Can a seller sign-back a bully offer?

Yes? No?

If not, then why?

I just had this conversation with a buyer client of mine, and upon explaining it, I realized how stupid this must all sound.

How incredibly ridiculous this process of pricing and selling homes in Toronto has become.

I can’t help but think of the 2015 video I produced in my “What If The Whole World Worked The Same Way As The Toronto Real Estate Industry?” which, five years later now, I think could have benefitted from a more succinct title.

Life moves pretty fast. I can’t believe this was five years ago:

The purpose of this series was to try and explain how insane the world of Toronto real estate is, by using analogies for every day life.

Imagine going to buy a tube of toothpaste, which reads “$1.99” on the sticker, only to find out that the pharmacy isn’t actually selling that toothpaste on that day, or, of course, for that price. Then imagine returning on the scheduled day to purchase the toothpaste, only to find out they sold it to somebody else, before the scheduled sale date?

Once in a while, I’ll have a conversation with a first-time buyer, often who isn’t from the city, and I’ll pause and think about just how insane the conversation around pricing and offers goes.

I’ll explain that properties aren’t really listed at the prices at which they’re intended to sell, except that, sometimes they are.

I’ll explain that there are “dates” on which offers will be reviewed, and that offers are only to be submitted on that date, except that, sometimes they’re not.

Then I’ll explain how no seller is forced to sell, even if their $999,900 listing received an offer for $1,250,000. And that they can continue to advertise the property for sale at $999,900, even though they have no intention of selling at that price, and, have already turned down more. I’ve butted heads with other brokers over this point, as I think once you turn down more than your list price, you’re guilty of false advertising if you don’t adjust the price. But some pretty big-name brokers out there have told me they believe otherwise.

So just when we think we have it all figured out, things start to change.

Pre-COVID, every house was listed low with an “offer date,” right? Especially in this first-time buyer segment, around $1,000,000, you’d expect the $799’s, $899’s, and $999’s to all sell for far higher, amid a dozen offers, on the scheduled “offer night.”

Sure, sometimes the offer date was a bust, and we’d see these $999,900 listings re-appear at $1,279,900, with “offers any time.” But for the most part, the “list low, hold back” strategy worked.

Then along came COVID, and we started to see more listings come out at fair market value, or as I would suggest, slightly above.

If you think your house is worth $1,200,000, and you don’t feel that listing at $899,900 with an offer date is going to generate the 40-50 showings and 8-12 offers that you would have received back in February, then list at $1,229,000.

This is what we saw for quite some time in March and April.

Sure, many sellers did try the “list low, hold back” strategy, and that provided varying levels of success. As time went on, the market got better and better, and I saw more of these listings selling. But in late-March and early-April, this was more likely to fail than it was to succeed.

So now here we are, late-May, two months into the state of emergency, with prices and sales having dropped in April but momentum having built back up for the past two or three weeks, and how are properties selling? How are they being listed and priced?

This is where things get really interesting.

I’ve mentioned the concept of the “soft holdback” in the past.

Consider that the note on MLS reading: “Offers If Any Reviewed On Wednesday, May 20th @ 7:00pm, Please Register By 5:00pm” is what you’d expect to see with any listing that has an offer date, aka a “holdback.”

So a soft holdback is what, then, exactly? Just a kinder, gentler version of the above?

Pretty much.

And it looks like this:

Once upon a time, we’d see “please allow 24 hours” in the showing remarks because sellers actually needed 24 hours. The seller was away in Thailand, and service on the Blackberry 8700 was slow, plus, the lineup at the fax machine at the 7-Eleven in Ko Pha Ngan was long at this time of year, with the Full Moon Party in full effect. So it would really, really help if the buyer provided 24 hours so that the listing agent could ensure the seller could be reached.

But in 2020?

Gimme a break.

Other than the need for a lawyer to review an offer during the sale of an estate, or through a divorce proceeding, I can’t see any reason why somebody “needs” 24 hours on an offer.

Needs versus wants.

24 hours aren’t needed, but rather they’re wanted by the listing agent.

Why?

To stall for time.

In this post-COVID market, there will undoubtedly be buyers who don’t want to line up to “bid” on the scheduled offer nights, and thus who will turn up their noses at those $899,900 listings for 3-bed, 2-bath houses on the east and west sides of the central core. A smart listing agent will recognize this, and while weighing the seller’s risk tolerance, perhaps provide an in-between strategy.

You don’t want to list low with an offer date, but you also don’t want to list at fair market value and limit your upside.

So what do you do?

A soft holdback.

That listing above is for a house that came out today, which I believe is priced attractively. Had this house been priced at $899,900 but with an offer date, there are a lot of buyes who wouldn’t go see it; buyers that don’t want to play like it’s February, even if that’s where we’ll be in a month or two. For today, they want to enjoy the sunshine.

So how do you keep those buyers interested and ensure you don’t limit your upside?

You ask for the “24 hour irrevocable.”

In theory, if this strategy works, then there’s a rush of buyers who all think they can get the house for the list price, who see the house the first day or night that it hits the market, or at the latest, the next afternoon. The first buyer might submit an offer of the list price, or maybe he or she knows this house could sell for more, and goes in at $1,150,000. The second buyer, who already knows he or she is in competition, comes in higher. And the third buyer? Well, he or she is up against not one, but two other bids, and thus the offer sails past $1.2M.

Of course, not every house that is listed with a “soft holdback” will end up with three offers in the first 24 hours. But for the ones that do, the above scenario is what the sellers are banking on.

It’s slick, right?

I know y’all hate it, except when it’s your own home for sale, that is. But it’s slick, and it works.

A colleague of mine listed a property this week with a soft holdback and a buyer saw the property in the early afternoon, and had submitted an offer by the early evening. That offer had a 24-hour irrevocable, which meant that it expired the next day at 6:30pm.

The next morning, two more offers were registered – one at 10:30am, and one by noon.

By the time 6:30pm rolled around, my colleague had one offer that was a higher price than the first offer with the 6:30pm expiry, so she had no reason to work with that first offer by the deadline.

That offer expired.

The second offer, which was higher, and having been submitted at 12pm, also had a 24-hour irrevocable, so now it was good until the next day.

Do you see where this is going?

My colleague could have held that offer for another 24 hours, having kicked the first offer to the curb, and still possessing the offer submitted at 10:30am. But by 8pm, she had another two offers, and the property was sold by 10pm.

A little more than thirty-four hours after the property hit MLS, there were five offers, and the property was sold firm.

Not bad for a property that, apparently, didn’t have an “offer date.”

This is the trouble for buyers in this market. The “soft holdback” looks so non-threatening, but trust me when I say that it can often prove more fierce than the old-fashioned “offer date.”

The problem for many buyers is the age-old culprit called “inexperience.”

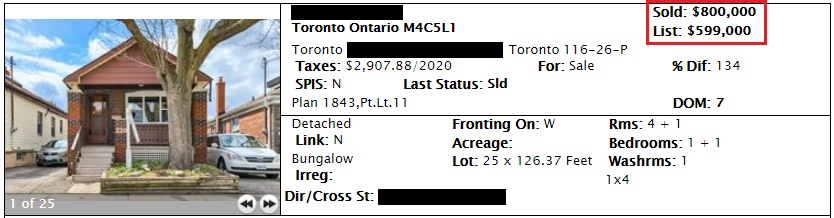

Remember the property I showed you a while back that received twenty-two offers in April at the height of COVID and the bottom of the market?

This one:

What I surmised happened with this listing is simple: every neighbourhood genius came out of the woodworks. Every wanna-be rockstar said to him or herself, “We’re in a pandemic and there are going to be firesales on houses! I’m gonna buy this house for $599,000 and laugh all the way to the bank!”

How many of the twenty-two offers do you think were for the list price? Ordinarily, I’d think one or two. But at this time? I bet they had 6-8. Then I bet there were another fifteen offers under $700,000.

If there’s one thing I’ve learned about pricing in this market, during the pandemic, it’s that there are always going to be naive, inexperienced people who submit dummy bids. It doesn’t matter if the market is hot or cold, or if we’re in quarantine. The twenty-two offers that materialized on this listing in April proved it.

So how does this relate to the listings that require a 24-hour irrevocable?

Same thing: there will always be buyers who simply believe that if they submit an offer of hte list price, they’re going to buy a house.

Without the presence of that “offer date” on the MLS listing, they think this signifies that the property is being offered at a “true” price, and an offer for the list price takes the house. But they’re ignoring the efficient market theory, more specifically that if there’s more demand than supply, and if the property is priced attractively, then the market’s built-in efficiency will push the price higher.

And that’s what happens.

The buyer who comes in with the bid of the mere list price always loses to a higher bid.

The lesson?

Don’t blind yourself.

You can’t merely look at the $999,900 listing with “offers any time w/24 hours” and assume this means you can buy the house for $999,900.

Do your research. Look at comparable sales. What else is up for sale right now? What is the interest level like? What is the listing agent saying? What do your colleagues think? How do agents in your office feel about it?

There are a lot of people out there who want to think that we have moved into a bear market, but as I sit here at 11:30pm on Wednesday night, in competition on a property that was just listed yesterday, I can tell you that the market is moving well.

I’m not suggesting that a house sold today will get more, or even as much as, it might have on March 5th.

But I am suggesting that there’s still more demand than supply, and buyers who don’t understand listing/pricing strategies, whether you think they’re fair or not, are going to get crushed in this market.

Side-note: is anybody willing to bet that the TREB average sale price will be lower in May than it was in April? Anybody? Nobody?

Appraiser

at 7:53 am

“There are a lot of people out there who want to think that we have moved into a bear market, but as I sit here at 11:30pm on Wednesday night, in competition on a property that was just listed yesterday, I can tell you that the market is moving well.” ~DF

Someone a while back (ok it was me) said that this pandemic would reveal just how resilient the GTA real estate market is.

So far it’s nothing short of remarkable.

As an aside, the appraisal business has seemingly doubled overnight, with a plethora of new HELOC applications (attention Ben Rabidoux), more MLS deals happening and brand new homes under construction again.

J G

at 8:20 am

You also said Toronto real estate is “unstoppable”. Lol ok.

Just because May number is looking good (relative to April) , the bulls are out in full force, I didn’t see many posts by you two weeks ago right after the April numbers came out.

Chris

at 8:55 am

Hmm no talk of composition change now either anymore? When price went down, that was all the rage among the bulls. Are more detached homes selling relative to condos now, compared to April?

Also curious how none of the bull wanted to wade in on CMHC’s dire forecasts. Instead just patting themselves on the back for, in their estimation, correctly predicting resilience.

Caprice

at 9:16 pm

OK Chris, I’ll play… here’s CMHC’s dire forecast for the Toronto market…in 2015:

“Hot Canadian housing market to slow next year, CMHC says”

https://www.thestar.com/business/real_estate/2015/10/26/hot-canadian-housing-market-to-slow-next-year-cmhc-says.html

How did that work out?

Chris

at 10:04 pm

“The Canadian housing market is expected to moderate over the next two years, Canada Mortgage and Housing Corp. said Monday it its fourth-quarter outlook.”

Published in late 2015. Market heated up over 2016, then slowed down in 2017 after a crazy spring.

“The average MLS price is forecast to be between $417,000 and $459,000 this year with a forecast of $437,700 before rising to between $420,000 and $466,000 in 2016. The average price in 2017 is expected to be in a range between $424,000 and $475,000.”

For 2016, CREA average price fluctuated between about $450,000 to $500,000; for 2017, it climbed as high as $550,000, before falling back to about $480,000 to finish out the year.

Those 2015 forecasts are also not nearly as dire as the ones that came out the other day.

Caprice

at 9:24 pm

TREB Average prices in December of each year:

2015 $608,714

2016 $730,124 (+19.95%)

2017 $734,847

2018 $749,014

2019 $837,788 (+37.63% since 2015)

Chris

at 8:52 am

So, in your estimation, the GTA market has plowed right through, and any impact that the pandemic was going to have has already occurred?

“The hilarious thing is everyone drawing conclusions on the housing market. It’s been six weeks!! Real Estate is not the stock market, check back in six months.”

– Steve Saretsky

“ Prices have remained stable and the market has been getting more competitive every week since mid April. Check back in 6 months”

– John Pasalis

“ a growing debt “deferral cliff” that looms in the fall, when some unemployed people will need to start paying their mortgages again. As much as one fifth of all mortgages could be in arrears if our economy has not recovered sufficiently.”

– Evan Siddall

Maybe a bit premature of you to sound the all clear?

J G

at 8:26 am

What is the point of the side bet? Everyone can see the stats these days. For example Zolo tells me 416 is up 5% compared to one month ago.

https://www.zolo.ca/toronto-real-estate/trends

That’s like me saying, anyone want to bet S&P will be lower in May compared to April? (Currently it’s at 2971, 1 month ago it was 2823)

Kyle

at 9:28 am

“What is the point of the side bet?”

The point is this is the Toronto Realty Blog, not the S&P 500 blog, not the Canada-wide Average real estate blog, not the opinions from a Vancouver Realtor blog.

If you can’t find relevant facts and data to back your side, it really is ok to not shitpost comments all day long.

Chris

at 9:49 am

“The point is this is the Toronto Realty Blog, not the S&P 500 blog”

“Dow Jones down 19% from the peak as of this morning and on the verge of a bear market !” – Appraiser

“not the opinions from a Vancouver Realtor blog”

“The latest weekly MLS data from John Pasalis, Scott Ingram and Steve Saretsky, seem to indicate that the bottom for activity (transactions) is history and inventory may already be starting to recede in the GTA.” – Appraiser

Kyle

at 9:59 am

“not the opinions from a Vancouver Realtor blog”

“The latest weekly MLS data from John Pasalis, Scott Ingram and Steve Saretsky…”

Chris

at 10:03 am

Oh, is MLS data Toronto only now? Was Steve Saretsky sharing GTA data, from his outpost in Vancouver?

J G

at 11:00 am

No need to get personal. It all comes down to the bulls trying to convince to people Toronto RE is the best way to go, while my point is there are other good alternatives.

One of your previous post said you don’t give a crap about any companies that go up against Toronto RE. Ok fine, go all in on RE.

I can say from doing both is that RE requires way more time/effort/money to carry.

Kyle

at 11:18 am

It’s a fair point, that there are alternatives to RE. What we should be discussing is under which scenarios and for whom does one make more sense. That said, if we are talking going all-in on one asset class. Like i said, i have never met anyone who went all-in on stocks while not owning RE, who came out ahead. At least not in this City. Is that a Toronto thing? Maybe. If we’re talking Alberta or Maritimes RE, probably a different story.

Also that is not what i said at all. What i said is that, i don’t give a crap about what random companies that know nothing about Toronto real estate, have to say about the direction of Toronto real estate prices. Hell one might as well be quoting random dudes in a coffee shop, or the girl at the gym, or their Aunt in South America. Like seriously, are some people really that desperate to find support for their arguments?

To be clear i hold both asset classes.

Chris

at 8:37 am

Even the Wall Street Journal has picked up CMHC’s recent forecasts:

“Canada Warned About Coronavirus-Induced Mortgage Arrears

Head of national mortgage insurer projects 20% of mortgage holders could miss payments”

https://www.wsj.com/articles/canada-warned-about-coronavirus-induced-mortgage-arrears-11589952497

jeanmarc

at 9:24 am

Goes to show how a listing price in real estate is like the wild wild west. There is no ethical standard of what listing prices means due to supply and demand. It is a tug of war between what a buyer is willing to pay and/or how much the seller is willing to sell for.

Geoff

at 1:51 pm

There are other considerations besides price. I don’t get why people don’t get that. You want to get the highest price for your home, but you also want to select an offer that’s likely to close, and suits your timing as well. A high price with a close 1 month later than desired might be manageable, or it might be a nightmare. A high price with a low deposit from unvested buyers might not close. It’s not just about price. Geez. PS Isn’t this the definition of how all products are priced – “It is a tug of war between what a buyer is willing to pay and/or how much the seller is willing to sell for.”

jeanmarc

at 9:03 pm

I was just pointing out from David’s examples above that price of listing does not mean anything in hot markets like the GTA. It’s just a starting point. Final price can fluctuate greatly from supply/demand (buyer/seller’s desires). Deposits, closing date, conditions, etc. are also important factors in negotiation. But sellers look at the offer price first before looking at deposits, closing date, conditions, etc.

Chris

at 10:49 am

“In our internal polling over 60% of tenants did not pay full rent on May 1st.

Over 50% in our internal polling shows small landlords are going to sell if they cannot collect rent or evict non-paying tenants within the next couple of months.”

https://ontariolandlords.org/blog/landlords-need-to-evict-non-paying-tenants-now/

J G

at 10:53 am

Sounds about right, one of my tenant could not pay full rent in both April and May. But good thing I have AMZN MSFT and FB all rallying.

Chris

at 11:08 am

It’s probably a little bit high, as their internal poll may not be perfectly reflective of reality. But seems likely a significant number of landlords didn’t get paid full rent.

“About 25% of NYC renters didn’t pay in May: survey”

https://therealdeal.com/2020/05/19/about-25-of-nyc-renters-didnt-pay-in-may-survey/

condodweller

at 11:12 am

You have to read these statements carefully. 60% not paying FULL rent might be similar to 25% not paying rent, i.e. not even partial payment. If there was 35% who did make a partial payment you’d be at the 60%

What I’d be interested in is what not paying full rent means. What percentage of the rent was paid and was there an agreement i.e. was a portion forgiven and has the tenant agreed to pay the balance later? J G care to provide some anecdotal data?

Regarding the stock market, what I find interesting is that there are companies out there that have more than 100% gains since the bottom and many with well over 30-40% which are still far from their previous highs. It’s also not hard to find some that are higher than their all time high in March.

Chris

at 11:45 am

Agreed, would be interesting to get some more data on what exactly “not paying full rent” breaks down to. As you suggested, I imagine that 60% figure includes many who are paying some, but not all, of their rent due.

M

at 11:34 am

Just because a seller requests/ demands a 24 hr irrevocable does not mean the buyer must adhere. They can offer whatever terms they want, just like a seller can ask for anything.

David Fleming

at 12:09 pm

@ M

Correct.

And the seller can reject the offer if it arrives without 24 hours’ notice, and ask/instruct the buyer to resubmit.

This cuts both ways, and in the end, supply/demand, risk, and desire among buyer and seller to transact will determine courses of action.

Thomas

at 3:08 pm

One word. Bull trap.

I am actively looking and it is clear as day that prices have fallen. Sellers who are adjusting to that reality are able to sell and others are either not able to sell or they are simply holding. However, it is true that there is still high demand. My bet is that it will stabilize over the next four to five months. What happens after that would be the interesting part.

Thomas

at 3:22 pm

“One word. Bull trap.”

Actually two 😀

Pragma

at 9:44 am

I 100% agree. I fully expect May and June prices to be higher than April. That’s an easy bet. There is minimal stress. Sellers are holding back thinking they can still get Jan/Feb prices and/or they don’t want to sell. There has been a huge uptick in listings for basements or entire homes for lease. People are buying time. At a certain point they will HAVE to sell. There is minimal stress right now. It’s been two months/two missed rents/payments. Let lending standards tighten up across the board, from banks to B lenders to private lenders. That’s demand destruction. Let those deferral periods lapse (if you were smart you would sell well before then). I’m very bearish on downtown condos. Every “investment” condo bought over the last two years makes zero financial sense as an “investment”. Cash flow negative + flat or shrinking equity + declining rents? Supply expansion. Unless you expect the economy to be back to 100% by September, and that everyone who deferred is back to earning the same income, nobody can deny that there will be quite a blip in that month. I keep saying it, housing is a slow moving inefficient market. 12%+ unemployment, defaults, deferrals, credit standards, all this new information will be incorporated much slower than the events that caused those outcomes.

condodweller

at 11:02 am

“There has been a huge uptick in listings for basements or entire homes for lease.”

To me this is one of the biggest warning signs about RE market weakness. I have mentioned this in posts several times that this was very noticeable during the 89 crash and the years that followed.

“Every “investment” condo bought over the last two years makes zero financial sense as an “investment”.”

If the investor was counting on future price/rent growth, absolutely. Even those who worked in some negative cash flow into the equation might have a rethink. I would also add that those who bought before 5-10 years ago might think about selling given the opportunity cost of the gains tied up in an investment property. I bet there are a lot more of them than those who bought two years and less ago.

” I’m very bearish on downtown condos.”

This remains to be seen. Anyone who is able to make it through this period could hold on and keep renting. As I said, there are a lot more investors who bought a long time ago who can easily afford to get through this period with much lower than current rent expectations. It will depend on whether there is enough first home buyer demand to take up the slack if investors do start selling.

I absolutely agree that as Warren Buffet says will find out who has been swimming naked after the mortgage deferrals end. The interesting issue here is though that theoretically, the deferrals can be extended indefinitely and if that happens it could go on until things return to normal. Therefore it is possible that even this debt cliff as it’s being called might not have a major impact or might not happen in a significant way.

Chris

at 11:54 am

“The interesting issue here is though that theoretically, the deferrals can be extended indefinitely and if that happens it could go on until things return to normal.”

Not so sure I agree with this. At the end of the day, the banks are a business with shareholders to appease, and mortgage payments are a part of their revenues. Unless the government is going to step in to cover the shortfall (a political nightmare, which will be seen as taxpayers bailing out the banks), continued mortgage deferrals will mean lower revenues, higher credit loss provisions, lower incomes, and a hit to share prices and possibly dividends.

Anecdotally, there are a fair number of older Canadians who rely on the steady big bank dividends to help fund their retirement. Would they tolerate this cash flow being reduced so that over-leveraged borrowers can avoid selling their real estate?

condodweller

at 1:45 pm

It is not a coincidence that (Canadian) banks have been around for over a hundred years and managed to get through challenging times. Banks constantly evaluate their risks and set aside reserves to cover expected shortcomings. During the worst case scenario in a long time during the 2008/9 financial crisis banks have halted dividend INCREASES. They continued to pay out dividends and as soon as the horizon cleared promptly started increasing it. No expectation of cutting dividends.

Mortgage deferrals are by no means a a generous gift to people. Banks are not giving up anything in fact they are making more money as you pay interest on the deferred amount. Income is simply delayed. They can use reserves if necessary in the short term. Don’t forget that they do have a lien on the mortgaged property as well as CMHC should things get really ugly. At the end of the day they win, one way or another. There is a reason Canadians rely on dividends from banks.

Bal

at 2:29 pm

My gut feeling is saying that the housing market will stay strong…i don’t think anything is going to happen to the GTA house market….i see it is going up in coming days instead of going down……i know I know my gut feeling is not any data..

Chris

at 2:48 pm

Oh, don’t get me wrong, Condo, I don’t think any rational person thinks our banks are going to collapse. They’ll be fine.

But, I don’t think they will simply acquiesce to interminable extensions to mortgage deferrals either. At some point, they will need that revenue to ensure they can pay their obligations, and continue to provide their shareholders with the dividends they expect. Particularly as their reserves are being increasingly consumed by provisions for credit losses.

I suspect we’ll learn more in the coming days:

https://www.bnnbloomberg.ca/record-reserves-for-bad-loans-poised-to-slash-canada-bank-profit-1.1439867

Bal

at 3:20 pm

Chris…no comments on my gut feeling….lol…hope my gut feeling is wrong.lol

Chris

at 3:30 pm

Haha Bal, I’d place more weight on CMHC’s forecasts than anyone’s gut feelings. But hey, that’s just me.

Bal

at 3:35 pm

????….true….Have a wonderful weekend all….enjoy beautiful sunny days…and stay safe

Chris

at 5:05 pm

Thanks Bal, you as well!

Chris

at 9:45 pm

Bal, I think Rob McLister overheard you talking about gut feelings!

“Forget all those economists and their shot-in-the-dark forecasts. What does your gut tell you about where home values might be headed when we’re about to see:

– An estimated 41.3-per-cent collapse in economic output this quarter, according to a Bloomberg survey of economists;

– As many as one in five working-age adults either jobless or with major loss of income;

– Up to one in five borrowers potentially unable to pay their mortgage after deferrals stop (the “deferral cliff,” as CMHC puts it);

– Tens of thousands of businesses that will never again reopen;

– Record mortgage delinquencies that could double the 1980s peak, per CMHC numbers.

Sure, the government is rolling out billions of dollars in various forms of short-term financial assistance, and sure, banks are deferring mortgage payments temporarily. But fast-forward to October when millions could still be off work while deferrals end. A year from now, CMHC fears tens of thousands of low-equity homeowners could owe more than their home is worth.”

https://www.theglobeandmail.com/investing/personal-finance/household-finances/article-if-you-dont-have-rock-solid-finances-now-is-not-the-time-to-buy-a/

Mxyzptlk

at 11:30 pm

Wow, Stephen Poloz apparently reads TRB Comments.

http://www.bnnbloomberg.ca/risks-to-economic-outlook-are-overblown-canada-s-poloz-says-1.1439635

Appraiser

at 9:40 am

Great link.

I especially liked this quote from Poloz regarding the doomdayers:

“…I do think on balance what I’m hearing, the flow that I’m hearing, is a little too dire, a little bit overblown.”

Nice to see some additional level-headed thinking out there besides Kevin Milligan.

Trivia Quiz:

What do Stephen Poloz, Tiff Macklem (Governor-Designate) and Caroline Wilkins (Deputy-Governor) have in common – they all have graduate degrees in economics from the University of Western Ontario.

Chris

at 6:43 pm

“1st, we expect prices to fall 9% on average if we have a prompt post-COVID recovery in Canada; our “moderate stress” case (worse than expected) results in -18%, both extrapolate from tentative @bankofcanada forecast.“

– Evan Siddall, President & CEO, CMHC

https://twitter.com/ewsiddall/status/1264274394408509446

Makes you wonder what their worst case scenario looks like…

Bal

at 8:01 pm

Chris- quick question…CMHC and realtor board are two different things right? So what is the TREB forecast?

Chris

at 9:02 pm

Yep, CMHC is the government corporation that insures mortgages and is tasked with ensuring Canadians have affordable housing. Organizations like TRREB represent realtors in the Toronto area. I’m not sure what their latest forecast is. They had one pre-covid, and said they were going to be issuing a revised one, but I don’t know if I ever saw it.

Caprice

at 1:30 pm

No Nosedive Ahead for Canadian Real Estate Prices: RE/MAX

https://blog.remax.ca/no-nosedive-ahead-for-canadian-real-estate-prices-re-max/

“CMHC doesn’t seem to understand the sheer number of sellers that would have to accept this kind of price reduction, in order for average housing prices to plummet to this degree in such a short time span,” says Christopher Alexander, Executive Vice President and Regional Director, RE/MAX of Ontario Atlantic Canada. “Sellers simply won’t accept that kind of discount on their listings. A statement of this nature is panic-inducing and irresponsible.”

Bal

at 2:27 pm

well what else Re-max can say? They have their self interest…so for sure they are going to criticize…

Chris

at 4:15 pm

Good point, Bal.

“I think he was highlighting a worst-case scenario,” Ben Tal says. Yet Evan Siddall just clarified that he was outlining a “prompt post-COVID recovery in Canada” for -9% or a “moderate stress case” for -18%. Worst case scenario is presumably an even deeper percentage decline.

“Canadian real estate prices will likely remain relatively stable or experience a single-digit price correction at worst”

So, Remax sees a decline of up to 9% as possible? That aligns pretty well with CMHC’s best case scenario.

“A single-digit decrease in house prices can be classified as a correction”

Minor point, but I believe most set the hurdle for a “correction” to be -10%. So, single digit decreases would not meet that criteria.

“When government financial aid runs out and the six-month mortgage deferral period expires, people may then start listing their homes if they can’t afford to keep them. However, right now this is not the case. If a flood of listings does occur in Toronto this fall, it will be a short cycle.”

Interesting. They identify many of the same risks as CMHC, in the deferral cliff and an insufficient rebound in the economy and employment. Yet, in the same breath, they dismiss it all, by saying it will be a short cycle? Genuinely curious what makes them think this? Are they expecting a quick V shaped economic recovery? They don’t really go into much more detail.

Caprice

at 9:19 pm

Just offering a counterpoint to CMHC, off course everyone has their own angle. Evan Sidall is hardly unbiased, his stance even before the pandemic has been towards reducing the exposure of CMHC… which by the way has generated billions in dividends over the years for the government.

Also, the “Canadian real estate market” and the Toronto market historically have deviated substantially. At the end of the day, we are all making guesses coloured by our own biases… let’s see how it plays out.