Last Saturday night, I met a young man at a party who said, “The property taxes we pay in Toronto are utterly insane, and now the city wants to RAISE them? Bastards!”

I have a rule that when I meet somebody at a party, and they take a stance on finance, politics, economics, or (gulp!) real estate, I rarely engage them, since it often amounts to a little more than a you-know-what contest.

But this time, I couldn’t help myself. This young man’s perception is so incredibly distorted, and I fear this might be the perception of many other Torontonians.

Personally, I wish the City of Toronto would raise my property taxes. Please, kind sirs, go ahead…

At the end of this past January, Toronto city council voted 32-13 in favour of a 2.71% increase in residential property taxes, representing a 2.23% overall increase in property taxes.

As we all heard, the meetings were full of childish antics, squabbles, and mud-slinging between none-other than (former?) Mayor Rob Ford, Frances Nunziata, and anybody else that had an opinion that day.

What didn’t receive a lot of coverage, however, was that councilor David Shiner made a motion to pass a 0.00% increase on property taxes! It was brought to the floor by Giorgio Mammoliti.

How ’bout that?

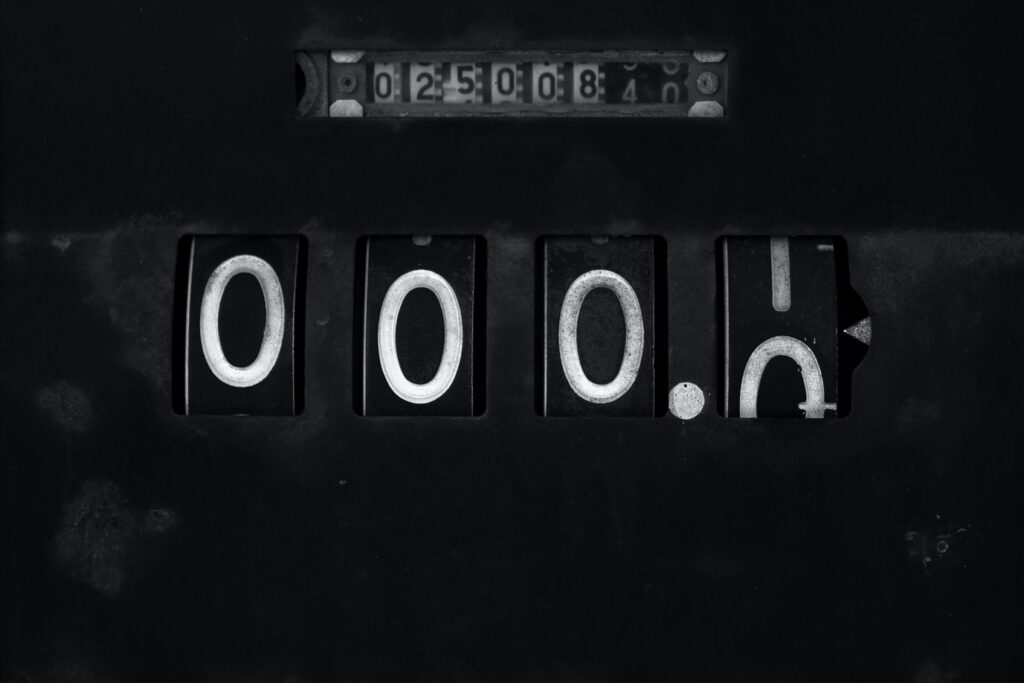

A zero percent increase!

I was under the impression that zero-percent increases were only used as campaign tools, that get politicians elected, to the detriment of the city’s financial health. Mel Lastman froze taxes in his first three years in office, and Rob Ford froze taxes in 2011 in his first year in office.

But imagine freezing property taxes, just as the normal course of business?

That’s insanity!

City councilors like to spout of rhetoric like, “We’re in a time when working-class citizens and business owners need every penny they can get, and raising property taxes won’t help them.”

Well, I’d suggest that these councilors have never opened an economic text book, and have no clue how the world truly works. “Give a boy a fish, feed him for a day. Teach a boy to fish…”

Geez.

Freezing property taxes. Don’t these councilors see the bigger picture? Can’t they see the ECONOMY as a large circle, where one point leads to the next, and the next, and the next, until everything comes back to where it started? Because that’s how it’s taught to twelve-year-olds…

I can’t teach four years of economics in 200 words, so I won’t bother trying. But can we all agree that a zero percent increase in property taxes is a bad idea for the economy at large? Are these city councilors merely posturing for their constituents, who are equally as uninformed?

We live in the biggest city in Canada, and our city is most in need of new infrastructure to support us going forward.

Whether it’s subways, highways, roads, or schools…..or prisons, we are in desperate need of infrastructure.

If this city continues to stagnate growth, the whole thing will come down like a house of cards in ten years, as people are living on top of each other, with nowhere to go, and no way of getting there.

Personally, I am in favour of larger property tax increases as we bring this city forward.

2.71%? 0.5% of that increase is going directly toward funding the $3.5 Billion Scarborough subway project, and although I don’t take the subway, let alone the TTC at all, I would personally say “yes” to a residential tax increase of 4.0%, every year, for the forseeable future.

My property taxes were $2,780 in 2013, and with a 2.71% increase this year, I’m looking at another $75.

$75.

Or 20 cents per day.

When I buy my large Tim Horton’s coffee each morning for $1.80, and give a Toonie to the cashier, my change is exactly $0.20. Every day, I take these two dimes, and shove them into my pocket. A lot of the time, they fall out when I’m reaching for my wallet later on in the day, and if imbedded in a snow-bank, I don’t bother fishing them out. Sometimes when I hang up my coat at the gym, the dimes fall out and roll around on the floor. I’ll give them a quick, honest look, but that’s about it.

Twenty-cents per day.

I know, I know – it sounds like one of those “Save A Child” advertisements on TV. But those places want you to spend the actual price of a cup of coffee; when it comes to the property tax increase, I’m only looking at the change from the coffee itself!

Oh – and I should mention that I split my property taxes with my wife, so it really only costs me ten cents per day…

I’m willing to do my part, or more than my part, to help move this city forward. We can’t all sit around and say, “Not on my dime,” and let the city’s population grow exponentially, while its infrastructure remains the same.

And if you think that Toronto’s property tax increases are in any way unfair, I beg to differ.

Royson James of the Toronto Star wrote a column over the weekend in which he noted:

“Since 1998, city councillors have increased the property tax rate an average of 1.7 per cent a year — less than half the increases that were levied in neighbouring Mississauga and other GTA cities.

In the past decade, the average annual hike in Pickering came in at 4 per cent. It’s been 3.8 per cent in Mississauga, 3.4 per cent in Oakville and 3.2 per cent in Richmond Hill and Ottawa. Toronto? Just 1.8 per cent.”

If you want harder data, fine.

Here are the rates of property tax increases on residential properties, over the last twelve years, as well as the Mayor who oversaw the tax increase:

2013: 2.50% (Rob Ford)

2012: 2.50% (Rob Ford)

2011: 0.00% (Rob Ford)

2010: 2.90% (David Miller)

2009: 4.00% (David Miller)

2008: 3.75% (David Miller)

2007: 3.80% (David Miller)

2006: 3.00% (David Miller)

2005: 3.00% (David Miller)

2004: 3.00% (David Miller)

2003: 3.00% (Mel Lastman)

2002: 4.30% (Mel Lastman)

Of course, you know I love to talk about inflation whenever we talk about the increase or decrease of virtually anything of value on planet earth. So while considering those property tax increases, we also have to look at how the value of a dollar has changed over those years as well.

Here is the rate of inflation in Canada, over the last ten years (from www.inflation.eu):

2013 – 0.94%

2012 – 0.83%

2011 – 2.30%

2010 – 2.35%

2009 – 1.32%

2008 – 1.16%

2007 – 2.38%

2006 – 1.67%

2005 – 2.09%

2004 – 2.13%

2003 – 2.08%

2002 – 2.26%

Note that the larger tax increases (2002 onward) seem to correspond with the largest inflationary times, and the lowest years of inflation (2012, 2013) correspond with the two lowest tax increases, save for the year when Rob Ford froze taxes as nothing more than a campaign pledge.

And what has happened to our property values in Toronto in that time frame?

If our properties, for which we are being charged taxes, were going down in value, then I would understand the argument for a zero percent increase in taxes, or some sort of handle on future taxation. But we all know that property values haven’t gone down over the last twelve years.

And here is the rate of property appreciation in Toronto over the last twelve years (from www.torontorealestateboard.com):

2013: 9.2%

2012: 6.9%

2011: 7.8%

2010: 9.1%

2009: 4.2%

2008: 0.8%

2007: 6.9%

2006: 4.8%

2005: 6.6%

2004: 7.6%

2003: 6.5%

2002: 9.4%

Great.

So property values are increasing, inflation is below 1% but has previously been well in excess of 2%, and………..people are complaining about a 2.71% increase in residential property tax rates?

What am I missing here?

This is a classic case of “having your cake, and eating it too.”

The city realistically needs about $30 Billion to build subways, highways, and roads to ensure that almost 6,000,000 Torontonians can move about the city the day after tomorrow, and I feel as though many citizens simply want the infrastructure built, but don’t want to pay for it, or know how it’s being paid for.

The young man I talked to on Saturday night said, “The city should just pay for the subways on their own, and not take money out of hard-working people’s pockets!”

This guy was living on another planet, and I had no choice but to ask, “Who does the city work for?”

He said, “Well recently, it would seem they work for themselves!”

He didn’t know the first thing about politics, economics, or real estate (don’t even get me started on that…), and he was like a child in suggesting that the Canadian mint just “print money” to use for infrastructure projects.

This is today’s modern, young, moron, who has no clue what the hell is going on in the real world. And my fear is that these folks are in abundance, and rather than learning about how the economy works, they are rather quick to point fingers, make accusations, and offer flawed suggestions with zero merit, that make even less sense.

I want the City of Toronto to raise my property taxes.

Raise them higher this year, and raise them again next year.

Toronto’s taxes are lower than most other municipalities that surround it, and yet we are the furthest behind in infrastructure that will support the city moving forward.

I’m a fiscal conservative, and believe me – I love my money! The last thing I want to do is pay higher taxes.

But even I can see the folly of our ways.

Our city, which I love dearly, is twenty years behind as it stands today, and if we continue to do nothing, which is exactly what has been accomplished through the first three years of Rob Ford’s tenure, then I can imagine being thirty years behind, ten years from now…

Alicia

at 8:06 am

The race to the bottom is never the way to go. Ever see the movie Elysium? That’s where we headed if we are just looking out for ourselves.

tbone

at 8:13 am

Amen. This brings to mind about number of conversations I’ve had with Ford supporters who tout his ability to “watch out for their wallets” and “respond to calls”. Meanwhile, while he’s concerning himself with filing in potholes, we’re ignoring the crucial infrastructure projects that will define the future of this city.

We’ve got some of the worst commutes and gridlock in North America – the potential positive economic and social impact of resolving or mitigating it could be staggering.

Ed

at 12:00 pm

Rob Ford’s new campaign slogan.

So I lied. You can’t handle the truth!

AndrewB

at 1:12 pm

Ford hasn’t even saved us or individuals moeny though. Every attempt that he has done to prove he has saved money has been completely debunked.

Geoff

at 8:26 am

I’m on board with a tax increase but your argument makes one big assumption — that the extra money will be spent wisely, and not wasted. That’s a big assumption.

Also comparing city of toronto taxes with the burb’s taxes isn’t a fair comparison, is it? I mean, we’ve had a hundred years of taxes already – the police stations, firehalls, sewers, etc should be built already, whereas oshawa/pickering/mordor need to build new ones, and we have more people here so the costs per person should be lower.

Instead we spend time and money debating if bars should open at 6am for one day. I think the world will survive if the bars are closed; get me my #$#$#@ing subway line!

Phil

at 12:17 pm

Subways! Subways! give me subways! on he shepard line where they are really needed!!

now!

Vote Rofo

Patrick

at 12:18 pm

You have to assume that it will be spend wisely. The alternative (not spending at all) is guaranteed not to work.

As for comparing to the ‘burbs, they don’t need the extra taxes for building new infrastructure, that’s what development charges are for. They will collect tens of thousands on every new residential unit to pay for those new firehalls, sewers, etc. Toronto does too. Those development charges are required by provincial law to be spend on capital costs related to new development.

Property taxes are spend (at least the majority of them) on the ongoing operation of City services. The property taxes of new houses in the burbs may for the staffing, operation and upkeep of the new firehall, for example.

Some amount of the extra residential taxes are related to the lower densities in the suburbs.

Brad

at 8:37 am

Good post David. I will steer clear of my opinions of Mayor Ford (it’s hard for me lol) but I agree 100% that the race to the bottom is so not the way to go. Absolutely if there’s a larger increase we want to see money spent wisely but to move this fine city forward there needs to be revenue, and lots of it. This mindset of ‘my tax money’ is so narrow, if we went with that Toronto would be in serious trouble, we’re already light years behind in transit for one.

I’ve always felt property taxes are low in Toronto and would happily pay more to see the city move–figuratively and literally. Two years ago I had to buy a house in the Hamilton area to care for an elderly parent, my property taxes are way high compared to what my Toronto house was, I’m in Dundas so not a new burb but yes obviously a smaller population contributing.

ps saw the spot on Global Morning Show, interesting and fun.

Richard Texas

at 8:57 am

Question: What if the price of coffee kept going up (which it has) and the size of the cup stayed the same? So you are paying for the same delivery of services.

That is what is happening to Toronto

The top four line budget items are Police, TTC, Social Services, Fire.

We spend as much on police as the city of Los Angeles (as %). Really.

Note that I am sure that those services are necessary, however, Toronto spends a disproportionate amount on certain services relative to other cities.

My point is that tax increases without a corresponding increase in value of services that actually benefit the broader population just becomes a mechanism to transfer $$ from the pockets of those who can afford it (ie you) to whatever spending black hole they have out there.

Seriously, look how the TTC has been used as a political football for the agenda du jour. And we are paying for it. That Sheppard TTC line? Jesus. Ya, that worked.

And how does the Police have the largest line item on the budget?

Los Angeles doesn

jeff316

at 9:50 am

Taxes need to increase without a corresponding increase in services just to keep up with inflation, let alone infrastructure replacements, one time costs, and new funding needs.

If increases in prices and costs were matched by increases in quality, volume or amount, relative to the fifteen cents it used to cost a 1.25$ box of Kraft Dinner today would be the size of a refrigerator.

(Psst the crime rates in Los Angeles are higher than in Toronto. Homicide is more than double, in fact.)

Dan Dickinson

at 9:01 am

“This is today’s modern, young, moron, who has no clue what the hell is going on in the real world.”

I’m sure this is implied in the rest of your post, but…it’s not just the young & modern who achieve peak moron.

David Fleming

at 9:59 am

@ Dan Dickinson

Good point!

You don’t have to be 24-years-old with expectations of a 6-figure salary while living at home to be clueless!

I feel as though many of the “families” that relish the idea of saving $50/year in property tax are also clueless about what is needed to move this city forward.

AndrewB

at 12:56 pm

Let’s not forget that some of the people complaining about property tax increases probably also love to spend their money frivolously in consumerist fashion, and wouldn’t ba an eyelash dropping $6.00 on a regular basis for their Starbucks.

wikito

at 10:18 am

While the readers of this blog (myself included) chuckle about an extra $75 a year when we are making > 100K in salary, it is rather presumptuous to think that this is a negligible amount for those making 20K a year (minimum wage).

Annie

at 12:22 pm

Someone making $20,000 a year almost certainly doesn’t own their own home and won’t be paying any municipal taxes…

Alex

at 5:00 pm

Chances are someone making 20K a year is renting, so their rent goes up 2.5% every year regardless of property tax changes (assuming they’re renting in an apartment building subject to the rental raise cap). If they do own then it’s probably worth a lot less than what David does, and so their increase is a lot smaller as well.

I think you’re just making an honest counter-argument, but often rich people like to use false arguments like that to pretend they want lower taxes to help the poor. Higher taxes and services benefit the poor much more than the rich though, and it’s frustrating seeing people taken in by lies like that and campaigning against stuff that benefits them. Like the medicare debate in the US. It’s painful to watch people who can’t afford to go to a hospital marching in the streets against medicare.

Valerie

at 8:50 am

Most hurt by these kind of increases are fixed income-earners like seniors. They are surviving in homes they’ve owned for decades, but they don’t have a huge amount of income coming in. OAP, CPP, maybe a company pension if they’re lucky, but remember that even with modest cost-of-living increases in those pensions, they are still based on salaries they made when earning significantly less than the dollars we earn now. At the time it may have been absolutely adequate to live on $20,000, but 30 years later, that’s poverty. And to be taking home 70% of that in a pension plus government benefits? That ain’t much.

So while I can absorb a 4% property tax increase (despite the $15000/year I’m shelling out for my toddler’s daycare), fixed incomes can’t really tolerate property tax increases. Let’s try to respect that not everyone is in the same demographic or situation as we are.

I’m sure someone’s going to come along and say “then they should sell the house that’s appreciated 1000% and live off that for the rest of their lives”, but to that I respond, “let’s allow our seniors some dignity.” If they are capable of remaining in their homes, we should support them in their efforts to stay for as long as they are physically able. It’s the right thing to do.

Phil

at 12:28 pm

This is a perfect examply why people that complain about the raise of 2.5% on property taxes does not even stop for a minute to think. Like others said who earns 20K will rent instead of own….

Whoever pays 75$ already paid 100K as downpayment for that house plus fees and other taxes,broker fees, maybe has a car and pays minimum 500$ to 1000$ for car and car expenses, plus dinner out once awhile, insurances, etc…. etc…

I dont love tax increases either, but I rather not let me influence by populist cluelest selfish minds and make sure the City does not go broke like others in Canada or US.

Mike

at 10:51 am

@wikito you might want to rethink the idea that anyone making 20,000 a year is paying property tax

Geoff

at 10:59 am

@ Mike – Seniors bro, seniors.

And lest you think they don’t — from the city of toronto website:

” Tax and Water Relief

Unable To Pay Due to Sickness or Extreme Poverty

The City of Toronto offers tax assistance for a person who is unable to pay taxes because of sickness or extreme poverty.

You can make an application to the City Treasurer asking for a cancellation or reduction of your property taxes. This program is not intended to assist applicants on an ongoing basis, but is intended to be one-time or temporary relief due to financial hardship. ”

One-time, not permanent.

Jeremy

at 11:30 am

“Wont’ someone think of the children!!!” – Helen Lovejoy.

Filthy Lucre by Joseph Heath has a good bit about this. Whenever people talk about raising prices on anything people point to seniors/children/the poor etc. who can’t afford to pay the market price, and argue to keep the price low to protect those people. What should actually happen is that taxes/prices should go up, and some other means should be implemented to protect the vulnerable.

If the GOAL is to protect the vulnerable then keeping taxes low is just an inefficient means to do that.

If as a society we decide we want to make sure seniors can afford their homes then we should find a better way to achieve that rather than artificially keeping taxes low for *everyone*.

Geoff

at 11:45 am

Hey I’m not totally against a tax hike Jeremy. Just responding to the question about who in the world earns $20K a year and might own property.

Al

at 3:00 pm

Hahahahah I can’t believe how so many Torontonians believe that more taxes, means more infrastructure….. How naive??? It seems that despite the fact of being a fully metropolitan and multicultural city, there are some people who never left the shell and would largely benefit from some open mind to learn and inquire about other possibilities. The hypothesis would hold, only if the money were to be properly managed and used!!!!!!!!!!! I fully agree with Geoff above.

Better administration perhaps could result in better infrastructure. Why don’t you check first what was the infrastructure budget for the city before any tax increase? And what was it after?

It is very frustrating, at least for those who once had to work very hard to earn one dollar, to see how the taxes increase without any additional benefit and then realize how many big mistakes and unfair things, some illegal, happen with those who manage those funds.

Get your house in order first, and then increase the taxes as much as necessary to properly sustain it, not like most politicians today desperately looking for increased budgets for their managing and for their own benefit, arguing they need taxes for good reasons, without having demonstrated that the more taxes have resulted in better living for everyone. With all my respect your point of view, and actually, of the majority writing here in agreement, is to me very much shortsighted. Nevertheless, I respect it. Cheers!

Annie

at 12:17 pm

Great post David – it’s a view I’m starting to hear from more and more people. Hopefully it will continue to catch on.

I like your various comparisons across time (inflation, real estate value increases) but there must be a way of presenting the information to make it more accessible.

The truth is, I don’t even know what people are referring to when they talk about a tax increase. It’s not the mill rate – that went down from 0.55% in 2012 to 0.53% in 2013 (excluding the education portion). How does this translate into actual dollars?

If someone had a (very) fictional $100,000 house in 2012, they would have paid $550 in municipal tax.

In 2013, the house would be worth $109,200 and municipal taxes would be $578.76 – so even though the mill rate went down, the tax paid went up, by 5.2%, because real estate values went up so much. But wait! We need to take inflation into account.

$578.76 is $571.68 in 2012 dollars, so the increase is only 3.9% after taking inflation into account. Still higher than the 0% we would expect if taxes were simply keeping pace with inflation.

But wait again! House assessments aren’t updated yearly which means that while actual real estate values have gone up by 9.2% between 2012 and 2013, the increase in real estate value on paper as documented by MPAC will not have gone up that much – only some houses will increase in value between 2012 and 2013 on MPAC, so what we really need is the average % increase in the value of houses as reported by MPAC, which will certainly be lower than 9.2%, in order to do a proper calculation.

Or maybe this all proves my point that I haven’t got a clue what “tax increase” refers to, and that we need a better way of explaining how taxes change over time, after accounting for real estate appreciation and inflation. I, for one, would like to see how the taxes on a $100,000 house in 1990 change from year to year, expressed in constant dollars. Any article that fails to express money in constant dollars is a non starter for me. Care to take a stab at it? Cause I have absolutely zero background in economics and figure I’m probably making some crazy mistake here somewhere…

Annie

M

at 1:16 pm

Annie, regarding tax rates and assessments, the following on the City of Toronto’s site provides a lot of good info.

http://www.toronto.ca/budget2013/2013_budget_summary/pdf/revenues.pdf

And Dave, I thoroughly agree with your “raise my taxes” view. We need infrastructure.

nancie

at 1:28 pm

I attended a budget presentation put on by my city councillor prior to the debate at city hall. Learned a ton as to where the various tax monies come from, how they could be used etc. but most importantly…. I came away with the understanding that we have some of the lowest property taxes in the world, and that a slight increase per month per household would make a world of difference to the city now… and it’s future. These points you make in your article David…well done! Perhaps Municipal Taxes 101 should be mandatory….for the public AND our elected representatives. A front row seat reserved for Mayor Ford!

engee

at 1:34 pm

I not only welcome an increase in property taxes in order to address the infrastructure deficit in this city, but I would welcome some kind of equalization process across the city for property taxes. It’s such a crapshoot these days what you pay for property tax. My house in Beaconsfield cost almost 50% more than my friend’s place at Queen and Coxwell, yet her property tax are a good 30% higher than mine. It makes no sense.

myeo

at 1:57 pm

Is her assessment 30% more? It should be your assessment multiplied by the tax rate. If you are finding a huge difference between your assessment-to-sale ratio (your assessment divided by the time adjusted sale price to the base date of valuation – January 1, 2012), then you should either appeal your assessment (if your assessment is much higher than your sale price) or be happy you are under-assessed (if your assessment is much lower than your sale price).

Joe Q.

at 2:10 pm

David, I agree with much of what you and other commenters have written. I would add that although Toronto has a relatively low residential property tax rate, the business property tax rate is quite high (much higher than surrounding municipalities).

And overall, there seems to be something not quite right about funding the budget of a large government — police, fire, transit operations, parks, etc. — almost entirely out of property taxes. Many cities in the USA have a very small municipal sales tax; from what I read, LA has implemented this very cleanly. We should think about doing something similar (or at least we could think about doing something similar if our Mayor were not so allergic to practical solutions).

David Fleming

at 10:38 pm

@ Joe Q.

Good point about property tax on businesses and commercial properties.

During the mid-2000’s, we lost hundreds of Toronto businesses that relocated in the 905.

I recall reading somewhere that commercial real estate taxes went up FOUR TIMES that of residential in the 2000’s.

johnnychase

at 4:37 pm

You’re paying $2700 in taxes for a condo valued at $800K? Well that’s the problem right there. Dave – how about your condo’s taxes go up to the normal amount of $6-7K and then you can have 4% annual increases.

David Fleming

at 10:37 pm

@ johnnychase

Short of going to MPAC myself and asking them to reassess my taxes, I don’t know what else I should do.

They know what I paid for the condo in 2011, and my tax asessment for 2014 is still well, well below that number.

A Grant

at 4:41 pm

Couldn’t agree more David. Living in Ottawa, I’ve found that most folks who rail against property tax increases usually live outside the greenbelt and feel all city taxes are being used irresponsibly to subsidize pet projects for the downtown core (bike lanes and the like) or large scale infrastructure projects they themselves will never use (such as the light rail expansion). Of course, what they fail to acknowledge is that, living in the ‘burbs, it’s my (significantly higher) property taxes that are subsidizing their car-dependent lifestyles and the infrastructure costs required to support their 3000 s/f homes.

And that’s fine. I realize that not everyone can live in the city. So I’m fine with my property taxes going to support infrastructure that will not directly benefit me. That’s what living in a community is all about.

joel

at 5:39 pm

David –

I don’t think that have have seen a blog post by you on it before, but what is your take on the Toronto Land transfer tax? I personally don’t like it, but it can help to explain why our property taxes are lower as there is such a high cost when purchasing..

Joe Q.

at 8:12 pm

Just FYI, the municipal land transfer tax was introduced only in 2008.

David Fleming

at 10:36 pm

@ Joel

I don’t like the Toronto LTT, but it’s hard for me to say that without people suggesting I’m biased, as a Realtor.

I don’t like it because it’s a “double tax,” or something that already exists and is imposed by one governing body, and then is basically “copied” by another.

It’s like the municipal governemnt went to a restaurant, looked over at another table, and simply said, “I’ll have the same steak as that guy is having.”

How could they DOUBLE the tax we pay? Think about all this quibbling about a 2.71% increase in property taxes, well what about a 100% increase in land transfer tax?

It’s insane to think if you want to buy a house in Toronto for $1 Million, you have to hand over $32,000 – just for purchasing!

Most new taxes are small, and insignificant. Sometimes they creep up on you, like all of Dalton McGuinty’s environmental taxes. I love paying a “disposal fee” when I buy NEW toner, since the assumption is that I’m disposing of OLD toner. But a massive tax like LTT just came out of nowhere.

Geez, you got me all riled up! And I have to go to bed soon!

Paully

at 11:42 pm

The greedy Toronto Land Transfer Tax is probably a good part of why you are complaining about a lack of inventory in the 416. Who wants to have to shell out thirty or forty grand for the sake of a couple of keystrokes at the land registry office?

Phil

at 12:48 pm

I don’t think LTT affects the lack of inventory, I was looking for houses before the LTT and I also had lack of inventory… it took me more than 6 months to find the house i wanted.

Plus for you to say that LTT would keep people away from buying houses, it would be the same thing as you being able to buy the house and not afford the property tax increase.

If you had the money to pay for a 600K house , paying 10K Provincial LTT, paying 120K downpayment, paying 4K a year in property taxes, why the hell you will not be able to pay an extra 10K for Toronto LTT? Sales did not even crashed just after the Toronto LTT. I really don’t get it…

The sellers do not pay Toronto LTT, so why are they not selling??? LTT is not the cause. I don’t understand why no one goes through the whole thought process and just shoot conclusions…

Seriously guys…

The only way it could affect inventory is by affecting speculators that normally would buy and sell the same house in almost the same condition to make a profit. The only peple i see this LTT affecting is the flippers and real estate agents.

I am a real estate investor, I know what I am talking about. I buy houses with LTT no problem, but I do not flip them, I buy and hold.

Why don’t you say the lack of inventory is because, a lot of people are settled in their newly renovated house, or retired enjoying mortgage free, because of crazy high prices , there is no new land , no new houses being built, and too many people wanting to buy a house instead of a condo?

Phil

at 12:51 pm

Guys, seriously, ask the real estate agents and investors what happened after Toronto LTT appeared: nothing happened.

I was buying during that time and all you felt was a blip, like the blips you see when Flaherty changes Mortgage rules, you feel something for 3 months and then, nothing… same as old days…

People are still buying like crazy nowadays after all those mortgage changes and LTT taxes…

Joe Q.

at 9:34 am

Always seemed to me that, at least in the market for semis and detached homes in the 416, the municipal LTT was just a rounding error when compared to the differences between successful and unsuccessful offers in a “multiple-offer scenario”.

Paully

at 7:44 am

I did not mean that the LTT was the only problem, but it at the very least has to be part of the inventory problem.

Let’s say someone in Toronto wants to sell their small $700,000 house and move to a larger or nicer $1,000,000 house.

The combined LTT on that million dollar purchase would be $32,200. Real estate commission on the $700,000 sale at 5% plus HST is $39,550. Add in some money for staging, moving, legal fees. It’s a safe bet that there will be at least some expenses incurred at the new house. Things like painting, landscaping, appliances, flooring. That stuff would all depend on the house and the buyer. Just adding up the known numbers you are pushing over $75,000.

That $75,000 adds 25% more to the whole proposed move-up budget, all for basically dead, sunk costs. Now maybe most people won’t care, since that is just the cost of moving up, but some people are going to ask themselves, “how much will a $75,000+ renovation at my existing house get me?” If they like the answer, then maybe they stay and renovate build an addition rather than move. If it is going to cost $375,000 to move, maybe they spend $150,000 and stay. And boom, there is one less house that comes to market.

The frictional costs of moving in Toronto are too high.

Joe Q.

at 9:37 am

You may not be disposing of old toner, but you’re probably disposing of an old empty cartridge (which often contain electronics).

Geoff

at 11:58 am

A tax on consumption is not the same as an annual tax on income. I have a simple way of avoiding the double land transfer tax by not buying a house every year; no way to avoid the property one.

Potato

at 12:15 pm

The LTT is a great tax. It just gets priced in: if you have to pay 1-2% more for a house or condo because of the new LTT, you just offer 1-2% less and you’re in the same boat you were before. Sure, sellers took a slight one-time hit, but it was introduced at a time when prices in Toronto were increasing so fast that a ~1-2% hit was not noticed at all — as Joe says, just a rounding error in the bidding wars. Or to put it another way, with prices increasing about half a percent per month, sellers were just set back about 2-3 months.

It’s a bit unfortunate that it’s levied on the buyer’s side rather than the seller’s, but that was to piggy-back on the provincial infrastructure so the admin costs are kept low for the city. This introduces the hardest thing to understand about the LTT: the buyer cuts the cheque, but the sellers pays.

And if you want to call it a doubling, well, it was a doubling off a low base. Before the municipal LTT owners paid ~0.8% per year just to hold their real estate, but only ~1% to sell it.

Now the vehicle registration tax was a double-taxation and a poor tax: the cost of parking or buying a car didn’t get cheaper to compensate Torontonians, and it was too easy to evade if you had a friend in the 905 whose address you could use to move your registration. And it wasn’t even introduced at a time when car ownership costs were otherwise decreasing so the overall effect would be hidden: gas prices were rising, as was insurance and parking.

Jason

at 4:58 pm

As a landlord in Montreal and Toronto, I am able to compare the two and I can safely say that the property taxes in Toronto are much lower then Montreal. On a 650 sq ft condo, I pay $1,900 a year in property tax and educational charges to the City of Toronto, while a similar priced condo in Montreal costs me $3,200 a year in property taxes and school taxes and that’s before the PQ has their way with us in the upcoming budget. The Quebec property market will be on life support in less then 5 years!

Joe Q.

at 9:33 am

From what I have read, the Montreal RE market is already in serious trouble. Over 12,000 condos listed for sale on Montreal MLS in January. They are already far above one year of inventory. Quebec City is even worse.

Rob Fjord

at 1:27 am

David…a fiscal conservative for higher taxes!…surely you jest.- perhaps a fake fiscal conservative, like our mayor rob ford, sure hes a good penny pincher, but never a bad word for the wasteful social housing scheme the city runs, i dont know the numbers, but eliminating that mess could build some major infrastructure. And how many multi millions do we waste on the homeless, mostly for paid staff to twiddle their thumbs. Anything the gov can do, private sector can do better, cheaper. didnt mel lastman turn down developers offer to build the shep subway for free?- brilliant mel.

ford privatized some garbage (thanks to doug holyday) why not privatize snow plow, parks and rec, hell why not privatize city council, evil corporations can then just by the office outright instead of greasing some politician. Toronto taxes are high in the extreme, ford talks gravy but he never really showed the real gravy or pursued it, government is synonym for waste, and the less of it the better. toronto could have been criss crossed with subways, instead we blew the $ on warehousing useless people in stalinist buildings. what happened to poor people sharing the rent? large beautiful heated underground parking lot at the social housing building near me…just 400 meters from a subway station, seems like every tenant owns a car. yeah lets build more of these atrocities, waste more $, and while were at it, lets introduce more daycare regulation to shut down more private spaces so gov can then tax more to recreate them. toronto taxes are astronomical- no joke…would i end up paying more to private companies if everything was private?-not bloody likely. privatize it all

Faisal Khan

at 10:11 pm

Hi, Every one,

I like you to pay attention about the tax raise.

I don’t understand one thing.

You know the economy is slow and Toronto city want to raise taxes. From where the poor people pay for the tax. They live there for ages and now city of Toronto want then to pay more taxes.

There income is the same no change now you tell me how they survive on limited income they need food as well and pay al expenses of the houses like electric, etc, etc and food as well for their families.

We are all not that rich if we are then the story is entirely different.

But here in Toronto, all kind of people live in harmony we all know s that.

Now the city of Toronto raise taxes. Give the poor people a break in their lives.

How can new man bought a house in Toronto when they saw the city of Toronto raise tax thet don’t buy a house. they move away from the city of Toronto and buy some where else then it is a hugh loss of the city of Toronto where they have high taxes they don’t get a single penny.

Who has the loss it the city of Toronto . that why in my opinion they should not raise the tax. In my eyes they have In loss in the long run.

Thank you for your time.

From:

Faisal Khan.

Amelia

at 1:19 pm

According to the city’s analysis, the top three areas Toronto property taxes contribute to are: Police Services, TTC and Debt Repayment.

2013 Link –> http://www.toronto.ca/budget2013/2013_budget_summary/howtax.htm

2012 Link –> http://www.toronto.ca/budget2012/2012_budget_summary/howtax.htm

2011 Link –> http://www.toronto.ca/budget2011/2011_budget_summary/howtax.htm

As the second largest expenditure, the TTC is its own entity and I consider it infrastructure spending. But what of other kinds of infrastructure spending?

The graphs don’t make it clear to me how much of Toronto property taxes are actually spent on city infrastructure above and beyond the TTC and after reading your article, I really want to find out!

This Star article from October of last year (link below) references a study that found “in Ontario at least, fuel taxes and other fees paid by motorists cover between 70 and 90 per cent of annual road construction, maintenance and policing costs.”

More shockingly, the article states: “And in the Greater Toronto and Hamilton Area, road users paid more in taxes and fees than it cost to operate the road network.”

Link –> http://www.therecord.com/news-story/4160052-motorist-fees-taxes-cover-70-90-of-road-costs-conference-board-study/

I guess my question is, if motorists are covering the majority of costs for roads and related infrastructure through fees that only motorists pay, is it accurate to state that an increase in Toronto property taxes equals more infrastructure spending?

Julian

at 6:39 pm

If I recall, there is an option to make an additional voluntary contribution over and above the required tax amount when paying your taxes.

Why don’t you do that, David?

natrx

at 4:15 pm

The real impact of inflation is higher than 2%. Since food and energy costs are removed. Just a dumb thing to do. It’s more around 6%.

Asos Dress

at 2:03 am

Hi Willena. Yes, persistence and consistency — good words to live by, which is hard for a flibberty-gibit like me. But I’m working on it. I appreciate your comment.

Asos Dress http://www.asosdresses.net

Chris

at 10:02 pm

Although this article was posted a few years back, I am interested in finding the property taxes in toronto for different types of properties. I noticed you have a list of the rate changes, do you have data on the actual rates? I have also tried the City of Toronto Archives.

Thanks!