Is The I.T. Sector Going To Drive Real Estate Growth In Toronto?

Have you ever been to San Francisco?

I have. In 1989 when I was 9-years-old.

We had a house in Park City, Utah growing up, and used to take road trips every summer. In 1989, we went through Nevada, and down the coast of California. Reno, Nevada was merely a rest-stop for us, and we ended up in San Francisco for a few nights.

My dad had been there in the summer of 1969, and told me that one of the things that stuck out the most in his memory was “The Human Jukebox.” San Francisco is home to a slew of street performers and buskers, and he told me there was one guy who had a cardboard box, painted like a jukebox, and you could put in $2, and pick a song, and he’d stick one of many instruments out through the makeshift door, and play the song.

I didn’t make anything of it at the time, but low and behold, on the very first night, down by Fisherman’s Wharf, there was that same street vendor; The Human Jukebox, still busking for dollars, after two decades.

Hang on, let me see if my mother can dig up a photo…

…ah, here:

Thanks to Mom, and the readily-available Fleming Family Photo Archive, plus her impressive knowledge of how to work a scanner and crop a JPG at 70-years-old!

I suppose in 2018, the Human Jukebox seems pretty lame. Today’s kids would ask, “Where do I plug in my USB?” I suppose the jokes are endless, and I probably sound like an old man for even trying.

But in 1989, the fact that this guy was still there, on the same street corner, with the same gimmick, and probably with more-or-less the same booth, was absolutely mind-blowing to my father, who had been right there, twenty years earlier.

Not much had changed in twenty years, it seemed. And that was the theme as we toured around, and my Dad pointed out some of the same restaurants he had been to in the late-60’s, or some of the places he got into trouble when he was a young 20-something.

The lack of change was astonishing. So I was told.

And since then, San Francisco and the surrounding area has done nothing but change.

That’s what I’m being told now.

A client of mine works in tech, and he started going out to San Francisco about six years ago for business. This was when we first met, and he bought his downtown Toronto condo. Over the last six years, he’s told me at least two or three times how “Toronto could end up just like San Francisco,” if the city would get “behind” technology, as he explained.

Now I will admit, this is not my field, or my area of expertise.

But I listened to his theories, just as I listen to the Manhattanites joke about our “cheap” downtown real estate, or the London-Englanders talk about how Toronto is a “cute city” and is a version of London from the 1960’s.

While I can accurately claim that I was downloading MP3’s on Napster, which is now merely a name studied in text books about the technology boom in the late-1990’s, the only thing I know about emerging tech is what I hear from my clients.

And over the last few years, the conversation about Toronto being “the next tech hub” has started to get louder.

But first let me show you what happened to real estate prices in San Francisco, as the tech boom went full throttle.

It’s tough to say exactly when the tech-boom started, and when Silicon Valley became the place to be. I might say it was 1995, when giants like Amazon got their start. That’s also the first time I ever used the internet.

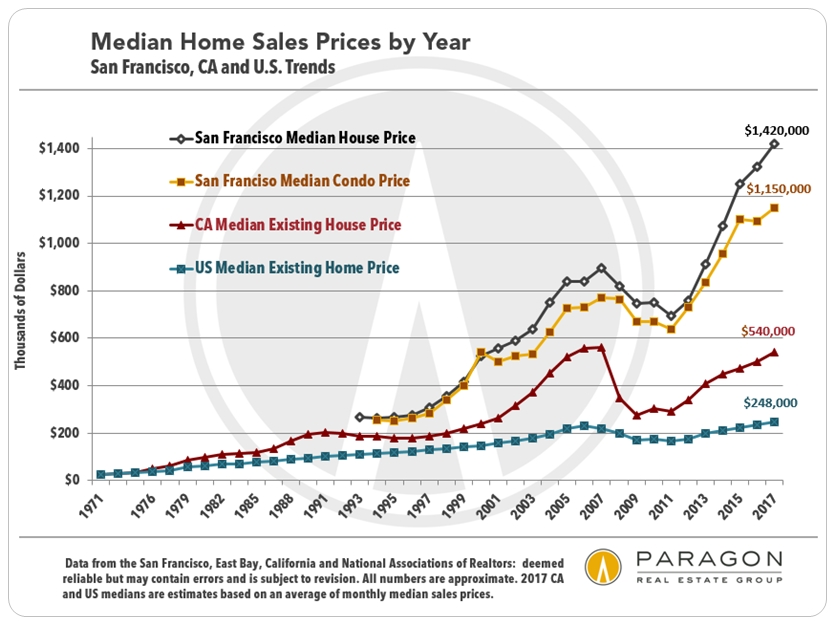

The median home price in San Francisco in 1995 was $225,000:

Yes, I know, I’d rather look at the average, but over a long enough time period, and with enough data, they’re somewhat comparable.

This is the only chart I could find that went back into the 1990’s, and actually into the 70’s which is kind of cool.

But that’s a bit far back for most of us. Yeah, I missed out on being a 70’s baby by eight months…

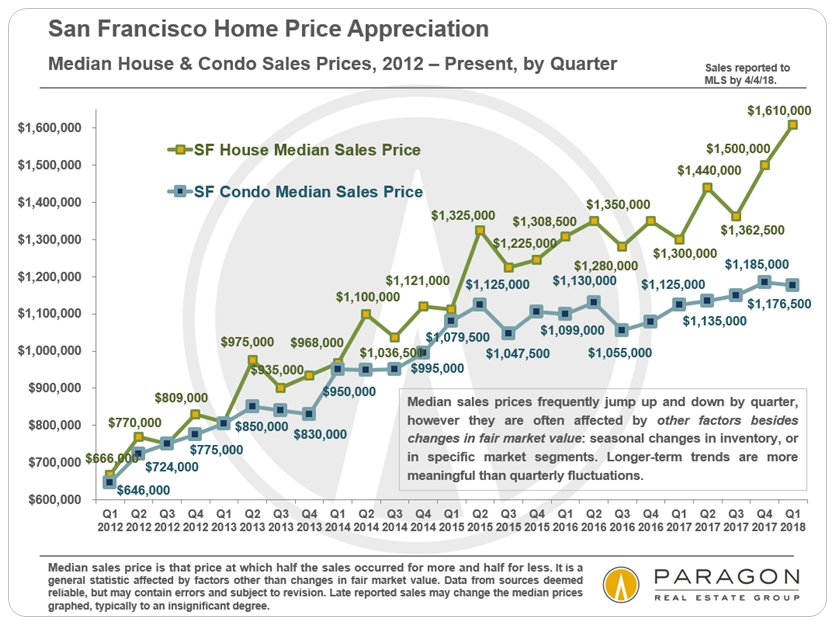

Now if you want to see where prices are today, then here’s an April, 2018 update:

That’s $1,610,000.

And looking back at the $225,000 median from 1995, that would also represent a 706% increase in value in that time.

How does this compare to Toronto?

The average home price in Toronto in 1995 was $203,150.

The average home price for the entire year 2017, was $822,681. But if we want to compare to San Francisco as per the chart above, which looked at the average in April, then we’d be looking at a slightly lower number of $804,584.

That’s a 296% increase in value. Not bad!

But not the 706% increase that San Francisco had.

The market bears out there are probably shaking their heads already, thinking, “He’s going to shine a positive light on Toronto by comparing it to San Francisco?” But as I said, I’m just looking at one particular theory out there, from a client who lives part-time in San Francisco, who’s been telling me to make this comparison for years.

And here’s the article he sent me in the summer that spawned this blog post:

From the article:

The average price of a house bought in San Francisco rose by $205,000 in the first half of 2018, the largest six-month increase in history, according to MLS data compiled by local real estate agency Paragon.

The average house in the city limits now costs $1.62 million. Condo prices also rose by $71,000, which is a significantly slower pace of change than in past years, but still comes in at a startling $1.21 million.

This is a direct outgrowth of the current tech boom in Silicon Valley, which shows no signs of slowing down.

It’s worth recalling that a lot of people in Silicon Valley were bracing for a slowdown in 2015. Venture investors like Bill Gurley were predicting that long-running start-ups would have to raise rounds at lower valuations because their last rounds came with restrictive conditions for future investors but they weren’t ready to go public yet. Start-ups cracked down on expenses. Apple’s share price actually dropped during the year, as investors grew concerned about slowing iPhone sales and the prospect of a general downturn. The next year, Silicon Valley stalwarts Intel and Cisco both laid off several thousand employees apiece.

Indeed, housing prices in SF actually slowed their growth in 2015 and 2016, before starting to rocket up again last year.

Toronto is not going to be the next Silicon Valley.

But I have to think that Toronto turned a major corner when Google (or Alphabet) announced that Sidewalk Labs would be coming to Toronto’s waterfront.

I remember back when Blackberry was the biggest name in Canada, and it seemed that Waterloo, Ontario would be Canada’s hub for innovation, technology, and all things intelligent in the future. But it seems as though Toronto is slowly developing as the front-runner for Canada’s tech-hub, and it could end up being one of the largest hubs in the world.

On Saturday, the Huffington Post published an article that basically stole all my thunder:

“Toronto’s Tech Boom Will Keep Real Estate Frenzy Going: Forecast”

I have a lengthy queue of blog ideas; some are written as soon the idea is logged, and some languish on paper for weeks or months. Well, the Huffington Post basically wrote the story for me! Read it if you have time, it’s fantastic.

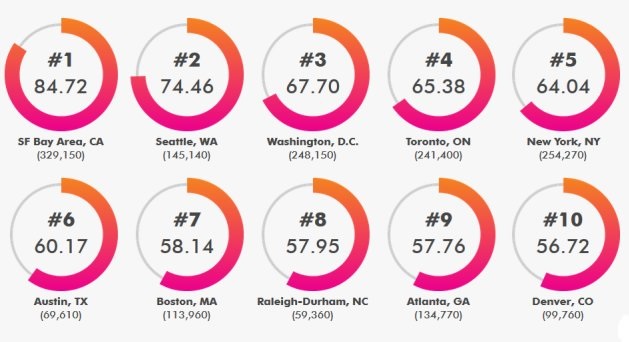

The article notes that between 2012 and 2017, Toronto added 82,000 jobs in the tech industry, which was more than any other city in all of North America, according to CB Richard Ellis.

CBRE provided this graphic as well to show how Toronto has moved up the ladder among tech giants:

As I’ve said, tech is not my field, and I don’t follow the industry much. I’m not a gadget-head, I don’t care for the latest/newest/brightest consumer products, and half the jobs people are doing out there right now, I haven’t even heard of.

But I read the headlines.

And everywhere you look, it’s tech.

When it’s not tech, it’s sort-of tech.

Like this, which was in the news on Tuesday:

“Spaces Plans Its Largest Co-Working Sites In Toronto, Vancouver”

Spaces is a co-working environment that provides on-the-spot, or short-term desks, offices, conference rooms, and meeting spaces for entrepreneurs, small business owners, or anybody that needs the space, but can’t afford it, or can’t make use of it, full-time. It’s like Uber for office buildings.

Some will argue that the presence of Spaces in Toronto’s downtown core will eliminate the need for large office buildings, but I disagree. I think Spaces and other co-work environments like them will supplement office buildings, not replace them. If anything, Spaces is necessitated by the city’s inability to build commercial space fast enough.

Commercial real estate, for what it’s worth, is booming in Toronto.

“Investors Lift Canadian Commercial Real Estate To New Heights”

Commercial transactions in Canada last year smashed the previous record by 38%.

Toronto accounted for a third of all transactions in Canada.

The pension funds, investment trusts, and huge private money wouldn’t be buying Toronto’s office towers if they didn’t think the city would be running low on space in the future.

And all the while, the people who work in tech, will have to live somewhere.

My client from San Fran has been telling me this for years. He’s the single-most bullish person I have ever met when it comes to Toronto real estate, and he only owns his primary residence, so he’s not some over-extended investor cheerleading the market out of blind will.

That’s only one voice, but I can’t deny all the other chatter.

Time will tell.

In the meantime, perhaps we can jump into the ongoing debate over whether or not Sidewalk Labs is going to allow Google to take over our souls?

True story. Google it…

Jay

at 7:31 am

August 1980? Happy belated man. Luv your content!

Joel

at 7:39 am

In the news yesterday was that pinterest is opening in Toronto and Mars is opening another large space by the sidwwalk labs location.

I think the tech jobs are already coming to Toronto and they are definitely going to have an effect on housing prices as a lot more money comes into Toronto.

The US’s current anti immigration stance is also going to put Toronto on the top of the preferred cities for many.

Oli

at 3:47 pm

If salary is stagnant and houses are still overpriced, it wouldn’t have any effect. Toronto needs to be decentralized.

Francesca

at 8:51 am

In 1999 I visited family friends in San Fran who had just moved from NYC and I remember then them telling me they paid more for their detached house in San Fran than there house 20 minutes away in a suburb of NYC. They were shocked at how expensive housing prices were already back then. I have another family friend who moved to the area from here back in 2008 and then moved back to TO after only 3 years as although he was making a ton of money in the tech sector there it wasn’t getting him that far ahead. I believe the average income in the tech valley there are pretty high compared to the rest of the USA but still not everyone works in that industry. If tech jobs start increasing here in Toronto and salaries don’t start to reflect the following increase in real estate prices, we are going to be in big trouble! Toronto will def become a city for the rich only, similar to what is happening already in Vancouver where many service jobs can’t be filled as min wage workers can no longer afford to live there and don’t want to commute hours each day for the privilege of working there.

Chris

at 9:00 am

It’s good that more tech companies are coming to Toronto. Greater diversification of our economy, more jobs, there’s a lot of positives here.

I would take the HuffPo article with a grain of salt, though, given the source of the forecast:

“a forecast from real estate agency Engel + Volkers says a new phenomenon is about to take over as the driver of Toronto’s housing boom: The tech industry.”

If tech is going to be a big economic and real estate market driver, salaries are also going to need to increase. Current compensation for Canadians pales in comparison to their American counterparts. From CBRE as well:

http://i.imgur.com/91qsdcm.jpg

Geoff

at 9:42 am

Research and source checking. +1 Chris!

Condodweller

at 10:02 am

Seeing that chart is eye-opening! I always knew this but to visualize it like is actually sad. Add to it that they pay less taxes in the US and many things here are basically priced in US$ the discrepancy is mind blowing.

It’s logical to think that that tech jobs had a contributing factor in our recent run up. It will be interesting to see if it will continue. I still say that we would need meaningful salary increases for RE to continue higher never mind rocket up like SF.

Also, while it’s easy to point to tech in SF for the reason for the runup, the skeptic in me wants to know the extent of contributions other sectors made. I have a hard time wrapping my head around a single sector being the only driving force.

Tom Tyman

at 10:20 am

I really liked this article that you posted. I could see very well how tech growth in Toronto will help in pushing real estate business in the area.

Thanks for sharing this!

Appraiser

at 10:26 am

Leave it to @Chris to find a worm in every apple. Attacking the source rather than the substance of an article is particularly weak.

I notice no comment on the article regarding the boom in commercial real estate where “Toronto accounted for more than a third of all transactions in the quarter, at $5.7 billion. That’s the city’s highest quarterly investment volume ever and 20 per cent more than the previous record, set in 2013.”

Cherry-picking combined with permanent negativity and denial are the hallmark of some.

Chris

at 10:49 am

I questioned the substance by raising the point about salaries for tech workers in Canada. Did you miss that part?

Further, it’s quite ironic to see you spouting off about “attacking the source rather than the substance”. You do this incessantly with sources you don’t like, such as Better Dwelling.

Sorry, we can’t all share your hallmark unabashed bullish optimism.

By the way, did you notice David’s new Data Hub? He must have missed your comments explaining that the TREB ruling doesn’t compel or oblige him to share this data!

Appraiser

at 11:23 am

Some people seem to have a problem for every solutiuon.

Your grasp of the ruling regarding TREB sold data is even weaker than I surmised.

The ruling does not compel the board or any of its members to provide the information, it permits the information to be made available for those who wish to do so.

Nuance doesn’t seem to be your forté.

Chris

at 11:45 am

Ah yes, I’m sure you have a very strong foundation in legal education and experience, given your career as a…real estate appraiser.

You’ve stated multiple times that the ruling doesn’t compel or oblige anyone to share data, it permits it should they wish to. We all know that, it is obvious and clear.

And yet, here is another source of this data, through David, in addition to the others I have shared previously.

So, clearly, despite not being compelled to do so, many are willfully choosing to share this data, rather than telling their clients to go to the land registry, as you seemed to suggest.

Rudimentary logic and reason don’t seem to be your fortés.

Housing Bear

at 11:17 am

Seattle and Bay area have both started to see a big slow down in both prices and rents with rents beginning to decrease in the former. Don’t feel like researching Washington D.C

Yes Toronto LONG term will continue to go up but we have a nasty correction/ crash to get through first. See what happened in California last decade based on these charts? Sure you are fine if you held on, but thousands if not millions of people (just in CA) got wiped out. Facebook, Netflix, Apple all either started in the mid 2000s or thats when they really started taking off (remember when everyone had to have the new Blackberry Pearl circa 2008). But that was not able to save the housing markets there. Also, ground zero for the US housing bubble was in secondary markets like Arizona, Nevada and Florida. Ours is concentrated in our larger economic hubs = bad news.

And while their housing market recovery was actually quite quick, just under 10 years, lets not forget that they US introduced both the unprecedented QE programs as well as held rates down at record lows for years. If anyone wants to get a sense of the strategy Bernake was trying to use – check out Irvin Fisher deflation theory and his “reflation” proposal.

Either way, now the US is raising rates much more aggressively then we have been. Let’s see how many of their markets post gains over the short -medium term. If San Fran can break the inverse correlation between prices and rates than maybe Toronto can too. We will ignore the fact that sunny CA is an actual dream spot for the global elite. How many billionaires strive to be shoveling snow in April?

daniel b

at 9:18 am

I’m not super familiar with the bay area housing market but i have seen several articles in the last few months about what a strong year it’s been for SF housing prices. Is the rest of the bay area moving the other way?

http://fortune.com/2018/07/06/san-francisco-real-estate-price-rising-record/

Housing Bear

at 11:43 am

Seattle looks much shakier right now than bay area. That article is talking about June and before. The slowdown in California only really started in the summer months of this year. Too soon to call it a trend but interest rates, and affordability are starting to work against the market.

https://www.sfchronicle.com/business/networth/article/Bay-Area-home-prices-fall-below-as-summer-13197202.php

Parklaw

at 10:24 pm

Sunny? Have you ever been to SF?

Appraiser

at 12:40 pm

“The Toronto area’s high-priced housing market is climbing again, with double-digit sales gains this summer expected to continue through the fall”

https://www.thestar.com/business/real_estate/2018/09/26/gta-home-sales-shake-off-very-dark-period.html

Housing Bear

at 12:59 pm

Was our bet that July 2019 would be higher YOY or was it August 2019 up YOY?

And what were the stakes again. If I lose I change my name to “Housing Fool” If you lose you change your name to “Defaulter” or was it “Unemployed”?

Chris

at 1:08 pm

It was July.

https://torontorealtyblog.com/blog/cruel-cruel-cruel-summer/#comment-90311

Housing Bear

at 1:41 pm

cheers

Appraiser

at 1:48 pm

How about “Retired and living off rental income from fine people such as yourself”

So yeah…unemployed.

Housing Bear

at 2:00 pm

I remember not too long ago you told someone on here that being cash flow negative on an investment property is sometimes a good strategy.

Are you sure its not “Commie, subsidizing the lifestyle of a fine person such as myself”

Don’t worry, I work in tech so I’ll hit you back when you go on government assistance.

Housing Bear

at 2:01 pm

You’re a good comrade Appraiser

Jennifer

at 1:11 pm

These reports released by brokerages are so self-serving they should be banned from being released or they should be called advertisements instead and posted to their websites only. Propaganda. Hardly a news article.

Jason

at 1:29 pm

“Fake news?”

Where have I heard that before?

Kyle

at 2:27 pm

Large tech announcements just In the last month:

– Uber spending $200 million to expand their Toronto office , adding 300 employees

– Microsoft building it’s new $570 million Canadian headquarters in downtown Toronto, creating 500 new jobs

– MARS and UofT opening a new waterfront innovation center, adding 3000 employees

– Shopify expanding to a new 434,000 sq ft office in The Well complex.

– Pinterest opening a new office in Toronto next week

Chris

at 2:43 pm

And Intel opening a new lab; although this is in North York, so not sure if everyone qualifies this as “Toronto”.

https://www.theglobeandmail.com/business/technology/article-intel-opening-graphics-chip-plant-in-toronto/

Appraiser

at 3:11 pm

“Instacart to transform Toronto office into tech hub and hire 200 employees”

https://www.thestar.com/business/technology/2018/09/25/instacart-to-transform-toronto-office-into-tech-hub-and-hire-200-employees.html

Tech Worker

at 8:06 pm

With US clamping down on skilled labor immigration programs, you can expect Canada to pick up some of the demand for cheaper labor. No surprise here, but hoping for wages to inch up to at least keep up with the cost of living increases.

AT555

at 3:49 pm

Low wages is not the main factor here…global talent and calmer political environment also plays a big role. All big tech companies in US are facing massive shortage of technically skilled workers and now they can bring global talent in to fill that shortage thanks to Trump’s nationalist agenda.

AT555

at 3:50 pm

*can’t

Appraiser

at 3:18 pm

“How Toronto became a technology hub”

Intellectual concentration:

“There are not many cities in the world with as much intellectual and educational horsepower as Toronto.”

https://blogs.thomsonreuters.com/answerson/how-toronto-became-a-technology-hub/

Housing Bear

at 4:14 pm

Fed raised rates today. Predicts one more in December, three next year and one in 2020. Wonder if any of them will be more than 25 basis points.

Thinking maybe I should start the amazon/craigslist for buying repossessed assets. My sources tell me that the tech scene is booming in Toronto, and you can find workers for half the price of many areas in the US! Ill call it “Repofi”. We will even let you buy on credit from a wide range of our trusted private lenders.

Trent

at 9:56 pm

Canada and US interest rate have diverged. Also don’t bet the farm on a crash due to interest rate hikes. If a crash was even sensed then the rates would drop Also anyone with interest rate risk may choose to refinance using a longer term rather than sell. For every possible scenario we have options, except unemployment. By they way, amazon is also expanding in GTA for a warehouse and considering toronto for HQ2. Just since Amazon announced toronto as top 20 and uptick of announcements have followed… Toronto is already a tech giant and its only the beginning…. oh ya Uber also recently announced investment in toronto… the list goes on….

Housing Bear

at 11:37 am

While the GTA is way bigger and makes up way more of total national housing value compared to Van, Van looks like it is starting to crash. Do you think this will stop a rate hike next month? Or would it only impact the BOC if GTA started to go? Also what do you think their threshold correction % would be before they reverse course? Obviously NAFTA could impact the movements as well, but that probably results in a couple hundred thousand auto sector jobs in Ontario disappearing overnight.

What happens when we don’t follow the fed? Our dollar drops. So sure the BOC could decide to keep rates on hold so that your mortgage stops eating up more and more of your disposal income, but the side effect is that almost everything else you buy with your disposable income goes up in price. The choice is this – squeeze over leveraged households via higher debt servicing or squeeze everyone including over leveraged households via higher cost of goods. Either way less disposable money to stimulate other areas of the economy. I think the play is to try and strike a balance between the two and hope that the US economy goes into a recession before our economy blows up. If/when the FED starts dropping rates again, the pressure will be off the BOC. I should also add that mortgage rates are not only impacted by the BOC overnight rate. As the risk free rate in the US goes up (which pretty much every financial asset in the world is priced off of), every institution now has to offer a higher yield to compete. Banks borrow money to lend households money. If their cost of funding goes up do you expect them to operate at a loss?

All of these tech companies opening up shop is definitely a good thing for Canada and will hopefully lessen the blow and probability of a severe crash. If they pay enough and they create enough rental/ownership demand for dt condos, then this could help to establish a firm floor on market prices which could than help out the over leveraged households in the outskirts of the city and 905 regions. 1 Bdr condos are the market floor, average townhouses/semis/detached will never costs less than these, so if 1 bdr condos hold firm then the rest of the market can eventually count on move up buyers to provide some sort of liquidity for their assets. That is if rates don’t shoot up too high and/or lenders keep making loans. We also would need to tech to make up for any potential job loss coming from FIRE related industries which I believe contribute about 20% of Ontarios GDP.

Those are big ifs however. From what I have looked at, we have records amount of investors in the condo sector, we have record supply on its way and even at current rates/prices, most of these investors are cash flow negative. Vancouver had similar stats and now their market is looking like it is starting to enter free fall. GTA rents could perhaps shoot a lot higher, and developers could start cancelling more projects to lower supply, but than that brings us back to some of the other issues outlined above. Renters have way more of their income going to housing and thus must reduce spending in other areas of the economy. Construction sector gets a bunch of layoffs. Fewer homes to sell probably also translates into fewer sales for RE agents, lawyers etc. Does anyone here know any construction workers or RE agents who own multiple properties?

Condodweller

at 12:37 pm

Some very good point here HB. You have obviously done your homework.

I think we are at a juncture which I can best describe as a reverse tug of war. Bear with me here for an explanation…

There is high demand for “affordable” housing, note I’m using affordable here to mean affordable mortgage, which is 1 bed condos and increasingly sub 1 bed i.e. less than 400sqft, and on the other hand we have SFH that most people still aspire to but increasingly few can afford though that might change with all these new tech jobs.

I have said in the past that I thought the price gap between 1 bed condos and SHF is going to be squeezed in the future as the low end demand pushes up prices while the lack of affordability and downsizing trends are at least keeping a lid on if not decreasing SFH prices on the other end of the specturm.

So what I mean by reverse tug of war is the above has the effect of pushing on a rope from both ends and whichever side has the biggest momentum will win in pushing the other in the opposite direction.

The interesting part is that taking everything into consideration we seem to be at a bit of an equilibrium point with a slight advantage to the 1 bed condo side currently which could change on a dime based on all the uncertainties.

I think NAFTA is the big potential for a black swan even here as it has the capacity to deliver the fatal blow to the RE market in terms of jobs losses. The question is will the new tech jobs outweigh the losses. Interesting times for sure.

Lol

at 7:23 pm

Lol

Condodweller

at 10:33 pm

All truth passes through three stages. First, it is

ridiculed. Second, it is violently opposed. Third, it

is accepted as being self-evident.

— By somebody smarter than me

BJA

at 10:39 pm

I’d say a hike of greater than 25 bps is extremely unlikely, particularly considering Trump’s recent comments about the FOMC’s current tightening cycle. Not that he can legally interfere with the Fed ….

FreeMoney

at 4:41 pm

“I suppose in 2018, the Human Jukebox seems pretty lame.”

Are you kidding? The “kids” would be (and I’d bet in SF they are) all over that!

Alf Anderson

at 11:03 am

Agree. Rented my house in Queen West recently and almost all applications were from tenants in the tech industry.

Appraiser

at 11:11 am

“My clients have been in a lot of multiple offer nights in recent weeks. Seems to be playing out in the stats too. 44% of freeholds sold over asking last week, compared to 32% in same week last year.”

Scott Ingram, CPA, CA https://twitter.com/areacode416

Housing Bear

at 1:33 pm

“And here you see they are among the lowest in DOM. Both of these charts are because the typical house in E1, E2, and E3 underlists the price (e.g. $799K but worth $925K) then holds an offer night 7 days later. So sold price > list price (i.e. over 100%) and lots of 7 DOM. /2”

Scott Ingram, CPA, CA

https://twitter.com/areacode416/status/1045358935396544512

Scott is one of the most honest and balanced agents out there, and he does seem to be implying an uptick in activity. This time last year probably isn’t the best comparison.

Either way, I still believe this uptick is condo owners with a ton of equity moving up and taking advantage of the closing gap between their condo and SFH. This can continue until condos start to drop and/or higher rates reduce their borrowing capacity.

Appraiser

at 3:41 pm

“Statistics Canada released preliminary estimates Thursday that showed the country’s population hitting 37.1 million on July 1, up 518,588 from a year earlier. That’s the biggest gain since 1957.”

https://www.bloomberg.com/news/articles/2018-09-27/migration-drives-canada-s-biggest-population-gain-since-1957

Valentino Arbabi

at 1:00 pm

For anybody to might be interested, Lamb Development Corp. is hosting a buying event on October 24th to talk about investing in Toronto real estate and to present a new building that will be ready September 2021. This project is ideal whether you are a young professional who is currently renting, but wants to own a home in the downtown core, or you are looking to make a guaranteed investment.

As a home buyer you might be particularly interested in some of the following opportunities:

– Our unique and achievable deposit structure: $5000 upon signing, 5% of balance in 30 days, another 5% in 120 days, and another 5% in 270 days.

– $5000 worth of upgrades for your floors, kitchen backsplash, and bathroom tiles

– Perfect 100 walk score (near a lot of the big tech companies, hence my comment)

As an investor you might be particularly interested in the following offers:

– Up to 2 years of free tenant management if you sign with me personally

– Free assignments

– Between $12000 to $15000 off any unit

These offers expire on October 27th and all the units will be spoken for within the next two weeks, so I encourage you to act quickly if you are interested in ever owning a home in Downtown Toronto. For more information you can visit our website thewoodsworthvip.ca