Do you remember a twelve-month period where we talked about interest rates any more than we have since this time last year?

I don’t.

I’ve been around for almost two decades and I’ve seen just about everything when it comes to interest rates.

I haven’t seen rates in the double-digits; but that’s about the only thing.

As exciting (or horrifying) as that proposition would be, I think the changes in every other area of the mortgage world that I’ve seen have more than made up for it.

Raise your hand if you remember the days of 107% financing? My hand is raised.

In March of 2007, a client of mine purchased a house for $1,060,000, with a $50,000 deposit. Upon closing, the bank gave him back his $50,000 deposit, then gave him a mortgage of $1,134,200, from which he drew $64,200 to put into his hedge fund.

Raise your hand if you remember buying a house over $1,000,000 with only 5% down?

Raise your hand if you remember buying an investment property, at any price, with only 5% down?

Everybody’s hand should be raised when I ask, “Do you remember life before the mortgage stress test?” I mean, that was only 2018, after all.

There have been so many changes in lending criteria over the past two decades – specifically since 2008, that talk about something as basic as interest rates almost seems boring by comparison.

Those who are, um, what’s the politically-correct term here…..“of an advanced age,” can probably answer this question from memory, but has there been a year in before 2022 where we saw seven successive interest rate hikes by the Bank of Canada?

I would bet, not.

An eighth rate hike came after the page turned to 2023, but all told, we saw the policy interest rate go from 0.25% in March of 2022 to 4.50% in January of 2023.

Again, I would ask: have we ever seen this before?

Not in many of our lifetimes, it seems.

I couldn’t leave this question unanswered, so I went searching.

In July of 1980, the Bank of Canada overnight rate was 9.93%.

By August of 1981, the Bank of Canada overnight rate was 20.78%.

However, the way that overnight rates were set back then was very different.

From the Bank of Canada website:

March 1980 to February 1996

The Bank Rate was returned to a floating rate, set at 25 basis points above the average yield on 3-month treasury bills at the federal government’s weekly auction.

February 1996 to present

Since 1996, the Bank Rate has been set by the Bank at the top of its operating band for the overnight rate. This provides a clearer indicator of monetary policy intentions, because the Bank’s influence on the overnight rate is more direct than on 3-month treasury bill rates.

In December 2000, the Bank began setting the level of the Bank Rate—and with it, the target for the overnight rate—on eight fixed dates per year.

So while we can conclude that there was a time, specifically in the 1980’s, that interest rates increased faster than what we saw in 2022, it wasn’t the Bank of Canada that was deliberately setting the rate. Not only that, the rate “only” increased five successive times in that period in 1980-1981, as the rate fluctuated up-and-down a few times therein.

All this is to say that those who want to talk about interest rates at the water cooler as though it’s the finale of The Sopranos, might be justified after all.

Much of the news this week was about the potential for another rate hike in July, which was exacerbated by the fact that the Canadian economy (gasp!) beat expectations.

Imagine that?

It’s almost like independently cleaning your room and then having your mother get mad, only to send you to your room…

Statistics Canada released data this week that noted a 3.1% annualized growth rate in GDP for the first quarter of 2023.

Great.

Right?

Except this growth rate exceeded the forecast of 2.5%.

Huh?

It’s a fine, fine line, and one that only an economist with a nurse’s bedside manner can really explain.

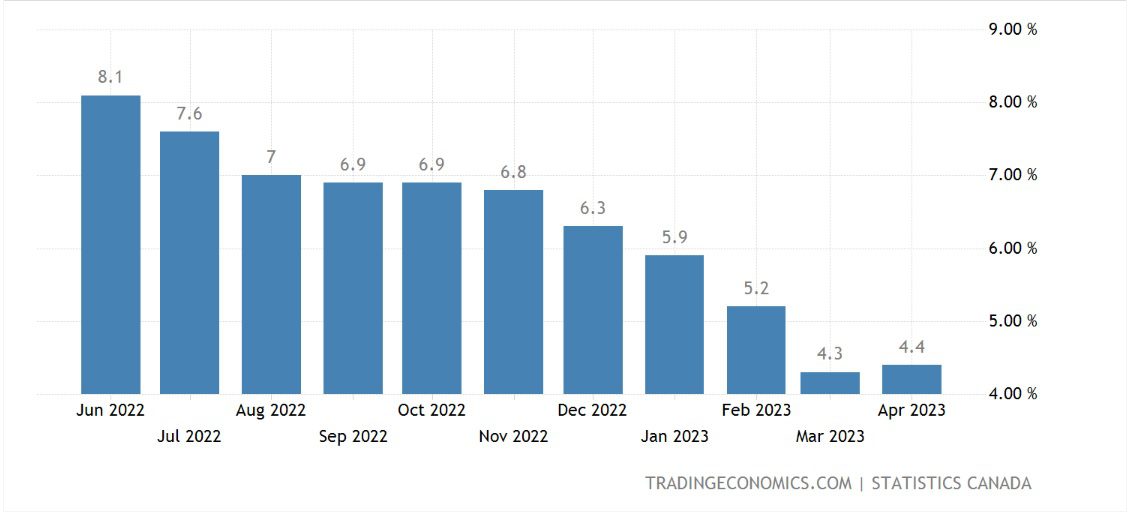

As we all know, inflation shot up in 2022 after two years of the federal government printing money. Inflation peaked at 8.1% last June and has since come back down.

Inflation dropped from 5.2% in February to 4.3% in March, which was all part of the plan.

But inflation increased, albeit modestly, from 4.3% in March to 4.4% in April, and that seemed to set off the alarm:

The problem is not so much that inflation increased by 0.1% last month.

The problem, from what I can gather, is that the economy increased 3.1% in the first quarter, compared to a 2.5% estimate, because of inflation.

Gosh, how can we explain this?

I have to go back to economics class…

In an ideal economy, the economy grows without excess inflation, which is why the target rate is always around 2%.

But how can an economy achieve huge growth without relying on consumer-driven inflation?

In short: demand has to increase at the same rate and by the same amount as supply, and both demand and supply must be organic. Moreover, supply has to increase because of increased productivity, or technology, or capacity, and not as a direct response to increased demand.

And about that increased demand – you don’t want to see it as the direct result of lower interest rates and/or higher government spending.

Unfortunately, this is exactly what’s happened in the past two years. The Canadian government has spent money like inebriated boat-people, and lower interest rates have caused consumers to buy houses, cars, watches, and God knows what else.

We’ve also seen inflation as a direct result of rising costs. Known as Cost Push Inflation, an increase in the price of materials to build a house, or food to cook a meal at a restaurant, or gas to transport goods, will all lead to higher prices. This has happened over the last two years as well.

So the problem in Canada is not that “the economy increased faster than expected in the first quarter,” but rather how it did so.

There’s still too much money being spent on “stuff and things,” so this is, as the media has been reporting, going to lead to further interest rate increases.

There were a lot of articles this past week!

“Odds Of Bank Of Canada Rate Hike Just Went Up As Economy Beats Expectations”

Financial Post

May 31st, 2023

From the article:

Economists have been putting more stock into the potential for a rate hike at some point over the next few months, with some predicting a bump as early as next week in its June 7 meeting.

Markets are now pricing in a 40 per cent chance of a hike next week, up from 28 per cent before the data, Reuters reports, and they now expect an increase of 25 basis points by September.

“It seems likely the Bank of Canada will be seriously considering raising rates next week,” said Royce Mendes, Desjardins head of macro strategy, in a May 31 note. “While they might pass on changing course just yet, the belief that the central bank will further tighten policy this summer is justifiably gaining traction.”

–

Here’s another that I bookmarked:

“First Quarter May Be Last Hurrah For GDP, But Bank Of Canada May Need More Rate Hikes Anyway”

Globe & Mail

May 31st, 2023

From the article:

While those first-quarter figures are too good for comfort, they’re also too good to last. The quarter may well be the last hurrah. We may avert the recession that everyone feared a few months ago, but there’s still every reason to think that a much cooler economy is on the way, if it isn’t here already.

Whether the Bank of Canada is prepared to wait for this slowdown to transpire is another question.

The biggest eyebrow-raiser in Wednesday’s GDP report is the stamina of the Canadian consumer, in the face of the past year’s interest-rate increases. Household consumption was up nearly 6 per cent annualized in the quarter, a strong rebound after posting little growth in the two prior quarters. The figures prompted some economists to suggest that the Bank of Canada would have to raise interest rates further to tame the consumer demand that is feeding inflation pressures.

But the first-quarter GDP data are a look into the economy’s rear-view mirror. Even Statscan’s figures for March, the final month of the quarter, suggest a waning of consumer appetites: Activity in retail, restaurants and bars declined for the second straight month. Statscan’s preliminary estimate for April pointed to further slowing in the retail sector.

The Canadian Chamber of Commerce’s new Local Spending Tracker, which captures monthly card and electronic payment transactions, found that nationally, year-over-year real (i.e. inflation-adjusted) spending per capita declined in March and April. On the same basis, spending was negative in seven of the country’s 10 largest urban centres.

–

For those of you that have seven minutes and a pair of earbuds, here’s a great video interview with Benjamin Tal:

“Bank Of Canada July Rate Hike Would Be A Mistake: Benjamin Tal”

Financial Post

May 27th, 2023

I’ve transcribed the following section from Mr. Tal where he talked about his feelings on whether or not the Bank of Canada should raise rates again:

“As far as the Bank of Canada is concerned, this labour market is too strong. I believe that the labour market on both sides of the market will start easting over hte next six months but it might be too late for the Fed or the Bank of Canada to avoid another tightening. And therefore, although our call is for the Bank of Canada to stay where it is, there is a real risk that they will start moving again in July. Quite frankly, I think that will be a mistake. I don’t think that the BOC at this point has to raise interest rates. Let’s remind ourselves that every economic recession was caused or helped by the monetary policy arrow in which central bankers raised interest rates way too much because of the fact that inflation is a lagging indicator. I believe that they’re getting closer to this kind of monetary policy than ever, unfortunately.”

Mr. Tal is merely one voice in the crowd, but he’s among the most respected and dare I say the most accurate?

Keep in mind, for those of you reading this blog because you’re interested in real estate, that the Bank of Canada and the federal government are making interest rate policy decisions on a stand-alone basis, never considering how this will impact the real estate market.

Why?

Because they don’t care.

Real estate prices are a by-product of interest rates, and if a policy-maker truly cares about the economy and is setting policy around interest rates to combat inflation and/or set the directon of the economy, then real estate prices can’t be a factor.

I bookmarked this article one year ago with the intention of coming back to it:

“How Far Do Housing Prices Need To Fall Before The Bank Of Canada Stops Raising Interest Rates?”

The Globe & Mail

June 10th, 2022

From the article:

How far will home prices have to fall before the Bank of Canada eases off on its rate-hiking strategy?

Further than you probably think.

The smart bet, until recently, was that the central bank would stop hiking rates at a level that might correspond to, say, a 10-per-cent decline in home prices. A fall of that magnitude would reverse several months of recent market gains. It would not, however, be a devastating blow to most long-standing homeowners or to the economy as a whole.

That benign outlook is fading. Central banks around the world, including the Bank of Canada, sound increasingly determined to crush inflation, whatever the cost. The recent rhetoric from policy makers in this country suggests that house prices – and the broader economy – could become collateral damage in the battle against persistently rising prices.

“The risk is that the bank will take a more aggressive approach to policy tightening than is ultimately required, driving home prices sharply lower and risking a major recession,” Stephen Brown, senior Canada economist at Capital Economics, said in an interview.

In a report this week entitled “Bank risks sending housing into a tailspin,” Mr. Brown outlined some disturbing numbers. He noted that recent rate hikes have already sent the national real estate market into a deep freeze. Home sales plunged in April and again in May.

The content of the article isn’t flawed, but the hypothesis in the title certainly is.

The tile suggests that there’s a correlation between “falling home prices” and the Bank of Canada’s interest rate policy, but the two are mutually exclusive.

The Bank of Canada isn’t saying, “We need home prices to fall.”

Also from the article:

Yet the Bank of Canada appears unconcerned. It devoted one sentence to housing in a policy statement last week. That was followed by a speech from deputy governor Paul Beaudry that didn’t even mention the housing market.

Exactly.

That’s how policies regarding monetary policy are supposed to work.

And it’s worth mentioning that, as we’ve seen here on TRB throughout 2023, the real estate market has clawed back much of the decline from 2022.

So, who wants to be the first to make a prediction?

Do rates go up in July?

One article this week featured a sub-headline that said there’s a “100% chance of a rate hike by September,” so surely that has to put the July announcement in perspective, right?

Appraiser

at 6:19 am

No chance of a rate hike. Interest rates are already too high.

Ace Goodheart

at 8:55 am

I was around in 1980-81, when the interest rate on a residential mortgage was over 20%.

Interest on a car loan in 1981 could be over 30% (the main reason why 1980s cars are such pieces of garbage – no one could afford a luxury car, so they made them as cheaply as they could, because people had to pay mostly cash for them – no one could afford the interest on a car loan – remember the Chevrolet Chevette? The Volkswagen Rabbit? The Ford Fairmont? The Dodge Aspen?).

The world runs on fossil fuels (despite what the climate activists want you to believe). When someone (like OPEC, or more recently, Justin Trudeau) gets in the way of oil and gas sales, everything gets more expensive. That is what happened in the 1980s and that is what is happening now.

Oil shocks always go the same way. You get a run up in prices, followed by interest rate hikes, followed by a deep recession. The process takes years. Usually governments will try to money print their way out of the situation (like Trudeau just recently did) and that always leads to inflation (like it did with us here).

The “bomb” in Canada is going to be when Trudeau gets voted out and we get a majority conservative government.

That will happen right about the same time when everyone is going to be renewing their 1.2% mortgages with 75 year amortization periods and they will have to renew at 25 year amortization with a fixed rate probably north of 7%. That is when it is all going to come crashing down. That will happen in 2025-2026.

Unless in some dramatic reversal, the Liberals get another mandate (or we get another coalition government) and they just push out people’s amortizations and hold existing mortgage holders to fixed payments they can actually afford.

The next few years should be interesting.

The BoC SHOULD increase rates on June 7th, but I don’t know if they will. Tiff seems to be a believer in MMT and that could influence his position on rate hikes.

Different David

at 4:38 pm

Ace, I think there will be a bit more leeway in terms of time. When the 5 year ultra low mortgages come up for renewal and the monthly payment goes from 6,000 to 8,000, that’s when vacations, eating out at restaurants, new furniture purchases will start tanking. Then, maybe 6-12 months later, people employed in these industries will start seeing layoffs.

Recession.

THAT’S when it all comes crashing down.

Higher interest rates = people battening down the hatches and spending most of their money on mortgage

Higher unemployment rates = I MUST sell the house.

Ace Goodheart

at 8:54 am

You may be right.

All I know is, the process is incredibly slow.

Like watching a super tanker come into port. Not like docking your bow rider at the cottage.

It takes forever for the situation to play out. People hoping for a real estate crash and recession this or next year are dreaming.

JL

at 10:10 am

I think that’s a safe bet; they’ll be slow to react and avoid doing anything on June 7th, maybe strengthen their guidance, and then be forced to act in July.

What did they say; “3% inflation by middle 2023”, right…? Given where we are I don’t see that happening.

Bryan

at 1:01 pm

The degree of naval gazing about interest rates among journalists, economists (outside of the unimpeachable Tal), and central bankers in Canada blows my mind. If we are trying to quantify inflation why don’t we, I don’t know, look at CPI? At the very least look at inflation before deciding on rate hikes. They say GDP went up because spending is high… but how do we know the relationship between spending and how much money people have? Or the relationship between how much money people have and GDP itself? Maybe there are answers to these questions, but they sure aren’t being reported on.

Cutting through all the noise, the bottom line is this: June 2022 was an inflexion point in CPI. In the 10 months since then (for which we have CPI data), CPI has grown 2.29%, which can be annualized to 2.5%. Since June, we have had 8 months where CPI grew less than 0.5% and 2 where it grew more than 0.5% (0.7% in April and October). Even if CPI grew 0.7% in both May and June, matching our 10 month high, annualized inflation will be in the 3s..

Pragma

at 3:32 pm

The view that BoC does not care/target house prices is incredibly naive. Once upon a time that was true but that stopped being true around 2015. To any policy maker it became abundantly clear that Canada was a one horse carriage, and we all know what that horse is. And there was absolutely no political will to slow down our only growth driver. So the BoC, and the government, had to keep pumping that gas. I would actually argue that the only reason that BoC kept rates way too low for too long was to support the housing market. Now their in a tough spot and can’t be just focused on housing anymore. Inflation is stickier and higher than you want, but to combat that you have to necessarily put pressure on the housing market – or you don’t, keep rates low or lower, let housing and inflation heat up again, wages will have to rise to keep up, and you’ll get a sustained feedback loop, CAD will weaken, more inflation will be imported, confidence in holding CAD will greatly drop, and something will break eventually…

Vancouver Keith

at 4:45 pm

With all the focus on interest rates, I read that it takes 18 months for an interest rate change to completely work its way through the economy. There are plenty of knock on effects to come from what has transpired in the last year. That was a speedy set of increases, I suspect the pause will continue.

Appraiser

at 5:12 am

So @Ace, this crash in 2005-2006; is it one from which there will be no recovery?

Because the GTA market recently had a correction – from which it has already recovered.

TRREB May MLS Report: https://trreb.ca/index.php/market-news/market-watch

Sales up +25% year over year. Active listings down -23%. Average sale price $1.2Million.

Ace Goodheart

at 9:54 am

I don’t think Toronto will experience a house price crash, at all.

Toronto will experience a condo price correction.

A house in Toronto is just to valuable to ever lose its price gains. I think that house prices in Toronto will continue upwards and we have a long way to go .

The suburbs are another story. It looks like there will be a correction.

However this entirely depends on who wins the next Federal election.

If it is Trudeau, then no correction. He will direct banks to push out amortization and ensure no one loses their house. This will result in young buyers being further locked out of the market, as there will be large groups of home owners who cannot sell, but who can remain in their houses with Liberal sponsored debt relief policies.

Predicting an election is hard.

This Saturday, for example, I watched 10.000 people march to Queens Park to protest against the Provincial govt.

Their complaint? Gas prices are too high, groceries cost too much and house prices are too high.

Ford cut the Provincial gas tax to bring gas prices down. Trudeau increased the Federal carbon tax, and up they went again. Trudeau carbon taxes farmers and pushed up grocery prices. He then blamed high grocery prices on profiteering by grocery stores. Protesters now blame the Provincial government (which tried to fight the carbon tax in court, and lost).

The Feds are almost fully responsible for high house prices. People blame the Provincial govt?

So you never know with an election. People are uninformed and mis informed (if you protest against Trudeau, you are a dangerous right wing extremist. If you protest against Ford, you are a righteous person with legitimate complains – according to our woke media).

Who knows?

cyber

at 7:34 am

Federal government’s carbon tax is revenue neutral, which means it raises NO net new revenue for the government. All funds collected get rebated, with PBO stating that most people will get more back than they paid extra (unless they drive multiple Hummers etc )

However, the Feds gave provinces an option – come up with your own plan that we approve, or get “federal option” imposed on you. Those provinces that get this option imposed on them, get 100% of the funds collected – Feds don’t keep any.

Ontario does NOT have the federally-imposed plan. Ford proposed his own plan on how to comply with the federal carbon mandate, which was approved: https://www.canadadrives.ca/blog/news/carbon-taxes-and-carbon-tax-rebates-in-canada-explained#ON

So yeah, if Ford’s plan is not revenue neutral and individuals in Ontario are ending up paying more overall, Queens Park is definitely the right place to protest.

Ace Goodheart

at 8:26 am

Ontario is on the Federal carbon tax plan.

Only two Provinces have their own carbon tax plan: Quebec and BC.

The Federal plan is revenue neutral if you are a private citizen.

If you operate a farm, it is not revenue neutral. It is a major new expense.

Sven

at 5:52 am

TMX publishes a useful tool on the outlook for interest rates here:

https://www.m-x.ca/en/trading/tools/canadian-interest-rate-expectations

2 further 25 bps rate hikes priced in for September and December 2023 followed by no cuts until December 2024.

Savita

at 10:39 am

Well,

It’s not the only way to decrease inflation. The increased interest rate have put lot of pressure on consumers. When they cannot afford payments and houses go for foreclosures , economy goes into depression. It brings so many other problems like bankruptcies, etc. so if we take whole round about the country suffers economically.

Last year of this government will leave the country in bad economic situation..

Yes I agree it will be mistake to increase interest rate again.