Do you hate when properties are severely under-listed?

You do. I know. Everybody does.

About 2-3 weeks into the pandemic, once real estate agents and sellers started to realize (about 2-3 weeks too late, of course…) that the market had changed significantly, we started to see properties actually being listed at fair market value.

No longer were $700,000 condos being listed at $579,900 with an “offer date,” and the buyer pool rejoiced!

But when many of those properties, listed at fair market value, weren’t selling, listing agents went right back to the well for an age-old strategy. Only this time, they’d really under-price!

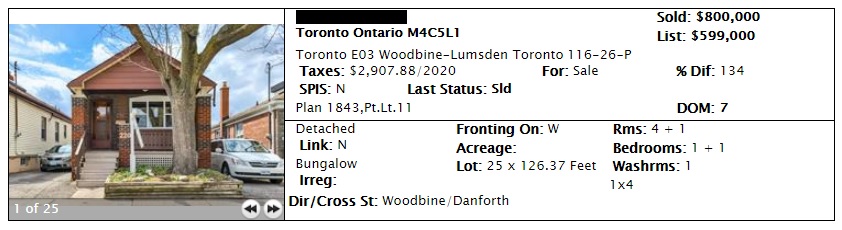

It started with this one:

Now, once upon a time, we wouldn’t bat an eye at a $599,000 listing selling for $800,000.

But this was during prime-pandemic when absolutely nothing was selling.

I referenced this property a while back, since it ended up receiving a whopping twenty-two offers. Even more surprising than the twenty-two offers was the fact that there were actually twenty-two showings! I have colleagues who are lamenting that they’re not getting ANY showings on their listings!

To be fair, this house woulda, coulda, shoulda sold for $850,000 in the first week of March. But that’s where we are, and few of us are denying it. The only conversations (See: Friday’s Blog) are about how much less you’d expect to get while selling your home during a pandemic than you would have in late-February or early-March.

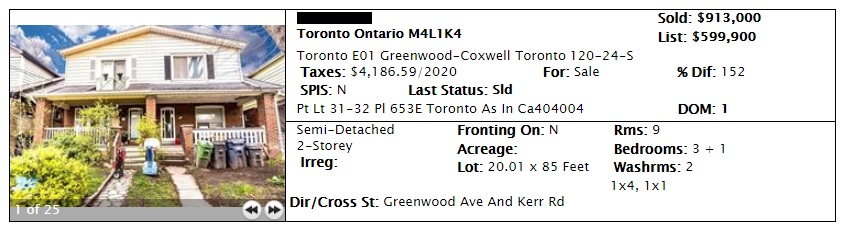

Last week, we saw the action on this beauty:

I mean, really?

Listing a 3-bed, 2-bath, semi-detached at $599,900?

Hey, it worked, right?

A lot of people wasted time on this, but I’ve long maintained that I blame the buyers and buyer agents for being clueless, inexperienced, naive, and hopelessly optimistic, before I ever blame the seller and listing agent.

The problem in both of these cases is that there are going to be a lot of buyers who think they’re geniuses, and who think, “I know what I’ll do! I’ll buy a house during a pandemic, for pennies on the dollar, and laugh all the way to the bank!” So a house comes out for $599,900, and a dozen morons offer $599,900. Then it sells for $913,000.

Here I thought that, as the pandemic goes on, we’d see more and more properties being listed at fair market value (or just above) with offers any time. Instead, we’re now seeing properties being listed even lower than before.

I honestly don’t know what to say about this.

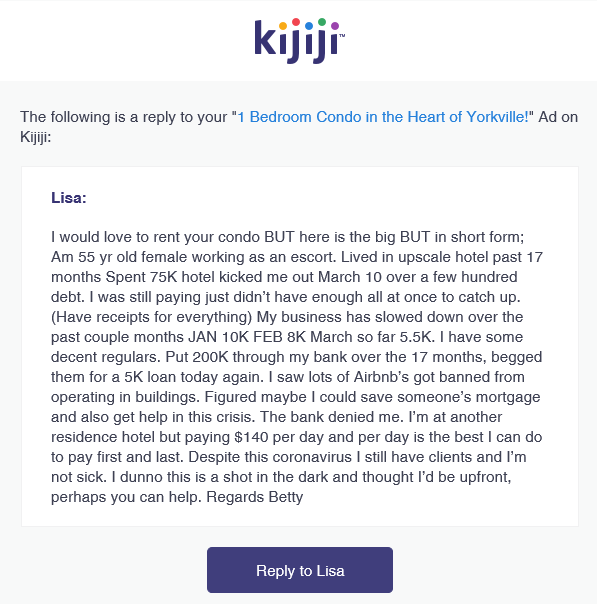

Perhaps I should just let you read it, and draw your own conclusions?

I guess I’ll say this, at the onset: you can’t blame a person for being honest…

Wow.

There are so many thoughts running through my mind right now, and none of it has to do with the idea of a 55-year-old escort.

First of all, good for this woman for being up front and honest. That’s something I rarely find anymore in these situations. A colleague of mine had a rental listing a while back, and she found the “perfect” tenant, on paper. But it wasn’t long before property management called her to say that the tenant had five or six male visitors sign in with concierge every night, and they wanted her out of the building. I won’t profess to know what legal rights a tenant, landlord, or a condominium corporation has in this situation, but let’s just say: somebody is going to lose in the end.

So can you blame “Betty” for trying her hand by being honest?

Does spending $75,000 to live in an upscale hotel for 17-months show that she has the ability to make a lot of money? Or does it show that she’s living a lavish lifestyle, and lets money flow through her fingertips like water?

She’s making decent money every month, and it’s all cash, no taxes.

Then again, this is a sex-worker trying to operate a business during a pandemic.

It’s also one of those situations where you’ll lose no matter what you say on the matter, so I’ll just leave it there…

You know that I don’t allow “guest blogs” on TRB, but from time to time, I’ll republish something of quality from Point2Homes or Rentals.ca if there’s statistics or surveys with data I can’t find anywhere else, that I think the readers will benefit from.

Point2Homes sent me the following last week, and I found it VERY interesting!

I’ve made no bones about the fact that I feel many real estate agents will be out of the business in 2021, after a year of losses due to the pandemic. Change is never immediate, and I feel that most agents will hang on to the bitter end, convincing themselves there’s a place for them, when all along, there wasn’t.

Some of my colleagues feel that we’ll lose as many as 25,000 agents, but I don’t think that’s going to happen.

And in the end, you know some of the really bad ones will find a way to hang on.

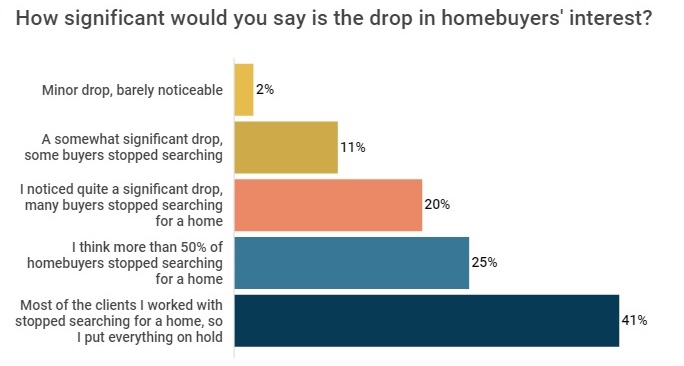

Nevertheless, here’s a survey from Point2Homes that sheds some light on what agents are feeling in this market.

–

Real Estate Agent Sentiment Plunging Amid Outbreak Concerns

Point2Homes

May 4th, 2020

Link HERE

COVID-19 has forced the real estate market to push the brakes at a time when activity was really starting to take off for the year. Since it began, open houses and showings have been replaced by virtual tours and live streams in an attempt to keep homebuyers informed, interested and engaged.

Unfortunately, most home seekers have put everything on hold, and home sellers have followed suit. For many, home buying and selling is too important to be rushed, especially with rising uncertainty.

With all these changes, we recently conducted a homebuyer sentiment survey to gauge the main concerns of homebuyers and how they are adapting. Then, for a complete view of the market, Point2 Homes reached out to real estate agents and professionals nationwide to learn how the pandemic was affecting their business and what changes they anticipated in the real estate market.

HomeBuyer Interest Falling, Agent Concern Mounting

A staggering 86% of the agents who took the survey said that they noticed a significant drop in homebuyers’ interest. While respondents to our homebuyer survey said they would continue to keep an eye on the market and were still searching (although less actively), agents and brokers reported that they had already heavily felt the toned down activity. In fact, only 2% of agents said that, so far, homebuyer interest hadn’t wavered much and that they had noticed only a minor drop in interest.

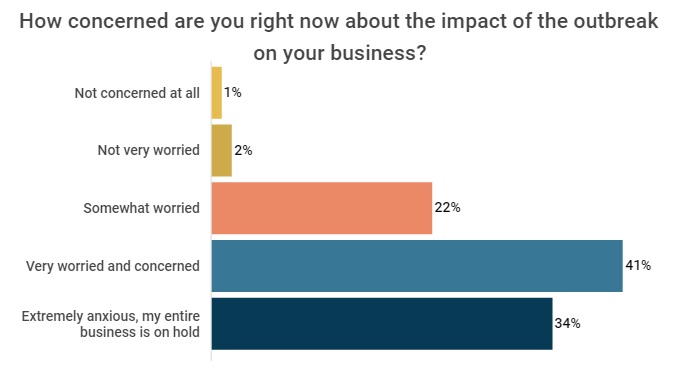

With the vast majority of agents experiencing plummeting homebuyer interest, their level of concern is, understandably, reaching new highs. Specifically, 75% of respondents said they were very worried or extremely anxious about the future of their business. Meanwhile, only 22% of agents said they were only somewhat concerned, and 3% were even optimistic, reporting no particular worries about the whole situation.

These numbers also seem to represent the situation at large. Many or most buyers and sellers have put everything on hold, choosing to be cautious at this time. But, the home seekers who are looking for a home to live in — as opposed to a property earmarked for investment — can’t afford to stop looking.

Grim Early Estimates Of Financial Loss

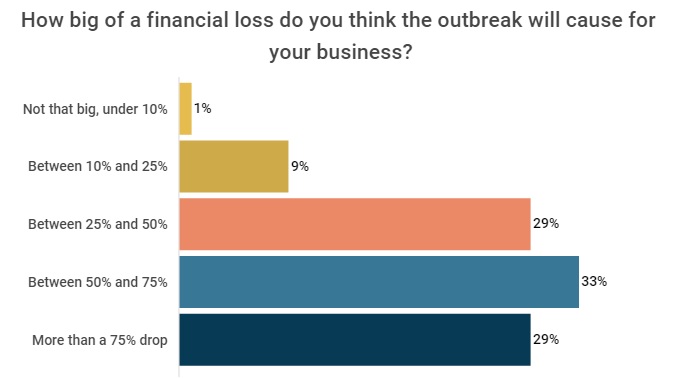

Just 10% of all agents surveyed estimated that this period would translate into business losses of less than 25%.

The majority of agents were much less optimistic. In particular, 62% of respondents expected at least half of their business to vanish after this period. Meanwhile, almost one-third of respondents believed the outbreak would cause a drop of more than 75%.

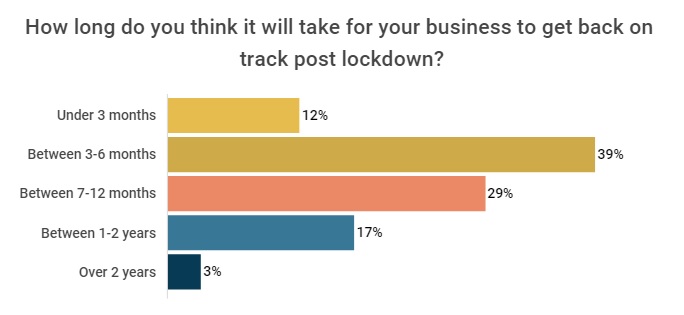

Despite this, most agents and brokers surveyed tended to be more positive in their estimate regarding the timeframe for recovery. A full 80% of respondents expected their business to be back on track in less than 12 months. Of the remainder, 17% believed it might take between one and two years to get back to normal, while a small minority (3%) had a more pessimistic outlook.

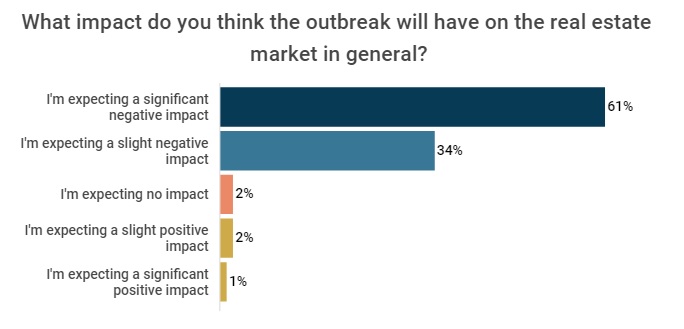

Unsurprisingly, given their perspective so far, 95% of agents surveyed believed the outbreak would have a substantial negative influence on the real estate market in general. That left only about 5% who were neutral or slightly positive about the future of real estate after activity begins again.

In the meantime, real estate agents reported that they were incorporating new solutions into their work process — in an attempt to prepare for the future, but also to navigate the current situation and help homebuyers who still want or need to find a home. Namely, 28% of agents said they had been doing more for their clients, such as taking more pictures of properties and spending more time on the phone answering questions about homes that buyers were unable to visit in person.

What’s more, 23% of respondents said they had become more dependent upon technology and the tools available online. These agents noted they had introduced virtual tours in their home descriptions and even offered live streams to address buyer questions in real time.

However, 44% of agents said they had either cut expenses to keep the business going or had put everything on hold temporarily. With almost half of respondents mentioning cuts, the domino effect becomes more apparent: professional photographers, home stagers and even interior designers are affected in turn.

Remember when laneway houses were all the rage in Toronto?

It seems like forever-ago, does it not?

I don’t believe we’re really discussed this at all in 2020, and yet a lot of laneway homes are popping up throughout Toronto.

What once seemed like a big part of the solution to Toronto’s housing woes hasn’t received a lot of attention, but I assure you, there’s a lot going on behind the scenes.

A house next-door to a garage.

This is something we’re going to have to get used to, and yet the door for cynicism is wide open.

For example, would you feel more awkward:

a) Sleeping and eating on the other side of a wall to where somebody stores their lawnmower and recycling bins?

b) Changing the oil in your hot-rod while an extended-family of twelve eats Christmas dinner on the other side of the wall?

Happy Monday, folks!

jeanmarc

at 7:44 am

Enjoy the read. Desperate times for some agents who will low ball listings to draw the attention of buyers. Surprised how RECO does not condone this type of practice as part of their ethics training. I always find this type of business practice “slimy”.

Caprice

at 11:14 am

If under-listing works, and it obviously did for the above two examples, then why not? Would you complain if you were the seller?

jeanmarc

at 11:39 am

Buyers (with a *knowledgeable* agent) who know the area and product that is selling, should be versed enough to “know” the value of the property. I say *knowledgeable* as there are lots out there who have no clue but only know how to list. Been through the (selling and buying) process 7 times in the past 20 years! It’s stressful enough with showings and open houses before a pandemic. To list it at $200-$300K less during a pandemic, do you really want all these people trekking into your house? Only takes one person to buy. If I were a seller, I would not.

Chris

at 11:22 am

LG JP with his weekly update – market is heating up a bit in his estimation!

– Weekly sales at 909 (compared to 505 for Apr. 12)

– Active listings at 10,331 (compared to 10,735 for Apr. 12)

“Sales are still down 60% from last year’s volumes so we are not “back to normal” and we’ll see if this trend continues in the weeks ahead. But it is interesting!”

https://twitter.com/JohnPasalis/status/1259861680407937034

Bal

at 2:13 pm

What could be the reason for all this? Why heating up? Must be some reason

Chris

at 2:24 pm

Still 60% below last year, so keep things in perspective. It’s “heating up” compared to the absolutely brutal metrics from a month ago. Things are less-bad than they were, but still far from normal.

“I also agree that we’re early into this crisis and haven’t even begun to see the ramifications. It’s a lame duck RE market right now- the numbers mean little. IMHO, it will play out over the next 1-2 years as bankruptcies, defaults, POS’s rise. Job’s either return or disappear.”

– Donna Bacher, Broker at PureRealty Brokerage

https://twitter.com/loveurhome/status/1259887466435227649

Bal

at 3:02 pm

But if the market is heating up that means people are confident that economy will improve faster…same way how the stock market is trending…..otherwise if people think the market will be further down….i think they will hold the buying…..i might be wrong

Chris

at 3:22 pm

Stock market is a bit of a different beast, especially with the Federal Reserve wading into things.

But yes, I’m sure some people are buying homes because they’re optimistic. Compared to last year though, it’s still significantly fewer. And we’ll have to wait to see the full impact of this recession.

Natrx

at 4:01 pm

FOMO is real for many, and yes, there were many who paused their activity. Seeing that it looks to be trending back to ‘normal’ in the 2nd half of this year vs next year, they’re moving.

Who knows, but it just shows you the pent up demand and inflationary policy that is seeing itself in housing assets.

Appraiser

at 11:31 am

“Since weekly sales bottomed out the week of April 11th, they have have been increasing every week since then. For the week ending May 9th weekly sales are 63% higher than they were on April 11th…

…Sales are still down 60% from last year’s volumes so we are not “back to normal” and we’ll see if this trend continues in the weeks ahead. But it is interesting! I don’t know of any credible housing analyst who thought we would return to bidding wars and bully offers so quickly ” ~John Pasalis

https://twitter.com/JohnPasalis/status/1259861680407937034

Chris

at 11:39 am

Already posted, 9 minutes prior.

Appraiser

at 12:25 pm

“Active listings on the other hand have been trending down since April 11th, although we did see a slight increase last week. The combination of rising demand and declining listings has made the market more competitive.” ~LG

Chris

at 12:45 pm

Already posted, 9 minutes prior.

Appraiser

at 12:50 pm

“Weekly thread looking at 416 sales transactions. More signs of stability, or even potential start of recovery.” ~Scott Ingram

https://twitter.com/areacode416/status/1259883793512640516

Chris

at 12:57 pm

Great news!

“Condos did better (less worse) than freeholds when comparing year-over-year (YoY).”

Caprice

at 3:28 pm

Yeah, but you conveniently omitted the line about bidding wars and bully offers 😉

Chris

at 3:30 pm

I’ve been asked to cut down on the length of quotes! Plus, I knew I could count on appraiser to highlight those aspects.

Chris

at 12:59 pm

“ cc: everyone who keeps saying telling me that immigration and international students will keep the bid under Canadian housing this year.”

– Frances Donald, Global Chief Economist & Global Head of Macroeconomic Strategy, Manulife Investment Management

https://twitter.com/francesdonald/status/1259864720426897410

Caprice

at 4:55 pm

There is no shortage of immigrants and students wanting to get into Canada… maybe even more so now. For students, coming here is a way to get a foot in the door, not just about getting an education. The question is, will the federal and provincial government continue to be supportive for newcomers?

https://globalnews.ca/news/6915220/coronavirus-canada-immigration-impact/

https://www.cicnews.com/2020/05/iec-visa-holders-can-now-come-to-canada-0514329.html

https://www.cicnews.com/2020/05/pnps-still-opening-pathways-to-canadian-pr-0514299.html

Chris

at 9:50 am

“The question is, will the federal and provincial government continue to be supportive for newcomers?”

I doubt it. Agree with Pragma’s statement from the other day: ” If a politician wants to end their career all the have to do is allow lots of immigrants in while the country is hemorrhaging jobs and the unemployment rate is 10+%”

From the Global News article you shared: “Considering this data and the grave current economic and logistical complications, if the current pattern mirrors the experience of the Depression, it is not too much of a stretch to suggest that what looms is a drastic drop — as much as 90 per cent — in immigration for several years.”

And from Ben Rabidoux: “Population growth will probably surprise people to the downside in Canada from this one dynamic along….and that’s not getting into the politics of immigration with unemployment in the teens”

https://twitter.com/BenRabidoux/status/1259664591673602048

cyber

at 2:21 pm

Laneway housing is here to stay – uptake will be slow, but soon enough most of the laneways will be secondary suites with an occasional garage remaining. The real estate is just too valuable, and with boomers retiring and wanting to age in place & their kids not being able to afford either downpayment or the mortgage on a home in the city, multi-generational living on the same lot will become more commonplace. Grandparents nearby to take care of grandchildren, millennial and gen X ‘sandwich generation’ taking care of their parents in turn. Especially since multi-generational living is quite commonplace among many immigrant cultures.

Kyle

at 4:46 pm

I agree 100%. They make a lot of sense for families. A family can live and grow in the main house while collecting rent from the laneway house, offsetting their costs. And eventually when the kids move out, the empty-nesters can then move in to the laneway house and live off of the rent from the main house.

The uptake has been slow, but not due to lack of interest. It’s because getting a permit has been damn near impossible. Of the hundreds of kilometres of laneway in Toronto, very few houses actually qualify, due to the 45 meter front door rule and fire access rules. Now that those rules have been successfully challenged at the BCC and they’ve loosened the fire access requirement, to allow that access to be on shared property, i think uptake will take off in the near future.

The examples David has posted actually look really nice to me.

cyber

at 9:02 pm

I’m betting that the examples of laneway dwellings that David posted look a whole lot nicer than ‘entry level homes’ with front door on ‘actual street’ that’s part of the same lot…

Appraiser

at 7:37 am

“In case we need more evidence of how unequal the impact of COVID-19 shutdowns have been on Canadian workers. Job losses have been 75% larger among workers who rent their homes than among home owners.

The economic shock has been exceptionally sharp, but good reason to think the recovery will be too. Crises appear the worst when you’re in the midst of them.”

~Mikal Skuterud Professor of Economics, University of Waterloo

https://twitter.com/mikalskuterud

“I think there is too much pessimism about the future path of the labour market and economy.

Yes, the labour market took a terrible hit in March and April. We will not get *all* of that back soon. But we will get *some* of it back–and soon.”

~ Kevin Milligan UBC Vancouver School of Economics.

https://twitter.com/kevinmilligan/status/1259641013095632898

Chris

at 9:58 am

Prof. Skuterud’s statements are based on the Labour Force Survey. We’ve already discussed how this doesn’t capture the full extent of employment and income impact – see Frances Donald quote on CERB numbers compared to LFS.

On Prof. Milligan’s comments, absolutely things will get better. But probably not back to normal for a long time:

“IN MANY THINGS 90% is just fine; in an economy it is miserable, and China shows why. The country started to end its lockdown in February. Factories are busy and the streets are no longer empty. The result is the 90% economy. It is better than a severe lockdown, but it is far from normal. The missing bits include large chunks of everyday life. Rides on the metro and on domestic flights are down by a third. Discretionary consumer spending, on such things as restaurants, has fallen by 40% and hotel stays are a third of normal. People are weighed down by financial hardship and the fear of a second wave of covid-19. Bankruptcies are rising and unemployment, one broker has said, is three times the official level, at around 20%.”

https://www.economist.com/leaders/2020/04/30/life-after-lockdowns

Chris

at 10:06 am

University of Chicago paper: COVID-19 Is Also a Reallocation Shock.

“We find 3 new hires for every 10 layoffs caused by the shock and estimate that 42 percent of recent layoffs will result in permanent job loss”

https://twitter.com/francesdonald/status/1259881521529475072

Verbal Kint

at 11:07 am

To put some numbers on it, I’d consider 10% unemployment four months from now to be a quite steep rebound. 10% unemployment with serious underemployment for many of those in jobs. That’s a level we haven’t seen in almost three decades, and would not be auspicious for household formation or immigration. But better than today, certainly!

Chris

at 11:20 am

Given that effective unemployment is currently 31.9%, getting to 10% in four months would be quite the achievement.

https://twitter.com/trevortombe/status/1258752040164982785

Verbal Kint

at 11:39 am

It would indeed. I think that whatever your estimate for the maximum level of unemployment consistent with a healthy real estate market, and the minimum level of unemployment we’re likely to see for the rest of this year, there’s a big gap.

Saying some (or even many) jobs will come back quickly is mere qualitative boosterism. Putting numbers to it — not even base case numbers, but optimistic ones — makes real how crappy things are likely to be.

P.S. Isn’t this all just gazing into the crystal ball that Appraiser claims nobody has (when convenient to his talking points)?

Chris

at 12:05 pm

“Saying some (or even many) jobs will come back quickly is mere qualitative boosterism. Putting numbers to it — not even base case numbers, but optimistic ones — makes real how crappy things are likely to be.”

Very good point, and absolutely true, those predictions are more along the lines of well wishes. And even still, a massive improvement to unemployment will likely leave us well above pre-Covid levels.

“P.S. Isn’t this all just gazing into the crystal ball that Appraiser claims nobody has (when convenient to his talking points)?”

Yep, pretty much. Predictions, anecdotes, metaphors – these are all ridiculed when used counter to his opinion. But completely fine when used to advance it.

Appraiser

at 12:33 pm

“Freehold Active Listings Up 2.0% WoW, but rolling 30 days of sales is Up 10.1% in that time, hence market tightening. Active Listings Up 1.8% WoW, while rolling 30 days of sales is Up 14.1%.

…Condos sold conditionally continue to increase …Share of listings on a Price Change continues to trend downward, which I take as another sign of strengthening…”

~ Scott Ingram CPA, CA

https://twitter.com/areacode416/status/1260238727399514113

Chris

at 1:33 pm

“The dichotomy in sales volumes and prices reveals an inherent characteristic of housing prices: they are sticky. Like wages, which do not decline as much during a recession as employment numbers do, housing prices have a way of sustaining themselves in short-lasting economic crises. However, all bets are off if a crisis lasts for a more extended period and has sustained job losses.”

https://business.financialpost.com/real-estate/mortgages/why-housing-sales-and-prices-are-marching-to-different-tunes

Pragma

at 2:24 pm

Housing is a slow moving inefficient market. When new information arises in stock markets what happens? You get a million transactions within seconds and that new information is then incorporated. Housing is the complete opposite – it takes a long time to get price discovery. You’ll have a house sell for $20k lower than the last … then a month later another house will sell for $20k lower than that one, and so on. When the RE market crashed in the US in 2007/8, home prices didn’t actually bottom out until 2012. I think the same will happen here.

Chris

at 3:07 pm

Yep, it will take time for effects to manifest. Between slow moving market and government programs, not surprising that many, e.g. John Pasalis, think we see true test of real estate in the 6-12 month time frame, rather than at present.

Carl

at 3:12 pm

“I think the same will happen here.”

Fair enough, but this is still an opinion. Your opinion. Based on your gut. Too much of this is going around IMHO. My advice would be to follow LG (sorry, John, but it’s the new meme, at least on TRB) in looking at numbers/statistics/facts (yes, Virginia, facts still exist). When the numbers “tell you” to be bullish, be bullish. When the numbers “tell you” to be bearish, be bearish. Do I need to trot out the old John Maynard Keynes chestnut?

Kyle

at 5:37 pm

Carl you are bang on!

I believe it was Pragma the other day, going on about how the bears area ll about data, and the Bulls are all about feelings. What a load? Just look at this thread. Appraiser is the one actually quoting data and stats. The bears, are the ones quoting other people’s opinions, interspersed with their own opinions.

Chris

at 5:50 pm

“Appraiser is the one actually quoting data and stats. The bears, are the ones quoting other people’s opinions, interspersed with their own opinions.”

Verifiably incorrect.

Here are some of my comments on this blog post:

Data: “– Weekly sales at 909 (compared to 505 for Apr. 12)

– Active listings at 10,331 (compared to 10,735 for Apr. 12)”

Data: “Discretionary consumer spending, on such things as restaurants, has fallen by 40% and hotel stays are a third of normal.”

Data: “We find 3 new hires for every 10 layoffs caused by the shock and estimate that 42 percent of recent layoffs will result in permanent job loss”

Data: “Given that effective unemployment is currently 31.9%”

Data: “Canadian households now own $5.7tn worth of property assets, according to Statistics Canada, nearly three times more than 15 years ago…property-obsessed Canadians are among the most indebted in the developed world, with debt at 101.6 per cent of GDP in the last quarter of 2019, according to the Bank for International Settlements.”

And here are some from appraiser (who has admittedly also shared data), sharing opinion:

Opinion: “I think there is too much pessimism about the future path of the labour market and economy. Yes, the labour market took a terrible hit in March and April. We will not get *all* of that back soon. But we will get *some* of it back–and soon.”

Opinion: “Canada’s social safety net and banking oligopoly are still far superior, especially in comparison to the unmitigated chaos and corporate grift currently taking place down south.”

Kyle

at 6:00 pm

this thread…

Chris

at 6:06 pm

Ok, for argument’s sake, let’s limit it to this thread only:

https://torontorealtyblog.com/blog/monday-morning-hodge-podge/#comment-120136

Opinion: “Canada’s social safety net and banking oligopoly are still far superior, especially in comparison to the unmitigated chaos and corporate grift currently taking place down south.” – Appraiser

Data: “Canadian households now own $5.7tn worth of property assets, according to Statistics Canada, nearly three times more than 15 years ago…property-obsessed Canadians are among the most indebted in the developed world, with debt at 101.6 per cent of GDP in the last quarter of 2019, according to the Bank for International Settlements.” – Chris

Kyle

at 6:22 pm

You’ve clearly missed the point as usual. Whether you’ve posted a few stats (whose sensitivity to Toronto Real Estate is highly questionable) or whether Appraiser has posted a few opinions is not the point.

The point is where do you guys get off quoting other people’s feely opinions and adding your own feely opinions about the market when you’ve posted this ridiculously laughable claim the other day.

“The bearish arguments look at the numbers, the economics, and markets. The bullish ones all seem to rely on feels. ” – Pragma

“Good points, Pragma. I agree on pretty well all counts. Bullish arguments lately seem to be focused on low sales volumes making pricing data meaningless, or highlighting 2010-era bears (e.g. Garth Turner, Hilliard MacBeth) who were wrong. ” – Chris in response

Chris

at 6:33 pm

Great, so you agree that when you said “Appraiser is the one actually quoting data and stats”, you were wrong.

Kyle

at 6:42 pm

No, when i said Appraiser is the one actually quoting stats, it means you and Pragma were wrong.

By the way, you may have quoted a few stats (which again are highly questionable whether they have any sensitivity to Toronto Real Estate), but when i look at all the comments on this blog the amount of feely opinion from the bears far overwhelms any sort of data.

Chris

at 6:49 pm

“Appraiser is the one actually quoting data and stats”

“By the way, you may have quoted a few stats…”

“it means you and Pragma were wrong.”

Ok.

Geoff

at 12:13 am

Hey nerds no one cares.

Chris

at 10:35 am

You cared enough to comment in the middle of the night!

Appraiser

at 3:19 pm

Why would Canada’s housing market follow the U.S. this time? Our economic recovery was much faster after the GFC.

Canada’s social safety net and banking oligopoly are still far superior, especially in comparison to the unmitigated chaos and corporate grift currently taking place down south.

“Can Canada’s property market repeat the success of 2008?” ~ Jason Kirby (?)

https://www.ft.com/content/74c1f00c-75b6-11ea-90ce-5fb6c07a27f2

Chris

at 3:38 pm

From the article:

“Canadian policymakers no doubt hope previous examples of the market’s resilience play out once more.

Canadian households now own $5.7tn worth of property assets, according to Statistics Canada, nearly three times more than 15 years ago.

…property-obsessed Canadians are among the most indebted in the developed world, with debt at 101.6 per cent of GDP in the last quarter of 2019, according to the Bank for International Settlements. And with unemployment expected to hit 15 per cent in the second quarter, that leaves the market in a precarious state going into this recession.”

John Pasalis, on comments in the article:

“Canadian real estate brokerages unfazed by the impact this recession & biggest economic event of our time might have on housing

How can they mitigate their client’s risk when they see no risk ahead?”

https://twitter.com/JohnPasalis/status/1260213801728819200

condodweller

at 3:39 pm

It’s important see what’s going on around you and be realistic. All of our banter is academic unless you are in a situation where you may want to or need to transact in the near future. In situations like these I like using my gut feel as numbers tend to be trailing i.e. by the time decide to act the market may have moved against you.

I’m hearing that there are concerns in the US that companies are using the pandemic to “right size” and not hire back everyone who was laid off prior. And that’s only the companies which will survive, never minds the permanent job losses due to failed businesses.

There are way too many variables and unknowns to predict how things will shake out.

Chris

at 3:45 pm

“I’m hearing that there are concerns in the US that companies are using the pandemic to “right size” and not hire back everyone who was laid off prior.”

Sounds about right. As I shared in another comment, a recent University of Chicago research paper “estimate that 42 percent of recent layoffs will result in permanent job loss”.

https://bfi.uchicago.edu/wp-content/uploads/BFI_WP_202059.pdf

Carl

at 4:16 pm

“I’m hearing that there are concerns…Sounds about right…”

Sorry, Chris. Not good enough. Okay, sure, University of Chicago researchers, but “I’m hearing” and “sounds about right” are simply not good enough, even from respected (not that we actually know they are) researchers.

Chris

at 4:35 pm

Carl, suggest you read more carefully. It was Condodweller who wrote that they were “hearing” about layoffs not being rehired. I shared the University of Chicago research paper in support of that.

Do you have a concern with or rebuttal to their research? Or are you just going to vaguely suggest that these PhD economists from reputable institutions, and their conclusions, may not be worthy of respect, for reasons unknown?

Carl

at 4:09 pm

“There are way too many variables and unknowns to predict how things will shake out.”

Exactly right, condo.

So why do so many of us (@Chris, @Appraiser, in particular) insist on *predicting* (although always framing their posts as “look at what this ‘expert’ says!”)?

Chris

at 4:29 pm

“So why do so many of us (@Chris, @Appraiser, in particular) insist on *predicting*”

I mean, this what many of us have been doing on this board for years.- trying to predict where the real estate market and prices are going to go. That’s the entire crux of the bear vs. bull debate. That’s the point of our guessing game.

Even David gets into predictions:

“We also need to bear in mind that this was ground zero for how COVID will affect the real estate market and it’s my opinion that this will represent the bottom.”

J G

at 2:53 pm

https://www.cnbc.com/2020/05/12/young-investors-pile-into-stocks-seeing-generational-buying-moment-instead-of-risk.html

Kids these days are not gullible anymore, this is where the money is going. The only demand I see for millennials is buy in first home to start a family, nobody is stupid enough to buy investment property at this point. Again, say it with me – “rent is down!”

condodweller

at 3:43 pm

I guess they haven’t seen the Goldman & Sachs warning of a possible 20% market tumble from current levels. Investment property may not be the best idea for someone who doesn’t own a home yet anyway.

Chris

at 3:19 pm

“We need to start thinking about the ‘economic’ 2nd wave, i.e. the next round of economic shocks that will hit us in 3-6 months. We are delaying/postponing a lot of pain, but we aren’t eliminating it.”

– Frances Donald, Global Chief Economist & Head of Macro Strategy – Manulife Investment Management

https://twitter.com/francesdonald/status/1260272863371833345

Appraiser

at 4:36 pm

Latest mortgage news: https://www.ratespy.com/the-stress-test-rate-might-fall-again-051213689

“RBC…cut its posted 5-year fixed rate by 10 basis points. That puts it at the lowest point since October 2017 (4.94%) and makes it the lowest 5-year posted rate in Canada…

…Who Cares? RBC’s posted-rate cut today has dual relevance:

1) As noted, the Big banks’ posted 5-year rates determine the government’s mortgage stress test. If one more bank lowers its current 5.04% rate, the minimum stress test rate could drop, making it easier for borrowers to qualify for a mortgage.”

Steve Johnson

at 7:15 am

Thanks for sharing this post. I am very interested in this topic. I would like to share this blog with my colleagues, and thanks again just carry on the topics like this… Best Sites for Trending Deals