Do you remember before the Ontario public school system fell off a cliff?

I do.

I remember things like “late marks” on assignments, and, God forbid, failing the kids who got like 19% in a class. Today, those kids have their marks rounded up to 51%, and/or receive something called “Credit Resuscitation,” which means that the teacher, who the kid probably swore at all year, provides extra credit assignments to the kid so he or she can obtain a passing grade.

Everybody passes.

Then they go to University where they expect that………….wait for it………..everybody passes.

Then they go into the “real world” where they expect that………well, you know where this is going…

When I was in Grade 10, I decided to take “enriched” courses, which were basically like a tougher version of the regular class. These were offered as an option for students who obtained over 80% in the corresponding class the year prior, and since I was an overachiever with a father who actively promoted things that were “enriched,” I decided to take enriched English and enriched math.

The class sizes were smaller, the kids were smarter, and the work was definitely tougher. But it was a unique learning environment with more outside-the-box thinking, and the teachers were different in their methods of teaching.

Mr. De Peizza was my Grade-10 Enriched Math teacher, and he was a tough son of a gun. There was a student in my sister’s class who took Mr. De Peizza’s OAC Calculus course, and was looking to obtain a perfect 100%, but he was “only” trending around 95% by the time parent-teacher interviews rolled around. The student’s father was a mathematics professor at the University of Toronto, and he pulled up a chair next to Mr. De Peizza and tore a strip off him, screaming, “These tests – I wouldn’t give these to my second-year students! You think this is appropriate for OAC students?”

My father witnessed this interaction first-hand. “Mr. De Peizza sat there with his arms folded,” my dad told me, “And he did not look impressed.”

That student dropped the class. With a 95% average in October, he dropped the class! He took OAC Calculus again the following semester with Ms. Burstyn and got 100%.

One day in 1995, on what Mr. De Peizza called “Fun Friday,” he brought in ten rolls of pennies, and asked us if we were ready to learn.

I had no idea what he was going to do with those pennies, but I did know we’d end up learning something.

He asked us what the percentage chances were that a flipped penny would land on heads vs. tails, and obviously we told him 50/50. But then he asked us what the percentage chances would be if we flipped that coin once, versus ten times, versus one hundred times, and so on.

It was a trick question, since the percentage chances remain the same, but the odds of obtaining a 50/50 split increase as the coin is flipped more.

So he divided us into groups, and had us flip coins and record the results.

First, we flipped the coin twice, and about a third of the groups had two heads, a third of the groups had two tails, and a third had one head and one tails.

Then, we flipped the coin ten times, and noticed how only one group found the same heads or tails 8/10 times, a couple 7/10 times, a few 6/10 times, and then most 5/10 times.

Then, we flipped the coin one hundred times, and no group found more than about 58 heads/tails out of 100. Most were obviously around 50-52.

Finally, we flipped the coin one thousand times (each of us had ten coins to flip/throw and record, so this didn’t take as long as it sounds), and once all the groups recorded their findings, the total number of heads was about 50.2%, and the total number of tails was about 49.8%.

This sounds so simple and obvious to you folks, since for one thing, you’re adults, but also because you probably went to school during a time when students were challenged to a greater degree. But in my 15-year-old mind, this was one of the coolest things I had ever experienced.

It was that experience, combined with my obsessive-compulsive nature, that I believe led me on a path to being the stats-obsessed 39-year-old that I am today. It started a lot earlier, don’t get me wrong. I can remember watching the 1992 NHL All-Star Game Skills Competition, and recording all the results in a fresh, Hilroy coiled notebook. I was unable to watch without writing it down; that is the compulsion, but I digress…

I love diving into real estate stats! It’s time-consuming, and often repetitive, but the “eureka” moment upon completion when you come to that conclusion is exhilarating. Or at least, it is for me.

On Monday, I dove into new listings in a selected group of neighbourhoods and property types, to try and figure out what’s happening in the market right now as it pertains to inventory.

The results were quite apparent: inventory is down. Way down.

Aside from downtown Toronto condos, which are only down 16.1% in terms of new listings in the first four weeks of May, most areas are down by about half.

If you’re an active buyer out there, having half as much choice is never a good thing.

But a reader made the following observation:

Fair point. And a good point, at that.

I suppose that to provide only information on new listings, and conclude that the market is A, B, or C, simply based on a massive decline in listings, is incomplete.

The other side of the proverbial coin, if you will, would be sales.

And if we’re going to understand the market in its entirety, it would behoove us to look at the SNLR, or “Sales To New Listings Ratio,” for each of the weeks we examined on Monday, in each of the areas, for each of the property types, and further compare that to 2020.

So, it was once more unto the breach, dear friend, once more for yours truly, as I dove back into the numbers.

A brief refresher for those not in the know:

SNLR or absorption rate looks at the ratio of sales in a given period to new listings. This does NOT represent a percentage of those specific new listings, that have then subsequently sold. So if there’s a new listing at 123 Smith Street in the first week of May, and that listings sells in the third week of May, then these will obviously not appear in the same week. This is why you can actually have a ratio over 100%, ie. there were more sales in that given period than new listings, since some of the sales represented properties that were, in fact, “new” in a prior period.

Let’s do the same order as we did on Wednesday.

First and foremost, let’s look at downtown condos, since this was an outlier on Wednesday, when we learned that new listings are “only” down by 16.1%.

I’ve kept the weekly figures in here, just beacause I already had the spreadsheet, but there’s potential for serious volatility in week-to-week numbers:

In May of last year, we saw an absorption rate, or SNLR of 56.6%.

That’s about right for condos, which are usually absorbed at a slower rate than single-family homes. Many condo listings are for properties being offered for sale with a lower chance of success, ie. tenanted condos.

The SNLR for May of 2020 was a mere 29.4%, and this is the most shocking piece of data that I’ll provide you with today.

That’s a 27.1% decline from the 56.6% absorption rate we saw last year, and surprisingly, the 22.6% in the 4th week of May represented the low-point for the month.

Continuing on to W06, here’s yet another shocking piece of data:

Only a 5.4% decline in absorption rate?

Trust me, I checked these numbers twice!

From 55.9% in 2019 to 50.5% in 2020, that’s a bit more than a rounding error, and quite surprising considering this is an area in which I’ve had many listings over the years, but only maybe put one or two buyers. I don’t love it, to be quite honest. It’s congested, tough to walk to anything, and unless you’re dead-south-facing, you can’t claim the benefit of a water view.

And yet, these condos are selling almost as well as they were last year.

Note that the 55.9% absorption rate in 2019 matches up well with the 56.6% absorption rate in 2019 for C01/C08. So with a 2020 absorption rate of 50.5%, the true outlier here for for condos is that C01/C08 absorption rate in 2020 – a mere 29.4%.

Sticking with condos, let’s look at Mississauga:

Alright, so the RED figure shows a drop in absorption of 23.6%.

But is that the story here?

To me, the story remains C01/C08.

The 2020 absorption rate is 46.3%, which, yes, is much lower than the 69.9% in 2019 (which is exceptionally high!), but still so much higher than that aforementioned 29.4% absorption rate in C01/C08 in the first four weeks of May.

This will be something worth watching as we move into June. Thankfully, I’ve had no problem moving condos, but these numbers are telling us something.

As for freehold, we’ll start on the east side:

This is exactly what I expected.

Listings are down, so are sales, and they’re down almost in tandem – only a 4.3% drop in absorption rate, from a very high 66.1% rate in 2019.

Most of my buyers are on the east side, and this lines up with what we’re seeing.

On the west side:

An absorption rate of 54.6% is still quite high, even if compared to a very high benchmark of 67.1%.

The west side is selling well; just not as well as the east side.

As for midtown:

This surprises me.

I have clients in C10 and C11 and we’re not seeing listings, but we are seeing properties move.

I saw a house for $2.5M last week that I didn’t like, and neither did the buyers, but it sold the next day for full price.

A decline in SNLR of 22.7% doesn’t fit with the “feel” in the market right now, but that’s what the numbers are saying.

Note that the east side and west side’s respective SNLR in 2019 was 66.1% and 67.1%, and midtown was merely 58.4%. This is, in my opinion, due to the substantially higher price point in C09, C10, and C11.

As for that “tough” area I describe, north of the 401, south of Markham:

This is interesting!

Only a 2.2% decline in SNLR, although it’s worth noting that these absorption rates are way lower than east, west, or midtown, at only 35.6% and 33.3% respectively.

I’ve had only a handful of listings up here in the past two years, and they were not easy sales.

Now what about freehold properties outside the core?

Surely this is where people are being hit the hardest?

Prices aside, surely this is where it’s tough to move real estate?

Nope.

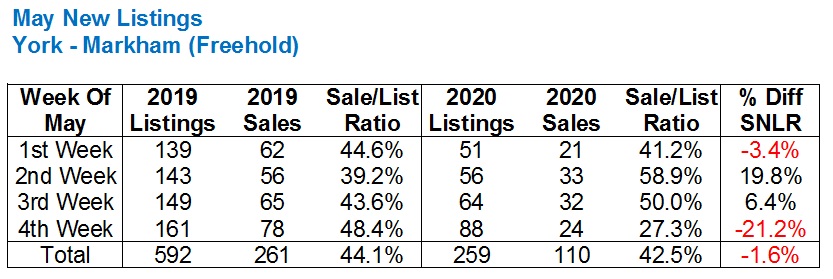

The numbers wouldn’t agree:

That’s astounding.

The definition of “rounding error” might just be 1.6%. Price aside, freehold properties in Markham are selling at the same relative pace in 2020 as they were in 2019. Lower absorption rate than the east, west, and central cores of Toronto, but I think sellers and agents plan for that. So really, what we’re seeing here is a market that’s, comparatively, ahead of its peers.

Speaking of ahead of its peers…

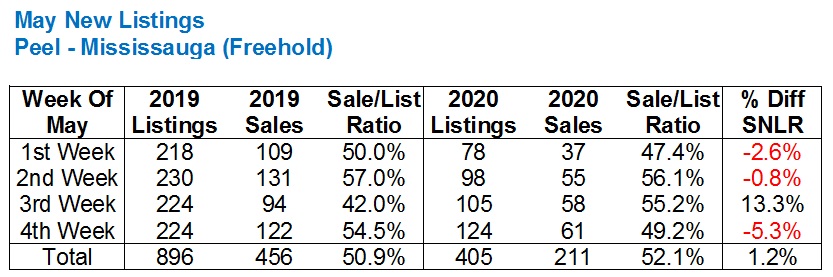

I know I said that the 29.4% absorption rate in C01/C08 condos in May was the most shocking piece of data that I would give you today, but I think that BLACK font 1.2% comes in at a close second.

Relatively-speaking, freehold properties in Mississauga are selling better than they were last year, and that’s wild.

Listings are down massively! From 896 down to 405. That’s less choice for buyers, but it doesn’t matter, since houses are being absorbed faster than they were last year.

All this said, and I don’t know what to make of this market.

After Monday’s blog, I would have argued that listings have plummeted and that it’s a seller’s market.

After today’s blog, I would still argue that it’s a seller’s market, but I would advise buyers to be aware of the reduced amount of competition that they’ll face.

The only buyers out there who are looking at properties are serious buyers. Going to show a house or condo, wearing a mask and gloves, is a new experience for me, and a new experience for every agent and buyer who has looked at properties before. The tire-kicking, fly-by-night buyers certainly are not going through these motions if they’re not serious, and I don’t just mean serious about buying – I mean serious about buying that specific property. Receiving a dozen showings on a listing today is tantamount to receiving thirty back in February. And when it comes to the number of offers on properties, 8-12 in February might mean 3-4 today.

It might not make a huge difference in the price, of course, since February saw the “dummy” offers from naive buyers that don’t seem to be out there today, but buyers need be aware, nonetheless.

It might also benefit sellers to be aware as well, and adjust expectations on showings and offers accordingly.

The TREB stats should be out later this week. I wonder what conclusions we’ll draw from those?

Appraiser

at 7:46 am

Official TRREB data for May, 2020 released today. Year over year vs. 2019:

Average price +3.0%

HPI Composite Benchmark price + 9.4%

Sales down – 53.7%

New listings down -53.1%

Appraiser

at 8:20 am

Mortgage rates are dropping again. HSBC and TD Bank have lowered variable and fixed rates respectively.

HSBC dropped two key variable rates:

5yr (regular): 2.25% to 2.15% (Prime – .30)

5yr (high ratio): 1.95% to 1.85% (Prime – .60)

TD has lowered the following special fixed rates:

3yr: 2.74% to 2.64%

5yr: 2.97% to 2.82%

5yr (high ratio): 2.69% to 2.59%

TD also dropped these posted fixed rates:

1yr: 3.44% to 3.24%

2yr: 3.54% to 3.39%

3yr: 3.89% to 3.79%

5yr: 4.99% to 4.84%

https://www.ratespy.com/variable-rate-discounts-on-the-path-to-recovery-060214080

J G

at 11:12 am

Wow, stock market on an absolute roll. Anyone who bought anything in late March early April would have made AT LEAST 30% gain.

Condodweller

at 12:09 pm

Those who sold RE during the height early this year and received their proceeds in March and deployed it in the stock market are looking more and more like a genius.

There are quality dividend prayers out there that were covered by 75% which are up 100% plus you’d be collecting around 10% dividend.

One stock I was looking at is up over 200%. If only I had the guts to pull the trigger.

Condodweller

at 12:11 pm

Covered=clobbered

Swipe correction again

Jimbo

at 2:29 pm

Just renewed 5 yr closed 2.19% today

Professional Shanker

at 9:54 am

fixed or variable – what were the offers? – Also Big banks or other?

Jimbo

at 5:03 pm

Fixed, BMO. The other offer was 2.09% variable. Mortgage was due in December so I called to see what the offer in September would be.

Choose fixed as the variable discount wasn’t very high and I don’t pay mortgage penalties if I break mortgage on a posting.

J G

at 8:22 am

I’m not surprised, I’ve been saying this for last 2 months about downtown condos.

Also, a glance at last 7 days sold on HouseSigma for downtown condos, almost every one is going below asking

Clifford

at 9:02 am

Depends where you look.

Pragma

at 9:08 am

Is this the tightest inventory has ever been? How does it compare with other tight inventory periods such as Jan/Feb of this year or Jan/Feb of 2017? I think what would provide tremendous insight would be a monthly avg price chart vs sales/listing ratio (or just inventory). Presumably we would see prices tick higher as inventory slips, but the last 5 months would be very interesting.

And I’m just throwing this out there, YoY if we saw inventory drop by half but prices rise by 5%, is that bullish or bearish?

I continue to be most downbeat on downtown condos. I believe it will be an outlier as one of the worst performing RE markets in Canada over the next 5 to 10 years.

Thomas

at 9:43 am

I couldnt agree more on the observations Pragma. What I read from Scott Ingram’s analysis is that the MOI for the 416 area is higher than it was in 2019 or 2018 but it is still low overall and quite competitive for the entry level homes. For me, the gist is that it still too early and I expect the prices to drop

David Fleming

at 10:10 am

“And I’m just throwing this out there, YoY if we saw inventory drop by half but prices rise by 5%, is that bullish or bearish?”

Bullish. Very bullish.

Thomas

at 10:38 am

Is it considered bullish because there is still demand in such a difficult market? What are the other reasons to consider this bullish?

Appraiser

at 8:03 pm

Despite a lock-down pandemic prices go up – and you are wondering why it’s bullish? At the very least you must admit to a rather obvious display of remarkable resilience. No?

The GTA market is and has been divorced from all of the usual economic metrics for decades.

Why would it start behaving now?

Professional Shanker

at 9:59 am

the stock market is not the economy.

the housing market is not related to incomes, etc.

What a world we live in….

Condodweller

at 12:20 pm

I only see a significant decline in downtown condo prices if SFHs come down in price to make them affordable to all the would be first time buyers and those moving up from lower tier homes.

I get the feeling that any selling of downtown condos due to forced selling after the deferral cliff, if it does materialize will be taken up by demand.

Thomas

at 9:22 am

That is some excellent analysis David! It does look like it is too early to draw any conclusions.

Ed

at 9:26 am

It’s funny how the mind works isn’t it? From Micheal’s comment you take two parts of it “half the story” and “my two cents” and it brings you back to Mr. De Peizza’s classroom 25 years ago.

David Fleming

at 10:10 am

@ Ed

My mother loves the “folksy intros” so I try where I can. 🙂

jeanmarc

at 5:01 pm

David, it sure brings back memories. I was in grade 9 enriched math (writing the cayley math contest, and then fermat, euclid and descartes). Then taking the 2nd hardest Calculus course in 1st year university was like climbing Everest. My calculus text (R. Courant) was all about the Fundamental Theory of Calculus. God help those kids who are in grade 12 entering 1st year now and attempting the same feat.

Libertarian

at 10:44 pm

I’m not surprised at the stats because the market was heating up in February and early March. Then the shutdown happens, so most people stopped selling/buying. Now things are opening up again, so those people have come back to the market.

It’ll be interesting to see what happens in a month or two once those people have completed their transactions. (Not to mention, the deferral cliff in about 5 months.) If someone was on the fence about buying/selling before the shutdown, and now we’re in a recession, will those people decide to sit out until the economy recovers? If they do sit out, things will get quiet. If they decide to transact, then I give up and people really have drank the real estate kool-aid.

Appraiser

at 9:35 am

FOMO is real. Not just a bear slogan.

daniel b

at 10:54 am

@David, interestingly current research suggests that the coin toss flip isn’t 50-50. Firstly, the odds of the coin landing same side up as when it was tossed are slightly higher. Secondly, the conditional probability also changes – 5 heads in a row does, in fact, increase the odds of a tails on the next flip. You’ll very much enjoy reading Ben Cohen on this topic – it ties in the idea of streaks in sports with coin tossing and probability.

Appraiser

at 11:16 am

Interesting market we are experiencing. Both the supply curve and the demand curve have shifted in the same direction and in unison. Very unlike 2017 when listings surged.

The market is smaller in terms of transactionsto be sure, but not much different than pre-Covid in the way of heat and direction.

P.S. to all the bears who think “deferral cliff” is a thing. Sorry just jargon.

Not ‘gonna happen. Banks DO NOT want to own your house.

Chris

at 11:40 am

So CMHC is just a bear who wrongly believes there’s a deferral cliff coming. Sure.

“It’s not theoretically impossible but its technically wildly difficult

Every mortgage lender has a counterparty of some type who expects the deferred interest to be paid NOW

Lenders are sending Millions a week to bondholders

So it just cannot go on indefinitely”

– Ron Butler on mortgage deferrals extensions

https://twitter.com/ronmortgageguy/status/1267857541037514765

Crofty

at 4:34 pm

Okay, so mortgage deferrals “just cannot go on indefinitely” (as per Ron Butler). Agreed. But who’s saying they can or will go on “indefinitely”? Not Appraiser, although many here “hear/read” him saying so. He may believe they can (although I doubt it) but he’s not saying that. Unfortunately, many respected analysts like Butler (but certainly not only him) too often casually toss around alarmist words along the lines of “indefinitely” or “forever” or “cratered” or “skyrocketed” or “plunged.” I guess all I’m really saying is, let’s all take the hyperbole with a large grain of salt,

Chris

at 6:17 pm

How long do you think the banks will acquiesce to widespread mortgage deferrals beyond the current six months? Keeping in mind ~15% of their total mortgages are currently being deferred.

condodweller

at 11:48 pm

They don’t have to go on indefinitely. They only have to go until the pandemic lasts and we get back to “normal”. I agree with the hyperbole, they are right, it can’t go on indefinitely. It doesn’t need to. Also, what exactly is referred to by the “deferral cliff”? That people won’t be able to pay their mortgage once the deferral is over? I’m sure most in that situation will not wait until the bank forecloses and list their homes for sale. The actual cliff for me will be if demand won’t be able to take up the slack and that’s when we might see price declines. If it comes to that.

Chris

at 12:13 am

When does the pandemic end? So far, Ontario hasn’t done a very good job of controlling our case numbers. Most experts believe there will be a second wave. And even once the public health issues dissipate, it will take years for the economy to get back to normal. Just the other day, Ben Tal of CIBC was talking about the recovery extending into 2022. Do mortgages get deferred for two more years?

The term “deferral cliff” was coined by Evan Siddall of CMHC, referring to this Fall, when the six months of deferral are over, yet many who had been deferring their mortgages are still out of work.

condodweller

at 12:27 am

If the 15% of mortgage holders making use of the deferral is to be believed that and we divide it out by the six banks plus credit unions etc. it seems like a relatively small amount which might be possible for the banks to carry for a while longer than the initial six months. If we assume this number will lower given people have gone back to work with the recent reopening, I don’t think it would be out of the realm of possibility for the banks to survive deferrals for a couple of years.

Jimbo

at 8:22 am

If I can’t pay my $2,500 mortgage, I probably can’t pay $2,500 in rent so once you lost where do you go?

I think there will be flexibility given by the banks to extend the deferral of their LTV is low enough.

Appraiser

at 11:19 am

Say what?

Sold-over-asking surging back to “normal” for both condos and freeholds already?

https://twitter.com/areacode416

As per ~Scott Ingram CPA, CA

Chris

at 11:41 am

Hmmmmmmm I wonder if this has anything to do with those new pricing strategies that David was talking about Last week? Either that or any Covid-19 impact is behind us, as you suggested the other day.

Chris

at 1:49 pm

“DEVELOPING STORY: According to sources: @CMHC_ca will announce lower debt ratio limits and higher credit score minimums for its insured mortgages, and ban borrowed down payments. If our sources are correct, this news could drop soon. The Spy will give you the scoop once it does.”

– Rate Spy

https://twitter.com/RateSpy/status/1268573330652696576

Chris

at 1:52 pm

“CMHC confirms “…We’re making an announcement this afternoon…””

– Rate Spy

https://twitter.com/ratespy/status/1268592486659784705

Appraiser

at 5:35 pm

Total nothing burger. No minimum 10% down payments will be required!

1) Limiting the Gross/Total Debt Servicing (GDS/TDS) ratios to our standard requirements of 35/42;

2) Establish minimum credit score of 680 for at least one borrower; and

3) Non-traditional sources of down payment that increase indebtedness will no longer be treated as equity for insurance purposes.

https://www.cmhc-schl.gc.ca/en/media-newsroom/news-releases/2020/cmhc-reviews-underwriting-criteria

Chris

at 6:08 pm

“There is no change to down payment rules. There was fear of down payments rising to 10% minimum a few weeks ago after CMHC’s CEO expressed opinions on it. But that could have all-out nuked the market. Today’s announcement is just a big cannonball…unless these changes are more widely adopted at some point.”

– Rate Spy

“ WHEN (not IF) CMHC changes the ratios, we’re going to go from 39/44 to 35/42 OR 32/40. How does that affect qualifying? Big time. Right now, 5% down buyer can borrow up to about 4.8x income. 35/42 is 4.2x. And 32/40 is 3.8x. In 416, that’s basically going from maybe to not buying”

– Mortgage Jake

Looks like two people in a better position to judge don’t share your nothingburger assessment.

Chris

at 7:30 pm

“This effectively lowers a borrowers qualifying amount by about 11% for insured mortgages.”

– Steve Saretsky

Total nothingburger indeed.

Bal

at 8:09 pm

so in simple English…this will have some impact on the house prices? prices might decline?

Chris

at 8:19 pm

In simple English, this is going to reduce how much people can borrow when they require an insured mortgage. It’ll also make some people ineligible to borrow if their credit scores are too poor. And it means no more using a HELOC as down payment.

I’ll defer to experts like Rob McLister, Jake Abramowicz and Rob Butler to asses the potential impact, but seems entry level homes and condos would be most impacted. Exactly the hottest sectors of the market, per Scott Ingrams MOI charts the other day.

condodweller

at 12:00 am

Recall that reduced qualifying amount was widely blamed for the slowdown in 2017. These rules similarly reduce the qualifying amount therefore it should stand to reason it would have a similar impact on prices.

The no borrowed down payment rule by definition only affect investors since if you have a HELOC to borrow from, you also have a home. Hence the “H” in Heloc.

Somebody definitely wants to put a lid on prices.

Borrowing restrictions, possible deferral cliff, airbnb investor squeeze, it looks like the clouds are gathering on the horizon.

The reduced earnings multiplier limit should not be underestimated.

Chris

at 12:08 am

Condo, you’re correct that if you’re taking out a HELOC for your own down payment, it’s almost certainly an investor home and therefore not covered by CMHC. But presumably this would apply to the Bank of Mom and Dad, so lending to Jr., so they can buy a condo. Unless that loan becomes a gift, seems that CMHC will no longer consider it equity for insurance purposes.

Probably not the biggest issue, as likely some creative ways around it, but the debt service ratio changes are more impactful.

J G

at 3:28 pm

Yep, more pressure on downtown condos. I’m more bullish on 905 towns and semis. First time family buyers who don’t qualify will likely be renting there, esp. lower cost burbs like Ajax, Oshawa, Brampton, etc.

Crofty

at 4:36 pm

They’d better be hoping to be offered WFH by their employer if they’ve got their eyes on Ajax, etc….

J G

at 8:54 pm

Or maybe because they don’t want to pay for a 1M house in Markham, so they go for the exact same house in Ajax for 750-800k? Commute time almost same.

Bal

at 9:08 pm

Thank you Chris….

Chris

at 9:31 pm

No problem Bal. Like I said, mine is just one take. Appraiser thinks it won’t change anything.

I’m curious to see what people with more expertise than either him or I have to say about it.

jeanmarc

at 9:50 pm

CMHC expects prices to fall. They obviously have the stats on the mortgages they insure to make these predictions.

Evan Siddall who steps down later this year states:

“The move would “protect home buyers, reduce government and taxpayer risk and support the stability of housing markets while curtailing excessive demand and unsustainable house price growth.”

Until the mortgage deferrals and CERB ends later this year, no one really knows what the impact will be.

condodweller

at 12:04 am

As I mentioned above, the effect of reduction in qualifying amounts should be predictable based on what happened in 2017. With the powers be intent on putting a lid on prices/borrowing it will be tough to see price increases in the near future.

jeanmarc

at 7:38 am

Add property tax/water/garbage (whatever else) deferral that was implemented by Tory and other GTA municipalities.

Chris

at 8:49 am

The 15% figure is for chartered banks. Some have reported up to 20% of their mortgages in deferral. Don’t know what the figures are for other lenders.

Nobody doubts this number will be lower in the Fall, as businesses re-open and people get back to work. But if we’re expecting a recovery to take 2+ years, how long do we expect banks to willing to defer mortgage payments for those people who don’t get back to work? Jimbo, why do you think the bank would care if you can’t afford rent in your neighborhood?

At the end of the day, the banks are not simply altruistic sources of credit. They are a business, with bondholders to repay, shareholders to pay dividends to, and other counter-parties and obligations to satisfy.

Maybe they will continue to defer mortgages beyond six months? But given that both Ron Butler and Evan Siddall, two people in much better positions than any of us to assess, think a deferral cliff is coming, well I’m apt to believe them.

Chris

at 8:50 am

Sorry, Condo and Jimbo this was meant in response to your posts above.

jeanmarc

at 1:11 pm

Almost every day Trudeau is announcing free money. Yesterday was seniors. Today is disabled.

https://www.ctvnews.ca/health/coronavirus/canadians-with-disabilities-to-receive-one-time-payment-of-up-to-600-pm-1.4970813

He will bankrupt the country at this rate with debt.

Ilona

at 6:30 pm

You have obviously never lived on a fixed income. These people are disabled and elderly and cannot make huge cuts to their lifestyles. The seniors I know are very careful with their money, and you begrudge them a one-time payment that might go some way toward the higher costs they incurred during this period. I’ve spent more for sure. And don’t know about you, but lining up for groceries for two hours early in the pandemic wasn’t fun and I have absolutely eaten more takeout than I normally would have. Seniors are just like you and me, except they can’t take a side gig to earn extra money, those days are long gone. And the disabled. I will just say what’s obvious to most people: their lives aren’t easy. This period has been hard for everyone. No one escaped the inconveniences and extra costs of the COVID era. I don’t begrudge them a one-time payment either. And yeah, it sucks that the country has a staggering debt to deal with – like the rest of the world. But seniors and the disabled are the first people who should get help in times like these. An honestly, the seniors payment is a sad way to acknowledge a generation who is so often forgotten by leaders and society at large. The travesty of the LTC homes and the fact that 80% of COVID deaths were seniors in care made it crystal clear that we do not respect our elders.

jeanmarc

at 9:31 pm

I am not finger pointing at particular group. I respect the young and old. My point is that he is doling out money in a reactive way without any accountability. There will be fraud cases with CERB, CESB, etc. when they try to claw back. For example, CERB cheques being sent to the jail inmates and even to a 15 year old. Foreign students applying and then disappearing from the country, etc. Gov’t have never set out a proper plan for a possible basic income to tackle situations like this. Their patch work will increase the national debt to unheard of numbers. Our kids and their kids will be paying for this decades to come. In the case of seniors, it’s one of the three musketeer governments that is voted in by the voters who provide these

licenses to LTC homes. They failed by not implementing proper policies and procedures from the beginning. Now Ford is finger pointing to previous governments. Taxpayers will always be on the hook for the government’s stupidity. Lovely.