Are you just a Toronto Realty Blog reader, or do you watch Pick5 as well?

If you think I’m insane from simply reading the blog posts, I assure you, to quote BTO, “You ain’t seen nothin’ yet…”

Pick5 is a completely unscripted half-hour segment where I choose five properties in the city of Toronto, perhaps based on geography, property type, or price, and I review the properties while not pulling any punches.

As you can imagine, my undiagnosed A.D.D., obsession with the past, and fondness for childhood often takes me on a tangent. Or two. Or ten.

A few weeks ago, I did a Pick5 with the theme “Let It Linger,” where I looked at properties that had been sitting on the market, er, lingering, and I explained whether the time was right to go in and make an offer or whether you, as a buyer, should let it linger.

Of course, this took me on a wicked nothing-to-do-with-real-estate tangent about the band The Cranberries, and their hit song, “Linger.”

In the Pick5, I explained how The Cranberries are one of my favourite ten bands of all time. That video spawned several emails from readers about their fondness for The Cranberries, and the following week in Pick5, I outlined my top-fifteen bands, in order, after much, much deliberation.

Could you do the same thing?

It’s not a simple task, I assure you.

Start with a master list – just throw any band on there that you like. Then try to put together the “most obvious” in a cluster, and you’ll come up with three, four, five, or more. Where it really gets tough is which bands get cut from the list. The entire reason I did a top fifteen instead of top ten was because I felt so bad for bands #11 and #12.

Seriously, give it a try.

If you’re sitting on the streetcar right now, if you’re bored in a company meeting and you’re reading TRB, or you’re, um….otherwise indisposed, the time is nigh!

For the record, atop my list is Green Day. And it wasn’t even close.

I was born in 1980, so if you subscribe to the theory that the early-teen years are your most impressionable, then consider I was in Grade 9 when “Dookie” came out.

“Insomniac” came out on year later, and I got that for Christmas in 1995.

“Nimrod” came out when I was in Grade-12.

“Warning” came out when I was in my third year of university.

And my favourite album of all time, “American Idiot,” came out in September of 2004, right after I started in real estate.

Look, I know that the name “American Idiot” might rub you the wrong way, as might the album cover or some of the lyrics, but trust me when I say that people who don’t know Green Day, or don’t know American Idiot, likely have all the wrong-impressions about this music. The lyrics and the themes, as the band members themselves go, are very progressive. These punk rockers are even more progressive than I am.

And my favourite song from that album?

Well, if you don’t know, then you’re not following very closely.

Only 200 Million views eh?

Wow, that’s a young Evan Rachel Wood and Jamie Bell! I didn’t realize it until just now.

But this isn’t just a music video. It’s a short film.

And it’s hard to watch this video without getting those heartstrings tugged on just a little bit.

“David, what the hell is your segue here?”

Um, September. Duh!

September of 2022 was perhaps the slowest month in the careers of a lot of real estate agents, no matter how long they’ve been in the business.

I try to talk to as many agents in a given week as I can, and non-stop, all month, all I heard was how slow things were.

Buyer agents, listing agents, and everybody in between felt the same way.

“It’s a little slow out there.”

But it’s not necessarily slow as the cynics and market bears will have you believe. I came into the fall market with seven buyer-clients and only one has bought; that deal came in October. Two other buyers started their searches in September, with one buying in September and one in October.

So what’s the cause of the slow market?

There’s nothing out there.

Sure, we can analyze the inventory figures and put some statistical evidence to that, or to the contrary, for those that think “there’s lots for sale!” But from my viewpoint, there’s just nothing to buy.

I’ve resorted to calling dozens of listing agents and asking if they have exclusive listings.

I’ve asked agents, “Do you have clients who are looking to buy, and have a backup listing that they’d consider selling with a flexible closing?”

No matter the price point, there’s just nothing out there.

And that’s why things are slow.

I felt it only a few days into the month. “Wake me up when September ends,” I told my colleague.

Two weeks into the month, three weeks into the month, I still found myself saying, “Wake me up when September ends!”

We’re only five days into October but already, I’ve felt things pick up. I know that’s crazy to say given we have only Monday and Tuesday as data-points, but there’s activity out there again.

So before we move on to October, let me give you my thoughts on September.

I came into the month suggesting that prices would uptick slightly, then by mid-month, I felt we’d see prices trail off. I mean, given the lack of product, especially in the higher price points (I have five clients looking at $2M+ and that market we’re without options on all fronts), I thought that a disproportionate number of lower-price properties would sell.

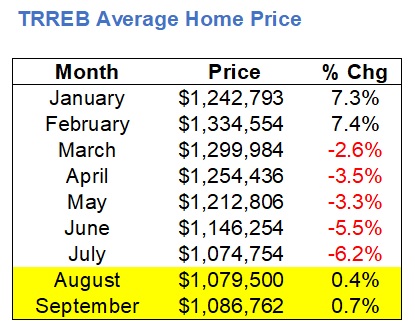

My flip-flop doesn’t really qualify me to say that I was right about anything, however, the TRREB average home price did uptick slightly, from $1,079,500 in August to $1,086,762 in September.

That’s a modest 0.7% increase for those without an abacus handy.

Now, how do prices usually move from August to September?

Like this:

We were only 0.8% away from seeing the first price regression from August to September since this data became available in 2002.

But perhaps an optimist would say, “An increase is still an increase!”

More to the point, when I wrote this feature last month, I suggested that the data showed we had bottomed out.

It’s still only a 0.7% increase, but if you look at the trend in average home price, it does look like a turnaround:

Now, just to show you another viewpoint, let’s consider a “first” of sorts.

We often use month-over-month data, and we often use year-over-year data. When we use the latter, and we want to be complementary, we might say that “prices are down month-over-month, but they’re still up year-over-year.”

While we spent the first few days of February shouting, “The average home price is up almost 30%, year-over-year!” we may have continued that glee into the first few days of March, but those figures diminished each and every month thereafter. Last month, the line was, “The average home price is still up in August, over August of 2021!”

But as you can see in this chart, we’re finally into the red:

So what conclusion do you draw here?

On the one hand, the month-over-month data shows a turn-around. Prices are up two months in a row, and when you combine that with the positive indicators that I noted in this space last month, we could argue that the “fork in the road” I described after analyzing the August data does indeed point to a rebound.

On the other hand, the above chart shows is red. And it’s a first. One could argue that this is the start of yet another trend, but in the opposite direction.

If we look at the number of sales, we can draw different conclusions by looking at the prominent yellow shading seen here:

Again, what conclusion do you want to draw?

I could argue that there’s absolutely, positively, nothing good to say about a month that just saw the lowest sales ever!

But I could also argue that nothing is selling because nothing is for sale. And that’s what my “gut feeling” on the market was, for whatever that’s worth.

If you don’t trust my gut-feeling, then let me pull up the data.

September of 2022 didn’t give us the fewest new listings since 2002, as we saw with sales.

No, it gave us the second-fewest:

So sales have plummeted, but so too have new listings?

And of those new listings, how many are quality? I mean, how many are re-listed from the summer?

I wrote about the ridiculous number of re-listed properties a few weeks ago.

I don’t have a full data set, but I’m going to surmise that there are more re-lists this September than last September. In fact, I believe I’ve seen more this past month than any September before.

If I’m guilty of sounding like I’m trying to make an argument, then fine. I just really, truly felt that this was the slowest September I’ve experienced in a long time, and the reason wasn’t a lack of genuine interest from buyers, but rather there was just nothing to sell them.

All in all, the pricing across the “Big Five” TRREB districts was somewhat mixed.

As I said, the average home price increased 0.7%, month-over-month, but only two of the three districts were up:

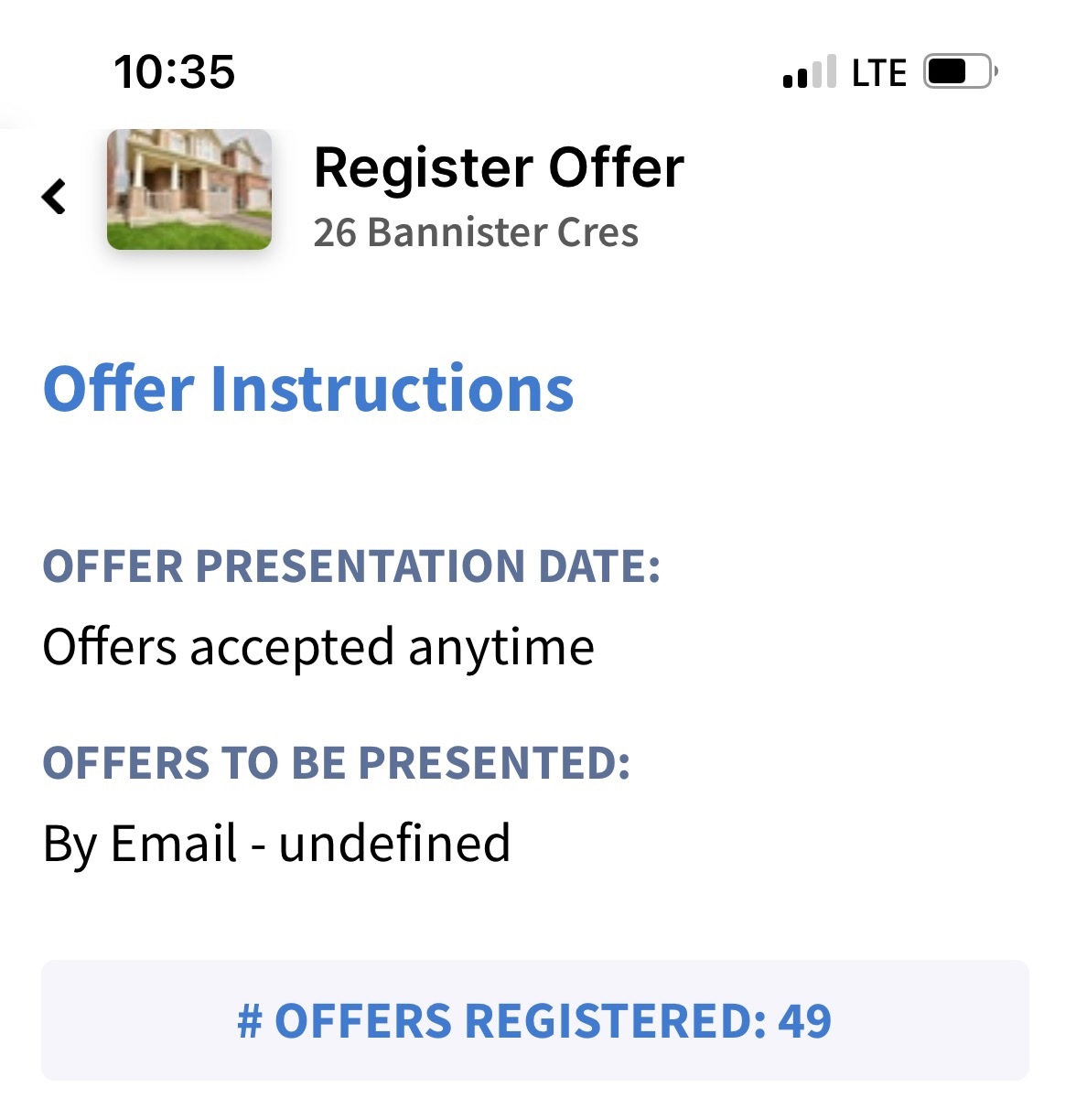

Despite the decline in price in Durham Region, you wouldn’t believe what’s happening out there. I’ve seen 30+ offers twice this week.

Here’s one that’s live, in progress, as I write this blog:

I’ll save you the Googling: this is in Brampton.

If you want something a little more local, there are currently 13 offers on a property on Kintyre Avenue in South Riverdale.

So the market’s not slow, and yet I still maintain that it is.

Er, it was. Past tense.

Because I’m awake. September has ended, so it seems.

That doesn’t have quite the same ring to it as the song lyrics, but I’m no Billie Joe Armstrong.

And I don’t believe Green Day made any references to October in their follow-up album, “21st Century Breakdown,” so we’ll just have to assume that the market will be wide-awake this month!

Oh, before I forget: you owe me your top band of all time. Top-five if you want to share, and I’m not sure if solo artists qualify or if that’s a whole other exercise, but we’ll say that they do.

Also, a free coffee for whoever can tell me which famous 1987 album I’m listening to right now. It’s a bit hard and loud for 11pm, but so too was the lifestyle those guys led…

PM

at 6:28 am

I think where the bears have it wrong, expecting a big crash, is there are no forced sellers. With unemployment at record lows, and most people locked in to 5 year fixed at good rates, why would you list? All the headlines are bad, you still have your job, so you just stay put. I guess we will have to see what happens if we get a recession and mortgage rates are still above 5% but I think they would be declining back to the 3’s by then.

Doubt prices shoot up for the rest of the year, but they probably stabilize around these levels. No increase in supply is coming to push them down

Nobody

at 12:58 pm

This is why real estate corrections take a LOOOONG time.

Real price declines (i.e. not just losing crazy gains from the last 12 months) need a huge amount of pain and take a long time to work through the system.

Mortgages are “safe” credit because people will do a LOT of hard work to not lose their house. Even at the expense of their long term finances (for a bunch of reasons).

We’re still going to see another 150 basis points of interest rate increases. That makes the mortgage math hard for lots of people who are renewing. Banks ALWAYS let you roll over.. but they don’t, it’s just been a long time since the math has been such that a bank would refuse to roll over an existing note. We’re getting into that territory, especially if rates stay at these elevated levels into 2024 and beyond.

US mortgage market got “interesting” in 06. First real tremors in financial markets were felt in June 07 when a couple mortgage hedge funds died (both tied to Bear Stearns…) and a money market fund broke the buck (these types of mutual funds are always supposed to be worth $1.00). Then Bear died in March 2008. Took until September 08 and Lehman going down for the crisis to happen in earnest.

Still took a couple years for the wave of foreclosures to work through the system and even longer for prices to bottom in places like San Diego, South Florida, etc. Greenwich CT prices are still effectively flat since the end of that crisis.

Toronto houses (including semis) are held by people with very strong equity positions and for mortgages over 7 years old even at our expected rates carrying it shouldn’t be a problem. Barring divorce, business bankruptcy, cancer…

Condos are held by people with much weaker positions in terms of tenure and balance sheet both in owner occupiers and huge amounts of landlords (with may properties) that are currently cash neutral to negative and counting on capital appreciation to make the numbers. Landlords are going to be pressed VERY hard by their own cash flows and by banks when rolling over a mortgage. Expect banks to be much more careful with verifying that people are ACTUALLY living in the units they are mortgaging. Plus the life stage of so many condo owner occupiers is that they are going to HAVE to move because they move for work, get into a relationship and can’t carry 2 units, they end a relationship and need to split the asset, they have a(nother) kid and need more space, and estate sales (focused on certain buildings/areas).

We could see reasonably gentle slowdown in “houses” while condos get HAMMERED, especially the units targeted at landlords. But the fastest this would really start to show would be Q2 23 but more like Q1 24.

Condodweller

at 4:04 pm

I’d agree with all of the above with the qualifier that I think you are overly optimistic about houses and too pessimistic about condos.

“Barring divorce, business bankruptcy, cancer…”

The divorce rate is around 50%, cancer is a close second to heart disease as leading cause of death, and bankruptcy well, apparently there is a recession coming.

The benefit of houses is that established families who have paid off mortgages can have kids come back to live with them and sell their condos.

Nobody

at 1:39 pm

Number of divorces per month is relatively low while the 20 year total is rather high. Plus people will do crazy things like live on different floors despite separating/divorcing if it looks like 18 months of sacrifice will be very rewarding.

People will do a bit of light insurance, bankruptcy, and other fraud to keep the mortgage going in a recession. Not a smart or ethical decision but people REALLY don’t want to move out of their family house.

Overall we agree and are just emphasizing different things. I believe that there are many more condo owners who will end up as forced sellers circa 24 at 7% mortgage rates. Would probably be circa 26 and/or 9-10% rates to really put pressure on large numbers of home owners.

Francesca

at 8:29 am

My all time favourite band is Fleetwood Mac. I grew up listening to their music as a child and I still listen to their music now and have even managed to get my 15 year old daughter to enjoy their music. Dreams is probably one of my favourite songs ever. I was born in 1974 so my childhood was full of Abba and the Bee Gees which I still listen to occasionally now but are definitely more dated than Fleetwood Mac I think. The Eagles are probably a close second for me. I still love their music today.

As for you David I’ll guess you were listening to Whitesnakes album! I was 13 when that album came out and still love Here I go again and is this love from that album.

Peter

at 8:58 am

1) Eagles

2) Steely Dan

3) Aerosmith

4) Led Zeppelin

5) Pink Floyd

Taylor Swift fell off my list. ☺️

Francesca

at 9:53 am

My husband and I both love Steely Dan and the Eagles and his all time favourite is Pink Floyd which I never cared for ironically.

Kyle

at 9:33 am

Stars

U2

New Order

Weezer

Coldplay

And i’m guessing the 1987 Album is The Joshua Tree

Mxyzptlk

at 11:17 am

“And I don’t believe Green Day made any references to October in their follow-up album, 21st Century Breakdown”

No, but speaking of U2 (my favourite album of theirs actually).

Appraiser

at 10:14 am

Pink Floyd, Genesis (with Peter Gabriel), Yes, Roxy Music, Beatles….so many more.

My guess is that you are listening to the 1987 debut studio album for Guns and Roses “Appetite for Destruction”

David Fleming

at 1:19 pm

@ Appraiser

You nailed it!

Damn, you know me well. I don’t even know you!

London Agent

at 11:10 am

1) Foo Fighters

2) Led Zeppelin

3) Fleetwood Mac

4) Queen

5) Rush

Supertramp, Metallica, Iron Maiden etc etc

Mxyzptlk

at 11:33 am

My Top Six bands (it would take way too long to cut one of them) listed alphabetically (it would take way too long to rank them):

The Beatles

Green Day

Jethro Tull

R.E.M.

The Smiths

XTC

Ace Goodheart

at 11:50 am

1. Dramarama (fronted by John Easdale – remember the 1993 hit “work for food” from the Hi-Fi Sci-Fi album?): https://www.youtube.com/watch?v=mqBjG2PnFTQ

2. Grimes (aka Claire Elise Boucher) – Elon Musk’s girlfriend. Flesh without blood: https://www.youtube.com/watch?v=Tv9YoYCKNoE

3. The War on Drugs: red eyes: https://www.youtube.com/watch?v=1LmX5c7HoUw (played live at Bonnaroo in 2015, never can find that video but it was an amazing show as I watched it in person).

4. The 1975 – “I’d love it if we made it” : https://www.youtube.com/watch?v=1Wl1B7DPegc (award for best lyrics? you have to listen to this one really closely)

5. Chvrches – watching Lauren Mayberry basically alone on the stage at the Firefly Festival in Dover, Delaware back in 2016 as she belted out Clearest Blue was quite the experience: https://www.youtube.com/watch?v=zbVqyXuyHio

Katie

at 1:23 pm

1. Smashing Pumpkins

2. Radiohead

3. No Doubt

4. U2

5. Bon Jovi

I don’t like Gwen Steani, 2022. But I loved her in the 90’s!

Julia

at 1:38 pm

The order depends on the day I’m having: The Radio Dept., Windsor For The Derby, Smashing Pumpkins, The Jesus and Mary Chain, The Strokes.

Mxyzptlk

at 2:53 pm

26 Bannister Crescent ended up selling for $985,000 (34.9% over asking, for those who think that matters).

Potch

at 3:43 pm

Faces

Black Crowes

J Geils Band

Oasis

AC/DC

The Faces were the perfect rock band, and the early albums from the next three on the list come close to that magic. AC/DC are a whole other thing, but an undeniably great thing.

Condodweller

at 4:34 pm

I have heard the argument about people moving mountains to keep their homes but when push comes to shove and one can’t meet their mortgage obligations they have to sell. I said this probably about 10 years ago that prices are going to crash when there is a group of people who have to sell. No ifs or buts about it. David has a good sense for sniffing out those who need to sell because they bought already in the recent environment and linger, imagine what it will be like if there is a rolling wave of renewals coming where people can’t afford the new payment and will have to sell, and will have to accept the low ball offers they get. Here is a good song reference for David. How low can you go.

I’m taking the 5th, or the Canadian equivalent of whatever section (25?) it is of the Charter, on my favourite bands. Let’s just say I’m surprised there are some conspicuously (my spell checker is not complaining I can’t believe I got this right unless it’s so wrong it has no clue what I’m trying to say lol) missing names.

BTW When you said “hard and loud” I immediately had Axel flash through my mind but I’m really bad with dates and album names. Their Toronto concert was canceled after their fans trashed the Montreal venue. Also, wasn’t it also him who dove off the catwalk and attacked one of his fans in the crowd at one of their US concerts? Or am I mixing him up with another hard rocker like Kurt Cobain?

David Fleming

at 6:25 pm

@ Condodweller

A lot of bands are “hard and loud” but I mentioned 1987 so I figured that narrowed it down.

The crazy thing is: I got ahold of a cassette of “Appetite for Destruction” when I was 11-years-old and the lyrics were anything but suitable for a child. I still had that cassette in my Toyota Corolla in 4th-year university. The drive from McMaster to Laurier was almost exactly the length of that cassette, side A and Side B.

And yes, it was Axl Rose that jumped into the stands at a St. Louis concert to attack a photographer. Then he walked off stage and ended the show. Then the crowed rioted. Then Axl was charged.

Condodweller

at 4:50 pm

I couldn’t tell you what albums were released in what year without google. That’s the downside of listening for decades, you lose track. To me, it’s all in the past. Whenever I see Axl sing I think he is about to spit out his Adam’s apple.

Speaking of hard rockers I’m stunned that I don’t see Black Sabbath, Kiss, Scorpions listed by anyone. What about icons like Dire Straits? I guess the “new’ generation only knows Ozzy as a reality tv star.

Daniel

at 6:51 pm

David I can’t find that Pick5.

Can you share your list?

David Fleming

at 9:50 am

@ Daniel

I’ll give you the top-15 that was in the Pick5:

1) Green Day

2) Red Hot Chili Peppers

3) Guns N Roses

4) Tom Petty & The Heartbreakers

5) Pearl Jam

6) Tragically Hip

7) The Cranberries

8) The Offspring

9) Blink 182

10) R.E.M.

11) Doors

12) Nirvana

13) CCR

14) Our Lady Peace

15) Bush

As I noted in Pick5, the Travelling Wilburys are one of my all-time favourites but they’re not really a band. They’re a supergroup who produced one album (one full album before Roy Orbison died). Imagine George Harrison, Bob Dylan, Roy Orbison, and Tom Petty all in the same damn band? And Jeff Lynn too. I don’t know anything about him.

If the Wilburys count for their ONE album, they’d be probably knock Pearl Jam out of the top five.

Appraiser

at 6:40 am

Nothing much for sale except a bunch of tired old re-lists. Once again we witness the debunking of the ever-popular perma-bear real estate crash theory.

It goes something like this: “Once the market turns, investors of which there are over 100 million in Toronto alone (cause I follow Reddit), and also because of this this huge (read: non-existent) market of “assignment sales in the pipeline??” The market will be FLOODED with new listings. Or something.”