I’ve talked a lot about supply and demand over the last thirteen years, have I not?

I’ve shown you more than enough X and Y axes with curves and intersecting lines to denote levels of supply, levels of demand, and surpluses and deficits.

I’m not sure if Economics is still taught in high school, or if this somehow violates one’s “safe space,” particularly while one is not standing during the national anthem, but if it is taught, then hopefully somewhere in this city there’s a Grade 11 student who can teach a particular condo-seller in North York the very most basic concept of “Supply & Demand.”

What I saw last week was something that defies all logic.

It’s something that, if I hadn’t said it so much already, I’d be tempted to label, “Just When I Thought I’d Seen It All” in a blog post.

But as the regular readers know, “just when I thought I’d seen everything” happens far too often in this business, and the phrase “nothing surprises me anymore” is probably more appropriate.

Supply and demand is everywhere. It’s in everything we do, it creates and affects so much of what we experience in life.

As I have alluded to many times on this blog, I recently took up an old hobby with my old man: collecting sports cards. It’s something that my Dad, my brother, and myself started as a male bonding exercise around 1988, and something that kept us busy for the better part of a decade.

There was a store on Jones Avenue in the late 1980’s called “Miscellanea,” but since we didn’t know what that was, we simply called the store “Jones.”

Every few weeks, we would head over there to meet with the store owner, a man named Robin. He taught us everything we knew about the sports-card hobby, from his very unique perspective.

Robin had a very rare collection of 1933 O-Pee-Chee hockey cards, and my Dad made Robin a deal: my Dad would purchase all the cards from Robin, but to keep things interesting, he would come back with my brother and I every couple of weeks and pick two cards at random. The price would be $115 each (Robin was too honest to sell without charging tax), and the cards would be selected at random.

I had no interest in the 1933’s. I was far more interested in 1980’s hockey and basketball, even though Robin kept telling me that I was “playing a fool’s game.”

In my eight or nine-year-old mind, I wasn’t just collecting; I was investing. I watched the price guides every single month (for those who remember Beckett was the authority), and paid attention to the ups and downs of card values like a 1920’s stock operator.

Robin challenged me one day, probably around 1989. He said, “Two weeks from now, bring me a list of 50 cards that you would want to own in 50 years, if you’re looking to invest.”

So I did.

I spent a considerable amount of time on this, and two weeks later, I brought in my hand-written, ruled 3-hole-punched sheet of Hilroy paper, and proudly handed it to Robin. This was probably my sixth draft, purposefully highlighted and colour-coded, ready for examination.

Robin looked at the paper for, if I had to think about it, maybe three full seconds. Then he took off his glasses as he shook his head, and said, “Nope. Not having it. It’s just no good a’tall.”

I was furious. And my Dad smirking didn’t help the situation.

1985 Fleer Baseball, Jimmy Key, XRC? Seriously? That was going to be gold in fifty years!

1983-84 O-Pee-Chee Hockey, Steve Yzerman, RC? You know the set – the one with the players’ photos in the bottom corner? One of the prettiest sets of hockey cards ever made! And Steve Yzerman was going to be a Hall-of-Famer!

1986-87 Fleer Basketball – oh so many! Charles Barkley, Dominique Wilkins, Patrick Ewing, and um, somebody named Michael Jordan! Still to this day, the most beautiful set of basketball cards ever produced, and in my top-5 of all time, in all sports.

Robin didn’t want to listen to any of this.

He said, “David, stick with your Dad. He’s got the pulse on this one.”

My brother and I did help my Dad with his collection, for what it’s worth. It was our collection. 1951-52 Parkhurst Hockey, likely the greatest set of hockey cards ever; that was our baby. We collected everything through the 1950’s, and of course, the 1933’s.

Somewhere around 1994, my Dad put all those cards in a safety deposit box downtown. And in typical my-Dad fashion, he lost track of them when an old branch of Bank of Nova Scotia closed, and its items were moved to another location, although I wonder if that even happened.

Every time I asked my Dad where the cards were, he’d say that he didn’t know. Year after year! Fast-forward to 2017, and our box was magically “found!”

This was a day I’ll never forget:

And now, almost a quarter-century later, I am collecting again.

But the industry has changed immensely since the early-to-mid 1990’s when we were last active. The industry has been completely commoditized by a grading company called “Professional Sports Authenticator,” or PSA.

In the 1980’s, you’d simply pick up a card, examine it, determine its worth, and then make a decision about value on your own.

But today, with the stakes as high as they are, people want graded cards; cards that are examined by lab technicians with microscopes, assessed with a numerical value, and then encapsulated in tamper-proof plastic holders forever.

Oh wait – what of my “list of 50 cards,” that I gave to Robin? Well, that crap all plummeted in value. A Steve Yzerman rookie card might have run you $300 back in the late 1980’s, and now you can pick one up (ungraded, of course) for probably $20 at a card show. Same goes for everything on my list, except the Michael Jordan rookie card. So I was basically 1-for-50.

What did keep its value is the older stuff, and this is where supply and demand comes into the equation. Yes, after this insanely-long introduction which has now basically swallowed this entire blog…

The reason why the 1985 Fleer Jimmy Key XRC has zero value today is twofold:

1) Nobody wants it.

2) There are tens of millions of them.

This failed both tests of supply and demand!

Those 1933 O-Pee-Chee’s?

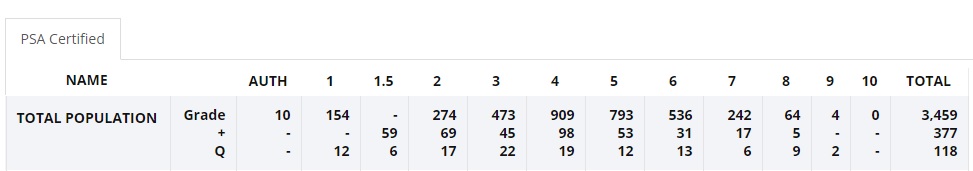

Well, thanks to the commoditization of the hobby, you can find out exactly how many graded cards exist in this set:

Only 3,954 cards have been graded by PSA.

That’s not to say there aren’t more out there (I’ve seen hundreds of ungraded out there at shows, but there’s usually a reason why…), but these are the ones that have been graded by PSA, and thus collectors can rely on the consistency and authenticity of the grades.

Now to take things a step further, PSA has a “Population Report” that specifies how many of each grade exists, as follows:

That is for the entire 1933 set.

But you can look at each individual card, and see how many have been graded.

Then you can look up sales history for each card, at each grade.

Sound familiar?

The market for cards has been commoditized just like the stock market, and in a similar fashion to the housing market.

If you wanted to know what 230 King Street, #1501 is worth, you can look up the sales history for #1601, #1701, etc.

The same goes for, say, a 1951-52 Parkhurst Gordie Howe, PSA-8. How many are there at each level of grading, and what are the recent sales? You can see the sale dates, and the platforms (ie. auction, Ebay, etc.)

So now that I’m 1,200 words in, what the hell does this have to do with real estate?

Well, for one thing, it’s cool. Just like my old man and I. I know, I know, you’re reading all this, and thinking “chick magnets, both of them,” and what can we say?

Secondly, I figured this was a far more interesting lead-in than showing supply/demand curves.

But most importantly, I wanted to draw a comparison to what a recent property seller in Toronto has done, versus what my Dad and I did with our cards we wanted to grade.

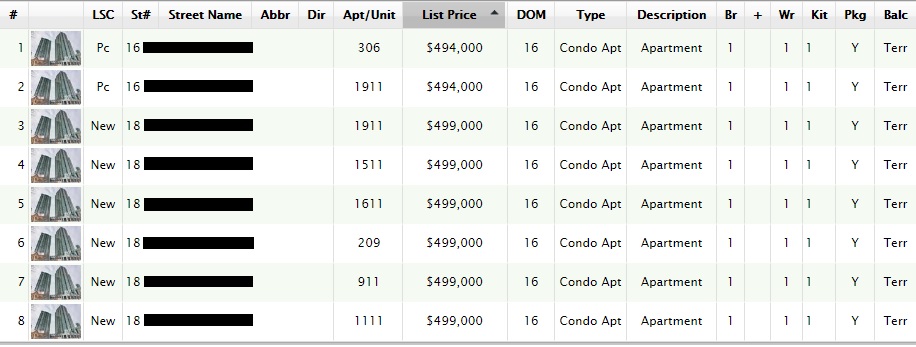

Last week, a reader sent me this:

Okay, cool. So there are eight crappy 1-bedroom units for sale in these two towers?

Who cares, right?

But if you look a little closer, you’ll see these eight condos all have one thing in common.

Is it obvious by now?

They’re all owned by the same person.

There are so many things wrong with this, I barely know where to start, but let’s try.

From a supply and demand standpoint, and this is true of condos, or of hockey cards, this makes absolutely zero sense whatsoever.

These are not just eight 1-bedroom condos.

These are not just eight 1-bedroom condos in the same building(s), because this is two towers in the same complex, no difference.

These are, in fact, eight identical units, with the only difference being the unit number, and I suppose, the view.

What in the world is this person thinking?

Did this person take Grade 11 economics? Or maybe this is a recent graduate of our distinguished provincial public school system, and he or she was too busy complaining that “public speaking causes anxiety” or that dodge ball is an unethical tool of oppression? No, really, this is where we’ve gone as a society, but I digress…

So let’s assume that these condos are not being sold under Power of Sale (because they’re not), and that there’s no duress, but even if this person needed to sell, and badly, flooding the market still wouldn’t be the way to go.

This “strategy,” if we can call it as much, ignores the very most basic tenets of supply and demand.

The seller could have put one unit up for sale, where it would have competed against………….wait for it…………..zero other units. But instead, he or she didn’t do that. He or she said, “You know what? I think I’ll compete against myself and flood the market.”

I just don’t understand this.

Unit #911, #1111, #1511, #1611, and #1911 – this is the same goddam unit, five times! This isn’t a pre-construction condo sales centre! This is the resale market, and this seller has undercut himself!

Consider that the average buyer doesn’t know that these units are all owned by the same person, so the buyer will likely think, “Wow, there’s a lot for sale in this building!” and no matter where that line of thinking leads, it’s not going to benefit the seller.

The buyer might think that there’s a negative reason why there are so many units for sale. Trust me, I get this all the time.

I had a listing last month where the very same unit next door was for sale, and so many agents were asking, “Is there something wrong?” No, there’s nothing wrong. It’s called “coincidence,” and yet nervous buyers (and their agents…) look for things that aren’t there.

The buyer might also think that there’s leverage, and I certainly can’t blame that buyer. If you’ve ever been a buyer of a condo where the same unit is for sale two floors higher, you know you have the leverage, and both sellers are vying for your offer.

The buyer might also think that the longer he or she waits, the more leverage there is to be had. I wholeheartedly believe that there is an inverse relationship between “days on market” and price, so the longer a property sits on the market, the less it’s going to sell for. In this case, there are EIGHT of the same unit up for sale, all listed on the same day, all with the same number of “days on market,” and the longer they sit, the less leverage the seller has, and the lower the eventual sale price.

This seller has basically tied a rope around all eight of these condos, and while he’s trying to move one unit, the others are going to move along with it. If one goes down, so do the others. The same can’t be said for a sale, unfortunately.

Whether this building is hot, luke-warm, or ice-cold, the laws of supply and demand still apply.

If the building is red-hot, and there would be five or six “bidders” for a standard 1-bedroom unit, then putting EIGHT units on the market at the same time would simply thin the buyer pool, and prices would plummet.

If the building is luke-warm, and units sell relatively well but not in competition, then putting EIGHT units on the market at the same time simply alleviates any and every buyer of any sense of urgency, and that not only allows the “days on market” to rack up, but also eliminates the emotional premium buyers often pay along with that sense of urgency.

And if the building is ice-cold, well, this goes without saying. It’s hard enough to sell one unit in the building in a reasonable amount of time, for a reasonable amount of money, so putting EIGHT units on the market at the same time makes it about eight times as hard.

No matter what market you’re in, this makes absolutely zero sense.

The seller should have listed one unit, sold it, then listed another.

He would have not only avoided every drawback listed above (competing against himself, creating over-supply, forcing ‘days on market’ to rack up, etc.), but he also could have created a benchmark price.

One listing, one sale.

Repeat.

One at a time.

It’s the same mentality that my Dad and I are implementing with respect to having a few of our cards graded.

We have in our possession four, 1951-52 Parkhurst Maurice Richard’s:

They are pristine.

We hope that they are graded PSA-9’s, but with only five such PSA-9’s in the world, we are weary of sending all four of our cards for grading at the same time.

So we are going to send one. Then see how it comes back.

Then we will send another.

And then another.

And while this isn’t exactly the same thing as the condos being sold above, similar logic applies.

If these cards were revealed to be, say, PSA-7, PSA-8, PSA-9, and PSA-9 respectively, then so be it. But if we submitted all four at the same time, would a professional grader, knowing there’s only five PSA-9’s in existence, give the same designation to two more, at the same instant?

Like I said, these cards should be what they should be. And in a perfect would, they would be. But we don’t want to take the chance that a grader gets emotional, or worse – thinks this lot is simply too good to be true, and it can’t be real.

Thus, one at a time.

But for a more exact analogy between the eight condos for sale above, and the now-commoditized market for vintage sports cards, let’s use the following example…

The most sought-after and expensive card on the planet is not the Honus Wagner T-206 that was first made famous when Wayne Gretzky and Bruce McNall purchased it in 1991, but rather a 1952 Topps Baseball Mickey Mantle, graded PSA-10 “Gem Mint.” Experts value this card at $10,000,000, but of the three people in the world that own the card, none are likely to sell if offered $10,000,000. Perhaps that’s a topic for another day, ie. how “value” is inaccurate when there is, in fact, no supply, and/or willing seller.

In any event, imagine a scenario whereby one of these sellers does put his card up for auction. Maybe it fetches $11,000,000? Or $15,000,000? Who knows. But there are a lot of insanely-rich people out there, who love tiny pieces of cardboard so much that they would pay these ridiculous prices!

But what if all three of these cards were put up for auction at the same time? Suffice it to say, the sellers wouldn’t fetch the same prices?

And there’s my analogy, which, for some reason, I used half this blog post to introduce. But what the hell, maybe you learned something new today!

Who knows, maybe the seller of those eight condos above was talked into this by an agent who wanted eight listings signed on the same day.

But bottom line: there’s absolutely no denying the position he or she has put him/herself in. Voluntarily, knowingly, and intentionally, and that’s the toughest part for me to accept…

Jeremy

at 11:27 am

Are you saying all my Pogs in storage in my mother’s garage are worthless?!?! ????

Graham

at 11:32 am

You have any Alf pogs (https://www.youtube.com/watch?v=M_UR201plc8)?

Carl

at 12:32 pm

OK, a great explanation the theory of supply and demand. But a theory only gets you so far, especially in economics. Now I’d like to see empirical validation. How quickly did those eight units sell, and for how much?

Condodweller

at 3:44 pm

Yeah, unless we know the seller’s motivation it’s impossible to judge if it’s the right strategy. When I took possession of my rental unit and put it on the market rentallifestyle alone had a whole bunch of units up for rent in my building which initially worried me, however as it turns out I had no problem at all renting it at market rate or higher.

What if this guy has a great investment opportunity and needs to raise cash to fund it? If it’s such a great opportunity that it doesn’t matter if he “loses” a hundred grand on the sale he/she will make it up with the new venture. Also, if you are trying to sell your unit when others have theirs on the market you may take less for yours to attract a buyer. This is one thing you don’t need to do if you are the owner of the other units.

Professional Shanker

at 1:01 pm

Condo – what is your take on the impact of Airbnb on condo prices, you mention you have a rental unit, have you ever considered this avenue?

Condodweller

at 6:06 pm

I haven’t considered it because I have had the same great tenant for over ten years and I’m not greedy/unprincipled enough to force him/her out to try something in the grey area.

As for the impact on prices is difficult to say. I think it would take government intervention to make it illegal where from one day to the next investors are forced to sell because simply renting out the same unit would result in a loss they couldn’t sustain. I have heard stats saying on average 50% of condos were owned by investors though that might have been prior to Airbnb. The question is what percentage of those units are used for Airbnb and what percentage of those would hit the market at the same time.

It seems while individual buildings are against Airbnb they have found it challenging to eradicate the practice. Even if they did, forced sales due to this would be staggered over time meaning the impact would be muted.

It would also be interesting to know what percentage of Airbnb owners are cheating on their taxes by under-reporting their income i.e. ~$2000 for rent vs $3000+ for Airbnb. If the government finds out and realizes that they are missing significant amounts in taxes they may decide to regulate from the tax end and to protect hotels/increase rental availability. As long as Airbnb is producing extra tax revenue for CRA I don’t see it as a priority for them but who knows.

Stanley

at 4:35 pm

All eight units are still listed. 17 DOM and counting. They’re up at Harrison Gardens Blvd. Agree with David on this one. This is asinine.

Carl

at 9:48 pm

Can’t wait to see how the story ends.

Condodweller

at 10:02 am

Ok, so this person seems to like the 11 unit which by no means seems crappy. Faces away from the 401, no pillars in living room, not much wasted space, 9′ ceilings. It wouldn’t surprise me if it was the best 1 bed layout. Most of them were acquired around 2004, probably pre-construction back when it made sense to buy pre-construction.

The only obvious issue I see with these listings is the price. There was a 1 bed penthouse sold recently for $495k but most prices were mid $400k though some last year.

This seems to be an intelligent investor who is mostly doing all the right things. The units are even empty which David keeps saying they should be prior to posting.

He/she is unloading these units at an all time high. Considering he/she has more than doubled the investment and made about 2 million $$ pretax. I don’t know about anyone else but I’d like to be in this person’s shoes.

jeff316

at 8:21 pm

I always thought that some of the collapse in the card market was down to the internet. With player bios, info and stats at your fingertips – for some, all the way back to their days in juniors or minors – the cards just lost their basic utility. Sure, an old card will appreciate due to rarity or nostalgia, but by and large there is just no need for sports cards anymore.

David Fleming

at 12:08 pm

@ Jeff316

The collapse in the card market was due to extreme over-saturation, a major reduction in demand from kids and hobbyists, as well as high prices in the mid-1990’s.

Consider that before players’ unions existed, sports teams were free to sign licensing agreements with individual sports card companies. So in 1963 as an example, the Toronto Maple Leafs, Detroit Red Wings, and Montreal Canadiens had signed with Parkhurst, but the Boston Bruins, New York Rangers, and Chicago Blackhawks had signed with Topps. Once players unions were formed, it changed the landscape of the market, and it allowed ONE sports card producer to dominate.

Baseball, as an example, saw Topps dominate in the 50’s, 60’s, and 70’s – an unprecedented run. Then in 1981, Major League Baseball allowed Fleer and Donruss to enter the market, and we saw all three of Topps, Fleer, and Donruss produce cards from 1981 through the end of the decade. Then in 1989, Upper Deck produced cards that had never been seen before, and that too changed the landscape. At the start of the 1990’s, all kinds of other companies entered the market, since there was demand from collectors, and because the players’ unions got more money. Bowman and Leaf both made comebacks. O-Pee-Chee launched their “Premier” series; Topps launched “Stadium Club,” and there were others, as companies realized they could have more than one line, so long as the name was different. And new lines such as Score, Pro Set, Skybox, and Hoops entered the market. By 1991 and 1992, every company had multiple lines, with some companies having five or six. There were sub-sets and sub-series, and “update” editions launched later in the year. Companies released “factory sets” for collectors who didn’t want to collect one card at a time via packs. And when “insert cards” became all the rage in the mid-1990’s, the hobby went nuts.

The problem, in the end, was over-saturation. In the 1980’s, baseball card collectors had three choices: Topps, Fleer, and Donruss. In my family, my Dad collected Topps, I collected Fleer, and my brother collected Donruss. In hockey, there was only Topps/O-Pee-Chee (USA/Canada). In football, it was only Topps. In Basketball, it was only Fleer, and to a lesser extent, Star.

Once 1990 hit, the players unions licencsed anybody and everybody who wanted to get into the industry, and by 1995 or 1996, there were just way too many sets.

The production of these sets was also at a level that made cards redundant. If the print-run of 1933 O-Pee-Chee in Canada was, say, 100,000, I would guess that the print-run of 1992 Upper Deck baseball was 50,000,000. So how is a card really “worth” a certain amount, if that card is in abundance?

A product or service, in a free market, is worth what somebody is willing to pay for it. And if people were willing to pay $25 for a 1990 O-Pee-Chee Premier Jaromir Jagr or Sergei Fedorov rookie card, then that’s what it was worth. But today, with tens of millions of them out there, these cards are worth a buck or so.

The same cannot be said for “vintage” cards.

Now the second part of the equation here is demand.

The hobby exploded in 1989/1990, and to your point, this was well before the technological innovation of the mid-to-late 1990’s. Not to sound nostalgic here, but in 1987, I would ride my bike three blocks to the corner store, buy some Popeye Cigarettes (now banned, of course), a freezie, and a pack of 1987 Topps baseball cards for 25-cents. Video games got much better in 1992 when Super Nintendo replaced Nintendo, and then again in 1994/1995 when we saw Nintendo-64 et al, which of course gave way to X-Boxes in 2001, etc. The Internet became mainstream in 1998, and cable modems thereafter in 1999/2000. Riding your bike to the store to buy baseball cards was just never going to be “a thing” again.

The last part of the equation was price.

My packs of 1987 Topps were 25-cents. But in the mid-1990’s, some packs were $5.00. There were way too many producers, too many sets, and the cards were too expensive. The “kids” riding their bikes to the stores had given way to kids playing video games and using the Internet, but even the collectors and hobbyists turned up their noses at the prices. It was one thing to lose the kids, but another to lose the hobbyists.

Fast-forward to 2019, and do you know who most collectors are? Middle-aged-men and senior-citizens. Picture a Baby Boomer, with money to spare, and some basic knowledge of how to use a computer, and you can see why there is a huge market for 1950’s hockey cards. The demand is present, and the supply is not. The industry has been commodotized by PSA as well, so there’s accountability and accuracy.

I still go to the show up at the International Centre twice per year, and there are very few kids. The 2019 hockey cards are like $150 per box, which is just insane. Who is buying this stuff?

So there’s my rant. Thanks for the impetus to provide my two cents!

Phil P

at 1:28 pm

The 1989 Fleer Billy Ripken was amazing to 10 year old me. I opened my factory set(!) to see which one I got – it was the FF variation.

Dane

at 2:39 pm

I would have had no idea what this meant except I read this article a few months ago:

https://www.google.ca/amp/s/www.sbnation.com/platform/amp/mlb/2019/1/25/18174412/bill-ripken-card-1989-fleer-frick-face-look-google-wont-index-this-if-the-url-has-the-actual-swear

Mike

at 11:13 am

The fact that one person owns all these units shows the problem with our RE market.

The fact that person is selling all simultaneously could also signify an issue.

daniel b

at 2:06 pm

if you’re going to list all your units at least do it at a wide price range. As much as supply and demand help set prices, so to does psychology. Anchor one or two units at $549k, suddenly your $499k unit looks like a steal!

Carl

at 3:29 pm

Great comments from everybody, but none of us really knows the seller(s), so we are all speculating. Nothing wrong with speculation of course, it’s fun, as long as you know that’s what you are doing and don’t take yourself too seriously. Maybe the seller(s) only want to sell one of the eight but don’t care which one. Or maybe they own not 8 but 800 condos, so they don’t have time to sell one at a time before the next recession.

cyber

at 2:35 pm

I immediately recognized the building(s) because I live in the same complex. My initial thought was that it was a pre-construction investor cashing out to raise a major chunk of cash for some other larger investment opportunity (e.g. smaller apartment building instead of individual condos, non-real estate), as the bulk of units appear to be investor-owned. The bulk of the units is still likely owned by original investors, as the first initial occupancy for the first of the two towers was in mid 2015.

The development was previously one of a handful to break $1000 per square foot in the resale market, and it looks like even late stage pre-con buyers could have gotten them in $600-700 per sf range and roughly doubled their money at this stage. The thinking was probably that even with some “volume selling” discount the investor could have netted around $2M that may have been needed fast in order to take advantage of another investment that was so good it would not be available for long, and that the units could move quickly enough due to the attractiveness of the building itself to investor buyers (potentially with interest in multiple units?) and the peak summer period.

In any case, it looks like only one of those units, #911, is currently on MLS, so the seller and their agent have likely found out the hard reality of micro-economics you described in this blog.

Randy

at 4:35 pm

Four pristine Rocket Richard rookies? Oh my God! Did you submit any to PSA yet?