This topic has been in my queue for the better part of a month, but I dreaded sitting down and going over stock charts.

God, it’s been a long time since I took an interest in Bollinger bands and ultimate oscillators. That really, really takes me back…

I think every young man coming out of business school thinks he is going to crack the code of the market, and I was certainly no different.

It took me several years of throwing darts at a board to realize that I actually didn’t know anything.

Remember E-Trade? That was my jam back in university.

I used to love buying shares of biotech companies before they release earnings or before they have a scheduled announcement for a new product. But if I had to guess, and add some honesty here, I’d say the results were favourable less than 40% of the time. It’s literally like gambling. I mean, what the hell did I know? Zero. Nothing. At least when you bet on Seattle versus Minnesota, you know that Kirk Cousins is 0-8 all-time on Monday Night Football, which is the worst record in NFL history.

But what 20-year-old knows whether TD Bank is going to out-appreciate Royal Bank? Or for that matter, whether either of those companies will out-appreciate the TSX Composite Index or the DOW Jones?

I think the most money I ever made on a stock was Rothman’s, back in the day. Great dividend, fantastic appreciation, and they eventually got acquired and that’s usually good for at least 3-to-2 on your money. I think it might have been 2-to-1.

Of course, I had no idea what I was doing when I bought Rothman’s in my late-teens or early-20’s. “People like to smoke,” I figured. I guess that’s like buying Lockheed Martin Corp. in 2019, right? “Americans like war.”

It took me until my mid-20’s to realize and accept that I knew nothing about equities, and that I was no different from your annoying friend who tells you “how to play” Blackjack in the cab on the way to the casino. You know that guy? I remember going to a casino up at Mount Tremblant, circa 2007, and one of my buddies had this really obnoxious friend who insisted on “practicing” with a deck of cards before we left. He knew everything. He had all the answers. He kept saying, “Nope, that’s wrong,” and telling all of us what to do, and when.

He got rinsed in the “high rollers” room that night. He was anything but a high-roller. I hope he tells the story differently today…

Today, I know even less about what a stock is going to do than I did in 1999.

Do I know what the price of real estate is going to do? No. I think I do, but nobody truly knows. At least with real estate, I can say that I’m an expert, and my opinions, predictions, and projections are based on knowledge rather than a 3-pack of darts.

There’s long been a debate about whether your money is better off in real estate or in the equities market, and we could make extremely compelling arguments either way. We could use different time periods, different markets, and different instruments, and come up with major wins and major losses in this comparison. We could do this all day, and all night.

Last month, I read an article in the Financial Post, of all places, that had a headline worthy of those stupid click-bait ads on the bottom of your browser that you just have to click. You know, the ones like, “You Wouldn’t Believe Which 90’s TV Stars Are Still Gorgeous!”

I’m a sucker for those, and I don’t know why. Twenty-five clicks later, and I’m still looking for the photo from the ad…

Here’s the article from the Financial Post:

“If You Thought Toronto Real Estate Was The Best Way To Get Rich, You’d Be Wrong – Stocks Have Done Better”

Financial Post

November 7th, 2019

Am I being unfair about that headline? Yes? No?

I certainly would click an ad with that headline! It honestly reminds me of click-bait, but I digress.

From the article:

Getting in on the ground floor of Toronto’s housing boom has been seen as a sure-fire road to riches over the past decade. Buying stocks would have been a better bet.

Canada’s S&P/TSX Composite Index has returned 157 per cent, including dividends, since the end of 2008 as the economy chugged along, jobs creation surged and corporate profits rose. Despite hogging all the headlines, prices of residential property in Canada’s most populous city trailed that with a 127 per cent increase, according to the Teranet-National Bank Home Price Index.

It’s clear either of those investments have delivered a tidy return but there’s one group of investors who have done exponentially better: those who bet on the equity version of real estate.

The S&P/TSX Capped REIT Index has risen 354 per cent, dividends included, since the end of 2008 and the S&P/TSX Composite Real Estate Index, made up of real estate income trusts and other companies in the industry gained 262 per cent.

“You don’t have to worry about things like actual maintenance and keeping the property lease up,” said Jenny Ma, an analyst at BMO Capital Markets. “And also you get the diversification of many properties, across different markets and potentially across different asset types as well.”

So here’s where many of you will take a stance, and yet you don’t even know where I’m going with this!

Because before we talk about the age-old subject of “stocks versus real estate,” I want to address what’s missing from this article.

I don’t want to suggest that this was an attempt to deliberately mislead, but I do think that anybody writing for the Financial Post should have mentioned it.

Any ideas?

Some of you know what I’m talking about, but it’s okay, don’t fault yourself if you missed it, and that’s exactly why I feel it’s so important to an author, writing for the Financial Post, to point it out.

Leverage.

Residential real estate is a leveraged investment. Always has been, always will be.

So when we compare the 127% increase quoted above which is for “prices of residential property in Canada’s most populous city trailed that with a 127 per cent increase” with the 354% rise in the S&P/TSX Capped REIT Index and the 262% increse in the S&P/TSX Composite Real Estate Index since 2008, a straight comparison is utter garbage.

How much do you think the buyer of a 1-bed, 1-bath condo in 2008 put down? 5%? 10%? Even 20%?

Let’s say that, for sake of argument, a buyer put down 20%. Doesn’t that mean that their return of 127% is being unfairly calculated?

If they purchased a condo for $100,000 in 2008 and sold it for $227,000 in 2019 (just to keep things simple, and line the timing up), then, yes, I would agree that the asset value has increased 127%. But if they made a 20% down payment, or $20,000, then their return is actually 635%.

We are ignoring maintenance, taxes, improvements, et al.

But the article ignores this as well, so I’m keeping it apples to apples.

As for the accuracy of these numbers, let’s have a gander at that, just for fun. We’ll look at a handful of sales for houses and condos in Toronto, and then we’ll look at a few real estate investment trusts.

I wanted to pull some sales of random properties that sold in 2008 and again in 2019, and since there’s no way to really search for this in MLS, I randomly picked three buildings:

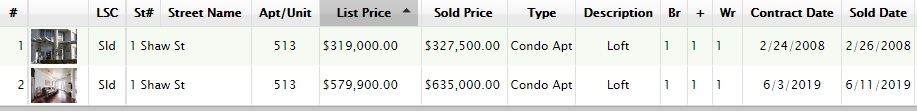

1 Shaw Street

438 King Street

230 King Street

I figured one or two in the west and east end respectively, and sort of settled on these.

Surprisingly, there are very few units that sold in both of 2008 and 2019, but I did find one for each”

So here we have a 1-bed, den, 1-bath unit that sold in 2008 for $327,500 and then again this year for $635,000

Oh what a shame! Only a 94% increase in value…

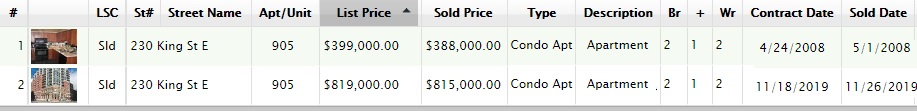

Here’s a slightly larger 1-bed, den, 2-bath at The Hudson:

Still “only” a 110% return from 2008 prices, and again, consider that we’re not looking at what month each of these properties sold in.

How about my old home; King’s Court?

Here’s a larger unit – 2-bed, den, 2-bath, and the return is still in line with the others at 110%.

Now that’s a look at condos, but what about houses?

For this section, I wanted to look at a 3-bedroom, semi-detched in Leaside, and a 3-bedroom, semi-detached in Danforth Village.

It was a lot harder to find the same property turning over in both 2008 and 2019, as I suppose house-owners stay a lot longer than condo-owners, so there are fewer houses for sale.

But here’s one that meets our criteria in Leaside:

This is a 139% return, which trumps the three condos.

If I were to have guessed coming into this, I’d have thought houses did out-appreciate condos, but that’s only because the run-up in condos is primarily 2016 onwards, whereas the housing market had out-appreciated condos in the years prior.

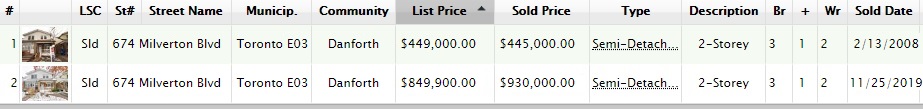

Now for one in Danforth Village:

I found four properties in the area that had turned over in both 2008 and 2019, but the other three were all radically different in 2019-form.

Here the return is only 109%, and I would gander that most houses in this pocket have appreciated at a far greater rate, and anybody looking for a sub-$1M house in here would know just how rare it is to find something at $930,000 with three true beds, a finished basement, and parking. Wow, this one was a steal!

So with five properties on our list, appreciating at rates of 94%, 110%, 110%, 139%, and 109%, that’s an average of 112.4%. This is highly inexact, but let’s just use this for illustrative purposes. With a 20% down payment, the return on the actual money down (again, ignoring land transfer tax, although back in 2008 it was nominal), is 562%.

With a 10% down payment, the return is 1,124%.

And with a 5% down payment, which many people made back in 2008 for their $445,000 houses or $327,500 condos, the return is 2,248%

So, yeah, I had a problem with the author of the Financial Post article ignoring the simple concept of “leverage,” and while I will happily be the first to admit that our little game here is anything but scientific, I think you get the picture.

Now at the same time, I’m not going to accept that just anybody would have put his or her money into the S&P/TSX Capped REIT Index and experienced a nice little 354% return.

While few of you will admit this as I have above, most people who run their own portfolios are merely amateur dart throwers, and they’d have been far more likely to purchase individual stocks.

Let’s give them all the benefit of the doubt, and assume that they’d have purchased real estate investment trusts.

I’d like to look at the 2008 to 2019 performance of a handful of the most well-known

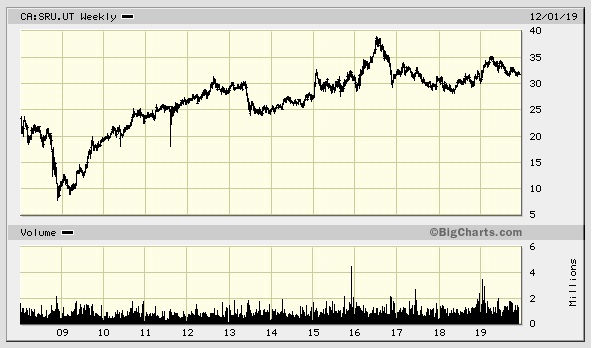

Here is Smart Centres REIT (ticker: SRU.UT), which is about as well-known as the Best Buy, LCBO, and Tim Horton’s that you’ll find in Smart Centres:

This REIT was trading at $24.33 to start 2008, and is currently at $31.63.

That’s a 30% return.

However, the dividend is currently 5.70%.

Again, highly unscientific here, and if anybody wants to do me one better, now is the time, let’s assume a 5% dividend for 11 years, which is another 55%. For a time, this was a 5% dividend of a much lower price, so the return isn’t a full 55%. Let’s assume 45%, just because we can?

That’s a 75% return, and I invite those of you in finance to provide me with actual returns here. We are only estimating for the purposes of our game.

How about a well-known residential REIT?

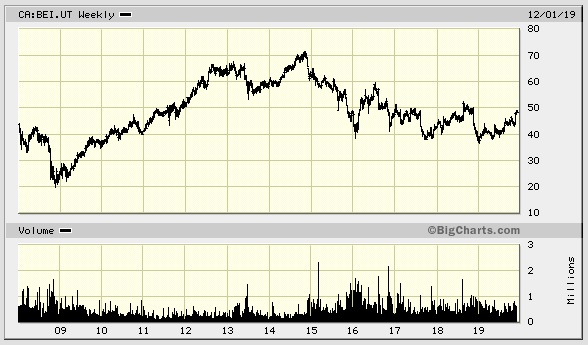

Boardwalk REIT (ticker: BEI.UT)

Trading at $44.85 to start 2008, now trading at $48.40.

That’s a 7.9% return, with a weak dividend currently at 2.07%.

How about RioCan? That has to be among the most well-known.

Trading at $21.70 to start 2008, now trading at $27.26.

You get the picture.

And while I can swear up and down that I picked these three real estate investment trusts at random, as well as those houses and condos, you probably had your mind made up quite some time ago as to where you fall in this debate.

There are far, far better investment vehicles than these three real estate investment trusts. Those of you who have worked your very first day on Bay Street will tell me that. But just as a condo-buyer in downtown Toronto is no expert in real estate, a chump with his $10,000, $30,000, or $50,000 to put down on the purchase of real estate, who instead, decides to try his hand at stock-picking, is no expert at that either. And if he does hand it over to the local “wealth manager” working over the counter at TD, with respect, you’re not exactly giving your money to Berkshire Hathaway to invest.

I’m simply making the argument here that to look back in hindsight at an index such as the S&P/TSX Capped REIT Index as though back in 2008, you would have simply put all your money into fund that perfectly traces this index and then say, “Oh look how much the index has increased, this is a higher return than owning real estate,” is dead wrong.

It also ignores leverage, which is literally dancing on the grave of the old “dead wrong” anyhow, but that aside, the basic premise is wrong too.

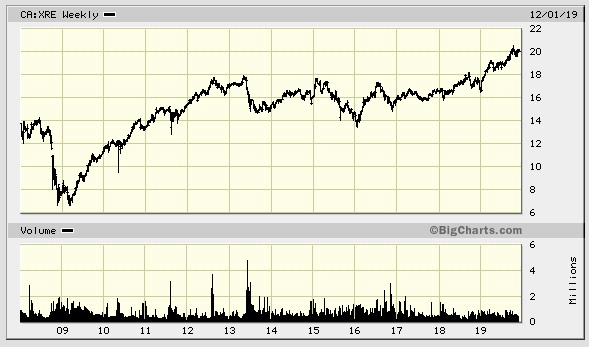

And isn’t the closest thing you can get to the S&P/TSX Capped REIT Index something like the iShares S&P/TSX Capped REIT Index ETF?

XRE?

Again, if we have to work this hard to find something like it, in hindsight, who would have had the foresight to purchase this in the first place?

I have this saying, and you might hate it, but here goes: “Some of the dumbest people I’ve ever met have made hundreds of thousands of dollars buying real estate.”

It’s true.

And it pains market bears to no end, because these folks who bought a $400,000 condo in 2016 and sold it for $650,000 in 2019 may not have “deserved” it.

But it doesn’t make the gain any less real.

I’m not convinced the folks who write for the Financial Post, and tout that “If You Thought Toronto Real Estate Was The Best Way To Get Rich, You’d Be Wrong – Stocks Have Done Better” have any clue what the hell they’re talking about…

Christopher

at 8:08 am

The leverage is a huge differentiation between the two and there are so many other factors: collected rent, interest costs on mortgage + requirement to payback loan, property maintenance costs, property taxes, tax implications of using an RRSP/TFSA vs taxes paid on rental income/capital appreciation.

Bal

at 8:11 am

You are correct….i disagree with the financial post as well…i invested in riocan and damn hardly made anything…

Max

at 9:11 am

It is even better when it’s personal use: Tax exemption on a principal residence, security of a roof over your head, etc…

Kyle

at 9:13 am

Here’s another very detailed study of Stocks vs Toronto real estate done by Igor Dragovic, Who also has a really great (if you like data and stats) real estate blog:

https://idragovic.wordpress.com/2019/05/28/what-is-a-better-investment-toronto-real-estate-or-the-sp-500/

He came to a very similar conclusion as you David. Basically depending on the time period, the return from stocks has sometimes beaten the return from Toronto real estate, but the reality is with leverage and rent there is no contest that real estate has won out.

And this totally jives with reality. As you say there are plenty of “dumb” people who have bought real estate long ago and inadvertently became millionaires just by paying their mortgage, while there are plenty of “smart” people who diligently invest but can only ever dream of having that kind of net worth.

David Fleming

at 9:50 am

@ Kyle

I have so many stories about people falling ass-backwards into riches in Toronto real estate.

One of the very first open houses I worked in real estate when I started in 2004 was for a new-build in Leaside. It sold for $865,000, and I honestly have no clue how a builder makes money on this, but that’s another story.

I remember seeing this property re-listed some time around 2014, and it sold for $1,900,000.

Those people made over a million dollars, simply by buying a house and raising their children. And they had the dream scenario – they were moving to Coburg or Keswick or something, and with $1M in cash, they could buy a brand-new house, and have enough money to buy two houses next door as well. They were set for life, provided they didn’t want to move back to Toronto.

These people were not rocket scientists. They just fell into the market at the perfect time.

Kyle

at 10:40 am

100%

I’ve moved around a lot and have been fortunate enough to have lived on many streets in this fine City. And on every street i’ve ever lived on, i’ve met folks who bought their home 10, 20, 30 or even 40 years ago, for what today would seem like a pittance. Today, those houses are worth well over $1.5M, many would be worth over $3M.

These types of stories are so common and plays out all over this City. People just going about their lives, and then one day they go and sell and realize they were living on a gold mine. What i have never met in my entire life, is someone who rents and has invested their way to millions of dollars through the stock market. Perhaps they exist, but i suspect they are vanishingly rare.

Kramer

at 10:40 am

And while most have blinders on in Toronto because of decades of hotness, it is so very possible to fall into a real estate market at a terribly, horribly wrong time and have that leverage completely crush you and your personal balance sheet.

kyle

at 10:53 am

Agreed, i don’t think anyone should be buying real estate as a short term investment. I think some people may have done that during the recent peak.

But most of the “dumb” people who have made money off of real estate were people really just looking for a place to call home.

Chris

at 11:21 am

Good article, thanks for sharing.

Scott Ingram also publishes a regular comparison of real estate versus equity returns; his most recent one is up to Q2 2019.

https://www.slideshare.net/ScottIngramCPACAMBA/toronto-real-estate-return-on-investment-19962018-q2-2019-roi

It’s not perfect (e.g. doesn’t include dividends), but is an interesting read.

Appraiser

at 7:27 am

“GTA price growth with strongest showing of the year. When sales are ⬆️ and there are ⬇️ listings to choose from, that’s going to put pressure on prices.”

~Scott Ingram https://twitter.com/areacode416

Chris

at 10:16 am

“A chart of note for those who fancy sales vs. listings as a leading home price indicator.

https://twitter.com/RobMcLister/status/1202424500610125824/photo/1”

– Rob McLister

“I use a variation on this chart. Since it looks at price change versus a year ago, it also uses the average of the sales:listings ratio for the same period (past 12 months). One of the most satisfying economic relationships I’ve ever seen. But, the relationship has shifted.”

– Will Dunning, in reply

Appraiser

at 10:11 am

“And it pains market bears to no end, because these folks who bought a $400,000 condo in 2016 and sold it for $650,000 in 2019 may not have “deserved” it.” ~ David Fleming

Yup.

I’ve taken note that most bears present as extra smart on the one hand, yet so resentful, dogmatic and bitter on the other.

Real estate and stocks have both done well. However real estate, especially principal residences are subject to very advantageous tax treatment. No capital gains tax upon disposition of a principal residence in Canada is the obvious benefit. Not being taxed on the imputed rent as The Netherlands, Iceland, Slovenia, Luxembourg, and Switzerland currently do, is another major tax advantage for U.S. and Canadian homeowners.

https://www.businessinsider.com/imputed-rent-hidden-tax-break-homeowners-20

For a deeper dive on the theory of imputed rent.

http://www.yorku.ca/bucovets/4070/personal/personal_d.pdf

With leverage, imputed rent and favourable capital gains treatment already on your side, home ownership is pretty hard to argue with, without considering the potential long-term capital appreciation of the property. Home ownership has also proven to be a time-tested and effective forced savings program, that most Canadians actually stick with.

Let’s not forget that whether you owns stocks or real estate, both or neither, everyone still needs a roof over their heads.

J G

at 9:48 pm

Most bears resentful? How do you think this person felt? Bought for 3.4M in 2017-03, sold for 2.4M in 2018-08. https://housesigma.com/web/en/house/mLzQ1y5OLdM3qdeK/278-Dunview-Ave-North-York-C4197614

Too bad with primary residence exemption, the poor guy can’t even claim capital loss.

Leverage is powerful? Well that works both ways too, imagine if he only put 20-30% down? Yikes.

Appraiser

at 7:22 am

Yeah, because anecdotes are the best way to judge the overall market.

J G

at 7:52 am

Ancedote? You are disputing it may not have not happened? I believe HouseSigma is reliable.

Steve

at 8:42 am

The word anecdote does not necessarily indicate the incident referred to didn’t happen, but refers to the fact that it’s an individual incident. Apparaiser is absolutely correct that a single incident is not indicative of the overall market.

Yes there will be sob stories here and there with the ebbs and flows of the market, but the overall story for the last 30 years has still been that people who invested in Toronto real estate made out like bandits.

Appraiser

at 8:59 am

“Wise men talk because they have something to say; fools, because they have to say something.”

~ Plato

Professional Shanker

at 8:37 am

York U paper is a good read. You could achieve close to the same tax treatment in Canada as the US using a HELOC, albeit at a higher borrowing rate.

Appraiser

at 9:21 am

I assume that you are referring to writing off the interest that would accrue from a HELOC for tax purposes, if the HELOC is utilized for investment purposes?

Professional Shanker

at 11:29 am

correct and only speaking from a principal residence POV and in order to achieve ~ tax parity one would require non registered capital equal to value of their principal residence.

Not sure on deductibility limits in the US.

Izzy Bedibida

at 5:32 pm

I did the exact same thing. I technically now have tax deductible mortgage.

Kramer

at 10:29 am

This conversation cannot exist outside of the “portfolio perspective”, where Real Estate and Equities are two of several asset classes one could include in their portfolio.

Further, your own personal house shouldn’t be counted as part of your investment portfolio. So only ‘investment properties’ should be considered.

Many factors define an asset class, and for Real Estate the key factors are buying costs, selling costs, legal costs, property taxes, maintenance costs, leverage, as well as a slew of unique risks:

– Location/geographical/environmental risk

– tenant risk

– legal/ownership risk: when you own $10 of a stock, your maximum liability legally is that $10. For a property, sky is the limit on liability/lawsuits.

– liquidity risk

– concentration risk – it is way harder for a typical person to diversify their real estate portfolio across potential risks and returns – i.e. typically they pick one property.

– financing risk – yes, typically people lever up.

Compared to Real Estate, Equities are easily diversified, have low transaction costs, are extremely liquid, etc.

Long story short, all of these factors work into the risk/return profiles of the investment classes, and AS AN ASSET CLASS, Equities are lower risk than real estate, and hence EXPECT lower returns.

This is easily seen when you consider a $100,000 investment in a portfolio of equities vs. a $100,000 investment in real estate. Suppose the market value of both investments stayed exactly the same over 5 years and you sold. Equity investment will yield a small loss from transaction costs and you would be able to easily get market value (liquid). Assuming that your taxable rental income covered the monthly mortgage costs and property taxes and even the maintenance fees… the real estate investment will yield a more significant loss due to land transfer taxes, legal fees, agent fees, and a new dishwasher or something else that broke over the period. You have also exposed yourself to many other risks over that period inherent to the asset class (listed above).

Yes… if you lever up and invest in a real estate market that goes nowhere but up across all neighbourhoods and property types for 5 years – you’re better off vs equities (and congrats to all Toronto bulls – I’m with you), but this SHOULD be the case because you’re taking on way more risk (even though it may not feel like it here in Toronto… you are), and you should be handsomely rewarded in this case because if the market goes the other way, your losses will also be amplified by leverage, which is why real estate has the ability to crush millions into bankruptcy. LEVERAGE GOES BOTH WAYS AND IS ALSO A RISK.

My overall point is that comparing returns of one asset class to another is USELESS without comparing the RISKS… and ideally one must take a complete portfolio perspective and allocate the proper amount of RISK to different asset classes based on THEIR personal risk tolerance which is derived from things like THEIR personal financial/income situation and THEIR personal investment time horizon. It is not a one-size fits all scenario, and no doubt if you are investing in real estate, your best friend in risk tolerance is TIME HORIZON and the ability to ride out a long investment holding period.

Chris

at 11:14 am

Great post, fully agree with pretty well all of it. You can leverage your investment in equities as well, but obviously this introducing additional risk. It amplifies both the ups and downs.

Steve

at 8:44 am

It’s interesting, I always see the ability to leverage equities here downplayed to the point that the capability might as well not exist. When I lived in Australia it was quite common (for good or for bad).

Chris

at 10:20 am

Agreed. It is frequently brought up with regards to real estate as if it is harmless way to simply amplify your gains. While undoubtedly more people utilize leverage in real estate, it can also be used with equities, and in all cases, it will increase risk.

Professional Shanker

at 11:43 am

One of the better summarized and non biased posts I have seen on this subject comparing the 2 asset classes.

The primary argument of RE being a leveraged investment requires comparison to margin investing in equities. The correct question to pose is what should one do when refinancing their principal residence – invest in equities or invest in RE via investment properties, MICs (which he does to), etc.

condodweller

at 4:15 pm

I agree with the premise of your post, definitely on not counting a home as an investment. I also agree the end game should be about the risk-adjusted return.

I’m not sure about your assertion about equities (assuming you mean stocks) are lower risk than RE. First of all historically there have been only three asset classes i.e. equity, bond, cash or cash equivalent. I know that some consider RE as a separate asset class however it is technically also equity.

Even stocks have different risks, hence their different beta values. I wouldn’t make a blanket statement that stocks are lower risk than RE. Perhaps your bank stock is but not your mining stock that’s prospecting for diamonds in the Yukon.

Kramer

at 7:43 pm

Hi Condodweller.

1. Yes, Equities refer specifically to stocks (fragmented ownership of a business). When you hear about someone being an “Equity Analyst”, they are always analyzing companies – they are not analyzing a piece of real estate, or bonds, or currencies. Equities are an asset class. Fixed Income (bonds) is also an asset class.

2. Real Estate is its own asset class, or you could group it under the umbrella asset class called “Alternative Investments”. Other Alternative Investments include Hedge Funds, Private Equity, Commodities, Infrastructure, etc.

3. In my post I very specifically said that Equities as an ASSET CLASS is less risky than Real Estate as an ASSET CLASS. This is a correct statement, and it is determined by the asset class level risk factors like the ones I listed in my previous post – i.e. liquidity risk, legal/regulatory risk, interest rate risk, etc.

If you start comparing an INDIVIDUAL asset in one Class (i.e. Yukon Diamond Prospectors) to INDIVIDUAL asset in a different Class (i.e. an apartment at Yonge and Eg), then you need to evaluate at the individual asset risk level and my statement certainly doesn’t apply.

Key: From a top down asset class risk perspective, it is always assumed that one is diversifying within the Equities asset class (and not just buying Yukon Diamond Prospectors Inc). A fundamental concept of Equities is that if you don’t diversify, you will not get the appropriate return for the risk you are taking… which is dumb.

Think of it another way though… Why would any individual average investor like us invest in real estate (and I mean an investment property, not your home) if there was not the potential for higher returns than buying equities? Investing in Real Estate is more time consuming, more effort, has more costs, tenants, all those risks I mentioned in my post, etc. People do it because of the potential for higher returns… and if it has potential for higher returns, then that absolutely means it has MORE RISK, BECAUSE the ONLY way you can expect higher returns is by taking on more risk (this is a fundamental market forces driven reality, as if the risk does not match the return for an asset, the gap is quickly closed via arbitrage).

Kramer

at 7:54 pm

I should add that investors don’t only buy real estate for the potential for enhanced returns, but also to diversify among more asset classes.

condodweller

at 1:05 am

Hey Kramer, I assume you are a different Kramer than the permabull Kramer we had comment in the past.

1. equity is a widely used term and as people pay down their mortgage they are said to have built up equity in their home. Equity AFAIK is characterized by risk as your invested capital is at risk vs fixed income where your capital is not at risk. This is why RE has been lumped in with equities in the past.

2. I have no problem if you want to call RE its own asset class. Hedge funds/private equity are investment vehicles not asset classes. They can hold any asset class you can dream up.

3. However, if you call RE its own asset class and you are talking about portfolio level diversification then it becomes very difficult for an average person to diversify their RE holdings as they would need to have multiple houses to properly diversify which would take significant wealth unless they do it through REITs. I suspect very few people have a diversified holding of RE and those who do, probably don’t have much equity holdings to diversify against their RE holdings as they tend to be hard core RE only investors.

Practically speaking there are really only two asset classes as you can tell by most investment statements. Most advisors will assign an Equity/Fixed income mix to investors and balance between the two. Equity will include RE and commodities and Fixed Income will include cash and cash equivalents as there is very little difference between them and bonds.

I have difficulty with you assigning a risk level to equities as one can choose to have very different equity portfolios. My bank/mining stocks were just illustration of the different risk levels you can have among equities. The ultimate risk of the equity portion of your portfolio will be determined by how much of each you use.

This is an interesting discussion but ultimately the question isn’t really weather it should be RE or equity, but rather how much of each if we are talking about it as an investment.

Kramer

at 12:53 am

Hi Appraiser.

Nope, it is me… the same Kramer. I’m back. For now. Never a purmabull, but still a bull, and still will be until demand severely drops, supply severely increases, or interest rates severely increase… and I don’t see any of those happening in Toronto in the foreseeable future based on the state of the country, the city, and policies. I look forward to a good bull vs bear showdown in the future, though it looks like a lot of the bears have been hibernating for a while.

1. We’ll just have to agree to disagree. Real Estate has a widely different risk profile than Equities – especially when you’re talking the real estate investments that this board discusses, which is individuals buying one or two investment properties to manage on their own.

2. We’ll just have to agree to disagree. Yes hedge funds can use equities, but they typically use complex strategies, leverage, and derivatives and drastically change the risk profile. People invest in hedge funds to expose themselves to much more risk and expect much higher returns and is largely the skill of the hedge fund manager that determines the success of the fund, not the economy or market. This is why hedge funds fit in the asset class called Alternative Investments, and are not the same as the Equities asset class.

3. Agreed. This is an increased risk when it comes to typical real estate investors who buy one or two investment properties: concentration risk, which I mentioned. Concentration risk is typically much lower in the Equities allocation of ones portfolio. However, if someone decides to invest their entire Equities allocation into one stock, then they have skyrocketed their concentration risk.

When you think about assigning risk to Equities as an Asset Class, you must take a top down approach. You start at the risk of investing in the entire universe of equities (stocks). There is RELATIVELY very little risk at that level. If your investment is diversified across every publicly traded business on earth, it would basically require society as we know it to go up in flames for you to lose your investment or even suffer any capital impairment.

You then analyze the risk of all those Equities by domestic/global/foreign, and by segment and allocate to those countries and segments based on how much risk you want to take. Then within the segments, you select your actual assets – could be 10 stocks, or could be the entire S&P 500 and FTSE indexes. No doubt you can end up taking on extremely high risk based on your decisions within the Equities Asset Class. But all the same, Equities as an Asset Class – at and near the TOP of the top down approach – is less risky than Real Estate.

Comparing Real Estate returns to the returns of the major Equities indexes like the S&P 500 is using Equities very near the top of the top down approach where investing in Equities has RELATIVELY very little risk. At this lower level of risk, investors should expect lower returns than investing in real estate, as per my original point.

Also, there is a difference between investing in Commodities and investing in Commodity companies. “Commodity companies” are Equities in a particular sector. Like Encana. Encana is a company that is in the business of oil and natural gas, and is obviously in the Energy sector. “Commodities” is investing in, for example, natural gas futures. Investing directly in commodities is also considered investing in an Alternative Investment asset class and has its own unique risk profile.

Kramer

at 12:57 am

Darn sorry, meant Hi Condodweller, not Appraiser 😉

Mxyzptlk

at 1:31 pm

Not to mention the fact that looking at stock market appreciation over the past decade is (intentionally?) misleading, since equity markets around the world tanked in 2008 following the global financial meltdown. Just take a look at the left side of all David’s equity related charts, which clearly show that early-2009 was the end of a wrenchingly sharp and steep decline in stock prices.

Just as a reminder, the S&P 500 index plummeted about 38% in 2008. And to go back a little further, it fell about 23% in 2002 and 13% in 2001 and 10% in 2000. So despite a period of growth between 2003 and 2007, the S&P 500 dropped by about 30% between January 1999 and January 2009. But back in 2009, was anyone trumpeting the wonderful returns that equity markets had provided over the previous ten years?

So looking at returns from the 2009 nadir to today’s all-time highs is disingenuous, to say the least.

sunshine

at 3:14 pm

I bought in 2007 in Toronto, not because I was timing the market, but that was when I had the down payment and could afford to buy. My home is now worth 3 times what i paid, and that gain is tax free. But, I also invested in the stock market post financial crisis and that has also been an excellent return. My TFSA has been maxed every year, and is now worth well north of 6 figures and growing- also tax free. My philosophy is to ensure you can afford to do both (house and investments), the house might be a better return, but it’s not very liquid. People entering the market now are not likely to realize the returns of the past decade, and selling a house has a very high transactional cost vs. investments…

Izzy Bedibida

at 3:27 pm

Plus stock, bonds etc pay interest and dividends. For owning them.

A house doesn’t. One can’t pull the increase in equity by cutting a hole in the wall.

I don’t officially count the value of my home as I can only bank the gains when I sell. I have no intention of selling in the future, and in the mean time my “investment” is costing me condo fees, property taxes, maintenance etc. None of which are tax deductible.

condodweller

at 3:42 pm

“One can’t pull the increase in equity by cutting a hole in the wall.”

You can pull equity out by a HELOC if you choose to.

“in the mean time my “investment” is costing me condo fees, property taxes, maintenance etc. ”

It’s also providing you with shelter without having to pay rent. You are also getting your gain tax free when you do sell which will offset a good chunk of your expenses.

Izzy Bedibida

at 8:08 pm

That’s correct, but I have to pay the HELCO back to the bank with interest. Stocks, bonds and other investments pay me to own them, and cost nothing to own.

Syed

at 6:21 am

I think rental income is also classed as a dividend as it’s a fixed %. So you can make income like interest from RE as well

Professional Shanker

at 6:22 pm

Sun – So you purchased a place in 2007 for let’s say $376k (avg price in 2007) and now it is worth $1,128k in 2019 without significant renovations? Average price in 2019 is roughly $815k. What area produced a more than 80% gain relative to the market.

Libertarian

at 3:22 pm

This post reminds me of what I’ve said on here for a long time and something David references once in a while: financial literacy.

I don’t think someone who bought a house is financially literate. They were just in the right place at the right time. But the same applies to stocks.

Does anybody on here doubt that somebody who bought shares of the Canadian banks 30 years ago is richer than the person with a house purchased 30 years ago? It doesn’t get more Canadian than bank stocks. I remember as a kid, my dentist telling me – buy bank stocks because they have a licence to print money. I wasn’t a financial genius then, but my dentist had a point. So anybody can win the lottery, whether it’s a house, a stock, or even the lottery itself.

All of that to say, I think financial literacy is a basic life skill that everybody should strive to have. Then all this debate about rent vs. buy, real estate vs. stocks, is irrelevant.

condodweller

at 3:53 pm

There are many ways of making money. If someone has a better strategy or a great stock picker that works for them, who is David to tell them otherwise? He points out that he is not Warren Buffet.

As soon as real estate is considered as an investment you are right financial literacy enters the picture. The irony is that you don’t necessarily have to be financially literate, you just have to realize you’re not and find a trustworthy advisor who will guide you. Of course that’s easier said then done.

As long as one is saving some of their money and growing it instead of blowing every penny who cares how they do it. I never worried about others or compared myself to others. As long as one has a plan and is following the plan with a realistic goal it doesn’t matter how they make their money.

condodweller

at 3:36 pm

The link to the article includes something that David missed in his article: “what-is-a-better-investment-toronto-real-estate-or-the-sp-500”

Investment is the operative word here. The article comparing the two as investments.

The “dumb” people whom David refers to are the Rip Van Winkle types who happened to purchase a shelter for their family where the idea of investment most likely never entered the equation and woke up 20 years later as millionaires by happenstance.

I agree with Kramer on this point.

Now the question is what is David’s point here? Is he hard selling us on real estate as an investment or advocating home ownership?

I always say that anytime is good time to buy a home if you are going to live there for the next 20 years and you have the financial stability to withstand a job loss(es) to continue to pay the mortgage and not be forced to sell in a downturn both of which could be likely at the same time, however, as an investment that’s a different proposition altogether.

Appraiser

at 4:26 pm

TREB data for November released today.

Sales up 14%.

Average price up 7.1%

Active listings down a whopping 27% !

J G

at 9:15 pm

Hi David, recently I commented on investing in FAANG stocks vs Toronto RE. As I mentioned, these stocks are part of many mutual funds and ETFs, so people are invested in them even if they don’t know it. Now:

2008 AMZN price: $70, today: $1760 – 2500% return

2008 AAPL price: $20, today: $260 – 1300% return

2008 GOOGL price: $200, today: $1300 – 650% return

RE bulls will say I’m cherry picking, but I think even in 2008 smart investors can see these blue chips have the potential to take over the world.

You can say it’s hard to put your entire portfolio in these stocks during the 2008 market crash. But I can say it’s also hard to put only 10% down on a Toronto Detached during that same time.

You’re absolutely right on the leverage argument. But personally for me, not having to deal with Insurance, Prop Tax, and Maintenance (time/money) is better since I can focus my energy on my career and business.

condodweller

at 12:28 am

Now the question becomes what’s better investment? FAANG stocks at current prices or RE at current prices?

You have the AAG part covered, any reason you excluded the FN part? You wouldn’t be cherry picking would you? Just kidding…

In any case, you made a call and placed your bet on FAANG stocks and fortunately for you it worked out. That’s the thing about making bets. They are great while they’re working……until they don’t. What’s your exit strategy on FAANG? Hold them for life or do you have a P/E level that’s too rich for you?

J G

at 3:08 pm

FB was not listed and Netflix was $9 in 2008, so 3000% return.

Going forward, I think Netflix is done due to too much competition. Apple is ok, Amazon and FB are both good investments, but the one I like best and I believe will clearly beat Toronto RE over the next 20 years is Google.

When investing I only have one advice, which is dont read anything online because most of it is BS. Think for yourself.

Where do you want to invest your money over the next 20 years – a one trillion dollar company that makes the world go around (Search, Gmail, YouTube, Chrome, Android, plus pretty much all the digital data in the world), or a condo in Toronto?

Condodweller

at 12:50 am

I’m glad it worked out for you so far. You must realize though what you are doing required skill/time/conviction/discipline which most people don’t have.

Google is certainly a force to contend with.

J G

at 3:13 pm

Sorry forgot to answer your question on exit strategy. The good thing about stocks is I can sell small number of shares each year to minimize the tax impact 🙂

But with RE, if I sell an investment condo and made $200k, that money is taxed along with my other income for that year 🙁

Condodweller

at 12:59 am

Each has its pros and cons. I’m sure many have that headache dealing with the tax consequences on their RE gains including myself. It’s a good problem to have though. It’s much higher than $200k for those who bought a long time ago. It’s almost worth taking a year sabbatical to reduce the tax.

Mike

at 8:55 am

Why can’t you leverage stocks? The fear may be that because stocks are more liquid than real estate that is there is a daily value that they are more volatile and if leveraged may result in ugly margin calls, but if you you can do it.

Libertarian

at 9:10 am

Yesterday in the news….Mayor Tory wants to raise property taxes substantially.

Does this help or hurt real estate going forward?

Bal

at 9:19 am

I think nothing can hurt real estate at this point…literally nothing

Appraiser

at 9:29 am

How did doubling the Land Transfer Tax in Toronto affect housing prices over time?

Unstoppable.

P.S. Toronto needs a substantial tax hike for several years in a row to make up for the backlog of deferred maintenance and future infrastructure projects that previous governments have been ignoring for far too long.

Thus there is a housing crisis, insufficient public transit and underground sewage pipes dating back to the late 1800’s still underpinning parts of the city.

Chris

at 10:30 am

“For the millionth time, no one on here has claimed that real estate only goes up – EVER! So can we all just stop making this bogus ass remark.” – Kyle Lin

“I think nothing can hurt real estate at this point…literally nothing” – Bal

“How did doubling the Land Transfer Tax in Toronto affect housing prices over time? Unstoppable.” – Appraiser

Kyle, to your credit, I don’t recall you ever saying that prices only go up. But it seems Libertarian was not mistaken the other day when they asserted that some here do make that (or similar) claim.

Kyle

at 10:40 am

I can’t speak for Bal because he is a new commenter, but Appraiser was also the one to say the RE market will go down when there is a recession, just like every other time before. So clearly he isn’t actually of the view that prices only move in one direction in perpetuity forever more.

Chris

at 10:45 am

Bal was commenting in May 2018:

https://torontorealtyblog.com/blog/in-the-news/#comment-84787

Though, to be fair, back then he wasn’t taking the same position he is now.

Appraiser, in my opinion, shifts between reasonable bullishness and outlandishness, depending on the day.

Appraiser

at 12:56 pm

Wow Kyle, good memory, thanks.

Yes, I am well aware that all markets fluctuate.

I lived through the late 80’s crash, a real estate market downturn that lasted for over five years, and much longer in some hoods.

Chris

at 1:31 pm

“I lived through the late 80’s crash, a real estate market downturn that lasted for over five years, and much longer in some hoods.” – Appraiser

“I’ve been right for 33 years in a row. How about you? Still waiting for the crash?” – Appraiser

So, taking these two statements together, you are claiming that you accurately predicted the last substantial Toronto real estate slowdown and subsequent recovery?

Bal

at 2:23 pm

I am not He..I am she..:(

Appraiser

at 1:09 pm

All the important indicators, especially population growth, high employment and chronically low listing inventory are still pointing to a long term bull market in the GTA and even more so in the 416.

You heard it here first (a long time ago).

Chris

at 1:38 pm

Many predictions have population growth rate reverting to the mean. From CIBC’s recent report:

https://pbs.twimg.com/media/EKZFAyGWsAAeZsq?format=jpg&name=small

As for low listing inventory, it sounds as though many move up buyers are holding on to their current real estate to rent it out:

“I’ve said it before, but all of my recent clients that have moved from condo to house (even condo to condo in one case) have kept their old condo to rent out. So it doesn’t hit the MLS like would’ve in years gone by when people “traded up” ” – Scott Ingram

“More and more people who are upsizing are holding on to their condos and to some degree low-rise houses as rental properties. I think that is the single biggest factor behind the decline in inventory” – John Pasalis

Difficult to predict what this means for future, but is interesting nonetheless. Especially if most of us agree that current Ontario tenancy laws make being a landlord relatively unattractive.

Kyle

at 3:00 pm

I think what’s driving people to hold on to their condo when moving up or to invest in a condo to hold on to is so they can hedge their own retirement or their childrens’ future.

Longer term, this means a bigger gap between the “Haves” and “Have Nots”. And increasing generational wealth transfers for certain families and a solidification of a wealthy owner class vs the common class. In 25 years, those families that still own a house and own a condo for their kids to move into are going to be like the old money families of New York.

Chris

at 4:38 pm

Could be, though I personally suspect it has more to do with recent rent increases. If it were primarily about hedging for retirement or children’s future, wouldn’t realtors like Scott Ingram and John Pasalis have seen similar behavior in 2017?

With regards to the widening gap between the Haves and Have Nots, this perceived growing inequality can be a big boost to populist politicians and their policies. South of the border, it’s certainly providing support to Sanders and AOC. Wouldn’t surprise me if we eventually saw similar results here in Canada.

However, despite what many may feel, the Gini coefficient in Canada (after taxes and transfers) has actually been declining since 2004. Though admittedly it is still higher than the late 70s through late 90s.

Bal

at 2:29 pm

wow Chris …you remember me …pretty Amazing….

Kyle

at 9:55 am

He is not talking about raising it “substantially”. He is talking about increasing an existing levy that is currently at 1.5% of your tax bill to 10.5% of your tax bill by 2025. The estimate of each 1.5% increase averages to $43 per year.

So by 2025 that ends up being an additional $258 per year. This will do absolutely nothing to real estate going forward, but i believe it will go a long way to restoring the infrastructure in this City. I am all for it.

Bal

at 10:18 am

I think only interest rates impact house prices….nothing else….

Kyle

at 10:27 am

I wouldn’t go that far. There are lots of risks, it’s just a matter of what are the probabilities they will come to fruition. For example:

– Mass layoffs

– Recession

– People en masse suddenly deciding they don’t want to live in TO anymore causing population to drop

– Big Tech Cos relocating to some other City

– New over-bearing rules from the Government

Nesa

at 9:58 am

110% agree, thank you!!

J

at 11:07 am

“With a 20% down payment, the return on the actual money down (again, ignoring land transfer tax, although back in 2008 it was nominal), is 562%.”

This is a grossly inaccurate method to estimate returns. You can’t just divide the gain by the down payment. This is only correct in the special case with zero principal paid and zero interest. In reality, the principal payment increases the amount of money invested, reducing the return on investment. And of course interest has the same effect. And the effect is big.

Using a spreadsheet and historical discounted mortgage rates, I found the IRR (internal rate of return) to be only 172%. This corresponds to an annualized rate of 9.53%, which isn’t all that impressive considering the extent of leverage used.

I made these calculations assuming a property was purchased on Jan. 1 2008 for $100,000 and sold for $212,400 on Jan. 1, 2019 (an increase of 112.4%) with $20,000 down. I assumed mortgages with 5-year fixed terms using the historical discounted rates found on Ratehub.ca:

2008-2013: $80,000 mortgage at 5.89% => $506.63/month with $71,754 principal remaining (yes, discounted rates were this high not so long ago)

2013-2018: $71,754 mortgage at 2.84% => $391.62/month with $57,412 principal remaining

2019: $54,412 mortgage at 2.79% => $390.27/month with $54,282 principal remaining

This still excludes other costs and benefits of the investment.

Condodweller

at 12:35 am

Nicely done sir, the silence is deafening among the bulls.

Out of curiosity how did you break out the mortgage payment to arrive at the interest/principal amounts for the inflows/outflows for your IRR calculation?

J

at 9:55 am

For the mortgage payments and principal balances I used TD’s mortgage calculator, which includes an amortization table.

By the way, here is the spreadsheet with all the cash flows along with the IRR calculation:

https://sheet.zoho.com/sheet/published.do?rid=hwga36be701cc3b2e4e0983ec5f90c8e240ed

XYZABC

at 10:26 am

This is more inline with what I would expect too. Got to factor in prop taxes, interest, maintenance for sure. But I think where home edge equities for sure is the saved rent. But if you are buying a home for rental the rates are probably going to be closer to equities, maybe a bit better maybe a bit worse.

John

at 10:58 am

You are dead on. On a cash basis, ie zero leverage, equities have historically done better in the long term, ie 15-20 years. Equities would also do better on a leveraged basis, especially if the interest on the leverage was at residential mortgage rates. However, here is the rub: Aside from the fact few are comfortable leveraging an investment in equities, the leverage ratio available is nowhere near that of residential real estate. Also, there can be margin calls if the leverage is secured by the equities if the market value of them decreases such that the margin is not mantained. Even if that doesn’t happen many get spooked by market drops and sell their holdings, which terminates the long holding period that is required to achieve the long-term superior returns. That doesn’t happen on residential real estate even when prices go down.

Further compounding the issue is that outside of a TSFA the capital gains on investments, except for a prinicipal residence, are taxed. Also, you can’t live in a portfolio but you can in your real estate investment and even rent part of it out to reduce your cost.

As with both investments, unless you are very lucky getting into the market at the bottom and exiting at the top, both are long term holdings. That reminds me of a joke:

Q: Do you know what they call someone who says they bought at the low of the market and sold at the high?

A: A LIAR!

Gordon

at 8:50 pm

Yearly 5% dividend in 10 years will come up to 285% instead of 55%, that’s why Financial post article stated that stock buyer has to re-invest all his dividend.

WOW

at 10:33 pm

How did I come across this absolutely asinine grossly inaccurate amateur hour piece of trash analysis? lol