toad

at 6:03 pm

To what Bryan is saying, inflation is reported based on YoY. So going back to a target of 2% basically means that inflation (all our high prices) is going to be locked in. They’re not shooting for deflation to bring prices down… they’re aiming to essentially keep prices where they are now and prevent them from shooting higher. High prices are here to stay and that may drag us into a recession after everyone’s reserves are all used up. We shall see.

Ace Goodheart

at 9:11 pm

True.

I can’t see the BoC holding rates as they are much longer.

We import a lot of stuff from the USA. Even a 2-3% devaluation of our dollar means 2-3% inflation on imported goods, in addition to core inflation.

A 0.60 cent dollar isn’t good for Canada.

They have to start raising again.

Nobody

at 12:03 pm

The bank reports rely on published data so they have an inherent lag vs someone who is in market daily AND can report on vibes vs metrics. You’ll note than bank reports on stock and bond markets can use real time data AND use vibes thanks to the accessibility of large traders in those markets. Real estate is fragmented, crappy data, VERY slow data, and there are hardly any reliable narrators – even David isn’t reliable for a variety of legitimate reasons.

You also see a bit of bifurcation in this market that’s similar to what is seen in customer data. Louis Vuitton does fine, WalMart sees increased business as people hunt for deals, while middle of the market gets hammered.

Low sales volume, lots of marginal customers are priced out, prices go higher as the people who are actually transacting are on the fancier end and have limited quality to buy.

I’m definitely on the bearish side but only short to medium term… price to income and interest rates are serious head winds but overall growth is huge opportunity for long term price appreciation.

One thing is that much of population growth has been hidden, as documented by Liberal strategist/think tamker Mike Moffatt. Massive increase in foreign students at colleges drove demand for apartments and since they can easily convert from temporary to permanent residents but ‘look” like temporary according to our dat. People, including at ciry and provincial government level, just didn’t know this growth was happening and so predictions on prices were very off.

Derek

at 12:13 pm

Not sure if the timing is right for it, but maybe we’re due for a flag planting game of some kind. Was the bottom in in January? Will GTA avg. price be higher in December than in February? Or some such guessing game? Some other metric? My ill-informed and unqualified theory is that there will be a new bottom below January this year.

David Fleming

at 7:02 pm

@ Derek

I love this idea.

Yes, the time is now!

Perhaps a Wednesday or Friday blog. It requires a LOT of reader participation, otherwise it’s just a really short blog from me.

Maybe I’ll trace back the declines of 2008, 2017, the pandemic in 2020, and 2022, and that’ll be the blog, then we’ll wager.

I’ll aim for this week.

Thx!