I hope you enjoyed that “trip down memory lane,” as Marina so eloquently put it, with the Top Five Blog Posts of 2022 in Monday’s post.

Picking my top five posts is always a difficult task, given I’m the author. As you saw with #5, which was the three posts offered by Matthew, Chris, and Tara, there’s a bit of bias showing, since those probably weren’t the “best” posts of the year. But London Agent commented that it should be a regular feature on TRB, so maybe I actually was on point with that one.

Picking the top five “stories” of the year is a whole other ballgame, however.

Believe it or not, this is the eighth year I’ve been working with this format; the top five blogs followed by the top five posts.

Since we are talking about Toronto real estate here, we’re going to see some overlap in the top stories. For example, real estate prices could be a topic every year!

But because our market is so dynamic, we often come up with stories that are one-off’s or unique.

For example, 2016’s top-five list featured “Kathy Tomlinson & Vancouver Real Estate” as the #2 story on the list. That was a year in which Ms. Tomlinson exposed multiple instances of bad practices in the Vancouver real estate market, including the now-infamous “assignment” of existing agreements, in this column: “The Real Estate Technique Fuelling Vancouver’s Housing Market”.

It’s often those stories that are most noteworthy or most memorable.

The same-old, same-old can often bore you to sleep.

Having said that, let’s review the Top Five Real Estate Stories Of 2021:

5) The Offer Process

4) Prices Outside The City Of Toronto

3) Market Frustration

2) The Election & Real Estate

1) The “Problem” In Our Housing Market

Do any of those sound familiar?

They’re much of the same, year-in, year-out.

There’s always some variation of the real estate market being “broken,” and as was the case in 2021, this year will be no different.

Even in 2020, my #4 story was, “Refusal To Accept Market Reality,” which is another way of looking at prices, as well as this idea that the market is problematic or broken.

For reference, here’s my Top Five: Real Estate Stories of 2020:

5) People Moving Out Of The City

4) Refusal To Accept Market Reality

3) The Rental Market

2) The Condo Market

1) The Pandemic

Ah, right, the pandemic!

In a few short months, we’ll be three years and counting…

So without further adieu, and thank you for accepting my apology in advance for covering one of these topics yet again, I present to you, my Top Five Real Estate Stories of 2022…

#5: The Rental Market & The Future Of Landlords’ Rights

See what I did there?

I added five words, plus an ampersand, and made this topic totally different from “The Rental Market” in 2021.

Plus, it was a TRB first; I used “ampersand” in a sentence…

How can the rental market not be a top-five story, every single year, in perpetuity? Rent is expensive in Toronto, and since there are just as many renters in Toronto as there are owners, it seems to reason that we should talk about renting as often as we discuss the purchase and sale of real estate.

Renting has never been a sexy topic. There aren’t big dollars involved. The stakes aren’t nearly as high. The stories don’t pack as much of a punch. But over the last couple of years, the rental market has been hotter than ever, and the conversations around the rights of landlords and tenants have changed significantly.

There’s a reason I added those words, “…..and The Future Of Landlords’ Rights,” and it’s just to make this a different topic than in years prior. As we saw in 2022, and as I wrote on my blog, there’s been a serious shift in public perception of the role of landlords.

Recall my blog from earlier this month about renovictions. I referenced a CBC article, which you can read HERE, and in the comments section, I found this:

Does this make any sense?

I understand the frustration with the rental market, as well as with bad-actor landlords, but this person seems to believe that it’s immoral for people to be landlords in the first place.

“Go look for other sources of income,” i.e., don’t be a landlord anymore.

But then what?

Then all rent is free?

Defend this comment if you choose, and argue a different meaning, but I’m one-hundred percent convinced that the person was suggesting landlords shouldn’t be landlords.

And without landlords, we have no apartments to rent.

“But where are people going to live?”

Um, you should have thought of that before you told landlords not be landlords!

So many people in the city are either frustrated beyond the point of being reasonable and logical, or, remain willfully ignorant about economics and the free market that it’s impossible to have a conversation with them about housing affordability.

Along the same lines, we had a discussion last summer about the idea of freezing rents for each individual unit, rather than for that tenant.

July 25th, 2022, I wrote, “Monday Morning Quarterback: Now THIS Is The Tipping Point!”

My Monday Morning Quarterback blog posts are always referencing something that happened the week before, but for which I didn’t spur into action with a blog post in response. In this case, it was something that I just couldn’t stomach writing about, because the idea was so damn stupid to begin with.

The blog was in response to this:

“Landlords Shouldn’t Be Allowed To Raise Rents Between Tenants, Says Toronto’s Top Housing Official”

I said in my blog post:

When I read articles like this, I get frustrated. And not as a real estate agent, so please don’t go down that road. Not as an investor, or a capitalist, or a home-owner. I get frustrated because “ideas” like this are thrown out by people who have no knowledge of, or don’t care about, any of the consequences, ramifications, or the fallout from such an idea.

This is a classic case of trying to solve one problem by creating another.

The logic behind this suggestion, supposedly, is that in order to deter bad actor landlords from evicting or renovicting tenants in bad faith so they can raise the rent, we should freeze rents for all rental properties.

That’s insane.

It also completely ignores the free market and it’s an incredible overstep by any government that wants to remain on the socialist spectrum and avoid a turn toward communist ideals. The government wouldn’t fix the price of gasoline nor would they fix the price of milk. So why in the world are we talking about fixing the price of rent in a free market?

This one really, really bothered me.

But a lot of my blogs solicited responses that surprised me!

June 17th, 2022, I wrote: “The Friday Rant: Punishing Good Deeds”

This was a blog post about an investor who went out of his way to help his tenant, only to have the tenant completely screw him over.

And what was the response from the TRB readers?

He should have known better!

About a dozen variations of that sentiment were what was shared by the readers, in a blog post that solicited 43 comments from the TRB readers.

Damn, I didn’t realize y’all were such heartless bastards! 🙂

It was a busy summer in the rental market.

July 12th, 2022, I wrote, “Leave Me Alone In The Rental Market Trenches!”

That was a story about just how unrealistic some tenants are about tenancy. Some people just don’t understand the process, and what’s worse is that they hire agents to represent them who know just as little!

July 14th, 2022, I wrote, “Rental Market Realizations”

This was my attempt to help would-be renters and their agents, by shining a light on poor work ethic, practices, or entitlements, but my tone often comes off as accusatory.

…..ask me if I care…

In the summer, we looked at just how crazy the rental market was, specifically with respect to prices!

August 24th, 2022, I wrote, “How Many Rental Listings Are Going Over The Asking Price?”

Who gets in a “bidding war” over a rental, you ask?

Many people. Just read the blog, look at the stats, and you’ll see just how common it is to offer $2,700 on a condo listed for $2,495/month, and still lose.

October 19th, 2022, I wrote, “Should Tenants Be Pre Approved For Candidacy?”

As I wrote in the blog, this turns the process completely upside-down and backwards, and it’s borne of lazy agents who don’t want to do their jobs.

Instead of showing a condo, gathering supporting documents, and submitting an offer to lease, agents are sending supporting documents first, to ask if their tenants would be “approved.”

First of all, it’s not my decision. It’s my landlord-client’s decision. Second of all, why would any landlord review and reject supporting documents without an offer in hand? It’s a discrimination suit in waiting!

After a few more brutal experiences in the rental market, and after hearing stories from renters, agents, and blog readers, I realized it might be possible that there are just a lot of first-time landlords out there who don’t know anything.

November 9th, 2022, I wrote, “Landlord Misunderstanding”

This is me trying to give some landlords the benefit of the doubt rather than just labeling them bad actors, but I do realize that some of these stories involve bad actors regardless.

There’s no qualification to be a landlord. You don’t need to take a course or pass a test. So it’s possible that many of these situations, ie. where a landlord tells a tenant to sign a new one-year lease rather than going month-to-month, is just a misunderstanding because the landlord doesn’t know any better.

Last month, this article appeared in the Globe & Mail:

“Vancouver Leads Country In Mom-And-Pop Landlords”

This necessitated a response!

November 21st, 2022, I wrote, “What Is The Profile Of Today’s Landlords?”

In an attempt to cure the myth that all landlords are bad people, which seems to be the way the winds of opinion are blowing, I listed off all of my lease deals to date in 2022, and provided a profile on the landlords.

And lastly, a post that is bound to be Google-friendly for years to come.

December 5th, 2022, I wrote, “Is ‘Renoviction’ A Bad Word?”

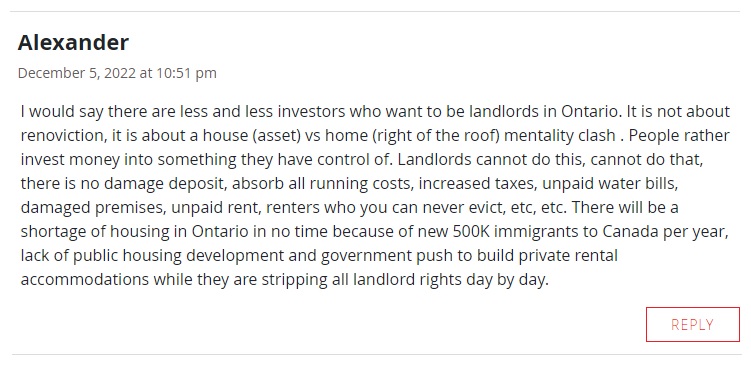

The comments were all fair, but I really liked this one:

If Alexander is right, and if the lady who commented on the CBC article had her way, and landlords “went and found another source of income,” then what effect does this have on housing in the GTA?

That’s a rhetorical question, in case it’s not obvious.

So while “The Rental Market” was a big topic in 2022, the future of the rights of landlords is just as big a topic, if not bigger…

#4: Development: Yes or No?

We would all agree that “development” is a topic that’s appeared on this list before, in one way, shape, or form.

But in 2022, as was the case with many other topics, it seemed as though we really narrowed our focus

In 2022, we looked at the fight for and against development, how new housing can be built, and who or what is both standing in the way versus attempting to spearhead progress.

Blog reader Katie commented on Monday’s blog that she liked the features on NIMBY’ism and she specifically referenced a few blogs that I wrote on Leaside.

You know what, Katie? I enjoyed those posts as well.

March 21st, 2022, I wrote, “Just How Dense Should Our ‘Densification’ Be?”

This is where it all started and trust me when I say that I had no idea this would result in two subsequent blog posts, a bunch of spiteful comments on TRB, a handful of angry emails from area residents, as well as one official complaint.

The irony is: I’m from Leaside!

But my opinion doesn’t count because I’m in favour of development…

In the “Densification” blog post, I looked at some of the comments in an old BlogTo article about banning tall buildings downtown, just to get a sense of what the public opinions are like.

What are they like?

Mixed.

And angry. Mixed and angry. Yeah, that’ll do.

Later in the blog post, I revealed the application to build a twenty-five-storey tower at the corner of Bayview Avenue & Broadview Avenue in Leaside, steps from the new TTC subway line, and in an area where there are no condos of this size. Not even close.

I offered that if we’re going to spend billions of dollars on mass-transit, we should have densification near that transit.

Common sense, right?

Most of the readers agreed and there were some incredible comments on TRB.

A few months later, I traced back the history of the failed “Spadina Expressway,” now known as Allen Road, and even posted a few of those incredible comments from TRB readers Elle O’Lelle and Jonathan C to further spur the conversation.

May 4th, 2022, I wrote, “Welcome To Toronto: The City of NIMBY’s”

I loved that post, if I may say so myself.

I just loved how the readers responded, not just because they agreed with my sentiments, but because they made such great arguments!

However, it all came crashing down when I followed up again a few months later.

August 8th, 2022, I wrote, “A Real Estate Case Of ‘Know When To Fold ‘Em'”

In a follow-up where I pointed out that Leaside residents have formed a corporation, are fundraising money, and have retained legal counsel to fight this development, an even larger development was applied for across the street!

Oh, the hilarity!

By this time, the Leasiders had found my blog, and one person posted under three different monikers on TRB attempting to discredit me.

Here’s one of his comments:

Ari Gold? Come on, dude. Just because you haven’t made partner at your law firm yet doesn’t mean you need to live vicariously through a TV show from the early-2000’s.

I love how he made his argument by trying to discredit all Realtors – quoting a Better Dwelling article that says there’s one real estate agent for every 59 people in the city.

Bravo!

He posted two other comments, one under the moniker “Peter Stazny,” which is the misspelling of a 1980’s hockey player, and another under “David Fleming ismyHero” which deserved better punctuation

It’s times like this that I consider myself incredibly mature. I just don’t understand people in 2022.

“The Bayview Focus Area requirement for transition,” he says. Like it matters.

It’s as comical as suggesting that the forest that existed in Ye Olde Town Of Yorke in the 1700’s would never become a city.

I can take the personal attacks in stride. Trust me, we get a real kick out of these at the office! But what I can’t stand is the combination of ignorance and entitlement, not to mention the NIMBY’ism.

If this city doesn’t build condominium towers within 200 meters of a multi-billion dollar subway that took decades to plan and build, then what hope does this city have to move forward?

By the same token, I took issue with the City of Toronto’s budget that was released earlier this year as well as some proposed legislation.

May 16th, 2022, I wrote, “How New Legislation Could Kill Condominium Construction”

Only two days later, I followed up with a similar topic.

May 18th, 2022, I wrote, “Increasing Development Charges Will Drive Condo Prices Higher”

This was classic.

The City of Toronto planned to increase its development charges by 48.8%.

Why stop there?

Did you know that upwards of 35% of the cost of a new condominium is government charges?

Development charges, HST, land transfer tax, property tax; it never ends!

Real estate is expensive in part because of all the money that flows to the government.

And here we are, talking about how to get more built in this city, lamenting the cost of real estate, and the City of Toronto wants to increase development charges by 48.8%.

Oh, how rich!

Imagine the smile on my face when the provincial government stepped into the fray a few months later and laid down the hammer!

Strong Mayor Powers! Don’t let John Tory sit on the fence anymore. Give him the power to make an actual decision and see what he does with it!

Build More Homes Faster Act! Don’t let city councilors make decisions on individual development projects anymore! None of them will put the city’s long-term needs before the desires or NIMBY’ism of John & Jane, who represent two votes in the next municipal election!

As I wrote in Monday’s blog, say what you want about Doug Ford, or the Conservative Party of Ontario, or Conservatives in general. Oppose the plans for the Greenbelt. But they’re going to get housing built. No government before has made a dent in the deficit.

Is it ironic that I spent the first eight months of the year writing about NIMBY’ism and how the City of Toronto makes real estate more expensive and gets in the way of development, only to see the Provincial government legislate those problems away?

Ironic, maybe.

Satisfying, yes.

2023 will be a very interesting year in this regard…

#3: The Market Shift

For many people, this is topic numero-uno.

But isn’t a market supposed to go up and down? Since when is a downturn in the market something worth freaking out about?

Um, since 2022. Since always.

As a client of mine lamented earlier this year when he was on the market just after it turned: “The market does nothing but go up for twenty years and now, you mean to tell me, that the minute I go to sell my goddam house, we’re in a downturn?”

That’s actually quite tame compared to some of the conversations I had, and I can’t imagine what other real estate agents went through.

But he summed it up perfectly, even though that wasn’t his goal.

Many people felt exactly like this; that the market really did go up, every day, every month, every year, for two decades, only to decline substantially this spring.

Of course, we know that’s not exactly true.

We saw a downturn in 2008. We saw another one in 2017.

And comparatively speaking, 2022 wasn’t as bad as 2017.

Man, this year was long! I know I say this every year, but when I think back to properties I sold in January or February, I actually have to look them up and confirm that they were in 2022, and not 2021.

I’m looking through the names and addresses now. Those guys? That was this year?

A lot of agents feel this, and after the market shot up and back down again, it made this year feel even longer.

March 7th, 2022, I wrote, “February TRREB Stats: Sky’s The Limit!”

That was meant to be in jest!

But after seeing month-over-month increases of 7.6% and 7.7% respectively, I thought “Sky’s The Limit” was appropriate!

If there’s one listing that stands out to me from earlier this year, it’s a west-end condo loft that I sold in January.

This property was on the market with another brokerage in the fall of 2021 for $799,900 and the only offer that the seller got was for $720,000.

That listing was terminated in December.

Fast-forward about six weeks and I sold that condo for $925,000.

Sure, I did have something to do with it, whether it was our staging, marketing, interacting with buyer agents, and/or our offer night. But I won’t pretend for one second like this wasn’t representative of the major jump in prices from December through February!

The insanity continued through March, but we noticed the market started to slow in April.

April?

Wasn’t that the same month where the market cooled back in 2017?

It was eerily reminiscent, except in 2017, the market just stopped.

In 2022, the market kept going, but instead of nine offers on a house, there were four. And instead of $1,200,000 on offer night, it was $1,160,000. A massive difference on a relative basis, but with these properties being listed at $899,000 or $999,000, it didn’t really feel like the market moved significantly.

May 2nd, 2022, I wrote, “Beware The Coming Real Estate Headlines!”

I wasn’t looking to tell readers that the market wasn’t in decline, but rather I was explaining to readers that when the market is hot, the media blows it up. And when the market is down, the media acts like the sky is falling.

Speaking of which…

May 9th, 2022, I wrote, “April TRREB Stats: Is The Sky Falling?”

Here’s where we examined the April TRREB stats, which showed that after a modest 2.4% decline from February to March, the market had further declined 3.5% from March to April.

This is where the media really grabbed on, where headlines became nasty, and where sellers began to panic.

As it is with every market downturn, most sellers refused to accept market reality.

I don’t want to sound unsympathetic, since I had clients of my own in this boat, but it’s not easy to convince a seller to accept an April price in April, when that juicy February price is in their mind’s eye.

Some sellers, whose houses were worth $1,400,000 in February and now had to accept $1,320,000 in April, purchased their homes for $375,000 twenty years ago, so it didn’t matter.

But other sellers, whose houses were worth $1,400,000 in February and who now had to accept $1,320,000 in April, had only purchased their homes three years ago for $1,100,000. They saw this market decline as an unacceptable travesty from which they would never recover.

If you’ve ever been in this position, it’s a lot harder to pull the trigger than you might think.

Maybe May will be better.

Maybe June will bring about more buyers.

Maybe the market will be better in the fall.

I had four clients keep their houses and rent them out rather than sell in a depressed market, at various points this year. But not everybody was able to do that.

And to be fair, we’re using the benefit of hindsight to look back now and say, “Oh they should have sold in April; look where the market is now.” But who knew this was going to happen?

Save that question for our #1 story below.

May 11th, 2022, I wrote, “What Does A Changing Market Look Like?”

This was a very, very important blog post at the time, for both buyers and sellers.

I outlined all the various “strategies” that sellers were employing to get their houses sold. Most of them didn’t work.

Some sellers went from under-listing to over-listing.

Some sellers, strangely, went from over-listing to under-listing with an offer date.

Some sellers kept listing at the same price, over and over.

Other sellers reduced their prices, over and over.

I showed properties that had been listed six times in two months! One such property was “under-listed” with an offer date, then terminated and re-listed higher, only to sell for less than the original ‘under-list’ price after another six listings.

June 6th, 2022, I wrote, “May TRREB Stats: What Does ‘Normal’ Mean To You?”

Here’s where we knew the market had declined, no doubt about it, partly due to the interest rate increases (which we’ll talk about a bit later…).

We tried to come up with a definition of the word “normal,” only to realize that was impossible.

Then the tone of my blogs began to change as the market did.

June 27th, 2022, I wrote, “Selling The Same House Twice”

Here was an inevitable return to what happened back in 2017: a property sells for $1,300,000 in February, the buyer breached and refused to close, and the property is resold in June for $1,100,000.

In this blog post, I showed the readers five examples of houses that had sold in Jan/Feb, didn’t close, and were re-sold in May/June.

The most egregious was a house that sold for a 24.8% difference the second time again.

This post, these actions, and the conversations in real estate circles necessitated the next post:

June 29th, 2022, I wrote, “What Happens When A Buyer Doesn’t Close?”

This was a fascinating case study of what happened in 2017 when buyers refused to close.

And if you’re too busy to read, or aren’t already aware: the buyers ALWAYS lose in court.

The buyers are on the hook for the difference in prices paid, plus all the costs involved.

But as the TRB readers pointed out: collecting is another story.

By the summer, we were focused on how the market had shifted, not just in terms of price, since the market had plateaued by then, but in terms of how properties were being listed.

July 27th, 2022, I wrote, “Listings, Re-Listings, Terminations, & Sales”

If you like my stats blogs, this one was a doozie!

I theorized throughout 2022 that “New Listings” data was massively inflated because of all the terminations and re-listings, and I used that blog to prove a point.

By the end of summer, we were already discussing the concept of “market bottom.”

August 15th, 2022, I wrote, “Catching A Falling Knife”

Given the average home price in the GTA from August through November has stayed within a range of about $1,075,000 to $1,090,000, I’d say that “plateau” exists, as does market stability, and the concept of catching a falling knife shouldn’t be that scary.

So here we are, end of the year, looking ahead to 2023.

Will the “market downturn” be a story in 2023?

I highly doubt it.

We have a better chance of “Market Resiliency” being a Top-5 story in December of 2023, and I’m not saying that because I sell real estate for a living. I’m saying it because I believe it.

#2: “Fixing” The Housing Market

Am I rephrasing last year’s #1 story?

“The ‘Problem’ In Our Housing Market.”

That was the #1 story last year, and if you wanted to take last year’s title, change a few words, and spit it back out, you might come up with our #2 story this year.

But while there are obvious similarities between the two, I contend that they are, in fact, different.

In 2021, I wrote two blogs that were very long, very poignant, and solicited an incredible response from the readers:

“Problems, Solutions, & Everything In Between”

“Problems, Solutions & The Problem With Those Solutions”

And in my year-end blog post when I discussed the concept of the “problem in our housing market,” I asked these questions:

Is the problem in our housing market that housing is too expensive?

Is the problem that people can’t afford to live in the city anymore?

Is the problem that prices are appreciating too quickly?

Is the problem that there is too much demand?

Is the problem that there is too little supply?

Is the problem that the government can’t actually affect the market?

Is the problem that the three levels of government can’t assist with the supply issue?

But this year was something different.

Last year, it seemed like much of the headlines, most of the media coverage, and a lot of the talk on TRB focused on these “problems” whereas in 2022, we looked at solutions.

I put the word “fixing” in quotations because many people believe that the housing market is broken.

Some are informed and realistic, but others are completely out to lunch.

Like you, I’m sure, many are tired of reading newspaper articles about that 26-year-old couple that can’t afford to buy a home, when there are 46-year-old couples in New York and London buying their first property. Then again, many are tired of the Toronto-to-London comparison, and can’t stand the idea that Toronto could ever be mentioned in the same breath as New York.

Many people understand economics, the free market, supply and demand, and while they sympathize with people who want to own real estate, they understand that it’s impossible to have a 100% rate of home ownership in this country, or any country for that matter.

But there are a lot of people out there that believe there’s a concept of “equality” in the housing market, such that everybody should own a home.

Huh? Come again?

There’s this concept of “fair” out there that suggests it’s only fair that a person who wants to live in the city of Toronto should be able to buy a house in the city of Toronto.

Try that in a New York, London, or Paris!

As a result, there are constant attempts to “fix” our housing market, which is to say that the fix is to get more people into the market, or to make housing more affordable, or to change the process of buying and selling real estate, just to say we did.

January 17th, 2022, I wrote, “Two Steps Forward, One Step Back”

This was my first post of 2022 on the idea of “fixing” something that isn’t really broken.

In the post, we discussed this article:

This is a classic move by the government. Create a “bad guy” and go after them.

Be seen as doing SOMETHING.

Fix the problem!

Only, investors aren’t the problem. And down payments for investors aren’t the problem, as a change, er, a “fix” wouldn’t have much of an effect.

How about this article from the Globe & Mail in January:

“Is Ottawa Finally About To Get Serious About Housing Bubbles?”

This sounds like something a 21-year-old would say.

“Get serious about the bubble.” Hmmm. Okay. You mean, “Allow me and my friends to buy cool lofts for $150,000.” Get serious, like that?

In my “Two Steps Forward, One Step Back” blog post, we looked at a variety of articles that seemed to be counter-intuitive.

I concluded with the following:

How in the world does increasing the minimum down payment on an investment property from 20% to 25% do ANYTHING to help our market?

Through the rest of 2022, we saw countless examples of the government attempting to “fix” the housing market.

March 30th, 2022, I wrote, “Here Comes The ‘Cooling Off Period,’ Right On Cue!”

We knew this was going to happen, and this is a classic case of politicians inventing a boogey-man and then telling people he’ll ward the scariness away.

A cooling-off period, as I wrote in the blog, would have a slew of unintended consequences and does nothing to “help cool the market.” It could, theoretically, add a layer of consumer protection, but this isn’t forcing people to wear a seatbelt in a car. Are we really at the point where we need to protect real estate buyers from themselves?

With the federal budget looming, it was going to be a topic of conversation.

April 13th, 2022, I wrote, “How Will The Federal Budget Affect Housing Affordability?”

Don’t forget when Chrystia Freeland said this early in 2022:

“Our ability to spend is not infinite. The time for extraordinary COVID support is over. And we will review and reduce government spending. Because that is the responsible thing to do.”

All the government has done since then is spend money, and it has had a huge effect on inflation, in my opinion, which we’ll discuss a bit later.

The federal budget included a $4 Billion “Housing Accelerator Fund,” as well as a “proposal” to extend $1.5 Billion over two years to the Rapid Housing Initiative, among other things.

That sure sounds like a lot!

Except, it’s not.

Not compared to this:

“The Largest Government Misallocation In Canadian History: $32 Billion”

I know, I know, I’m such a bad guy for posting that! I already beat that dead horse, and it’s just unattractive at this point.

The federal budget included a lot of fluff as well, ie. the $475 Million to be shelled out in one-time payments of $500 to “those facing housing affordability challenges,” which has zero medium or long-term impact on housing.

But in the end, this is exactly what I expected. No “fixes” but rather just voter candy.

May 30th, 2022, I wrote, “OREA Survey: Sellers Choice In Housing Reform”

Here was a discussion about how sellers wanted the process of selling houses to change, in the face of, in my opinion, zero change ahead. So you want to pass legislation to allow sellers to disclose prices and terms of competing offers to buyers in competition? Great! But sellers will only do that if it works in their favour, so this isn’t really going to “fix” anything.

August 29th, 2022, I wrote, “Monday Morning Quarterback: Mandatory Cooling Off Periods”

This topic came up again, so again, we discussed it!

October 31st, 2022, I wrote: “Monday Morning Quarterback: Ontario’s Big Housing Announcement”

Finally, some real change ahead!

Many will say that the “fixes” aren’t there, but it’s a hell of a lot better than we had up to this point.

As I wrote in Story #4, we’re going to see the impact of this legislation in 2023, whether there’s actual impact, or not.

November 18th, 2022, I wrote, “The Friday Rant: Public Sentiment Has Turned”

This was a very important blog as I think it could represent a turning point in public opinion. Sadly, I believe that the true “fix” many people in the GTA want to see is that nobody owns their home, or everybody does.

As I wrote in that blog, we’ve never witnessed such incredible disdain for homeowners as we do in 2022, let alone investors, who are made out to be evil-doers.

There are problems in our housing market and there can be “fixes.”

But in order to fix a problem, you must first identify a problem. And to date, we haven’t done a good job of that.

Everybody and anybody being able to afford anything and everything they want, in a free market, in a hot market, is not the problem. So when various levels of government step in to “fix” it, we’re not going to see results.

If public sentiment is any indication, this will be a topic in 2023 and beyond.

#1: Inflation & Interest Rates

Yes, I put both of these in one section. You can thank me later.

If we had to discuss each of “inflation” and “interest rates,” on their own, I fear many of you would close your browser or swipe up on your mobile app, and never come back to TRB again.

Before the fall of 2021, how many times per month did you hear the word “inflation?”

Is it a non-zero number? Seriously, I’m asking.

And yet as rumblings of 2022 interest rate hikes were first heard in the fall of 2021, we started to hear the word inflation.

Now, I’ll admit here, as I have done many times in the past year, that I did not expect the government to raise interest rates from 0.25% to 4.25%, via seven different rate hikes.

But did anybody?

January 6th, 2022, I wrote: “Burning Questions For 2022!”

And my #2 question was, “What will happen with interest rates?”

From the blog:

In the fall of 2021, we started to hear the talking heads at CMHC, the Bank of Canada, and the PMO’s office begin talking about “rates increasing in late-2022.”

Blink, and we’ll be there. But first, we’ll see home prices rise.

I was sort of right.

“Blink and we’ll be there,” since rate hikes started on March 2nd.

“First we’ll see home prices rise,” since they went up about 14% from December of 2021 to February of 2022.

Then I wrote:

Some market analysts are predicting as many as five interest rate increases throughout 2022.

I said this in amazement.

And yet, we saw seven hikes instead of five.

One thing you know, or will grow to know about me: I always admit my mistakes.

Here’s a big one:

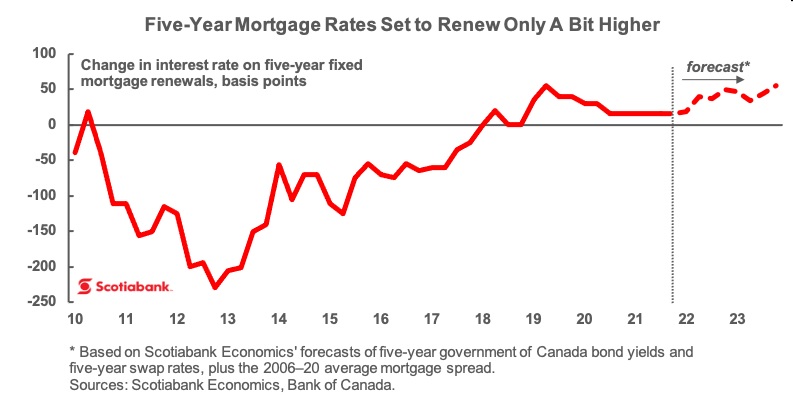

So multiple increases in the bank rate will not lead to a corresponding increase in the typical five-year, fixed rate mortgage, and we’re not going to see a 3.99% mortgage rate any time soon.

I mean, “any time soon,” as in, like, how long?

Look, I didn’t think we’d see 5-year fixed rates of 5.79%, but nobody did. At least, nobody that I heard from, on record.

In fact, as I wrote in my January blog, there were a lot of economists expecting minimal interest rate increases.

Here’s a chart from a Maclean’s article that relied on two economists at Scotiabank:

Yeah.

Whoops!

Now, keep in mind, borrowers in the fall of 2021 were being stress-tested for rates around 5.25%. That’s a rate that we never thought we’d see this year or next, but now that rates are that high, it’s good to know that the borrowers can handle them.

So approximately when did we start to get inundated with the word “inflation?”

Those of you who work in finance or perhaps the government have been hearing this word since last year. But “inflation” has become as common in the media as “Leafs” and that started a couple of months into 2022.

Can we rewind a little bit and look at inflation from 2018 through 2021?

It looks like this:

Alright, not too shabby.

In fact, since the goal of any government is to keep inflation around 2%, we were actually doing pretty well by the end of 2020.

All things considered, in the midst of a pandemic, inflation was at a mere 1.0%.

And then something happened in 2021 that caused the government to take notice and plan ahead.

Let’s extend that chart:

Ah!

Oh, that!

Yes, inflation went from 1.0% in January of 2021 to 5.1% in December of 2021.

That is why we started to hear those “rumblings” about rate hikes in late-2021 and why we all know what followed in 2022.

Inflation of 5.1% in January led to a rate of 5.7% in February.

February 28th, 2022, I wrote: “Is An Interest Rate Hike The End Of The World?”

I wasn’t being facetious.

I didn’t think a rate hike, or several rate hikes would be the end of the world.

We saw the first interest rate hike on March 2nd, 2022; a mere 25-basis points.

Inflation of 5.7% in February led to a rate of 6.7% in March.

We saw the second interest rate hike on April 13th, 2022; a larger 50-basis point increase.

Inflation of 6.7% in March led to a rate of 6.8% in April.

Inflation of 6.8% in April led to a rate of 7.7% in May.

We saw the third interest rate hike on June 3rd, 2022; a similar 50-basis point increase, now bringing the rate from 0.25% in January to 1.50%

That was significant.

Three rate hikes through June?

And yet, all indicators were that this was going to continue.

Inflation of 7.7% in May led to a rate of 8.1% in June.

We saw the fourth interest rate hike on July 13th, 2022; a colossal 100-basis-point increase, which was the largest rate hike since August of 1998.

Inflation of 8.1% in June declined to 7.6% in July.

Inflation of 7.6% in July declined to 7.0% in August.

We saw the fifth interest rate hike on September 17th, 2022; another huge increase at 75-basis points, bringing the rate up to 3.25%, a full three points higher than where we started the year.

Inflation of 7.0% in August declined to 6.9% in September.

We saw the sixth interest rate hike on October 26th, 2022; a mere 50-basis points this time, representing a reprieve from the last two massive hikes.

Inflation of 6.9% in September was matched by an identical rate of 6.9% in October.

At the time of this writing, we do not have the November inflation data, but it should be released this week.

We saw the seventh and final interest rate hike on December 7th, 2022, a day that will live in infamy for those of us who mocked the notion of five rate hikes in 2022, only to witness a seventh.

The rate now stands at a whopping 4.25%.

And if we extend that chart above to a full five years, it looks like this:

Some of you may be asking, “If we see inflation rising from 1% to 5.1% in 2021, why did the government wait so long to raise rates?”

That’s the benefit of hindsight. There’s just no way that we can sit back here now and critique the Bank of Canada, in all fairness. And that’s me saying this! You know I’d look for any opportunity to critique our beloved government!

Now, I’d be remiss if I didn’t mention that increasing interest rates to combat inflation does not good when your federal government is spending money like water, but that’s a topic for another day.

I’ve also mentioned in passing that one day, our kids will write a university paper on how Amazon Prime and grocery delivery services like Voila, Instacart, and Grocery Gateway were major contributing factors to inflation in the pandemic-era. As we were all told, “Stay home, don’t go out,” we began to order everything online. This made ordering easy, and we began to consume far more than we did pre-pandemic. When you had to leave your house, go to Winners, HomeSense, or an actual brick-and-mortar location, and search through the aisles for what you needed, you’d do it far less frequently than when you can simply order from Amazon Prime.

Bookmark this post, folks. Because when your child writes their thesis on “Pandemic Spending & Inflation” in fifteen years, I want a little credit.

There are rumours of another rate hike coming in 2023, but I don’t think it matters at this point. It’s like adding that third empty net goal to go up 4-1.

As for inflation, any wagers on where it stands this time next year?

The November, 2023 inflation figure. What say ye?

Guessing game, no penalty for higher/lower like Price Is Right. Just throw out a number, and the closest wins. And you know I’ll come back to this next year.

I’m going to wager 3.9%.

Well, folks, that was way too long, I know.

If this was mid-season, I’d have divided this into three blog posts.

But for those of you who made it this far, thanks for reading, and I hope you’re not out of cereal.

Perhaps blog reader Ed is right; there’s nothing left for you to say at this point!

But feel free to have your say regardless, as always.

Appraiser

at 7:08 am

My guesstimate for inflation next November is 3.5%.

Jenn

at 8:31 am

Lol this is looooong!!

London Agent

at 9:17 am

Fantastic. November 2023 inflation: 3.2% but somehow a head of lettuce is still $5 and god forbid you want to eat chicken breast in 2023.

Different David

at 11:15 am

I think housing is the biggest strategic problem facing the province. As you mentioned, the risk/reward equation for rental housing just doesn’t work for most investors. 5 years ago, there was the potential of rapid capital appreciation, so cash flow negative investments were still palatable.

Now, you are looking at a risky investment (revenues could stop at the whim of a renter, with no short term recourse for the owner), alternatives such as 5+% dividend return on big bank stocks, and the illiquid nature of the investment are turning off all but the commercial property management/ownership companies that have the resources and capital to weather bad times.

Short of completely revamping the LTB, where there was an express route for non-payment of rent cases (i.e. burden of proof is on the renter, hearings within 1-2 weeks, with a 2 week removal period thereafter), I can’t see why people would bear the risk of becoming casual landlords.

JL

at 2:37 pm

“There’s just no way that we can sit back here now and critique the Bank of Canada”

Sure we can! (and many people have and continue to do so)

I mean, sure, give them a pass in the early and summer months of 2021 – things were uncertain then – but by December to keep rates at 0% when inflation was 5%+ was questionable, even at the time (which is why the public discussions about rate increases had started them). And they followed up by only “issuing guidance” rather than acting in February (when we were at 5.7%), and followed that up with a very timid 0.25% increase in March (when we were at 6.7%!). I think the general consensus is that they were perpetually behind and slow to act, and there are solid reasons to support that criticism.

November 2023 prediction: 4.2%

Derek

at 3:05 pm

T.O. Vacancy Tax update: Received our Notice from the City requiring a Declaration of occupancy be provided by February.

I have no idea where inflation will be, but sure hope it comes way down sooner than later.

Kyle

at 4:12 pm

I also received my notice. When i went on to the City’s website to do my declaration, it turns out the site isn’t even operational yet. Basically they’ve sent a letter to everyone putting the onus on them to make a declaration in a short amount of time or else face stiff fines, and yet they’re not ready themselves to be able to accept the declarations. Someone at the City should be fired.

Sirgruper

at 6:15 pm

The site worked today. The exemptions are pretty confusing and arbitrary. Is a Pied a terre in the city vacant? Grandma gets sick near the end of the year and unstable, better decide quickly what to do with her next year or get taxed. I understand the goal to boost housing or to tax but because property rights are not entrenched in Canada’s constitution, the government can decide too much about what you can do with your own property.

Izzy Bedibida

at 9:06 am

Mom got hers as well, and we experienced the same thing with the web site as well. I’ll fill out the declaration over the Christmas break.

Mom feels that the city is targeting the elderly-especially widows etc. to quietly force them out of their homes, or to extract more taxes out of them because they’re mortgage free homeowners who built up equity over decades.

Kyle

at 9:11 am

I agree the way they’re going about this is a big problem. A lot of Seniors don’t use or aren’t comfortable with the internet, so they may struggle declaring.

Kevin

at 8:45 pm

To win a bet like this inflation prediction, you need to be at one of two extremes. The middle ground gets you lost in the shuffle.

I’ll go with 2.0%.

RPG

at 7:49 am

The story in 2023 will be about the inability of the city and the province to agree on housing strategy. Trouble is already brewing. It’s a power struggle.

TT

at 11:20 am

What power struggle?

Ford stripped the municipality of its power.

No longer can one NIMBY with forty bucks, an application, and an axe to grind hold up a development for two years. No more public consultations. No more city councillors with personal agendas stopping progress. No longer can these two-bit jokers hold developers hostage.

New game in town in 2023.

Alexander

at 1:08 pm

Prediction for November 2023 CPI – between 4 and 5 %. I am sure somebody can narrow it down to the last digit, but at this point nobody really knows how things are going to be.

Regarding BoC not acting fast enough – by early fall 2021 it was obvious inflation is getting out of hand and by December the numbers were simply screaming. I commented that Tiff was smoking something really strong to ignore all signs of doom and gloom. To wait from September to March was simply inexcusable and it simply should be investigated why it too BoC so long to start hiking.

Sandy Williams

at 8:08 am

This article is interesting. Thank you for sharing!

Best Real Estate in Florida

ranjithatech

at 1:24 am

Hi

Thanks for sharing your stories

http://www.sivantafoundations.com/about-us/

Caleb White

at 10:47 am

This article is interesting. Thank you for sharing!

Best Real Estate in Florida