Here’s a conversation that took place in my office on Thursday.

Him: “Wow, did you see that August sales were up 8.5%, year-over-year? That’s huge!”

Her: “No, not really. What? Why?”

Him: “I’m just saying, August is a slow month. An increase in sales, year-over-year, in a slow month, has to say something, does it not?”

Her: “No, it doesn’t. It’s August.”

Him: “Well, you can’t throw the entire month out the window like that.”

Her: “Okay, fine, I won’t. But the July sales were up 18.6%, year-over-year. So if August was only up 8.5%, then what does that say?”

Him: ………

As I always say: you can make numbers say anything you want.

Every discussion about the market is essentially an argument, or at the very least, a debate. There are no absolutes when it comes to the analysis of market statistics, simply interpretation.

August is a very tricky month in which to transact, but also as a tool for future predictions. A lot of the properties on the market during August are leftovers from July, and many of those are leftovers from June! Sixty days on the market and counting; those are far from “prime” pieces of real estate. And while many buyers keep tabs on the market in August, most do so with far greater effort than in the spring.

For the thirty-one days in August, every single time I saw a quality listing hit MLS, I asked out loud to anybody there (or just an empty room), “Why in the world is this person listing right now?” It just makes no sense, and I would never advise a client, freehold or condo, to list their property for sale in the month of August, if they were able to list in September.

If you’re a seller, and you’re not a “testing-the-market” seller, but rather an “I-need-to-sell” seller, why would you list in a very slow month, when you’re one, two, or three weeks away from one of the busiest months of the year?

Sure, the odd August-seller out there might have a strategy in mind. Maybe the thought process is: “There’s so much new inventory in September, and while there are new buyers, I’m going to try to find a holdover buyer from the spring, who is active in August, and avoid the competition.”

That strategy has some merit. Some.

But what about the fact that most active buyers in the summer are less-likely to pull the trigger because they know that there’s a bounty of new listings on the horizon? I can personally attest to the fact that I had two summer buyers that both passed on houses that were solid B+ matches, maybe even A-, because they wanted to see what was lurking around the corner in September.

I believe that August-buyers are only going to pull that trigger for the “dream home,” otherwise, they’ll wait.

So I think an overwhelming majority of the time, those August-sellers just haven’t really thought it through. There’s always something off about those listings.

I saw a house last week that was newly-listed, with an offer date – the date being Tuesday right after Labour Day.

The house was about 97% renovated, but perhaps the seller thought that house was “finished.” You’d be surprised how many flippers and/or sellers who renovate for sale think that the buyer pool is less diligent than they actually are, and thus they don’t feel the need to join pieces of trim, properly sand over drywall tape, paint the part of the wall that you see when you open cabinets and/or move plates to see what’s behind, etc. Add up a good 12-15 of these little nuances, and it’s enough to wonder what corners they’ve cut behind what you can see.

There was no home inspection for the property, no feature sheets, and no public open house scheduled.

Two of the four bulbs in the kitchen track light were out.

The basement had a dehumidifier running. I know many people have these out, but you really, really should put it away when the house is up for sale!

This house just didn’t feel like an A+ effort from the seller or the listing agent, and bringing the property out the week before Labour Day, when nobody is watching, and holding back offers, just reeks of inexperience, and a lack of knowledge and direction.

And oh, by the way, it didn’t sell.

Now we wait and watch to see if they’ll raise the price, and go 2/2 in stupid decisions.

That is the type of property I expect to see listed in the latter half of August.

And that is why I think August is a really, really tough month to use for the basis of any snapshots or reads on the market, and indicator of future market trends.

So having said that, I will now completely spit in my own face, and try to…………take snapshots or reads on the market.

First thing’s first: the average home price in August was $765,270.

That’s down from the $782,129 in August.

Up 4.7% from August of 2017, but who cares, right? Last summer was a massive fall-off in prices from last spring, and to point to this 4.7% increase as a “win” is truly making numbers say what you want.

In my Wednesday blog, I looked at the history of August-to-September increases in average home price, and estimated the August price at around $775,000, and thus applied a 4-5% increase to that number to arrive at a potential average sale price for this September.

With a slightly lower average home price in August, we might see a slightly lower average home price in September.

Or not. Right? If there are no future predictors in here, that is…

But having seen a larger-than-expected drop in average home price in August, I couldn’t help myself – I went back to look at the average drop over the last nine years, to echo Wednesday’s theme:

I was surprised to see that August of 2018 was one-tenth of a percentage off from tying the decade-high drop.

These numbers, for the most part, are rather tightly-knit. -1.6%, -1.9%, -1.9%, -2.0%, -2.2%, and -2.3%; six of the nine are within a small delta.

One of the two years that saw an increase in average home price was only 0.1%, so that’s a wash.

Overall though, this is much ado about nothing.

If this pas August saw the average of a 1.3% drop in average home price, we’d be at $771,961, and compared to the $765,270 we saw, this is basically a rounding error.

So with respect to “average sale price,” I don’t see any conclusions to be drawn here.

The second most looked-upon statistic in our market is total sales; a measure I put far less stake into than price, but one that the media often uses to prove its point, whether they want the market to look better or worse.

The total number of sales in August was a mere 122 sales less than July; 6,839 down from 6,961.

That’s 1.8%.

And it’s shockingly-low, in my mind.

So once again, I decided I had to go back and see what the trend was like in order to make sense of the drop, and this is what I found:

2017 was an absolute anomaly.

Just look at the drop in sales from July of 2016 to 2017: 40.4%.

It was nuts. And so was August.

But even with that 7.4% increase from the hard-hit month of July last year, to August, we still see an overall 7.3% average drop from 2009 to 2017.

So my gut was right to think that the 1.8% drop I saw this past month was low.

Maybe that points to a “strong” month in August?

The newspapers seem to say so.

Globe & Mail: “Toronto Housing Sputters Back To Life As Prices, Sales Grow In August”

Financial Post: “Toronto’s Housing Market Stabilizes After Turbulent Year As Sales Rise, Prices Steady”

Toronto Star: “Home Prices Rise Against Tighter Supply In August”

That’s the three major newspapers, all taking an upbeat tone with the real estate market.

But having just gone through the numbers, what do you think about “sales rising?”

They’re up 8.5% from last August, but we know that last year was an anomaly.

So just for good measure, one more chart.

I want to know what “sales rising” really means, comparing August 2018 sales to the August 2017 sales, when the August 2017 sales were exceptionally low.

What do August sales look like over the past decade? Well, you saw it above. But what’s the average, and how does this last “rise” look, in the context of a decade’s-worth-of data?

Right.

Just as we thought.

The media might put a positive spin on August by saying “sales are rising,” but they rose against a 2017-figure that was 40% lower than 2016!

This past month saw the third-lowest sales figure in August, over the past decade.

In case you’re wondering, my “gut feeling” for August was that it was a slow month.

As mentioned, I didn’t list anything in August, for reasons which should be obvious by now. I sold three condos to buyers, all of which I felt sold for less than they woulda, coulda, shoulda in the fall, or even in the spring. Overall, it was a slow month for sales, and a slow month for prices.

And I don’t see much in the August sales data to contradict that, even if the media is putting out positive pieces.

Now, what does the August result mean for the market moving forward?

Probably nothing, as noted here, many times.

So why did I spend two hours writing this blog?

I don’t know. That’s a very good question… 🙂

For those of you that don’t feel like you really got that ‘release’ you desire when you come to read TRB, don’t worry, – I’ve got you covered.

Introducing………………(drumroll please….)

….

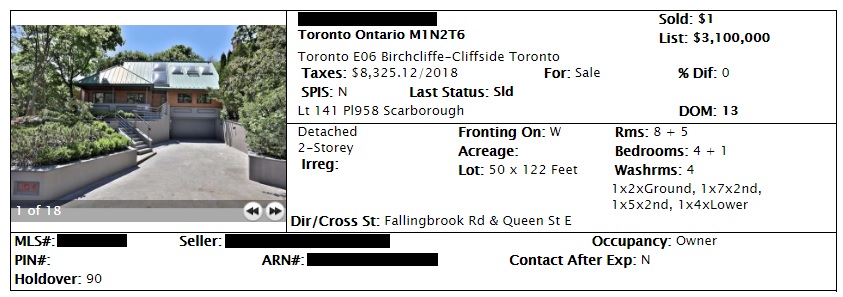

The new way to get around releasing the sale price of your home!

Yes, really.

This happened.

Wow, oh wow, are we ever in weird times…

Chris

at 7:48 am

Yup. August was a slow month, as is commonly the case. Plus, the comparison against the doldrums of August 2017 makes this year’s data appear more flattering.

Fully agree that these results don’t mean a whole lot moving forward. Hardly an indication of a market “ripe for further price gains”. But doesn’t predict imminent disaster either. Let’s see what the Fall holds.

Housing Bear

at 12:56 pm

Can’t really draw anything from one month of data. Especially one of the slowest historically.

Only thing interesting I found was the drop in sales for Toronto Condos. Way to soon to call this a trend, but I believe the overall market will continue to be propped up until condos face their reckoning. Line of thinking is as follows; Condos (especially 1bdr) are the market floor (lowest price point). They continued to increase after fair housing plan and early rate hikes. SFH (in similar/ nearby locations) will not drop below the price of these. As condo owners saw their equity increase and the price of the move up buy dropping, it has provided a window to make the jump up. Example, friend of mine bought precon (1bdr, 500sqf, 1 parking, 1 storage, tiny balcony) in leslieville for $290k in early 2015. Occupancy started in mid 2016. He sold in July for 525k and bought a detached bungalow just last month around Bmount and Kingston for 710k. Decent enough condition, great lot with potential, at peak it probably would have gone at around 900k. Seller orginally listed at 780, dropped it to 750, only offer, let it go for 710 provided my friend could close in 2.5 weeks (Proving David’s point that maybe the only people selling in AUG are desperate) . I think the bungalow will drop further but he sold his condo at what could be peak condo, and bought a house that had already cooled in price a fair bit. Have to say this was a pretty solid move on his part, as I see condos dropping much further from today in terms of % than SFH.

Anyway, point I am getting at, is if condos just give back 2-3 years of their gains, this move up would not be possible for him short of further SFH correction. Keep an eye on the condo market Boomers, do not want your liquidity to disappear.

When will condos face their day? Impossible to time it perfectly, but I’m trying to keep tabs on when the record supply under construction starts to hit the market. These are ones pre sold between the end of 2015- through to the end of 2017/ early 2018. By early 2017 presale prices were on par if not higher than their same neighborhood resale peers. All of these were contracted prior to B-20, many before rates started to go up. As per my post yesterday, will the financing be there to support these prices?

Juan

at 2:47 pm

I have been waiting for the shoe to drop on condos for almost 2 years now. It makes no sense for the sudden appreciation that began in late 2016.

JL

at 4:20 pm

I guess it depends on what the “normal” price differential between condos and houses should be in the market, and whether there has been a shift in that differential (temporary or permanent) due perhaps to the rising entry level cost for home ownership (i.e. condo prices lagged while entry level bungalows were still available, and now catching up as many entry level buyers shift to condos?)

Housing Bear

at 7:56 pm

@Juan – I think its a combo of; a) by the end of 2016 condos were the only option first time home buyers could actually afford with Canadian wages. b) the masses still believed that real estate is the only wise investment that you can make. c) If you plan to flip the contract; you don’t have to worry about financing, and you can jump on the bandwagon with 5-20% down. d) assignment flipping could get you around foreign buyers tax. Also with the construction time it takes for condos to hit the market. You could have a shortage relative to demand that would be satisfied with one years worth of pre sale projects, however a perceived shortage remains for a few years worth of sales until the first years worth of construction is completed and comes online. – Well wouldn’t this show up in a reduction of pre sales in the later years? In a non speculative market yes, but in a market where half or more than half of the presales are going to investors the oversupply will not show up until there is too many completed and resale units………… where a lot more supply is on its way.

@JL – Condo prices definitely lagged SFH on the way up. Some argue that the recent gains were justified to close this gap and that now everything is balanced. I am in the camp that once price appreciation stops there will be a rush to the exits, I think we are building way to much and the bulk of 50%+ of condos coming online that are investor owned will be listed and than prices will plummet. (This won’t happen overnight but the drop will be faster than the rise). On todays metrics, a lot of these investors will be cash flow negative and more so than they originally planned because borrowing costs have increased, and look they will increase further. Prices will eventually settle close to what the traditional price difference is between condos and SFH. SFH could hold up somewhat above the traditional average due to the fact we have had strong population growth and land is finite vs condos which could be errected in numerous places across the city. ( Look at all the 100 year old 2-3 story buildings which line streets like queen, danforth, st clair etc).

The biggest factor in my friends example was the amount of equity he had in his condo, which allowed him to make the move up. More recent condo buyers dont have this, and would not be in a position to move up to that bungalow. If prices give back 2-3 years then it will only be older condo owners who have paid off a sizable portion of their mortgage that would be able to make this jump up, without further decreases to SFH that is.

Also, every time interest rates tick up, everyone’s borrowing power drops.

Condodweller

at 10:12 am

“I am in the camp that once price appreciation stops there will be a rush to the exits”

I agree with the overall logic of your strategy, however, this expectation of rush to the exists may prove to be premature. I believe longterm, steady price depreciation is what will trigger people to rush the exits which is an unlikely scenario in the current environment given that even if one is forced to sell, there is a wave of demand to sell into. Your best hope for a sudden price drop is a significant job loss event.

Failing that, I don’t see a trigger for a crash. Rising rates may put a cap on prices however it will not be sufficient to trigger a drop unless we see a sharp rise in rates of another 2-3%.

Based on demand, and what we have seen since spring 2017 it looks like the market can absorb another 1-2% rate increase which will cap prices for a while or possibly cause a reasonable pullback neither of which will trigger a crash IMHO.

Housing Bear

at 11:51 am

You’re right depreciation is what will cause a rush to the exits. I just believe that a lot of the demand is not real end users. Its speculators buying their 2nd, 3rd, 10th condo. Once price appreciation stops, considering todays prices would put you at a negative carry (short of a huge down payment) I think a lot of the speculative demand goes away. Is there enough end user demand out there to soak up the record supply? From the standpoint of the number of people who want to own vs total units I would say yes, however this brings financing back into the equation. Will lenders be willing to make enough loans for the supply to be soaked up? and will the average would be buyer be able to take out a large enough loan to sustain todays prices? If not supply surge, incremental sellers bring down the value for everyone. If a big job loss event occurs, then expect more people being forced to sell, a further reduction in new potential buyers, along with a further tightening in bank issuing new loans.

I also believe that a market slowdown will impact a fair amount of jobs. RE agents, eventually new construction, brokers, inspectors, etc

daniel b

at 9:19 am

i think the 10%+ growth in rents and near zero vacancy, combined with the historical run up in prices in condos, convinced a good many investors that the future prospects for condo purchases are good, even if the going in yield is low.

For whatever it’s worth, i think your predictions about what will lead to an unwinding are very much off base. Prices tend to be sticky on the way down because sellers aren’t enthusiastic at prices below their peak. You need a shock to move the sellers off the sidelines, which could take one of two forms: either a really hard spike in rates that dramatically drives up the cost of holding the assets, or an unemployment shock. The rate shock needs to be pretty strong though to push people to sell. Just my two cents, time will tell…

Condodweller

at 4:21 pm

“if condos just give back 2-3 years of their gains”

Condos have had some significant gains over that period. I would not bet on them giving it up in a short period of time. Your friend’s is the classic buy low sell high strategy, the trick is recognizing the opportunity and acting on it. The inverse was possible in spring 2017 when people who were looking to downsize could have sold their homes at the peak and still buy a condo before they peaked.

Housing Bear

at 8:10 pm

Drop won’t happen overnight but the fall will be faster than the rise, and I also think condos will go through price discovery faster than SFH.

My friend did amazing on his condo as a single trade, but levered up further and in a few years could still have zero RE equity. That being said, the sell and rent strategy isn’t for most, so I still think he did the best he could in his situation. He has good job security and will be able to afford his mortgage even rates go up a further 100-200 bps. People underestimate that you can easily get trapped in your current place if a bad correction or crash occurs. I would much rather be tied to a house with a yard than a 500sqf condo in that scenario.

Condodweller

at 10:21 am

I can think of worse things than being “trapped” in your own home. As long as you can afford your payments and not forced to sell there is no issue with having short-term negative equity, heck even long-term negative equity as long as you have a roof over your head and you are not at the whim of your landlord. Regardless whether it’s a condo or a SFH. There is nothing wrong with a condo if that’s all you can afford. A big strike against renting right now is high rental prices. That’s not to say it’s not a viable strategy for a sophisticated investor. However, most people are not sophisticated investors this is why you are in the minority.

Housing Bear

at 11:56 am

Never mind not be able to easily move to work in another region but what about if you and your spouse are “trapped” in a 1bdr condo and want to start having kids? Guess you could get one of those cool bunk beds – queen on bottom/ single on top. Rent it out and go live with one of your parents?

Derek

at 2:03 pm

Great post

Ralph Cramdown

at 5:48 pm

“As mentioned, I didn’t list anything in August, for reasons which should be obvious by now.”

Please don’t take this the wrong way, because I assure you it isn’t intended as snark, but the “obvious” reason that an agent doesn’t have any listings is that the phone isn’t ringing. Absent any visibility into your sales funnel or your production stats, that’s going to be the assumption of 97% of the people out there.

Anyway, the last two weeks of August struck me as a bit busier than usual, and this for sellers that I assume could wait a few weeks if they chose to, and agents who know what they’re doing and aren’t behind on their car payments. Why? I do not know, but, assuming the aforementioned are true, the next guess is that they didn’t want to compete in the fall market. Worried about more sellers than buyers in their category? I dunno, but they can’t all be desperate or stupid, and some of them are now proudly sporting sold signs.

David Fleming

at 7:36 pm

@ Ralph Cramdown

Okay Ralph, I’ll bite.

I had two sellers approach me in August about selling – both are listing this September, as I told them to.

I had one listing in July that I took OFF the market, to re-list in September, to avoid having it on the market in the slow month of August.

I know you don’t intend any snark, but you’re calling me dishonest, and insincere. I have proven over the last 11 years on TRB that I am neither.

Jenn

at 8:44 pm

#burn

!!

Kyle

at 10:25 pm

@Ralph

Please don’t take this the wrong way, but for a guy who has never transacted in real estate, you sure seem to think you have it all figured out. Every single one of your comments is like the real estate equivalent of mansplaining, but with a dash of bitterness.

The obvious reason David didn’t have many listings in August is because he spent the last two weeks of the month in Idaho.

Derek

at 11:24 pm

If your point was that some houses on some streets won’t suffer to be listed in the slow month, you could make it without insulting the host; I doubt many people think the base stigmas attributed to RE agents apply to the host;