Have you read the headlines?

The Toronto real estate market is crashing!

But before you rush to put your home on the market and try to recoup most of what you paid for it back in 1998, maybe we’ll take a look at two opposing narratives, from two different newspaper, and then discuss the definition of a “crash” as it pertains to the price of a hard asset…

Perspective. I think the analogy is quite apt, don’t you?

We can all choose to see the cup as half-empty, or half-full, and we can elect to wear our rose-coloured glasses, or not.

We can listen to the devil on one shoulder, or the angel on the other.

And we can certainly hand-pick where we get our news, and which opinions, and narratives, we’ll actively absorb.

With blog posts like this, I’m one step from becoming a full-blown market cheerleader, but if the shoe fits, then I’ll wear it – in the downtown core, where prices continue to escalate, in the face of headlines that tout the exact opposite.

You’ve heard this rhetoric from me before. The whole “fight the headlines” angle is nothing new.

But this blog post was spurred by two things:

1) An incredible read in last week’s Financial Post.

2) A completely misleading and incorrect headline from Tuesday.

Let’s start with the former, shall we? It’s more to the point, and the point itself is indisputable.

I receive the TREB stats a day before they’re released, through a contact of mine, so I knew what Tuesday morning’s headlines would say.

But upon opening my news feed on my way to the office on Tuesday morning, I was shocked to see this:

Does anybody here see the problem with this?

Home prices are not down 35%. Not even close.

Sales were down 34.9%, from February of 2017 to February of 2018.

The average Toronto home sale was down 12.4% in the same time period. That’s a weeeeee difference from 35%, no?

This could be an “honest mistake,” it really could be. I’m not suggesting that somebody deliberately wrote that prices were down 35%.

But I think the origin of this mistake, which is catastrophic in nature, is that the writer, editor, or entire department, so badly wanted the market to decline, because those are the headlines that get the most clicks.

It’s a societal shift in our reading habits. Nobody cares about a good Samaritan anymore; give us murder, death, and pain!

But this erroneous news story simply reinforced what I wanted to talk about today.

Last week, I read an incredible article in the Financial Post about the reason for the supply problem in Toronto.

For those that don’t think there’s a supply problem in Toronto, we probably won’t connect on anything from here on out. But for the rest of you, which I assume is almost all of you, don’t you wish we spent more time asking why there’s a supply problem? Or how we got to this point?

Investigative journalism and insightful opinion are the two best forms of print media, and this article was what many of us have been hoping to find:

“Toronto Has A Housing Supply Problem And The Reason May Lie In Ontario’s 2006 Growth Plan”

The sub-heading for the article sums it up best:

The plan favours multi-family housing and other strict rules, creating a demand-supply mismatch as buyers seek coveted detached homes and developers wade through regulations

–

An excerpt from the article:

New homes replace demolished ones at a sharply lower rate than early this decade, completion times for multi-family projects have doubled and prospective buyers have far fewer new homes to choose from than only a few years ago.

The reason, in part, may lie in an ambitious growth plan for the greater Toronto area the Ontario province forged over a decade ago.

With new “density” targets favouring multi-family housing, designated urban growth areas and tougher environmental rules, the 2006 plan sought to check urban sprawl while supporting the area’s further growth as North America’s major economic hub.

The market, though, did not follow that vision.

Detached homes are still most sought-after and their tight supply keeps prices high even as some condominiums and multi-family projects languish.

Developers say the growth plan, updated in 2017 with higher density targets, both created a demand-supply mismatch and added a layer of new municipal regulations.

“The growth plan has throttled growth severely,” said Matthew Cory, principal at planning consulting firm Malone Given Parsons.

Ryerson University economist Frank Clayton said part of the problem was the plan’s emphasis on protecting the environment and heritage sites at the expense of development.

“That superimposed more planning on a planning structure that was already bureaucratic-heavy,” he said in an interview.

Toronto’s troubles are of national concern given its role as Canada’s top financial and technology hub, which, together with surrounding towns, accounts for a fifth of the nation’s economy.

Read the entire article if you have time, but I think this chart the Financial Post has provided pretty much sums up where we are in today’s market:

So we have a supply problem in the GTA; on this, we can agree.

We have a major supply problem in the central core. There’s simply no doubting this. Although having said that, I feel like this is one of those spots where somebody copies-and-pastes this into the comments section, and then provides data to the contrary.

For example,

We have a major supply problem in the central core. There’s simply no doubting this.

Really? Aren’t active listings up an ungodly 147.4% since last year? Check your facts.

Right. But I might counter with the following:

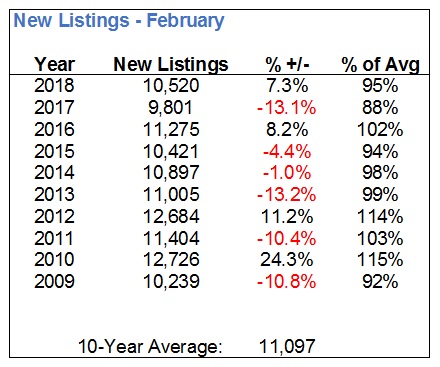

New listings in February were up only 7.3%.

That’s from a decade-low level that existed in February of 2017.

In fact, the level of new listings remains well below the decade-average.

Take a look at the following:

New listings were only up 7.3% in February, and I say “only” because that’s coming off a major outlier that existed in 2017.

You can blink once at this chart, and you’ll see the “9,801” sticks out.

With an average of 11,097 new listings in the month of February, over the last decade, the 10,520 new listings we saw this past February is still only 95% of the decade-average.

So while you’re free to continue the conversation on supply in the comments section below, I want to turn the discussion back to perspective.

On Monday night, I was representing buyer-clients on the potential purchase of a home in the Davenport & Christie area.

Listed at $995,000, there were eight offers, and I sat and waited in my office to hear if we had “won,” or if we were going home with six other groups of buyers.

As I sat and waited, a blog reader (I assume…) sent me the following article, with a subject line that said simply, “thoughts?”

“Real Estate Sales Are Cratering Around The GTA. Is This A Crash In The Marking?”

And there it is.

There’s the other perspective.

While the National Post article talks about the drastic dearth of supply, and how the deficit that exists between supply and demand continues to help prices move upwards, the Maclean’s article refers to the sales “cratering.”

Then it asks the sexy, eye-catching question, “Is this a crash in the making?”

Honestly, folks, it’s like 1960’s Batman:

Headlines have become more BAM POW than ever before.

“CRASH!”

BAM! POW!

REAL ESTATE! CRAPPER! YOU’RE SCREWED!

BIFF! SOK! BLAP!

And sometimes, like we saw today with the CBC faux-pas, you screw up big-time in your efforts to create an eye-catcher.

If you read into the Maclean’s article, you’ll see that the article actually talks about the outskirts of Toronto, and not the central core.

But the article contains a link in the middle to: Praying for a real estate crash

As well as: Andy Yan, the analyst who exposed Vancouver’s real estate disaster

And then a video: Five signs Canada has real estate mania

And then at the bottom of the article:

MORE ABOUT HOUSING BUBBLE:

–

And look, I get it – this is how online media works in 2018.

If you’re reading an article on the Toronto Maple Leafs, there’s probably going to be another related article at the bottom of the story, to try to keep you on the page. Maybe TRB is just about the only website out there today that doesn’t have click-bait at the bottom of each post, and on the sidebars.

But you can feel that the Maclean’s story, via the headline and the narrative, and further reinforced by all the links to “bubble” talk, is providing a completely different perspective, than the Financial Post article above.

Surely both can’t be correct in their perspectives and narratives, can they?

Fox News offers a completely different perspective than CNN.

And in the Toronto market, you’ll see completely different perspectives through the eyes of a multitude of different participants.

But as I write this – Tuesday evening at 7:30pm, two properties listed for sale by my brokerage are taking offers; there are currently 11 offers on a property on Simpson Avenue in Riverdale, and 12 offers on a property on Glebeholme Avenue in Danforth Village.

So while the Maclean’s article is absolutely correct about York Region cooling off, you have to dig deeper than just the headlines.

The average home price, GTA-wide, is down 12.4%, year-over-year, for the month of February. It’s also up 4.2% from January to February, this year.

But do you care about GTA-wide pricing, or 416-specific? Are you in Pickering, or are you in Roncesvalles?

Are you buying a house, or are you buying a condo?

Are you looking at $500,000, or are you looking $5,000,000?

Change the parameters, and you’ll change the perspective…

Appraiser

at 7:03 am

Macleans is a joke. Who can forget their ‘boffo’ headline from 2013:

“Great Canadian real estate crash of 2013. The housing bubble has burst, and few will emerge unscathed”

http://www.macleans.ca/economy/business/crash-and-burn/

Long Time Realtor

at 8:20 am

Note to Macleans: The average price in February 2013, was $510,580. Whereas February, 2018 it was $767,818. That’s a reverse-crash of +34%.

And in case anyone else is interested, the HPI ( I know, I know, it doesn’t use averages), was actually up this month. Main stream media missed / ignored it. Not very sexy. Ben Myers caught it.

“What a difference it makes when you control for the composition of units via the MLS Home Price Index: values actually up annually in the GTA by 3.2%” ~Ben Myers https://twitter.com/benmyers29/status/970997482355245056

C'mon!

at 8:39 am

…and ten years ago when Garth Turner was bloviating about a sure-fire market crash, the February TREB average price was $382,048!

Sardonic Lizard

at 3:17 pm

>> Ben Myers caught it.

Nice to see you trust Mr. Ben “Syndicated Mortgages” Myers as your source of factual information.

Need I remind you about the fraud that was Fortress Real Developments?

C'mon!

at 5:28 pm

@SARDONIC LIZARD:

The “source” of the data is TREB’s HPI. Apparently, you have an axe to grind.

Appraiser

at 5:31 pm

@Sardonic, Seems you got lost at the word “composition”

IanC

at 7:11 am

When I see a suspicious headline, I want to say to the author “Show Me The Receipts” !

Kramer

at 7:33 am

“If it bleeds it leads.”

I have seen the market first hand this week in the City… detached and semis are red hot. Looking at a property’s true comparables, everything is UP vs a year ago in price.

The higher up you go in the stats, all the way up to Total GTA Average Price or even down one level to Total GTA average price detached/semi/condo, the more the regional differences and sales composition (ie # detached sold >$2mm) differences kick in and skew the VYA results.

So, as per david’s Post, it all depends… where are you looking and what are you looking for. If you’re looking in the city for a detached or semi, I wish you good luck in buying one for less than it’s direct comparables one year ago.

Kyle

at 10:12 am

“If it bleeds it leads”

This is super true. However i also get the sense that many of the more bearish writers, columnists and reporters tend to be projecting their own personal frustrations on the market.

Pk007

at 8:21 am

I think it’s all about perspective. I believe while Toronto has already picked up its pieces from craziness of last spring and started moving on GTA is still struggling with the change. Still see people trying to sell their semis and detached for more than a month with at least one markdown in midst of the listing price. Was in Oakville last week and houses were listed at least 100-150K less from last Spring with no offer dates.. same is the case in south west brampton’s newer developments..Summer might bring up a different storyline for GTA as well but IMO if you are out looking for a home GTA is the best place to seek a bargain in the interim.

Geoff

at 8:46 am

The house that was literally just listed last week in my hood at lawrence and underhill already has a ‘sold’ sign on it. So yeah, headlines are misleading.

J

at 4:01 pm

Yes, a more apt headline would have been “House Sells in One Week in Geoff’s ‘Hood.”

Geoff

at 4:22 pm

Not sure if that was meant to be snarky but that headline would at least have the merit of being more accurate than “Home prices are down 35% in GTA ” (unless you’re willing to concede that this sale was a unique outlier, which I don’t think it is – particularly since we know the original headline is wrong).

A Grant

at 9:09 am

At the same time, the Financial Post article cited doesn’t really address the supply/demand issue either. The mere fact that a new single-detached home replaces a demolished single-detached one does not address the supply side.

And sorry, if the solution is to scrap current regs in favour of new single-detached homes, I fear the results. Specifically the demolishing of existing multi-family homes in the core and building on the greenbelt – all in an effort to build more detached single family homes. The latter in particular will only lead to more sprawl and infrastructure that the city can nary afford to build or maintain.

Bottom line is, the current generation of home buyer, unless they have sufficient capital, is no longer entitled to a new single detached home in the core.

Libertarian

at 11:15 am

I agree.

As much as everyone talks about Toronto being a global city and is catching up to the other global cities in terms of population and housing prices, Toronto is built like a suburb. Toronto, for the most part, was built after the invention of the car, so a lot of the downtown core looks like a suburb. Then of course there is the actual suburbs.

As you wrote, people have to accept the fact the dream of having a detached house, with white picket fence, garage, driveway, backyard, etc. is over, especially in the downtown core, and I would argue, even in the suburbs themselves, for the reasons that you cite. And if that means that house prices go up forever in the core, so be it.

Condodweller

at 12:14 pm

“the current generation of home buyer”

I think to write off the possibility of buying a home is a bit too pessimistic. “current generation” is a key qualifier here. Patience is a virtue. Yes, people will have to plan and diligently save in order to get into the market if/when the opportunity presents itself but history has shown us that we should expect pullbacks along the way that the resourceful/opportunists should be able to take advantage of.

A Grant

at 12:19 pm

Probably the only time we’ll agree on something. Progress, I guess 🙂

As you note, Toronto in various ways (and excluding certain pockets) is built like a suburb. The solution is to redesign the city (akin to what is being done in NYC and Paris) to emphasize other means of transport. Fewer cars on the road means less strain on infrastructure both in terms of maintenance and traffic.

With respect to the Financial Post article, I would argue that the most desirable houses are not just single detached, but single detached in walkable neighbourhoods. And I’ll bet when given the choice, consumers would prefer the latter rather than the former.

O

at 12:44 pm

“Toronto is built like a suburb.”

I think that is the appeal which is driving up the prices….you can work/party in the city, but a short drive/subway ride takes you to the “inner suburbs” with a yard and green space. You can make the big bucks on Bay street then be relaxing in your backyard in Forest Hill in under 30 minutes.

Name another major North American city which offers that.

Libertarian

at 3:04 pm

Yes, it’s very appealing and there is a huge demand for that. But the issue is supply. People are grumbling that the gov’t isn’t doing anything to have more detached houses. As A.Grant and others have commented, the problem is that people want detached houses in the core, not in the 905. But where exactly are we supposed to build more detached houses in the core if the core is already filled with detached houses? That’s why I think talking about supply is a waste of time. The supply is what it is. People have to learn to accept it and go from there in choosing how and where to live.

Kyle

at 1:17 pm

This is a good thread right here…Lots of good points raised and good conclusions reached.

I agree with A Grant, the solution to the supply issue IS NOT to eliminate the Green Belt. It’s actually to eliminate or loosen the Yellow Belt (which is the 60% of the total 416’s land area, that is currently exclusively zoned as 2 storey, 60% coverage Detached housing only). This is the true reason (as Libertarian points out) that Toronto looks like a suburb, even in huge swaths of the 416.

The solution IMO is to loosen up the zoning. If you look around the City you can actually see many small hard loft buildings or infill townhouses that were developed in the 80’s, 90’s 00’s. These were not built by the Tridels, Daniels or Freeds of the world. Not that long ago, there were far more Developers, little guys like George Popper who did small scale projects out of a love for City building. These projects weren’t 40 storey buidlings filled with 1 bedroom and studio condos, these buildings fit into their neighbourhoods and had a mix of units. But today that can’t happen, there is too much bureaucracy at the City. You need to be a big player with deep pockets to face the City and the NIMBYs. And of course after a Developer has had his capital tied up and has faced long delays and after long delays and uncertainty, he’s going to want to maximize his risk-adjusted return. So he builds big….which pisses off the NIMBYs….which leads to more bureaucracy….and the cycle starts all over again.

daniel

at 11:11 pm

Sadly if only it were zoning. New building code, and a slew of other regs and fees have dramatically driven up the cost structure to deliver housing in the GTA. Not to be too cynical, but it would require a complete overhaul of the entire system to get that kind of product delivered again in any meaningful quantities, IMHO.

Kyle

at 12:13 am

Yes i 100% agree, there is over-bureaucracy in the zoning AND in the building codes (e.g. if a building has more than thirty something units, it needs to create enough of an allowance for garbage trucks to enter and exit without reversing, minimum number of parking spots, etc) AND yes development charges which are astronomical. All of this discourages any form of new supply other than the tried and true – tall buildings full of tiny units which can only be built by an oligopoly of developers.

Kyle

at 9:20 am

Contrary to what some people want to believe (e.g. Josh Gordon and anyone who thinks his ridiculous study makes sense), there is absolutely a shortage of supply in the City and the reasons cited in the Financial Post article are bang on. Basically, the only ones with the ability to add new supply in this City are those with mountains of cash, planners and lawyers at their disposal. And the only supply they’re adding is the kind that generates the best returns (i.e. small condos). Unless they overhaul the Planning Department, bring back the OMB or loosen the City’s Official plan, i see this trend continuing and only getting worse as our population continues to grow.

As for the hotness of the market, i used to say that, “there is no such thing as a Canadian Real estate Market”, because obviously real estate markets are very regional and whenever someone makes pronouncements on the Canadian Real Estate market, it was always a sure sign they had no clue what the they were talking about. I think we’ve now actually reached the point where we can say there is no such thing as a GTA real estate market. The markets have really become very local. In the core i am observing sales that make last Spring look mild. In the 905’s…crickets.

Professional Shanker

at 10:31 am

Agree with most of your points re: localized real estate, etc. but with respect to

“The markets have really become very local. In the core i am observing sales that make last Spring look mild”

Is that true – the TREB stats in 416 do not support it, unless you are discussing condos or towns in the less than $1m range, then sure

Kramer

at 10:53 am

Maybe not in the aggregate, i.e. all 416 detached where composition can still skew the total… but granularly, looking at true comparables of properties selling, I see the same thing… i.e. a renovated roncey semi: UP vs. year ago (to $1.5MM).

Even disregarding price the total market has changed so much that getting as granular as possible is more important than ever in order to understand price.

Kyle

at 12:01 pm

Bingo! And some of the prices i’m seeing are actually WAY UP…

Kyle

at 11:52 am

@ Professional Shanker

I am mainly speaking about the core, not all of 416. And even then, i’m not saying every property is outperforming last year, but the good listings definitely are. Basically the way Kramer has put it – Same for same, many properties in the core are outperforming last year. Condos for sure are, and in many instances freeholds are too. I’m mind blown at what some semis(1.8M+) and detached (2.3M +) in “normal” neighbourhoods are getting now. However there still is not that much supply of good listings (i.e. not in need of a major reno, not multi-plexed houses and not ones that are clearly cheap flips), so these are still exceptional and therefore not moving the average.

Some examples below:

351 Crawford St is a 3 bd 3 bth semi on an 18′ lot, sold for $1.9M

90 Markham St is a 16.4′ row house that has been converted to a duplex, sold for $2.2M

481 Dovercourt Rd is a semi on a busy street without parking , sold for $1.86M

822 Palmerston Ave, medium-sized detached on a corner lot, sold for $2.42M

Trust me when i say, all these houses are nice, but they would have not got those prices last year.

Daniel

at 10:45 am

But kyle, don’t you know that it’s all the vacant houses in Toronto. THere’s enough supply it’s just foreign investors buying it up and leaving it empty. Never mind that the ratio of vacant dwellings at 4% is lower than it was in the 90’s and lower than it is in speculative hotbeds like Saskatoon!

But kyle, the most recent census data shows that we built a greater number of housing units than households that were formed. Never mind that the Census stats infer the household count from population using a headship rate (basically, the number of people in each household) from a stat last collected in the 90’s.

Kyle, a 0.7% vacancy rate in condos and a 1.1% vacancy in purpose builtrental housing definitely in now way indicates a shortage of housing supply. Adding more market rate housing, even condos, to the GTA will do nothing to alleviate pricing increases. If you don’t agree you’re a RE shill in the pockets of developers and foreign money.

Condodweller

at 10:59 am

LOL Grab the popcorn folks, this should be interesting…

Kyle

at 11:53 am

FYI – Daniel is being sarcastic.

daniel

at 11:28 pm

Kyle, normally it’s my wife’s job to have to explain to people when i’m making a joke. She’s too wise for the comments section though. Thanks for subbing in

Condodweller

at 9:17 am

@Daniel Your sarcasm wasn’t lost on me. My comment was aimed at the fact that Kyle had endless arguments in the past over the points you mentioned usually devolving into personal attacks when he refuses to accept that others may have a different opinion from his.

If your wife normally has to explain your jokes maybe you need different jokes. I can be sarcastic myself and I can tell you that when people don’t get sarcasm they often get offended.

Kyle

at 9:26 am

@ Condodweller

I don’t attack people who disagree with me, I attack the arguments of people who attack me by pointing out how dumb their arguments are. Most people can get over it, you clearly can not.

Chris

at 9:44 am

“I don’t attack people who disagree with me, I attack the arguments of people who attack me by pointing out how dumb their arguments are.”

A 30 second google search produced the following:

https://torontorealtyblog.com/archives/13595#comment-55572

https://torontorealtyblog.com/archives/13387#comment-55150

https://torontorealtyblog.com/archives/13595#comment-55571

There are certainly more, but I don’t really want to comb through the archives.

You are able to form logical, well crafted arguments, Kyle. But you are also frequently rude, attack others, and resort to insults.

Kyle

at 10:06 am

OK, let me correct that statement then Chris…

I don’t attack people for disagreeing with me, I attack the arguments of people who attack me by pointing out how dumb their arguments are, which often makes them feel the need to attack me further, which i then respond to by being rude.

By the way, I’m not wasting my time trolling the archives, but let’s not pretend that you haven’t made unsolicited attacks on Appraiser and Boris.

Chris

at 10:30 am

“let’s not pretend that you haven’t made unsolicited attacks on Appraiser and Boris”

A good example of the Tu quoque fallacy.

Regardless, we should all try to avoid the unpleasantness and rudeness. I will admit to succumbing to frustration and saying things that needn’t be said. But, I am making an effort, when someone insults me, to point out that their slights are unnecessary and unproductive, rather than lashing out in retaliation.

Kyle

at 11:54 am

Exactly!

steve

at 9:22 am

I agree that downtown is not like the suburbs, and that some unrealistic prices were resulting from speculation and FOMO last year. But housing is a necessity, and prices really do have to be more or less affordable (this is where credit comes in). We are getting signals that money will be tighter in the future, and that B20 as well as new rent controls are likely to result in some hesitation. Even downtown properties, although still selling, are subject to a turn in sentiment.

Chris

at 9:51 am

CBC has corrected their error. Headline now reads:

Greater Toronto home sales down 35% from February 2017, board says

Selling prices also dropped more than 12% from last year’s highs, Toronto Real Estate Board reports

http://www.cbc.ca/news/canada/toronto/greater-toronto-home-sales-down-35-from-february-2017-board-says-1.4563773

Anyways, as I’ve said before, I expect the 416 to be more resilient than the 905, and this seems to be what is happening. Forest Hill probably won’t decline anywhere near as much as Richmond Hill.

Should be interesting to watch the rest of this year play out.

Alex

at 10:30 am

I looked at the numbers, yes y/y there is a drop but if you compare to last month the numbers are going in a positive direction. I guess we just have to wait and ser. Last year , this time around, was not normal market conditions and that won’t return … but a full on market crash? I am not so sure

Professional Shanker

at 10:55 am

month over month increase in price from Jan to Feb is somewhat misleading, each year on average over the past 20+ years prices have increased greater than the average increase recorded in Feb 2018….deduce from this what you will

Condodweller

at 10:55 am

snooooze….

Those of us who follow the market have expected this given the spike last year and it’s a given the media will exploit it. Move on, nothing to see here unless you just crawled out from under a rock.

I had been reading the FP since before it was absorbed by the NP and I am glad to see they are still a good source of info. It’s just too bad they can’t deliver a newspaper….

It was sad to see that even BNN had this in their “headlines” however IIRC they said the RE market was down 35% which I think is intentionally vague which is much worse than CBC’s mistake unless of course, CBC’s mistake was also intentional.

Real estate millennial

at 11:42 am

If the areas around the Toronto core are currently struggling and softening, how does opening the green belt help with the Toronto core supply? The Green belt starts outside the GTA so houses would be built in areas where there is no supply problem. On a sidenote the commute from the green belt areas to the downtown core where most people tend to be employed would be 3-4 hours (total commute) daily during rush hour is that practical just to live in a detached home?

lui

at 11:59 am

The one bedroom condo market is still smoking hot by the recent scan of what was sold the last 3 months.I do notice homes above the 1.5 million price is sitting on the MLS much longer but mostly due to sellers asking way too much from the start.

Paul

at 12:57 pm

But somehow the greenbelt restrictions and lack of single family housing development is causing 1 bedroom prices to skyrocket?

Alexander

at 4:54 pm

bank tightening and demographics does

Bidio

at 12:25 pm

Er, David, you wrote “Let’s start with the former, shall we?” and proceeded to talk about the latter. To quote yourself, “this could be an honest mistake, it really could be. I’m not suggesting…”

JCM

at 12:36 pm

Quibbling with newspaper headlines has a strong whiff of desperation doesn’t it?

The credit cycle has turned — the Bank of Canada noted as much today. B-20 is only starting to bite now. The party’s only just getting started. Housing downturns always take years.

Sardonic Lizard

at 2:56 pm

At the end of March, a lot of mortgage pre-approvals that were granted near the end of 2017 before the B-20 stress test came into effect will expire. Buyers re-applying for loans in April will have to qualify at the sensational level of 5.14% – which may actually be 5.4% by then.

Alexander

at 4:52 pm

With the low CAD/CNY exchange rate new Asian buyers will be coming to town. And loosening of money outflow from China is over the horizon. Who cares if new millennials have cash in the piggy bank?

JCM

at 6:01 pm

Chinese capital outflows have fallen dramatically, and there’s no loosening on the horizon.

But who cares? Domestic speculators and FOMO drove the bubble in Toronto, not Asian money. Sentiment has shifted (as demonstrated by, among other things, Mr. Fleming’s increasingly sad tilting at windmills in this blog). FOMO is over and the speculators are gone.

We’re likely to see years of declining real estate values. That’s usually how this plays out (Japan, Ireland, Spain, the US in 2008, Toronto in 1989, etc., etc.).

Kramer

at 10:32 pm

A very shallow argument.

Housing bear

at 9:05 pm

Kool aid cool on that post Alex. Keep drinking the good stuff…….

Let’s think about that logically. Sure it’s looking like CAD might start to tank. New foreign buyers would get a discount on the conversion. They would also be getting a “discount” on the fact that prices are down 100 to 200k on average. But how does that feel for current foreign owners. If they were To cash out and convert back to their home currency not only have they lost some wealth due to the fact prices have fallen, they lose more now due to dollar. Double wammy for those investment geniuses. Why catch a falling knife?

Alexander

at 9:49 pm

They are diversifying and at the same time putting a roof over their kids. Some are buying 10 new condos, but some only one for their single kid. Just compare population of Beijing and Canada and realize that people who own properties their are multimillionaires in CAD. And we are talking about Beijing, there is Shanghai, Shenzhen, Guangzhou, etc. The party is not over, guys. It is just a break.

Paul

at 12:37 pm

A mismatch of wrong housing types in the growth plan doesn’t explain why bachelor, 1 bedroom, and 1+1 condo prices are skyrocketing.

Professional Shanker

at 1:02 pm

correct – 1 beds being owned 50% by investors/speculator would though

Condodweller

at 1:46 pm

I sure hope for their sake that investors are not driving up small condo prices. I believe it’s more likely that it’s people who have been priced out of the SFH trying desperately to get on the property ownership ladder.

Paul

at 2:36 pm

But if that was the case prices wouldn’t rise that quickly.

If the market wanted 100 condos and 100 SFHs, and instead we built 190 condos and 10 SFHs, 90 of the people looking for SFHs would begrudgingly buy condos (as per your assumption). But in that case the number of homes built is still appropriate for amount of people looking for housing. So in this example only the price of SFHs should go up (because of the mismatch between supply and demand).

The only way condo prices go up is if every person who can’t get a SFH is buying multiple condos (or speculators are doing this), thereby overshooting the governments supply numbers and leading to rapid price appreciation.

Professional Shanker

at 2:54 pm

Affordability is obviously at play as people are being priced out of the detached market. That said speculation is a driver and we would be foolish to disregard an obvious driver – whether it be Airbnb, landlords renting apartments at negative cash flow, etc, condo’s have become a popular investment vehicle, potentially rightfully so.

The question on condo’s for me has always been about the long term value when the maintenance costs go up/special assessments as the building’s infrastructure starts to deteriorate.

Condodweller

at 4:47 pm

@Paul Judging by what David has reported here demand far outweighs supply for the small condo market. The mix of investors, home owners, down sizers, priced out SFH buyers doesn’t matter. This would suggest that, using your example there are 250 people going after the 190 condos, begrudgingly or not again does not matter. It is what it is.

@PS I am sure there are still plenty of investors buying condos I just don’t think it’s a good idea at these prices. Personally, the risk adjusted return would not be worth it for me.

The soundness of the construction is a different discussion. It would only affect prices if stories of buildings falling down surfaced, and I don’t mean just glass.

Kyle

at 2:57 pm

Almost half of all young adults (age 20 – 34) in this City still live with their parents. They are entering their prime home buying years, which explains a lot of what’s driving 1 bedroom price increases.

Edwin

at 12:46 pm

Just once I would love somebody to analyze the number of new homes constructed per year in the GTA, vs. the population increases.

That is the only way to know if supply is actually lacking.

Kyle

at 1:23 pm

It’s actually been done by Josh Gordon, but as Daniel sarcastically points out below. changes to population is a really terrible way of trying to determine the right size of supply.

Edwin

at 2:39 pm

Well there are other factors, including immigration (and foreign students using housing stock as University residences), migration of Canadians to Toronto, the difference in the rate of millenials entering the housing market vs. boomers leaving it.

But somebody should be able to look at all of this. Isn’t this what planners are paid to do?

daniel

at 11:24 pm

Edwin, one of the reasons you don’t see lots of coverage on it is that the data is really hard to come by. The census data, which is only collected and published periodically, was seriously compromised by the whole long-form census fiasco under Harper (not trying to get into politics here, just stating a fact). The data was always missing a fair bit of detail on inter and intra provincial migration. Ontarians would keep their address back in small town ontario because the car insurance rates are lower. Back in ’14 you’d see a lot of alberta plates as people would move here but not move their official residences over right away, etc.

Once you get a reasonable guess at the actual population you then have to contend with the conversion of population to households. I’ll spare you the detail, suffice to say this is a contentious topic (amongst a very small group of nerds) and that overall, the avg household size has been declining over time, meaning that for a given pop number, the number of households has been increasing.

I’ve tried to hire several consulting firms to give me a precise read on this very matter and none of them could pitch me a persuasive methodology to get there. As a substitute, i look at it this way – if the proportion of vacant homes is staying constant or declining, and the vacancy rate is falling, then by inference you must be under supplying the market. Air bnb, foreign capital and the host of other factors are all exacerbating the problem but are not the root cause.

Kyle

at 11:56 pm

There is also a feedback issue. It isn’t just the number of households that determine the need for supply. It’s a two-way street – the availability of or lack of supply will either allow for or constrain new household formation.

Derek

at 2:16 pm

I wonder what percentage of February and March buyers, if any, have pre-approved mortgages, pre-dating the B-20 guidelines.

Calm their nerves Garth

at 7:50 pm

Keep clinging @ Derek.

Cling tightly to your security blanket.

One day it will all come crashing down, just like you’ve envisioned.

Derek

at 8:34 pm

Say what now?????????

Josh

at 8:41 am

How’s the negative cash flow on your investment property treating ya? Douch

Kramer

at 9:19 am

As I observe the spring market one thing is becoming more clear.

6 months ago or so I was wondering what was going to become of the narrowing spread between condos and SFH. A lot of the data, especially the headlines were saying SFH prices were going down, and condo prices were going up. The articles are still showing this.

The answer is that there is no narrowing spread. Because as soon as you dial in the data regionally (ie to the core) and then look at actual sales individual property comparables (key – because this is not directly in the data), what you have is this:

In the core, condo prices are going up, and so are SFH. The spread is being maintained, which makes sense.

Once you add in the fact that less $2MM+/luxury homes in the core were selling over the past 10 months (possibly because wealthy people aren’t going to be shuffling $5mm homes at the same clip while the government is directly and openly trying to cool the market), and once you add in all the remaining GTA data which is SFH dominated and definitely getting hit harder by all the housing measures/intentional market cooling… then you get the TOTAL GTA data we are seeing in the articles:

– Condos up

– SFH down

– Spread narrowing

The spread is not narrowing, and in the core, demand is insatiable and SFH and condo prices are BOTH going up, maintaining the spread between them.

Kyle

at 9:41 am

This generally jives with what i see, with one slight variation. In the core what i notice, is that the junk listings (those that have been on the market for a while – many since last year) are not selling as well this year as last. Last Spring, even those were snapped up. But good listings are definitely selling for more than this time last year, often for considerably more.

Professional Shanker

at 9:56 am

But the TREB stats for Feb 2018 vs. 2017 for detached houses in all C zones have both median and average prices down 13% to 20% on average. Now I do not dispute entirely what you are saying as your opinion is specific property based but your logic then stands to reason that prices did not climb as high as previously reported in 2017, as the # of +2m luxury homes sold pushed the average up.

Kramer

at 10:19 am

Yeah, definitely I am talking specific property based… I am desperately trying to explain why the spread is not narrowing because a narrowing spread makes absolutely no sense. And yes, I cannot trust the raw treb data to tell the Feb 2018 vs. Mania 2017 story in its entirety, because so much has changed, while some things have not – not a straightforward Past 12 Months where raw data can tell the whole story.

That’s a good point about last year’s reported price increases possibly being ‘artificially’ higher i.e. due to composition – I only say possibly because you would need to look back at the Spring 2016 (one year before mania) sales compositions as well and show that the % of sales that were $2MM+/luxury houses was indeed less than in Spring 2017. I assume that it was… but maybe it was still higher than normal because the market was pretty hot 2 years ago as well and interest rates were at their lowest point then as well. But I get what you’re saying, and that question should indeed be answered.

Ambel

at 3:55 pm

Fact: pre-construction SFH in Richmond Hill are lowered by 1 mil by developer few weeks ago. Fact: more agents are listing private sale with significant price decrease on properties over 1M (would have been sold for close to 1.5-2M during peak). Fact: there are many people holding 5+ units of pre-construction condos (downtown core) and now having trouble closing. I’ve been presented multiple units to get a 10% discount on market price to take the unit over before closing.

Demand & Supply is the oldest tale that any people tell themselves and yet not to be true. During good times, the price is high because short of supply. During bad times, the price is low due to no supply of high priced units. How self contradicting! There is no shortage of supply, there is just shortage of properly priced units. And when the buying action stops, the price will and have dropped.

Appraiser

at 6:15 pm

Fact: Anecdotal nonsense with a soupçon of bullshit on the side.

My_Own_Choice

at 9:25 pm

Agreed, that advertisement for 1 Million dollars price drop by a developer in Richmond Hill had also turned up in Chinese newspaper few days ago.

Housing bear

at 8:47 pm

Full disclosure. I sold last spring because I thought prices were going to drop. ( detached 416 home) I have been renting ever since. I do have a position that would benefit from a drop, I also have expressed my theories to friends and family leading up to the sale and have stuck to it since, some of them told me I was an idiot for selling when I did, if I am wrong I will have egg on my facr. I plan to buy multiple properties in 2022-2023 as I see this being a low. I believe in long term fundamentals of Toronto and Canada. IE we are one of the most resource rich countries in the world. We will find a way but a ton of pain is on the way.

That being said the author of this article is an absolute shill. Only economic issue he raises is supply vs demand (economics 101).

No reference to buyer borrowingpower being reduced by over 20% due to B20. No reference too record household debt levels. No reference to rising interest rates (or to the fact we were in a declining rate environment the last 10 years). No reference to the fact that the number of Canadian “investors” (those that own more than one property) has doubled in the last ten years. Or how about th fact that the number of active real estate agents grew from 20 000 in the GTA in 2005 to over 50 000 today. How about the fact that real estate and related industries now make up about 20% of GDP. (Finance, custruction, legal taxes etc) How about the fact that Canada has been a money laundering haven and our politicians and public are finally starting to tackle it. How about the fact that our major source of foreign speculation is looking like they are starting to go through a deleveraging cycle themselves. Finally how about the fact that on a lot of these metrics we are worse off then our friends to the south were ten years ago.

I recommend every here google search “Credit Cycles”

I would argue that we have plenty supply for true buyers. Mayb just not all the speculative groups above. Today we found out that we had a record start of new construction for the month…….. more than any single month since 1990………. that was the start of a 30% plus correction in Toronto.

Everyone should also search “the four stages of the real estate cycle”

Appraiser

at 8:25 am

You are an obvious real estate genius.

Professional Shanker

at 10:14 am

No, I think HB presents valid and an economically rationale perspective of the potential/almost guaranteed headwinds which will present developed economies in the years to come. It is so happens that Real estate will be negatively affected as a credit deleveraging cycle unfolds.

If you are bullish on RE throughput the back end of a credit cycle, then you believe the micro will outweigh the macro environment, as a property owner I would like to believe that as well…..although I believe history states otherwise.

Hey who knows maybe the world goes belly up and we get negative nominal interest rates in the next few years……that would an economic experiment

Chris

at 10:19 am

Yep, I agree. Housing Bear has formed his opinion based on his research, and adjusted his investments accordingly. Whether you agree with his opinion or not, he is putting his money where his mouth. If you disagree, you can always rebut his points and/or bet against him by going long on real estate.

Appraiser, on the other hand, is simply insulting people left, right, and centre these days. As our good pal Kramer would say, “very shallow arguments”.

Kramer

at 12:34 pm

We could debate whether HB’s market forecast is correct all day and all year.

What I think is more interesting is the “big move”, which at the end of the day is filled with personal choices.

Hopefully the big move is part of a thorough plan to meet some specific financial objectives. If it is, then the risk of not meeting the objectives will be managed, and the objectives should not be at risk of being significantly compromised.

In other words, it shouldn’t be a question of whether HB has egg on his/her face or not… HB should be able to look his disapproving family in the face and say “this is not speculation, this is part of meeting my long term financial objectives which are X, Y, Z, and a wealth and risk management plan is in place.” But if the next 5 years of real estate market performance is going to make or break HB meeting his/her objectives, then this “big move” is more like gambling/speculation than financial planning/wealth management.

So, no one can comment on the appropriateness of this move for HB – everyone’s scenario and objectives are different… However, if this big move is rooted in speculation and not some thorough long term financial plan with objectives and risk management to protect those objectives, then I would say “good luck” because that’s all it will come down to..

Chris

at 12:55 pm

While I, personally, would most likely not sell my Toronto house and rent, in anticipation of a correction, all are free to do as they choose. Perhaps this is part of a thorough and comprehensive plan, chalk full of methods to mitigate risk and hedge against loses. Or, perhaps HB is comfortable with the risk, and is gambling/speculating, just like many others do with various assets, such as bitcoin, gold, penny stocks, leveraged ETFs, etc.

Those who anticipate continued appreciation are equally free to speculate and buy as much real estate as they can afford.

Good luck to both groups. However, neither deserves sympathy if their bet goes south.

Agreed

at 9:02 am

I agree. David always seems to neglect record level household debt and assume that ppl will be able to keep this up. What about that Ipsos survey where it showed half the Canadians are $200 away from meeting their financial obligations and can’t handle more interest hikes. There are a lot of people stretched thin right now. Surely, a junk economy running on debt must mean something in the real estate outlook.

Condodweller

at 10:06 am

Good for you for doing your own research, taking a position and making a decision based on it while going against the grain. If you have a large equity position in your home this could very well prove to be a very wise move. Just be extremely careful with what you do with all that cash! You can be a case study for us. Good luck!

Sardonic Lizard

at 2:20 pm

The smart money left a long time ago. The bagholders and greater fools seem to be the ones who bought real estate late in the credit cycle, and will eventually get burned.

Money is not stupid.

Shepple are stupid.

Already 30 billions has been going out of this place in the last few months alone, with Shell and Conoco Phillips moving production to the States.

We will be hit with tariffs, i.e. less steel, aluminum exports. NAFTA is uncertain.

No one will invest in this place with it’s retarded policies.

https://www.armstrongeconomics.com/international-news/canada/foreign-investment-into-canada-has-collapsed-by-26-in-2017/