Shall we start this blog post like the last one?

Another story from my personal life that has nothing to do with real estate?

Well, I was mowing the lawn the other day, and this chipmunk came up to me and started asking about interest rates. Er, well, let’s skip the story this time…

Having regaled you with an unnecessarily-long post on Tuesday about external factors that will affect the 2019 fall real estate market, I figured today I would give you my two cents.

Now, since my predictions are likely going to be bullish in nature, I figured I would get out ahead of the biggest bearish counter-argument: “You’re in sales. What else are you going to say?”

My wife and I purchased a house in 2018.

There. I said it. For the first time on this blog.

I haven’t exactly made this a secret, since I refer to it quite a bit in my Pick5 videos, and all my clients know. But for the open book that I am, it’s fair to assume that, at the very least, I would have said something by now, and at most, I’d have documented the process in an epic 5-part blog series.

Believe it or not, an epic series is still in the works. I just haven’t found the time, and I’ve been planning this since the spring.

I love sharing my personal adventures in real estate for all to read, and this story will be exactly that. I promise.

In the meantime, realize that I tell you this now because I want to counteract the argument I’ve grown most tired of over the last few years, which is that my bullishness is merely a necessity, given my occupation.

Now you realize, that couldn’t be further from the truth.

As I tell my clients – I wouldn’t have bought my “forever home” if I thought the market was going down. I wouldn’t have chosen now, or in this case, a year ago, to take the plunge, make the jump, and slap on the golden handcuffs, if I thought I’d do better by waiting, or if I had any concerns about the future of Toronto real estate.

So if you doubt my bullish nature, and the sincerity of the following predictions, just know that I’m in the same boat as every home-owner, and every would-be home buyer.

Now where should we start?

Perhaps with the prediction that will get the most attention, if it comes to fruition…

–

1) Average home price will rise.

This is an easy prediction to make, right?

Well first of all, are we talking month-over-month, or are we talking year-over-year?

For my prediction, I’m taking about both, and while the former should be obvious, on account of the seasonal dip in August, I do believe that most people should see the latter coming as well.

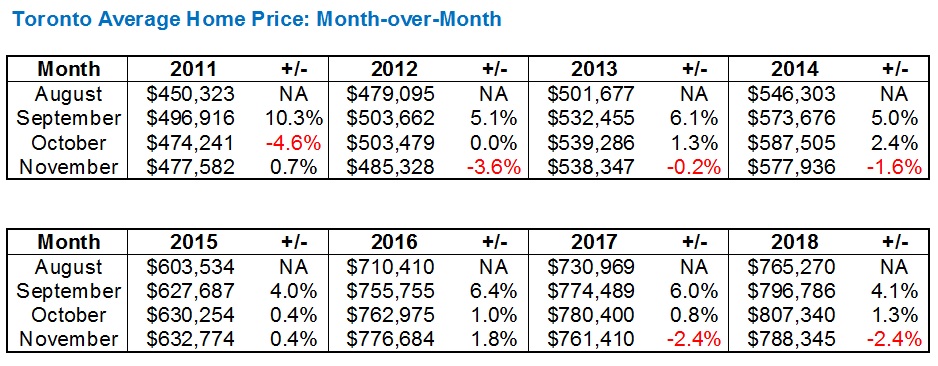

So first, let’s look at the average home price, month-over-month, throughout the last eight years.

This will help us predict where prices are going from August to September, and if you’re a buyer in this fall market, you’ll want to know where the peaks and valleys lay within.

I’ve had to put the data on two lines here, so it looks odd but you’ll get the point:

You’ll want to look this data over on your own terms, but here’s what I see:

1) Prices rose (obviously…) from August to September in 8/8 years.

2) Prices rose from September to October in 6/8 years, with one of those years – 2012, being a decline of 4/100th’s of a percent.

3) Prices declined from October to November in 5/8 years.

4) The average increase in price from August to September is 5.875%

5) The average increase in price from September to October is 0.32%. This is largely due to a huge decline of 4.6% in 2011, followed by modest increases from 2013 onwards of only 1.3%, 2.4%, 0.4%, 1.0%, 0.8%, and 1.3%.

6) The November average home price was lower than September in 4/8 months, and higher than September in the other 4/8 months.

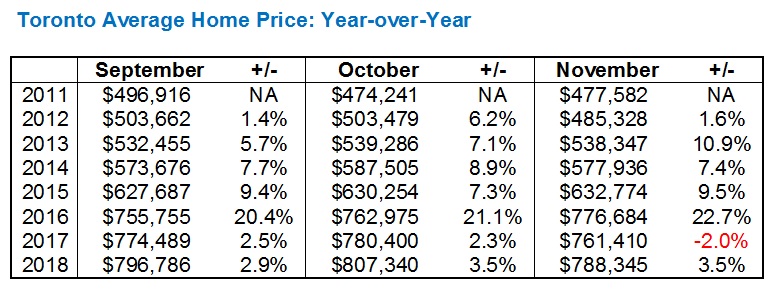

No let’s look at the numbers, year-over-year:

So in a combined 20/21 months, the average home price, year-over-year, has increased.

This is the story of our Toronto real estate market, and that one bit of red ink you see on the right-hand side relates to the crazy 2017 market. Having come off a peak of over $920,000 in April, prices were slow to recover throughout the summer and into the fall. Notice that the $774,489 price in September 2017 still wouldn’t have topped the November price in 2016. Shocking!

The price growth through the last two years has been modest. Ignoring November of 2017 as the outlier, we’re seeing between 2.3% and 3.5% in year-over-year growth.

So let’s assume that in 2019, we see the same levels of growth.

This would give us upcoming fall prices of:

September: $819,893

October: $835,597

November: $815,937

Now keep in mind that “peak” prices in 2019 so far have been as follows:

April: $820,148

May: $838,540

June: $832,703

So the bigger question is: will the fall surpass the spring?

October trumped May in 2014, 2016, and 2018, but not in 2015 or 2017.

My prediction is that it will, and the Toronto average home price will pass $840,000.

–

2) Inventory will be high.

We talked about inventory in Tuesday’s blog, referring to this as one of the factors affecting the fall market, and while the world economy and Canadian election will have major ramifications on our lives, indirectly, and over the medium term, inventory will play the largest role in what happens to the market this fall.

I have absolutely nothing to base this prediction on, unfortunately.

It’s simply my gut feeling.

In C01/C08 on Tuesday, there were 81 new listings.

I always use C01/C08 as the measure of the market, for one, because this number is the highest of areas I chart (ie. E01/E02/E03, C9/C10/C11, etc), and thus it has the lowest volatility, but also because downtown is where the most action should happen.

As I’ve written before in this space many times, we’re accustomed to seeing 100+ listings on the busier listing days (Tues/Wed/Thurs) when the market is in peak season, and often 120+ when the market is insane.

So 81 new listings for the Tuesday after Labour Day? That’s telling me something.

And we’re seeing listings across an array of price points and property types. On Tuesday, I saw more quality listings (ie. ones I emailed to clients) than I did in the last two weeks of summer combined!

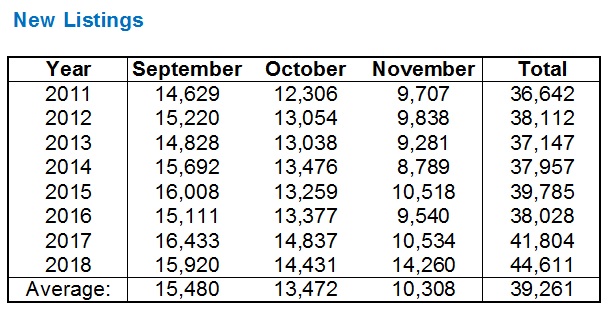

Going back to the data shown on Tuesday, we can get a sense of how the fall market plays out, and where we expect inventory to be:

How would you choose to analyze this data?

Well, if you’re a buyer, you want to know what different months are like in the market in terms of inventory.

Take last year, for example. We saw 15,920 new listings in September, and that figure dropped by 9.4% in October before levelling out by a modest 1.2% in November.

So if you’re a buyer, you’ll note that October isn’t really a “worse” month for inventory than September, and it’s not like November is barren.

However, and this was perhaps misleading, but however nonetheless – if you look at the eight-year trend, you’ll see listings drop an average of 13.0% from September to October, and then a whopping 23.5% from October to November.

Do we expect 2019 to follow closer to 2018? Or should we believe that the trend will ultimately prevail?

Personally, I think that September is going to give us a massive influx of listings, and those buyers who slow-play the market and wait until October will have a lot less to choose from.

In terms of actual inventory levels, the delta over eight years isn’t huge. In September, for example, we see a low of 14,629, a high of 16,433, and an average of 15,480. Whether we see 15,500 or 16,000 new listings won’t have an effect on price. Supply still lags behind demand, as it has in virtually all market segments for the better part of two decades. But my gut tells me we’ll see higher inventory levels this fall, and I still think prices will increase.

–

3) The market will get “tighter” as the fall moves on.

This is a term I use quite often – a “tight” market.

Tight. Firm, tense, hard to move.

In the context of a real estate market, it’s about the shrinking gap between sales and listings, thus that place in which you find yourself in the market becomes tighter.

This is one of those predictions where I’m going to look for data to back up my theory, and this time, it honestly wasn’t hard to find. In fact, I’d probably have been better of leaving these stats out, and then playing dumb. The dumb genius.

As I alluded to above, the amount of new listings, historically, drops from September to October, and then October to November.

But what do you think about sales?

Would you expect to see more sales in September or October? Think about it for just a moment.

September gives us more inventory, and more hot-to-trot buyers. Should we expect to see more sales in September?

I’d have thought so, to be honest. And I’d have been wrong.

Sales actually increased in October, over September over the past eight years.

How many of those eight years?

All of them.

8/8, as you’ll see below:

And as a result, you will also undoubtedly notice that the “Sales-to-New-Listings” ratio increased, on average, from 48.1% to 59.5%, September to October.

And although sales decline from October to November in 7/8 years above, it seems as though new listings declines at a higher rate. And thus the SNLR ratio increases to 68.2%.

So when I say that “I expect the market to get tighter as the fall moves on,” now you can see that the stats back up my theory, at least, historically.

–

4) Condo prices will defy logic, and keep rising.

Here’s a story that will make you sick…

Clients of mine purchased a condo in July of 2011 for $333,000. They renovated the condo for $15,000, which to be quite honest just can’t be correct. I mean, when I ask my wife how much she spent on something, I’m pretty sure she tells me it was less than it actually was. In this case, they did everything themselves, including removing the “popcorn” ceiling, and sourcing every single feature and finish from the good ole, “back of the truck,” and the reno felt like it should have cost triple.

In November of 2015, they purchased a house outside the city and sold the condo. Listed for $399,900, they got the full list price.

This was one of those rare times where I represented both buyer and seller, as I had a client interested in this building. This was a completely different market climate, with no “offer dates” and over-asking premiums, trust me when I say that the $399,900 list price was fair.

Having paid real estate fees to sell the condo, land transfer tax to buy the condo, and legal fees on both, these guys were walking away with a little more than $25,000.

The current owners of this condo have also purchased a house, and they too will be selling the condo next month.

This time, however, the price is expected to be a smidge higher, and they might have a little more walking-around money.

How much higher?

Well, I think our floor for this unit is $600,000, and they could very well see $640,000.

So again, taking acquisition and disposition costs into the equation, these guys will still profit upwards of $200,000.

So the first people owned the condo for 4 years and 4 months, and made $25,000.

The second people owned the condo for 3 years and 11 months, and stand to make $200,000.

And the first people were the ones who put in the work!

My point is that the run-up in condo prices that we’ve seen in the last decade is most pronounced in the last three to four years. And this is while the market for freeholds has been spotty by comparison.

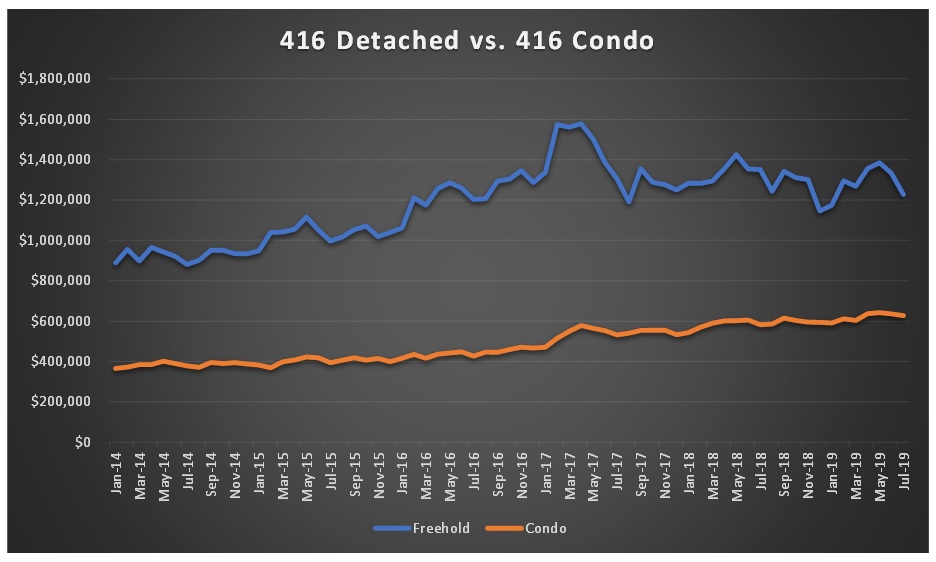

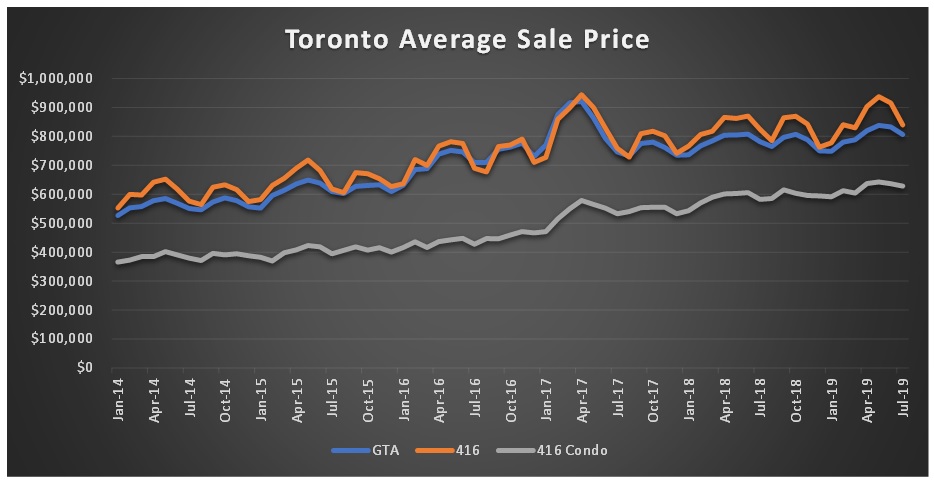

Let’s plot the average price of a 416 freehold detached house versus that of a 416 condominium, every month since the start of 2014:

What jumps out at you first?

Is it the level of volatility with respect to detached?

Or is it the difference between how both property types responded to the spring of 2017?

To be fair, keep in mind that the average price of detached will always fluctuate through the different seasons. We simply do not expect the average price of a detached home in April or May to keep pace in July or August. It’s never happened and it’s never going to. Condos, on the other hand, are a far less volatile animal, and this is likely due to the fact that freehold home sales trace the school and family calendars.

Now let’s plot average home price versus condos, and this time we’ll use both the GTA average as well as the 416:

Interesting to note that the 416 looks more volatile than the GTA, but that’s a topic for another day.

Once again, however, we see that the rise in condo prices has been very gradual, and there are far fewer peaks and valleys than with any other market segment.

Now for the rub: how do you think condos have appreciated versus the market average? Or versus freehold segments?

Let’s choose 2014 as our starting point, and keep in mind that we’re comparing to July of 2019, since the August data isn’t out yet (should be tomorrow).

January 2014 to July 2019:

GTA: +53.2%

416: +52.1%

416 Detached: 38.2%

416 Condo: +71.6%

Did you see this coming? I don’t mean did you see it coming – as of January, 2014, because nobody did. Except maybe Barry Fenton.

The appreciation in condos versus freehold detached is almost double.

And 416 condos out-appreciated the GTA sales average by 18.4% in absolute terms, which is 34.6% on a relative basis.

Let’s try something else…

January 2016 to July 2019:

GTA: +27.8%

416: +31.9%

416 Detached: 15.6%

416 Condo: +50.9%

Tell me you even knew about this before today, go on.

Appreciation on 416 condos has tripled that of detached in the last 2 1/2 years, and is 83% higher than the rate of return on the GTA overall.

So despite all of this, why am I saying that condos are going to continue to rise?

Because it’s about relative prices now, not absolute.

Before Labour Day, a colleague of mine was offering on a small unit in King West at 39 Brant Street. The unit was a mere 389 square feet.

Ten years ago, that unit would have been 589 square feet. Of course, it would have cost about $350,000, but I digress.

This 389 square foot unit was listed at $424,900 and received thirteen offers.

The unit promptly sold for $481,000.

To the buyer, he or she thinks, “I got a condo downtown for $481,000, which is a price point you n-e-v-e-r see! I got in! I did!”

That’s true. I’m selling small 1-bed, 1-bath units in Liberty Village to investors for $525,000, so a condo in King West at that price point is unheard of.

But do you know what else is unheard of? $1,237 per square foot for a bachelor with no parking, no locker, and no outdoor space. Not even a Juliette balcony from which to spit about the high price of real estate.

Buyers care less and less about the relative price of real estate downtown, so long as they can afford the absolute price. And developers are all too happy to play along, with units shrinking in size with every successive project.

Condos are going up in price this fall, you heard it here first.

–

Well folks, that’s it for today.

Only four predictions, but as I just turned 39-years-old, and somebody told me “40 is the new 50,” I’d like to think that four predictions is the new five.

I was also told by a new member on my team – an early millennial, “God, you talk about when you were younger a lot.”

I’m sure another child will only cushion the blow, right?

Happy fall, folks!

Appraiser

at 7:43 am

TREB sales date for August now out:

Sales up +13.4%

Average Prices up +3.6%

HPI composite index up +4.9%

Active Listings Down -11.2%

Yes David the market is getting tighter. Oh and congrats on the new baby and the new house – well done!

Chris

at 9:11 am

GTA Detached Average Price +0.3% YoY

GTA Condo Average Price +6.1% YoY

The odd dichotomy in the market continues.

Appraiser

at 9:41 am

GTA detached HPI +3.07% YoY

GTA condo HPI +7.97% YoY

There, fixed it for ya.

Chris

at 9:52 am

A difference of 4.90% is still, in my opinion, a dichotomy in the market.

Professional Shanker

at 3:36 pm

Let’s stop using the hocus pocus HPI figure…..

Appraiser

at 7:54 am

Thanks Garth. He never took a stats course either.

Kyle

at 9:31 am

There’s nothing hocus pocus about it. The HPI is just a constant formula. They don’t re-engineer the formula or manipulate it each month to make the numbers say what they want.

If you don’t like what the HPI says, because it’s higher than the average for a given period, you really should be questioning your belief-perseverance rather than the rigour of the methodology.

Professional Shanker

at 4:16 pm

Nope – I modelled HPI vs average price from 2012 onwards and what I found is it lagged the average price increases TREB put out.

Flip flopping between the 2 makes zero sense, need to use 1 consistently.

TREB & bulls are now using HPI as it fits their narrative…..

Professional Shanker

at 4:17 pm

Sorry I am not Garth – I don’t have an investment arm I try and push people too, wish I did though…….lucrative business.

Appraiser

at 8:11 am

“There was no science behind the 200 basis point stress test. It needs to be flexible. B20 stress test doesn’t result in lower mortgage amounts (only 7%), it typically results in people continuing to rent or live with relatives. We’re seeing this in rental data.”

Benjamin Tal ~ Deputy Chief Economist CIBC World Markets Inc.

Chris

at 9:13 am

“…while some housing industry insiders have urged the Office of the Superintendent of Financial Institutions to relax, or abandon, the B-20 mortgage stress tests, Porter (CEO of Scotiabank) said it’s best to stand pat for now.

“You have to see these through different economic cycles, too,” Porter said. “The economy in Canada is pretty good, on a relative basis, to everywhere else in the world.”

“So, I wouldn’t be doing any tweaking [to B-20] right now, but the government has the ability to do that over time.””

Appraiser

at 9:29 am

I can reasonably imagine what would happen to prices in Toronto if there were no stress test. It’s called supply and demand.

Artificially suppressing demand has its consequences.

It appears that the powers that be can live with those consequences until supply catches up.

Good luck with that.

In the mean time, price increases will not abate and rents are going ballistic.

Chris

at 9:48 am

Again, yours is but one opinion on the stress test. Here are a couple others:

– “The revisions to B-20 are working; strengthening mortgage underwriting across Canada and improving the resilience of the Canadian financial system to future shocks,” OSFI’s information sheet said. “While improvements have been made OSFI will continue to monitor lender practices, particularly in the area of income verification, and will be proactive with lenders when it identifies areas requiring attention.”

– “The stress test is doing what it is supposed to do,” wrote president and CEO Evan Siddall in a letter dated Thursday to the Standing Committee on Finance, calling out accusations of unintended consequences…“My job is to advise you against this reckless myopia and protect our economy from potentially tragic consequences,” he said, asking the committee to “look past the plain self-interest” of the Canadian Home Builders Association, the Mortgage Professionals Association of Canada and the Ontario Real Estate Association.

– The governor of the Bank of Canada is rejecting calls to unwind some of the strict new mortgage policies that have contributed to a cooldown in the country’s previously red-hot housing markets. “I would frown upon it,” Stephen Poloz told BNN Bloomberg when asked about pressure on policymakers to loosen certain rules.

Appraiser

at 9:19 am

Other August real estate stats of note:

City of Toronto HPI detached home price $1.133M Up +2.95% year over year.

Metro Vancouver HPI detached home price $1.407M Down -9.8% year over year !!

Chris

at 9:49 am

“Sure looks like the correction in Vancouver is in the rear view mirror.” – Appraiser, Sept. 4, 2019

Appraiser

at 11:50 am

You missed the point, as usual.

Chris

at 12:02 pm

http://creastats.crea.ca/natl/images/natl_chartC03_xhi-res_en.png

Would you care to re-assess your statement on the Vancouver market (quoted above)?

Appraiser

at 8:16 am

Greater Vancouver’s housing market may finally be bottoming out:

https://www.livabl.com/2019/07/worst-vancouvers-housing-market.html

“…it looks like home sales activity across the province — and Greater Vancouver in particular — appears to be scraping the bottom of the cycle.”

“Declining mortgage [rates] are providing a lift to some purchasers, although pass-through is constrained by the stubbornly high posted rate (stress test constraint),”

The above article was written Jul 23, 2019, before the latest August sales numbers were in – which were up 23.5% Y/Y and 23.1% month over month.

Chris

at 10:15 am

“And momentum continues to rebuild in Vancouver. Based on our rough calculations, home sales rose nearly 5% m/m in August following a 26% surge in July. This brought activity closer—but still 9.2% short—of the 10-year average. Importantly, demand-supply conditions have returned to a healthier balance in the past couple of months. While this should eventually stabilize prices, we don’t think this will occur in the near term. Several layers of policy (ultimately designed to curb prices) and poor affordability are still exerting intense downward pressure at this stage.”

– RBC Economics Focus on Canadian Housing

http://www.rbc.com/economics/economic-reports/pdf/canadian-housing/TREB_REBGV_results_aug19.pdf

While momentum and healthier balance are positive for the market, intense downward pressure would seem to suggest that, in RBC’s opinion, Vancouver’s correction is not in the rear view mirror, as you had suggested.

Kyle

at 10:08 am

Congratulations on the home front, David.

I agree that the average numbers point to a strong Fall market, but i sense changes to the mix of sales are masking just how much values have risen in the core right now. Some of the prices i am seeing are simply mind-blowing. Renovated homes are selling for big premiums, i don’t think i recall ever seeing so many semis selling for over $2M nor homes on urban lots (<25' wide) selling for over $3.5M before.

Looking forward to hearing some of the stories you plan on sharing next week.

Professional Shanker

at 3:31 pm

Care to name a few by address, interested in what you are seeing as the official TREB numbers paint a different picture.

Kyle

at 4:04 pm

Detaches over 3.5M on 25′ or less lots this year:

111 Givins St

428 Euclid Ave

30 Boswell Ave

Semis over $2M this year:

429 Brock Ave

169 Robert St

29 Draper St

541 Palmerston Blvd

323 Brock Ave

93 Pearson Ave

202 Dovercourt Rd

155 Huron St

210 Brunswick Ave

329A Clinton St

14 Barton Ave

129 Bedford Ave

18 Lowther Ave

32 Tranby Ave

97 Hazelton Ave

9 Berryman St

25 Gibson Ave

176 Machperson Ave

148 Macpherson Ave

107 Marlborough Ave

3 Rathnelly Ave

184 Cottingham Ave

206 Cottingham Ave

21 Balmoral Ave

36 Summerhill Ave

68 Pricefield Ave

22 Ameila St

45 Salisbury St

358 Berkeley St

I could go on, but you get the point….

Professional Shanker

at 6:08 pm

Will have a look and compare to prior years

Derek

at 12:13 pm

check out 619 Beresford and 617 Beresford on H.Sigma. Sticks out to me as it’s in my general neighbourhood. 619 might be the best/craziest example with reference back to David’s post(s) on list price/listing strategy failures.

GinaTO

at 11:56 am

I can’t wait to read your series on your home-buying experience. Please tell us in which neighbourhood, roughly? Junction, Leslieville, Mimico, Moore Park?

Kyle

at 1:32 pm

My money is on Leaside

johnny chase

at 4:45 pm

it will be interesting to see his reader’s reactions. Big $$ and hes probably mortgage free.

Jimbo

at 7:18 pm

Not really any of our business, but money is basically free right now. Most people would mortgage over half to keep their money earning revenue.

Only advantage to paying cash is not having to insure your house in places like Florida, NC, Cali. When disaster strikes just rebuild it. Defies logic but that is what most people do when they have the money, they risk it.

Appraiser

at 8:18 am

I tracked it down and like a true professional, I shall not reveal the address. Let’s just say that David is doing just fine, thanks.

johnny chase

at 9:44 am

who spends that kind of money and goes on vacation to Deerhurst? People take note!

David Fleming

at 1:35 pm

@ Johnny Chase

Okay, I’ll bite on this one.

I consider myself, outside of this line of work, to be a very simple person. I don’t like extravagance. While many of my colleagues are out on Saturday night, dining at absurdly-expensive restaurants that only have 18 seats and take nine months to get a reservation, I would prefer to watch a show with my wife, and when she turns in, I’ll go to my laptop and bid on vintage hockey cards.

A friend-of-afriend heard we were going to Deerhurst, and shouted, “Deerhurst fucking sucks! There’s no nightlife, zero shopping, and everybody there is a bum!” Knowing him, what he’s into, and what he values in life, I realized that Deerhurst would be great for us.

I don’t “need” to stay in an Italian villa and post photos of it on Instagram. Call me boring, but I have no desire, right now, to spend two weeks in the south of France. I want to spend time with my wife and little girl, and do what my little girl wants to do. A 2-hour drive to a simple resort with all the things that will entertain her. My daughter spent an hour running around on the putting green, collecting the flags, and putting golf balls in a pile, and I’ve never seen her smile more. Would she enjoy sailing through the Mediterranean while eating caviar?

Your comment obviously struck a chord with me.

I work hard, and I make a good living. No doubt. But I never want to be those people. I just don’t. I see other real estate agents on Instagram, spending money they don’t have, posting selfies in front of luxury hotel signs, and it makes me all the more confident in the life I have, the company I keep, and the values I hold near.

Chris

at 2:03 pm

Good post, David. While each of us are entitled to live and spend our money as we see fit, I would absolutely align more with your worldview. Family is more important, in my opinion, than flashy things.

As to those who spend absurd amounts, the saying “big hat, no cattle” comes to mind. But hey, to each their own.

I’ve passed Deerhurst numerous times over the years en route to a bug infested Algonquin backcountry campsite, where the bathroom is a wooden box set back in the woods; it seems like a nice resort and great place to be with your family. Don’t concern yourself with what others think of it, or how you spend any of your free time, frankly.

Appraiser

at 2:42 pm

@ johnny chase

Your shallowness is duly noted.

Chris

at 10:15 am

Well now that’s a bit creepy…

Derek

at 4:31 pm

Deerhurst is great for reasonable proximity and activities. Have gone many times and the girls, now 7 and 3 1/2, always have a blast. It is expensive though, especially to get a separate room for the rugrats. With more time and some trial/error, one could probably find a similar experience for less, but you know what you’re getting when you say, “whatever… let’s just go to Deerhurst”.

johnny chase

at 4:34 pm

Sorry all – and to you too David. It was totally meant as a compliment!

I love that about you.

David Fleming

at 10:30 pm

@ Johnny Chase

Sorry Johnny, don’t get me wrong – I wasn’t taking that as a dig, nor did I mean my repsonse as a retort to you! I’ve seen you comment on here many times, I know you typically have my back.

I meant that it struck a chord because you said, “People, take note.” I’m the guy buying Costco chicken in bulk, after all. I tout fiscal responsibility on here all the time, and I’m showing that I’m as good a player as I am a coach.

Kyle

at 4:51 pm

Deerhurst and the surrounding area (Hidden Valley, Huntsville and Arrowhead Park) are awesome for families, with stuff to do all year round. My family has stayed at Deerhurst and we enjoyed it. It isn’t bougie like other parts of Muskoka, but that was part of the attraction for us. Kids can actually be kids there. And there is so much to do around there, whatever the season.

In the summer they have water sports, a splash zone, great golf courses, tree top trekking, pool, arcade, rock climbing wall. In the winter they have dog sledding, snowshoeing and next door at Hidden valley is the ski resort. Arrowhead Provincial Park is the next exit up and they have an ice skating trail through the forest, snow tubing runs, snowshoeing, cross country skiing.

Julia

at 6:48 pm

Deerhurst is great when you have kids. Your idea of vacation definitely changes once you have little ones – it absolutely becomes more about what keeps them happy and entertained. Curious to hear where you ended up buying David!

Megsy

at 12:14 am

That’s my guess too… but I could be blurring things together. I’m actually tempted to go back through his posts as I’m certain David mentioned the house purchase ages ago. Maybe it was just in the pick 5…

FDP

at 12:40 pm

When the interest rates are low, the market has been flat and economy is ok, it’s the best time to buy. I’m thinking people are waking up to this and hopefully can invest and get ahead. Long game now. The Fall market( and beyond),prices are on the upside.

Cyberd

at 1:49 pm

Congrats on the new house!

Professional Shanker

at 3:29 pm

Not sure how anyone can be bullish on condo prices in the medium term, remember what happened when detached homes appreciated at 20% a year……..same story transpiring in the condo market.

Long detached/semi, short condos……….

Hopefully we don’t see a significant recession in the next year or two, the amateur/domestic condo speculator will get crushed.

Appraiser

at 8:29 am

It’s a little sad (bust mostly pathetic) that the last vestiges of the bear clan are desperately clinging to the hope of a recession in search of redemption.

Reminds me a bit of Trump and the whole hurricane / sharpie thing.

Max

at 8:51 am

Sometimes it’s hard for one, based on personal confidence, accept that there are others with high incomes that can sufficiently support these it even higher prices. Unfortunately, over the long term, that person would just end up paying more for the same property. There are so many factors that push process up over time: immigration, inflation, tech wages, development costs, transfer taxes, rent price pressure… Sure, there are factors that affect them the other way, but over time, everyone needs a place to live and renting is becoming less of a viable option.

Max

at 8:51 am

Correction: push prices

Kyle

at 9:15 am

Could not agree more with this comment Max. It wasn’t long ago, when bears would frequently extol the superiority of renting over owning in Toronto, from a flexibility and Cost perspective. This clearly is dead wrong.

Today, many renters live in such constant fear that they may get evicted, that they even stay silent about about necessary repairs, just to not risk having to face the crazy rental market again, so there goes that whole flexibility argument. And i think you’d be very hard pressed to find a renter now, that would say, “Financially i am so glad i didn’t buy a home in Toronto these last few years”.

The reality as you’ve pointed out is the City is rapidly expanding in households but not nearly as rapidly in the number of dwellings. We have more immigration and more households being formed as millennials leave the nest. People are attracted to this City because it’s an amazing place to live andthe diverse and successful economy which supports high paying jobs. However the ability to add new dwellings is completely mired in bureaucracy. There is a housing crisis, and unfortunately no real way or political will to address the root cause – lack of supply.

Izzy Bedibida

at 10:17 am

Good points, and I agree with a few of them. My friend rents a large 1 bdrm in an older building at Eglinton/Allen. Its more or less rent controlled. She did that math, (she’s a banker) and it would be impossible to buy a similar sized unit with parking at her current cost. For her renting has proven to be much cheaper. At the same time she lucked out on scoring that apartment as well.

Chris

at 10:34 am

I can’t speak for all the bears who post here, but I have said before, and continue to believe that rent vs. buy is a personal decision, that does not have a one size fits all answer. I take a bearish position on Toronto real estate’s valuation, but do not recommend that individuals sell their home and rent, or put off buying, or really take any action, without carefully considering their own situation.

While there have been some high-profile stories in the media about tenants being evicted for own use or renovation, I can’t seem to pin down too many actual statistics on it. The Globe reports that in 2017, there were 2,928 N12 evictions filed in all of Ontario. Given a provincial population of roughly 13.5M, and a home-ownership rate of 69.7%, it seems like it would be a very small number of renters who are being subjected to N12 evictions. Anecdotally, in chatting with people who rent in Toronto, I haven’t come across tenants living in constant fear. But, open to any statistics or anecdotes you have on the subject.

Anyways, bears, bulls, and otherwise, we’ve all made incorrect calls. I thought 2019’s market would be weaker than it has been. Kyle, you thought we would re-attain a $900k average price in 2018. Housing bear thought July 2019’s average price would be lower than July 2018’s. None of us can pat ourselves on the back for being consistently correct, so a modicum of modesty from all sides is probably warranted.

Kyle

at 10:40 am

First, i’m not bragging about being right, i’m reiterating a substantive point. Second, your score keeping is a bit off. Being “consistently correct” as you put it, is not about having a perfect record correctness, it’s about having a more consistent record of correctness.

Chris

at 10:59 am

Apologies for breaking out the dictionary on you again, but the definition of the word “consistently” is “in every case or on every occasion; invariably”.

So, being consistently correct would indeed seem to imply having a perfect record of correctness, which none of us, to my knowledge, can brag of.

Anyways, rather than delving further into another debate on semantics, are there any data or anecdotes on evictions you can share? Genuinely interested, as it seems like there is no good comprehensive source on the topic.

Kyle

at 11:19 am

The dictionary definition i see for consistent, also includes as synonyms “steady, regular, uniform”. But regardless the broader point still stands just because a 20 handicap golfer and a 4 handicap golfer both have bogeys on their scorecard, doesn’t mean their golf advice should be treated as equal.

I don’t have data on the number of evictions. To be clear, nor was my point. My point is that the consequences of being evicted now are far more severe than ever before. There is far more competition for units, and the current market rents (which a Renter who moves has to pay) are typically going to be much, much higher than what they are currently paying.

Chris

at 11:32 am

And the dictionary definition of a synonym is “a word having the same or nearly the same meaning as another in the language”. Thus, synonyms do not always have exactly the same meaning. In this case, consistently means “in every case” (as defined above), while the synonyms “steady, regular, uniform” may have nearly, but not exactly, the same definitions.

Ah, ok, I was hoping you had some data. Quite a pretty strong statement to make, asserting that renters are living in constant fear of eviction (so much so that they stay silent about repairs), while having little supporting evidence.

Kyle

at 11:42 am

Like i said, the number of evictions has nothing at all to do with my point, so not sure what not having that particular data set has to do with anything.

My broader point still stands and is backed up by the sentiment found in articles such as this one:

https://www.theglobeandmail.com/investing/personal-finance/household-finances/article-canadian-renters-with-deals-are-reluctant-to-move-clinging-to/

Feel free to refute the broader point or dismiss it if you like, But i am not interested in debating the nits you so like to pick.

Chris

at 12:01 pm

That article paints a picture of tenants reluctant to move, because they are in rent controlled housing, and would be subject to higher rents if they relocated, so they voluntarily stay put. It does not seem to suggest that people are living in fear of eviction or keeping quiet about necessary repairs.

As for the picking of nits, one must simply scroll up to see that it was you who, incorrectly, sought to distinguish being “consistently correct” from “having a perfect record of correctness”. You then attempted to counter the definition of the word through the substitution of synonyms. If you’re now done debating diction, that’s fine.

Kyle

at 12:08 pm

“When I first moved in, a squirrel had taken up residence in one of the walls and would sprint back and forth at all hours of the night. When the hinges fell off our bathroom door, for months we used a cinder block to keep it shut. At one point during a particularly rainy spring our fire alarm came bursting down from the ceiling and water started pouring into the hallway. My roommates and I always dealt with these things by ourselves, only bringing in the landlord as a last ditch effort.”

https://www.vice.com/en_ca/article/8qwbkg/being-evicted-in-toronto-right-now-is-devastating

There are also countless comments on Facebook pages as well that express the same sentiment. Hope this satisfies that nit you’re desperately picking.

If you actually want to refute the broader point and make some kind of claim that Toronto Renters are a happy bunch these days with your own evidence and data, by all means have at it. Otherwise i’m done indulging your nits.

Chris

at 12:22 pm

While those stories from Vice are bleak, it sounds as though the tenants they spoke to are on comparatively low incomes, and renting pretty cheap housing. Not sure you can extrapolate their experiences to say the young professionals renting a $2,100 condo in liberty village. Can you share some of these Facebook pages?

Also, you’ve been a bit unclear; is it nit picking to ask for data and anecdotes to support your assertion of many tenants living in constant fear, as it doesn’t quite jive with what I have witnessed? Or is it nit picking to set straight your incorrect definition of a word?

Kyle

at 12:34 pm

Did you actually have a counter to the broader point?

Cause i frankly don’t care if you the evidence that i provided isn’t quite satisfactory enough to you, you’re welcome to satisfy yourself and come to your own conclusion.

Chris

at 1:00 pm

As stated initially, my points are:

– I am bearish on Toronto real estate valuation, and take no position on an individual’s choice to rent or buy, as it is far too reliant on unknowable and personal variables

– I am doubtful of the assertion that “many renters live in constant fear that they may get evicted”, as this seems to run counter to my own observations and anecdotes

– None of us have been consistently (read: perfectly) correct, thus it behooves us all to temper the certainty with which we make predictions and contentions

Professional Shanker

at 5:01 pm

Please let us not get into a discussion whether incomes in Toronto and the surrounding GTA can support continued higher prices. If someone subjectively assesses wage data vs. property prices, they will come to a bearish conclusion. Incomes in Toronto cannot continue to support property prices in perpetuity unless we continue to reduce/suppress interest rates, the CBs have done a commendable job for the past quarter century.

I only hope the world finance system can survive on lower interest rates as I and everyone else on this blog will not benefit from a credit shock.

Kramer

at 8:08 am

The Greater Toronto Area (GTA) is projected to be the fastest growing region of the province, with its population increasing by 2.8 million, or 40.8 per cent, to reach

almost 9.7 million by 2041. – Ministry of Finance

Chris

at 9:04 am

Welcome back, Kramer.

I’m fairly certain we’ve already discussed the Ontario Ministry of Finance’s population projections on this blog. The Ministry states right at the top of the page that their projections are “Based on the 2011 Census”.

Yet, when the 2016 Census came out, it showed that the Toronto CMA’s population growth had slowed from 9.2% between 2006-2011, to 6.2% between 2011 and 2016.

https://www12.statcan.gc.ca/census-recensement/2016/as-sa/fogs-spg/Facts-cma-eng.cfm?LANG=Eng&GK=CMA&GC=535&TOPIC=1

If you look at Chart 8 of the Ministry’s report, you can clearly see how this impacts their projections. They predict the GTA will grow from 6.9M people in 2017 to 9.7M in 2041. Yet, Statistics Canada’s population figure for the GTA from the 2016 Census was actually 5.9M.

I would suggest waiting for the Ministry of Finance’s updated report, rather than continuing to tout projections based on eight year old data.

Kramer

at 9:16 am

That’s fine… as long as “subjectively” looking at wages includes considering every other factor in the supply/demand function, including the fact that the population will be growing substantially (and it will be, whatever the exact % increase to 2041 ends up being, and there is no reason to reasonably think otherwise).

Nothing angers me more than someone who looks ONLY at average wage and it’s growth and says “Impossible – it’s a bubble.” It’s the only pet-peeve that can bring me out of TREB posting-retirement. 😉 And glad to see you and Kyle are still at it. Love you both.

Chris

at 9:29 am

I would encourage you to drag yourself out of TREB-posting retirement more often; I enjoy debating with you!

Professional Shanker

at 5:11 pm

Appraiser – putting words in my mouth, you are good at that! Trying to align bears with Trump is an unfortunate leap for you.

I would prefer the bubble continues to inflate over a recession, given your age/experience I believe you have lived through a couple, it does not benefit the greater population, which includes myself.

I would not claim redemption when an eventual recession runs havoc, but I would also never discount it’s ability to expose the over leveraged.

Appraiser

at 7:32 pm

You guys need more sharpies.

Condodweller

at 11:22 am

Felicitations on all your achievements (baby/house/reaching age 39 etc..).

I agree with all four points with the qualifications that as you say #2 is a toss-up and #4 I’d say only up to the limit of SFH prices or just under.

Regarding all the talk about you ragging on millennials, I just realized something. You should be careful about dumping on them as you are but a few months shy of being one yourself! A few years ago when the millennial term became popular I was surprised to learn that millennials went back to 1981. When I was growing up there was a Gen-Y after Gen-X however Gen-Y has since disappeared and I guess they were just extended and renamed millennials. According to a quick google search anyways.

My take on housing prices is still the same as before i.e. I believe they will go up in the short term, however, long term there are a few significant challenges to overcome. I am still curious to see if the 2017 peak SFH average prices will be surpassed and if so when?

Considering all the regulatory tightening prior to 2017 which may have not worked their way through the system plus B20 I would venture a guess that prices will have difficulty surpassing the 2017 peak. If we extrapolate future increases based on the increases since 2017 it will take years just to get back to 2017 levels. A lot can happen to the economy during those years and it wouldn’t surprise me if prices bounced around between the2017 highs and the post-2017 lows and moved sideways for a number of years.

Appraiser

at 2:31 pm

Feasting on data from 2017 is getting real old.

Max

at 6:08 pm

Maybe if the NDP won the federal majority and started all kinds of new taxes and free homes for people.

meagicano

at 12:12 am

The millennial tag is BS anyway. The old Gen Y made more sense, with a tighter range… you can’t lump someone from 81 in with someone from 93 and expect there to be commonalities.

Appraiser

at 7:49 pm

How about those job numbers!

https://www150.statcan.gc.ca/n1/daily-quotidien/190906/dq190906a-eng.htm

Mxyzptlk

at 9:40 pm

“Gulp.”

— Andrew Scheer

Appraiser

at 1:44 pm

“Of all the things people (self included) got wrong about Toronto real estate, this is the big one”

https://twitter.com/BenRabidoux?ref_src=twsrc%5Egoogle%7Ctwcamp%5Eserp%7Ctwgr%5Eauthor

Well what do we have here.

A perma-bear publicly admitting to being dead wrong about the Toronto Real Estate market. Finally.

A good example that should be followed by a few more.

Jimbo

at 2:12 pm

https://www.google.ca/amp/s/www.cbc.ca/amp/1.5242298

What are your thoughts on this?

Dominique Feazel

at 4:41 pm

Appreciate discussing these details during this awesome blog. i will talk about this informative article in my facebook be the cause of my girlfriends