Oh boy. Here we go again!

My “predictions” blog post for the fall of 2016 set a TRB-record with 202 posted comments, and the debate was fierce.

Will the 2018 predictions be any different?

As I remain exceptionally bullish for the Toronto market both long-term and medium-term, I think it follows that my short-term outlook has to be partially bullish as well.

Let’s look at some of the top stories that lay ahead for 2018, and my predictions for the market…

The Christmas holidays are a strange time for me.

I basically work non-stop from January 2nd until the end of June, and spend the summer working, save for Canada Day weekend at a cottage and two weeks in Idaho before the market ramps back up again after Labour Day.

Real estate is a fast-paced, dynamic industry, and those who don’t live and breathe real estate, don’t really work in the business.

When Christmas rolls around, I honestly don’t know what to do with myself.

Maybe that’s why I’m sitting in the office on December 29th, with my dog, Bella, staring at me from the corner of my desk, as I write a blog for January of 2018.

I loved spending time with my family over the holidays. My brother and his family were in from London, England, and as we only see them at Christmas and in the summer, every moment with them was extra-special.

I feel like I really bonded with my daughter, Maya, more than I ever have before through her 13 months in this world. I spent so much time with her over the holidays – full days! Something I had never done before, save for August’s vacation in Idaho.

Have you ever heard my all-time favourite comedian, David Cross, talk about his friends with babies?

He maintains that every person in the world without a child always says, “I’m not going to be ‘that guy’ when I have a baby, you know? Like become ‘those people with kids’ and all that, I won’t change.”

Then once they have their first-born, they regale you with long-winded, boring stories of every piece of minutiae about their kids: “David, oh boy, you wouldn’t believe my little guy, yesterday he was just staring at this grape….”

I’ve officially joined the club.

I can’t tell you how many stories I want to regale you with about my daughter, that mean everything in the world to me, and absolutely nothing to you.

For example, she loves anything “fluffy,” and she loves to rub it against her nose and lips. So she’ll pull the tiniest pieces of fabric off her blanket, and then hold this invisible thread between her thumb and forefinger and calmly run it back and forth under her nose for an entire half-hour car-ride.

Like I said – I’ve officially joined the club. And I have a hundred more stories, just like this one.

And in the midst of all of the incredible family-time over the holidays, part of me is longing to go back to work. I’m sure there are many other people, in many other industries, who feel just like I do. But I can’t help but think that so many folks with this passion (sickness?) work in the wonderful world of real estate.

So what’s in store for the Toronto real estate market in 2018?

Well as you might have assumed, I have a thought or two I’d like to share.

First, however, let me provide you with a few “predictions” from economists, banks, and other noted pundits.

RBC Economics predicted that Canada-wide average home prices would increase 2.2% in 2018.

PWC Canada didn’t provide a specific figure on appreciation, but did offer this:

Prospective homeowners may disagree, but industry players don’t feel Toronto is too expensive—certainly not in comparison to current world-class markets, including Vancouver. Most foresee continued immigration and investment, foreign and domestic, contributing to upward pressure on prices overall. And while there may be temporary price dips, no one should expect a major pullback on prices—barring an unexpected event that upsets the global economy or a major change in government policy.

Royal LePage CEO, Phil Soper, predicts that the Canada-wide home price will increase by 4.9% in 2018, and in Toronto, that number is even higher at 6.8%.

I know, I know – you laugh at the idea of the CEO of a real estate brokerage providing a bullish outlook on the market.

This Globe & Mail article says “a poll of Reuters analysts” expects the Canada-wide price to increase by 1.9% in 2018.

I’m not searching for only bullish forecasts. I Googled, and these were the results. And ironically, the only bearish forecast I found in my quick search was from a source you wouldn’t expect.

The Canadian Real Estate Association itself predicted that prices in Canada will drop 1.4% in 2018, and drop 2.2% in Ontario specifically.

There are no shortage of predictions out there, both bullish and bearish. I’m finding more bullish ones, but please – if you have an outlook from one of the Big-5 banks, please post in the comments below.

So now allow me to provide my predictions, on some of the biggest topics affecting real estate in Toronto, and then you can pick them apart to your heart’s delight.

Enjoy!

–

1) The average home price will increase in Toronto, in 2018.

Why not start with a bang, right?

This is what everybody wants to talk about, and it’s really the only number we see thrown around in the media and among experts and prognosticators. Well, to be honest, sales data is thrown around a lot, but I feel that’s only used to prove a point about the market, whether one wants to show the market in a positive or negative light, when the price data isn’t telling the ‘right’ story.

For the rest of us, we don’t care about how many people are buying, but rather what they’re paying and how that affects us.

So before we begin the discussion, perhaps a refresher is necessary.

As I write this, I don’t have the ‘final’ 2017 average home price (ie. sale) from TREB, and for fear of waiting until Friday the 5th, or Monday the 8th, I figured I would use the year-to-date figure from November as a place-holder.

Keep in mind – that “year-to-date” number encompasses all sales from January 1st to November 30th; that’s 87,513 sales. So tack on, say, another 5,000 in December, and I don’t expect the needle to move that much.

For example, the November 2016 YTD figure was $729,849, and the full 2016 figure at year’s end was $729,837.

So I think for our purposes, we can use the November 2017 YTD number in the context of where the market has been in the past three decades.

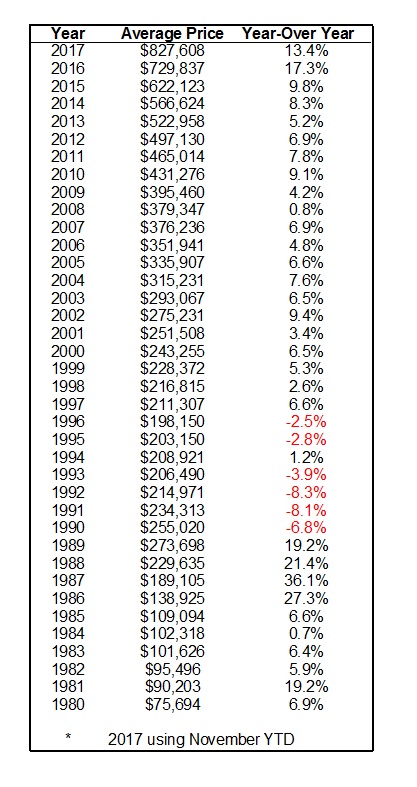

This is the chart I used in my first blog post of 2017, so let’s update it with one more line of text and take a look:

So the first thing you’ll notice is that the average home price, or sale price, in 2017 shows $827,608, and yet the November number was only $761,757, down from $780,000 and change in October.

You might cry, “This is misleading, since the chart shows this whopping 13.4% increase, but home prices aren’t averaging $827,608 – they’re down in the mid-to-high $700’s.”

The latter part of that is true; prices aren’t up over $800,000, currently, based on the past month.

But keep in mind, that these numbers represent the average sale through the year. So when the average sale was up to $920,000 in April of 2017, this is being incorporated into the full calendar-year average.

So a 13.4% increase in 2017, after a whopping 17.3% increase in 2016. And I have the audacity to suggest that we’ll see an increase yet again?

Correct.

And I’m up against a monster here, when you think about it.

The average home price in November of 2017 was $761,757. For me to say, “The average home price in 2018 will increase…….above the final number from December of 2017,” would be a slam-dunk, no?

I ask of ye bears, answer me this: do you think that the average yearly home price in 2018 could be below the monthly home price for November or December of 2017, ie. that of some $760,000’ish? Surely even the most bearish folks can’t predict that with a straight face, given the “hot pockets” of April, May, and June, not to mention September, will inflate that figure.

But the slam-dunk aside, I’m going to take it a step further, and shoot well outside the paint, and perhaps even into 3-point territory here.

I do believe that upon the completion of 2018, the average home price (I keep saying “home price” but we’re really talking about the sale price) for the year will be higher than the $827,608’ish figure that we’ll see for 2017.

The “monster” I spoke of above refers to the fact that within that $827,608’ish number lays those huge averages from March and April that were $916,567 and $920,791 respectively. So in theory, we’d have to see two months above those numbers, in 2018, to beat the year-end average.

In theory, perhaps.

But in practice, I see a much smoother ride for the 2018 market, with far less volatility, and a more typical “trajectory,” if you will.

In most years, the market begins slow in January, ramps up through March, and we see a frenzy in April, May, and June, before a calmer summer.

In 2017, the market started hot right out of the gates, and with a 50% decrease in listings, plus more buyers out there (sales were 12% higher, despite the 50% drop in listings), the result was the dramatic increase in prices on a monthly basis (see the chart in prediction #2 for reference).

By the time April rolled around, combining general buyer fatigue with the Liberal government’s “Fair Housing Plan,” we saw a dramatic drop in both sales, as well as average sale price.

The summer was an absolute dead zone.

And while the September average freehold price rallied 11% over that of August (also in chart below in prediction #2), it wasn’t a strong enough fall market to get us back to where we were in the spring.

So what do I expect to be different in 2018?

Everything. Basically, the opposite of all those points above.

I expect the market to start slow, unlike in 2017 (more on this in prediction #4 below), as buyers “adjust” to new mortgage rules (more on this in prediction #3 below, as you see everything is somewhat intertwined).

Personally, I think January and February are going to be great months to buy, as I expect things to ramp up in the spring.

In previous years, the slow January and February months led to four extremely busy months in March, April, May, and June, and that’s how I see this year shaping up.

The big difference in 2018, however, is that we won’t have the market stop-on-a-dime as it did in 2017, with the “Fair Housing Plan” announcement. I mentioned above that I think “buyer fatigue” had set in, and I do believe that even without the FHP being introduced, I think the market would have cooled off. But to the same extent? Not a chance.

As I’ve written before in multiple blogs, I dont’ think the FHP itself had any tangible effect on the market (save for rentals), but rather the general “idea” of the Fair Housing Plan did.

Preceeding the FHP, of course, was the “Toronto Housing Summit,” which just based on the way the government was speaking, and the media was reporting, made it sound like the government was about to do something drastic.

Along with the “idea” of government intervention, comes the imagery.

And this classc photo of Charles Sousa, John Tory, and Bill Morneau – three men who were about to “enact change,” was almost set up to mimic Woodrow Wilson, Lloyd George, and Georges Clemenceau…

Hyperbole on my part, I know.

But as the media continued to report, and photos like the one above began to surface, the public took notice. And why wouldn’t they? Real estate has always been an incredibly hot topic, if not the hottest, over the last few years. All this talk of a “real estate summit” was bound to be seen and heard.

In the end, it scared the crap out of people.

Throw in Kathleen Wynne, standing in front of a giant poster, talking about how “unfair” the real estate market is, and how the Liberal government is going to change all that, and as we know, the market came to a screetching halt in April.

Governments can, and have demonstrated that they will, enact policies to effect change, no matter the need, the level of support, the results, and/or the unintended consequences. And I believe that with talk about a “Housing Summit” preceding a Liberal government, capable of anything, standing in front of a podium talking about “Change” like Obama in 2008, many existing buyers were petrified with fear.

As I’ll explain in prediction #6, I think we’ve heard the last from the government as it pertains to the real estate market, at least for a while.

And without a massive knife to the fish-guts of the market like we saw last April, I see the Toronto market starting 2018 steady-as-she-goes, and gaining momentum, ever-so-slowly, through the end of the year.

Say goodbye to the volatility, hyperactivity, and hyper-appreciation of 2017.

But you won’t be saying goodbye to the price points…

–

2) The freehold market will outpace the condo market.

An absolutely crazy thing happened in the 2017 real estate market.

No – I’m not referring to the 26.1% increase in the average home price from December of 2016 to April of 2017.

No – I’m not referring to the subsequent 18.4% decrease in the average home price from April to November.

I’m referring to the idea that the condo market outpaced the freehold market, across the board, in every category.

In my year-end blog post, somebody asked me facetiously, “When are you going to buy a house?” Another reader said I should put my money where my mouth is.

I tell every single buyer that I interact with, “A house will out-appreciate a condo, no question about it.” It’s then up to the buyer to decide if he or she can afford a house, otherwise, there’s really no decision to be made.

I live in a condo, in part, because as an occupational hazard, it’s nearly impossible for me to find the “perfect house.” But I also live in a condo because I work an obscene amount of hours, and I simply don’t have time for the upkeep on a house, as much as I would have loved to live in one over the past few years.

But ask me what is a better investment, a house or a condo, and I’ll tell you honestly, that while my condo has appreciated nicely since I purchased it, all of my friends, to whom I sold houses around the same time, are laughing all the way to the bank.

So having said all this, I suppose now is the part where I go back to the point above – that in 2017, condos actually out-appreciated houses.

And nobody, and I mean nobody, saw this coming.

Like me, most people assume that houses will always out-appreciate condos. How can they not? There are thousands of new condominium units completed in the central core each and every year, but save for the rare occasion when a large bungalow is torn down, the lot is sub-divided, and two houses are built where one house once stood, we’re really not building any more houses!

More people want to own houses than condos, and if prices were equal, there’s no question that just about everybody would choose a house.

So it’s altogether shocking that the condo market performed the way it did in 2017.

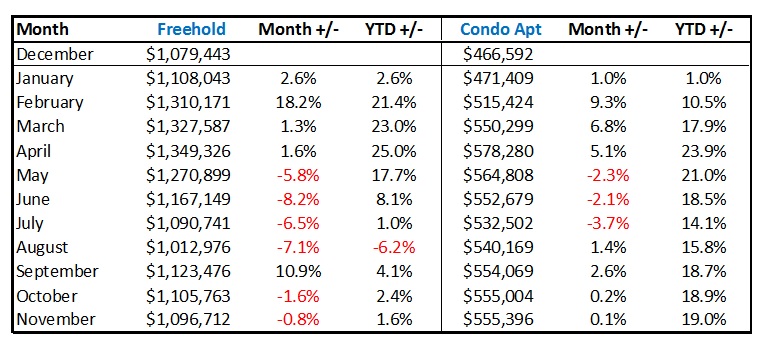

Take a look at the chart below, which shows you the average sale price for both freehold in Toronto (416) each month in 2017, as well as for condos (also 416).

And for those of you wondering where I got the freehold numbers, since strangely, TREB’s Market Watch doesn’t provide these (are you listening, Jason Mercer?), I devoted an hour to inputting all the freehold numbers for each month, and taking a weighted average based on the number of each detached, semi-detached, and townhouse. Email me if you’re interested in the calculations.

Shocking!

The average sale price for freehold finished the year (November) only up 1.6%, since December of 2016, but condos were up 19.0%.

The condo market just seemed to be a bit less volatile, and the gains were steady.

Note that in February, when the average freehold price increased 18.2% from January, the average condo price only increased 9.3%. This made it a lot easier for the condo market to continue on a “slow and steady” pace.

We could spend all day on this chart (which would be nice, since I spent an hour on it…), but we must move on.

Bottom line: what happened in 2017 was an abberation. For the average condo price in Toronto (416) to increase 19.0%, and the average freehold price to increase 1.6%, simply shows me that it’s absolutely, positively, impossible for this to happen again.

You might even argue that as a result of 2017, freehold prices, where they are right now, are actually quite reasonable.

–

I certainly didn’t mean for this to turn into a 2-part blog post, but I have about 5-6 other points I want to make, and I think I’ll lose some of the skimmers here if I keep going.

Let’s adjourn until Thursday!

Chris

at 8:54 am

Interested to read part two. Not sure I agree with prediction 1, but I didn’t agree in the fall either, and you turned out correct on the main point of price increasing!

With regards to other 2018 predictions, I would highly recommend reading Scott Ingram’s post where he succinctly details the headwinds and tailwinds he perceives in the market:

http://www.century21.ca/scott.ingram/blog/What_s_in_store_for_2018

Appraiser

at 12:24 pm

I especially like this quote from Ingram’s post:

“*NOTE* I am not at all saying don’t buy real estate in Toronto right now. This market has a lot going for it, and if you’re buying for the long term everything will work out fine. If you see a house today that you really like in an area that you like and it’s within your budget, go ahead and buy it and enjoy it.”

Chris

at 1:14 pm

I would definitely agree with that sentiment. I’ve said it before, I’m much more optimistic on Toronto RE over the long-term, particularly for those looking for a place to live, rather than as a speculative investment.

Condodweller

at 11:52 am

There have been many debates about when is a good time to buy a home. I think it is important to differentiate between a home to live in vs. an investment property. As long as it is affordable to the purchaser and they don’t mind holding on to it for a long time or taking a loss if the market should turn down I agree now is a good time to buy, though I certainly wouldn’t blame someone to hold off due to high prices. Investing is a whole different story.

Chris

at 9:08 am

Oh and CBC has an article today with some other predictions from Big 5 Bank figures:

TD’s Dolega agrees, saying in a note to clients recently that “we anticipate a continuation of the soft-landing narrative that has so far characterized dynamics in Canada’s housing market.”

After years of double-digit gains, 2018 is likely to be a bit more muted, Bank of Montreal economist Robert Kavcic says, adding that rate hikes and the new OSFI rules “should keep the froth from returning.”

http://www.cbc.ca/news/business/real-estate-trends-1.4460775

Chris

at 2:55 pm

One more I missed from the article; BMO seems to be of two minds!

While the OSFI rules are significant, economist Doug Porter at the Bank of Montreal says he expects the market will largely be able to withstand the impact of new stress tests, just as it has withstood other policy changes.

“Canada’s housing market has defied the incessant talk of its imminent demise for years,” Porter said in a recent report. Which is why this year, he expects the housing market to “exceed expectations, even with the new tighter OSFI rules, yet again crushing the bears’ calls, if not their spirits.”

JCM

at 1:50 pm

I would love to hear some concrete factors indicating that home prices will increase in 2018. Personally, I can’t think of a single one (other than continuing, moderate levels of net immigration, I guess, but that seems unlikely to move the needle in such a speculation-driven market).

He are some concrete factors suggesting that home prices will continue to fall: Interest rates are up and are likely to rise further, sales volume is currently down 20% compared with early 2017, active listings are currently up around 100% compared with early 2017, the new stress test will reduce buying power for the vast majority of buyers by 10 to 15%, and market sentiment is likely to erode further in Spring 2018 when the news media reports year-over-year declines in the neighbourhood of 20%.

If anyone cites the “great Canadian land shortage” I will laugh.

Professional Shanker

at 6:57 pm

All the factors you mention are known headwinds, which is why I give David respect on his #1 prediction – This IMO this is quite a limb to go out on – are you in California enjoying some of that legal sticky icky? Nevertheless this is a bold prediction as I believe the 905 Detached market is in for a speculator sell off in 2018 which will impact the averages. My call is for average prices to be $770k but this is strictly linked to 2 interest rate increases in the 1st half of 2018.

JCM

at 9:23 am

Exactly — there are many known headwinds but very few tailwinds.

I don’t really see David’s prediction as courageous. He stands to profit from continuing strength in the market.

$770k sounds like a reasonable prediction to me. Absent an economic shock, I would agree. If NAFTA falls apart, however, prices might fall rather quickly

Professional Shanker

at 10:39 am

That is the trouble with listening to advice from people within any industry, they always paint an optimistic perspective – not intentionally though. Ask a stockbroker about equities – they are bullish 95% of the time on stocks, Ask a Miner about commodity prices and the majority of them are bullish on long term prices, even more so during the 2000s boom.

David seems to be a reasonable industry professional but I do think like the entire industry has, underestimated the presence of speculation, whether it be domestic or foreign, which has led to parabolic increases in prices over the past couple years, especially in the condo & detached GTA market. The reduction in inflows from this segment will have an impact in 2018 & 2019 – This may very well be the largest headwind which has contributed to some of the lower realized prices in Q4 2017

One thing in for certain, a forecast is wrong the second it is made!

Natrx

at 10:51 am

The thinking generally goes like this. As long as job numbers remain strong and healthy, people will not be forced to sell at a lower price than expected. In other words, it’s the sales number that will decline, which leads to the higher priced transactions to remain and continue (sales numbers adjust to support the pricing figure). Long-term demographic trends continue to support GTA housing demand: peak millennial cohorts are still below traditional household formation age, immigration going to continue increasing.

Professional Shanker

at 11:27 am

Is your statement that long term demand fundamentals will led to increased 2018 prices (i.e. short term)? I agree that long term fundamentals will support long term demand and prices, no one usually debates this.

Ralph Cramdown

at 3:08 pm

Fun fact: If you had 25% down for an “average” Toronto home in 1989, you could have financed the remainder for $2,154 a month. If instead you stuck the down payment in a savings account until 1996, you could then have bought the same “average” place with an $862 monthly.

Sources: TREB, Bank of Canada

Kyle

at 3:17 pm

But how much is the lease on a time machine?

Appraiser

at 3:36 pm

Reminds of the character in an episode of Southpark – Captain Hindsight.

ed

at 8:35 am

Zero. If you time it right.

Kyle

at 3:15 pm

Something the media hasn’t really caught onto is the size of the shadow demand for housing. The number of new households waiting to form is actually quite shocking. In my mind it is doubtful that these young adults plan to live the rest of their lives living with their ‘rents.

“Among the 35 census metropolitan areas (CMAs) in the country, Toronto (47.4%) and Oshawa (47.2%) had the largest shares of young adults living with their parents—almost one in two young adults.”

http://www12.statcan.gc.ca/census-recensement/2016/as-sa/98-200-x/2016008/98-200-x2016008-eng.cfm

I agree with David the rule changes have introduced just enough uncertainty into the market to cause a stall, but IMO after an initial slow start to 2018, i see the market regaining it’s confidence and ending the year higher.

Chris

at 3:29 pm

From the Census in Brief article:

“The high proportion of young adults living with their parents in Ontario is most likely the result of a combination of economic realities, including the high cost of housing, and cultural norms that favour young adults living with their parents for longer. Analyses from the 2006 Census and the 2011 National Household Survey (NHS) suggest that immigrants, especially those who arrived as children, and those who are second‑generation Canadians (born in Canada but with at least one parent born outside of Canada) were more likely to live with a parent than were Canadians of the third or more generations.”

I agree that those who are living with parents for economic reasons are more likely to be home purchasers in the short to medium term future. However their parents may also become home sellers, offsetting some of the demand from their children, and negative media portrayal of housing price appreciation come Spring could reduce demand in the very short-term.

For those who are living with parents for cultural norms though, economics may not have much of an impact. If it is your culture to live with your parents and children all under one roof, home prices falling or climbing probably won’t make you change your mind.

Kyle

at 3:53 pm

Sure there are some people who have always planned to live with their parents, for cultural or personal reasons. But in my mind that is the exception not the norm.

As you go about your everyday life, imagine every other person that you see between the ages of 20 and 34, and realize that they still live “at home”. Now ask yourself how many of those people do you think are doing it for cultural reasons?

The vast majority of young adults that i know, are living at home for one reason only – to save for a place to buy. IMO, April 2017 did not mark the day that those people all suddenly changed their minds about wanting to have their own place. At some point they will return to the market, but in the meantime the pent up demand is building.

Chris

at 6:07 pm

“But in my mind that is the exception not the norm…The vast majority of young adults that i know…”

These are anecdotes though, and are subject to your personal interpretation based on your background and the community you surround yourself with.

If you’re Caucasian, then yes, many of the young people you know probably are looking to move out. If, as an example, you were of South East Asian descent though, it is likely that many more of the young people you knew would be living with parents for cultural reasons. They may have even purchased a home with one or two other generations of their family, and thus would be captured in these stats as “living with parents” yet are also homeowners.

I don’t believe we have concrete numbers on how many 20-34 year olds are living with their parents for economic vs. cultural reasons, so we’re left to speculate. However, the fact that Statistics Canada felt the cultural impact was worth mentioning indicates to me that it is not an insignificant number.

Kyle

at 11:52 am

You need to re-read the quote Chris, no where does it say that the cultural tendencies are for them to live multi-generationally in perpetuity.

“…cultural norms that favour young adults living with their parents for longer. “

Chris

at 12:21 pm

So how long is “longer”, Kyle?

By your own admission, you reside in the High Park neighborhood (a primarily Caucasian area, with large Polish and Ukrainian populations), and surround yourself with a community that sees young people living with their parents for primarily economic reasons.

From my experience with those cultures (South East Asian, etc.) that have multi-generational households, it is relatively common for them to purchase large homes together, and reside together for long periods of time.

Of course this is anecdotal, but as I stated previously, these home-owning-yet-living-with-parents millennials would be captured in the statistics you shared; however, surely you would agree they do not represent “shadow demand” for housing?

My overall point is that this “shadow demand” you cite due to millennials living with parents may not be as robust as you suspect. Professional Shanker’s point regarding credit and interest rates also throws a wrinkle into the equation.

Professional Shanker

at 6:38 pm

But the people who are living at home and saving to purchase a place will not be helped by B-20, they will be severely negatively impacted. I believe this pent up demand statement being used will only come to fruition if affordability is reduced – which will either come through price reductions which allows this segment to get into the market or credit growth but I do not expect this due to increased interest rates which we can debate the pace of which and B-20. This pent up demand will build but I do not believe it will help the 2018 market, possibly I will be wrong!

Kyle

at 12:18 pm

Perhaps they won’t be able to afford to buy and will instead rent. Either way, when the number of households increase, the demand for housing increases and so too will prices, as investors take advantage of the more competitive rental market.

Sevyn

at 10:00 pm

Happy New Year Everyone! Let’s keep these wonderful posts going. I agree with Professional Shanker and David et al. I believe people will get tired of sitting on the sidelines. People will be afraid of losing out. No matter what prices are, owning is always better than renting… even if prices fell 20%… over a 25 year period you’d still end up winning vs renting an apartment. Millennials will continue to get help from their parents or other sources. I think people will stop spending money in order to purchase a home. I also think the first quarter will be slow but afterwards it will pick up. However, I live in Durham Region and many listings have been terminated. Builders have dropped their prices and increased their incentives but no one is buying… people are afraid. Prices have been up and down this year. I don’t think we will ever see bidding wars again either. I also think the government should never have interfered. I do think the government can still make changes though… 20 year amortization why not? Or go back to 25% down for uninsured mortgages. I lost a lot of money in this market for 2017 and I’m bitter about it. I’m totally turned off by real estate now. I will be staying in my current home for a very long time and watching the INTERESTING boxing match go down for 2018!!! Front seat tickets anyone?

Professional Shanker

at 4:35 pm

Kyle, from a pure theoretical standpoint I agree with you, but then why would a market ever experience a prolonged decrease in price – ie. 1990 to 1996 – why wouldn’t investors have bid up prices during that market? Reason is because long term inventors need to realize positive operating cash flows otherwise the long term say 5% annual increase in a properties value is not worth the capital investment when compared to other investment vehicles.

Are we at a point where prices will not support speculative investment demand – I believe the answer is yes for SFD – apparently not for condos, but let’s be honest no investor is in the game for positive operating cash flows of a SFH.

Kyle

at 5:28 pm

@ Professional Shanker

To be more specific it isn’t just expanding # of households, it’s change in households relative to change in available housing units. In the early 90’s homes and condos were being built on spec, faster than actual households were forming. Today condos are pre-sold before being built and as has been thoroughly debunked, Toronto condos are not being bought up by speculators and being left empty. By and large there are actual households living in them.

lui

at 7:04 pm

Lots of people who own houses and condos I know needed help from the parents,most of them have decent salaries of $65,000+ but still downpayment, plus carrying the mortgage and paying for everyday expenses leaves them almost nothing in savings.I know people who left their parents home to “explore the world” but moved back home a few years later realizing they have zero savings even though working at a good job .2018 they expect slower sales but still 5%+ increase in prices which I can see happening by a quick survey of what is for sale on the real estate boards these days.

Jason

at 8:42 pm

Too many factors are going to influence housing in 2018. Predictions are for fools, balance in life is key. Being to over weight in any sector can lead to ruin. If I remember correctly, over 90% of analysts predicted positive returns prior to the global financial crisis.

To your question can prices be lower this year vs November prices. Sure they can or they can be higher. I have no idea but neither does anyone else. Anyone suggesting they’re certain one way or the other is lying.

Appraiser

at 9:29 am

Market timers get crushed…time and time again.

As I’ve said before, the best time to buy is when you find the right house.

Guru

at 8:59 pm

My prediction (not so bold) is that prices drop another 20% from the Apr 2017 peak by the summer of 2018. Avg. prices will slowly melt/flatten in the next 3-4 years as rates continue to rise in lock step with the US Feds (As proven 95% of the time, Canada rates are in line with the US). B20 will also be a major roadblock to any more price increases as it eliminates 1 out of every 5 buyers while reducing purchasing power to everyone else. Source: Veteran Banker for one of the financial institutions in downtown Toronto.

Condodweller

at 11:43 am

I’m late to the party yet again.

“Another reader said I should put my money where my mouth is.”

I just want to note that I would never presume to tell anyone what to do. I believe what I said was that I was waiting to see IF David was going to put his money where his mouth is. It’s a subtle difference but that is what I meant to say even if it didn’t come across like that.

“And nobody, and I mean nobody, saw this coming.”

Ahem… at the risk of beating my own drum, I believe I mentioned several times in the past that I felt SFH prices were getting unaffordable to the point where condos would be in higher demand and therefore was not at all surprised their price increase had outstripped those of SFH. Having said that IMO it is a short term phenomena where condo prices are catching up.

In light of all the issues already mentioned (affordability, increasing rates, B20 etc.) I think it will be very difficult for average prices to increase yoy the next few years. Particularly if interest rates continue to rise I don’t see new highs in the near future. That’s a big if though, as I have seen this in the past where rates started climbing where people were telling me I was crazy to go with a variable rate on my mortgage only to see rate increases reverse where we ended up with close to 1% mortgage rates.

I still want to see the price action in the spring but at this time I do not believe we will see higher prices this year.

Sardonic Lizard

at 2:07 pm

Canada’s household debt has hit record levels (more than GDP!). At the same time, StatsCan released data showing the net worth of Canadians is at an all time record level high. Clearly this is due to the high number of real estate holdings.

When Mortgage debt increases, so do house prices. That’s what has driven this record growth for the past three years. Mortgage debt has to be assumed at a high enough rate in order to keep the housing market going. There is a point where, mathematically, you cannot continue to acquire enough mortgage debt to keep the housing market rolling forward.

Due to the B-20 rules, there will be less mortgage originations, and I think it’s safe to say we will see a decrease in the number of sales and a decline in house price gains.

Also, I believe we can expect about three interest rate increases this year. Get ready.

Lewis Wheeler

at 6:10 am

Thanks for sharing such a nice information

Visit our website-https://www.casalova.com/c-brampton-real-estate-on