Here’s the scene on Friday morning: I’m sitting in my office just after 9:00am, drinking my extra-large coffee, listening to Alice In Chains and Faith No More in what can only be described as a deliberate flashback to a simpler life in 1992, reading through the morning’s comments on TRB, and suddenly the phone rings.

9:09am? Who calls at this time?

It’s a client of mine, and he’s being a bit aloof. He’s sounding somewhat hesitant.

We shoot the you-know-what for a bit, COVID-this, COVID-that.

And then he tells me, “I was really hoping to have received more listings from you this month. You know, I mean, I really do want to get into this market.”

His tone made me feel like he was trying to convince me of his sincerity to purchase. There was something off about the call, and trust me – I’m in a people business, I have a sixth sense for these things.

So I simply said, “John (not his name), what’s up? What’s on your mind?”

And then it came out: he felt that with listings having “skyrocketed,” I would have found the time to send him some options.

Three thoughts crossed my mind:

1) I have nothing but time. I’d be lying if I said that I’m working at the same capacity as I was in May 2019.

2) I don’t email a daily blitz of listings like most agents, and expect the client to go through them. I only send a listing when it’s perfect, or next to it.

3) Listings haven’t “skyrocketed.”

I glossed over points one and two with him, and then asked, “What gave you the impression that listings have skyrocketed?”

“It’s all I’m hearing,” he said.

“AirBnB units are flooding the market; that’s what the guys at work are saying…”

Once I heard “the guys at work,” I didn’t need to hear anymore. Office-talk in real estate has probably never been hotter.

Remember the water cooler? Not the proverbial one, but the actual water cooler? Younger folk know this merely as a metaphor, but once upon a time, people did congregate around an actual cooler of water, with environmentally-unfriendly paper cups, and this is where we’d chat. I had a water cooler when I was an intern at Celestica in the summer of 2001 and I spent a lot of time there. Same with the fax machine, which was a great place to meet people from other departments. I was in procurement but I dated the girl in sourcing for a couple of months. She was ten years older than me and turned me into a man. Wait, why am I writing this…

Where do people congregate in the office in 2020? Seriously, I’m asking.

Do you have an inter-office chat? Has ICQ made a comeback?

I never much enjoyed the small-talk made at the urinal, and I always found that eye-contact to be slightly awkward, but that’s another favourite place for banter.

Real estate has been one of the most-discussed topics in the past decade, and I’ve mentioned this many times on TRB before. Whether it’s the guy in your office that commutes every day from Port Hope, and constantly brags about how much you’re missing out, or the lady who is still renting because the market is going to crash, or your boss who tells you about every single house he’s seeing with his wife, every single weekend, going on two years – there’s no shortage of real estate talk in your office.

But not all of it is accurate.

In fact, those of you who read TRB regularly, and dip into the comments, are likely in the 99th percentile of real estate knowledge among those who are not in the field. And having said that, many of you do know more than some agents, appraisers, mortgage brokers, et al.

After my client finished his rant about the inter-office real estate gossip, I simply said, “Listings have not skyrocketed. They’ve plummeted.”

But he didn’t believe me! Such a simple concept, and something that was so easily found online, was a notion he refused to believe simply because of the conjecture at his office.

So while on the phone with him, I sent him the link to TREB Market Watch, and showed him that April “New Listings” were down 64.1%, year-over-year.

“But that’s April,” he told me. “The guys at work are saying listings have spiked this month, and that’s sorta why I was wondering if you’d like forgotten about me, or what. I should be getting like ten listings a week from you, right?”

What my client is looking for is unique, and we’d be lucky to get two options per month, but that’s a story for another day.

“And I heard that the drop in listings is in houses, but condos are through the roof.”

So I sent my client a Zoom link, and we did a call. Not because this is en vogue, or because I was dying for him to see me in a t-shirt, with my dog sitting on the desk behind me, but because I wanted to screen-share with him. I went into MLS and did a search for each week of May, 2020 vs. 2019, and showed him the drop in listings.

Then, and only then, did he take me at my word.

There’s a lot of misinformation out there about inventory levels, and while most of the media has it right – that listings have dropped, I’ve heard people say this week that “post Victoria-Day listings blew up, as well as “AirbnB owners are listing like crazy,” and “the overall stats don’t tell the whole story.”

Sounds like hearsay and gossip to me, but one I was on MLS, walking my client through these stats, I was hooked.

I came back to this on Sunday night, since we’re now through the fourth week in the month of May, and decided to run comparisons to the same period in May of 2019, in a host of different areas and property types, just to see exactly, without the shadow of a doubt, what’s happened to inventory.

The first four weeks in May of 2019 were as follows:

Week 1: May 6 to May 12

Week 2: May 13 to May 19

Week 3: May 20 to May 26

Week 4: May 27 to June 2

I want my stats to be exact, which is why I’m not comparing day-by-day or anything like that, which might end up comparing a Tuesday to a Friday, or even a Sunday when fewer properties are listed.

I can see no better indication of inventory than this, and I’m looking at all properties listed on each of those days, in that given week.

May of 2020:

Week 1: May 4 to May 10

Week 2: May 11 to May 17

Week 3: May 18 to May 24

Week 5: May 25 to May 31

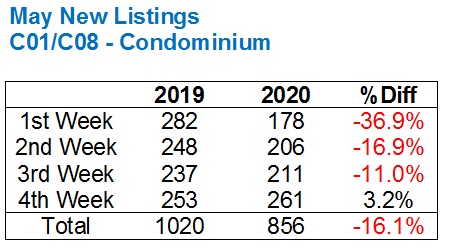

First and foremost, let’s look at downtown condos, specifically C01 and C08:

As you can see, there’s some volatility in the week-to-week numbers, ie. the first week saw a 36.9% drop, but we’re seeing much smaller drops thereafter, and listings in the fourth week of May actually increased from 2019 to 2010.

Spoiler alert: that is the last time you’ll see any percentages not in RED. Actually, wait, there’s one more. But you get the idea…

The overall drop in new listings was from 1,020 to 856 – a slight 16.1% decrease, which doesn’t sound like much, but if you’re an active condo buyer in the month of May, that’s a lot less choice!

Interestingly enough, the numbers are all downhill from here…

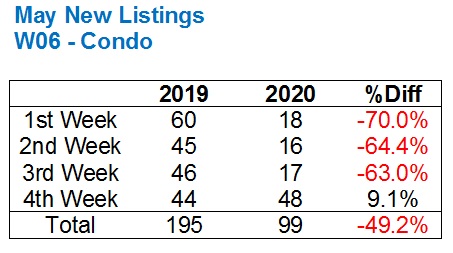

Let’s continue with condos and look at another area that’s a hotbed for activity: W06. When you drive on the Gardiner Expressway, and you remark, “My God, that’s a lot of condos,” well, that’s W06.

The decline in new listings in the downtown core was just over 16%, so what then, do we make of this?

Again, the fourth week saw a small uptick in new listings over 2020, and maybe this is the start of another trend, but who knows.

Bottom line: there were half as many new condo listings in 2020 as there were last year, and if you were an active buyer, pounding the pavement in the first three weeks of May, you saw about 65% fewer listings, which means you were barely active.

Where do you think condo listings are abundant?

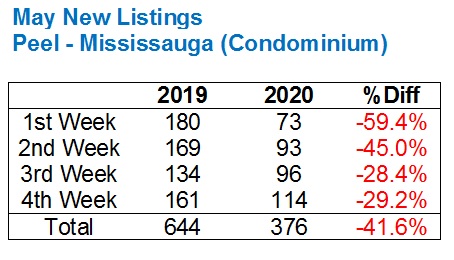

How about, say, Mississauga? Lots of investors out there, maybe some AirBnB folks who need to unload?

The data says otherwise:

The decrease in new condo listings in Mississauga is about 2.5x that of downtown Toronto.

Where are all these supposed investors who are bleeding? Not in Mississauga, it seems.

Now what about freehold?

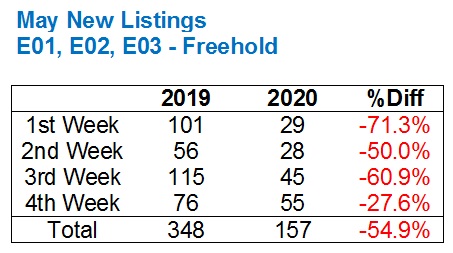

Let’s start in my go-to area on the east side:

This “feels” about right to me. I’m highly active in this area right now, and that first week of May, where listings were down 71.3%, was a barren wasteland for buyers.

The fourth week of May is still in the red, but as you can see, the figure isn’t quite as dire.

Overall, fewer than half as much choice as in 2019.

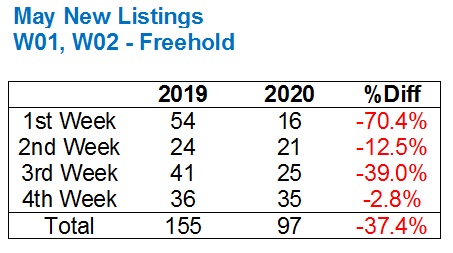

How about the west side?

Again, the fourth week of may helps 2020 to play catch up – all the way to a modest 37.4% drop. But this is why we can only take the weekly data with a grain of salt; the volatility is obvious. We go from a drop of over 70% down to a drop of 12.5%, then back up to 39%, then back down to almost a rounding error at 2.8%.

I suppose if we were only interested in the monthly data, I could have waited until the end of next week when the TREB Market Watch comes out. But I didn’t want to wait. This is the story I want to tell right now, and I do find the weekly data helpful.

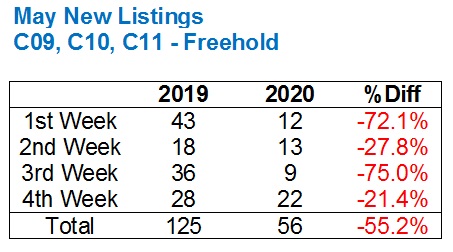

Midtown tells the same story:

I have active buyers in Leaside and in Davisville Village, and there’s nothing for us to look at. I just met buyers this week to see a house (which we didn’t like) and it was the first house we saw since March.

Fewer than half as many listings were available this month, and while I’m sure there are fewer buyers out there than last year, this isn’t an area in which people compete on every listing, like on the east side. If you’re looking for a $2.4M property to call “home” for the next twenty years, if you were used to seeing, maybe, one suitable candidate per month, based on the numbers above, you’ll now be seeing one every other month instead.

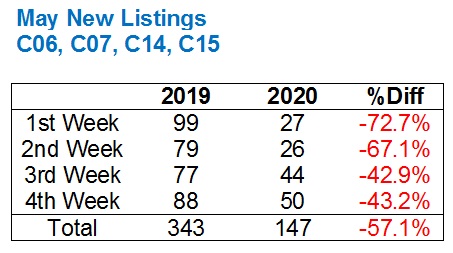

What about areas that we might not expect to fare so well?

North of the 401 lays four TREB districts: C06, C07, C14, C15. These are home to very different property types in different price ranges, but I include them together in a group because they represent the north part of the Central TREB districts, and they’re just south of Markham:

Nothing new here. This is pretty much in line with what we’re seeing above in the freehold market, so perhaps there’s no urge to sell among those in areas that, in a tougher market, typically get hit the hardest.

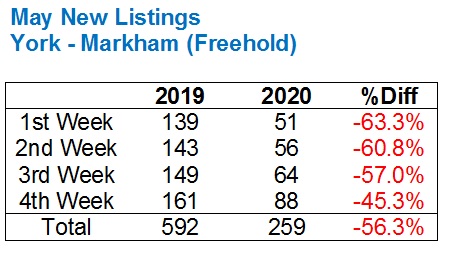

What about the aforementioned Markham?

Almost identical to C06, C07, C14, and C15.

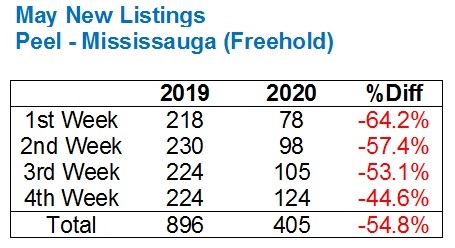

Last, but not least, we’ll look at freehold in Mississauga:

Interesting symmetry here.

The last three areas saw declines of 57.1%, 56.3%, and 54.8%.

Is there any area out there that bucks the trend in the freehold market?

I’m sure there is.

But take it back full circle: what’s happening in the downtown condo market?

Only a decline of 16.1%?

Compared to the following areas we examined above:

-57.1%, North York Freehold (C06, C07, C14, C15)

-56.3%, Markham Freehold

-55.2%, Midtown Freehold (C09, C10, C11)

-54.9%, East Side Freehold (E01, E02, E03)

-54.8%, Mississauga Freehold

-49.2%, W06 Condo

-41.6%, Mississauga Condo

-37.4%, West Side Freehold (W01, W02)

It looks to me like downtown condo listings are quite healthy right now, at least on a relative basis.

I was out on the weekend look at entry-level freeholds, east and west, and I could barely keep track of which properties had registered offers, which had already sold via bully offers, and which might stick around until next week.

I’m very interested to see if this trend continues, as it seems there are going to be some red-hot pockets in the market moving forward, and that’s 100% driven by inventory, or rather, a lack thereof…

Ed

at 8:37 am

I was in procurement but I dated the girl in sourcing for a couple of months. She was ten years older than me and turned me into a man. -David

/////

I had to do a double take there, at first I thought I read “it turns out she was a man”.

Now THAT would be a story.

Natrx

at 10:02 am

While not as excessive, offices have those water taps that people fill their jugs or big cups. Remember, it’s all about full-day hydration. So yes, people still congregate. It’s also usually by the coffee machine so that also generates a crowd. But with easy “hey, let’s go get a coffee” IM around, it’s not the same as before.

2nd, I don’t know many who’s still in the actual office. Certain call centers may be.

I agree that certain hot spots will be in demand, but as of now, the lack of schooling, lack of need of transportation, lack of restaurant/local happening buzz will curtail the traditional “we need to get in this area now” FOMO.

Julia

at 10:28 am

Curious as to where C04 is at YOY for May… noticed it wasnt included in your summary above. From what I am seeing the listings around here are pretty sparse…

Appraiser

at 11:19 am

Once again, excellent number-crunching there David. Hard to see anything but continued upward price pressure with a puny inventory and with what appears to be a boat load of pent-up demand.

Where is this mythical flood of listings – the panicked sellers – the endless supply of Airbnb’s ?

Remember FOMO is not just a acronym. It’s real.

Bal

at 11:49 am

and the winner is Appraiser…you have a very valid point…I see wicked smile on your face

condodweller

at 12:20 pm

Remember that he who laughs last laughs best. FOMO is real but it took an exit stage left in March and as far as I can tell hasn’t returned yet. That’s probably because there hasn’t been a big drop. Since David hasn’t mentioned prices I assume we have no rampant price increases as one might expect due to these low numbers.

Natrx

at 1:43 pm

So taking it to the extreme, if only 1 seller came to market in Toronto and sold their house for $5 million, does that mean the average price in Toronto for that month is $5 million? The hottest real estate month in history?

Geoff

at 2:17 pm

How is that a question? Of course it would be the average price for that month, that’s how math works.

Jimbo

at 3:54 pm

but would it be the median as well? is that how math works?

Natrx

at 4:36 pm

Geoff: Think about the meaning of that ‘average’. Would you say that would make it the best housing market in the history of Toronto and Canada? As in that one transaction would make everybody on average, “approx 5 multi-millionaires” as that is now the average price of a homeowner’s home?

Nathan

at 7:38 pm

I think the reason why people are perceiving a “flood” of new properties is because while there hasn’t been a jump in listings YoY, there has been a significant increase WoW. People’s short memories don’t remember how many properties are typically on the market this time of year, only how many are on compared to recent weeks. As far as whether or not this is being driven by investors offloading their properties, the areas with the greatest increase may seem to suggest that. I don’t think this will have much impact on the market though, as everyone who doesn’t need to sell seems to be holding back.

Geof

at 11:02 pm

That simply put wasn’t the question asked. If your asking how stats can be interpreted there’s lies damn lies and statistics.

Appraiser

at 11:33 am

Week over week data from Scott Ingram: Could the market be gaining momentum?

“The +28% for the week is largest gain in last 3 months.” https://twitter.com/areacode416/status/1267466267218378752

Bal

at 11:49 am

Appraiser is dancing with joy…….

J G

at 12:59 pm

Wow, congratulations. After -40% and -36% drops in March and April.

Chris

at 1:00 pm

+28% week over week, when comparing against the Victoria Day Long Weekend week.

-52% compared against the same week last year.

Michael

at 11:57 am

Great look into the numbers here, David. This is most appreciated. However, without the corresponding sales data, it’s really only telling half the story. That’s just my two cents.

Chris

at 1:04 pm

Fully agreed. This is a granular assessment of supply without any insights on demand.

condodweller

at 12:14 pm

This is the reason I want to verify everything myself that may be important to me. You simply can’t rely on what people tell you. What’s scary is that this often includes “experts” in the field.

I mean there’s been speculation that airbnb hosts may be forced to sell, and this may still happen after the mortgage deferral period, but as these numbers show it hasn’t happened yet and may not happen at all.

I’m curious how this is going to affect prices.

Libertarian

at 12:26 pm

David, this doesn’t apply to you directly because you’re an outlier in the industry, but your industry thrives on the misinformation! All the talk of FOMO and real estate only goes up and so many foreign buyers and renting is stupid, etc., etc.

I honestly believe that if every person was financially literate, there would be way less demand for real estate, and by extension, way fewer real estate transactions. Your industry needs transactions to survive, so that’s what they tell people to do it.

J G

at 1:07 pm

Yes, thank you. I honestly think the large demand for RE is because most people are retarded (no offence).

However, that’s the world we live in. The mass retardation is the result of marketing $ invested by RE industry and government policies. That’s why I have to have some balance in physical RE, definitely not because I enjoy being a landlord.

J G

at 1:29 pm

Btw, the realtor I work with personally is quite good, very fact based like David. But definitely the same cannot be said about many others.

Chris

at 1:01 pm

LGJP Weekly Update:

– Sales -40% compared to last year

– New listings -36% compared to last year

– MOI gradually decreasing, down to 2.5

https://twitter.com/JohnPasalis/status/1267491818415013890

Appraiser

at 1:31 pm

Yup! Here’s a direct twitter quote from LG himself:

“I don’t know too many people who were predicting that Toronto’s real estate market would be heating up so quickly, but here we are. Inventory continues to tighten as buyers rush back into the market faster than sellers.”

condodweller

at 1:45 pm

Tell that to this expert RE agent/investor:

https://www.cbc.ca/news/business/mortgage-penalty-pandemic-1.5588741

Chris

at 1:54 pm

Not sure the numbers quite bear that out.

From HouseSigma’s GTA Market Trends, May 2020 compared to May 2019:

Sales down 58%

New Listings down 53%

Active Listings down 41%

Average Price up 5%

Seems like sellers/listings are back to a greater degree than buyers? But hey, average price is up, so there’s that.

Kyle

at 1:57 pm

Excellent number crunching David. In the neighbourhoods that i watch, it also appears that much of the New Listings, aren’t “New” at all. They tend to be unrealistic Sellers who just keep relisting over and over again. Many were listed/relisted before the lock down even started. If we take this dummy inventory out, the actual inventory is really, really thin.

Professional Shanker

at 6:41 pm

David/Die Hard contributors

Would be interesting to get your opinion/perspective on how remote working will change the relative value of real estate in Toronto, if at all?

If office work changes to full/partial remote, why would people pay top $ for Toronto proper real estate? It could change the dynamic of land/dwelling value, with the land price part of the equation declining in relative value with that of dwelling value.

Any type of increased remote working scenario puts condos/semis/towns under price pressure, in my opinion.

Suburbs becomes an interesting question, under a partial work from home scenario this would be bullish while under a full work from home scenario it would be terrible as net migration would transpire over time.

This potential change would challenge everyone’s preconceived notions of RE in large urban centers, is this an inflection point or much to do about nothing?

Jimbo

at 7:59 pm

I’m not convinced that companies stick with work from home. Human nature will dictate that many will take advantage of the freedom and lose productivity. Examples I can think of are more time doing household chores as a break, some getting rid of childcare for savings, gaming for the under 35 crowd. Wouldn’t be widespread but there would be a noticeable difference overall. The counter argument would be better rested employees increasing productivity.

That being said, there is more to living in the city than driving to work. More events, better venues that are walkable to meet up with friends etc. This could change over time, if more people left for the suburbs you could see more businesses open up in neighborhood as families get rid of extra vehicles and rely on walking more.

Professional Shanker

at 10:00 pm

I tend to agree with you – I don’t believe the trust factor is there yet, perhaps we are underestimating it.

Maha

at 9:36 pm

I started a new job in February, and got a whole 4 weeks in the office before the place closed down to WFH until (minimum) September. I have to say that while it may seem sustainable for existing employees, it would have been near impossible to learn the deliverables and all the workplace nuances while working remotely and never meeting my colleagues face to face. I still feel at a huge disadvantage actually. And I’m well-established in my field, can’t imagine what it would be like if I were a true rookie. Or for HR or any manager trying to orient a new employee entirely via Zoom or Teams. So yeah, I think office life will come back, although maybe with more flex vs. core days. Personally I’d be most happy with a 50/50 split between office and home. Which honestly, isn’t enough for me personally to move out of the city for a bigger house and more square footage in the burbs/exurbs/hinterlands. So, while admittedly based on a sample of one, I don’t believe that the desirability of urban RE will be upended in a significant or longterm way due to remote work.

Kyle

at 10:42 pm

I agree with most of the points already mentioned, but additionally those with kids in a local school will have a lot of reason to stay put. Generally the top schools are within the GTA, so leaving for better RE value, will likely involve putting your kids in a lower ranked school. Also the kids will be returning to classrooms at some point, so you might save a commute to the office, but you still have drop off and pick ups until your kids are old enough to go on their own.

Also the “new normal” is still evolving, i suspect most companies will settle on some portion of the week being WFH, but not 100%. What i can see happening if people have more flexibility is that they’ll want to add an out of town property, like a cottage, country property or ski chalet, so that they can have the best of both worlds.

Professional Shanker

at 10:02 pm

I had the same thought initially, WFH could pressurize the price of seasonal properties

J G

at 12:43 am

Even 50/50 WFH will convince significant number of people to move to the burbs. How far will depend on that person’s financial situation and personal preferences.

Some people (likely wealthy) will stay in city, some will go to Sauga, and still some Hamilton.

J G

at 12:55 am

It’s like 10 years ago most people didn’t embrace online shopping, many thought Amazon was a bubble stock. Well, here we are.

Videoconferencing, cameras, laptops, collaboration tools (zoom, slack, etc.) will all be much better 10 years from now.

I’m not saying Toronto RE will crash, but to say this pandemic doesn’t have long term impact (coupled with technological advancement), I think is foolish.

Not Harold

at 11:55 am

Toronto is an outlier in terms of its urban form compared to similar cities in North America.

It never burned in the 60s and it has lots of high end housing very close to downtown.

There’s been a 30+ year trend of renovating 50s and 60s houses on large lots into much larger and fancier houses, be it in Hoggs Hollow, Lawrence Park, Don Valley, Islington, Mimico…

Much of the professional set already works remotely much of the time thanks to conferences, working at client’s site, and visiting remote offices. They were already able to work from home when they wanted to. There’s a reason why Muskoka ALWAYS gets the first rollout of new mobile data first and why highspeed internet to the cottage has been a thing for 15 years.

For young people the access to nightlife and other young people is the big draw. Its cratered in the short term but WFH doesn’t reduce its attraction, especially for people that can work from Starbucks. Again this was already a huge component of downtown condo population so not having an office doesn’t really change things. Living in Mississauga when you’re 25 and single doesn’t get more attractive with a WFH policy.

The gap is in the demand for family condos, semis, and lower end singles. They’re INCREDIBLY expensive in Toronto, even in crappy school districts that aren’t that convenient to downtown. Givens Shaw ain’t Blythwood, John Ross Robertson, or Whitney and the commute downtown is horrific by foot, car, or streetcar.

Married with kids and coming in a coupe days a week (or month) from Oakville gets a hell of a lot more attractive than Bellwoods, Leslieville, or Leaside. The big loss is that you don’t have access to private schools – Appleby or Country Day as the only option without boarding is not ideal, especially if you’re thinking of French language instruction or want a Catholic private school.

The other big thing is that you lose the networking and spontaneous events that being closer to downtown allows. This is of course gone at the moment but will come back in the next 3-9 months. It’s huge in terms of career progression and staying successful at the high end. This doesn’t go away and is one of the big reasons why WFH has always been a career limiter.

Overall there’s some overall loss in demand but I think WFH longterm is limited to back office functions that are ripe for automation anyways. Technology development and critical revenue producing aspects of businesses stay downtown and in office thanks to improved productivity and attractiveness for staff.

J G

at 1:48 pm

All fair points. Will there be 25 year-olds young professional renting downtown condo? Absolutely.

But how much rent are they willing to pay when they can WFH 50% or only 20% of time? Let’s say he makes 65k per year and parents live in Oakville.

J G

at 2:05 pm

Career progression argument is valid, but it depends on the position. If the kid is in Sales or Marketing, yes. If he’s in Tech (growing field obviously), then it matters a lot less.

Not Harold

at 7:54 am

Tech networking is HUUUGE downtown. Lots of meetups with lectures about different products and languages, lots of 1 day events, all put on by companies large and small.

Not as much random socializing – coders aren’t at Ki or Cactus – but an unbelievable amount of events every single day.

J G

at 11:52 am

Most of it is BS. I’ve been a coder for 10 years, I know.

jeanmarc

at 8:44 pm

Demand areas such as Leslieville, Leaside, Riverdale, Beaches, etc. will continue to be hot regardless of the “new normal”. Bikes are selling like hot cakes and there is a shortage. People are starting to think biking to get to work as opposed to using public transit. City just approved more bike lanes. This is not an option if you live in the burbs. Also, certain “hot pockets” in midtown have lower crime/safer and car insurance rates are lower. Car insurance rates are generally way higher (car dependent) in the 905 (i.e. Brampton one of the highest in the country) and gunslingers on HWY410.

Professional Shanker

at 9:59 pm

In a WFH scenario biking to work is moot. For the few times you venture to a shared work spot whether you bike, take public transit, drive becomes less of a priority. Suburbs would be able to transform themselves into miny urban centers over time and a portion of Toronto’s population (over 30 crowd) would realize the potential financial benefits from relocating.

jeanmarc

at 10:15 pm

WFH was forced upon during the lockdown. A lot of companies still have the “old school” mentality that being at home is not seen as productive. Ask the same question in the next 6-12 months or when things start to go back given time.

Professional Shanker

at 10:58 pm

I share the same perspective as you, I don’t believe WFH is here to stay when the pandemic fizzles out (at least I hope it does), but if it is – Toronto and other big urban centers (SF, NY, LA) will feel pain.

Kramer

at 12:40 am

Happy to hear most of these responses are in line with my thinking. Occasional WFH can be a great way to add some efficiency and flexibility to employees’ lives. It can help productivity when done well. But having a central offices provides culture and a greater sense of job satisfaction. (I’m speaking in generalities of course).

Furthermore, for many jobs and businesses, a central office is required… for infrastructure and roles that can’t be done remotely. There simply hasn’t been a big and economy wide step yet toward having “an infrastructure location” and then employees scattered in their homes everywhere. Some small and unique businesses yes, but not broadly whatsoever. The only real step that has been taken so far is toward a more “hoteling” model to save on space, accounting for the fact that some roles (sales people for example) do not need a desk on site assigned to them 5 full days a week. What i’m saying is that this pandemic WFH was forced and we’re dealing with it. Restructuring things to make this the new reality is completely different in execution, cost/benefit… and I don’t think it will ever happen.

Appraiser

at 12:19 pm

“Why housing is still the best investment for most Canadians”

“…The intrinsic value of a home comes in part from the fact that it is the only investment you can actually live in. It’s an asset you can rest your head in it at the end of the day no matter what value the market places on it. In addition to the potential for it to go up in value over time, a home pays a sort of dividend equal to the cost of rent if you didn’t own a home. A home can also generate income by renting out all or part of it…”

https://www.bnnbloomberg.ca/why-housing-is-still-the-best-investment-for-most-canadians-1.1442476

J G

at 1:55 pm

Same old argument, here’s a counter –

https://m.huffingtonpost.ca/entry/condo-investors-losing-money_ca_5db46899e4b006d4916f8837

condodweller

at 3:21 pm

Quoted from the article you linked:

“About 18 per cent are breaking even, while 33 per cent said they are losing money on their investments. Presumably, they are counting on rising house prices to turn a profit; the Veritas survey showed 84 per cent of investors don’t plan on selling for now.”

If an investor is planning long term it’s possible to “lose money” but still be profitable in the end. The question is how much you can make once the property is paid off. Having paid off the mortgage should turn a money losing investment into a money making venture. The key issue is what the definition of losing money is. There is a difference between cash flow negative and losing money.

Appraiser

at 2:46 pm

More corroborative data from Scott Ingram. Inventory levels falling for both condos & freehold.

“If all of this new inventory was not selling we’d see a rise in MOI, which would mean the market is getting softer (and you might see price drops coming). However, these new listings have had no problem selling and the MOI is trending downwards meaning a tightening market.” https://twitter.com/areacode416

Appraiser

at 5:53 pm

We now have John Pasalis’s May 2020 TRREB MLS update, with evidence of what appears to be the end of a very short-lived “correction.”

“The average sale price for homes sold in the Greater Toronto Area in May 2020 was $868,905, up 3.3% over the same month last year.”

https://www.realosophy.com/greater-toronto-area/neighbourhood-market-trends

Chris

at 6:16 pm

Do you mind sharing the quote where John Pasalis declares the end of any Covid related correction? Because as far as I recall, him, Steve Saretsky, Evan Siddall, etc., have all pretty clearly stated it is going to take at least until the Fall (a.k.a. the “deferral cliff” as CMHC put it) to see the full impact of what is arguably the largest economic crises of our lifetimes. Or are they just reciting the same old bear mantra?

Meanwhile:

“Rent for condos in Central Toronto were down 8% over last year in May.”

– LGJP

https://twitter.com/JohnPasalis/status/1267907322036224000

Thomas

at 7:15 pm

The market is definitely tightening. The prices aren’t going crazy like February but they are definitely increasing. But that still doesn’t mean that RE is ‘good investment’

Chris

at 7:24 pm

Scott Ingram has some interesting analysis showing different levels of MOI by price range. Long story short, the lower the price the lower the MOI.

https://twitter.com/areacode416/status/1267852031655542792

Thomas

at 8:35 pm

Yes, I did see that and the MOI has reduced across all segments compared to last month. And it is kind of crazy to think that 1.25M is a low price. I simply don’t understand how this can be sustainable. Then again, it is still too early to draw conclusions

jeanmarc

at 8:56 pm

It’s called the loan ranger (i.e. bank) and low low interest rates at the moment. Ask how many homeowners who have very large mortgages with as low as 5% down. Having a $1.2M home with $1M mortgage even though you can make the payments is not a sound decision. What happens if BofC raise rates when the economy picks up. BofC cannot leave rates at 0.25% forever.

Professional Shanker

at 9:43 pm

I made the mistake thinking that rates would rise materially from 2009 and here we are right back to where we started…….11 years ago. There is a better chance we drop from here than increase.

jeanmarc

at 10:03 pm

Even if BofC drops to 0% or negative, chances of banks passing that to consumers will be slim. Negative would mean we would need to pay them. And banks are no longer offering prime minus variable rates. Those days are over for now.

Professional Shanker

at 1:48 pm

From what I understand prime minus discounts have already crept back into the market.

Appraiser will love to hear this but housing markets look tame compared to the valuations on the S&P these days…..

Chris

at 9:07 pm

Definitely agree with your last point.

It’s pretty absurd that some people think any correction is in the rear view mirror when over 8M Canadians (~45% of our entire labour force) are on CERB, and the Skydome is about to become a food bank:

https://www.cbc.ca/sports/baseball/mlb/rogers-centre-to-be-used-as-temporary-facility-to-help-food-banks-canada-1.5593100

jeanmarc

at 9:18 pm

And Canada’s debt load is not properly conveyed to Canadians. Liberals (friends, I need your vote) continue to announce free money almost every other day.

https://business.financialpost.com/opinion/jack-m-mintz-canadas-debt-load-is-even-worse-than-you-think

Thomas

at 9:12 pm

Besides, one thing Inhave noticed is that while the ‘entry level’ markets like Durham are tightening up, regions like York are loosening. If the same trend continues it will start reflecting in the ‘lower’ price brackets too. This is long from over

jeanmarc

at 9:39 pm

I spoke to a work colleague this afternoon and he mentioned in his area of north Richmond Hill houses are not selling.