What’s Happening With Toronto Lease Prices?

If only the actual writers of newspaper articles could pick the headlines, right?

I’ve mentioned this before, but back when I used to write for The Grid, was quite caught off guard when I learned that I didn’t get to pick the titles of my articles. Many of the articles I wrote, I felt, were mischaracterized by the headline itself.

In fact, the very first article I wrote about development in Regent Park came with a headline that I didn’t write, and then a level of scorn in the comments section that I never expected.

I think I have a photo of that somewhere….

….ah, here:

And yes, that’s exactly what I look like…

Anyways, the point I wanted to make was that this article in the weekend’s Globe & Mail came with that sort of “don’t do what Donny Don’t doesn’t do” type of headline:

“The More Affordable Grows Less Affordable As Toronto Condo Rents, Prices Surge”

You have the benefit of reading that with a head’s up, but I had to read it twice before I understood it.

Read it ten times, and it’s a question of how a person could not read that correctly. But wow, I don’t understand how headlines are chosen.

The article itself, however, came with a fantastic look at what’s happening with condo rents.

From the latest Toronto Real Estate Board article:

The latest report, from the Toronto Real Estate Board, showed “robust average annual rent increases” for condo apartments in the third quarter of the year. Average rent for a one-bedroom unit surged 9.5 per cent to $2,163 from a year earlier, while that for a two-bedroom climbed 8.3 per cent to $2,822.

“Average rents are continuing to increase at annual rates far beyond the rate of inflation in the GTA as rental demand remains very strong relative to the supply of units available,” said Jason Mercer, the group’s director of market analysis.

“We will need to see a sustained period of time within which growth in the number of rental units listed outstrips growth in the number of units leased before we see the rental market return to balance,” he said in the report.

The latest report, from the Toronto Real Estate Board, showed “robust average annual rent increases” for condo apartments in the third quarter of the year. Average rent for a one-bedroom unit surged 9.5 per cent to $2,163 from a year earlier, while that for a two-bedroom climbed 8.3 per cent to $2,822.

“Average rents are continuing to increase at annual rates far beyond the rate of inflation in the GTA as rental demand remains very strong relative to the supply of units available,” said Jason Mercer, the group’s director of market analysis.

“We will need to see a sustained period of time within which growth in the number of rental units listed outstrips growth in the number of units leased before we see the rental market return to balance,” he said in the report.

What’s happening with rent prices?

So rents are up 9.5% and 8.3% respectively for 1-bedroom and 2-bedroom condos, and keep in mind – we’re talking about the GTA. If we were talking about Toronto, more specifically, downtown Toronto, I think the numbers might be higher.

These massive increases, which are not in line with inflation, clearly don’t scream “rent controls,” do they?

In fact, I think we can all admit that the Liberal government’s attempts to cool the rental market with their April, 2017 legislation, have failed. Some might argue that the rental increases are because of the legislation, and not merely in spite of it.

Say what you want about the political cause-and-effect, but there’s no denying where we stand in Toronto with respect to rents.

Of course, many saw this coming.

A quick Google search provides us with the following:

April 20th, 2017: “Wynne’s Rent Control Will Backfire, Says Property Owners Association”

The irony with that particular article was that, in the same article in which property owners were suggesting that rent controls would backfire (which they did), tenants rights groups were clamouring for the rent controls to apply to vacant units as well!

May 6th, 2017: “Wynne’s Rent Controls Will Repeat Past Mistakes”

I could go on, but you get the gist of it.

There are plenty of articles from April and May of 2017 suggesting that the rent control legislation was not only misguided, but would have an inverse effect.

Where does that leave us today?

With articles like this:

September 5th, 2018: “Rent Control Is Doing Little To Curb Soaring Rents”

October 4th, 2018: “Ontario’s Expanded Rent Control Is Failing Tenants”

And the best part is – one of the contenders for the Mayoral race doesn’t even understand the rules surrounding rent controls in Ontario.

Say what you want about Jennifer Keesmat, and defend her if you want to. I won’t fight you on it.

But there is no misunderstanding what she said here:

“What Doesn’t Keesmat Know About Rent Control”

I personally spoke to two people who were in that room when the questions were being asked and answered, and Ms. Keesmat really, truly did not know that rent controls applied to condos built after 1991.

Anyways, that’s not my point. I don’t like Keesmat or Tory, for what it’s worth…

If you could take the classic “put a face to the name” saying, and apply it to the increase in Toronto rent prices, I think it might help put the increases in closer perspective.

It’s one thing to throw around statistics like the 9.5% increase, year-over-year, for the 3rd quarter, for 1-bedroom condos in the GTA.

But it’s another thing altogether to see what one particular unit’s rent looks like under a microscope.

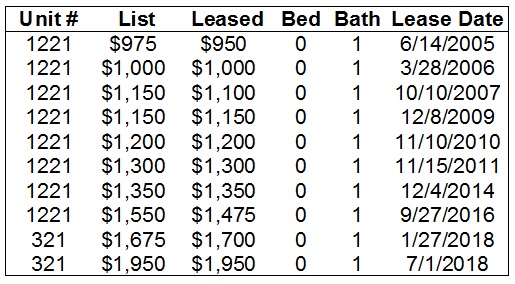

So for that, I went to MLS, and picked a building at random – 230 King Street East.

I looked at the history of rents on MLS, trying to find a unit that has been leased over and over, and came up with the following:

That’s a bachelor condo, 470 square feet.

First leased in June of 2005 for $950/month.

As you can see, there is a lot of turnover in Toronto, and in March of 2006 (assuming the tenant was leaving, and the landlord put the unit up months in advance), the rent increased a mere $50 per month in absolute terms, but that’s a 5.3% increase in relative terms.

The unit went up $100 per month in 2007, then only $50 per month in the next two years – bringing it to $1,100/month in 2009.

Then $50 in 2010, $50 in 2011, only $50 in the three years up to 2014, but then rents went crazy.

A $125 per month increase from 2014 to 2016 – another 4.5% per year.

But that unit hasn’t been leased since 2016, so I had to look at other “21” models, and there’s only one – Unit #321.

I know what some of you are thinking – perhaps #321 and #1221 are different. But they’re not. They’re identical 470 square foot models.

The craziness in the rental market dates back about 18 months, and as you can see, this unit went from $1,475 per month in 2016 to $1,700 per month in January of 2018, and then when the tenant left after only six months (who knows what happened here), the landlord took advantage of a barren summer market and got a whopping $1,950/month.

That’s a 105.3% increase in 13 years.

But more importantly, a 44.4% increase in less than four years.

What about larger units?

How about a true 1-bedroom, and perhaps with a den?

And what about the other side of the downtown core?

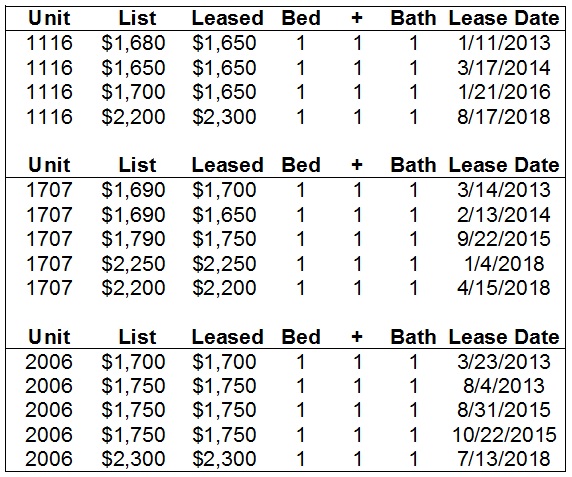

I went to Liberty Village and took a look at 65 East Liberty Street; a pretty standard, 24-storey condo that has a slew of rental units, and was completed in 2013.

I looked at three units this time, (ensuring that I found units that were actually leased in 2018) and here’s what I found:

Unit #1116 has increased from $1,650 per month to $2,300 per month. That’s an annualized increase of 7.1%

Unit #1707 has increased from $1,700 per month to $2,200 per month. That’s an annualized increase of 5.8%.

Unit #2006 has increased from $1,700 per month to $2,300 per month. That’s an annualized increase of 6.6%.

What do you make of these numbers?

Overall, they’re actually less than the 9.5% figure we were given at the onset, which was for 1-bedroom units, GTA-wide, from the 3rd quarter of 2017 to the same period this year.

But despite the lower figure, I still think a 6.5% yearly increase in rental prices, over the past five years, is shocking.

If the government hopes to keep rent increases in line with inflation, I simply do not see that happening.

Sure, they can mandate a 1% increase in rents for existing tenants. But as you can see from the listings above, turnover is natural in the downtown core. Those units at 65 East Liberty Street have turned over five times in five years. So while the rent increases could keep prices low, in theory, in reality – landlords are given opportunities naturally to increase prices on the free market.

Not only that, consider that every time a new condo unit is finished, that unit’s price is set at market rent.

So if a 500 square foot unit at 123 King Street was leasing for $1,500 in 2017, the tenant stayed for two years, and thus the rent was only increased to $1,520 in 2018, and then $1,540 in 2019, a unit completed next door at 125 King Street, and completed in 2019, would be leased anew for $2,000 per month.

Every single new unit will be set at market rent.

And as we can see above, units turnover constantly in the downtown core.

I could go on and give you demonstrations like the above all day long, but I think you get the three major take-aways:

1) Rents were slow to rise from 2005 to 2010.

2) Rents have skyrocketed from 2016 to present.

3) Turnover is natural among Toronto’s downtown condos.

Is it any wonder why “investors” keep buying?

And just to finish on a sarcastic note that perhaps the market bears can use – does anybody know where I can get a 1-bedroom condo for investment that’s cash flow positive each month?

Condodweller

at 9:12 am

I had no idea turnover was this high. Mind you if a building is typically rented 50% then even three units are irrelevant statistically. I suspect the average is much lower which means rent control should help keep average rents lower though it won’t help new renters.

I would expect trun-over to reduce with rent control as people with below market rents have an incentive to stay put. Perhaps it will take a few years for the difference to be significant enough to dissuade people from moving. My tenant has been there for over a decade now and I don’t think he is going anywhere considering his rent is below market with the recent explosion.

The help incremental renters, rent-control would have to extend to empty units and also somehow to new builds. Perhaps tie it to current average rents. Of course, I’m speaking from a renter’s point of view. This would be disastrous for new builds and investors would disappear overnight making the whole situation worse.

Appraiser

at 9:33 am

For all of the free-marketers out there, this is how supply and demand works and why rent control doesn’t.

Prices rise as demand exceeds supply. Econ 01.

Condodweller

at 10:54 am

Right. I don’t know if it’s econ101 or you would have to take the econ201 but if the government imposes a rent ceiling, as they have the right to do, below market price it would create a surplus….eventually.

I’m not saying they will but if there is noise from enough voters it just might happen.

Housing Bear

at 12:45 pm

To be honest, I think anyone who is bearish on market prices should be anticipating the upwards pressure on rent prices to continue over the short term. a) As correction sets in, people will hold off on buying new property and this should create more demand for rental units. (Increase in rental demand) B) If correction gets bad and starts to build momentum, you will have the more amateur or over leveraged landlords giving their tenants the boot to list and sell. (reduction in supply) C) Over leveraged households who can’t afford their mortgage will sell and than start renting (increase in rental demand) D) Boomers who are trying to secure their retirement will sell existing home with a lot of equity, they will have the cash to outbid others on more desirable rental locations further driving up prices (and increasing rental demand).

If rents get to a point where it would be more cost effective for me to weather more capital depreciation than to continue my current plan, I may jump back in sooner, or further from the market bottom.

Of course, rent prices can fall and rents are more tied to incomes than buying prices are (banks wont lend you your rent payments) , so this growth will hit a wall eventually. If all those broke loser renters (as some of the landlord’s here like to call them) reach a point where they have no life in the city because most of their income just goes to shelter, than expect to see an exodus. Still have record supply of condos on their way, at least half of which went to investors (AirBnB, rental unit, or hold empty to flip) many of which were bought at record high pre con prices before rate hikes started and B-20 came into effect. David hit the nail on the head here, these individuals will all be cash flow negative, in an environment where they are watching the carrying costs going up. If rents can continue to grow to offset rate increases and make all resent investors cash flow positive (I dont think they can), this would relieve a lot of the eventual downwards pressure I see for the market as a whole, IE investors will be in a better position to weather the storm and there wont be as big of a rush to the exits. If not big downwards spiral until either new investors are confident cap rates will hold (price vs rent) and start to buy, or economy improves enough where buyers are willing to take on debt and banks are willing to lend to them again.

Condodweller

at 1:49 pm

@HB I agree with most of this however I don’t think D is going to be a major factor. Seniors are not as agile as you think and since they are more likely to have advisors they will either sell at current levels or not panic with a downturn if it happens. Most will only sell when they get close to actually needing the funds for retirement income or they are forced to sell due to health reasons. If there is a downturn it A) is not going to have a huge impact on them give their likely cost 20-40 years ago and B) with proper advice, they could unlock equity without necessarily selling.

The pain is going to come from reckless investors and over-leveraged homeowners.

Housing Bear

at 8:20 pm

I think D) aka the boomers are one of the biggest x factors in this whole mess.

A lot of them were the bag holders during the last crash so they have witnessed first hand how a large correction can play out and how long it can take to get back the lost value.

If they are willing to hold through thick and thin than this should mitigate some of the fall out. If a large enough chunk of them have been allowing their saving rates to drop/ living beyond their means/ taking out debt to help their kids get into the market thinking they they could always sell their house if they ran out of money or got into trouble than we could see a rush for the exits. Remember they will look at this different than the recent buyer who is down 20% on their 1 million purchase. If new buyer can make their payments, the might want to hold on to avoid locking in the loss. The boomer might be thinking I bought this for 200k, have only 150k in HELOC. Last year I could have cashed out for 850k in cash, this year I can only cash out for 650k cash. ……… What will my retirement look like next year?

And yes, there are ways to get equity out like reverse mortgages, but these options don’t make as much financial sense as selling and buying something cheaper or renting. Only reason to do it is the sentimental value of the family home. yada yada yada. In a crisis, I will take fear/greed over sentiment any day of the week

Jimbo

at 8:03 pm

I would like to bite in the sarcasm, how much have similar units sold for in those buildings?

J

at 1:03 pm

The most recent sale of a 1+1 bedroom w/ 1 bath at 65 East Liberty Street was for $540k in January 2018.

Taxes are $177/month and maintenance is $365/month. A 25-year mortgage at 3.5% with a 20% down payment is $2,157/month.

Assuming you can rent it out for $2,300/month, you’re bleeding $400 in cash every month. And that’s before even considering the following expenses:

– Maintenance and repairs within the unit

– Special assessments

– Insurance

– Vacancy

– Delinquencies

– Opportunity cost on the down payment

– Compensation for your time and effort of being a landlord

– Sales commission, legal fees and land transfer taxes on the eventual sale

– Accounting fees

Alex

at 6:30 pm

Yes, and some are complaining that rents are too high… With current prices, taxes, maintenance fees the landlords are actually subsidizing tenants…If municipal and provincial governments are really into making rents/housing cheaper, start with dropping all those development fees and transfer taxes…And it is not going to happen.

daniel b

at 10:02 am

i’d say the general response to the cash flow negative investment properties has been “who are these idiots, they must be betting on price appreciation to flip the unit in a few years”. I offer a counter investment thesis:

1. same was true several years ago at lower purchase prices, meanwhile rents have risen flipping many of those properties cf positive

2. in your cash flow analysis ~50% of the mortgage payment is principle repayment.

3. what is the opportunity cost on the $100k downpayment, how does that compare with the principal repayment and the cf subsidy?

4. with rents going up how long until it is cf positive?

steve

at 8:40 pm

Ahhh … but what if rent controls were to be applied even after a unit was vacated? An increasing number of frustrated voters want government to “do something”. Scary thought, since it would slow new investment, but desperation breeds extreme results.

Cash flow positive units at current prices are unicorns. What happens when price appreciation grinds to a halt (coming sooner than most people believe)? Yup, growing inventory of unsold units, followed by lower prices, followed by more competitive rents.

Condodweller

at 12:04 am

The only way we are going to get more competitive rents, without government interference, is after a significant price correction where owning becomes more affordable than renting and renters become owners in droves thereby increasing vacancy and lowering rent.

After the 89 crash everyone trapped in their house tried to rent as they couldn’t/wouldn’t sell to take the 25%+ loss. I remember for rent signs sprouted on just about every other lawn. Rent’s dropped by about 50% back then.

Numberco owner

at 9:55 pm

You can always find cash flow positive properties but the question is how much of a down pmt you make.

What’s your down pmt percentage, David?

Condodweller

at 11:54 pm

Cash flow positive is only one part of the picture. The rate of return is the other. As you increase the downpayment you also decrease your rate of return as the rental income, even with significant increases, is a small percentage of a large downpayment.

Once you increase your down payment to the point where it might become cash flow positive, you have diluted your income to the point that investing it elsewhere becomes much safer and more attractive.

Give us an example of how much downpayment you would use to be cash flow positive where your return is at least 6-10%. I would want at least 10% but closer to 15% return in the current environment to risk my capital Toronto RE at current prices.

Jimbo

at 2:24 am

That depends how you apply the discount rate. Given the appreciation over the past 5 years you are laughing, stocks couldn’t keep up bc of the leverage involved. I wouldn’t have taken the bet 5 years ago just like I wouldn’t now, but there is no way to beat the ROR given hindsight. I say discount rate bc there is no such thing as a safe investment unless you stick to bonds. Given bonds are lower than 4% the 10% return you “want” is a pipe dream that may come true from time to time just not consistently.

Condodweller

at 1:37 pm

@Jimbo I am using present day as we live in the present and can’t change the past. I think even the resident raging bulls will concede that we are not going to see double-digit RE appreciations going forward.

I agree with you on not taking the bet 5 years ago or today, in fact I didn’t. I had funds even 10 years ago to buy RE but I did not take the bet. It’s easy for the bulls to say I missed out but 20/20 hindsight vision is great. Between my home and investment property I had plenty of exposure to the RE boom and I don’t feel I missed out at all.

10% return on RE today is a pipe dream. That was my point. However, you can easily get 10% over the long term in the equity markets. You only have to beat the average by about 3% which I can easily do simply be savings on fees never mind with some strategic investing.

David Fleming

at 6:23 am

@ Numberco owner

20% down is the standard in the calculation of cash flow. It’s the minimum down payment required for an investor.

You are correct – you can find cash flow positive units if you put down 30%, but that’s moving the goal posts, in my opinion.

Condodweller

at 1:50 pm

I just got a duplicate comment detected message on this. Let’s see if it works now….

@HB I agree with most of this however I don’t think D is going to be a major factor. Seniors are not as agile as you think and since they are more likely to have advisors they will either sell at current levels or not panic with a downturn if it happens. Most will only sell when they get close to actually needing the funds for retirement income or they are forced to sell due to health reasons. If there is a downturn it A) is not going to have a huge impact on them give their likely cost 20-40 years ago and B) with proper advice, they could unlock equity without necessarily selling.

The pain is going to come from reckless investors and over-leveraged homeowners.

Bluetheimpala

at 4:21 pm

Bubbles bubbles toil and trouble

What will rise from out the rubble?

The match is lit, watch it glow.

Paper people; burn row by row.

Tick tock.

Harold

at 6:44 pm

Yeah right. Ten years and counting.

Hey don’t you have any more inane, fear-mongering, hair-on-fire, end of the world comments to add over at pinhead Punwasi’s portal.

Soooo…scary. Get lost.

Rick Aurora

at 5:54 pm

It is incredible how the rent prices continue to raise, it is almost impossible t fin 1 bed condo in a decent area for less than 2000

Toronto Bank Foreclosure Homes

Clifford

at 12:55 pm

I’m sure tenants paying 1500 with no intentions of moving are feeling pretty good right now. Sadly, I can relate. Losing $500/month and counting since providing tenant with subsidized housing and he knows it.

crazyegg

at 1:50 am

Hi All,

Yes. It is a painful to be undercharging rent as a landlord in Toronto.

I am renting one 2 BR Riverside stacked unit with parking and bike locker and utilities. All for the bargain price of $1500. The tenants are never moving. The only legal way to get out of this is to sell…

The lesson here is to raise rents every year by the maximum allowed. Being nice and not raising rents (just because you have a good positive cash flow) will come back to bite you.

The second lesson is to buy the cheapest, smallest unit in a low to mid-rise building with minimal amenities. The return on investment (from a price paid to rent received will work in your favour) I did that with the next 3 doors we bought.

But builders now are becoming smart. The huge negative price gaps enjoyed by studio units compared to the 1 BRs+ are long gone…

Next lesson is to go short on a mortgage. That way, you can exit on the investment with no mortgage penalties…

Regards,

ed…

Lewis Wheeler

at 10:06 am

Nice to read blog

https://www.casalova.com/boss-agent