Soooo……how have you been?

I know, it’s been a while since we last met.

Me? How am I?

Well, that’s rather kind of you to ask…

As I sit here on January 1st, 2025, cracking my knuckles and preparing to hit the keys several thousand times, I can’t help but ponder what it means for one to be “ready” to go back to work after a winter holiday.

Can any of you relate? Many, if not most of you can.

Allow me to show my age for just a moment here, but I’m going to suggest that if you’re in your 20’s or maybe even 30’s, there’s no real reason why you should want to go back to work after a holiday break. But for those of you with families and/or other responsibilities that take effect over the holidays, well, there are pros and cons to being released back into the wild, I suppose.

I was putting my 8-year-old daughter to bed last night and I said, “Think back to when mommy went to Atlanta over the American Thanksgiving. Think about all that we’ve done since then.”

She and I then counted all the events, occasions, and activities, starting with the Bosley Holiday Market on November 30th, and then cutting down a Christmas tree on December 1st. The festivities continued the following weekend when we set up all our front lawn decorations including string lights, candle lights, and a ridiculous amount of inflatables that my son is obsessed with. Then came the first snowfall, then the end of school, then family coming from England, and on December 21st, we had a wonderful holiday skate with our team, clients, friends, and family. Then Christmas Eve. Then Christmas morning. Then lots of time with family, lots of relaxing, laughter, silliness, and treats.

I have an odd affinity for December. As a self-described atheist who’s Jewish and celebrates Christmas extra-hard, December isn’t about religious holidays for me, but rather it truly is, as the saying goes, “The most wonderful time of the year.”

Well, December and perhaps the summer?

Who doesn’t like summer in Toronto? I’ve always felt like January through May is just a slog to fight through to get to summer! Then I wonder how people who live in warm-weather climates feel about summer; is it any more special than the rest of the year?

Looking out my home office window right now, I’m not exactly feeling inspired.

Have a look for yourself:

Not much of a view, is it?

It’s wet and rainy, and there’s no snow.

The Christmas decorations are still up, only because I feel a tremendous sense of sadness when it’s time to take them down.

The lack of snow means no sledding with the kids; no smiles, no uncontrollable laughter, and one less activity to keep them preoccupied!

The kids are back at school next week (or today, if you’re reading this on Monday, January 6th…) and by then, the December holiday will be a memory. A fantastic one, at that, and hopefully all of you can relate. I will be back in the office on January 2nd preparing for the year ahead, and oh what a year I believe we’re about to have.

At this same time one year ago, I was announcing here on TRB that the Monday/Wednesday/Friday blog posts that you’ve enjoyed since 2007 would be pared down to Monday and Thursday only, but a new podcast feature would soon be added.

We didn’t get off the ground until April, but we’ve been going steady ever since:

While I’m at it, let me remind you that we still launch a weekly video review of properties in the GTA called “Pick5” that’s been running since 2015:

In 2025, the real estate discussion, analysis, opinions, information, and education will flow as freely here on the Toronto Realty Blog as ever before, starting today with what has become an annual tradition, looking at the year ahead.

Just as I am predictable in my year-end posts, the start of any calendar year offers a similar opportunity for me to repeat history.

Let’s take a brief look at the last handful of years:

2024: “What’s On Your Real Estate Mind For 2024?”

2023: “Top Ten Topics of Discussion For 2023.”

2022: “Burning Questions For 2022.”

2021: “Top Ten: Burning Questions For 2021.”

2020: “Real Estate Discussion Points For 2020”

2019: “Top-Ten Burning Questions For The 2019 Real Estate Market”

Yikes! Anything before 2020 and I have to think, “Pre-COVID.” Unfortunately, this is what the pandemic did to many of us, but that’s where my mind automatically goes.

In any event, you get the idea.

To start each year, I like to look ahead to the big moments already earmarked in the real estate calendar, or at what we expect to be topics that dominate the headlines, or often ask questions about particular segments of the real estate market.

Last year, I asked, “What’s on your real estate mind?” and aimed to discuss what you, the reader, would be thinking about at the onset of 2024.

Those topics, through a three-part blog series, were as follows:

1) Prices

2) Sales & Inventory

3) Interest Rates

4) Immigration & Housing

5) Government’s “Bright Ideas”

6) Industry Tinkering

7) Affordable Housing

But after finishing the three posts, I realized that these were topics on my real estate mind. I mean, who among you was thinking about “industry tinkering?” Many of you probably had no idea about changes in real estate legislation, just as you might not be politics-obsessed like me, and have been pondering what “bright ideas” the government would introduce to the real estate market or industry in 2024.

That’s why this year, I’d like to slightly alter the theme and discuss “What’s On My Real Estate Mind In 2025.”

I wish that I could say I took a complete mental break from real estate over the holidays, but who would believe that?

Many of the ideas, thoughts, concerns, or issues on my mind today are similar to those of last fall, but seeing as it’s January 1st and we’re sitting on the precipice of a fresh beginning, I believe that only the topics themselves are the same. As you’ll read shortly, the content and application of these topics are as fresh as the first page of your wall calendar.

Fair warning: these discussion points will not be short.

If you want quick, easy-to-digest, bullet points about real estate, Toronto Realty Blog is not the place for you.

So without further adieu, let me flush out the first two items on my real estate mind in 2025 with very lengthy explanations, analyses, and insights…

–

1) The Spring Market

Technically, spring begins on March 20th every year and runs through to June 20th.

In reality, the “spring real estate market” starts as early as January 1st. As complicated as the market itself can be, you can’t imagine trying to explain the duration of the spring market to a buyer or seller.

“What about the winter market?” we are always asked.

“There isn’t one,” we tell people. “The spring market starts in mid-to-late January.”

“But isn’t January winter?” we’re then asked.

“Yes, January is winter,” we tell them, “But we don’t call it that. We call January through June the ‘spring market’.”

“Wait, what’s this about June?” we’re then asked. “Isn’t June summer?”

Honestly, this must be how Europeans felt in the early 19th century when they ran into people still using Roman Numerals…

In any event, you might have assumed that real estate prices would have been the number one item on my real estate mind to start 2025, but believe it or not, that’s further down the list.

Prices, sales, and so many other items on my real estate mind will be a function of, or shape, or be shaped by the upcoming spring market.

Here’s what we’re all wondering as of today:

When will it start?

How busy will it be?

How late will it go?

When will the music stop?

The first two questions are the easiest to answer, and the third and fourth have some overlap.

But whether you’re a buyer, seller, or agent working in the business, you’re all waiting to see what happens this week and next.

If you can think back a few months, you’ll recall that I felt we would see a busy fall market in 2024, and I was proved to be exceptionally incorrect.

My thinking was based on the Bank of Canada interest rate cuts in June, July, and September, which not only improved affordability and mortgage qualification for buyers, but also signaled that we had clearly entered into a period of declining borrowing rates.

The fact that the September rate cut took place on September 4th, which was basically the second day into the fall market, only strengthened my position.

I figured that any buyer who was looking at entering the market in the next 12 months would be smart enough to do so now, before the masses jump back in and prices rise accordingly.

As I wrote several times last fall, it seemed to me that many buyers would rather wait until further cuts took place, ie. the December 11th cut, the upcoming January 29th cut, and perhaps another cut on the next scheduled date thereafter, which is March 12th.

But for any buyer with a timeline of 0-12 months to not become active in the fall of 2024 meant one of two things:

1) They were bearish on the market and thought that prices wouldn’t rise.

2) They were uninformed and/or naive about market dynamics.

Consider this situation:

A house at 123 Fake Street is for sale in July of 2024 for $1,200,000.

The Bank of Canada’s lending rate is 4.75%, down from 5.00%.

A potential buyer says, “Nah, I’d rather wait until mid-2025 when rates are lower.”

The Bank of Canada cuts the lending rate down to 3.75% in December, then to 3.25% in January, then to 3.00% in March, and finally to 2.75% in April.

The identical house next door at 125 Fake Street is listed for sale in May of 2025.

The same potential buyer says, “Rates are way lower now! My affordability has skyrocketed! I’m all in!”

But does that house:

a) Cost the same at $1,200,000, rendering this buyer an absolute genius.

b) Cost $1,300,000, rendering this buyer painfully naive.

I don’t have to tell you which of the two I’m putting my weight behind…

Tell me that I’m wrong if you’d like. Tell me that the 416 average home price will be the same in April or May of 2025 as it was in the summer or fall of 2024.

Go ahead.

Does anybody want to tell me this? Or can I connect the dots for us:

Reducing the BOC lending rate from 5.00% to 2.50% – 3.00% is going to push real estate prices up.

Geez, remember when I said that I wasn’t going to talk about price as my first point today? No, seriously, I have a different conversation about price upcoming, but this conversation about price simply introduces why I think the spring market will be busy.

We didn’t have a busy market in the fall of 2024. Prices were flat, sales were flat, and while we all experienced those “red-hot offer nights” on a property here, there, or in between, for the most part, the market was a slog.

I remember back in 2020 when COVID hit and sales ground to a halt in April and May. Those are typically the busiest months of the year, and they lead into a very slow summer.

But remember what happened that summer?

Sales were through the roof!

All of the sales that should have taken place in April, May, and June ended up taking place in July and August instead.

That’s how I feel coming into 2025 and that’s how I feel about the upcoming spring market.

I think all those sales that should have happened last fall via those buyers that could have bought but didn’t, will end up taking place this spring.

And when I look at the amount of listings that we have upcoming, I think this is a microcosm for the market as a whole.

In January, we’re bringing three east-side houses to market, all which are above the “starter home” price threshold, but file them between $1.3M – $1.5M.

All will be listed with “offer dates” because I am that confident the market will necessitate it.

We’re also bringing a detached starter home, located further east, in the $1.1M price range to market and it too will be listed low, with an offer date.

We have three condos coming to market and none will be “under-listed, with an offer date,” but that’s us acknowledging the market. All three are vacant, cleaned, painted, staged, well-marketed, and ready to beat out the glut of competing properties which show like crap because both sellers and agents don’t want to spend time, effort, and money on listings in this market.

There are a few others in the queue as I write this, so assuming that we bring, say, two of those to market, we’re looking at nine new listings for the “slow” month of January, and that speaks volumes to me.

My business has always been somewhat predictable. Sure, there are outlier months and often slower or busier periods when we look at a long enough time horizon, but over the last few years, January has brought about 3-4 listings as the month is typically a “gateway” to the spring market.

Not this year, it seems.

There are a few listings from 2024 that stand out in my mind, but one in particular that I think frames the concept of a “busy spring market” perfectly. I know I already told this story last fall, but it’s the ideal example for this point.

In the late fall of 2023, I met with two aspiring home owners who had listed their property for sale in the summer, then in the fall, but without success.

The listing and pricing strategy that their agent used was quite different from what I would have advised, as was the presentation of the property. Neverhteless, I told them that there would be a “prime” time to list in the 2024 spring market and that if they were willing, we could do all the work ahead of time, and then list exactly when we felt it was prudent.

They agreed, and they did minor renovations on their home over the holidays, packed up most of their stuff, and we knew that we could get the property to market with a one-week lead time when the market was in full swing.

Inventory for quality starter homes was very low in January of 2024 and this continued into February. Offer nights started to provide us with outrageous stories, and suddenly the market was suffering from a dearth of $1.1 – $1.4M homes.

We listed the house for sale in mid-February and the response was phenomenal.

They were on the market, unsold, for $1,299,000 in the fall of 2023, without a sniff of an offer.

We sold the home in late-Febraury, 2024, for $1,420,000, with eleven offers on the scheduled offer night.

This is the power of a “busy spring market” and I do believe that we’re going to see these conditions again.

When?

I’m tempted to say right out of the gates, but we’ll need to see how the first handful of “offer nights” go. As mentioned, we have a few properties in this price point coming out in January, and I think theyr’e going to do very well.

Now, how long will this last? When will we “peak,” so to speak?

I think the market is going to be busier, earlier in 2025, so I think that peak will also come sooner.

June of 2024 was an absolute slog and the contrast between a listing in March and a listing in June was stark. As I explained in some year-end posts last fall, the “offer dates,” even for quality listings, werne’t working, and sellers and agents failed to adapt. Inventory piled up and many of those homes remained on the market until the fall.

If I’m a freehold seller, I’m trying not to put my home on the market after Victoria Day in 2025. Ironically, some of the would-be sellers I spoke to in December and over the holidays were actually targeting the month of June for their sales, but I told them they were far better off to target March, April, or May.

I’ve had a long break. I’m ready to get back to work.

I’m excited for January even though January is, to be fully transparent, my least favourite month of the year.

I’m a person that needs to be busy. I’m at my happiest when I feel productive, and I’m so incredibly enthused and inspired for the month ahead.

There’s no doubt in my mind that I’ll have stories to share about the market as we move through the next couple of weeks, and I promise to share details on how our “offer nights” are going…

–

2) Prices

The Toronto Regional Real Estate Board must have made a new year’s resolution to wreak havoc with my blog schedule, because I don’t remember the last time that I had to wait six days into a calendar month to get my hands on the coveted TRREB Market Watch and the associated real estate stats!

By the time you read this, I’m sure the stats will be out.

But that’s too late for me. And this means it’s too late for you too.

Do we really care about December’s home prices though? I mean, I want the stats to finalize my 2024 sales figures, and I’d like to know what the overall average home price for 2024 was, but as for the December stats, it’s a big “meh.”

We can move on without them.

As we move in to 2025, the conversation about prices could veer off in many different directions.

Are we talking about where prices are going? Do we even need to? They’re going UP….right?

Most say up, some say down, other say flat, but even if we did agree on the direction, we would still want to know the veracity of the movement!

Because it’s one thing to know if prices are going up or down, but it’s another thing entirely to know by how much.

And when would this take place? That’s another great question!

Perhaps most importantly, what will prices do on a relative basis? More specifically, can we expect prices to regain lost ground?

Before I get into my analysis, I’d like to provide you with two projections from the so-called “experts.”

Specifically for Toronto, Re/Max and Royal Lepage provided two very different projections:

Re/Max: 0.1% increase

Royal Lepage: 5.0% increase

Respective sources are HERE and HERE.

That’s a pretty stark contrast, wouldn’t you say?

Over the next week, you’re going to see a lot of click-bait headlines about the 2025 real estate market, and I think there will be just as many bearish predictions as bullish ones, because the accuracy of the predictions doesn’t matter, so long as people are clicking on the articles.

With respect to prices, there are four things I’m wondering about 2025:

- Which month will represent the “peak” for average home price in the GTA?

- Will we see any month surpass $1,200,000?

- Is there any shot of topping the all-time record of $1,334,554 from February of 2022?

- How much will the total 2025 average home price surpass the total 2024 average home price by?

Let me look at these one at a time.

Which month will represent the “peak” for average home price in the GTA?

Can we make the assumption that this takes place in the spring?

Because I typically do.

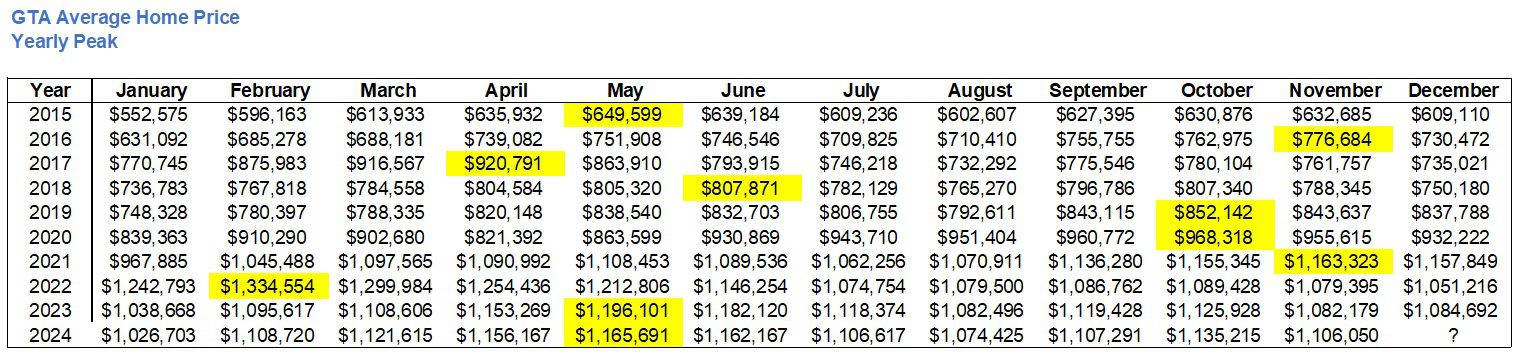

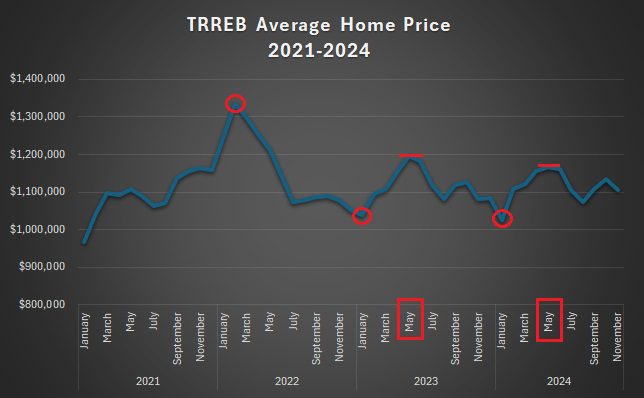

It’s why I keep this chart handy:

Now, keep in mind, this doesn’t necessarily tell you “the best month to sell.”

Ironically, the market became really tough in May and June last year, but it was an incredible seller’s market in February and March. The statistics do NOT tell this story.

But as far as the on-paper peak price goes, I’m thinking it will take place in May.

That brings me to my second question:

Will we see any month surpassing $1,200,000?

Coming off the peak of $1,334,554 in February of 2022, prices declined significantly before starting to regain ground in the spring of 2023. We saw the 2023 high come in May of that year, checking in just under the $1,200,000 figure, as you can see in the chart above.

When we began 2024, I asked if we would see any individual month’s average home price top $1,200,000, since we just missed in 2024.

Once again, we did not.

In addition, the 2024 “peak,” which occurred in the month of May, was 2.5% lower than the peak in May of 2023.

So I’ll ask again, Will we see any month surpassing $1,200,000?

I believe that we will.

In fact, I believe that we will sail past that and see an average home price of $1,230,000+ at some point in 2025.

In case you’re wondering about the yearly peak over the last decade and when it occurs, have a look at this:

As for the last question on my list, this is the most fun!

I don’t think anybody believes that we will top the all-time record for GTA average home price in a single month at any point this year. Some probably don’t think we’ll ever surpass it!

But as I’ve written before many times: every previous record has eventually been surpassed.

Not only that, ever spectacular decline has been followed by a recovery period, and these periods have seen dramatically different lengths.

Some of you have seen this analysis on TRB before, but either way, it’s a fun exercise to start 2025.

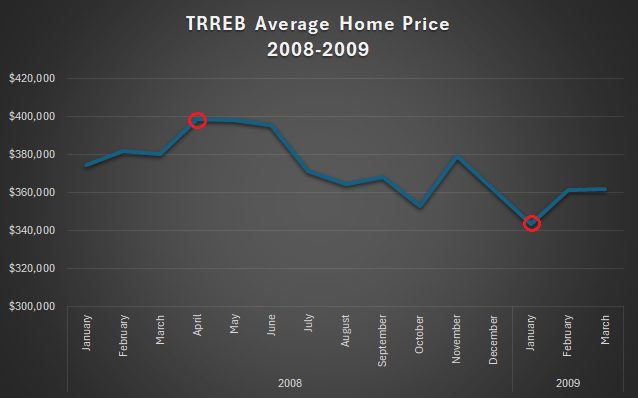

Remember the Financial Crisis of 2008?

Many of you don’t. Many of you heard about it from the likes of Selena Gomez when you watched, “The Big Short” with Christian Bale and Brad Pitt.

But after the United States saw their economy implode, and the shockwaves were felt through the rest of the world, the Canadian real estate market took a bit of a “dip.”

You’ll laugh at this dip now, but at the time, a lot of folks were worried. Some even hurting.

The all-time high for the GTA average home price back then hit $398,687 in April of 2008.

That sounds like a pittance, I know. But it’s 2025, folks. That was seventeen years ago!

The average home price fell off significantly thereafter and the “trough” was reached nine months later in January when the average home price declined to $343,632.

That’s a decline of 13.8%.

In fairness, the average home price is always depressed in the month of January.

If you want to remove seasonality, then maybe the October average home price is a more fair measure?

From April to October is still 11.5%. That’s hardly insignificant.

But how long did it take for the market to recover?

That is very important in the context of today’s conversation since I want to use these market declines to predict the market’s current recovery.

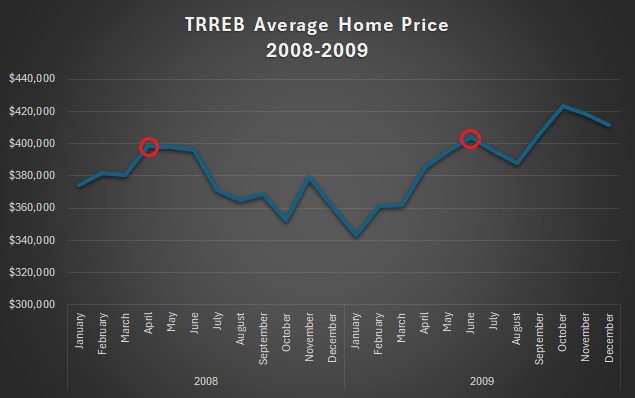

The next chart takes the above data and stretches it out through the rest of 2009:

Ah, yes, through the rest of 2009 and through the recovery!

Fourteen months.

That’s how long it took for the average home price to recover after the decline.

Fourteen months.

Now, let’s move on to 2017 and another significant market decline:

The “insanity” of 2017 was similar to what was felt in 2022, only it lasted longer and was far more pronounced.

The GTA average home price hit $920,791 in April of 2017 and then began to fall off, as history shows, and as we have discussed to death on TRB over the years.

The “trough” was reached in August of 2017 at $732,292.

That’s a decline of 20.5%.

In 2008, we saw the recovery take only fourteen months, but in 2017, the market crawled along at a snail’s pace, inching up, little by little, for years.

Ironically, it took a worldwide pandemic to help the market recover!

Although prices dropped off significantly in March, April, and May of 2020, as we all hid in our homes for fear that the world was going to end, but when we started to get back to our lives, and when we learned how to navigate the new world in which we lived, people started to find all kinds of reasons why they needed to move.

The average GTA home price in June of 2020 hit $930,869, and thus the market had “recovered” from the 2017 decline.

Thirty-eight months.

That’s how long it took:

Of course, prices continued to run from there, as we all know.

A mere two years later, and we were looking at that incredible $1,334,554 average home price in February of 2022!

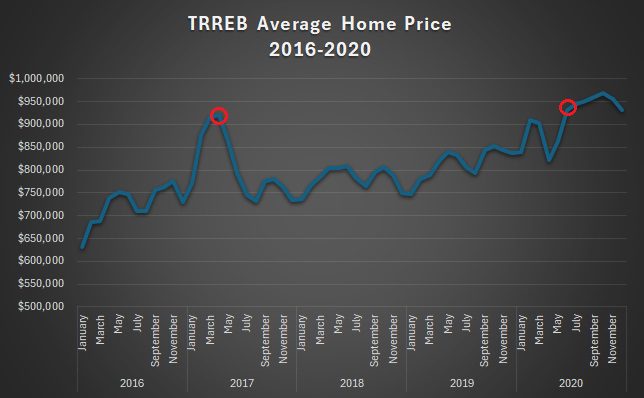

So what is the point of all this?

What do the 2008 and 2017 markets tell us about the 2025 market?

They tell us, first and foremost, that the $1,334,554 average home price will be surpassed again.

We just don’t know when.

As I noted above, the 2024 peak was lower than the 2023 peak, and both occurred in the month of May.

Also, the “trough” of $1,038,668 from January of 2023, which I called a “seasonally-depressed” price and not one to put any stake into, was actually beaten out by a deeper trough in January of 2024 when the average home price hit $1,026,703.

All this is noted in the following chart:

Thirty-four months.

That’s how long it’s been since the previous peak.

We don’t have January data, so it’s not thirty-five months for those of you who think you can count slightly better than I can, but you get my point.

Thirty-eight months would be April of 2025, for those comparing 2017-2020 to 2022-current, but I’m not making that prediction. As I said, I think we’ll have a month in 2025 when the average home price tops $1,250,000, but nothing close to the previous peak.

This is going to take into 2026, but it will happen.

As for prices in the spring market, well, I think you’re going to start hearing the “stories” pretty soon…

–

Alright, so if you thought that today’s blog post wouldn’t be ridiculously long, then you clearly don’t know me.

See you back here on Thursday to pick this up with Part II.

Peter

at 10:05 am

I feel like I need to take a leave of absence from work in order to read this post. JK.

Lengthy but solid. Looking forward to part two.

Happy New Year!

Marina

at 10:12 am

Happy New Year all!

I’m not as optimistic in terms of new peaks on 2026, or 1.25 mil in 2025, but I don’t think it’s out of the question either. With Donald Drumpf going back into the White House, there are a LOT of things that could affect us either way. Plus we are headed into an election… Too many variables.

I do believe though that we are going into a very busy market, regardless of price. My neighborhood has been absolutely dead the last while so I’m sure there’s pent up activity.

One of my neighbors has been thinking of selling for awhile, and that’s one I’m waiting for since the house is very similar to ours. Would love to have that benchmark.

Derek

at 11:59 am

Happy New real estate year!

I think I had March 2026 for the new high in peak pricing in the old “contest”. Not sure I would make the same guess today.

Ed

at 1:20 pm

TL:DR

Ace Goodheart

at 6:20 pm

And the answer to the question “what will last longer, once Parliament resumes, Justin Trudeau, or a head of lettuce is. …….

The lettuce

Anwar

at 7:34 am

He just set this country and its people back even further by stalling until March. His arrogance is astounding.

The Libs will spend months trotting their candidates out for the public in a lame-duck contest that nobody wants to see.

This needs to end!

Ace Goodheart

at 9:18 am

People are about to become very upset with the Liberals. If the Trump tarrifs happen, Canada will lose 70% of our exports overnight to a 25% tariff. Our Parliament will be closed down and the Liberals will be having a leadership convention, while our country is badly danaged by Trump tariffs.

I doubt they’ll win more than a few seats when the election does happen. People are going to be extremely upset with them.

TT

at 12:56 pm

Big rate cut coming in three weeks!!

Laura Dave

at 12:27 pm

My name is Laura Dave. I reside in Miami, Florida. I invested a substantial amount of $216,500 in cryptocurrency, believing that my initial investment had grown significantly to $381,550. This rapid increase in just a few weeks felt incredibly rewarding and promising. However, when I decided it was time to retire and attempted to withdraw my funds, my withdrawal request was denied. It was at that moment I realized I might never recover my money. Determined not to lose my investment, I reached out to MBCOIN RECOVERY GROUP for assistance. They guided me through a structured recovery process, which included the following steps: First, I provided them with detailed information about my investment, including transaction records, account details, and any communication with the cryptocurrency platform. Next, their team conducted a thorough investigation to trace the funds and identify any fraudulent activities. They then collaborated with legal and financial experts to build a case for recovery. Finally, through persistent efforts and negotiations, MBCOIN RECOVERY GROUP successfully helped me recover my funds. For anyone facing similar issues, I recommend contacting MBCOIN RECOVERY GROUP via their email for professional assistance.

Email: Mbcoinrecoverygroup @ aol. com

Text OR Call Number: +1 346 954-1564