I honestly think this is the slowest week I’ve seen in Toronto real estate in years.

That’s not to say I’m not keeping busy. We have seven listings coming out in September, which we are working toward in the present. With each passing year, higher prices, and higher stakes, I find we need to do more and more to properties before we list them for sale. De-cluttering, packing, moving and storage, painting, staging, then marketing – this takes time!

But what’s actually going on in the market right now? Not a whole heck of a lot!

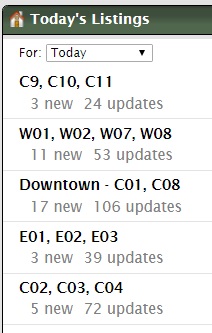

Here’s a look at the Today’s Listings tab on my MLS, as it stands at 4:30pm on Thursday:

Three new listings in all of C9, C10, and C11? Do you know how large an area that is?

How about only 17 new listings in all of downtown? In peak season, we’re up over 100 every day.

Some of this has to do with the upcoming long weekend, since many sellers, and listing agents, will elect not to list in the days preceding a long weekend, for fear of fewer eyes on the property. I agree with that, for what it’s worth.

Of course, then there’s the property I’m showing tonight, which has an offer date on Sunday, which is strange to begin with (ie. who takes offers on a weekend?), but even stranger because it’s a long weekend! I’m expecting a substantial discount on this property, and the prospects excite me!

In the meantime, I haven’t seen a slowdown in news about real estate, that’s for sure! I’ve mentioned many times before that I am a news junkie, and while reading about politics or the ills of society often leave me chewing my pillow at night, and will probably take ten years off my life, I do love being informed.

This week, there are a host of news articles I’ve bookmarked, and while each one doesn’t necessitate its own blog post, I think they all bear mentioning.

Let’s start with the least-attractive, shall we?

–

“Toronto’s Condo Communities Have A Dog-Poo Problem”

You don’t really need to read this if you already live in a condo, but part of you wants to even though you know it will only upset you further.

It’s the kind of article that will make your 4-year-old child (or inner 4-year-old child…) laugh uncontrollably. The word “poo” appears in the article twenty-one times.

For those of you that don’t live downtown, consider just how our city has grown over the last decade.

There are more people, those people are taking up less and less space, each of them have less time, and more of them have dogs. Put that all together, and you can see where the problem lays.

This article spells out exactly what I have come to expect from the human race in 2019:

Not long ago, on a baking hot summer day, Gary Pieters sat on a public bench surrounded by soaring new residential buildings in downtown Toronto when he smelled something horrid coming from the public garbage bin nearby.

It was overflowing with dog poo.

“I left after about five minutes,” he said. “You can smell the stench.”

As the number of dogs increases in dense, vertical communities, real-estate developers and condo managers are starting to look for ways to deal with a persistent problem: dog poo. It builds up in public garbage bins, contaminates recycling and sometimes isn’t even picked up at all.

“It’s an every day [problem],” Mr. Pieters said. “When you walk, you have to look down. It’s on the floor, in the park, in the grass, in the elevator.”

There are more than 230,000 dogs in Toronto, and increasingly they are living in dense vertical communities. Green spaces, where dog owners bring their pets to do their business, are particularly rare around many high-density urban developments in the city centre, contributing to a build up of dog waste in public areas of many condo buildings.

As a real estate agent, when I show condos, the unit keys are often lockboxes in the stairwells on the same floor as the unit. Can you guess how many times I’ve gone into a stairwell and been greeted with a fresh, steaming load?

You think it’s unimaginable, but it’s not. It’s downright common.

And you all want to know who is doing this. What does he or she look like? What drives this person? What makes this person think this is acceptable?

And fifty-dollar follow-up question: what would you do if you caught somebody doing this?

For real, if you happened to be taking the stairs from one floor to the next, and you happened upon a dog owner letting his or her dog take a rich, creamy crappola right on the concrete landing in the stairwell, would you say anything? Be honest – would you make a scene?

I would go absolutely ballistic. I like to think that I’m the nicest person in the world until somebody does me wrong, and if I found some lazy, entitled asshole letting his or her dog crap in the stairwell, then damn my clean hands, I think I would pick up the crap and put it their shirt pocket.

But it’s not just the stairwells that are the issue. Again, from the article:

Living two dozen floors up, it’s a trek to bring a dog down to the street and to the nearest patch of grass to do its business. Adam Taylor used to live on the 27th floor of a condo complex in Toronto with his two dogs: a border terrier and a golden retriever.

“I noticed a lot of people around me letting their dogs pee on their balcony,” he said. “It caused a lot of problems for property management because when it rained, these people’s balconies that had poop and pee all over them, it would just flow down the balconies underneath them.”

This is an even bigger problem, with a less offensive result, but it still doesn’t make it okay.

As a new(er) father, I often wonder why people who can’t support children, have them. Is it entitlement? Boredom? The assumption that somebody else will step in and make everything okay? I have the same thoughts about pet ownership, and I’m sure you all have “that friend” who thinks it’s okay to get a dog even though he or she doesn’t have time to look after the pet, and then leave that pet in the condo from 7:30am until 6:00pm, every single day, and often until 10pm when the after-work nightlife is calling.

I’m no PETA member here, I just think the city is filled with down owners who probably aren’t fit to properly own and look after pets.

It’s no wonder several downtown neighbourhoods smell like crap.

–

“Hong Kongers Are Looking To Buy Properties In Toronto & Vancouver As Protests Rage”

Just when we thought it was over, right?

Honestly, I’ve never seen anything like what I saw in early 2017.

I’ve told this story before, and since everything in 2019 is racist, sexist, offensive, and some-sort-of-phobic, I’ll try to choose my words carefully here.

In early 2017, I had about four or five downtown condo listings that ended up getting 10-15 offers each, and for every one of those properties, an overwhelming majority were in the names of………um…….foreign-sounding buyers. I had one listing at 25 The Esplanade where only one of fourteen buyers sounded like he or she wasn’t from Hong Kong.

My critics will suggest that I’m ignorant, and there are lots of people here in Toronto with names that aren’t “John Smith” and “Jane Jones,” but we all know what was happening back in 2017. Maybe not at the time, but in hindsight, we know now.

That activity came to a screeching halt in May of 2017, and public policy enacted in both Ontario and British Columbia in the next two years would help push those buyers out of the market.

All the while, however, many of us agents figured that this would happen again. Maybe not today, maybe not tomorrow, but sooner or later, there would be another boom of foreign money coming into the country, snapping up real estate.

I don’t think that day is today, despite the headline above.

From the article:

As protests continue to rock Hong Kong, real estate brokers in Canada and the U.K. are fielding a flood of inquiries from investors in the former British colony who are eager to get out.

Dan Scarrow, president of Macdonald Real Estate Group in Vancouver, said many of his Chinese agents saw an uptick in interest for both sales and rentals this month from Hong Kong. One of his agents is putting off her planned retirement this year to capitalize on the opportunity.

Before, it was usually a ratio of five mainland Chinese to one Hong Kong buyer coming to open-houses, he said. “It has completely flipped now,” said Scarrow. “Whether or not that actually translates into deals, that comes down to what continues to happen in Hong Kong.”

People have begun scouting for properties in cities including Toronto, Vancouver and London as the unease surrounding Hong Kong’s political future grows amid China’s increasing influence. A drop in residential property prices is making some of these cities attractive.

“Hong Kong money could become a major source of capital,” said David Ho, a broker at CBRE Ltd. who deals with Asian investments. “People are shocked, given Hong Kong was always branded as a stable, rule-of-law financial hub, and now want to move their capital to other cities to mitigate the risk and also to look for other homes.”

–

“Amazon Launches Service With Real Estate Giant That Offers Homebuyers Up To $5,000 In Credits”

Many GTA agents shy away from conversations about different real estate business models, but I invite them.

I’ve been open and honest over the years about commissions, services, brokerage models, access to information, and my disdain for much of organized real estate. Some people agree, some don’t.

When it comes to “discount brokerage models,” I firmly believe that you get what you pay for, and I’m not saying this because I’m a full-service agent, but rather because I see the mounting losses from buyers and sellers who use this model.

A couple of months ago, clients of mine were negotiating on a property that was for sale outside the city, priced at $879,900. We had come in very low – around $800,000 (this is how this particular segment of the market works), hoping to get the property for $830-$835K, and eventually we reached a stalemate with the seller around $850,000. I told my clients we would step aside, and wait for the seller’s agent to come back to us.

Two weeks later, the seller’s agent reached out and asked if we would agree to $830,000, which was our goal from the very start. We agreed, and put an offer on paper.

The next morning, the agent called me, almost laugh-talking into the phone. He was giddy, and I had a bad feeling.

“David,” he said, “I’m sorry, but we got another offer this morning and my sellers are going to accept it. The offer is…..well…..it’s good. Really good.”

Bad timing, and bad luck for us.

But the sting came when we saw what the house sold for – $879,900. The full list price. The buyer’s agent? One of those colourful discount brokerages, who in this case, simply drafted the paperwork for the buyer, at full list price, and submitted it.

The buyer probably thinks he or she made out like a bandit, receiving $5,000 or $10,000 in “rebates.” But what they don’t realize is that they overpaid for the house by $50,000.

I have a hundred stories just like this one, but for those that don’t like real estate agents, and/or think they know best, they don’t want to hear it. This is why I seldom tell these stories, even though they would paint full-service agents in the best light possible.

But when I saw this Amazon service, I sighed. They’re going to offer $5,000 in credits for, what? Amazon Prime? Even if it was cash in an envelope, it’s still not worth having a discount agent work on your behalf on either the buy or sell side.

Amazon is branding this in a completely different way, for what it’s worth.

From the article:

On Tuesday, Amazon said that it was working with Realogy, the nation’s largest residential real estate brokerage company and owner of Century 21, Coldwell Banker and other brands, to create TurnKey, a service that will help prospective homebuyers find real estate agents. To entice customers, Amazon will give buyers up to US$5,000 in home services and smart-home gear when they close.

The best prospects are sent to agents. Depending on how much buyers ultimately spend on a home, those who close with one of Realogy’s agents get a coupon for US$450 to US$1,500 in Amazon Home Services like unpacking, cleaning and furniture assembly, along with US$500 to US$3,500 in smart-home products that Amazon or some affiliate will install. To get the maximum benefit, worth US$5,000 in equipment and services, a buyer would have to purchase a home for US$700,000 or more.

“Neither us nor Amazon envision this as a way to give cash back to people,” said Ryan Schneider, Realogy’s chief executive. “We took a different lens, thinking, ‘What could we do together that would just make it much easier to move into a house?’ People want the stress release of getting someone to clean the house or getting someone to put the furniture together.”

–

Complete with the candid “photo of person profiled in article looking sad in photo,” this one is quite the read.

I’ll be honest, I’d never really sat down and thought about the rights of a 1% owner in a property, but if I did, I’m not sure if I would have come up with this.

From the article:

It is a case of mass eviction that began with a remarkably modest real estate deal.

The tenants of a semi-detached house in Toronto’s east end could be forced from their rental homes after a 1 per cent stake of the property, at a cost of $9,000, was transferred to a 20-year-old first-time homebuyer.

With that sliver of ownership, Jacky Bai Jun Liu also acquired the title of landlord andas such, sevenpeople in two apartments in the house were informed, he would be pursuing his legal right to push them out because he intended to move into the home near Danforth and Greenwood Aves.

“It was kind of like a slap in the face,” says tenant Devon McKenzie, 24, who shares a lower-level unit with three roommates. “How does that 1 per cent give anybody any sort of right to have any say at all.”

The upstairs neighbours opted to move. McKenzie, with the support of her roommates, is fighting the eviction and a hearing is scheduled at the Landlord and Tenant Board for Sept 18. There, a board member must determine if it is both fair and legal for Liu, as a 1 per cent owner, to claim both apartments in the house under a part of the Residential Tenancies Act that allows landlords to evict for personal use.

It sucks, yes. On that, we can all agree.

But it’s damn clever, even those who hate it, must admit.

From a legal standpoint, I think this landlord is within his rights.

From the old “smell-test” viewpoint though, I think it’s shady, and awful.

So what will the courts decide?

Will they follow the letter of the law, or will they make an example out of this scheming, conniving, albeit ingenious individual?

I’m going to be following this one closely. The hearing is in mid-September, so I’ll bookmark this and come back to it for you guys.

–

Well, that’s it for this week!

I’m here all long weekend, even though there’s not a heckuva-lot to do. I emailed maybe three (?) clients listings this week, because there’s just so little out there. I have three listings which are a bit slow as well (ironic, considering my previous statement, but it all depends on what/where the buyers are, as well as what/where your listings are), and most of what we’re doing is gearing up for the fall.

I do expect to see a nice influx of listings after the long weekend, which is quite common, even in August. But then I expect the last two weeks in August to be slow as well, representing the calm before the storm.

I’m quite interested to see the July TREB numbers when they come out. July isn’t a month you can really draw any conclusions from, but I’d like to see how it compared to July of 2018, just as an aside.

Have a great long weekend, everybody!

Derek

at 10:09 am

David, I don’t doubt your comments and views about full service versus discount services. But, on that deal you described, the other agent / buyer, full service or not, presumably would have only known that they were in competition with another offer that was presented in the previous 12 to 24 hours. Can you describe a strategy they could have used in that situation to beat out your client, other than put their best offer on the table?

J

at 10:55 am

While there certainly can be justifications for using a full service/commission agent, as a buyer I think it’s hard to justify mainly for the purpose of valuating potential properties. With price and listing history now readily available, this can be done independently. The standard buyer commission structure can incentivize a quick sale at an elevated price even with a full service/commission agent, so it’s beneficial to have knowledge and awareness as a buyer in this regard.

Appraiser

at 11:03 am

Let me guess. You have never purchased a home before and you have no clue how the process works.

Sirgruper

at 6:55 pm

The 1% idea is brilliant and should hold up as it meets the definition of landlord under the act. Whether the second test of it being required “in good faith” for the landlord’s own use is the question. Please do write about the decision!

Appraiser

at 10:59 am

Speaking of July TREB sales data:

Preliminary numbers indicate a 20% increase in freehold sales and a 15% increase in condo sales vs. 2018.

David Fleming

at 7:26 pm

@ Appraiser

You always seem to have the stats early!

Can you send me a link?

da**********@**************te.com