Post-Victoria Day in the Toronto real estate market usually means a flurry of activity as both buyers and sellers scramble to transact before the end of June.

It’s been an interesting, albeit mostly positive first 4 1/2 months to the year for Toronto real estate.

But questions still remain about the Toronto market, so let’s get them asked, and hopefully answered…

What were you doing over the Victoria Day long weekend?

Relaxing at home?

Weekend trip out of the city?

Blowing off steam from a few busy weeks, or months, at work?

I can tell you from experience, there were a lot of Toronto home-owners that were doing nothing of the sort. “Time off” over the long weekend was a luxury they didn’t have.

Why?

Because we’re about to make the final push in the busy spring real estate market, and the Victoria Day long weekend always affords home-sellers those three days strung together that they really needed in order to get their homes ready for sale.

By association, there are also a lot of buyers out there that are hoping the day after Victoria Day is like the day after Labour Day, and the real estate market just explodes with new listings. Historically, that’s been the case. But the “final push” in the spring-market is short-lived; only six weeks before the calendar turns to July. So active buyers will need to be more aggressive, and recognize that patience is not a virtue.

Keep in mind, that I’m speaking more generally about the housing market, which is far more cyclical in nature than the condo market. The housing market is firmly tied to the school-year, and/or the family calendar. So when school is out, and summer begins, fewer people are looking to buy and sell freehold homes. The condo market, on the other hand, might slow down marginally once July hits, but the drop-off is not nearly as pronounced.

So where does this leave us?

For many, it leaves us asking questions about the market, both general and specific, as we prepare for this final push.

Let me post five questions which I think are the most likely to be asked:

1) What direction is the market headed?

2) Where is the Toronto average home price going?

3) Will we see more inventory?

4) What’s happening with interest rates?

5) Is the booming condo market sustainable?

So let me jump right into it…

1) What direction is the market headed?

Simple question to start, right?

But it’s what everybody wants to know, and it’s also tied to virtually every other question on the list.

So in order to understand where the market is going, first we need to look back at where it’s been.

Last year’s market was incredible. The first four months of the year were the hottest four months I had ever seen, and then things dropped off significantly in May. We had the coolest June I think I’ve ever seen, and then a very slow summer. The fall did what the fall always does – it put upward pressure on price again, and we saw those prices increase through to December, which is a month I never use to judge anything, on account of, well, it’s December.

So far in 2018, prices have moved, but ever-so-slowly. Unless you’re looking at the condo market, but that’s another story.

May and June are historically very busy months, and save for last year, I’d say that May is the busiest month of the calendar year. But 3/4 of the month are in the rear-view mirror, so really we’re asking ourselves: “What do we expect for the last six weeks of the spring market, and into the typically-slow summer?”

Then of course, you need to ask yourself, “Am I looking short, medium, or long-term?”

I’m bullish short, medium, and long-term. But I’m a real estate agent, right? So what do I know.

I think even the market bears would agree that in the long-term, unfortunately for many, prices are going to be on the upswing. Medium-term too.

So really the only question at hand refers to the short-term, and that’s somewhere between 6-18 months, depending on your definition. That question will be answered, in part, by the following…

2) Where is the Toronto average home price going?

This seems like it’s the same question a second time, but it’s not.

To measure a market, some people look at sales (which I don’t), and some people look at price. Others look at new or active listings, and some have their own ratios.

As for the average home price itself, as I explained last week, that’s still just one number. And within that one number, are many others that you might find more important.

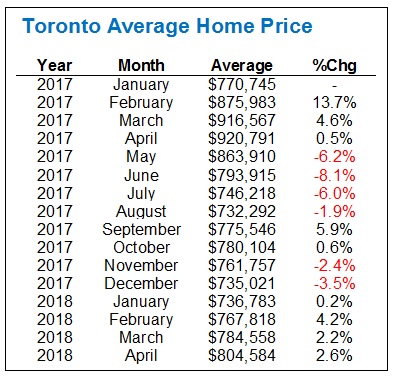

But here how the average home price has fared from 2017 onwards, including the monthly change:

As I said in point #1, the average home price has been creeping ever-so-slowly this year.

To be fair, a 2.2% and 2.6% monthly increase are not “slow.” Tell that to a wealth manager, who is looking to add a low-risk 5-6% to his clients’ portfolio.

But in the context of the 2017-2018 real estate market, it’s a very gradual change in average home price, especially if you consider where this number fell in March/April of last year.

So let me ask two questions here:

i) Will the May average home price be higher than April?

ii) Will the June average home price be higher than May?

To the first question, I say, “Yes.” Without question, and this actually has less to do with that 2.2% – 2.6% pattern, and more to do with what I’ve seen through the first three weeks of the month.

As to the second question, I would say, “Maybe.” ordinarily, I’d say “Yes.” June is a very strong month. But I’m not sure if the demand we saw in the spring will carry through to June. I feel as though many, if not most spring buyers, have already bought. I have one set of buyers from January 1st that have yet to purchased, and everybody else has done so. Of course, I’ve collected new buyer-clients along the way, some of whom are still looking, but many of them have bought as well. Call it happenstance, or call it strategy, but most spring buyers have already bought.

So while I expect June to be a strong month, and I would likely say “yes” rather than “no” to the question above, I don’t think the average home price in June, being higher than May, is a shoe-in.

Moving into July and August, I would expect the average home price to level off, and actually drop from the peak in May/June. But you must keep in mind – the ratio of condos-to-houses increases dramatically as move through the summer, since fewer home-sellers are looking to hit the market. This always exacerbates the drop in average home price in these months.

3) Will we see more inventory?

Discussions about inventory are always interesting because no matter what the data shows, there are always people who believe it’s a buyers market, or that “there’s so much out there.”

Those folks often subscribe to what I call the “Crane Theory.” They simply point to all the cranes visible in the downtown Toronto skyline, and say, “There’s so much under construction! Everywhere you look, there’s a condo going up!” They’re not wrong, as you know. But they feel that because their old Tim Horton’s at Dundas & Jarvis is being turned into a condo, or where they used to park their car at Spadina & Front is being turned into a condo, that anecdotally, “Everything” is being built into residential real estate, and that there’s “so much for sale.”

But what if you told these folks that despite all the visible construction, it’s still not enough to satisfy the demand?

In every interview I’ve done for the last couple years, when the subject of demand comes up, I always bring up supply. And vice versa, depending on the line of questioning.

If somebody is asking about the government implementing a stress test to try to take buyers out of the market, and thus decrease demand, shouldn’t we then open a line of discussion about, alternatively, fixing the inefficiencies that exist at City Hall so that developers aren’t left waiting for years to start projects, thus increasing the supply?

The two go hand-and-hand, but I’ve always felt that any article about the market you’ll find will focus solely on one of supply or demand, giving no weight to the other.

Quite simply, if there’s more demand than supply, or more supply than demand, prices must go up or down accordingly.

Last April, we saw new listings surge. The story early in 2017 was the dearth of supply, and prices increased accordingly. Whether sellers were intentionally holding back for May or June, which are historically strong months, or whether more people made the decision to sell because the market was on edge, remains to be seen. But once inventory levels spiked, prices dropped.

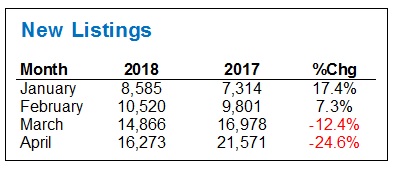

Through the first four months of 2018, however, new listings have dried up:

January is a tough month to measure. Not nearly what December represents in real estate, but as the effective “door” to the spring market, I would have thought a 17.4% increase in new listings would be meaningful. Then again, with January of 2017 representing the lowest number of new listings in a decade, perhaps the 17.4% increase sends the wrong message.

Since then new listings have dropped dramatically over last year, and we’re feeling it.

The agents that lament, “There’s nothing out there” on a daily basis are right. Save for a few segments of the market, the effective choice for buyers just isn’t there. And dare I say that even compared to last year, it feels as though there’s less for sale.

With almost 26,000 new listings in May of 2017, I expect the 2017-2018 comparison to be in the red, once again.

But I do expect the summer to be a lot busier than it was last year.

4) What’s happening with interest rates?

Good question, and one that I explored on my blog in a post last Wednesday.

At the same time that the 5-year variable rate mortgage is dropping, the banks are also increasing their benchmark 5-year fixed rate mortgages.

It’s a little confusing, and those who say that it makes perfect sense, and they understand it, are either in the extreme minority, or are just trying to sound smart.

Seriously, this isn’t even apples and oranges. This is like the supermarket increasing the price of Fuji apples, but dropping the price of Macintosh.

Then on May 30th, we have the next interest rate announcement from the Bank of Canada.

People’s predictions on whether the BOC will raise rates are usually tied to their predictions about the real estate market, so once again, can anybody really say they have a better idea than the person sitting next to them?

Say this, however: if the BOC does increase rates, I see more of an impact among those that already own than those that are looking to buy. At some point, successive rate increases might affect affordability to the point where we actually see the unthinkable: people selling their homes because they have to, not because they want to.

5) Is the booming condo market sustainable?

Ask my client who was in the city on the weekend, and he would smile as he says, “Yes.”

My client described the Toronto condo market as simply a “A joke.”

Not a funny one to those who can’t afford to buy in, or those who have witnessed the increase in prices and can’t make sense of it, but as the conversation so often goes, he compared Toronto to other cities around the world and said, “It’s a joke. It’s dirt cheap.”

He referenced a recent sale at 55 Front Street, aka “The Berczy,” for a 2-bed, 2-bath, close to 1,000 square feet for $929,000; one that he unfortunately couldn’t fly here in time to seel.

“You’re a banker or somebody who works in finance, and you walk six minutes to work, past a brand-new beautiful urban park, past the Hockey Hall of Fame, an iconic theatre, Toronto’s answer to Grand Central Station, and a host of top-notch restaurants, and you can get a 2-bedroom apartment for 900-grand? It’s a joke!”

In Manhattan, he explained, the price would be triple.

“And you’re not making triple the salary,” he explained. “If you are, then you’re out every single night trying to keep up with the life that’s attached to the work. Hundreds, thousands of dollars a week these young kids are shelling out to be part of the social scene.”

“The cost of living in Toronto for young professionals is a fraction of what it is in New York,” he said.

And this is after our insane run-up in condo prices too.

Now his opinion is only one opinion, but without getting too far into this case study, let’s just say he knows more about international real estate than most of us.

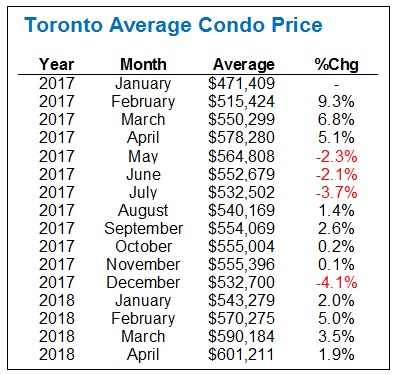

But take a look at where condo prices have gone in 2017-2018:

Those 2.3%, 2.1%, and 3.7% dips in May, June, and July of last year pale in comparison to the 6.2%, 8.1%, and 6.0% corresponding drop in the average overall home price.

And since the, the condo market has roared back, and is actually higher than the peak last April.

How is it possible that this pace continues?

That might be the best question from our list…

–

Carl

at 7:07 am

4) What’s happening with mortgage rates is no big mystery. Lenders use variable rates to increase/preserve their market share, and fixed rates to increase/preserve their profits.

Housing Bear

at 10:36 am

Variable rates are tied to the BOC rate. Fixed are tied to the bond market. Our bond market is tied to US bond market (why lend to Canadians when you can get a better return from US). US Bonds are tied to FED rate (Why invest in a bond if I can get close to the same return from a “risk-free” treasury).

What happens if Fed raises and BOC holds off for an extended period of time?…….. our dollar loses value and then everything we import gets more expensive (this will start to show up in inflation numbers). Its a game you can play, but gets riskier and riskier the longer it goes on.

Can I say for certain which way rates are going? No. But from all indications coming from the FED they plan to continue raising rates until they break the economy. BOC has pretty much said the same, only it will be done at a more gradual pace. Poloz has the hardest job in Canada right now.

jeff316

at 11:39 am

Bingo. Banks are discounting the variable rates because they know pretty much for sure that those discounts will be evaporating over the next 6 months.

Carl

at 4:02 pm

Sure, mortgage lenders operate under constraints. But that doesn’t mean the rates are determined for them. They have a leeway to decrease and increase the rates within some range, as they manage their risks and profits.

“Variable rates are tied to the BOC rate.” — yes, connected, but very loosely. Right now lenders are heavily discounting variable rates because they are competing for shares of a shrinking total.

“US Bonds are tied to FED rate” — again, connected, but only loosely. The spread between five- or ten-year bonds and the Fed overnight rate fluctuates over time.

Increases by central banks in the overnight rates get all the attention in the press. But just as important is the reversal of “quantitative easing”. Central banks are beginning to withdraw the extra money they inserted into markets after 2008. The effect of that will be just as important as that of their interest rate intentions. Nobody quite knows what that effect will be.

Housing Bear

at 4:57 pm

Well considering those are the two main avenues the banks use to grow funds to lend out, their flexibility is those rate + what ever profit margin they feel is necessary. Otherwise they are lending out at a lose.

Spread between the FED rate and different bond yields do fluctuate over time, however the later categories have to remain higher at all times otherwise no one would invest in them.

You are right about QE unwinding though. Completely unprecedented. Bond market could get flooded with supply which could drive rates through the roof. The Trump cuts and deficits will only add more supply to the market as the treasury tries to raise funds.

If you are interested in what Jarome Powell (new fed chair) predicted back in 2012 about what would happen once this process started. (QE) You can view that in the link below.

His bit starts at page 192.

https://www.federalreserve.gov/monetarypolicy/files/FOMC20121024meeting.pdf

Whats also note worthy is that the FED only released these minutes in January of this year.

Pkap07

at 7:41 am

There is a lot of immigration (legal one) happening in Ana’s right now after the rules changed I think mid 2015 or early 2016 to Express entry. All these folks coming in to live in Toronto or GTA mostly in my experience and in many cases either have one or properties back home as well as support of Mon n Pop bank. So to them either renting high in Toronto or even buying within a short period is no biggie and I believe with numbers close to 300000 immigrants a year even if 30% decide to stay in Ontario we are talking of need for a huge supply increase which I don’t think is possible. So expect to see increase in condo prices and rentals for near term

Kyle

at 8:49 am

For a medium-term outlook, this article outlines some of the big factors that will affect GTA housing in the next 5 years:

https://www.thestar.com/news/gta/2018/05/22/millennials-still-want-houses-with-backyards-report-says.html

“There are one million millennials still living with their parents in the Greater Toronto and Hamilton Area, and over the next decade, 700,000 of them will be looking to move into their own houses, according to a report released Tuesday.”

“The report suggests there could be more than 50,000 new millennial households created per year, as they begin leaving their parents’ homes.”

“Millennials will probably have to flee the urban core to find housing they can afford, which will in turn lead to longer commutes and more traffic congestion.”

” 35 per cent of baby boomer households in the GTHA plan to give, or have already given, their children about $50,000 toward a down payment.”

Housing Bear

at 10:51 am

“The average income needed to buy a house in the GTHA requires six times more than what millennials make.”

Everyone wants to own their own home. Only problem with millennials is that they need to figure out their student loans first and then figure our a way to increase their earnings 6 fold. (Maybe 3 fold if you and your partner climb that later quick). If their incomes don’t grow prices can either fall, or lenders can allow people to take on more and more debt relative to their ability to pay it back.

35% of boomers have or will lend 50k on average………..How many boomers can afford to make such a gift to their children. I guess at least 35%. How many have the cash vs think that because their homes have appreciated so much (and wont fall) they can just lend to their kids via taking out a HELOC………..I know many families who will not be in a position to do this.

Or should we go back to your argument from the other day, that local incomes and averages do not matter…………. Its the rich lawyers and bankers that will buy everything up? How many of these millenials will be getting one of those jobs?

FYI, a lot of the richest bankers began unloading their PERSONAL homes (not even investment properties) in 2016.

https://www.huffingtonpost.ca/2016/06/16/bank-execs-put-homes-on-sale_n_10508922.html

Kyle

at 11:24 am

Be careful not to fall in love with your bet, and only think of ways to dismiss the article, rather than considering whether the article might have some merits that could very well blind side you if you’re only looking to reinforce your opinions.

A) The average does not matter it is the right tail that matters, and when you have a huge bulge of people entering the home market, that increases the number of people all along the income distribution (not just the average), including the right tail. Put simply if say the top 5% of a graduating class is making $$$$ and are able to buy a house one would expect the same to hold, except over the next few years that graduating class is much, much larger than the previous cohort’s. And 5% of a much, much larger number will equal more demand – full stop.

B) Even if they can’t all afford to buy, the increase in # of households means an increase in demand for ALL housing, be it rental or end user. So i see no scenario where an increase in renters or home buyers will decrease prices for housing.

C) I think this mythical bear notion that anyone who buys a home, has chosen a single strategy to put everything into real estate and have no other form of investments and savings, is completely baseless and over-played. Particularly when we are talking about boomers, some of whom bought their homes for less than they are making in annual salary today and most of whom have bought so long ago that their mortgages have been long ago extinguished. Do you seriously think these people have no other forms of equity? Where is the evidence for this?

Housing Bear

at 12:36 pm

First off, it should be noted that the Ryerson report was sponsored by OREA.

Second, Not anyone who buys a home. A percentage. I just personally know some boomers (with kids living at home) who do not have anything outside of their property. Also know a lot of them who are not debt free because they have taken out HELOCs to help their kids pay for school, renovations, or to shift higher cost debt (credit card) to a lower rate. What I am saying is that not every single boomer will be able to gift their kid that down deposit. The more kids they have the harder this will be for them

Third, while future demand is an important indicator of future prices, and we do have a lot of future demand, its only true demand if they are actually in a position to buy. In RE (for the majority anyway) most do not pay cash. They are dependent on borrowing money. Thus in RE, a place is worth what someone is willing and ABLE to borrow.

Why has the millenial generation delayed their purchases in comparison to older generations…….. Because a lot of them are not making enough to afford this market…….. There are 4 ways in which they could get in. Have their income go up by 300-600%, parents pay for it or gift them (but how many can count on this), get larger and larger loans from the bank, or prices decline.

Incomes going up 300-600% is possible but not likely for the majority. With B-20, rising rates in the US and the unwinding of QE, I expect this to lower the amount the masses can borrow (also impacts the highest earners by about 20% of their borrowing power). Thus at least in the near term……. what is the only way the millenial generation will be able to afford? Prices have to fall

Kyle

at 3:25 pm

Agree, not every boomer can sponsor their kids. The survey says 35%, which to me feels totally reasonable. Doing a back of the envelope calc, if we say there are 2M households in the GTA, and 65% own, and 40% of those are boomers, and 35% of those boomers are willing to give out a $50K cheque, we are talking about $9.1B war chest to help enable these kids. I think we can debate about how much impact this will have, but there is no denying the impact is going to be supportive to higher house prices.

Similarly, We can talk about the hurdles kids now face, but at the end of the day many more people will need to be housed. They don’t all have to buy, some can rent (e.g. maybe it is a boomer, or Gen X-er who has 300-600% more income buying and renting it back to them). Again we can debate about how much the impacts will be, but unless your thesis is that they will remain at home with their parents and never move out, there is no denying the impact from that bulge of people looking for housing is going to be supportive to higher prices.

So i don’t see how you conclude prices will have to fall.

Housing Bear

at 4:44 pm

The survey says 35% who have already lent or plan to. Does not specify how much of that 35% has already been deployed. Lets assume none of it and then multiply that pent up demand (those still living at home) by 0.35 to get a true sense of those that may be able to afford at current prices.

Again, how are the next wave of buyers going to be able to afford prices at this level? Debt? Do prices stay flat until their incomes are able to catch up?

Not arguing that they will live at home for ever. Just rents have to be tied to income. Those are people that actually work and live here. There is a ceiling on rent growth. If rents cannot support carrying costs how long before “investors” want to redeploy their wealth into something that is generating a return on equity?

Condodweller

at 4:57 pm

@HB I have been thinking about the relationship between rent and RE prices lately and my current working theory is that rent increase should stall out with RE price increases. I realize that condo prices are still increasing, however, I believe growth will be at a slow pace and can’t continue forever. Just as people can’t afford a mortgage above a certain price level (seems to be around the million mark) they also can’t afford rent above a certain level. If rents were to continue to increase after prices have stalled, there will be a level at which it won’t make sense to rent again. I am brainstorming here but I wonder if rents will stall out even in the face of high demand due to affordability.

Housing Bear

at 6:42 pm

Good theory. Your guess is as good as mine but I think rents will hold up a bit longer than prices will. As more and more owners get worried about the market we could see an increasing flood of people who choose sell and rent to see what happens vs sell and buy. This would cause a spike in rental demand some of which would be from people who are cash rich and can afford to bid things up.

I see rents falling hard once the next recession hits.

Tommy

at 7:27 pm

I think rents will definitely plateau and perhaps decline a bit. Those predicting huge gains in rent going forward are delusional. Half of Torontonians rent and half of Torontonians make less than $40k/year. They’re one and the same group. You can squeeze water from a stone. Believe me, I wish I could jack up rents to the Heavens but I have to stay realistic.

I’m not sure that rents will “crash hard”. Unfortunately average rent prices only go back as far as 1990 (so we cannot compare late 80s before the crash) but as far back as 1990, rents have been very stable with only a few years of declines all of which were minor (including in 2008), at least on average. https://www03.cmhc-schl.gc.ca/hmip-pimh/en/TableMapChart/Table?TableId=2.2.11&GeographyId=2270&GeographyTypeId=3&DisplayAs=Table&GeograghyName=Toronto

Even changes in vacancy rates over the past 17 years seemed to have little impact over the steady incline of rents https://www.torontorentals.com/blog/toronto-vacancy-rates

Tommy

at 7:40 pm

That’s supposed to read “Can’t squeeze water from a stone”. Alas, more not-so-good news out of VanCity https://twitter.com/SteveSaretsky/status/998990131653586944

As Vancouver goes, so goes the nation. Let’s keep a close eye on them.

D

at 9:06 am

Toronto is not New York… Why would you compare them as apples to apples when Toronto’s economy is only one fifth of New York’s economy..

Ralph Cramdown

at 9:52 am

And now, for his take on the downtown Toronto condo market, Anonymous Guy from Newark…

David Fleming

at 10:19 am

@ Ralph Cramdown

Okay that literally made me LOL, and I don’t think I’ve ever used the term LOL…

Geoff

at 9:57 am

Agreed – why do people always compare Toronto to NYC or London. A more apt comparison might be boston or perhaps chicago – and even that’s a stretch. Maybe in 50 years T.O will compare nicely to major cities, but for now it’s more like a 2nd tier city at best. (ps I love toronto, livein the 416, etc). But it detracts from the other points above (and realize you’re just reporting what a single client said).

O

at 10:47 am

Looking for work or something to do? Toronto has: Media, high tech, provincial capital government jobs, universities, hospitals, finance, manufacturing, entertainment etc etc.We have beaches, an opera house, museums and galleries, world class dining, a football, baseball, soccer and hockey team. Every major concert and show comes to Toronto. Face it. We are already a major world class city with real estate prices to match.

Condodweller

at 2:34 pm

@O Your mention of the opera house jumped out at me as it is a great example of how Toronto is nothing like major cultural centers around the world such as London and NYC. All you have to do is google their current events and their history to see the difference. London’s Royal Opera dates back to 1662 though one had to wait until 1734 to see the first opera with June events such as Swan Lake/La Boheme/ Lohengrin. If you think that’s an unfair comparison since Colombus didn’t land in America until 1492 then the original NY Metropolitan Opera House opened in 1883 with current June events of Don Quixote/Swan Lake/Rome and Juliet/La Bayadère.

In Toronto, after decades of trying, our Four Seasons Opera House opened in,…..wait for it…….2006. If you actually want to see an opera there, you may have to wait until Christmas for the Nutcracker as rap and metal seems more their speed with performances in June by Vic Mensa/Goatwhore/The Black Dahlia Murder/Whitechapel or just drive to NYC.

You didn’t really list soccer did you? I will let you google how long they have been around.

Sticking with RE Toronto’s real estate, our condo product is deplorable compared to NYC and I am being polite there.

Whaaa?

at 9:56 am

NYC’s opera house is old. Toronto’s is new. London’s is old. Sydney’s is new. Milan’s is old. So what?

RealGeorge

at 10:03 am

Why in the world does it matter how long Toronto FC have “been around”? Sheffield Wednesday are a century older than PSG. Does that mean Sheffield is somehow better than Paris?

O

at 10:10 am

Not really here to debate opera, but again, if you do not think Toronto is world class, there is nothing I can say to convince you. Do we have the history of New York? No. Is New York London? No. Does London have more history than Jerusalem? No.

Maybe the guy in New York is sick of the crime and wants Toronto for the safety. Maybe the guy in London has to commute and wants a house with a backyard close to the core. Maybe the guy in Jerusalem wants Toronto so his kid won’t have to join the army.

Whatever the reason, people from all over are coming here and loving it. We have everything the other cities have. Time will give us the history.

RealGeorge

at 11:15 am

“People from all over are coming here and loving it.”

Exactly. And if that doesn’t fit someone’s definition of “world class,” so be it. Opera houses, symphony halls, five-star restaurants, Broadway shows, the most exclusive private schools, centuries-old architecture, and so forth are not de facto criteria for the WC designation (except for a handful of culture vultures out there).

Real estate millennial

at 11:18 am

Toronto makes up right around 20% of Canada’s GDP and New York makes up right around 10% of the U.S GDP. Obviously New York has a larger population but Toronto is #4 in North America with Mexico City #1. I see the comparison as valid when we compare the significance of the respective cities to the proportion of the economy they represent. And there is usually a strong correlation between gdp output and housing prices within a particular city. It’s apples to apples Toronto and the U.S both having the largest gdp’s of their respective countries.

https://www.google.ca/amp/s/www.macleans.ca/economy/economicanalysis/torontos-economy-doesnt-get-the-respect-it-deserves/amp/

jeff316

at 11:38 am

Exactly.

Comparing Toronto to NYC in terms of their respective roles in their respective national economies is legit. This, however, does not explain differences in pricing, etc.

Geoff

at 12:03 pm

So put another way, Toronto GDP is 0.306 trillion, and NYC is 1.857 trillion. So shouldn’t prices in NYC be sextuple that of Toronto (versus the triple above).? I mean I guess you could argue that NYC pricing is under priced then, I guess. Anyway, aside from housingbear, most of us aren’t willing to make more than armchair quarterback kind of calls (myself included!). Should be an interesting year.

Whaaa?

at 9:48 am

“Shouldn’t prices be sextuple”..?!?!

Do you really need me to tell you how incredibly stupid that statement is?

Ralph Cramdown

at 1:08 pm

How is Toronto #4 in North America? Greater L.A., Chicagoland, DFW and Baltimore-Washington are all larger…

Kyle

at 8:12 pm

https://en.wikipedia.org/wiki/List_of_North_American_cities_by_population

Cities not metro areas

Ralph Cramdown

at 12:36 pm

Actual NYC financial district 2 bedrooms, under a $mil, and enjoy a fixed mortgage rate for 30 years:

https://www.zillow.com/homedetails/333-Pearl-St-APT-10K-New-York-NY-10038/244700632_zpid/

https://www.zillow.com/homedetails/82-Beaver-St-APT-409-New-York-NY-10005/2089783480_zpid/

Or buy at the Berczy in Toronto and get a tiny living room, no views, and a bedroom that’s in a glass shower enclosure.

Not Harold

at 12:17 am

Ralph your first example is under the brooklyn bridge, in need of renovation, and has $726/mo maintenance.

Second has better location and condition but $1400/mo maintenance.

Berczy is about 50 cents a foot maintenance so call it 500/mo…

Now not a 3x difference but those units are not comparable in location, quality, or total cost, ignoring exchange rates.

Tommy

at 2:48 pm

The increased prices of condos is an example of exuberance which usually precedes a crash or correction. The fact that 50% of condos are being bought by speculators that can’t cover their mortgage (let alone property taxes and maintenance fees) using their rental income should be a cause for concern. We’ve seen this movie before. When the math doesn’t work, you build a rocky foundation for further growth and when the momentum changes, the results are disastrous. The “demand” is therefore temporal or artificial and tight supply can quickly turn into a glut.

It doesn’t matter whether Toronto condos are cheaper than in other cities. They’re expensive to the local population and it is this group that is required to sustain it. Still, when I look at condos in NYC for sale on Zillow, they are often comparable in price for what you get (size, location), which makes Toronto appear disproportionately expensive, considering differences in income and population.

Debt levels put Canada on shaky ground. The stock market and US debt levels are once again on shaky ground. Liquid cash in the bank is becoming more valuable every day as prices continue pushing forward against every conceivable fundamental. Population growth is projected to be the lowest in 30 years despite increased immigration. For 2018 and 2019, don’t spend or invest in anything you don’t have to. Having a healthy stash of liquid funds will come in handy.

None of this matters if you intend to buy and hold long term, which has been my strategy for all income properties I own.

Professional Shanker

at 3:44 pm

“They’re expensive to the local population and it is this group that is required to sustain it” – You said it, likely the #1 rule of RE valuation 101 if such a course existed, but yet somehow we have convinced ourselves that this cardinal rule can be broken on a medium to long term basis.

Tommy

at 7:18 pm

Look at it this way. We know that half of new condo buyers are “investors” (actually, speculators). We also know that in the suburbs such as Richmond Hill, similar “investors” made up a significant portion of buyers (over 20%) of low rise homes. Today the low rise homes in Richmond Hill have corrected by 30%.

Libertarian

at 3:45 pm

I’m glad that you brought up the fact that condos are primarily driven by investors, so the “demand”, in my opinion, isn’t real. I’ve been saying for a long time on this blog that I don’t want the gov’t doing anything based on the demands of real estate investors.

If that’s going to be the case, I’d rather the gov’t go the other way and limit the number of properties that a person/married couple could own. After all, if the gov’t can limit how much we can invest through RSPs and TFSAs, why can’t it limit real estate investing? I’ve mentioned before that I wouldn’t be surprised that Trudeau got rid of the PRE since there is so much money tied up in real estate now and he needs money to pay for all his promises.

Condodweller

at 5:08 pm

@Lib.. Please stop suggesting the elimination of PRE as it would be devastating for prices. Think about the move up buyers with a few hundred percent gains.

Libertarian

at 5:38 pm

I’m not suggesting it. I don’t want it. I’m a homeowner, so it wouldn’t benefit me. But I recognize the situation is getting worse in the sense that millenials cannot afford to buy and since Trudeau bends over backward for that cohort, he will do something to help them, especially considering millenials don’t want condos, as that article that Kyle links below explains.

Professional Shanker

at 12:25 pm

A sobering fact – millennials as a cohort are larger than boomers and this gap will only increase, therefore governments understand that future votes and their job security will shift towards this demographic.

PRE exemption is ridiculous, why should housing gains be tax free, they shouldn’t if other forms of retirement savings are not, plain and simple tax equality across asset classes is not achieved. That said taxing of inflation should be removed from both housing and other asset classes – all gains from an investment should be indexed by a prescribed inflation factor.

Libertarian

at 3:18 pm

Speaking of gov’ts shifting to millenials for votes, if you believe the new polls, Horwath and the NDP could win here in Ontario. Their platform is full of new real estate laws. I’m sure all the investors on this blog will love those!

I would even say last week’s blog about OREA vs. TREB raises the issue of real estate/housing policy. OREA admits that housing is unaffordable, so TREB asked them to shut up because sellers and investors are making tons of money. I don’t trust Hudak at all, so his message is disingenuous, but they are lobbying for change.

The bottomline is that much of Canada’s real estate/housing policy came into effect after WWII (PRE, CMHC, etc.). That was well over 60 years ago. A lot has changed in those 60 years, so maybe the policy should too.

Tommy

at 2:52 pm

FWIW, all other major real estate markets are cooling or regressing. Manhattan, Sydney, London, you name it… all suffering from inflated prices and weakness in foreign buyers. Toronto can’t defy gravity any more than those markets.

Professional Shanker

at 3:41 pm

To me this synchronized decrease in RE markets across the globe cannot be overlooked, Toronto is not different than every other big city.

Housing Bear

at 6:08 pm

Era of cheap easy money is reversing. China cracking down on debt and capital outflows. The FED raising rates and reversing QE.

JDF

at 9:21 pm

David – would you consider cottage properties within 2.5 hours of the GTA for a future post. The reason I ask is because I am now the proud owner of a waterfront cottage after a 6 way bidding war earlier this month. Yep, that’s right……6 offers on a cottage property !! (who said the market was dead ??) I have written before that I believe the bully offer is the way to go but in this case, the seller was pretty set on waiting till offer night so we played by the “rules”.

The property was priced appropriately for the market, (however, water front property is difficult to price given the large number of factors), not significantly low like you see in Toronto but enough to generate quite a bit of activity…..so on offer night we needed a strategy. Ultimately the best and right advice was “go with a number that you would be ok at losing the property at”. That’s what we did and we “won”. But isn’t that crazy ? Our bidding strategy never considered bidding what we were comfortable with, what the property is worth, or just over list…..instead we needed to submit an offer that we wouldn’t kick ourselves over if we lost.

I have to think what’s happening in cottage country is a result of what’s been happening in the city whether it’s boomers cashing out or house rich Gen X’s tapping into the huge equity to buy a seasonal home or the latest trend (see article in Toronto Star) where people can no longer afford GTA and rent while getting their foot on the property ladder via a rural or cottage property. As for interest rates, we are going variable prime – 1.06% (could not turn that down)…..I guess we’ll see in a few years, if that was the right call.

Housing bear

at 9:56 pm

You’re 100% correct that what’s happening out there is a result of what’s been going on in the city. Congrats on your win.

Curious, did that right advice come from a real estate agent that gets a commission based on what you paid? IE they make more money if you bid what you would be comfortable losing at vs paying what your are comfortable with or what it’s worth? Who told you that it’s hard to get a comparable? Cottage country has been hot, I’m sure there are a few price points you could compare too.

Also, do you have any money or access to credit left? I ask because I have these magic beans for sale. All you have to do is plant them water them once a month and by the end of the summer you will have a money tree that can yield 100k a year………:… wish I had more room in my garden or else there is no way I’d be looking to sell these off. I’ll even finance the sale for you at 2% below prime (just I hold the right to up that rate at will)

bal

at 6:01 am

housing bear can you please call me 647 283 8475

Housing bear

at 10:02 pm

Sarcasm aside. You might have gotten a good deal and good on you for buying land rather than construction materials in the sky. Vacation property can be more volatile in the short term, but long term I think you will get a better return then someone who buys a house in Toronto today.

JDF

at 12:02 am

I like your handle – it’s clear where you stand. The problem is I have access to too much credit so your magic beans are definitely tempting !

We have bought 2 other properties in downtown Toronto (not condos) in bidding wars over the past 7 years and we have “won”. The advice I followed is really my own…….intuitively I am confident enough to know what a property is “worth” and that’s what I will pay for it. It’s usually a gut instinct where you know that you will always compare every other property to the “one” and know that you made a bad call. I would love to get a great deal but those don’t exist for premium properties (well maintained, good location, generally not a piece of crap). I know how the agents get paid but generally I feel like I am intelligent enough to make and trust my own decisions.

As for comps, you’d be surprised, here are some factors that may or may not be important to you when considering waterfront property:

– Lake – in addition to which lake you are on, distance from Toronto, water quality – algae levels, hard/soft bottom, suitable for swimming, weeds, bullrushes (protected in some lakes), motorized vs non-motorized, in a bay, canal front, river front, near a marina – be prepared for boat traffic

– Land – how much, frontage, well treed, privacy – can I see and hear both my neighbors when I am in the back yard, off a main road/hwy, road access (serviced or private), grading and sloping, water access (am I walking down 20+ stairs to get to the dock), sandy shore, rocky cliffs, soil erosion

– Dwelling(s) – winterized, condition, boathouse (generally grandfathered), bunkies, garage – not even going to get into number of bedrooms/bathrooms, true cottage or just another suburbanesque house that happens to be on a lake

Sorry for the excess information – again, worth considering for a future post !

In person, we probably looked at less than 15 cottage properties but this was the one and we knew it. Anyone who buys a cottage is naive to think it’s a good financial decision, sure, you may sell it in 10 years and not take a loss but it cost you a crap load while you owned it 🙂

Housing Bear

at 3:57 pm

@JDF

I honestly know very little about the cottage market, other than then fact there has been a huge spike in demand. Looks like you know what you are talking about though. They are definitely expensive to carry but its hard to put a price on the joy it can bring a family. Long term as our cities grow more and more people will want a lake front property that is still accessible. With improvements to communication tech might even be a great place to work remotely

Not Harold

at 12:06 am

I’ve long had a view that it was big 3 or Georgian for serious money on cottages, with some bits of Simcoe as well bu targeting a different market. Due to quality of properties, lifestyle, and water quality, Recently seeing huge prices well outside of this.. not just Lake of Bays but non big 3 muskoka as well as Halliburton – small lakes with little accessible by boat and very different lifestyles. Crazy change in the market compared to 10++ years ago.

Congrats on the cottage – it’s an amazing life despite the work and the driving. Great secret to the drive home: leave at 6am Monday if you can. Much more relaxed than Sunday night and you beat traffic through the city as well (depending on where you live).

JDF

at 7:05 am

Thanks for the tip and well wishes.

Agree that the big three and parts of Simcoe see huge prices but lots of other lakes have many properties well over a million.

One key consideration I forgot to mention is exposure – do you get the sunset because if so, it will be “worth” tens of thousands more.

Not Harold

at 9:36 am

SW exposure is key! Want sun as long as possible on dock and water access so you can enjoy during social and warm hours!

Crazy how many very expensive spec places with east exposure. You’re done by 4 at best.

Kyle

at 9:31 am

Congratulations JDF. Yours and Not Harold’s observations are bang on. I bought my first cottage 8 years ago, and continue to watch the cottage markets closely. I’ve noticed that prices have been very gradually rising, and inventory has been gradually shrinking across the various cottage regions over the last 9 years.

Million dollar cottages are now common on any lake large enough to handle water sports with in 2.5 – 3 hours of Toronto. The starting point for the big three is over $1M (for a non-island) and sometimes that just gets you a lot.

Starting point in Lake of Bays, Fairy/Vernon/Mary/Pen chain, or the Gold/Mississauga/Cathacoma/Beaver/Cold chain are $750K for anything turn key.

There is literally nothing under $500K with clean, direct waterfront on a medium sized lake or larger, except for tear-downs or access-challenged.

JDF’s points about difficulty valuing properties is bang on. There are a tonne more variables compared to City housing. It is naive to think you can just pull comps and zero in on a value. Well vs lake water, sun exposure, view, slope of lot, lot features, outbuildings, lake amenities, changing water levels, local by-laws / zoning restrictions, even the type of fish in the lake, can all drastically impact the price of the cottage from 10’s of thousands to 100’s of thousands.

Tommy

at 6:10 pm

Cottages, whether used year round or seasonally, is a luxury for boomers. You’ll get the odd millennial in the “trend” of buying a cottage while renting in the city but it won’t happen in significant numbers.

The Wealth Effect shows us that when times are good and people feel rich, even if the wealth is on paper only (equity), people will spend on luxuries including cottages and nice new cars. The consequences in a down market can be especially painful.

That said, if you plan to stay in the cottage for a long while, it’s just like other real estate – it’ll go up in value.

steve

at 4:04 pm

The wise folks who’ve seen it all assure me that what matters most is interest rates …. and that now the tide is turning towards higher rates around the world (apparently these trends are cyclical). Of course, pend up demand has an impact, but rates are the key.

steve

at 4:06 pm

Quite simply …. higher rates will impact values and for sure curb price increases.

MortgageJake

at 12:47 am

Not according to some. Higher rates do not mean lower prices. Just means people don’t sell, inventory stalls, and higher rates also means a better economy therefore less worry about selling (or wanting to) therefore no downturn in prices. Just a theory.

Professional Shanker

at 10:11 am

In short term your theory could easily play out and arguably is currently doing so, but I doubt it does under a prolonged environment of interest rate increases – who knows maybe real wage inflation actually happens!

Appraiser

at 5:28 pm

Blah blah blah! “…market-gonna-crash-we’re-all-screwed-living-off-rat-meat” never get’s old…does it?

Tommy

at 6:04 pm

Screwed living off rat meat doesn’t seem so outlandish to half of renters in the city: https://www.blogto.com/real-estate-toronto/2018/05/new-report-says-half-toronto-paying-unaffordable-rent/

Tommy

at 12:53 am

All that demand out there yet…. https://www.thestar.com/business/real_estate/2018/05/23/new-home-sales-in-gta-hit-20-year-low-in-april.html

Tommy

at 12:05 pm

It seems price insanity it now reaching its peak in the development sector, too: http://urbantoronto.ca/news/2018/05/guest-column-gta-land-sales-redevelopment-take-turn

MortgageJake

at 12:46 am

I’m sorry. People who constantly compare TO to NYC have never spent a formidable amount of time of in NYC. Is it “Similar”? Sure. They’re both cities, they both have subways, they both are financial hubs. BUT no. They should never be compared. Just much too much of a difference to think “oh it’s cheap here because it’s 3x more there” or “oh I’m in finance I’d love to walk six minutes to work” therefore it SHOULD be more expensive. I just do not buy this anecdotal argument at all and I’ve heard it for 15+ years from Realtors. Why not compare TO to cities like TO: Chicago or Boston? Please?

Professional Shanker

at 10:05 am

and if you do compare to Boston and Chicago, Toronto is more expensive when benchmarking to many local economic metrics. That said does it really matter – won’t certain cities in close proximity to one another always have valuation discrepancies or over the medium to long term will populations relocate to the more affordable city? In the example above I find a comparison of Toronto to US cities somewhat arbitrary for the simple fact that labour mobility is constrained for obvious reasons. A Boston to Chicago comparison is more apples to apples.

Tommy

at 1:03 am

Hmmm will bank projections like this have any impact on the housing market? http://business.financialpost.com/news/fp-street/cibc-reports-second-quarter-net-income-up-nearly-25-per-cent-from-year-ago

Tommy

at 1:33 am

Bubbles have been studied for centuries. Here’s the anatomy of typical bubble: https://static1.squarespace.com/static/57570822b6aa60059e0b9c58/575a0c821e848814a8c2e43f/575a0c9e1e848814a8c2e7ee/1493327932317/?format=1500w

I think we’re somewhere in the Denial thru Return To “Normal” stages, how about you?

Tommy

at 2:11 pm

Lending growth slowing abruptly https://dir.richardsongmp.com/documents/136777/590856/Lending+growth+slows+abruptly+in+Canada.pdf/b05e1aab-4212-47c2-88a8-b2d10fdad953

Tommy

at 2:54 am

The hits keep coming http://business.financialpost.com/news/economy/unprecedented-reliance-on-housing-fuels-canada-recession-call

Bobbie

at 1:32 am

Articles like this really grease the shafts of knedlewgo.